Hospital Acquired Infection Control Market by Product & Service [Sterilization (Equipment, Services), Disinfectants (Hand, Skin, Surface, Wipes, Sprays)], End User (Hospitals, Nursing Homes, Diagnostic Centers) & Region - Global Forecast to 2026

Market Growth Outlook Summary

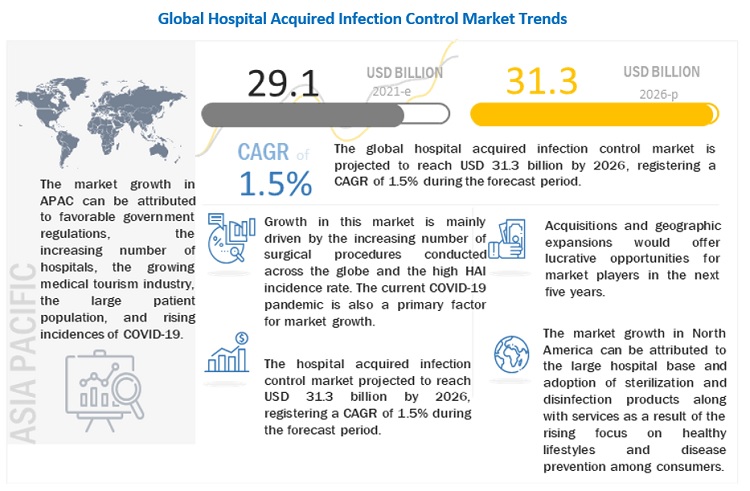

The global hospital acquired infection control market growth forecasted to transform from $29.1 billion in 2021 to $31.3 billion by 2026, driven by a CAGR of 1.5%. The growth of this market can largely be attributed to factors such as the high incidence of hospital-acquired infections, the increasing number of surgical procedures, the growing geriatric population and the increasing incidence of chronic diseases, technological advancements in sterilization equipment, and the growing awareness of environmental & personal hygiene due to COVID-19. The increasing use of E-beam sterilization, reintroduction of ethylene oxide sterilization, and the growing healthcare industry and outsourcing of operation to emerging countries are expected to offer high-growth opportunities for market players during the forecast period. Currently, with the surge in COVID-19 cases, there is an increasing focus on personal hygiene along with the increasing production of medical nonwovens and single-use products such as face masks and gloves. This is further expected to drive the growth of the global market in the coming years. On the other hand, concerns regarding the safety of reprocessed instruments are expected to limit market growth to some extent in the coming years. This, along with factors such as the high cost of endoscope reprocessing and limited reimbursement in developing countries and end-user noncompliance with sterilization standards, is expected to restrain the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

Hospital Acquired Infection Control Market Dynamics

Driver: Increasing number of surgical procedures

Over the years, there has been a significant rise in the number of surgical procedures performed worldwide. According to the WHO (2019), approximately 235 million major surgical procedures are performed worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, and the increasing incidence of spinal injuries and sports-related injuries. The growing number of surgical procedures performed has resulted in the increasing demand for different surgical equipment and medical devices. This is expected to drive the demand for hospital acquired infection services due to the proven benefits of sterilized products and growing awareness about their effectiveness in healthcare settings.

Restraint: Concerns regarding the safety of reprocessed instruments

Healthcare providers reprocess reusable medical devices to save money and reduce waste. Examples of reusable medical devices include surgical forceps, endoscopes, and stethoscopes. However, there are concerns about the safety and performance of reprocessed devices. Inadequate cleaning and sterilization of instruments can result in the retention of blood, tissue, and other biological debris in reusable devices, which increases the risk of surgical-site infections (SSIs) in patients. The debris can allow microbes to survive the subsequent disinfection or sterilization process, which could then lead to HAIs. Inadequate reprocessing can also result in other adverse patient outcomes, such as tissue irritation from residual reprocessing materials such as chemical disinfectants. These factors are limiting the acceptance of reprocessing among hospital administrators and physicians.

Opportunity: Reintroduction of ethylene oxide sterilization

Ethylene oxide is one of the most effective gaseous sterilizing agents for instruments susceptible to high temperatures, such as plastic instruments and instruments with electrical components. However, the CDC has stated that chronic exposure to ethylene oxide in workplaces can cause cancer. Also, ethylene oxide sterilization can irritate the skin and mucous membranes, resulting in CNS abnormalities in humans. Similarly, acute exposure to EtO gas may result in respiratory irritation, lung injury, headache, nausea, vomiting, diarrhea, shortness of breath, and cyanosis. EtO also degrades in the atmosphere by reacting with photochemically produced hydroxyl radicals. Authorities in several countries have defined regulatory frameworks to govern EtO usage in specific sterilization applications. In December 2016, the US Environmental Protection Agency (EPA), under the Integrated Risk Information System (IRIS) Assessment Program, declared ethylene oxide a probable human carcinogen. The European Union has already banned the use of ethylene oxide for any food fumigation due to safety and environmental concerns. The use of EtO for sterilizing ground spices is forbidden in the US.

