In this research, the utilization of both primary and secondary sources was done to a great extent. This included studying the factors affecting the industry to find out the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and strategies by key players.

Secondary Research

The secondary research process involves methods using directories, databases such as D&B Hoovers, Bloomberg Businessweek, Factiva, white papers, annual reports, company filings, investor presentations, and SEC filings, and collation of the database of industry leaders. This would help in fleshing out basic information on key players and market segmentation based upon the trends of the industry at various levels, major developments in the market, and technological perspectives pertaining to the in vitro fertilization market.

Primary Research

Primary research for this report featured interviews with a cross-section of sources from both the supply and demand sides to generate qualitative and quantitative data. On the supply side, there were primary sources from industries represented by CEOs, vice presidents, marketing and sales directors, regional sales managers, technology and innovation directors, and other key executives from leading companies and organizations in product therapy markets. Primary sources on the demand side included but were not limited to: embryologists, clinicians, procurement managers, purchase managers, department heads, and professionals from hospitals, fertility clinics, in vitro fertilization centers, and reference labs, among others. This primary research was hoped to validate market segmentation, identify key market players, and get an overview of the key trends and dynamics of the industry.

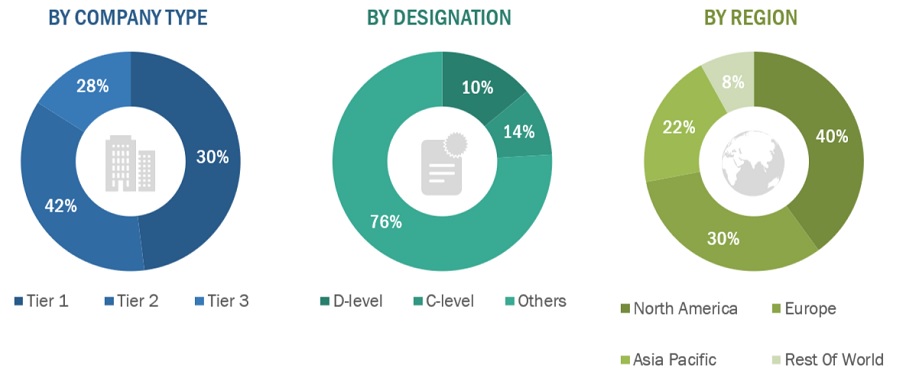

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 1 billion, Tier 2 = <USD 500 million, and Tier 3 = <USD 100 million.

Market Estimation Methodology

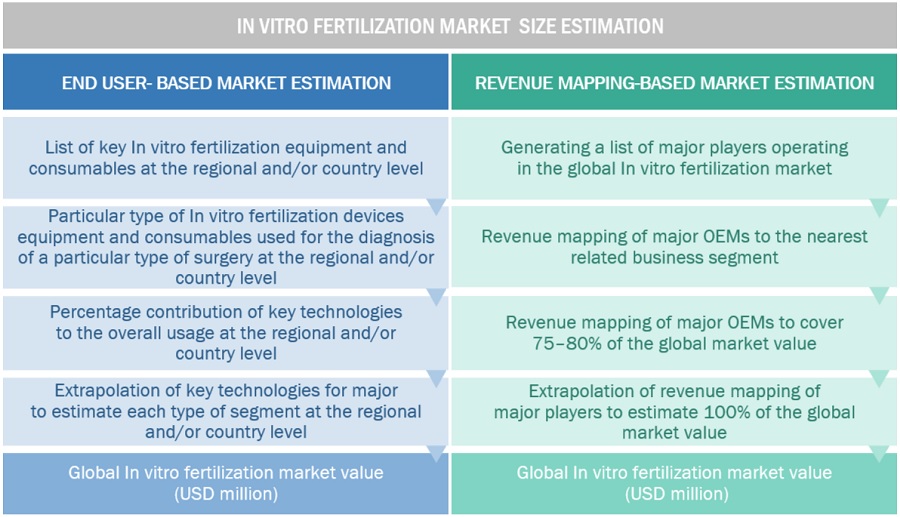

This report also presents the key players' revenue share analysis for the size of the in vitro fertilization market. The identification of key market participants and insights about their revenues in the in vitro fertilization sector are gathered through phases of primary and secondary research. The secondary research process relied heavily on top players' annual and financial reports, while primary research involved highly exhaustive interviews with key opinion leaders, viz., CEOs, directors, and senior marketing executives.

The methodology adopted to calculate the global market value was on a segment basis. These segmental revenues were then sourced through the revenue data of major solution and service providers. The steps involved in the process are

-

Draw up a list of key global players operating in the in vitro fertilization market. Map the annual revenues accrued by players from the in vitro fertilization market or nearest reported business unit/ product category.

-

It represents the current major share of the global market as of 2022, using revenue mapping of the key players.

