Infertility Treatment Market Size, Share & Trends by Product (Equipment, Media, Accessories), Procedure (ART (IVF,ICSI, Surrogate), Insemination, Laparoscopy, Hysteroscopy, Patient Type (Female, Male), End User (Fertility Clinics, Hospitals, Research) & Region - Global Forecast to 2026

Infertility Treatment Market Size, Share & Trends

The size of global infertility treatment market in terms of revenue was estimated to be worth $1.5 billion in 2021 and is poised to reach $2.2 billion by 2026, growing at a CAGR of 8.1% from 2021 to 2026. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Growth in the global market is primarily driven by factors such as the declining fertility rate, rising number of fertility clinics worldwide, technological advancements, and increasing public-private investments, funds, and grants. However, the high procedural costs of assisted reproductive technology procedures in developed markets and unsupportive government regulations for certain infertility treatment options are expected to limit market growth to a certain extent.

Infertility Treatment Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Infertility Treatment Market Dynamics

Driver: Declining fertility rate

The fertility rate worldwide is declining steadily owing to various factors, such as the growing trend of late marriages and increasing age-related infertility. Global fertility rates are projected to decline to 2.4 children per woman by 2030 and 2.2 children per woman by 2050. This declining fertility rate has led to a significant increase in the demand for infertility treatment products that determine the fertility window in males and females

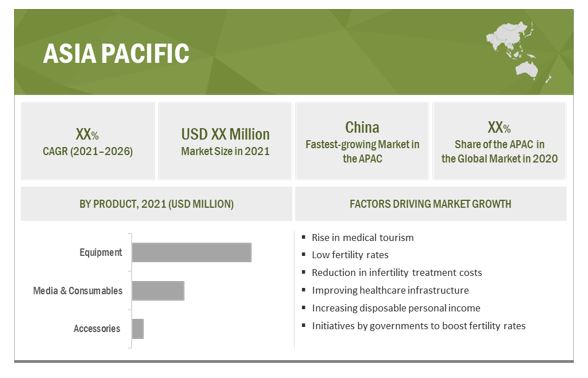

Opportunity: Emerging markets in APAC and RoW

Emerging markets such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities for players in the infertility treatment market. The market in Asia and other emerging countries is characterized by the growing focus on healthcare infrastructural improvements. Additionally, the medical tourism industry in emerging countries is thriving owing to a number of factors. In Asia, healthcare facilities are of high quality, treatment procedures are affordable, and many of the doctors and surgeons are trained and educated in the top institutes in the US and Europe. Emerging countries such as India, China, Singapore, Thailand, Brazil, and Malaysia present significant opportunities for the growth of the global market.

Restraint: High costs associated with assisted reproductive technology in developed markets

Along with fertility surgeries, thousands of cycles of ART procedures such as in vitro fertilization (IVF) are performed every year globally. The cost of IVF treatment varies from country to country due to the lack of reimbursement policies. A lack of insurance coverage and the poor reimbursement scenario in some parts of the world are limiting the growth of this market.

To leverage the significant growth opportunities in emerging countries, players are increasingly focusing on undertaking strategic developments agreements/partnerships with regional/domestic players, geographical expansions, and acquisitions.to increase their presence in these markets and tap a large number of customers. In addition, government \initiatives to increase the accessibility of infertility treatments, and the growing number of fertility centers are also fuelling the growth of infertility treatment procedures in emerging countries.

Challenge: Concerns related to ART procedures

Assisted reproductive technology (ART) involves procedures that require the handling of the human egg and embryos. Since the inception of ART procedures, there have been various ethical, legal, and societal controversies regarding the safe administration of gonadotropins, transparency of pregnancy data from clinics, and addressing economic barriers to ART access. Issues related to embryos and what to do with unused embryos are one of the major concerns related to the ART procedure.

In order to monitor activities related to ART procedures, strict regulations have been formulated by authorities in various countries across the globe. Authorities such as the International Federation of Fertility Societies (IFFS), European Society of Human Reproduction and Embryology (ESHRE), Indian Council of Medical Research (ICMR), Ethics Committee of American Society for Reproductive Medicine (ASRM), and Human Fertilization and Embryology Authority (HFEA) have implemented stringent regulations for infertility treatment.

These ethical concerns and restrictions on ART procedures, however, limit the adoption of infertility treatments to a certain extent

The equipment to capture the largest share in infertility treatment industry, by products during the forecast period.

The equipment segment of the infertility treatment market is expected to witness the highest growth rate during the forecast period. The high growth in this owes to the technological advancements and presence of well-established players with strong product portfolio. Along with this growing focus of players towards base expansion through adopting various strategies such as new equipment launch, showcase across the globe is likely to contribute towards the growth of the segment.

The assisted reproductive technology (ART) to capture the largest market share of infertility treatment industry, by procedure.

The assisted reproductive technology segment captured the largest share of the global infertility treatment market procedures during the forecast period. The growing awareness of the presence of ART, rise in success rate of this procedure and growing worldwide acceptance of ART is likely to boost the growth of the segment.

