Inline Metrology Market

Inline Metrology Market by Equipment (CMMS, ODS, Laser Line Scanners, Machine Vision Systems, Multisensor Measuring Systems), Application (Quality Control & Inspection, Reverse Engineering, Assembly Verification) - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The inline metrology market is projected to reach USD 3.80 billion by 2032 from USD 2.63 billion in 2026, growing at a CAGR of 6.3%. Market growth is driven by the increasing adoption of zero-defect and right-first-time manufacturing practices, rising automation across production lines, and the pressing need for real-time quality control in high-precision industries. Additional momentum comes from semiconductor fabrication, automotive and EV manufacturing, and advanced electronics, where inline measurement supports higher throughput, improved yield, and closed-loop process control in complex manufacturing environments.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific region accounted for 45.2% of the market share in 2025.

-

BY OFFERINGBy offering, the equipment segment is expected to dominate the inline metroogy market throughout the forecast period.

-

BY EQUIPMENTBy equipment, the optical digitizers & scanners (ODS) segment is projected to register the highest CAGR during the forecast period.

-

BY APPLCIATIONBy application, the assembly verification segment is expected to record a CAGR of 7.8% during the forecast period.

-

COMPETITIVE LANDSCAPE - KEY PLAYERSHexagon AB, Carl Zeiss AG, and KLA Corporation, among others, were identified as key players in the inline metrology market, driven by their strong focus on continuous technology innovation, deep integration with production-line automation, global customer presence, and robust operational and financial performance across key manufacturing industries.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMEsSmartRay GmbH and Nearfield Instruments have distinguished themselves among startups and SMEs in the inline metrology market through their strong focus on advanced sensing technologies, expanding inline measurement portfolios, and growing adoption in high-precision and high-growth applications, particularly in automotive manufacturing and advanced semiconductor process control.

The inline metrology market is witnessing steady growth, driven by increasing demand for real-time quality control, rising manufacturing complexity, and the shift toward zero-defect production across high-precision industries. Growing adoption of in-line optical, laser, and vision-based measurement systems is improving dimensional accuracy, process stability, and production efficiency. Advancements in sensor technologies, high-speed data processing, and integration with automation and analytics platforms are further reshaping the inline metrology landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The inline metrology market is going under a significant shift in revenue streams, driven by increasing adoption of advanced, software-driven inspection technologies. While revenues were historically led by offline and near-line CMMs, manual or semi-automated vision systems, and post-process inspection, demand is increasingly shifting toward fully automated inline measurement, machine vision–based inspection, multisensor and hybrid metrology platforms, and SPC-enabled analytics. Automotive, aerospace & defense, and semiconductor manufacturing are expected to remain the primary growth drivers, supported by higher requirements for precision, throughput, and zero-defect production. Growing integration of robotics and automation is further accelerating adoption across inline machine vision, optical scanning, and BIW applications, enabling suppliers to capture higher-value opportunities through advanced technology and deeper system integration.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing emphasis on zero-defect and right-first-time manufacturing

-

Rising focus on high-volume, high-precision production

Level

-

Requirement for substantial upfront capital investment

-

Complexities associated with integrating inline metrology into existing production lines

Level

-

Global expansion of semiconductor manufacturing capacity

-

Rising focus on expanding electric vehicle and battery manufacturing capacity

Level

-

Maintaining measurement accuracy at production line speeds

-

Balancing system robustness with measurement sensitivity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing emphasis on zero-defect and right-first-time manufacturing

The increasing emphasis on zero-defect and right-first-time manufacturing is a primary driver for the inline metrology market. Manufacturers are moving away from post-process inspection toward real-time quality control to minimize scrap, rework, and yield losses. Inline metrology enables continuous measurement directly within production lines, allowing immediate detection of deviations and closed-loop process adjustments. This capability is increasingly critical in high-precision, high-throughput manufacturing environments where quality failures can quickly propagate across large production volumes.

Restraint: Requirement for substantial upfront capital investment

The requirement for substantial upfront capital investment remains a significant restraint for inline metrology adoption. Inline systems require advanced sensing technologies, high-speed data processing, automation interfaces, and customization for specific production lines, all of which increase system cost. In addition, installation often involves line modifications and downtime, further elevating total investment. As a result, adoption is slower among cost-sensitive manufacturers, particularly small and mid-sized players, despite the long-term benefits of improved quality and reduced operational losses.

