Insect Pest Control Market by Insect Type (Termites, Cockroaches, Bedbugs, Mosquitoes, Flies, & Ants), Control Method (Chemical, Biological, & Physical), Application, Form (Dry and Liquid), and Region - Global Forecast to 2026

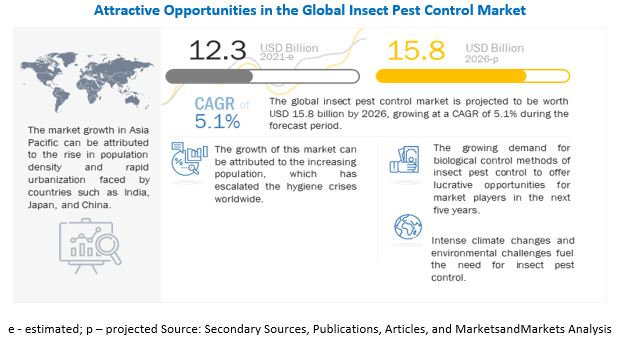

The global insect pest control market is estimated to reach $15.8 billion by 2026, growing at a 5.1% compound annual growth rate (CAGR). The global market size was valued $12.3 billion in 2021.

Insect pest control products find applications in diverse end-user industries, including residential buildings, commercial and non-commercial institutions, livestock, and the industrial sector. The demand for pest control is primarily driven by bulk end-users such as hospitals, airports, hotels, offices in commercial establishments, factories, and manufacturing plants. Additionally, non-commercial institutions, storage and transport facilities, and public landscapes are also contributing positively to the market. Prominent companies in various industries, including Hilton, ITC, General Mills, and Nestlé, require pest control services, particularly in their kitchens.

To know about the assumptions considered for the study, Request for Free Sample Report

Insect Pest Control Market Insights

Drivers: Impact of climate change on insect proliferation

According to the “Public Health Significance of Urban Pest” publication by the WHO, climate change would result in an increase in the population of flying insects. There would be an increase of 244% in fly populations by 2080, according to the statement provided by the WHO. According to the Centre for Agriculture and Bioscience International, the Asian tiger mosquito, mainly found in Asian countries such as India, Indonesia, Malaysia, Myanmar, Nepal, Taiwan, Thailand, and Vietnam, had spread quickly to 28 countries in the past 10 years.

Restraints: Interminable time for regulatory approval of products

Strict and rigorous regulatory requirements in the environmental protection sector are applicable to the manufacturers’ production processes and their production environments. Moreover, these vary with the policies of each country. The usage of insect pest control products is subject to registration by health, environmental protection, and pest control agencies in various countries. Governments evaluate the policies related to the purchase, registration, formulation, application, and disposal of insecticides. The nature of government policies affects the demand and prices of the market.

Opportunities: Adoption of IoT and AI-based technologies in insect pest control

The adoption of AI and IoT in insect pest control has enhanced the effectiveness and efficiency of pest control by integrating an array of tools such as chemical pesticides, biological agents (predators and microbial), light traps, and synthetic pheromones. This cumulative formulation is popularly called Integrated Pest Management (IPM). The adoption of various trending technologies, such as AI, has been on the rise due to the low service cost and its operation in remote and difficult-to-access locations continuously without interrupting the operation of the facility. The insect pest control market has these opportunities.

Challenges: Development of resistance among insects against chemical compounds

Even though insects are effectively controlled by the application of chemicals, these insect species have the ability to develop resistance to insecticides when exposed to a larger dose of these active ingredients frequently. For instance, flies are known to have developed high resistance against all types of insecticides due to the improper handling of pesticides. According to the Center for Integrated Pest Management, over 600 species of pests have developed resistance to chemical compounds.

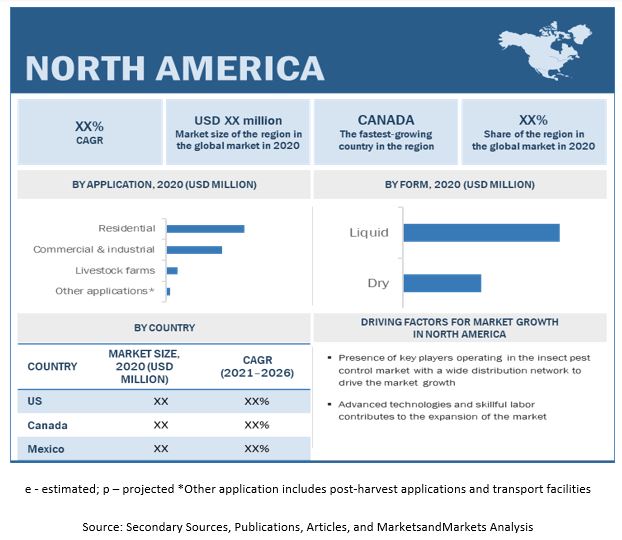

North America is projected to account for the largest market during the forecast period