The female infertility treatment segment commanded for the largest share of the infertility treatment industry, by patient type

The decreasing rates of fertility among females, the growing availability of various fertility treatment options, and the increasing number of fertility centers across the globe are driving the growth of the female global infertility treatment market.

The fertility centers segment accounted for the largest share of the infertility treatment industry, by end user

The rising government initiatives to establish fertility clinics, initiatives taken by large international healthcare providers to establish fertility centers, and the increasing popularity of IVF & ICSI treatment globally are some of the factors likely to contribute towards the rapid growth of the segment.

Asia Pacific is the largest regional market for infertility treatment industry

Asia Pacific dominates the global infertility treatment market. Significant rise in the medical tourism, Increase in the awareness of availability of infertility treatment procedures, growing fertility centers in the region, rising healthcare expenditures, increasing rate of infertility in the region, and initiatives by the government to increase the accessibility of the infertility treatment in the emerging nations.

The prominent players operating in the global market include The Cooper Companies Inc. (US), Cook Group (US), Vitrolife (Sweden), Thermo Fisher Scientific, Inc. (US), Esco Micro Pte. Ltd. (Singapore), Genea Biomedx (Australia), IVFtech ApS (Denmark), FUJIFILM Irvine Scientific (US), The Baker Company, Inc. (US), Kitazato Corporation (Japan), Rocket Medical plc (UK), IHMedical A/S (Denmark), Hamilton Thorne Ltd. (US), ZEISS Group (Germany), MedGyn Products, Inc. (US).

THE COOPER COMPANIES, INC.

The Cooper Companies operates through two business units, namely, CooperVision (CVI) and CooperSurgical (CSI). The company offers a wide range of products and services focused on women’s health, fertility, and diagnostics through its CooperSurgical business segment. This business unit markets its products under various brand names, such as ORIGIO (provides in vitro fertilization (IVF) products), Reprogenetics (provides genetic testing solutions), and LifeGlobal (providing media products as well as IVF laboratory air filtration products). Through offering a broad range of innovative technologies and services to clinicians and patients worldwide, the company aims to further strengthen its position in the market, by pursuing the strategy of acquisitions.

The company commercializes its products in over 100 countries and has its presence across the US, Europe, and the RoW. Some of its major subsidiaries include CooperVision International Holding Company (UK), Ocular Sciences SAS (France), CooperSurgical, Inc. (US), CooperSurgical Holdings Ltd. (UK), Cooper Medical, Inc. (US), The Cooper Companies Global Holdings LP (UK), Research Instruments Ltd. (UK), and TCC Holdings S.a.r.l (Luxembourg).

Scope of the Infertility Treatment Industry

|

Report Metric |

Details |

|

Market Revenue in Size 2021 |

$1.5 billion |

|

Projected Revenue Size by 2026 |

$2.2 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 8.1% |

|

Market Driver |

Declining fertility rate |

|

Market Opportunity |

Emerging markets in APAC and RoW |

This research report categorizes the infertility treatment market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Equipment

- Microscopes

- Imaging Systems

- Sperm Analyzer Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- Media & Consumables

- Accessories

By Procedure

-

Assisted Reproductive Technology

-

In Vitro Fertilization

- Intracytoplasmic Morphologically Selected Sperm Injection

- Gamete Donation

- Intracytoplasmic Sperm Injection

- Surrogacy

-

In Vitro Fertilization

-

Artificial Insemination

- Intrauterine Insemination

- Intracervical Insemination

- Intratubal Insemination

-

Fertility Surgeries

- Laparoscopy

- Hysteroscopy

- Myomectomy

- Laparotomy

- Tubal Ligation Reversal

- Varicocelectomy

-

Microsurgical Reconstruction

- Vasovasostomy

- Vasoepididymostomy

- Other Infertility Treatment Procedures

By Patient Type

- Female Infertility Treatment

- Male Infertility Treatment

By End User

- Fertility Centers

- Hospitals & Surgical Clinics

- Cryobanks

- Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoEU

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Infertility Treatment Industry

- In 2021, CooperSurgical announced a partnership with Virtus Health to strengthen its fertility technology, increasing the accessibility of advanced treatment to infertile couples.

- In 2021, Hamilton Thorne Ltd. received FDA approval for the commercialization of the GYNEMED GM501, a ready-to-use medium designed for in vitro washing and handling procedures of human oocytes and embryos in the US and Europe.

- In 2020, Genea Biomedx (Australia) collaborated with Hamilton Thorne to commercialize Genea Biomedx’s (Australia) fertility products in the US and Canada.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the infertility treatment market?

The infertility treatment market boasts a total revenue value of $2.2 billion by 2026.

What is the estimated growth rate (CAGR) of the infertility treatment market?