However, with the growing number of COVID-19 cases worldwide, the adoption of EtO has increased to sterilize protective gear and single-use instruments before their initial use. This sterilization technology plays a vital role in enabling the sterilization of critical medical products and devices before reaching patients. According to the FDA, more than 20 billion devices sold in the US every year are sterilized with EtO, accounting for approximately 50% of the devices that require sterilization.

Challenge: Complications associated with hospital acquired infection control procedures

There are certain concerns related to the cleaning, disinfection, and sterilization of advanced medical devices. Inadequate sterilization and disinfection of these devices might expose patients to the risk of acquiring HAIs. Moreover, with the introduction of technologically advanced instruments such as endoscopes and analyzers in the market, there is a growing need for advanced sterilizers compatible with the automated endoscope reprocessors used for cleaning and disinfecting flexible endoscopes after each procedure. Inappropriate disinfection of these complex and delicate instruments can increase the risk of infection among patients. An AER that is difficult to use or one that breaks down frequently can significantly increase the risk of improper or ineffective endoscope cleaning and create costly delays. Currently, reprocessing of these instruments after every use is a major challenge faced by healthcare providers in complying with infection control standards.

The Association for the Advancement of Medical Instrumentation has several working groups focusing on developing standards in several areas aimed to address the challenges involved in reprocessing medical devices. These working groups are focusing on instructions for reusable device reprocessing, steam sterilization hospital practices, reusable surgical textiles processing, endoscope reprocessing, human factors for device reprocessing, quality systems for device reprocessing, and cleaning of reusable medical devices. Reprocessing medical devices is a difficult and complex job. Currently, hospitals are demanding sterile processing staff to be certified as it is a skill-intensive process.

The ethylene oxide (EtO) sterilization segment is expected to account for the largest share of the hospital acquired infection control industry

Based on method, the hospital acquired infection control market has been classified into ethylene oxide (EtO) sterilization, gamma sterilization, electron beam (e-beam) radiation sterilization, steam sterilization, x-ray irradiation, and other sterilization methods. The ethylene oxide (EtO) sterilization segment accounted for the largest share of the global market. This segment’s large share can be attributed to its extensive usage in various applications, including medical device sterilization, food testing, pharmaceutical sterilization, and sterilization and disinfection in the life sciences industry.

The protective barrier segment accounted for the largest share of the global hospital acquired infection control industry

Based on the products and services used in the control of HAIs, the global hospital acquired infection control market is segmented into sterilization, disinfectors, endoscope reprocessing products, disinfectants, protective barriers, and other infection control products. The protective barrier segment accounted for the largest share of the global market. Once the pandemic situation returns to normalcy, the purchase of protective barriers will witness a downward trend. This is expected to result in a negative growth rate of the protective barriers segment.

The ambulatory surgical and diagnostic centers segment of the hospital acquired infection control industry is expected to witness the highest CAGR during the forecast time

Based on end user, the global hospital acquired infection control market has been segmented into hospitals & intensive care units (ICUs), ambulatory surgical and diagnostic centers, nursing homes and maternity centers, and other end users (dental clinics, trauma centers, and clinical laboratories). The ambulatory surgical and diagnostic centers segment is expected to witness the highest CAGR during the forecast time. The highest CAGR of this market is majorly attributed to the rising prevalence of HAIs, increasing adoption of single-use medical devices, growing medical devices industry, and rising number of surgical procedures worldwide. Also, increasing demand for minimally invasive surgeries, and growth in the development of outpatient services fuel the growth of the ambulatory surgical centers. In addition, the number of outpatients has increased significantly as a result of increased public health awareness and initiatives by the government to provide ambulatory healthcare services.

North America is expected to account for the largest share of the hospital acquired infection control industry