The North American insect pest control market has been experiencing significant growth. The US acquired the largest share of the North American insect pest control market. According to the Centers for Disease Control and Prevention (CDC), between 2004 and 2016, more than 640,000 cases of insect-borne diseases were reported in the US. Additionally, during this period, nine new germs spread by bites from infected mosquitoes and ticks were discovered or introduced in the US. As a result, the demand for effective pest control methods has significantly increased in recent years.

Top Companies in the Insect Pest Control Market

- Bayer (Germany)

- BASF (Germany)

- Sumitomo Chemical (Japan)

- Korea Henkel home care Co. Ltd. (Korea)

- FMC Corporation (US)

- Syngenta (Switzerland)

- ADAMA (Israel)

- Rentokil Initial Group (UK)

- Terminix (US)

- Rollins, Inc. (US)

Insect Pest Control Market Report Scope

|

Report Metric |

Details |

|

Market valuation in 2021 |

USD 12.3 billion |

|

Revenue prediction in 2026 |

USD 15.8 billion |

|

Progress rate |

CAGR of 5.1% |

|

Base year considered |

2020 |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments Covered |

|

|

Regions covered |

|

|

Companies studied |

BASF (Germany), Bayer (Germany), FMC Corporation (US), Syngenta (Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Rentokil Initial Group (UK), Ecolab (US), Rollins, Inc. (US), Terminix (US), Adama (Israel) |

Insect Pest Control Market Report Segmentation

This research report categorizes the insect pest control market based on insect type, application, control method, source, and region.

|

Segment |

Subsegment |

|

By Insect Type |

|

|

By Application |

|

|

By Control Method |

|

|

By Form |

|

|

By Region |

|

Frequently Asked Questions (FAQ):

What is insect pest control?

Insect pest control refers to the management or regulation of insect populations that pose a threat to crops, livestock, humans, or the environment. Insect pests can cause significant damage to agricultural crops, forests, stored food products, and structures, as well as transmit diseases to humans and animals.

How big is the insect pest control market?

The global insect pest control market is predicted to develop at an 5.1% compound annual growth rate (CAGR) to $15.8 billion by 2026. In 2021, the global market size was valued $12.3 billion.

Which players are involved in the manufacturing of insect pest control market?

Key players in this market include BASF (Germany), Bayer (Germany), FMC Corporation (US), Syngenta (Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Rentokil Initial Group (UK), Ecolab (US), Rollins, Inc. (US), Terminix (US), Adama (Israel).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the insect pest control market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of the insect pest control market?

With growing concerns about food safety, public health, and environmental sustainability, there's a rising demand for effective pest control measures. Also, innovations in pest control methods, such as biological control, pheromone traps, and precision targeting, are enhancing the efficiency and effectiveness of insect pest management.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNIT CONSIDERED

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Market: Primary validations

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: SUPPLY SIDE (1/2)

FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY SIDE (2/2)

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND SIDE

2.2.1 MARKET SIZE ESTIMATION NOTES

FIGURE 6 INSECT PEST CONTROL MARKET SIZE ESTIMATION – TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.6 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

FIGURE 9 SCENARIO-BASED MODELLING

2.7 COVID-19 HEALTH ASSESSMENT

FIGURE 10 COVID-19: GLOBAL PROPAGATION

FIGURE 11 COVID-19 PROPAGATION: SELECT COUNTRIES

2.8 COVID-19 ECONOMIC ASSESSMENT

FIGURE 12 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.8.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 13 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 14 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 48)

TABLE 1 MARKET SNAPSHOT, 2021 VS. 2026

FIGURE 15 IMPACT OF COVID-19 ON INSECT PEST CONTROL MARKET SIZE, BY SCENARIO, 2020 VS. 2021 (USD MILLION)

FIGURE 16 MARKET SIZE, BY INSECT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 18 MARKET SIZE, BY FORM, 2021 VS. 2026 (USD MILLION)

FIGURE 19 MARKET SHARE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 20 THE GLOBAL MARKET IS DRIVEN BY RAPID URBANIZATION AND NEED TO REDUCE DISEASE OUTBREAKS