The global infertility treatment market has an estimated compound annual growth rate (CAGR) of 8.1% and a revenue size in the region of $1.5 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 INFERTILITY TREATMENT MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 MAJOR INFERTILITY TREATMENT MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: INFERTILITY TREATMENT MARKET

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

2.2.2 USAGE-BASED MARKET ESTIMATION

FIGURE 4 INFERTILITY TREATMENT INDUSTRY SIZE ESTIMATION: GLOBAL MARKET BASED ON PRODUCT UTILIZATION METHODOLOGY

FIGURE 5 INFERTILITY TREATMENT INDUSTRY SIZE ESTIMATION: GLOBAL MARKET BASED ON REVENUE MAPPING METHODOLOGY

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 7 INFERTILITY TREATMENT MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 8 GLOBAL INFERTILITY TREATMENT MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 9 GLOBAL INFERTILITY TREATMENT MARKET, BY PATIENT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 10 GLOBAL INFERTILITY TREATMENT INDUSTRY, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL INFERTILITY TREATMENT MARKET

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 INFERTILITY TREATMENT MARKET OVERVIEW

FIGURE 12 DECLINING FERTILITY RATE AND RISING NUMBER OF FERTILITY CLINICS WORLDWIDE TO DRIVE MARKET GROWTH

4.2 GLOBAL MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 13 MEDIA & CONSUMABLES SEGMENT TO REGISTER THE HIGHEST GROWTH IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

4.3 GLOBAL MARKET, BY PROCEDURE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 ASSISTED REPRODUCTIVE TECHNOLOGY IS THE LARGEST PROCEDURE SEGMENT OF THE GLOBAL MARKET

4.4 GLOBAL MARKET, BY PATIENT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 MALE INFERTILITY TREATMENT SEGMENT TO WITNESS THE HIGHEST GROWTH IN THE FORECAST PERIOD

4.5 GLOBAL INFERTILITY TREATMENT MARKET SHARE, BY END USER, 2021

FIGURE 16 FERTILITY CENTERS ARE THE LARGEST END USERS OF INFERTILITY TREATMENT PRODUCTS

4.6 ASIA PACIFIC: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT AND COUNTRY (2021)

FIGURE 17 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE APAC MARKET IN 2021

FIGURE 18 APAC MARKET TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD (2021–2026)

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 INFERTILITY TREATMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Declining fertility rate

FIGURE 20 DECLINING GLOBAL FERTILITY RATE, BY REGION, 1990 VS. 2019 VS. 2030

FIGURE 21 RISING OBESITY RATES (PERCENTAGE OF THE US POPULATION): 2010 VS. 2030

5.2.1.2 Rising number of fertility clinics worldwide

5.2.1.3 Technological advancements

5.2.1.3.1 Advancements in infertility treatment devices

5.2.1.3.2 Increasing use of time-lapse technology worldwide

5.2.1.4 Increasing public-private investments, funds, and grants

5.2.2 RESTRAINTS

5.2.2.1 High costs associated with assisted reproductive technology in developed markets

TABLE 1 INFERTILITY TREATMENT COSTS

5.2.2.2 Unsupportive government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Growth opportunities in emerging markets

5.2.3.1.1 Improving healthcare infrastructure

5.2.3.2 Increasing medical tourism due to low treatment costs

5.2.3.3 Use of fertility treatment options by single parents and same-sex couples

5.2.4 CHALLENGES

5.2.4.1 Concerns related to ART procedures

5.2.4.2 Reduced efficacy among older women

5.3 REGULATORY LANDSCAPE

5.3.1 NORTH AMERICA

5.3.1.1 US

5.3.1.2 Canada

5.3.2 EUROPE

5.3.3 ASIA PACIFIC

5.3.3.1 India

5.3.3.2 Japan

TABLE 2 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.4 COVID-19 IMPACT ON THE GLOBAL MARKET

5.5 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN OF THE GLOBAL MARKET

5.6 PRICING TREND ANALYSIS

TABLE 3 AVERAGE PRICE OF INFERTILITY TREATMENT EQUIPMENT AND MEDIA, BY COUNTRY, 2020 (USD)

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

FIGURE 23 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

FIGURE 24 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

FIGURE 25 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

FIGURE 26 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

FIGURE 27 INTENSITY OF COMPETITIVE RIVALRY

5.8 ECOSYSTEM COVERAGE

6 INFERTILITY TREATMENT MARKET, BY PRODUCT (Page No. - 75)

6.1 INTRODUCTION

TABLE 5 GLOBAL INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.1.1 EQUIPMENT

TABLE 6 INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 7 INFERTILITY TREATMENT INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

6.2 MICROSCOPES

6.2.1 TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF MICROSCOPY HAS RESULTED IN THE GROWING ADOPTION OF MICROSCOPES

TABLE 8 MICROSCOPES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 MICROSCOPES MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 10 MICROSCOPES MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 11 MICROSCOPES MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.2 IMAGING SYSTEMS

6.2.2.1 Advantages offered by imaging systems in the field of infertility treatment are driving their adoption

TABLE 12 IMAGING SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 IMAGING SYSTEMS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 14 IMAGING SYSTEMS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 15 IMAGING SYSTEMS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.3 SPERM ANALYZER SYSTEMS

6.2.3.1 Sperm analyzer systems have a wide range of applications in fertility screening

TABLE 16 SPERM ANALYZER SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 SPERM ANALYZER SYSTEMS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 18 SPERM ANALYZER SYSTEMS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 19 SPERM ANALYZER SYSTEMS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.4 OVUM ASPIRATION PUMPS