Opportunity: Global expansion of semiconductor manufacturing capacity

The global expansion of semiconductor manufacturing capacity presents a strong growth opportunity for the inline metrology market players. Advanced semiconductor fabrication and packaging processes demand extremely tight dimensional control and continuous monitoring to maintain yield at smaller nodes. Inline metrology systems are increasingly deployed to measure critical features in real time without interrupting wafer flow. As fabs scale production and transition to advanced technologies, demand for high-speed, high-precision inline metrology solutions is expected to accelerate.

Challenge: Maintaining measurement accuracy at production line speeds

Maintaining measurement accuracy at production line speeds is a key challenge for inline metrology systems. As manufacturing lines operate at increasingly higher throughput, metrology solutions must deliver precise measurements within extremely short cycle times. Factors such as part movement, vibration, thermal variation, and surface reflectivity can negatively impact measurement stability. Ensuring consistent accuracy without slowing production or increasing false rejects requires advanced hardware, software algorithms, and robust system design, making true inline deployment technically complex.

INLINE METROLOGY MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deploys inline optical and CMM-based metrology systems within body-in-white and powertrain assembly lines to measure critical dimensions in real time during vehicle production. | Enables early defect detection | Reduces rework and scrap | Supports right-first-time manufacturing in high-volume automotive plants |

|

Uses inline metrology and inspection tools across wafer fabrication and advanced packaging lines to monitor critical dimensions, overlay, and process drift at advanced nodes. | Improves yield control | Minimizes process excursions| Supports high-throughput semiconductor manufacturing with real-time feedback |

|

Implements inline metrology solutions in memory and logic device production to monitor layer thickness, alignment, and surface quality during high-speed fabrication. | Enhances process stability | Increases throughput | Ensures consistent quality in large-scale semiconductor and electronics manufacturing |

|

Integrates inline laser scanning and optical metrology systems in aircraft structure and composite component assembly lines for dimensional verification and alignment. | Reduces manual inspection time |Improves assembly accuracy |Minimizes costly rework in complex aerospace manufacturing processes |

|

Deploys inline vision and laser-based metrology systems in battery module, pack assembly, and vehicle production lines to ensure dimensional consistency and weld quality. | Improves production efficiency | Reduces defect rates | Supports high-speed EV manufacturing with consistent quality control |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The inline metrology ecosystem consists of hardware, software, and service providers and end users across high-precision manufacturing industries. Hardware and software providers such as Hexagon AB, Carl Zeiss AG, KLA Corporation, KEYENCE CORPORATION, Nikon Corporation, FARO, and Jenoptik develop inline measurement systems, sensors, analytics software, and automation-ready platforms. These solutions are integrated directly into production lines to enable real-time dimensional inspection and closed-loop process control. End users including automotive OEMs, electronics manufacturers, and aerospace companies such as Volkswagen Group, Toyota Motor Corporation, Boeing, BMW Group, and large-scale electronics manufacturers drive demand through increasing automation, tighter quality tolerances, and the need for high-throughput, in-line quality assurance.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Inline Metrology Market, By Offering

In 2025, equipment accounted for the largest share of the inline metrology market and is expected to maintain its dominance through the year. The strong position of equipment is driven by high demand for inline optical, laser, and vision-based measurement systems integrated directly into production lines. Manufacturers continue to prioritize capital investment in measurement equipment to enable real-time quality control, process monitoring, and closed-loop manufacturing in high-volume and high-precision production environments.

Inline Metrology Market, By Equipment

In 2025, optical digitizers and scanners (ODS) held the largest share of the inline metrology market. Their dominance is supported by non-contact measurement capability, high-speed data acquisition, and flexibility across a wide range of materials and component geometries. ODS systems are widely deployed in automotive, electronics, and industrial manufacturing lines where fast, accurate, and automated dimensional inspection is critical to maintaining throughput and quality consistency.

Inline Metrology Market, By Application

In 2025, quality control & inspection represented the leading application segment in the inline metrology market. Inline systems are increasingly used to detect defects, dimensional deviations, and surface anomalies in real time, reducing reliance on downstream inspection. The ability to perform 100% inspection at production speeds supports higher yield, lower scrap rates, and improved process stability across automated manufacturing environments.

Inline Metrology Market, By End-use Industry

In 2025, the automotive industry dominated the inline metrology market due to extensive adoption of in-line measurement systems across body-in-white, powertrain, and battery manufacturing lines. Automotive manufacturers rely on inline metrology to meet tight dimensional tolerances, ensure process consistency, and support high-volume production. The shift toward electric vehicles and increased automation further reinforces automotive dominance in inline metrology adoption.

