Infection Surveillance Solutions Market by Software (On-Premise, Web-Based), Services (Product Support & Maintenance, Implementation, Training & Consulting), End User (Hospitals, Long-Term Care Facilities) and Region - Global Forecasts to 2027

Infection Surveillance Solutions Market Size, Growth Drivers & Restraints

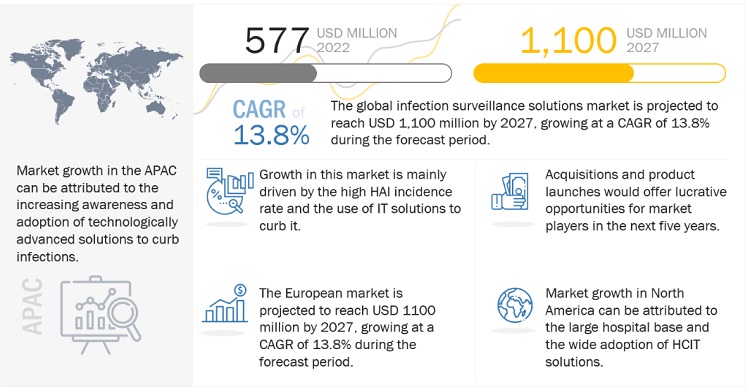

The global infection surveillance solutions market growth forecasted to transform from $577 million in 2022 to $1,100 million by 2027, driven by a CAGR of 13.8%. The market growth is primarily driven by the rising number of hospital-acquired infections (HAIs) and new Medicare policies that include non-payment for hospital-acquired conditions. Additionally, factors such as increased healthcare spending, growing number of surgeries, growing aging population, and increasing prevalence of chronic diseases are also contributing to the market growth. On the other hand, the high cost of health IT solutions deployment in small healthcare organizations especially in developing countries and the reluctance among medical professionals to adopt advanced healthcare IT solutions are likely to hinder the growth of this market during the forecast period.

Attractive Opportunities in the Global Infection Surveillance Solutions Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession Impact on Global Infection Surveillance Solutions Market

A recession is a temporary economic decline during which trade and industrial activities are reduced. It is generally identified by a decline in the GDP in two successive quarters. According to the International Monetary Fund’s World Economic Outlook Report (October 2022), global GDP growth would slow from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023. Similarly, global inflation would rise from 4.7% in 2021 to 8.8% in 2022 but decline to 6.5% in 2023 and 4.1% by 2024.

The key reasons behind this slowdown are the rising global inflation and the Russia-Ukraine war, which led to a severe energy crisis in Europe, where gas prices have escalated fourfold since 2021. Frequent lockdowns in China under its ‘Zero COVID policy’ led to a weakened economy, which, in turn, impacted global trade and led to a sharp appreciation of the US dollar.

The covid-19 pandemic forced governments to spend heavily on rolling out vaccination programs and investing in healthcare infrastructure and staffing. However, government plans to maintain or increase spending to tackle a backlog of non-COVID care and resolve staffing issues have been upended by the global economic slowdown. The Economist Intelligence Unit expects total healthcare spending (public and private combined) to rise by 4.9% in nominal terms in 2023, propelled by higher costs and wages. However, spending is expected to decline slightly in real terms as it may fail to keep pace with inflation.

Healthcare digitization efforts will continue, but the use of health data is expected to come under stricter regulation in the US, Europe, and China. The demand for infection surveillance solutions is expected to fall slightly, and the recession will have a low-to-moderate impact on healthcare-oriented businesses. Macroindicators such as inflation and supply chain disruptions might temporarily affect the demand for infection surveillance solutions. High prices of infection surveillance solutions due to inflation will affect the demand in the short run. But in the long run, the demand is expected to become normal.

Infection Surveillance Solutions Market Dynamics

Drivers: Increasing adoption of antimicrobial stewardship programs

Infection Control and Epidemiology (APIC) are focusing on curbing the increasing incidence of HAIs.

Antimicrobial resistance (AMR) is a global health and development threat. The WHO declared AMR one of the top 10 global public health threats facing humanity. According to the WHO 2020 report, the cost of AMR to the global economy is significant. In addition to death and disability, prolonged illness results in longer hospital stay, the need for more expensive medicines, and financial challenges for those impacted. In 2015, the WHO launched the Global Antimicrobial Resistance and Use Surveillance System (GLASS), which incorporates data from the surveillance of AMR in humans and surveillance of antimicrobial medicine use. GLASS provides a standardized approach to collecting, analyzing, interpreting, and sharing data by countries, territories, and areas and monitors the status of existing and new national surveillance systems. Various market players such Wolters Kluwer N.V. (Netherlands), Vecna Technologies, Inc. (US), bioMerieux SA (France) among others as have created surveillance solutions for antimicrobial stewardship to cater to the needs of healthcare facilities.