6.2.4.1 Ovum aspiration pumps are widely used to retrieve and protect oocytes

TABLE 20 OVUM ASPIRATION PUMPS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 OVUM ASPIRATION PUMPS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 22 OVUM ASPIRATION PUMPS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 23 OVUM ASPIRATION PUMPS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.5 MICROMANIPULATOR SYSTEMS

6.2.5.1 Micromanipulator systems are used in cases pertaining to poor sperm quality/mobility

TABLE 24 MICROMANIPULATOR SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 MICROMANIPULATOR SYSTEMS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 26 MICROMANIPULATOR SYSTEMS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 27 MICROMANIPULATOR SYSTEMS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.6 INCUBATORS

6.2.6.1 Incubators play a vital role in embryo development and improved clinical outcomes

TABLE 28 INCUBATORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 INCUBATORS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 30 INCUBATORS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 31 INCUBATORS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.7 GAS ANALYZERS

6.2.7.1 Gas analyzers contain multiple ports enabling analysis of sequential gas samples

TABLE 32 GAS ANALYZERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 GAS ANALYZERS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 34 GAS ANALYZERS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 35 GAS ANALYZERS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.8 LASER SYSTEMS

6.2.8.1 Common applications of laser systems include the treatment of stress urinary incontinence and vaginal tightening

TABLE 36 LASER SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 LASER SYSTEMS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 38 LASER SYSTEMS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 39 LASER SYSTEMS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.9 CRYOSYSTEMS

6.2.9.1 Demand for cryosystems is on the rise as women are seeking to extend their childbearing years

TABLE 40 CRYOSYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 CRYOSYSTEMS MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 42 CRYOSYSTEMS MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 43 CRYOSYSTEMS MARKET, BY END USER, 2019–2026 (USD MILLION)

6.2.10 SPERM SEPARATION DEVICES

6.2.10.1 Introduction of advanced sperm separation devices to boost their adoption

TABLE 44 SPERM SEPARATION DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 SPERM SEPARATION DEVICES MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 46 SPERM SEPARATION DEVICES MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 47 SPERM SEPARATION DEVICES MARKET, BY END USER, 2019–2026 (USD MILLION)

6.3 MEDIA & CONSUMABLES

6.3.1 EASY AVAILABILITY OF CULTURE MEDIA TO SUPPORT MARKET GROWTH

TABLE 48 INFERTILITY TREATMENT MEDIA & CONSUMABLES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 INFERTILITY TREATMENT MEDIA & CONSUMABLES MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 50 INFERTILITY TREATMENT MEDIA & CONSUMABLES MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 51 INFERTILITY TREATMENT MEDIA & CONSUMABLES MARKET, BY END USER, 2019–2026 (USD MILLION)

6.4 ACCESSORIES

6.4.1 ANTI-VIBRATION TABLES ARE COMMONLY USED FOR IVF TREATMENTS TO PROVIDE A SMOOTH WORKSPACE DURING PROCEDURES

TABLE 52 INFERTILITY TREATMENT ACCESSORIES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 53 INFERTILITY TREATMENT ACCESSORIES MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 54 INFERTILITY TREATMENT ACCESSORIES MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 55 INFERTILITY TREATMENT ACCESSORIES MARKET, BY END USER, 2019–2026 (USD MILLION)

7 INFERTILITY TREATMENT MARKET, BY PROCEDURE (Page No. - 106)

7.1 INTRODUCTION

TABLE 56 GLOBAL INFERTILITY TREATMENT INDUSTRY, BY PROCEDURE, 2019–2026 (USD MILLION)

7.2 ASSISTED REPRODUCTIVE TECHNOLOGY

TABLE 57 ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 58 ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.2.1 IN VITRO FERTILIZATION

FIGURE 28 UK: IVF BIRTH RATES, 2010–2019

TABLE 59 IN VITRO FERTILIZATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 60 IN VITRO FERTILIZATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.2.1.1 Intracytoplasmic morphologically selected sperm injection

7.2.1.1.1 IMSI is highly recommended in patients with a low sperm count and recurrent implantation failure

TABLE 61 INTRACYTOPLASMIC MORPHOLOGICALLY SELECTED SPERM INJECTION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.2.1.2 Gamete donation

7.2.1.2.1 Increasing number of women registering as egg donors is a key factor aiding market growth

TABLE 62 GAMETE DONATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.2.2 INTRACYTOPLASMIC SPERM INJECTION

7.2.2.1 ICSI is a specialized form of IVF involving fertilization used commonly in male infertility treatment procedures

TABLE 63 INTRACYTOPLASMIC SPERM INJECTION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.2.3 SURROGACY

7.2.3.1 High success rates guaranteed and achieved with the help of surrogacy are driving market growth

TABLE 64 SURROGACY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 ARTIFICIAL INSEMINATION

TABLE 65 ARTIFICIAL INSEMINATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 ARTIFICIAL INSEMINATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.1 INTRAUTERINE INSEMINATION