REGION

Asia Pacific to be fastest-growing region in global inline metrology market during forecast period

The Asia Pacific inline metrology market is expected to register the highest growth rate during the forecast period, driven by the region’s strong manufacturing base, rapid expansion of electronics and automotive production, and increasing adoption of automation and advanced quality control technologies. Countries such as China, Japan, South Korea, and India are key contributors, supported by investments in smart factories, semiconductor fabrication, and high-volume production lines. Rising demand for electric vehicles, advanced electronics, and industrial automation further accelerates the adoption of high-speed, high-precision inline metrology solutions across the region.

INLINE METROLOGY MARKET: COMPANY EVALUATION MATRIX

In the inline metrology market matrix, Hexagon AB (Star) leads with a strong market presence and a comprehensive portfolio of inline measurement systems, software platforms, and automation-integrated solutions. Its deep focus on digital manufacturing, closed-loop process control, and global customer reach positions it as a dominant force across automotive, aerospace, and industrial production environments. Mitutoyo (Emerging Leader) is steadily strengthening its position through expanding inline-capable metrology offerings, strong dimensional measurement expertise, and growing adoption in automated production lines. Its increasing emphasis on shop-floor and inline integration signals strong potential to move toward the leaders quadrant.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Hexagon AB (Sweden)

- Carl Zeiss AG (Germany)

- KLA Corporation (US)

- KEYENCE Corporation (Japan)

- Mitutoyo Corporation (Japan)

- FARO Technologies (US)

- Jenoptik (Germany)

- Renishaw plc (UK)

- Creaform (Canada)

- Cognex Corporation (US)

- Accscan (China)

- Baker Hughes (US)

- Nordson Corporation (US)

- ATT Metrology (Spain)

- Intertek Group plc (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 2.49 Billion |

| Market Forecast in 2032 (Value) | USD 3.80 Billion |

| Growth Rate | CAGR of 6.3% from 2026-2032 |

| Years Considered | 2021-2032 |

| Base Year | 2025 |

| Forecast Period | 2026-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: INLINE METROLOGY MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Semiconductor Manufacturer |

|

|

| OSAT (Outsourced Semiconductor Assembly & Test) Vendor |

|

|

| Automotive OEM/Tier-1 Supplier |

|

|

| Electronics & Consumer Device Manufacturer |

|

|

| Aerospace & Industrial Manufacturer |

|

|

RECENT DEVELOPMENTS

- December 2025 : Hexagon AB acquired IconPro, a Germany-based provider of industrial AI solutions focused on intelligent asset maintenance. IconPro’s Apollo software enables remote monitoring of machine performance and operating conditions. The integration of this software with Hexagon’s metrology portfolio is expected to enhance intelligent CMM maintenance, minimize downtime, and improve manufacturing productivity and quality.

- April 2025 : Nikon launched the VOXLS 20 C 225, a space-efficient industrial X-ray CT system delivering a robust CT inspection envelope and high data quality, suitable for automated quality control and production-integrated inspection workflows.

- January 2025 : FARO launched FARO Leap ST, a handheld 3D scanning solution that expands its portable metrology lineup. With five advanced scanning modes and integration with the updated FARO CAM2 Software, Leap ST delivers speed, accuracy, and versatility for manufacturing applications, reinforcing FARO’s leadership in 3D metrology.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

The study involved major activities in estimating the inline metrology market size. Exhaustive secondary research was done to collect information on the inline metrology industry. The next step was to validate these findings and assumptions and validate them with industry experts across the supply chain through primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. Following this, the data triangulation procedure was used to determine the market sizes of segments and subsegments within the inline metrology market and to validate these findings with industry experts.

Secondary Research

Secondary research for this study involved gathering information from various credible sources, such as company reports, white papers, journals, and industry publications. This process helps understand the supply and value chains, identify key players, analyze market segmentation and regional trends, and track major market and technology developments. The data was used to estimate the overall market size, which was later validated through primary research.