Restraints: High cost of deployment for small healthcare organizations

Implementing healthcare IT software solutions is costly due to the high cost of interoperability and deployment. Smaller healthcare organizations face challenges in implementing internet connectivity, which results from difficulties in setting up multiple networks in healthcare environments, limited wireless options, and the need for extensive security measures to prevent data breaches. Additionally, infection surveillance software is expensive. Moreover, support and maintenance services, which include modification and upgrading software as per the changing user requirements, represent a recurring expenditure that accounts for a large share of the total cost of ownership. Furthermore, custom interface development for device integration post-sales requires extra validation and verification, adding to the total cost of ownership for healthcare providers. These additional costs are unaffordable for smaller hospitals and healthcare organizations.

Opportunities: Emerging Markets

The infection surveillance solutions market is expected to experience significant growth opportunities in countries with emerging economies such as India, China, Brazil, Russia, and countries in Latin America and Southeast Asia. This is due to the fact that these regions are home to a large portion of the world's population, with over half residing in India and China. Additionally, factors such as public demand for better quality hospital care, the rise in costs associated with healthcare-associated infections (HAIs), the emergence of multi-drug-resistant microorganisms, and government initiatives are contributing to the growth of the market in these countries.

With the growth in per capita income, increasing healthcare awareness, a growing number of hospitals and clinics, and a vast patient population, the demand for better healthcare services has increased in these countries. Also, emerging economies in the APAC present lucrative investment opportunities for multinational healthcare IT companies to offshore their business operations to these markets. Expansions in emerging markets are driving the adoption of infection control technologies in the medical device manufacturing industry in these countries, thereby providing opportunities for market growth.

Challenges: Data security concerns

The growing reliance on networking and automated technologies (EHR) and the shifting trend toward healthcare integration and health information exchanges have helped expand the healthcare privacy and security landscape. The electronic exchange of patient data offers greater reach and efficiency in healthcare delivery; however, issues related to data loss and liability due to broader access are associated with the electronic exchange of patient data.

Wide patient information exchanges lead to privacy and security risks and increase the chances of data breaches. In healthcare, approximately one-third of data breaches result in medical identity theft, mainly due to a lack of internal control over patient information, outdated policies, procedures (or nonadherence to existing ones), and inadequate personnel training. In the US, the Identity Theft Resource Center reported that the healthcare industry had the second-largest number of data breaches in 2019, along with the highest exposure rate per breach.

Data collected from various sources are transferred or directly entered into infection surveillance platforms. Creating a secure communication platform is a major challenge faced by healthcare IT vendors catering to the healthcare industry. Potential security concerns related to HCIT systems in healthcare organizations may lead to a sense of insecurity among users, restraining the adoption of HCIT solutions, including infection surveillance solutions, across the globe.

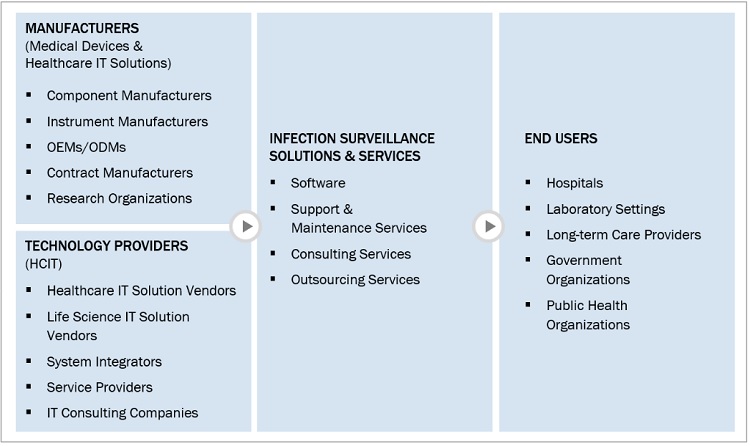

Infection Surveillance Solutions Market: Ecosystem Analysis

The infection surveillance service segment, by product & service, is expected to witness the fastest growth, in infection surveillance solutions market, during forecast period

Based on product, the market is segmented into infection surveillance software solutions and infection surveillance services. In 2021, the infection surveillance software segment is expected to be witness fastest growth during the forecast period. Growth in the infection surveillance services market is mainly driven by the increasing importance of infection surveillance in the healthcare industry. Moreover, the growing need to ensure effective HAI management and reduce the burden of HAI-related complications is expected to play a major role in the growth of the infection surveillance services market during the forecast period.

By type, the on-premise software segment accounted for the largest share of the infection surveillance solutions market during forecast period

The on-premise software segment dominated the market during the forecast period, accounting for the largest share. This can be attributed to the requirement for secure access to healthcare IT solutions and the need to minimize the risk of data breaches and external attacks. As a result, many healthcare organizations prefer on-premise software solutions to ensure that their confidential information is kept secure. Another benefit, specifically for organizations migrating or upgrading from one system to another, is the possibility of reusing existing servers and storage hardware.