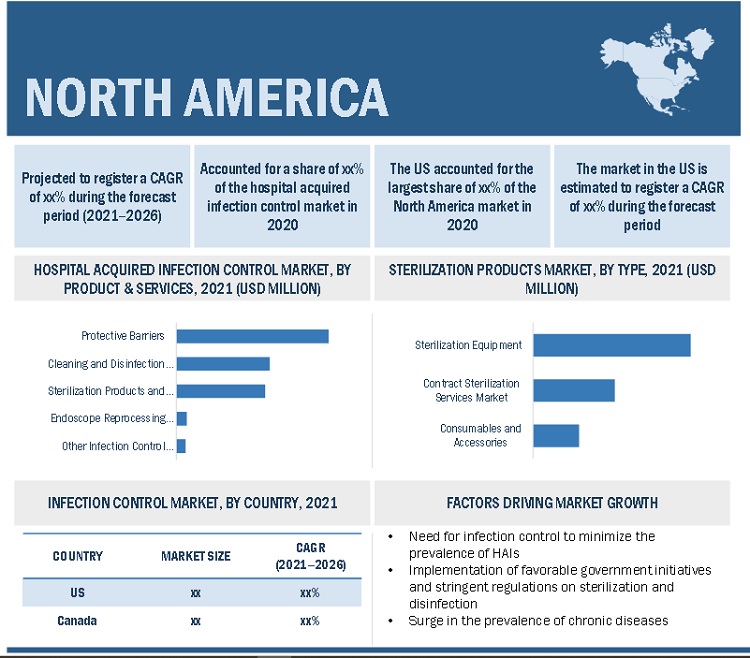

North America accounted for the largest share of the global hospital acquired infection control market. Market growth in this region is characterized by the growing demand for and adoption of sterilization and disinfection products along with services as a result of the rising focus on healthy lifestyles and disease prevention among consumers. The surge in the geriatric population in the coming years and the subsequent increase in the prevalence of chronic diseases, the need for hospital acquired infection control to minimize the prevalence of HAIs, and implementation of favorable government initiatives and stringent regulations on sterilization and disinfection are also propelling the hospital acquired infection market in the region.

The prominent players in this market are STERIS plc (US), Sotera Health Company (US), Getinge AB (Sweden), Advanced Sterilization Products (ASP) (US), Ecolab Inc. (US), 3M Company (US), MATACHANA GROUP (Spain), MMM Group (Germany), Belimed AG (Switzerland), Reckitt Benckiser (UK), Metrex Research LLC (UK), Miele Group (Germany), Pal International (UK), MELAG Medizintechnik GmbH & Co. KG (Germany), Contec, Inc. (US), MEDALKAN (Greece), Systec GmbH (Germany), C.B.M. S.r.l. Medical Equipment (Italy), Continental Equipment Company (US), and BGS Beta-Gamma-Service GmbH & Co. KG (Germany)

Scope of the Hospital Acquired Infection Control Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$29.1 billion |

|

Projected Revenue Size by 2026 |

$31.3 billion |

|

Industry Growth Rate |

poised to grow at a CAGR of 1.5% |

|

Market Driver |

Increasing number of surgical procedures |

|

Market Opportunity |

Reintroduction of ethylene oxide sterilization |

The study categorizes the global hospital acquired infection control market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Services

- Protective Barrier

- Sterilization

-

Disinfectants

-

Disinfectant, By Product

- Hand Disinfectants

- Surface Disinfectants

- Skin Disinfectants

- Instrument Disinfectants

-

Disinfectant, By Formulation

- Liquid Disinfectants

- Disinfectant Wipes

- Disinfectant Sprays

-

Disinfectant, By Product

- Disinfectors

- Endoscope Reprocessing Products

- Other Infection Control Products

By End User

- Hospitals & ICUs

- Ambulatory Surgical & Diagnostic Centers

- Nursing Homes & Maternity Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments of Hospital Acquired Infection Control Industry

- In 2021, STERIS acquired Cantel, a global provider of infection prevention products and services, through a US subsidiary, to diversify its vast portfolio of sterilization services.

- In 2021, Sterigenics S.A.S., a subsidiary of Sotera Health Company, expanded its ethylene oxide (EO) facility located in Rantigny, France, thereby increasing its European sterilization capacity.

- In 2020, Getinge launched the Getinge Solsus 66 steam sterilizer for hospitals and surgical instruments with increased capacity and operational reliability compared to other sterilizers

- In 2020, Sotera Health Company acquired Iotron, a key outsourced provider of E-beam sterilization services in North America. This acquisition helped expand its electron beam (E-beam) footprint and added new expertise to its Sterigenics business.

- In 2020, STERIS completed the acquisition of Key Surgical, a global provider of sterile processing, operating room, and endoscopy products. This acquisition enhanced the company’s product offering and STERIS’ revenue by 35%.

- In 2020, 3M partnered with Cummins to increase the production of high-efficiency particulate filters for use in 3M’s powered air-purifying respirators (PAPRs) due to the surge in demand for personal protective equipment due to the COVID-19 outbreak

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the hospital acquired infection control market?

The hospital acquired infection control market boasts a total revenue value of $31.3 billion by 2026.

What is the estimated growth rate (CAGR) of the hospital acquired infection control market?