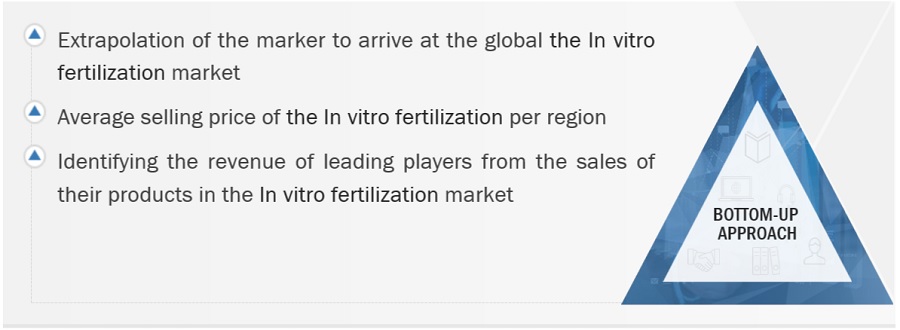

Extrapolation to the global value for the in vitro fertilization market. Global In vitro fertilization Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

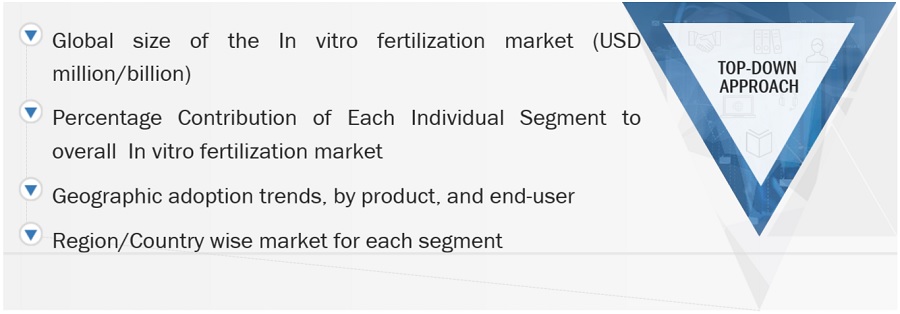

Global In vitro fertilization Market : Top-Down Approach

Data Triangulation

The in vitro fertilization market was segmented under various categories and subcategories using the above-mentioned methodology. Thereafter, proper data triangulation and the market segmentation process are carried out to further increase the accuracy of the data for each segment. Factors and trends from both the demand and supply sides were studied. Rigorous employment of both top-down and bottom-up approaches provided the result of the analysis of the in vitro fertilization market.

Market Definition

The in vitro fertilization market refers to the global landscape of Assisted Reproductive Technologies services and products that help a person or a couple conceive. It is a market that represents fertility clinics, hospitals, and even research institutions that provide in vitro fertilization treatments and related services, including medical devices, laboratory equipment, drugs, and consumables used for in vitro fertilization procedures. It also includes the diagnostic tests carried out prior to and in the course of in vitro fertilization, genetic screening technologies, and cryopreservation services. In vitro fertilization market has been used as a generic term describing the portfolio of diverse technologies, services, and products relating to the alleviation of infertility and the promotion of reproductive health.

Key Stakeholders

-

Manufacturers and distributors of In vitro fertilization devices

-

Healthcare institutions (Hospitals and clinics)

-

Surgical centers

-

Healthcare institutions (hospitals and cardiac centers)

-

Research institutions

-

Clinical research organizations

-

Academic Medical Centers and Universities

-

Reference labs

-

Clinical research organizations

-

Accountable Care Organizations (ACOs)

-

Research and consulting firms

-

Contract research organizations (CROs) and contract manufacturing organizations (CMOs)

-

Academic medical centers and universities

-

Market research and consulting firms

-

Surgery Centers

-

Group Purchasing Organizations (GPOs)

-

Medical Research Laboratories

-

Academic Medical Centers and Universities

Objectives of the Study

-

Define, describe, and forecast the In vitro fertilization market on Product, cycle, procedure, end user and region.

-

Analyze opportunities in the market for stakeholders and details of the competitive landscape for market leaders.

-

Detailed information regarding major factors influencing the market growth.

-

Analysis of the micro markets with respect to individual growth trends, prospects, and contribution to the total market.

-

Tracking and analysis of competitive developments such as new product launches and approvals, agreements, partnerships, expansions, acquisitions, and collaborations in the in vitro fertilization market.

-

Description of key companies operating in the market along with their market share analysis and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global In vitro fertilization market

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top 5 companies.

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Europe's In vitro fertilization market: Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

-

Further breakdown of the Rest of Asia Pacific In vitro fertilization market Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

-

Further breakdown of the Rest of the world In vitro fertilization market: Latin America, MEA, and Africa

Reuben

Oct, 2022

Which major players are dominating the Global In Vitro Fertilization Market?.

Albie

Oct, 2022

Which geography is expected to hold the major share of the global In Vitro Fertilization Market by 2030?.

Rory

Oct, 2022

Which factors are responsible for boosting the growth of In Vitro Fertilization Market?.