Insect Repellent Active Ingredients Market by Type (DEET, Picaridin, IR 3535, P-Methane3,8 DIOL, DEPA), Concentration (Less than 10%, 10% to 50%, More Than 50%), Insect Type (Mosquitoes, Bugs), End Application and Region - Global Forecast to 2028

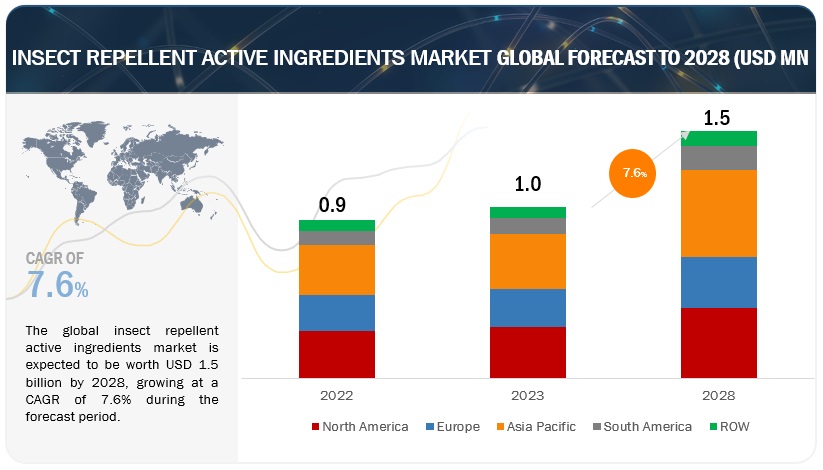

The insect repellent active ingredients market is anticipated to be valued $1.0 billion in 2023, with a 7.6% CAGR to reach $1.5 billion by 2028.The demand for insect repellent has been steadily increasing over the years due to several factors. One of the main drivers is the growing vector population. Insect repellents focus on controlling the infestation of mosquitoes, flies, ticks, bugs, fleas, and other organisms, which can cause adverse effects on humans. There have been rising instances of epidemics caused by pests such as cockroaches, bugs, mosquitoes, flies, and ants across the globe. To prevent such epidemics, various types of insect repellent formulations are being manufactured. The manufacturing may vary according to the type of insects targeted, formulations, active ingredients, concentration, permit requirements, and product registration.

Manufacturers must ensure that new formulations are developed, keeping in mind human health and environmental sustainability. As a result, several laws and regulations have been laid out for manufacturers to protect the people, the environment, and pesticide handlers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Insect Repellent Active Ingredients Market Dynamics

Driver: Growing cases of disease outbreak.

More than 17% of all infectious diseases are vector-borne, according to a report released by the WHO in March 2020. Each year, these illnesses result in about 700,000 deaths. They may be caused by viruses, bacteria, or parasites. Life-threatening diseases like chikungunya, influenza, the H1N1 virus, Zika virus, and dengue have all been on the rise over the past ten years and are typically carried by insects. The Zika virus outbreak in the Americas in 2017 (spread by Aedes aegypti and Aedes albopictus) was the most latest outbreak caused by insect vectors.

The most harmful diseases are spread by mosquitoes. Millions of people globally contract mosquito-borne diseases including malaria and dengue each year. The need for insect repellent products has increased recently due to the spread of diseases.

Malaria is a parasitic infection transmitted by Anopheles mosquitoes. Globally, an estimated 219 million cases of malaria are reported; it results in more than 400,000 deaths annually. Most of the deaths occur in children below the age of five years.

Dengue is another deadly infection transmitted by Aedes mosquitoes. Every year, more than 3.9 billion people in over 129 countries contract dengue. The disease reportedly claims an estimated 40,000 lives every year. According to the National Vector Borne Disease Control Programme (NVBDCP) (India), in 2017, about 11,552 cases of dengue were reported in Tamil Nadu, recording a 350% increase in the number of cases compared to 2016.

Restraint: Side effects on babies

The potential side effects of insect repellent chemicals on babies can impact the market for insect repellent active ingredients. Concerns regarding the safety and well-being of infants can lead to reduced consumer confidence and demand for these products. Parents and caregivers prioritize the health of their children, and if they perceive insect repellents as posing risks or adverse effects, they may seek alternative methods of protection or avoid using repellents altogether.

Opportunity: Increase in demand for insect repellent products in outdoor activities

In recent years, there has been a growing demand for insect repellent products in outdoor activities. This trend can be attributed to several factors, including an increase in outdoor recreation and travel, rising awareness of insect-borne diseases, and the growing popularity of natural and eco-friendly insect repellent products. Products, such as water-based repellents or naturally derived insect repellents, provide efficient and long-term protection against mosquitoes, fleas, bugs, ticks, and other insects.