The global hospital acquired infection control market has an estimated compound annual growth rate (CAGR) of 1.5% and a revenue size in the region of $29.1 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY DEFINITION & SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKET SEGMENTATION

FIGURE 1 HOSPITAL ACQUIRED INFECTION CONTROL MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 HOSPITAL ACQUIRED INFECTION CONTROL MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION: MARKET

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 TOP-DOWN APPROACH

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MARKET (2021–2026)

FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 11 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 12 HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY PRODUCT & SERVICE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY FOR DISINFECTANTS, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY FOR DISINFECTANTS, BY FORMULATION, 2021 VS. 2026 (USD MILLION)

FIGURE 15 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 16 GEOGRAPHIC ANALYSIS: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 HOSPITAL ACQUIRED INFECTION CONTROL MARKET OVERVIEW

FIGURE 17 GROWING INCIDENCE OF HAIS AND INCREASING NUMBER OF SURGICAL PROCEDURES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY END USER AND COUNTRY

FIGURE 18 HOSPITALS & ICUS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 CHINA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.4 MARKET, BY REGION (2019–2026)

FIGURE 20 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY DYNAMICS

TABLE 3 HOSPITAL ACQUIRED INFECTION CONTROL MARKET: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 High incidence of hospital-acquired infections (HAIs)

5.2.1.2 Increasing number of surgical procedures

TABLE 4 US: PERCENTAGE INCREASE IN THE NUMBER OF SURGERIES PERFORMED

5.2.1.3 Growing geriatric population and the increasing incidence of chronic diseases

5.2.1.4 Technological advancements in sterilization equipment

5.2.1.5 Growing awareness of environmental & personal hygiene due to COVID-19

5.2.2 MARKET RESTRAINTS

5.2.2.1 Concerns regarding the safety of reprocessed instruments

5.2.2.2 Adverse effects of chemical disinfectants

5.2.2.3 High cost of endoscopy reprocessing and limited reimbursement in developing countries

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Reintroduction of ethylene oxide sterilization as a disinfectant in healthcare settings

5.2.3.2 Rising adoption of single-use medical nonwovens and devices

5.2.3.3 Growing healthcare industry and outsourcing of operations to emerging countries

FIGURE 22 INDIA: HEALTHCARE SECTOR GROWTH TREND (USD BILLION)

FIGURE 23 INDIA: NUMBER OF HOSPITALIZATIONS DUE TO VARIOUS DISEASES

5.2.4 MARKET CHALLENGES

5.2.4.1 Complications associated with hospital-acquired infection control procedures

5.2.4.2 End-user noncompliance with sterilization standards

TABLE 5 US: DECREASING COMPLIANCE AMONG END USERS

5.2.4.3 Development of alternative technologies for surface disinfection

6 INDUSTRY INSIGHTS (Page No. - 73)

6.1 INTRODUCTION

6.2 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY TRENDS

6.2.1 INCREASING ADOPTION OF STERILIZATION USING NO2

6.2.2 ROBOTICS UTILIZATION FOR DISINFECTION

6.2.3 GROWING POPULARITY OF SINGLE-USE PRODUCTS

6.2.4 LAYERING/BUNDLING IN INFECTION PREVENTION

6.3 REGULATORY ANALYSIS

6.3.1 REGULATORY JURISDICTION

TABLE 6 FDA- AND EPA-REGISTERED PRODUCT CATEGORIES

6.3.2 BY REGION

6.3.2.1 North America

6.3.2.1.1 US

FIGURE 24 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR REPROCESSED MEDICAL DEVICES

6.3.2.1.2 Canada

TABLE 7 SPAULDING’S CLASSIFICATION OF MEDICAL EQUIPMENT/DEVICES AND REQUIRED LEVEL OF PROCESSING/REPROCESSING

6.3.2.2 Europe

TABLE 8 STERILIZATION STANDARDS IN THE EUROPEAN UNION

FIGURE 25 CE MARKING FOR REPROCESSED MEDICAL DEVICES

6.3.2.3 Asia Pacific

6.3.2.3.1 Japan

TABLE 9 SOME GUIDELINES FOLLOWED UNDER ISO IN JAPAN

TABLE 10 SPECIFICATIONS OF BIS RECOMMENDED FOR USE IN STERILIZATION PROCESSES

6.3.2.3.2 Australia

6.3.2.4 Latin America

6.3.3 ENFORCEMENT POLICY FOR STERILIZERS AND DISINFECTANT DEVICES DURING COVID-19

6.3.3.1 Sterilizers

TABLE 11 CLASSIFICATION REGULATIONS FOR STERILIZERS

6.3.3.2 Disinfectant devices

TABLE 12 CLASSIFICATION REGULATION FOR DISINFECTANT DEVICES

6.4 TECHNOLOGY ANALYSIS

6.4.1 KEY TECHNOLOGIES

6.4.2 COMPLEMENTARY TECHNOLOGIES

6.4.3 ADJACENT TECHNOLOGIES

6.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 PORTER’S FIVE FORCES ANALYSIS (2020): MARKET