7.3.1.1 Limited risk of complications during pregnancy and high success rate are driving the market for IUI procedures

TABLE 67 INTRAUTERINE INSEMINATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.2 INTRACERVICAL INSEMINATION

7.3.2.1 Low cost of this procedure as compared to other AI procedures to support market growth

TABLE 68 INTRACERVICAL INSEMINATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3.3 INTRATUBAL INSEMINATION

7.3.3.1 High cost and uncertain success rate of this procedure to restrain the market growth

TABLE 69 INTRATUBAL INSEMINATION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 FERTILITY SURGERIES

TABLE 70 FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 71 FERTILITY SURGERIES MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.1 LAPAROSCOPY

7.4.1.1 Laparoscopy allows for the biopsy of suspect growths and cysts that hamper fertility

TABLE 72 LAPAROSCOPY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.2 HYSTEROSCOPY

7.4.2.1 Growing demand for minimally invasive procedures is driving the adoption of hysteroscopy infertility treatment surgeries globally

TABLE 73 HYSTEROSCOPY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.3 MYOMECTOMY

7.4.3.1 Advantages of myomectomy in alleviating problems caused due to fibroids while preserving future fertility to drive the demand for this surgery

TABLE 74 MYOMECTOMY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.4 LAPAROTOMY

7.4.4.1 Laparotomy is used in common infertility surgeries that require large exposure to the reproductive system

TABLE 75 LAPAROTOMY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.5 TUBAL LIGATION REVERSAL

7.4.5.1 Tubal ligation reversal is performed in women who still have a large portion of healthy fallopian tube remaining

TABLE 76 TUBAL LIGATION REVERSAL MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.6 VARICOCELECTOMY

7.4.6.1 Varicocelectomy results in a high chance of improved fertility with reduced complications

TABLE 77 VARICOCELECTOMY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.7 MICROSURGICAL RECONSTRUCTION

TABLE 78 MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 MICROSURGICAL RECONSTRUCTION MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.7.1 Vasovasostomy

7.4.7.1.1 Vasovasostomy is a reversal surgery commonly used in the treatment of infertility in men

TABLE 80 VASOVASOSTOMY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4.7.2 Vasoepididymostomy

7.4.7.2.1 Vasoepididymostomy provides a higher pregnancy rate than IVF with ICSI

TABLE 81 VASOEPIDIDYMOSTOMY MARKET, BY REGION, 2019–2026 (USD MILLION)

7.5 OTHER INFERTILITY TREATMENT PROCEDURES

TABLE 82 OTHER INFERTILITY TREATMENT PROCEDURES MARKET, BY REGION, 2019–2026 (USD MILLION)

8 INFERTILITY TREATMENT MARKET, BY PATIENT TYPE (Page No. - 129)

8.1 INTRODUCTION

TABLE 83 GLOBAL INFERTILITY TREATMENT INDUSTRY, BY PATIENT TYPE,2019–2026 (USD MILLION)

8.2 FEMALE INFERTILITY TREATMENT

8.2.1 INCREASING FEMALE INFERTILITY RATES TO DRIVE THE GROWTH OF THE FEMALE INFERTILITY TREATMENT MARKET

FIGURE 29 US: IVF SUCCESS RATES BY AGE FOR ALL IVF CYCLES, 2019

TABLE 84 FEMALE INFERTILITY TREATMENT MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 MALE INFERTILITY TREATMENT

8.3.1 GROWING ADOPTION OF MALE INFERTILITY TREATMENT PROCEDURES TO DRIVE MARKET GROWTH

TABLE 85 MALE INFERTILITY TREATMENT MARKET, BY REGION, 2019–2026 (USD MILLION)

9 INFERTILITY TREATMENT MARKET, BY END USER (Page No. - 133)

9.1 INTRODUCTION

TABLE 86 GLOBAL INFERTILITY TREATMENT INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

9.2 FERTILITY CENTERS

9.2.1 GROWING NUMBER OF INFERTILITY TREATMENT CENTERS WORLDWIDE TO DRIVE MARKET GROWTH

TABLE 87 GLOBAL MARKET FOR FERTILITY CENTERS, BY REGION, 2019–2026 (USD MILLION)

9.3 HOSPITALS & SURGICAL CLINICS

9.3.1 GOVERNMENT INITIATIVES TO INCREASE HOSPITALS EQUIPPED TO PERFORM INFERTILITY TREATMENT PROCEDURES IS SUPPORTING MARKET GROWTH

TABLE 88 GLOBAL INFERTILITY TREATMENT MARKET FOR HOSPITALS & SURGICAL CLINICS, BY REGION, 2019–2026 (USD MILLION)

9.4 CRYOBANKS

9.4.1 INCREASING NUMBER OF ART PROCEDURES USING DONOR SPERM AND DONOR EGGS FOR INFERTILITY TREATMENT TO DRIVE MARKET GROWTH

TABLE 89 GLOBAL MARKET FOR CRYOBANKS, BY REGION, 2019–2026 (USD MILLION)

9.5 RESEARCH INSTITUTES

9.5.1 GROWING NEED FOR IMPROVING THE CLINICAL EFFICACY OF VARIOUS INFERTILITY TREATMENT OPTIONS TO DRIVE MARKET GROWTH

TABLE 90 GLOBAL INFERTILITY TREATMENT INDUSTRY FOR RESEARCH INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

10 INFERTILITY TREATMENT MARKET, BY REGION (Page No. - 139)

10.1 INTRODUCTION

TABLE 91 MARKET, BY REGION, 2019–2026 (USD MILLION)