4.2 NORTH AMERICA: MARKET, BY APPLICATION & COUNTRY

FIGURE 21 THE US IS ESTIMATED TO ACCOUNT FOR A SIGNIFICANT MARKET SHARE IN NORTH AMERICA IN 2021

4.3 MARKET, BY CONTROL METHOD & REGION

FIGURE 22 CHEMICAL CONTROL METHODS DOMINATED THE MARKET IN 2020

4.4 MARKET, BY INSECT TYPE

FIGURE 23 THE TERMITE SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 MARKET, BY FORM

FIGURE 24 LIQUID FORM TO DOMINATE THE INSECT PEST CONTROL DURING THE FORECAST PERIOD

4.6 MARKET SHARE (VALUE), BY KEY REGION/COUNTRY

FIGURE 25 US IS ESTIMATED TO DOMINATE THE INSECT PEST CONTROL MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASING POPULATION DENSITY

TABLE 2 GLOBAL POPULATION DENSITY, 2019

FIGURE 26 POPULATION GROWTH TREND, 1950–2050 (BILLION)

5.2.2 GROWTH OPPORTUNITIES IN DEVELOPING REGIONS SUCH AS ASIA PACIFIC AND SOUTH AMERICA

FIGURE 27 PESTICIDE USAGE IN AGRICULTURE, BY REGION, 2015–2017 (TONS)

5.2.3 EFFECTS OF RAPID URBANIZATION ON INSECT PEST POPULATION

FIGURE 28 MOST URBANIZED COUNTRIES, 2020

5.3 MARKET DYNAMICS

FIGURE 29 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Impact of climate change on insect proliferation

FIGURE 30 LONDON: SEASONAL PEST ACTIVITY, 2017

5.3.1.2 Increase in instances of insect-borne disease outbreaks to encourage public health initiatives

FIGURE 31 US: SALMONELLA OUTBREAK CASES DUE TO LIVESTOCK PESTS, 2002–2018

TABLE 3 GEOGRAPHICAL DISTRIBUTION OF DISEASES TRANSMITTED BY INSECTS AND TICKS

5.3.1.3 Ease of application, availability, and high efficiency of insect pest control products

5.3.2 RESTRAINTS

5.3.2.1 Interminable time for regulatory approval of products

5.3.2.2 Risks associated with storage of insect pest control products

5.3.3 OPPORTUNITIES: INSECT PEST CONTROL MARKET

5.3.3.1 Adoption of IoT and AI-based technologies in insect pest control

5.3.3.2 Emergence of biological insect pest control solutions

5.3.4 CHALLENGES

5.3.4.1 Inadequate technological expertise in AI-based insect pest control solutions

5.3.4.2 Development of resistance among insects against chemical compounds

FIGURE 32 GLOBAL INCREASE IN UNIQUE PESTICIDE-RESISTANT CASES, 1970–2020

5.4 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.4.1 COVID-19 TO DRIVE THE DEMAND FOR INSECT PEST CONTROL AS AN “ESSENTIAL SERVICE”

5.4.2 COVID-19 IMPACT ON THE INSECT PEST CONTROL SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 71)

6.1 INTRODUCTION

6.2 VALUE CHAIN

6.2.1 RESEARCH & PRODUCT DEVELOPMENT

6.2.2 RAW MATERIAL SOURCING AND MANUFACTURING

6.2.3 ASSEMBLY

6.2.4 DISTRIBUTION

6.2.5 MARKETING & SALES

FIGURE 33 VALUE CHAIN ANALYSIS OF THE MARKET: RAW MATERIAL SOURCING AND MANUFACTURING IS A KEY CONTRIBUTOR

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 34 SUPPLY CHAIN ANALYSIS OF THE MARKET

6.4 TECHNOLOGY ANALYSIS

6.4.1 INSECT PEST CONTROL AND CRISPR

6.4.2 INSECT PEST CONTROL AND MICROENCAPSULATION

6.5 PRICING ANALYSIS: MARKET FOR INSECT PEST CONTROL

FIGURE 35 INSECT PEST CONTROL MARKET PRICING ANALYSIS, BY CHEMICAL CONTROL METHOD, 2016–2020 (USD/KG)

FIGURE 36 MARKET PRICING ANALYSIS, BY PHYSICAL CONTROL METHOD, 2016–2020 (USD/KG)