6.5.1 THREAT FROM NEW ENTRANTS

6.5.2 THREAT FROM SUBSTITUTES

6.5.3 BARGAINING POWER OF SUPPLIERS

6.5.4 BARGAINING POWER OF BUYERS

6.5.5 INTENSITY OF COMPETITIVE RIVALRY

6.6 ECOSYSTEM ANALYSIS

FIGURE 26 INFECTION CONTROL MARKET: ECOSYSTEM ANALYSIS

6.7 VALUE CHAIN ANALYSIS

FIGURE 27 INFECTION CONTROL MARKET: VALUE CHAIN ANALYSIS

6.8 TRADE DATA

6.8.1 EXPORT DATA (USD)

6.8.2 IMPORT DATA (USD)

6.9 PATENT ANALYSIS

6.9.1 PATENT PUBLICATION TRENDS FOR HOSPITAL-ACQUIRED INFECTION CONTROL

FIGURE 28 PATENT PUBLICATION TRENDS (JANUARY 2011–JULY 2021)

6.9.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR HOSPITAL-ACQUIRED INFECTION CONTROL PATENTS (JANUARY 2011–JULY 2021)

FIGURE 30 TOP APPLICANT COUNTRIES/REGIONS FOR HOSPITAL-ACQUIRED INFECTION CONTROL PATENTS (JANUARY 2011–JULY 2021)

TABLE 14 LIST OF FEW PATENTS IN THE MARKET, 2020–2021

6.10 IMPACT OF COVID-19 ON THE MARKET

7 HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY PRODUCT & SERVICE (Page No. - 98)

7.1 INTRODUCTION

TABLE 15 COMMONLY USED INFECTION CONTROL CHEMICALS

TABLE 16 GLOBAL HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

7.2 PROTECTIVE BARRIERS

7.2.1 RISING ADOPTION OF NONWOVENS IN SURGICAL INTERVENTIONS TO PROPEL MARKET GROWTH

TABLE 17 MARKET FOR PROTECTIVE BARRIERS, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 STERILIZATION

TABLE 18 GLOBAL MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 19 GLOBAL MARKET FOR STERILIZATION, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 STERILIZATION EQUIPMENT

7.3.1.1 Effectiveness of sterilization equipment in sterilizing heat-sensitive products is expected to boost the market growth

TABLE 20 STERILIZATION EQUIPMENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 STERILIZATION SERVICES

7.3.2.1 Increasing prevalence of HAIs and rising surgical interventions to drive market growth

TABLE 21 STERILIZATION SERVICES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 STERILIZATION CONSUMABLES & ACCESSORIES

7.3.3.1 Low cost and efficacy of sterilization consumables & accessories in monitoring the sterilization process to drive market growth

TABLE 22 STERILIZATION CONSUMABLES & ACCESSORIES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 DISINFECTANTS

TABLE 23 JOINT COMMISSION STANDARDS FOR INFECTION CONTROL AND PREVENTION

TABLE 24 COMMON DISINFECTANTS USED IN HEALTHCARE SETTINGS

TABLE 25 MARKET FOR DISINFECTANTS, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1 DISINFECTANTS, BY TYPE

TABLE 26 MARKET FOR DISINFECTANTS, BY TYPE, 2019–2026 (USD MILLION)

7.4.1.1 Hand disinfectants

7.4.1.1.1 Increasing availability of various hand disinfection options to aid market growth

TABLE 27 HAND DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

TABLE 28 HAND DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1.2 Surface disinfectants

7.4.1.2.1 Surface disinfectants limit the transfer of microorganisms that can occur through hand contact between contaminated surfaces and patients or staff

TABLE 29 SURFACE DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

TABLE 30 SURFACE DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1.3 Skin disinfectants

7.4.1.3.1 Growing awareness about different HAIs and SSIs to aid market growth

TABLE 31 SKIN DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

TABLE 32 SKIN DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.1.4 Instrument disinfectants

7.4.1.4.1 Increasing number of surgeries and government initiatives for ensuring cleanliness in healthcare facilities are boosting the instrument disinfectants market

TABLE 33 SPAULDING’S CLASSIFICATION OF MEDICAL EQUIPMENT AND THE REQUIRED LEVEL OF REPROCESSING

TABLE 34 INSTRUMENT DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2 DISINFECTANTS, BY FORMULATION

TABLE 35 MARKET FOR DISINFECTANTS, BY FORMULATION, 2019–2026 (USD MILLION)

7.4.2.1 Liquid disinfectants

7.4.2.1.1 Liquid formulations are inexpensive and are an effective disinfection solution for porous and nonporous surfaces