The product support and maintenance services segment accounted for the largest share of the infection surveillance solutions market, by type, in 2021

In 2021, the product support and maintenance services segment dominated the market owing to the requirement for continuous product updates and technical support for infection surveillance software. The growth of the product support and maintenance services segment is driven by the need for clients (healthcare providers) to access the technical knowledge base of the vendor company, receive support from its product support team, and develop application management skills. These services help ensure that healthcare providers are able to effectively use and manage their infection surveillance software, resulting in improved outcomes and increased efficiency. By offering these services, vendor companies can provide ongoing value to their clients and enhance customer satisfaction.

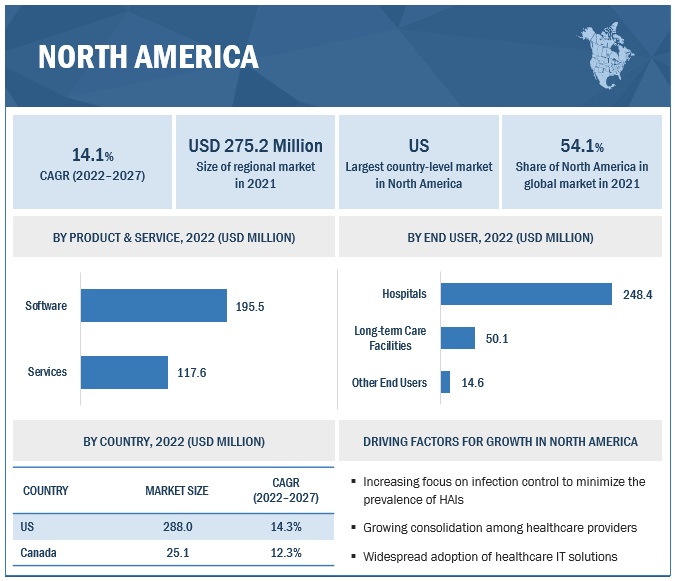

North America is expected to be the largest and fastest market segment in the global infection surveillance solutions market during the forecast period

North America is expected to dominate the global market between 2022–2027, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market in North America is witnessing significant developments owing to factors such as the widespread adoption of healthcare IT solutions to curtail the escalating healthcare costs, growing consolidation among healthcare providers, and increasing incidence of HAIs in the US. The presence of a large number of players in the region is also a key factor contributing to the large share of North America in the infection surveillance solutions market.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the infection surveillance solutions market include Becton, Dickinson and Company (US), Premier, Inc. (US), Wolters Kluwer N.V. (Netherlands), Cerner Corporation (US), Baxter International Inc. (US), GOJO Industries, Inc. (US), Clinisys (US), Deb Group Ltd. (UK), BioVigil Healthcare Systems (US), RLDatix (UK), Merative (US), Vecna Technologies, Inc. (US), VigiLanz Corporation (US), Ecolab (US), Harris Healthcare (US), PeraHealth (US), Medexter Healthcare (Austria), CenTrak, Inc. (US), bioMerieux SA (France), CKM Healthcare (Canada), Asolva Inc. (US), PointClickCare (Canada), STANLEY Healthcare (US), Vitalacy Inc. (US), and VIZZIA Technologies (US). Between 2020 and 2023, the companies adopted growth strategies such as product launches/enhancements, expansions, agreements, partnerships, collaborations, sales contracts, investments, joint ventures, and acquisitions to capture a larger share of the global market.

Infection Surveillance Solutions Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product & Services and End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

Becton, Dickinson and Company (US), Premier, Inc. (US), Wolters Kluwer N.V. (Netherlands), Cerner Corporation (US), Baxter International Inc. (US), GOJO Industries, Inc. (US), Clinisys (US), Deb Group Ltd. (UK), BioVigil Healthcare Systems (US), RLDatix (UK), Merative (US), Vecna Technologies, Inc. (US), VigiLanz Corporation (US), Ecolab (US), Harris Healthcare (US), PeraHealth (US), Medexter Healthcare (Austria), CenTrak, Inc. (US), bioMerieux SA (France), CKM Healthcare (Canada), Asolva Inc. (US), PointClickCare (Canada), STANLEY Healthcare (US), Vitalacy Inc. (US), and VIZZIA Technologies (US). |

The study categorizes the Infection Surveillance Solutions Market into following segments and sub-segments:

By Product & Services

-

Software

- On-premise Software

- Web-based Software

-

Up to 50 hp

- Product Support & Maintenance Services

- Implementation Services

- Training & Consulting services

By End User

-

Hospitals

- Large Hospitals

- Medium Sized Hospitals

- Small Hospitals

-

Long-term Care Facilities

- Nursing Homes

- Skilled Nursing Facilities

- Assisted- Living Facilities

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Switzerland

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia & New Zealand

- South Korea

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In November 2022, Wolters Kluwer strengthened its clinical surveillance portfolio with Sentri7 Sepsis Monitor. Sentri7 Sepsis Monitor (formerly known as POC Advisor) leverages clinical natural language processing (cNLP) and advanced algorithms to surveil a hospital’s patients 24/7 to identify early signs of sepsis.