Primary Research

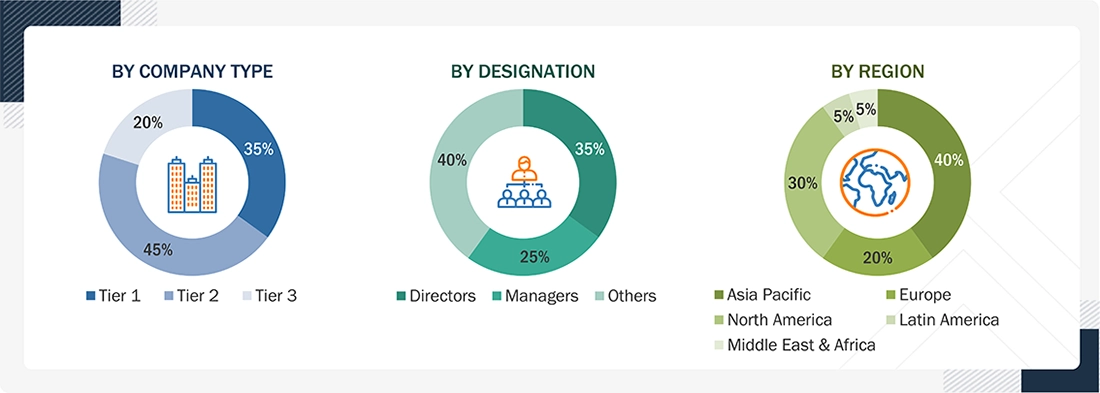

Extensive primary research was conducted after gaining an understanding of the current state of the inline metrology market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across five major regions—North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa. This primary data was collected through questionnaires, emails, and telephonic interviews.

Other designations include product managers, sales managers, and marketing managers.

Tier 1 companies include market players with revenues exceeding USD 500 million; Tier 2 companies earn revenues between USD 100 million and USD 500 million; and Tier 3 companies earn up to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A bottom-up procedure was employed to determine the overall size of the inline metrology market.

- Identifying various types of inline metrology equipment, software, and services provided or expected to be offered by players in the value chain

- Tracking the major manufacturers and providers of inline metrology equipment and related services in different regions

- Tracking the ongoing and upcoming product launches and different inorganic strategies, such as acquisitions, partnerships, and collaborations

- Estimating and forecasting the inline metrology market in each country and, thereby, region based on trade data and GDP analysis

- Conducting multiple discussions with key opinion leaders to understand the types of equipment, software, and services deployed by inline metrology players, as well as analyzing the breakup of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level by discussing with key opinion leaders, including CEOs, directors, and operations managers, and then finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, and white papers

The top-down approach was used to estimate and validate the total size of the inline metrology market.

- Identifying top-line investments in the ecosystem, along with segment-level splits and significant developments

- Obtaining information related to the market revenue generated by the key players of the inline metrology market

- Conducting multiple discussions with key opinion leaders from major companies that manufacture inline metrology solutions

- Estimating geographic splits using secondary sources based on the number of players in a specific region, the types of inline metrology solutions provided, and various supply chain participants related to the market

Inline Metrology Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market was segmented into several segments and subsegments. The data triangulation procedure has been employed to complete the entire market engineering process and obtain exact statistics for each market segment and subsegment. The data has been triangulated by examining various factors and trends on both the demand and supply sides of the inline metrology market.

Market Definition

The inline metrology market comprises measurement, inspection, and quality-control systems integrated directly into manufacturing production lines to enable real-time verification of dimensional accuracy, surface integrity, geometric conformity, and internal component structure during active production. Unlike offline or near-line systems, inline metrology operates within cycle-time constraints and provides immediate feedback without interrupting material flow. Solutions include inline and shop-floor CMMs, optical digitizers and scanners, machine vision systems, multisensor platforms, and inline X-ray and CT systems, leveraging advanced optics, sensors, lasers, motion control systems, and embedded computing systems to deliver high-precision measurements under dynamic shop-floor conditions. Inline metrology plays a critical role in ensuring product quality, manufacturing consistency, and process stability across automotive, aerospace, semiconductor, medical, energy, and industrial sectors, and is a foundational element of Industry 4.0, smart manufacturing, and zero-defect production environments.

Key Stakeholders

- Raw material and optical component suppliers

- Inline metrology equipment manufacturers

- Machine vision hardware and software providers

- Metrology software & analytics providers

- System integrators and automation solution providers

- Robotics and motion control system providers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODMs)

- Contract manufacturing and engineering service provider

- Distributors and value-added resellers (VARs)

- Research institutes and metrology testing laboratories

- Industry associations, standards bodies, and metrology forums

- Governments, financial institutions, and regulatory bodies

Report Objectives

- To define, describe, and forecast the size of the inline metrology market, by application, end-use industry, offering, equipment, automation level, and region in terms of value

- To describe and forecast the size of the inline metrology market, by equipment (optical digitizers & scanners), in terms of volume

-

To forecast the market for various segments with respect to the main regions, namely,

Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, in terms of value - To provide a global macroeconomic outlook

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, value chain, unmet needs and white spaces, interconnected market and cross-sector opportunities, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders and buying criteria, case study analysis, trade analysis, patent analysis, Porter’s five forces, key conferences and events, AI impact, impact of 2025 US tariff, and regulations related to the inline metrology market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation, and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive strategies, such as product/service launches, expansions, agreements, collaborations, and acquisitions, undertaken by market players

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

Customization Options:

Based on the given market data, MarketsandMarkets offers customizations tailored to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Inline Metrology Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Inline Metrology Market