TABLE 4 PRICING ANALYSIS, BY PHYSICAL CONTROL METHODS, 2020

6.6 MARKET MAP AND ECOSYSTEM: MARKET

6.6.1 MANUFACTURERS

6.6.2 SERVICE PROVIDERS

6.6.3 END-USER COMPANIES

6.6.4 INSECT PEST CONTROL: MARKET MAP

TABLE 5 MARKET: SUPPLY CHAIN (ECOSYSTEM)

6.7 TRENDS/DISRUPTIONS IMPACTING BUYERS

FIGURE 37 TRENDS/DISRUPTIONS IMPACTING BUYERS IN THE MARKET

6.8 PATENT ANALYSIS

FIGURE 38 NUMBER OF PATENTS GRANTED BETWEEN 2011 & 2020

FIGURE 39 TOP 10 APPLICANTS IN TERMS OF PATENT DOCUMENTS

TABLE 6 SOME OF THE PATENTS PERTAINING TO INSECT PEST CONTROL, 2019–2021

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 INSECT PEST CONTROL MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 DEGREE OF COMPETITION

6.9.2 BARGAINING POWER OF SUPPLIERS

6.9.3 BARGAINING POWER OF BUYERS

6.9.4 THREAT FROM SUBSTITUTES

6.9.5 THREAT FROM NEW ENTRANTS

6.10 CASE STUDIES: MARKET

6.10.1 USE CASE 1: RENTOKIL USED IOT SOLUTIONS TO INCREASE ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

6.11 REGULATIONS

6.11.1 NORTH AMERICA

6.11.1.1 US

6.11.1.2 Canada

6.11.2 EUROPE

6.11.2.1 Confederation of Europe Pest Management Association (CEPA)

6.11.2.2 European Food Safety Authority (EFSA)

6.11.2.3 European Committee for Standardization (CEN)

6.11.2.4 Biocidal Product Regulation (BPR)

6.11.2.5 Commission Implementing Regulation (EU) 2017/1376

6.11.2.6 UK

6.11.3 ASIA PACIFIC

6.11.3.1 India

6.11.3.1.1 The Insecticides Act

6.11.3.1.2 Central Insecticides Board (CIB)

6.11.3.2 China

6.11.3.3 Australia

6.11.4 SOUTH AMERICA

6.11.4.1 Brazil

6.11.4.2 Argentina

7 INSECT PEST CONTROL MARKET, BY INSECT TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 40 MARKET SIZE, BY INSECT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 8 MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 9 MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

7.2 TERMITES

7.2.1 TERMITE PEST CONTROL WITNESSES THE HIGHEST DEMAND IN THE MARKET

TABLE 10 TERMITE PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 TERMITE PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 COCKROACHES

7.3.1 ADAPTABILITY OF COCKROACHES TO HARSH WEATHER CONDITIONS TRIGGERS GLOBAL DEMAND FOR COCKROACH PEST CONTROL

TABLE 12 COCKROACH PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 13 COCKROACH PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 BEDBUGS

7.4.1 BEDBUGS ACCOUNT FOR A LARGE SHARE OF THE MARKET DUE TO THEIR PREVALENCE IN COMMERCIAL AS WELL AS RESIDENTIAL SET-UPS

TABLE 14 BEDBUG PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 BEDBUG PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 MOSQUITOES

7.5.1 MOSQUITOES ARE THE CAUSE OF THE MOST WIDESPREAD VIRUSES AND INFECTIONS

TABLE 16 MOSQUITO PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 17 MOSQUITO PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 FLIES

7.6.1 ABUNDANCE OF FLIES ALL OVER THE WORLD FUELS THE NEED FOR EFFICIENT PEST CONTROL

TABLE 18 FLY PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 FLY PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 ANTS

7.7.1 CARPENTER ANTS AND FIRE ANTS REQUIRE REGULAR PEST CONTROL TO ERADICATE THEIR COLONIZATION

TABLE 20 ANT PEST CONTROL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 21 ANT PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.8 OTHER INSECTS

7.8.1 INSECT PEST CONTROL FOR FLEAS, BEETLES, AND WASPS IS GAINING TRACTION DUE TO INCREASING CASES OF BITES AND STINGS

TABLE 22 OTHER MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 OTHER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 INSECT PEST CONTROL MARKET, BY APPLICATION (Page No. - 100)

8.1 INTRODUCTION

FIGURE 41 MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 24 MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 25 MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 RESIDENTIAL

8.2.1 PROTECTIVE ADVANTAGES OFFERED BY RESIDENTIAL INSECT PEST CONTROL FUELS ITS DEMAND IN HOMES AND DOMESTIC SET-UPS

TABLE 26 MARKET SIZE IN RESIDENTIAL APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 MARKET SIZE IN RESIDENTIAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.3 COMMERCIAL & INDUSTRIAL