- In June 2022, Premier unveiled the PINC AI solution for long-term care (LTC) facilities. The solution provides the same level of clinical surveillance used in the acute setting.

- In January 2022, Becton, Dickinson and Company (US) collaborated Pfizer (US) and Wellcome (UK). The collaboration enabled the companies to survey existing diagnostic practices to highlight benefits and gaps in diagnostic testing in AMR stewardship to improve and further advocate for patient care, clinical practice, and healthcare economics.

- In July 2021, Baystate Health and Cerner Corporation collaborated by introducing a digital health platform to integrate care delivery and financing systems for a more consumer-focused approach to patient care.

- In February 2021, Ecolab (US) launched Hand Hygiene Compliance Measurement (HHCM) System. This system is a digitally connected technology that systematically monitors and improves hand hygiene in healthcare across Europe.

Frequently Asked Questions (FAQs):

What is the projected market value of the global infection surveillance solutions market?

The global market of infection surveillance solutions is projected to reach USD 1,100 million.

What is the estimated growth rate (CAGR) of the global infection surveillance solutions market for the next five years?

The global infection surveillance solutions market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% from 2022 to 2027.

What are the major revenue pockets in the infection surveillance solutions market currently?

North America is expected to dominate the global market between 2022–2027, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The market in North America is witnessing significant developments owing to factors such as the widespread adoption of healthcare IT solutions to curtail the escalating healthcare costs, growing consolidation among healthcare providers, and increasing incidence of HAIs in the US. The presence of a large number of players in the region is also a key factor contributing to the large share of North America in the infection surveillance solutions market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSMARKET DRIVERS- Increasing prevalence of hospital-acquired infections- Increasing adoption of antimicrobial stewardship programs- Increasing number of surgeries- Growing geriatric population and increasing incidence of chronic diseases- Growing investments to improve healthcare systemsMARKET RESTRAINTS- High cost of deployment for small healthcare organizations- Reluctance among medical professionals to adopt advanced healthcare IT solutionsMARKET OPPORTUNITIES- Increasing consolidation in healthcare industry- Cloud-based software solutions- Emerging marketsMARKET CHALLENGES- Shortage of skilled healthcare IT professionals- Data security concerns

- 6.1 INTRODUCTION

-

6.2 INDUSTRY TRENDSSHIFT TOWARD WEB-BASED SOLUTIONSAI-POWERED SURVEILLANCE SOFTWARESHIFT TOWARD AUTOMATION IN HEALTHCARE FACILITIESINFECTION SURVEILLANCE USING MOBILE APPLICATION TOOLS

-

6.3 REGULATORY ANALYSISNORTH AMERICAEUROPEASIAMIDDLE EAST & AFRICALATIN AMERICA

-

6.4 TECHNOLOGY ANALYSISCLOUD COMPUTING TECHNOLOGYARTIFICIAL INTELLIGENCEBLUETOOTH LOW-ENERGY SENSORS

-

6.5 ECOSYSTEM ANALYSIS

-

6.6 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR INFECTION SURVEILLANCE SOLUTIONSJURISDICTION AND TOP APPLICANT ANALYSIS

- 6.7 IMPACT OF RECESSION

- 7.1 INTRODUCTION

-

7.2 SOFTWAREON-PREMISE SOFTWARE- Data protection and in-house access to HCIT solutions to drive marketWEB-BASED SOFTWARE- Increasing demand for data centralization and cost-benefits of solutions to drive adoption

-

7.3 SERVICESPRODUCT SUPPORT & MAINTENANCE SERVICES- Rising reliance on outsourcing HCIT support to boost demandTRAINING & CONSULTING SERVICES- Need to develop IT infrastructure and demand for expert assistance to offer growth opportunitiesIMPLEMENTATION SERVICES- Focus on ensuring regulatory compliance among end users to boost service sector growth

- 8.1 INTRODUCTION

-

8.2 HOSPITALSLARGE HOSPITALS- Growing need to deploy cloud-based solutions to drive growthMEDIUM-SIZED HOSPITALS- Increasing demand for more specialized and advanced care to boost marketSMALL HOSPITALS- Need to decrease operational costs and growing competition to support adoption

-

8.3 LONG-TERM CARE FACILITIESNURSING HOMES- Growing geriatric population to favor end-user growthSKILLED NURSING FACILITIES- Advancements in HCIT solutions to favor adoption in SNFsASSISTED LIVING FACILITIES- ALFs to show significant growth alongside rising geriatric population