10.2 ASIA PACIFIC

TABLE 93 ASIA PACIFIC: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 94 ASIA PACIFIC: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 ASIA PACIFIC: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 96 ASIA PACIFIC: ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 97 ASIA PACIFIC: IN VITRO FERTILIZATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: ARTIFICIAL INSEMINATION MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 99 ASIA PACIFIC: FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 ASIA PACIFIC: MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: INFERTILITY TREATMENT INDUSTRY , BY END USER, 2019–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Declining birth rate in China to drive the demand for infertility treatment procedures in the country

TABLE 103 CHINA: INFERTILITY TREATMENT MARKET, BY PRODUCT,2019–2026 (USD MILLION)

TABLE 104 CHINA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Growing awareness has served to boost the adoption of IVF procedures in Japan

TABLE 105 JAPAN: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 106 JAPAN: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.3 INDIA

10.2.3.1 Rising medical tourism to offer high-growth opportunities for players in the Indian market

TABLE 107 INDIA: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 108 INDIA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.4 AUSTRALIA

10.2.4.1 Initiatives by the Australian government to support market growth

TABLE 109 AUSTRALIA: MARKET, BY PRODUCT,2019–2026 (USD MILLION)

TABLE 110 AUSTRALIA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.5 SOUTH KOREA

10.2.5.1 Supportive government initiatives will positively impact market growth

TABLE 111 SOUTH KOREA: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 SOUTH KOREA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.2.6 REST OF ASIA PACIFIC

TABLE 113 ROAPAC: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 114 ROAPAC: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 115 EUROPE: INFERTILITY TREATMENT MARKET, BY COUNTRY,2019–2026 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 117 EUROPE: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 119 EUROPE: ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 EUROPE: IN VITRO FERTILIZATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 EUROPE: ARTIFICIAL INSEMINATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 EUROPE: FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 123 EUROPE: MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 EUROPE: INFERTILITY TREATMENT MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 125 EUROPE: INFERTILITY TREATMENT INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Favorable funding scenario for IVF treatments in Germany to drive market growth

TABLE 126 GERMANY: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 127 GERMANY: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Supportive regulatory framework in the UK to drive market growth

FIGURE 31 UK: NUMBER OF IVF CYCLES BY EGG AND SPERM SOURCE, 2010-2019

TABLE 128 UK: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT,2019–2026 (USD MILLION)

TABLE 129 UK: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Rising healthcare spending in France to drive market growth

TABLE 130 FRANCE: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 131 FRANCE: INFERTILITY TREATMENT EQUIPMENT MARKET,BY TYPE, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Decreasing fertility rates to drive the demand for fertility testing treatment procedures in Italy

TABLE 132 ITALY: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 133 ITALY: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Spain is an established destination for IVF tourism

TABLE 134 SPAIN: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 135 SPAIN: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 136 ROE: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 137 ROE: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4 NORTH AMERICA

TABLE 138 NORTH AMERICA: INFERTILITY TREATMENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 140 NORTH AMERICA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 NORTH AMERICA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 142 NORTH AMERICA: ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 NORTH AMERICA: IN VITRO FERTILIZATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 NORTH AMERICA: ARTIFICIAL INSEMINATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 146 NORTH AMERICA: MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 147 NORTH AMERICA: INFERTILITY TREATMENT INDUSTRY, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 148 NORTH AMERICA: INFERTILITY TREATMENT MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 US

10.4.1.1 The US dominates the infertility treatment market in North America

TABLE 149 US: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 150 US: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.4.2 CANADA

10.4.2.1 High cost of infertility treatment in the country to restrain the market growth

TABLE 151 CANADA: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 152 CANADA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

TABLE 153 LATIN AMERICA: INFERTILITY TREATMENT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 155 LATIN AMERICA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 157 LATIN AMERICA: ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 LATIN AMERICA: IN VITRO FERTILIZATION MARKET, BY TYPE,2019–2026 (USD MILLION)

TABLE 159 LATIN AMERICA: ARTIFICIAL INSEMINATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 LATIN AMERICA: FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 161 LATIN AMERICA: MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: INFERTILITY TREATMENT INDUSTRY, BY END USER, 2019–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Brazil holds the largest share of the Latin American infertility treatment market

TABLE 164 BRAZIL: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 165 BRAZIL: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Growth in medical tourism is a key factor driving market growth

TABLE 166 MEXICO: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 167 MEXICO: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 168 ROLATAM: INFERTILITY TREATMENT INDUSTRY, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 169 ROLATAM: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 RISING INCIDENCE OF INFERTILITY TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