TABLE 36 LIQUID DISINFECTANTS OFFERED BY KEY MARKET PLAYERS

TABLE 37 LIQUID DISINFECTANTS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2.2 Disinfectant wipes

7.4.2.2.1 Wipes help eliminate a broad spectrum of bacteria, viruses, and allergens

TABLE 38 DISINFECTANT WIPES OFFERED BY KEY MARKET PLAYERS

TABLE 39 DISINFECTANT WIPES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4.2.3 Disinfectant sprays

7.4.2.3.1 Disinfectant sprays are used in fogging techniques for antimicrobial control in hospital rooms and operation theaters

TABLE 40 DISINFECTANT SPRAYS OFFERED BY KEY MARKET PLAYERS

TABLE 41 DISINFECTANT SPRAYS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 DISINFECTORS

7.5.1 GROWING NEED TO REDUCE THE SPREAD OF HAIS IS DRIVING MARKET GROWTH

TABLE 42 GLOBAL MARKET FOR DISINFECTORS, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 ENDOSCOPE REPROCESSING PRODUCTS

7.6.1 INCREASING NUMBER OF ENDOSCOPY PROCEDURES CONDUCTED TO DRIVE MARKET GROWTH

TABLE 43 MARKET FOR ENDOSCOPE REPROCESSING PRODUCTS, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 OTHER INFECTION CONTROL PRODUCTS

TABLE 44 GLOBAL MARKET FOR OTHER INFECTION CONTROL PRODUCTS, BY COUNTRY, 2019–2026 (USD MILLION)

8 HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY END USER (Page No. - 131)

8.1 INTRODUCTION

TABLE 45 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

8.2 IMPACT OF COVID-19 ON THE END USERS IN THE MARKET

8.3 HOSPITALS & INTENSIVE CARE UNITS (ICUS)

8.3.1 HIGH PREVALENCE OF HAIS TO DRIVE THE DEMAND FOR DISINFECTION AND STERILIZATION PRODUCTS AMONG HOSPITALS & INTENSIVE CARE UNITS

TABLE 46 MARKET FOR HOSPITALS & INTENSIVE CARE UNITS, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 AMBULATORY SURGERY & DIAGNOSTIC CENTERS

8.4.1 GROWING NUMBER OF OUTPATIENTS AND AWARENESS OF MINIMALLY INVASIVE SURGERIES IS EXPECTED TO PROPEL MARKET GROWTH

TABLE 47 MARKET FOR AMBULATORY SURGERY & DIAGNOSTIC CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 NURSING HOMES & MATERNITY CENTERS

8.5.1 GROWING NEED TO ENSURE THE SAFETY OF ELDERLY PATIENTS AND RISING SURGICAL PROCEDURES IN WOMEN TO DRIVE THE ADOPTION OF HAI CONTROL PRODUCTS IN THIS END-USER SEGMENT

TABLE 48 MARKET FOR NURSING HOMES & MATERNITY CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

8.6 OTHER END USERS

TABLE 49 MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

9 HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY REGION (Page No. - 142)

9.1 INTRODUCTION

FIGURE 31 GLOBAL HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY: GEOGRAPHIC SNAPSHOT (2020)

TABLE 50 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 IMPACT OF COVID-19 ON THE GLOBAL MARKET

9.3 NORTH AMERICA

TABLE 51 NATIONAL ACUTE CARE HOSPITAL HAI METRICS

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 57 NORTH AMERICA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.1 US

9.3.1.1 Increasing prevalence of HAIs, high R&D expenditure, and the presence of well-established pharmaceutical, medical devices, and hospital industries to drive market growth

TABLE 59 US: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 60 US: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 61 US: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 62 US: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 US: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 64 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.3.2 CANADA

9.3.2.1 High prevalence of HAIs to increase the adoption of infection control products in the country

TABLE 65 CANADA: HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 66 CANADA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 67 CANADA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 68 CANADA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 69 CANADA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 70 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4 EUROPE

TABLE 71 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 73 EUROPE: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 75 EUROPE: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 76 EUROPE: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.1 GERMANY

9.4.1.1 Rising incidence of nosocomial infections and chronic diseases to drive growth in the market in Germany

TABLE 78 GERMANY: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 79 GERMANY: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 GERMANY: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 81 GERMANY: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 GERMANY: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.2 FRANCE

9.4.2.1 High healthcare spending in the country to favor market growth

TABLE 84 FRANCE: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 85 FRANCE: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 FRANCE: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 FRANCE: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 88 FRANCE: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 89 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.3 UK

9.4.3.1 Rising number of surgical procedures to drive the market growth in the UK

TABLE 90 UK: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 91 UK: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 UK: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 UK: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 94 UK: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 95 UK: HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.4 ITALY

