Industrial Wastewater Treatment Service Market by Service Type (Design, Installation, Operations, Maintenance), Treatment Method (Filtration, Disinfection, Desalination), End User (Power, Oil & Gas, Pulp & Paper), Region - Global Forecast To 2024

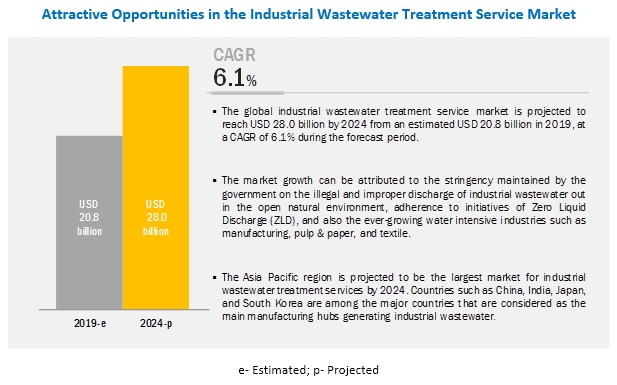

[158 Pages Report] The global industrial wastewater treatment service market is projected to reach USD 28.0 billion by 2024 from an estimated USD 20.8 billion in 2019, at a CAGR of 6.1% during the forecast period. This growth can be attributed to factors such as growing government policies and legislative mandates for illegal discharge of wastewater into the environment, need for policy and standards compliance, and need for adhering to the Zero Liquid Discharge (ZLD) initiatives.

The operation & process control segment, by service type, is expected to be the largest contributor to the industrial wastewater treatment service market during the forecast period.

The report segments the industrial wastewater treatment service market, by service type, into design & engineering consulting, building & installation, operation & process control, and others. The operation & process control segment is projected to hold the largest market share by 2024. With increasing industrialization, a huge emphasis is laid upon operation & process control. Minor tweaks in this segment affect the quality and quantity of industrial wastewater generated. The operations & process control services are mainly provided for the facility operation improvement and control of wastewater treatment plants. Major industrial customers outsource such services to dedicated wastewater treatment service providers. These types of services include, but are not limited to, laboratory testing, facility troubleshooting, routine maintenance, parameters monitoring, statistical process control, and report generation. The smooth functioning of unit operations, such as separation, floatation, settling, filtration, neutralization, absorption, adsorption, ion exchange, and chlorination, is ensured through proper monitoring. Thus, organizations are currently paying more heed to this critical segment.

The pulp & paper segment is expected to be the fastest growing market during the forecast period.

The industrial wastewater treatment service market, by end-user, is segmented into power generation, oil & gas, chemical & pharmaceutical, metals & mining, pulp & paper, and others. The power generation segment is expected to hold the largest market share; however, the pulp & paper segment is expected to be the fastest growing market with developing nations expected to invest in water-intensive industries such as pulp & paper. Not only is the industry high on water consumption, but it also ejects a lot of wastewater that requires treatment. Organizations such as Asia Pulp & Paper (APP) recently celebrated the sixth anniversary of APPs Forest Conservation Policy (FCP). For 6 years, the organization has been monitoring the FCP implementation and providing suggestions for improvement in the policy as well as its implementation. With NGOs intervention, APP made an additional commitment to conserve and restore 1 million hectare of ecosystems in Indonesia. The company is also planning a massive expansion on this front. It is because of such companies operating in Asia Pacific, the pulp & paper segment is expected to flourish in this region.

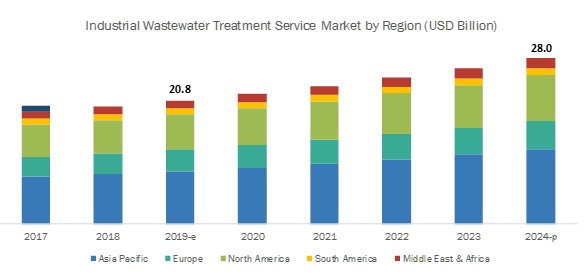

Asia Pacific is expected to be the largest market during the forecast period.