TABLE 170 MIDDLE EAST & AFRICA: INFERTILITY TREATMENT MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: INFERTILITY TREATMENT EQUIPMENT MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: INFERTILITY TREATMENT INDUSTRY, BY PROCEDURE, 2019–2026 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: ASSISTED REPRODUCTIVE TECHNOLOGY MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: IN VITRO FERTILIZATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: ARTIFICIAL INSEMINATION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 176 MIDDLE EAST & AFRICA: FERTILITY SURGERIES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MICROSURGICAL RECONSTRUCTION MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: INFERTILITY TREATMENT INDUSTRY, BY PATIENT TYPE, 2019–2026 (USD MILLION)

TABLE 179 MIDDLE EAST & AFRICA: INFERTILITY TREATMENT MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 198)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

11.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 32 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE INFERTILITY TREATMENT MARKET

11.4 MARKET SHARE ANALYSIS (2020)

TABLE 180 GLOBAL INFERTILITY TREATMENT INDUSTRY: DEGREE OF COMPETITION

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 33 GLOBAL INFERTILITY TREATMENT INDUSTRY: COMPETITIVE LEADERSHIP MAPPING, 2020

11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2020)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 34 GLOBAL INFERTILITY TREATMENT INDUSTRY: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES, 2020

11.7 FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE GLOBAL INFERTILITY TREATMENT INDUSTRY

11.7.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS OF THE TOP PLAYERS IN THE GLOBAL INFERTILITY TREATMENT INDUSTRY

TABLE 181 PRODUCT FOOTPRINT OF COMPANIES

11.8 COMPETITIVE SCENARIO

11.8.1 GLOBAL INFERTILITY TREATMENT INDUSTRY: PRODUCT LAUNCHES AND REGULATORY APPROVALS

TABLE 183 KEY PRODUCT LAUNCHES AND REGULATORY APPROVALS, JANUARY 2018–SEPTEMBER 2021

11.8.2 GLOBAL INFERTILITY TREATMENT INDUSTRY: DEALS

TABLE 184 KEY DEALS, JANUARY 2018–SEPTEMBER 2021

11.8.3 GLOBAL INFERTILITY TREATMENT INDUSTRY: OTHER DEVELOPMENTS

TABLE 185 OTHER KEY DEVELOPMENTS, JANUARY 2018–SEPTEMBER 2021

12 COMPANY PROFILES (Page No. - 210)

12.1 MAJOR PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 THE COOPER COMPANIES INC.

TABLE 186 THE COOPER COMPANIES INC.: BUSINESS OVERVIEW

FIGURE 35 THE COOPER COMPANIES INC.: COMPANY SNAPSHOT (2020)

TABLE 187 THE COOPER COMPANIES, INC.: PRODUCT OFFERINGS

12.1.2 COOK GROUP

TABLE 188 COOK GROUP: BUSINESS OVERVIEW

TABLE 189 COOK GROUP: PRODUCT OFFERINGS

12.1.3 VITROLIFE

TABLE 190 VITROLIFE: BUSINESS OVERVIEW

FIGURE 36 VITROLIFE: COMPANY SNAPSHOT (2020)

TABLE 191 VITROLIFE: PRODUCT OFFERINGS

12.1.4 THERMO FISHER SCIENTIFIC

TABLE 192 THERMO FISHER SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 37 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT (2020)

TABLE 193 THERMO FISHER SCIENTIFIC: PRODUCT OFFERINGS

12.1.5 HAMILTON THORNE LTD.

TABLE 194 HAMILTON THORNE LTD.: BUSINESS OVERVIEW

FIGURE 38 HAMILTON THORNE LTD.: COMPANY SNAPSHOT (2020)

TABLE 195 HAMILTON THORNE LTD.: PRODUCT OFFERINGS

12.1.6 ESCO MICRO PTE. LTD.

TABLE 196 ESCO MICRO PTE. LTD.: BUSINESS OVERVIEW

TABLE 197 ESCO MICRO PTE. LTD.: PRODUCT OFFERINGS

12.1.7 GENEA LIMITED

TABLE 198 GENEA LIMITED: BUSINESS OVERVIEW

TABLE 199 GENEA LIMITED: PRODUCT OFFERINGS

12.1.8 IVFTECH APS

TABLE 200 IVFTECH APS: BUSINESS OVERVIEW

TABLE 201 IVFTECH APS: PRODUCT OFFERINGS

12.1.9 FUJIFILM IRVINE SCIENTIFIC

TABLE 202 FUJIFILM IRVINE SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 39 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 203 FUJIFILM IRVINE SCIENTIFIC: PRODUCT OFFERINGS

12.1.10 THE BAKER COMPANY, INC.

TABLE 204 THE BAKER COMPANY, INC.: BUSINESS OVERVIEW

TABLE 205 THE BAKER COMPANY, INC.: PRODUCT OFFERINGS

12.1.11 KITAZATO CORPORATION

TABLE 206 KITAZATO CORPORATION: BUSINESS OVERVIEW

TABLE 207 KITAZATO CORPORATION: PRODUCT OFFERINGS

12.1.12 ROCKET MEDICAL PLC

TABLE 208 ROCKET MEDICAL PLC: BUSINESS OVERVIEW

TABLE 209 ROCKET MEDICAL PLC: PRODUCT OFFERINGS

12.1.13 IHMEDICAL A/S

TABLE 210 IHMEDICAL A/S: BUSINESS OVERVIEW

TABLE 211 IHMEDICAL A/S: PRODUCT OFFERINGS

12.1.14 ZEISS GROUP

TABLE 212 ZEISS GROUP: BUSINESS OVERVIEW

FIGURE 40 ZEISS GROUP: COMPANY SNAPSHOT (2020)