9.4.4.1 Improving quality and accessibility to medical care and technologies to support market growth

TABLE 96 ITALY: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 97 ITALY: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 ITALY: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 ITALY: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ITALY: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 101 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.5 SPAIN

9.4.5.1 Rising incidence of chronic disorders to drive market growth

TABLE 102 SPAIN: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 103 SPAIN: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 SPAIN: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 105 SPAIN: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 SPAIN: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 107 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.4.6 REST OF EUROPE

TABLE 108 ROE: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 109 ROE: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 ROE: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 111 ROE: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 ROE: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 113 ROE: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 119 ASIA PACIFIC: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.1 JAPAN

9.5.1.1 Rising standard of care due to the increasing healthcare expenditure to support market growth

TABLE 121 JAPAN: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 122 JAPAN: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 JAPAN: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 JAPAN: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 125 JAPAN: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.2 CHINA

9.5.2.1 China is the fastest-growing market for hospital-acquired infection control products and services

FIGURE 34 CHINA: TOTAL NUMBER OF HOSPITAL BEDS (2009–2019)

TABLE 127 CHINA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 128 CHINA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 CHINA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 CHINA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 CHINA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 132 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.3 INDIA

9.5.3.1 Large patient population to support the growth of the MARKET in the country

TABLE 133 INDIA: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 134 INDIA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 INDIA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 INDIA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 INDIA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 138 INDIA: HOSPITAL ACQUIRED INFECTION CONTROL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.5.4 REST OF ASIA PACIFIC

FIGURE 35 NUMBER OF INBOUND VISITORS TO SOUTH KOREA FROM 2000 TO 2020 (IN MILLIONS)

TABLE 139 ROAPAC: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 140 ROAPAC: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 ROAPAC: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 ROAPAC: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 ROAPAC: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 144 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 RISING NUMBER OF COSMETIC SURGERIES IN THE REGION TO DRIVE THE ADOPTION OF INFECTION CONTROL PRODUCTS

TABLE 145 LATIN AMERICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 LATIN AMERICA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.7 MIDDLE EAST & AFRICA

9.7.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND FOCUS ON SAFETY MEASURES TO DRIVE MARKET GROWTH

TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT & SERVICE, 2019–2026 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET FOR STERILIZATION, BY TYPE, 2019–2026 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: MARKET FOR DISINFECTANT PRODUCTS, BY TYPE, 2019–2026 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: DISINFECTANTS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: DISINFECTANTS MARKET, BY FORMULATION, 2019–2026 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 201)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN THE HOSPITAL ACQUIRED INFECTION CONTROL MARKET

10.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 36 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 37 MARKET SHARE, BY KEY PLAYER, 2020

TABLE 157 HOSPITAL ACQUIRED INFECTION CONTROL INDUSTRY: DEGREE OF COMPETITION

10.5 COMPETITIVE BENCHMARKING

10.5.1 COMPANY PRODUCT/SERVICE FOOTPRINT

TABLE 158 COMPANY PRODUCT OFFERING FOOTPRINT (20 COMPANIES)

TABLE 159 COMPANY END-USER FOOTPRINT (20 COMPANIES)

TABLE 160 COMPANY REGION FOOTPRINT (20 COMPANIES)

10.6 COMPETITIVE LEADERSHIP MAPPING

10.6.1 STARS

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE PLAYERS

10.6.4 PARTICIPANTS

FIGURE 38 HOSPITAL ACQUIRED INFECTION CONTROL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

10.7 COMPETITIVE SCENARIO

10.7.1 PRODUCT LAUNCHES & APPROVALS

TABLE 161 PRODUCT LAUNCHES & APPROVALS, 2018–2021

10.7.2 DEALS

TABLE 162 DEALS, 2018–2021

10.7.3 OTHER DEVELOPMENTS

TABLE 163 OTHER DEVELOPMENTS, 2018–2021

11 COMPANY PROFILES (Page No. - 215)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 STERIS PLC

TABLE 164 STERIS PLC: BUSINESS OVERVIEW

FIGURE 39 STERIS PLC: COMPANY SNAPSHOT (2021)

11.1.2 SOTERA HEALTH COMPANY

TABLE 165 SOTERA HEALTH COMPANY: BUSINESS OVERVIEW

FIGURE 40 SOTERA HEALTH COMPANY: COMPANY SNAPSHOT (2020)

11.1.3 GETINGE AB

TABLE 166 GETINGE AB: BUSINESS OVERVIEW

FIGURE 41 GETINGE AB: COMPANY SNAPSHOT (2020)

11.1.4 ADVANCED STERILIZATION PRODUCTS (ASP)

TABLE 167 ADVANCED STERILIZATION PRODUCTS: BUSINESS OVERVIEW

FIGURE 42 FORTIVE CORPORATION: COMPANY SNAPSHOT (2020)