In this report, the industrial wastewater treatment service market has been analyzed with respect to 5 regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. Asia Pacific is estimated to be the largest market from 2019 to 2024. Increasing industrialization is likely to be a key component driving the market in this region. The developing countries in this region are expected to give more thrust to the market in this region. Globally, the production of all major paper related products (industrial roundwood, sawnwood, pulp, and paper) has shown gradual recovery from 2012. The production of paper products in 2016 was comparatively higher than that in 2015 for all the product groups (with cardboard panels at 4% growth, industrial roundwood paper and sawnwood both at 3%, wood pulp at 2%, and paper at 0.5%). The fastest growth was in Asia Pacific, Northern America and Europe, due to positive economic growth in these regions.

Key Market Players

The major players in the global industrial wastewater treatment service market are Veolia (France). SUEZ (France), Xylem (US), Thermax Group (India). Ecolab (USA), Pentair (UK), Evoqua Water Technologies (USA), WOG Group (USA), SWA Water Holdings (Australia), Aries Chemical (USA), Terrapure Environmental (Canada), and Golder Associates (Canada).

Veolias (France) key strategy is to improve profitability while reducing costs, even amidst a volatile economic environment. The company is concentrating on gaining a larger market share by expanding business operations in the APAC region along with reducing operating costs. It is strategically focused on expanding capacity as well as geographical reach with new R&D facilities, capacity expansions, and other ventures. It is investing a lot and strengthening its foothold in the African region through tie-ups with official government authorities.

As a part of its growth strategy, SUEZ (France) has adopted the strategy of mergers & acquisitions to cater to the growing demand for wastewater treatment services in various regions. Another prominent factor worth noticing is a large number of contracts & agreements in China and the European region clearly indicating the fact that apart from strengthening its foothold on home soil, it is largely focusing on dominating the Asia Pacific region, especially China. Also, with the introduction of new applications, it can be noted that even though the investments in R&D have been going down annually, they are becoming more effective. To achieve faster growth, SUEZ is working to align its R&D, marketing, and technical services throughout the organization. Its diverse regional operations are helping the company attain a strong foothold globally.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service type, treatment method, end-user, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

|

Companies covered |

Veolia (France), SUEZ (France), Xylem (US), Thermax Group (India), Ecolab (US), Pentair (UK), Evoqua Water Technologies (US), WOG Group (US), SWA Water Holdings (Australia), Aries Chemical (US), Terrapure Environmental (Canada), and Golder Associates (Canada) |

This research report categorizes the industrial wastewater treatment service market on the basis of service type, treatment method, end-user, and region.

On the basis of service type, the industrial wastewater treatment services market has been segmented as follows:

- Design & engineering consulting

- Operation & process control

- Maintenance & repair

- Building & installation

- Others (analytical & training services)

On the basis of treatment method, the industrial wastewater treatment service market has been segmented as follows:

- Filtration: Chlorine filtration

- UV filtration

- Ozone filtration

- Disinfection: By granular/sand filtration method

- Adsorption

- Reverse Osmosis

- Microfiltration

- Desalination

- Testing

On the basis of end-user, the industrial wastewater treatment service market has been segmented as follows:

- Power generation

- Oil & gas

- Chemical & pharmaceutical

- Metals & mining

- Pulp & Paper

- Others (food & beverage, construction, manufacturing, and textile)

On the basis of region, the industrial wastewater treatment service market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In January 2019, Veolia Water Technologies South Africa was re-awarded the operational and chemical water treatment contract for ArcelorMittal South Africa at its Vanderbijlpark Steel Works operation.

- In April 2019, Samsonite conceived the Green Grey edition of SCure ECO, a new suitcase collection made from secondary raw materials, to preserve natural resources and reduce the environmental impact of plastic waste. This is the first suitcase composed of post-consumer plastic waste wherein the shells of the suitcase are made up of recycled Polypropylene (PP), and the inside fabric is made of recycled PET bottles. SUEZ is expected to deliver the raw materials from its wastewater treatment plants.

Key Questions Addressed by the Report

- The report identifies and addresses key markets for industrial wastewater treatment, which would help various stakeholders such as service providers, regulators, vendors, and industrial personnel to review the growth in demand.

- The report helps service providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the market share analysis of key players in the market, and with the help of this, companies can enhance their revenues in the respective market.