- 8.4 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: IMPACT OF ECONOMIC RECESSIONUS- Advanced medical infrastructure and increasing healthcare expenditure to drive market growthCANADA- Rising adoption of advanced HCIT solutions to propel market growth

-

9.3 EUROPEEUROPE: IMPACT OF ECONOMIC RECESSIONGERMANY- Germany to hold largest share of European marketFRANCE- High healthcare spending and favorable government initiatives to drive market growth in FranceUK- Rising number of surgeries and implementation of favorable government initiatives to drive market growth in the UKITALY- Increasing adoption of eHealth technologies to propel market growth in ItalySPAIN- Emphasis on infrastructural improvement and rising disease prevalence to contribute to growthSWITZERLAND- Increasing demand for healthcare services and growing healthcare awareness to augment marketNETHERLANDS- Increasing healthcare initiatives to favor demand growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: IMPACT OF ECONOMIC RECESSIONJAPAN- Japan to dominate APAC market over forecast periodCHINA- Healthcare infrastructure improvements in China to contribute to market growthINDIA- Increasing demand for HCIT solutions to support market growthAUSTRALIA AND NEW ZEALAND- Increasing number of hospitalizations and government initiatives for infection prevention to drive market growth in ANZSOUTH KOREA- Increasing medical tourism to boost marketREST OF ASIA PACIFIC

-

9.5 LATIN AMERICAFAVORABLE HCIT INITIATIVES TO DRIVE MARKET GROWTHLATIN AMERICA: IMPACT OF ECONOMIC RECESSION

-

9.6 MIDDLE EAST & AFRICAIMPROVING HEALTHCARE INFRASTRUCTURE AND FOCUS ON SAFETY MEASURES TO DRIVE MARKET GROWTHMIDDLE EAST AND AFRICA: IMPACT OF ECONOMIC RECESSION

- 10.1 OVERVIEW

-

10.2 KEY PLAYER STRATEGIESOVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

- 10.3 ADOPTION TRENDS FOR INNOVATIVE SOLUTIONS

- 10.4 REVENUE SHARE ANALYSIS

- 10.5 MARKET SHARE ANALYSIS

- 10.6 COMPETITIVE BENCHMARKING

-

10.7 COMPANY EVALUATION QUADRANT, 2021STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.8 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

10.9 COMPETITIVE SCENARIOPRODUCT/SERVICE LAUNCHES/ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSBECTON, DICKINSON AND COMPANY- Business overview- Products & services offered- Recent developments- MnM viewCERNER CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewPREMIER, INC.- Business overview- Products & services offered- Recent developments- MnM viewBAXTER INTERNATIONAL INC.- Business overview- Products & services offered- MnM viewWOLTERS KLUWER N.V.- Business overview- Products & services offered- Recent developments- MnM viewMERATIVE- Business overview- Products & services offered- Recent developmentsECOLAB- Business overview- Products & services offered- Recent developmentsBIOMÉRIEUX SA- Business overview- Products & services offered- Recent developmentsGOJO INDUSTRIES, INC.- Business overview- Products & services offered- Recent developmentsRLDATIX- Business overview- Products & services offered- Recent developmentsVIGILANZ CORPORATION- Business overview- Products & services offered- Recent developmentsDEB GROUP LTD- Business overview- Products & services offeredCLINISYS- Business overview- Products & services offered- Recent developmentsBIOVIGIL HEALTHCARE SYSTEMS- Business overview- Products & services offered- Recent developmentsVECNA TECHNOLOGIES- Business overview- Products & services offeredHARRIS HEALTHCARE- Business overview- Products & services offered- Recent developmentsPERAHEALTH- Business overview- Products & services offered- Recent developmentsMEDEXTER HEALTHCARE- Business overview- Products & services offeredCENTRAK- Business overview- Products & services offered- Recent developmentsCKM HEALTHCARE INCORPORATED- Business overview- Products & services offered

-

11.2 OTHER PLAYERSASOLVA INC.POINTCLICKCAREVITALACY INC.STANLEY HEALTHCAREVIZZIA TECHNOLOGIES

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

- TABLE 2 RISK ASSESSMENT: INFECTION SURVEILLANCE SOLUTIONS MARKET

- TABLE 3 MARKET DYNAMICS: INFECTION SURVEILLANCE SOLUTIONS MARKET

- TABLE 4 US: PERCENTAGE INCREASE IN SURGICAL VOLUMES

- TABLE 5 AVERAGE SELLING PRICE OF HEALTHCARE IT SOLUTIONS, BY PRODUCT, 2021

- TABLE 6 NORTH AMERICA: REGULATIONS AND LAWS

- TABLE 7 EUROPE: REGULATIONS AND LAWS

- TABLE 8 ASIA: REGULATIONS AND LAWS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATIONS AND LAWS

- TABLE 10 LATIN AMERICA: REGULATIONS AND LAWS

- TABLE 11 KEY GLOBAL REGULATIONS & STANDARDS GOVERNING INFECTIONSURVEILLANCE SOLUTIONS

- TABLE 12 AI IN HEALTHCARE MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 13 AI IN HEALTHCARE MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 14 INFECTION SURVEILLANCE SOLUTIONS: LIST OF PATENTS/PATENT APPLICATIONS, 2020–2022