11.1.5 ECOLAB INC.

TABLE 168 ECOLAB INC.: BUSINESS OVERVIEW

FIGURE 43 ECOLAB INC.: COMPANY SNAPSHOT (2020)

11.1.6 3M COMPANY

TABLE 169 3M COMPANY: BUSINESS OVERVIEW

FIGURE 44 3M COMPANY: COMPANY SNAPSHOT (2020)

11.1.7 MATACHANA GROUP

TABLE 170 MATACHANA GROUP: BUSINESS OVERVIEW

11.1.8 MMM GROUP

TABLE 171 MMM GROUP: BUSINESS OVERVIEW

11.1.9 BELIMED AG (A SUBSIDIARY OF METALL ZUG GROUP)

TABLE 172 BELIMED AG: BUSINESS OVERVIEW

FIGURE 45 METALL ZUG GROUP: COMPANY SNAPSHOT (2020)

11.1.10 RECKITT BENCKISER

TABLE 173 RECKITT BENCKISER: BUSINESS OVERVIEW

FIGURE 46 RECKITT BENCKISER: COMPANY SNAPSHOT (2020)

11.1.11 METREX RESEARCH LLC (A SUBSIDIARY OF DANAHER CORPORATION)

TABLE 174 METREX RESEARCH: BUSINESS OVERVIEW

FIGURE 47 DANAHER CORPORATION: COMPANY SNAPSHOT (2020)

11.1.12 MIELE GROUP

TABLE 175 MIELE GROUP: BUSINESS OVERVIEW

FIGURE 48 MIELE GROUP: COMPANY SNAPSHOT (2020)

11.1.13 PAL INTERNATIONAL

TABLE 176 PAL INTERNATIONAL: BUSINESS OVERVIEW

11.1.14 MELAG MEDIZINTECHNIK GMBH & CO. KG

TABLE 177 MELAG MEDIZINTECHNIK GMBH & CO. KG: BUSINESS OVERVIEW

11.1.15 CONTEC, INC.

TABLE 178 CONTEC, INC.: BUSINESS OVERVIEW

11.1.16 MEDALKAN

TABLE 179 MEDALKAN: BUSINESS OVERVIEW

11.1.17 SYSTEC GMBH

TABLE 180 SYSTEC GMBH: BUSINESS OVERVIEW

11.1.18 C.B.M. S.R.L. MEDICAL EQUIPMENT

TABLE 181 C.B.M. S.R.L. MEDICAL EQUIPMENT: BUSINESS OVERVIEW

11.1.19 CONTINENTAL EQUIPMENT COMPANY

TABLE 182 CONTINENTAL EQUIPMENT COMPANY: BUSINESS OVERVIEW

11.1.20 BETA-GAMMA-SERVICE GMBH & CO. KG

TABLE 183 BETA-GAMMA-SERVICE GMBH & CO. KG: BUSINESS OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 MIDWEST STERILIZATION CORPORATION

11.2.2 BLUE LINE STERILIZATION SERVICES LLC

11.2.3 STERIPACK GROUP

11.2.4 STERI-TEK

11.2.5 STERILIZATION SERVICES

12 APPENDIX (Page No. - 296)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the hospital acquired infection control market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

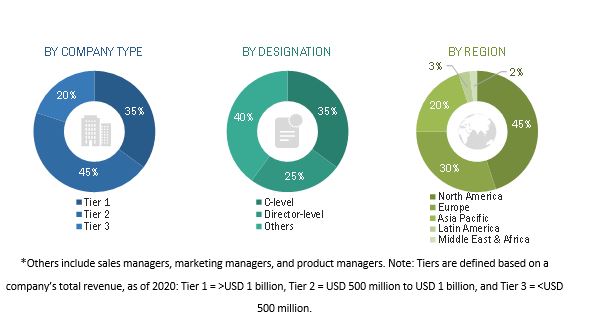

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the hospital acquired infection control market. The primary sources from the demand side include key executives from hospitals, pharmaceutical and medical device companies, and research institutes.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the hospital acquired infection control market was arrived at after data triangulation from different approaches, as mentioned below. After each approach, the weighted average of the approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the hospital acquired infection control market by products and services, end user, and region

- To provide detailed information about factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players in the market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities, of the leading market players

- To benchmark players within the hospital acquired infection control market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe hospital acquired infection control market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific hospital acquired infection control market into Australia, New Zealand, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hospital Acquired Infection Control Market

Which is the top end-user that will reshape the Hospital Acquired Infection Control Market?

In what way recent developments impacting the Hospital Acquired Infection Control Market?

Which region contributing more to revenue growth in Hospital Acquired Infection Control Market?