- The report provides insights about emerging geographies for market. Hence, the entire market ecosystem can gain a competitive advantage from such insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.1.1 Demand-Side Analysis

2.1.1.1 Assumptions

2.1.2 Supply-Side Analysis

2.1.2.1 Assumptions

2.1.2.2 Calculation

2.1.3 Forecast

2.2 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Industrial Wastewater Service Market During the Forecast Period

4.2 Market, By Region

4.3 Market, By Service Type

4.4 Market, By Treatment Method

4.5 Market, By End-User

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Environmental Regulations

5.2.1.2 Initiatives of Zero Liquid Discharge (ZLD)

5.2.1.3 Expanding Global Manufacturing Industry

5.2.2 Restraints

5.2.2.1 Enormously High Cost of Wastewater Treatment Technologies

5.2.3 Opportunities

5.2.3.1 Rising Population and Rapid Urbanization in the Emerging Economies

5.2.3.2 Adopting A More Sustainable Approach Through Initiatives of Reduce-Recycle-Reuse

5.2.3.3 Proper Environmental Management Will Help Curb Risks of Environmental Noncompliance

5.2.4 Challenges

5.2.4.1 Lack of Required Techno-Commercial Awareness

6 Market, By Service Type (Page No. - 40)

6.1 Introduction

6.2 By Service Type

6.2.1 Design & Engineering Consulting

6.2.1.1 Design & Engineering Consulting Service Determines the Lifelong Performance of the Treatment Unit

6.2.2 Building & Installation

6.2.2.1 Correct Installation is the Core for Smooth Operations in Future

6.2.3 Operation & Process Control

6.2.3.1 Quality and Quantity of Wastewater Generated Depends Largely on the Optimization of Processes

6.2.4 Maintenance & Repair

6.2.4.1 Preventive, Corrective, and Predictive Maintenance Make Up This Segment

6.2.5 Others

7 Market, By Treatment Method (Page No. - 47)

7.1 Introduction

7.2 Filtration

7.2.1 Filtration Forms the Basic and Cost-Intensive Treatment Process

7.3 Disinfection

7.3.1 Uv Disinfection is the Most Cost-Intensive Form of Disinfection

7.4 Desalination

7.4.1 Desalination is the Most Effective Process to Bring Down the TDS Content

7.5 Testing

7.5.1 Testing Helps in Determining the Composition of Wastewater

8 Market, By End-User (Page No. - 54)

8.1 Introduction

8.2 Power Generation

8.2.1 With Huge Amount of Investment, This Segment is Expected to Grow Massively

8.3 Oil & Gas

8.3.1 Operations in Downstream Segment Would Require Extensive Wastewater Treatment

8.4 Chemical & Pharmaceutical

8.4.1 Stringent Regulations Require Proper Treatment of Wastewater Generated By This Segment

8.5 Pulp & Paper

8.5.1 The Pulping Process in This Segment is Hugely Water Intensive and Generates Massive Amount of Wastewater

8.6 Metals & Mining

8.6.1 The Wastewater Generated in This Segment has Enormous TDS

8.7 Others

9 Industrial Wastewater Treatment Service, By Region (Page No. - 62)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Service Type