TABLE 213 ZEISS GROUP: PRODUCT OFFERINGS

12.1.15 MEDGYN PRODUCTS, INC.

TABLE 214 MEDGYN PRODUCTS, INC.: BUSINESS OVERVIEW

TABLE 215 MEDGYN PRODUCTS, INC.: PRODUCT OFFERINGS

12.2 OTHER PLAYERS

12.2.1 DXNOW, INC.

12.2.2 NIDACON INTERNATIONAL AB

12.2.3 GYNOTEC B.V.

12.2.4 SAR HEALTHLINE PVT. LTD.

12.2.5 INVITROCARE INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 247)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

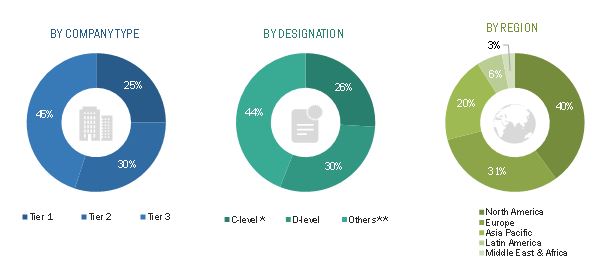

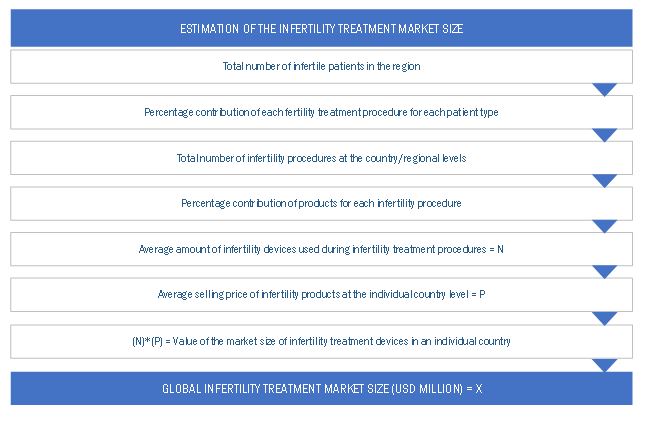

The study involved four major activities to estimate the current size of the infertility treatment market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and publications from government sources such as World Health Organization (WHO), World Bank, Human Fertilization and Embryology Authority (HFEA), International Federation of Fertility Societies (IFFS), American Society for Reproductive Medicine (ASRM), Australia and New Zealand Assisted Reproduction Database (ANZARD), Centers for Disease Control and Prevention (CDC), were referred to identify and collect information for the infertility treatment market study.

Primary Research

The infertility treatment market comprises several stakeholders such as manufacturers Of infertility treatment equipment, media & consumables, and accessories market research and consulting firms. The demand side of this market is characterized by the rise in number of fertility clinics, decline in fertility rates, presence of well established players in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the infertility treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Estimation Of Infertility Treatment Procedures By Country/Region

Market Size Estimation: Infertility Treatment Services Market Based on Revenue Mapping Methodology

Data Triangulation

After arriving at the overall size of the global infertility treatment market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Report Objectives

- To define, describe, and forecast the global infertility treatment market on the basis of product, modality, usage, disease indication, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key market players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global infertility treatment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global infertility treatment market report

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players.

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Geographic Analysis

- Further breakdown of the Rest of Europe infertility treatment market into Belgium, Austria,

- Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific infertility treatment market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America infertility treatment market into Argentina, and Colombia, among other countries.

Growing Opportunity for Businesses

IVF market: In vitro fertilization (IVF) is a medical procedure that involves fertilizing a woman's egg outside of her body. The IVF market is expected to grow at a CAGR of 11.4% from 2023. The IVF market is driven by the increasing prevalence of infertility, as well as the rising number of couples who are delaying childbearing.

Infertility drugs market: Infertility drugs are medications that are used to treat infertility. The infertility drugs market is expected to grow at a CAGR of 6.5% from 2023. The infertility drugs market is driven by the increasing demand for these drugs from couples who are struggling to conceive.

Infertility market: The infertility market is the collection of businesses that provide infertility treatments and services. The infertility market is expected to grow at a CAGR of 7.2% from 2023. The infertility market is also driven by the increasing number of women who are choosing to undergo egg freezing.

Infertility treatment devices market: Infertility treatment devices are medical devices that are used to treat infertility. The infertility treatment devices market is expected to grow at a CAGR of 8.1% from 2023. The infertility treatment devices market is driven by the increasing demand for these devices from couples who are struggling to conceive.

Fertility drug market: Fertility drugs are medications that are used to increase the chances of conception. The fertility drug market is expected to grow at a CAGR of 7.6% from 2023. The fertility drug market is driven by the increasing demand for these drugs from couples who are trying to conceive.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infertility Treatment Market

You have given very good information.