8.3.1 FOOD SECURITY AND HEALTH CONCERNS HAVE AUGMENTED THE DEMAND FOR COMMERCIAL & INDUSTRIAL INSECT PEST CONTROL

TABLE 28 MARKET SIZE IN COMMERCIAL & INDUSTRIAL APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 MARKET SIZE IN COMMERCIAL & INDUSTRIAL APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

8.4 LIVESTOCK FARMS

8.4.1 INSECT PEST CONTROL IN LIVESTOCK FARMS IS NECESSARY TO ENSURE SAFE AND EFFICIENT PRODUCTION AND OUTPUT

TABLE 30 MARKET SIZE IN LIVESTOCK FARMS, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 MARKET SIZE IN LIVESTOCK FARMS, BY REGION, 2021–2026 (USD MILLION)

8.5 OTHER APPLICATIONS

8.5.1 POST-HARVEST APPLICATIONS WITNESS RISING DEMAND AMID FOOD SECURITY CONCERNS

TABLE 32 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9 INSECT PEST CONTROL MARKET, BY CONTROL METHOD (Page No. - 107)

9.1 INTRODUCTION

FIGURE 42 MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021 VS. 2026 (USD MILLION)

TABLE 34 MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 35 MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 36 MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (TONS)

TABLE 37 MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (TONS)

9.2 CHEMICAL CONTROL METHODS

9.2.1 CHEMICAL CONTROL METHODS ARE MOST WIDELY USED IN THE GLOBAL MARKET

9.2.2 PYRETHROIDS

9.2.2.1 Permethrin

9.2.2.2 Deltamethrin

9.2.2.3 Cypermethrin

9.2.2.4 Lambda-Cyhalothrin

9.2.3 ORGANOPHOSPHATES

9.2.3.1 Malathion

9.2.3.2 Temephos

9.2.3.3 Chlorpyrifos

9.2.4 LARVICIDES

9.2.4.1 Pyriproxyfen

9.2.4.2 Cyromazine

9.2.4.3 Diflubenzuron

9.2.5 NEONICOTINOIDS

9.2.6 OTHER CHEMICAL METHODS

TABLE 38 CHEMICAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 CHEMICAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 40 CHEMICAL MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 41 CHEMICAL MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

9.3 PHYSICAL CONTROL METHODS

9.3.1 PHYSICAL CONTROL METHODS ARE LESS ECONOMICAL AND TIME-CONSUMING COMPARED TO CHEMICAL METHODS

TABLE 42 PHYSICAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 43 PHYSICAL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 44 PHYSICAL MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 45 PHYSICAL MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

9.4 BIOLOGICAL CONTROL METHODS

9.4.1 BIOLOGICAL CONTROL METHODS OFFER A LONG-LASTING EFFECT AND ARE AN ENVIRONMENT-CONSCIOUS MODE OF PEST CONTROL

9.4.2 MICROBIALS

9.4.3 PREDATORS

9.4.4 BOTANICALS

TABLE 46 BIOLOGICAL MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 47 BIOLOGICAL INSECT PEST CONTROL MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 48 BIOLOGICAL MARKET SIZE, BY SUBTYPE, 2017–2020 (USD MILLION)

TABLE 49 BIOLOGICAL MARKET SIZE, BY SUBTYPE, 2021–2026 (USD MILLION)

9.5 OTHER CONTROL METHODS

9.5.1 TEMPERATURE CONTROL METHODS FIND WIDE APPLICATION IN THE AGRICULTURAL SECTOR

TABLE 50 OTHER INSECT PEST CONTROL METHODS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 51 OTHER INSECT PEST CONTROL METHODS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 INSECT PEST CONTROL, BY FORM (Page No. - 121)

10.1 INTRODUCTION

FIGURE 43 MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021 VS. 2026 (USD MILLION)

TABLE 52 MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 53 MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

10.2 LIQUID

10.2.1 MULTIPLE ADVANTAGES OFFERED BY LIQUID FORM OF INSECT PEST CONTROL PRODUCTS FUEL ITS DEMAND

TABLE 54 LIQUID MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 55 LIQUID MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 DRY

10.3.1 FOOD SECURITY AND HEALTH CONCERNS HAVE AUGMENTED THE DEMAND FOR COMMERCIAL & INDUSTRIAL INSECT PEST CONTROL

TABLE 56 DRY MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 DRY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 INSECT PEST CONTROL MARKET, BY REGION (Page No. - 126)