9.2.2 By Treatment Method

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 China

9.2.4.1.1 Stringent Norms Laid Down By the Government to Fight Pollution

9.2.4.2 India

9.2.4.2.1 New Manufacturing Policy is Expected to Drive the Manufacturing Sector

9.2.4.3 Japan

9.2.4.3.1 Act to Reduce Groundwater Usage is Expected to Increase Wastewater Treatment and Reuse

9.2.4.4 South Korea

9.2.4.4.1 Advanced Membrane Technology to Impact the Growth of the Market

9.2.4.5 Rest of Asia Pacific

9.3 North America

9.3.1 By Service Type

9.3.2 By Treatment Method

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 US

9.3.4.1.1 The Water Infrastructure Finance is Expected to Bring in Funds for Wastewater Treatment Projects

9.3.4.2 Canada

9.3.4.2.1 Canada is the 6th Largest Producer of Electricity in the World, Generating A Considerable Amount of Wastewater

9.3.4.3 Mexico

9.3.4.3.1 Booming Oil & Gas Sector is Expected to Drive the Wastewater Treatment Sector

9.4 Europe

9.4.1 By Service Type

9.4.2 By Treatment Method

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 Russia

9.4.4.1.1 Revamping of Power Generation Units is Expected to Boost the Power Generation Sector

9.4.4.2 UK

9.4.4.2.1 Stringent Regulations Regarding Wastewater Treatment Have Been Enforced and Monitored

9.4.4.3 Germany

9.4.4.3.1 Huge Number of E-Prtr Facilities Ensures Proper Wastewater Treatment

9.4.4.4 Italy

9.4.4.4.1 A Resilient Industrial Sector is Expected to Continue Having A Steady Generation of Industrial Wastewater

9.4.4.5 France

9.4.4.5.1 Fuel-Based Power Plants are Expected to Drive the Wastewater Treatment Service Market

9.4.4.6 Rest of Europe

9.5 South America

9.5.1 By Service Type

9.5.2 By Treatment Method

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Brazil

9.5.4.1.1 Huge Scope of Wastewater Treatment Due to Growing Industrialization

9.5.4.2 Argentina

9.5.4.2.1 Growth in Natural Gas Processing is Expected to Increase Wastewater Generation

9.5.4.3 Venezuela

9.5.4.3.1 Growth in Crude Oil Processing is Expected to Drive the Market Forward

9.5.4.4 Rest of South America

9.6 Middle East & Africa

9.6.1 By Service Type

9.6.2 By Treatment Method

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 UAE

9.6.4.1.1 Dominant Oil & Gas Industry is Expected to Drive the Market

9.6.4.2 Saudi Arabia

9.6.4.2.1 Several Water Projects Expected to Take Place in the Nation

9.6.4.3 South Africa

9.6.4.3.1 Growing Electricity Demand Resulting in the Increase in Power Generation Units, Which in Turn is Expected to Increase the Wastewater Generation

9.6.4.4 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 105)

10.1 Overview

10.2 Ranking of Players and Industry Concentration, 2017

10.3 Competitive Landscape Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Competitive Scenario

10.4.1 Contracts & Agreements

10.4.2 New Product Launches

10.4.3 Investments & Expansions

10.4.4 Mergers & Acquisitions

10.4.5 Partnerships & Collaborations

11 Company Profiles (Page No. - 113)

(Business Overview, Products/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Veolia

11.2 SUEZ

11.3 Xylem

11.4 Ecolab

11.5 Thermax Group

11.6 Pentair

11.7 Evoqua Water Technologies

11.8 WOG Group

11.9 Golder Associates

11.10 SWA Water Holdings

11.11 Aries Chemical

11.12 Terrapure Environmental

* Business Overview, Products/Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 151)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (68 Tables)

Table 1 Wastewater Generated From the Key End-User Industries and Wastewater Treated are the Determining Factors for the Global Market

Table 2 Global Market Snapshot

Table 3 Global Ceo Survey: 2016 Global Manufacturing Competitiveness Index Rankings By Country

Table 4 Global Ceo Survey: Manufacturing Powerhouse Rank Trending and Future Forecast

Table 5 Industrial Wastewater Treatment Service Market Size, By Service Type, 20172024 (USD Million)

Table 6 Design & Engineering Consulting: Market, By Region, 20172024 (USD Million)

Table 7 Building & Installation: Market, By Region, 20172024 (USD Million)

Table 8 Operation & Process Control: Market, By Region, 20172024 (USD Million)

Table 9 Maintenance & Repair: Market Size, By Region, 20172024 (USD Million)

Table 10 Others: Market Size, By Region, 20172024 (USD Million)

Table 11 Industrial Wastewater Treatment Service Market Size, By Treatment Method, 20172024 (USD Million)

Table 12 Filtration: Market Size, By Region, 20172024 (USD Million)

Table 13 Disinfection: Industrial Wastewater Treatment Market Size, By Region, 20172024 (USD Million)

Table 14 Desalination: Market Size, By Region, 20172024 (USD Million)

Table 15 Testing: Market Size, By Region, 20172024 (USD Million)

Table 16 Industrial Wastewater Treatment Service Market, By End-User, 20172024 (USD Million)