- TABLE 15 INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 16 INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 17 INFECTION SURVEILLANCE SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 ON-PREMISE SOFTWARE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 19 ON-PREMISE SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 WEB-BASED SOFTWARE OFFERED BY KEY MARKET PLAYERS

- TABLE 21 WEB-BASED SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 23 INFECTION SURVEILLANCE SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 24 PRODUCT SUPPORT & MAINTENANCE SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 25 TRAINING & CONSULTING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 IMPLEMENTATION SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 28 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 29 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LARGE HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR MEDIUM-SIZED HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR SMALL HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 34 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 35 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR NURSING HOMES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR SKILLED NURSING FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 37 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR ASSISTED LIVING FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 INFECTION SURVEILLANCE SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 39 INFECTION SURVEILLANCE SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE,2020–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 47 US: KEY MACROINDICATORS

- TABLE 48 US: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 49 US: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 50 US: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 51 US: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 52 US: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 53 US: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 54 CANADA: KEY MACROINDICATORS

- TABLE 55 CANADA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 56 CANADA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 57 CANADA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 58 CANADA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 59 CANADA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 60 CANADA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 61 EUROPE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 62 EUROPE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 63 EUROPE: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 64 EUROPE: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 65 EUROPE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 66 EUROPE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 67 EUROPE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 68 GERMANY: KEY MACROINDICATORS

- TABLE 69 GERMANY: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 70 GERMANY: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 71 GERMANY: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 72 GERMANY: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 73 GERMANY: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 74 GERMANY: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 FRANCE: KEY MACROINDICATORS

- TABLE 76 FRANCE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 77 FRANCE: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 78 FRANCE: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE,2020–2027 (USD MILLION)

- TABLE 79 FRANCE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 80 FRANCE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 81 FRANCE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 82 UK: KEY MACROINDICATORS

- TABLE 83 UK: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 84 UK: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 85 UK: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 86 UK: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 87 UK: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 88 UK: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 89 ITALY: KEY MACROINDICATORS

- TABLE 90 ITALY: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 91 ITALY: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 92 ITALY: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 93 ITALY: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 94 ITALY: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 95 ITALY: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 96 SPAIN: KEY MACROINDICATORS

- TABLE 97 SPAIN: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 98 SPAIN: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 99 SPAIN: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 SPAIN: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 101 SPAIN: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 102 SPAIN: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 103 SWITZERLAND: KEY MACROINDICATORS

- TABLE 104 SWITZERLAND: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 105 SWITZERLAND: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 SWITZERLAND: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 107 SWITZERLAND: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 108 SWITZERLAND: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 109 SWITZERLAND: INFECTION SURVEILLANCE SOLUTIONS MARKET FORLONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 110 NETHERLANDS: KEY MACROINDICATORS

- TABLE 111 NETHERLANDS: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 112 NETHERLANDS: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 113 NETHERLANDS: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 NETHERLANDS: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 115 NETHERLANDS: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 116 NETHERLANDS: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 117 ROE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 118 ROE: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 119 ROE: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 120 ROE: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 121 ROE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 122 ROE: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 129 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 130 JAPAN: KEY MACROINDICATORS

- TABLE 131 JAPAN: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 132 JAPAN: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 133 JAPAN: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 134 JAPAN: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 135 JAPAN: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 136 JAPAN: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 137 CHINA: KEY MACROINDICATORS

- TABLE 138 CHINA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 139 CHINA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 140 CHINA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 141 CHINA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 142 CHINA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 143 CHINA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 144 INDIA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 145 INDIA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 146 INDIA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 147 INDIA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 148 INDIA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 149 INDIA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 150 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 151 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 152 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 153 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 154 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 155 AUSTRALIA & NEW ZEALAND: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 156 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 157 SOUTH KOREA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 158 SOUTH KOREA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 159 SOUTH KOREA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 160 SOUTH KOREA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 161 SOUTH KOREA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 162 SOUTH KOREA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 163 ROAPAC: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 164 ROAPAC: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 165 ROAPAC: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 166 ROAPAC: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 167 ROAPAC: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 168 ROAPAC: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 169 LATIN AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 170 LATIN AMERICA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 171 LATIN AMERICA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 172 LATIN AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 173 LATIN AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 174 LATIN AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR HOSPITALS, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: INFECTION SURVEILLANCE SOLUTIONS MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 181 COMPANY FOOTPRINT ANALYSIS

- TABLE 182 PRODUCT & SERVICE FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 183 END-USER FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 184 REGIONAL FOOTPRINT ANALYSIS (25 COMPANIES)