11.1 INTRODUCTION

TABLE 58 MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2017–2020 (USD MILLION)

TABLE 59 MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2017–2020 (TONS)

TABLE 61 MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2021–2026 (TONS)

FIGURE 44 REGIONAL SNAPSHOT: NEW HOTSPOTS TO EMERGE IN ASIA PACIFIC, 2021–2026

11.2 COVID-19 IMPACT ON THE MARKET, BY REGION

11.2.1 OPTIMISTIC SCENARIO

TABLE 62 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET, BY REGION, 2019–2022 (USD MILLION)

11.2.2 REALISTIC SCENARIO

TABLE 63 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET, BY REGION, 2019–2022 (USD MILLION)

11.2.3 PESSIMISTIC SCENARIO

TABLE 64 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET, BY REGION, 2019–2022 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Strong service provider and pesticide supplier network to lead to the US dominating the market

TABLE 75 US: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 76 US: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 77 US: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 78 US: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Global warming and temperature anomalies contribute to the growth of the Canadian market

TABLE 79 CANADA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 80 CANADA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 81 CANADA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 82 CANADA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Advancements in biological control methods leading to increased demand for insect pest control in Mexico

TABLE 83 MEXICO: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 84 MEXICO: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 85 MEXICO: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 86 MEXICO: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4 EUROPE

TABLE 87 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

11.4.1 GERMANY

11.4.1.1 Rapid increase in pest infestation drives the German market

TABLE 97 GERMANY: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 98 GERMANY: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 99 GERMANY: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 100 GERMANY: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.2 FRANCE

11.4.2.1 Cockroaches are major insect pests in the country and, thus, dominate the market in France

TABLE 101 FRANCE: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 103 FRANCE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 104 FRANCE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Maintenance of hygiene standards at workplaces and food businesses boosts the market in the UK

TABLE 105 UK: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 106 UK: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 107 UK: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 108 UK: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.4 SPAIN

11.4.4.1 Rise in instances of harsh climate changes augments the demand for a pest-free environment

TABLE 109 SPAIN: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 110 SPAIN: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 111 SPAIN: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 112 SPAIN: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.5 SWITZERLAND

11.4.5.1 The bustling tourism industry drives the demand for insect pest control

TABLE 113 SWITZERLAND: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 SWITZERLAND: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 115 SWITZERLAND: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 116 SWITZERLAND: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.6 ITALY

11.4.6.1 The growing construction market has boosted the demand for termite pest control services in the country

TABLE 117 ITALY: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 118 ITALY: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 119 ITALY: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 120 ITALY: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 121 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 122 REST OF EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 123 REST OF EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 124 REST OF EUROPE: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 125 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

11.5.1 JAPAN

11.5.1.1 Increase in insect population and rise in urban activities would lead to insect pest control growth in Japan

TABLE 135 JAPAN: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 136 JAPAN: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 137 JAPAN: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 138 JAPAN: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.2 AUSTRALIA

11.5.2.1 A rich faunal heritage and a delicate ecosystem strengthen the insect pest control prospects in Australia

TABLE 139 AUSTRALIA: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 140 AUSTRALIA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 141 AUSTRALIA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 142 AUSTRALIA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.3 CHINA

11.5.3.1 Dense population of humans and livestock bolsters insect pest control prospects in China

FIGURE 47 CHINA: URBANIZATION TREND, 2010–2050

TABLE 143 CHINA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 144 CHINA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 145 CHINA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 146 CHINA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.4 INDIA

11.5.4.1 Disease outbreaks and government initiatives drive the growth of insect pest control in India

FIGURE 48 INDIA: URBANIZATION TREND, 2010–2050

TABLE 147 INDIA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 148 INDIA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 149 INDIA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 150 INDIA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.5 THAILAND

11.5.5.1 Rapid urbanization drives the market in Thailand

TABLE 151 THAILAND: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 152 THAILAND: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 153 THAILAND: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 154 THAILAND: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.6 PHILIPPINES

11.5.6.1 Mosquito-borne epidemics fuel the market in the Philippines

TABLE 155 PHILIPPINES: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 156 PHILIPPINES: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 157 PHILIPPINES: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 158 PHILIPPINES: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.5.7 REST OF ASIA PACIFIC

TABLE 159 REST OF ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 163 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 164 SOUTH AMERICA: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 165 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 166 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 167 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 168 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 169 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 170 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