Table 17 Power Generation: Market Size, By Region, 20172024 (USD Million)

Table 18 Oil & Gas: Market Size, By Region, 20172024 (USD Million)

Table 19 Chemical & Pharmaceutical: Market Size, By Region, 20172024 (USD Million)

Table 20 Pulp & Paper: Market Size, By Region, 20172024 (USD Million)

Table 21 Metals & Mining: Market Size, By Region, 20172024 (USD Million)

Table 22 Others: Market Size, By Region, 20172024 (USD Million)

Table 23 Strong Regional Regulations Driving Water Investments in Various Regions

Table 24 Industrial Wastewater Treatment Service Market Size, By Region, 20172024 (USD Million)

Table 25 Asia Pacific: Market Size, By Service Type, 20172024 (USD Million)

Table 26 Asia Pacific: Market Size, By Treatment Method, 20172024 (USD Million)

Table 27 Asia Pacific: Market Size, By End-User, 20172024 (USD Million

Table 28 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 29 China: Market Size, By End-User, 20172024 (USD Million)

Table 30 India: Market Size, By End-User, 20172024 (USD Million)

Table 31 Japan: Market Size, By End-User, 20172024 (USD Million)

Table 32 South Korea: Market Size, By End-User, 20172024 (USD Million)

Table 33 Rest of Asia Pacific: Market Size, By End-User, 20172024 (USD Million)

Table 34 North America: Market Size, By Service Type, 20172024 (USD Million)

Table 35 North America: Market Size, By Treatment Method, 20172024 (USD Million)

Table 36 North America: Market Size, By End-User, 20172024 (USD Million

Table 37 North America: Market Size, By Country, 20172024 (USD Million)

Table 38 US: Market Size, By End-User, 20172024 (USD Million)

Table 39 Ten of the Largest Upcoming Water Treatment Construction Projects

Table 40 Canada: Market Size, By End-User, 20172024 (USD Million)

Table 41 Mexico: Market Size, By End-User, 20172024 (USD Million)

Table 42 Europe: Market Size, By Service Type, 20172024 (USD Million)

Table 43 Europe: Market Size, By Treatment Method, 20172024 (USD Million)

Table 44 Europe: Market Size, By End-User, 20172024 (USD Million

Table 45 Europe: Market Size, By Country, 20172024 (USD Million)

Table 46 Russia: Market Size, By End-User, 20172024 (USD Million)

Table 47 UK: Market Size, By End-User, 20172024 (USD Million)

Table 48 Germany: Market Size, By End-User, 20172024 (USD Million)

Table 49 Italy: Market Size, By End-User, 20172024 (USD Million)

Table 50 France: Market Size, By End-User, 20172024 (USD Million)

Table 51 Rest of Europe: Market Size, By End-User, 20172024 (USD Million)

Table 52 South America: Market Size, By Service Type, 20172024 (USD Million)

Table 53 South America: Market Size, By Treatment Method, 20172024 (USD Million)

Table 54 South America: Market Size, By End-User, 20172024 (USD Million

Table 55 South America: Market Size, By Country, 20172024 (USD Million)

Table 56 Brazil: Market Size, By End-User, 20172024 (USD Million)

Table 57 Argentina: Market Size, By End-User, 20172024 (USD Million)

Table 58 Venezuela: Market Size, By End-User, 20172024 (USD Million)

Table 59 Rest of South America: Market Size, By End-User, 20172024 (USD Million)

Table 60 Middle East & Africa: Market Size, By Service Type, 20172024 (USD Million)

Table 61 Middle East & Africa: Market Size, By Treatment Method, 20172024 (USD Million)

Table 62 Middle East & Africa: Market Size, By End-User, 20172024 (USD Million)

Table 63 Middle East & Africa: Market Size, By Country, 20172024 (USD Million)

Table 64 UAE: Market Size, By End-User, 20172024 (USD Million)

Table 65 Saudi Arabia: Market Size, By End-User, 20172024 (USD Million)

Table 66 South Africa: Market Size, By End-User, 20172024 (USD Million)

Table 67 Rest of Middle East & Africa: Market Size, By End-User, 20172024 (USD Million)

Table 68 SUEZ, the Most Active Player in the Market Between 2016 and 2019

List of Figures (27 Figures)