- TABLE 185 INFECTION SURVEILLANCE SOLUTIONS MARKET: PRODUCT/SERVICE LAUNCHES/ENHANCEMENTS, 2020–2022

- TABLE 186 INFECTION SURVEILLANCE SOLUTIONS MARKET: DEALS, 2020–2022

- TABLE 187 INFECTION SURVEILLANCE SOLUTIONS MARKET: OTHER DEVELOPMENTS, 2020–2022

- TABLE 188 BD: COMPANY OVERVIEW

- TABLE 189 BD: PRODUCTS & SERVICES OFFERED

- TABLE 190 BD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 191 BD: DEALS

- TABLE 192 CERNER CORPORATION: COMPANY OVERVIEW

- TABLE 193 CERNER CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 194 CERNER CORPORATION: DEALS

- TABLE 195 PREMIER, INC.: COMPANY OVERVIEW

- TABLE 196 PREMIER, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 197 PREMIER, INC.: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 198 PREMIER, INC.: DEALS

- TABLE 199 BAXTER INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 200 BAXTER INTERNATIONAL INC.: PRODUCTS & SERVICES OFFERED

- TABLE 201 WOLTERS KLUWER N.V.: COMPANY OVERVIEW

- TABLE 202 WOLTERS KLUWER N.V.: PRODUCTS & SERVICES OFFERED

- TABLE 203 WOLTERS KLUWER N.V.: LAUNCHES/ENHANCEMENTS

- TABLE 204 WOLTERS KLUWER N.V.: OTHERS

- TABLE 205 MERATIVE: COMPANY OVERVIEW

- TABLE 206 MERATIVE: PRODUCTS & SERVICES OFFERED

- TABLE 207 MERATIVE: OTHERS

- TABLE 208 ECOLAB: COMPANY OVERVIEW

- TABLE 209 ECOLAB: PRODUCTS & SERVICES OFFERED

- TABLE 210 ECOLAB: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 211 ECOLAB: DEALS

- TABLE 212 ECOLAB: OTHERS

- TABLE 213 BIOMÉRIEUX SA: COMPANY OVERVIEW

- TABLE 214 BIOMÉRIEUX SA: PRODUCTS & SERIVCES OFFERED

- TABLE 215 BIOMÉRIEUX SA: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 216 BIOMÉRIEUX SA: DEALS

- TABLE 217 GOJO INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 218 GOJO INDUSTRIES, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 219 GOJO INDUSTRIES: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 220 RLDATIX: COMPANY OVERVIEW

- TABLE 221 RLDATIX: PRODUCTS & SERVICES OFFERED

- TABLE 222 RLDATIX: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 223 RLDATIX: DEALS

- TABLE 224 VIGILANZ CORPORATION: COMPANY OVERVIEW

- TABLE 225 VIGILANZ CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 226 VIGILANZ CORPORATION: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 227 DEB GROUP LTD.: COMPANY OVERVIEW

- TABLE 228 DEB GROUP LTD.: PRODUCTS & SERVICES OFFERED

- TABLE 229 CLINISYS: COMPANY OVERVIEW

- TABLE 230 CLINISYS: PRODUCTS & SERVICES OFFERED

- TABLE 231 CLINISYS: DEALS

- TABLE 232 BIOVIGIL HEALTHCARE SYSTEMS: COMPANY OVERVIEW

- TABLE 233 BIOVIGIL HEALTHCARE SYSTEMS: PRODUCTS & SERVICES OFFERED

- TABLE 234 BIOVIGIL HEALTHCARE SYSTEMS: DEALS

- TABLE 235 VECNA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 236 VECNA TECHNOLOGIES: PRODUCTS & SERVICES OFFERED

- TABLE 237 HARRIS HEALTHCARE: COMPANY OVERVIEW

- TABLE 238 HARRIS HEALTHCARE: PRODUCTS & SERVICES OFFERED

- TABLE 239 HARRIS HEALTHCARE: DEALS

- TABLE 240 PERAHEALTH: COMPANY OVERVIEW

- TABLE 241 PERAHEALTH: PRODUCTS & SERVICES OFFERED

- TABLE 242 PERAHEALTH: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 243 PERAHEALTH: DEALS

- TABLE 244 PERAHEALTH: OTHERS

- TABLE 245 MEDEXTER HEALTHCARE: COMPANY OVERVIEW

- TABLE 246 MEDEXTER HEALTHCARE: PRODUCTS & SERVICES OFFERED

- TABLE 247 MEDEXTER HEALTHCARE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 248 CENTRAK: COMPANY OVERVIEW

- TABLE 249 CENTRAK: PRODUCTS & SERVICES OFFERED

- TABLE 250 CENTRAK: PRODUCT LAUNCHES

- TABLE 251 CENTRAK: DEALS

- TABLE 252 CENTRAK: OTHERS

- TABLE 253 CKM HEALTHCARE INCORPORATED: COMPANY OVERVIEW

- TABLE 254 CKM HEALTHCARE INCORPORATED: PRODUCTS & SERVICES OFFERED

- FIGURE 1 INFECTION SURVEILLANCE SOLUTIONS MARKET SEGMENTATION

- FIGURE 2 INFECTION SURVEILLANCE SOLUTIONS MARKET: RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 CAGR PROJECTIONS