TABLE 171 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 172 SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 High rates of urbanization and insect-prone habitats pose strong growth opportunities for insect pest control in Brazil

TABLE 173 BRAZIL: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 174 BRAZIL: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 175 BRAZIL: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 176 BRAZIL: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 Disease epidemics and unhygienic living conditions spruce the demand for insect pest control

TABLE 177 ARGENTINA: INSECT PEST CONTROL MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 178 ARGENTINA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 179 ARGENTINA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 180 ARGENTINA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 181 REST OF SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 182 REST OF SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 183 REST OF SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 184 REST OF SOUTH AMERICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.7 REST OF THE WORLD (ROW)

TABLE 185 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2017–2020 (USD MILLION)

TABLE 186 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY REGION, 2021–2026 (USD MILLION)

TABLE 187 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 188 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 189 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2017–2020 (USD MILLION)

TABLE 190 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY CONTROL METHOD, 2021–2026 (USD MILLION)

TABLE 191 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 192 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

TABLE 193 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2017–2020 (USD MILLION)

TABLE 194 ROW: MARKET SIZE FOR INSECT PEST CONTROL, BY FORM, 2021–2026 (USD MILLION)

11.7.1 AFRICA

11.7.1.1 Hazardous termite infestations and unsanitary environments drive the market

TABLE 195 AFRICA: INSECT PEST CONTROL MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 196 AFRICA: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 197 AFRICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 198 AFRICA: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

11.7.2 MIDDLE EAST

11.7.2.1 Hot weather and humidity in the Middle East create an ample breeding ground for insect pests

TABLE 199 MIDDLE EAST: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 200 MIDDLE EAST: MARKET SIZE FOR INSECT PEST CONTROL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 201 MIDDLE EAST: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2017–2020 (USD MILLION)

TABLE 202 MIDDLE EAST: MARKET SIZE FOR INSECT PEST CONTROL, BY INSECT TYPE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 203)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 203 MARKET SHARE ANALYSIS, 2020

12.3 REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 49 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD BILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.5.1 STARS

12.5.2 PERVASIVE PLAYERS

12.5.3 EMERGING LEADERS

12.5.4 PARTICIPANTS

FIGURE 50 INSECT PEST CONTROL MARKET, COMPANY EVALUATION QUADRANT, 2020 (KEY PLAYERS)

12.5.5 PRODUCT FOOTPRINT

TABLE 204 COMPANY FOOTPRINT, BY INSECT TYPE

TABLE 205 COMPANY FOOTPRINT, BY APPLICATION

TABLE 206 COMPANY FOOTPRINT, BY REGION

TABLE 207 OVERALL COMPANY FOOTPRINT

12.6 MARKET, START-UP/SME EVALUATION QUADRANT, 2020

12.6.1 PROGRESSIVE COMPANIES

12.6.2 STARTING BLOCKS

12.6.3 RESPONSIVE COMPANIES

12.6.4 DYNAMIC COMPANIES

FIGURE 51 MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UPS/SMES)