Figure 1 Asia Pacific Held the Largest Share of the Market in 2018

Figure 2 Operation & Process Control Segment is Expected to Dominate the Industrial Wastewater Treatment Segment Market, By Service Type, From 2019 to 2024

Figure 3 Filtration is Expected to Dominate the Market, By Treatment Method, From 2019 to 2024

Figure 4 Power Generation Segment is Expected to Dominate the Market, By End-User, From 2019 to 2024

Figure 5 Increasing Investments in Green Initiatives Such as Zld are Expected to Drive the Industrial Wastewater Service Market

Figure 6 Asia Pacific is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 7 Operation & Process Control Segment Dominated the Market in 2018

Figure 8 Filtration Segment Dominated the Market in 2018

Figure 9 Power Generation Segment Dominated the Market, By End-User, in 2018

Figure 10 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 11 Change in the Rate of Urbanization From 2014 to 2016

Figure 12 Market, By Service Type, 20192024 (USD Million)

Figure 13 Industrial Wastewater Treatment Service, By Treatment Method, 20192024 (USD Million)

Figure 14 Industrial Wastewater Treatment Service, By End-User, 20192024 (USD Million)

Figure 15 Industrial Wastewater Treatment Service Size (Value), By Region, 2024

Figure 16 Asia Pacific: Regional Snapshot

Figure 17 North America: Regional Snapshot

Figure 18 Key Developments in the Market, 20162019

Figure 19 Veolia Led the Market in 2018

Figure 20 Industrial Wastewater Treatment Service (Global), Competitive Landscape Mapping, 2018

Figure 21 Veolia: Company Snapshot

Figure 22 SUEZ: Company Snapshot

Figure 23 Xylem: Company Snapshot

Figure 24 Ecolab: Company Snapshot

Figure 25 Thermax Group: Company Snapshot

Figure 26 Pentair: Company Snapshot

Figure 27 Evoqua Water Technologies: Company Snapshot

This study involved 4 major activities in estimating the current size of the industrial wastewater treatment service market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. Thereafter, the market breakdown and data triangulation technique was undertaken to estimate the market size of the segments and corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as OECD-data, Bloomberg Business Week, Factiva, and water & wastewater journal, to identify and collect information useful for a technical, market-oriented, and commercial study of the industrial wastewater treatment service market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

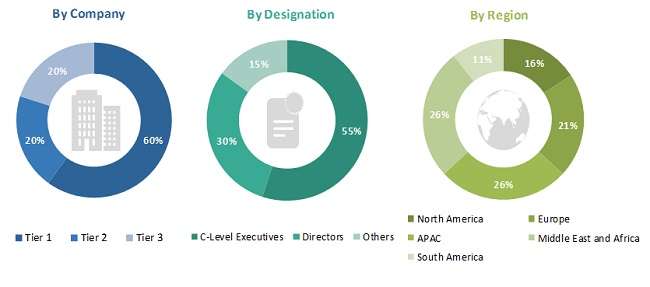

The industrial wastewater treatment service market comprises several stakeholders such as companies related to the wastewater treatment service industry, such as, consulting companies in the wastewater and sustainability sector, government & research organizations, investment banks, organizations, forums, alliances, and associations, power generation utilities, smart grid players, smart water metering organizations, state and national utility authorities, textile, oil & gas, and chemical & pharmaceutical companies, venture capital firms, wastewater treatment equipment manufacturers, dealers, and suppliers, and water testing and packaging vendors. The demand-side of this market is characterized by its applications such as industrial, wastewater support, and others. The supply-side is characterized by advancements in wastewater treatment technologies such as wastewater treatment through filtration, demineralization, desalination, disinfection, and increased emphasis on environmental compliant treatment processes. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global industrial wastewater treatment service market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends, from both the demand and supply sides, in the wastewater generation from the industrial sector.

Report Objectives

- To define, describe, and forecast the global industrial wastewater treatment service market by service type, treatment method, end-user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To track and analyze the competitive developments such as contracts & agreements, expansions, new product developments, mergers & acquisitions, and partnerships in the industrial wastewater treatment service market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Industrial Wastewater Treatment Service Market