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 INFECTION SURVEILLANCE SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 INFECTION SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

- FIGURE 14 INFECTION SURVEILLANCE SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 15 INFECTION SURVEILLANCE SOLUTIONS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 16 INFECTION SURVEILLANCE SOLUTIONS MARKET: GEOGRAPHICAL SNAPSHOT, 2021

- FIGURE 17 GROWING INCIDENCE OF HOSPITAL-ACQUIRED INFECTIONS TO DRIVE MARKET GROWTH

- FIGURE 18 HOSPITALS HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

- FIGURE 19 CHINA TO REGISTER HIGHEST REVENUE GROWTH FROM 2022 TO 2027

- FIGURE 20 NORTH AMERICA TO DOMINATE INFECTION SURVEILLANCE SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

- FIGURE 22 HEALTHCARE IT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 INFECTION SURVEILLANCE SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2012–JANUARY 2023)

- FIGURE 25 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR INFECTION SURVEILLANCE SOLUTIONS PATENTS (JANUARY 2012– JANUARY 2023)

- FIGURE 26 TOP APPLICANT COUNTRIES/REGIONS FOR INFECTION SURVEILLANCE SOLUTIONS PATENTS (JANUARY 2012–JANUARY 2023)

- FIGURE 27 INFECTION SURVEILLANCE SOLUTIONS MARKET: GEOGRAPHIC SNAPSHOT (2020–2027)

- FIGURE 28 NORTH AMERICA: INFECTION SURVEILLANCE SOLUTIONS MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: INFECTION SURVEILLANCE SOLUTIONS MARKET SNAPSHOT

- FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 31 INFECTION SURVEILLANCE SOLUTIONS MARKET: MARKET SHARE ANALYSIS, 2021

- FIGURE 32 INFECTION SURVEILLANCE SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 33 INFECTION SURVEILLANCE SOLUTIONS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2021

- FIGURE 34 BD: COMPANY SNAPSHOT, 2022

- FIGURE 35 CERNER CORPORATION: COMPANY SNAPSHOT, 2021

- FIGURE 36 PREMIER, INC.: COMPANY SNAPSHOT, 2022

- FIGURE 37 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT, 2021

- FIGURE 38 WOLTERS KLUWER N.V.: COMPANY SNAPSHOT, 2021

- FIGURE 39 ECOLAB: COMPANY SNAPSHOT, 2021

- FIGURE 40 BIOMÉRIEUX SA: COMPANY SNAPSHOT, 2021

The study involved major activities in estimating the current size of the global infcetion surveillance solutions market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the infection surveillance solutions market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the infection surveillance solutions market. The primary sources from the demand side include key executives from hospitals, long-term care facilities, ambulatory care settings, imaging and diagnostic services, assisted living facilities and research laboratories. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

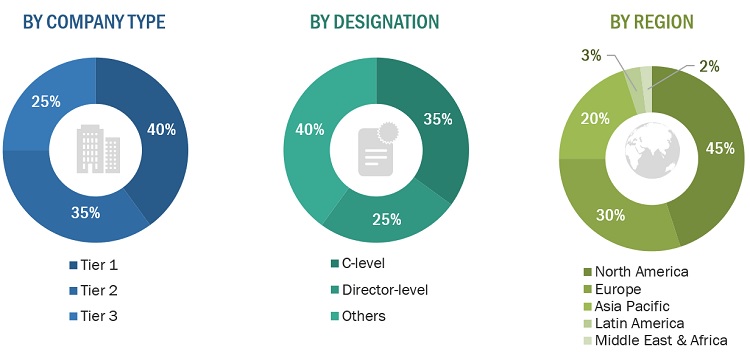

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends, by product & service, end user, and region) were used to estimate and validate the total size of the infection surveillance solutions market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Infection Surveillance Solutions Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the infection surveillance solutions market by product & service, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the global market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, investments, joint ventures, sales contracts, and R&D activities of the leading players in the global market

- To benchmark players within the global market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of region or country-specific analysis

- Further breakdown of the Latin American market into Brazil, Mexico, and other Latin American countries.

- Further breakdown of the MEA (Middle East & Africa) market into the UAE, Saudi Arabia, and other MEA countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infection Surveillance Solutions Market

Want to know about the key driving factors of Infection Surveillance Solutions Market

What is the gross addressable market of Infection Surveillance Solutions Industry

What are the growth estimates for Infection Surveillance Solutions Market till 2026?