12.7 COMPETITIVE SCENARIO

12.7.1 NEW PRODUCT LAUNCHES

TABLE 208 MARKET: NEW PRODUCT LAUNCHES, JULY 2020–JANUARY 2021

12.7.2 DEALS

TABLE 209 MARKET: DEALS, MARCH 2018–JANUARY 2021

13 COMPANY PROFILES (Page No. - 214)

13.1 INSECT PEST CONTROL SOLUTION MANUFACTURERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 BASF

TABLE 210 BASF: INSECT PEST CONTROL MARKET: BUSINESS OVERVIEW

FIGURE 52 BASF: COMPANY SNAPSHOT

TABLE 211 BASF: PRODUCTS OFFERED

13.1.2 BAYER

TABLE 212 BAYER: BUSINESS OVERVIEW

FIGURE 53 BAYER: COMPANY SNAPSHOT

TABLE 213 BAYER: PRODUCTS OFFERED

TABLE 214 BAYER: PRODUCT LAUNCHES

13.1.3 FMC CORPORATION

TABLE 215 FMC CORPORATION: BUSINESS OVERVIEW

FIGURE 54 FMC CORPORATION: COMPANY SNAPSHOT

TABLE 216 FMC CORPORATION: PRODUCTS OFFERED

13.1.4 SYNGENTA

TABLE 217 SYNGENTA: BUSINESS OVERVIEW

FIGURE 55 SYNGENTA: COMPANY SNAPSHOT

TABLE 218 SYNGENTA: PRODUCTS OFFERED

13.1.5 SUMITOMO CHEMICAL CO., LTD.

TABLE 219 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

FIGURE 56 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

TABLE 220 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS OFFERED

13.1.6 ADAMA

TABLE 221 ADAMA: INSECT PEST CONTROL MARKET: BUSINESS OVERVIEW

FIGURE 57 ADAMA: COMPANY SNAPSHOT

TABLE 222 ADAMA: PRODUCTS OFFERED

TABLE 223 ADAMA: DEALS

13.2 GLOBAL INSECT PEST CONTROL SERVICE PROVIDERS

13.2.1 RENTOKIL INITIAL GROUP

TABLE 224 RENTOKIL INITIAL GROUP: BUSINESS OVERVIEW

FIGURE 58 RENTOKIL INITIAL GROUP: COMPANY SNAPSHOT

13.2.2 ECOLAB

TABLE 225 ECOLAB: BUSINESS OVERVIEW

FIGURE 59 ECOLAB: COMPANY SNAPSHOT

13.2.3 ROLLINS, INC.

TABLE 226 ROLLINS, INC.: BUSINESS OVERVIEW

FIGURE 60 ROLLINS, INC.: COMPANY SNAPSHOT

TABLE 227 ROLLINS, INC.: DEALS

13.2.4 TERMINIX

TABLE 228 TERMINIX: BUSINESS OVERVIEW

FIGURE 61 TERMINIX: COMPANY SNAPSHOT

13.3 START-UPS/SMES (INSECT PEST CONTROL SERVICE PROVIDERS)

13.3.1 PEST PULSE

TABLE 229 PEST PULSE: BUSINESS OVERVIEW

13.3.2 UNITED PEST CONTROL

TABLE 230 UNITED PEST CONTROL: BUSINESS OVERVIEW

13.3.3 MILLS PEST MANAGEMENT

TABLE 231 MILLS PEST MANAGEMENT: BUSINESS OVERVIEW

13.3.4 KNOCK-DOWN PEST CONTROL

TABLE 232 KNOCK-DOWN PEST CONTROL: BUSINESS OVERVIEW

13.4 START-UPS/SMES (INSECT PEST CONTROL SOLUTION MANUFACTURERS)

13.4.1 1ENV SOLUTIONS LTD.

13.4.2 CHEMRON

13.4.3 PACICORP ORGANICS PRIVATE LIMITED

13.4.4 BIOFEED

13.4.5 GREENZONE

13.4.6 PATHOGEN & ENVIRONMENTAL SOLUTIONS (PES)

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS TO INSECT PEST CONTROL MARKET(Page No. - 250)

14.1 INTRODUCTION

TABLE 233 ADJACENT MARKETS TO INSECT PEST CONTROL

14.2 LIMITATIONS

14.3 PEST CONTROL MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 234 PEST CONTROL MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

14.4 INSECT REPELLENT ACTIVE INGREDIENTS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 235 INSECT REPELLENT ACTIVE INGREDIENT MARKET SIZE, BY END APPLICATION, 2019–2026 (USD MILLION)

15 APPENDIX (Page No. - 253)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

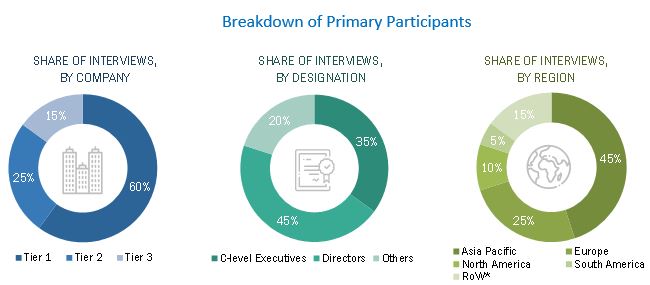

The study involved four major activities in estimating the insect pest control market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The insect pest control market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Insect Pest Control Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the insect pest control market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of insect pest control was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall insect pest control market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Insect Pest Control Market Report Objectives

- Determining and projecting the size of the market, with respect to insect type, application, form, control method, and regional markets, over a period, ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on insect pest control supply chain and its impact on various stakeholders such as suppliers, manufacturers, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the market and impact of COVID-19 on the key vendors.

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the market.

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe insect pest control market, by key country

- Further breakdown of the Rest of Asia Pacific market, by key country

Segmentation Analysis

- Market segmentation analysis of other insect types for insect pest control

- Market segmentation by other applications

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insect Pest Control Market