As more people are engaging in outdoor activities like hiking, camping, and fishing, they are increasingly concerned about protecting themselves from insect bites and the diseases that they can transmit. Insect bites can not only cause discomfort but also lead to serious illnesses such as Lyme disease, Zika virus, and West Nile virus. According to Centers for Disease Control and Prevention 2021, each year, approximately 30,000 cases of Lyme disease are reported to CDC by state health departments and the District of Columbia. As a result, people are increasingly looking for ways to protect themselves from insect bites and reduce their risk of contracting these diseases. As people become more aware of the risks associated with insect bites, they are more likely to take precautions, such as using insect repellent products. This increased awareness has led to a rise in demand for insect repellent products, particularly those that are effective against mosquitoes, ticks, and other disease-carrying insects.

Challenge: Development of active ingredient-resistance among insects reducing the effectiveness of chemical compounds

The development of active ingredient resistance in insects inadvertently create a daunting challenge for effective insect repellents. Through continuous exposure to specific active ingredients, such as DEET or picaridin, insects can develop resistance over time, rendering repellents less effective. This resistance occurs when genetic mutations enable insects to tolerate or avoid the repellent's effects. For instance, mosquitoes have displayed resistance to pyrethroids, a common class of insecticides used in repellents. Such resistance jeopardizes the efficacy of repellents, necessitating the development of alternative active ingredients and strategies to combat evolving insect populations and ensure effective protection against insect-borne diseases.

Insect Repellent Active Ingredients Market Ecosystem

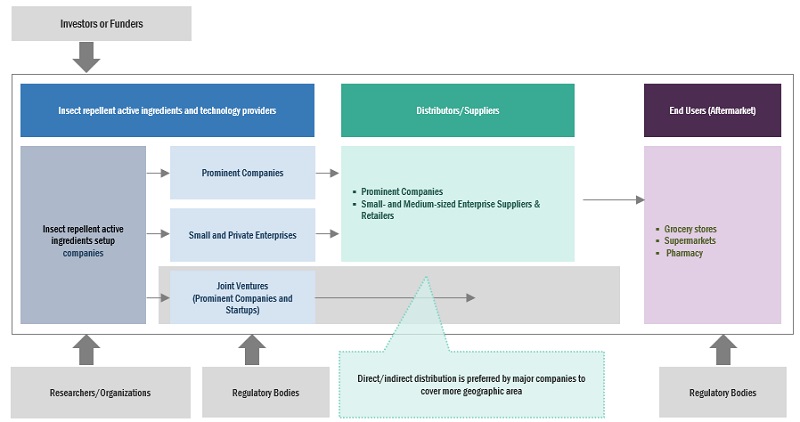

Prominent companies in this market include well-established, financially stable manufacturers of insect repellent active ingredients market. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Sumitomo Chemical Co., Ltd(Japan),BASF SE (Germany), Spectrum Brands, Inc. (US), Reckitt Benckiser Group PLC (UK), Henkel Ag & Co. (Germany), Merck Kgaa (Germany), S C Johnson & Sons Inc. (US), Dabur (India), Godrej Consumer Products Limited (Us), Enesis Group (Indonesia) and Sawyer (US).

Based on concentration type, 10-50% is estimated to account for the largest market share of the insect repellent market

Based on concentration type, 10-50% concentration segment is estimated to account for the largest market share. Products containing a 10%- 50% concentration of active ingredients are most widely used in tick-infested areas with a higher risk of contracting vector-borne diseases. This is because lower concentrations of most EPA-registered repellents are not effective at warding off ticks. A repellent with at least 20% concentration is deemed effective for protection in an infested area. The Center for Disease Control and Prevention (CDC) recommends at least 20% DEET to evade tick bites. According to the American Academy of Paediatrics (AAP) 2020, it is safe to administer DEET to children older than two months old in concentrations of 10% to 30% DEET. Protection against products containing less than 20% picaridin or DEET lasts only a short time. DEET is considered to work best at a concentration of 30% to 35%. DEET and picaridin should be used by travellers of tropical regions in the recommended concentrations (i.e., 20% or greater) every 4 to 6 hours.

Aerosols segment of the insect repellent active ingredients market by end application is projected to witness the highest CAGR during the forecast period.

Based on end application type, the aerosols segment estimated to account for the highest growth rate. Aerosol insect repellents are widely used and highly effective forms of insect protection, providing a convenient and versatile solution for repelling a variety of biting insects. These products come in pressurized cans or containers and are designed to disperse a fine mist or spray of repellent. Aerosol insect repellents offer several advantages. Their spray format allows for easy and even application, ensuring complete coverage on exposed skin. The fine mist enables the repellent to reach difficult-to-access areas, such as clothing folds or hair. This makes aerosol repellents suitable for outdoor activities and areas with high insect populations.

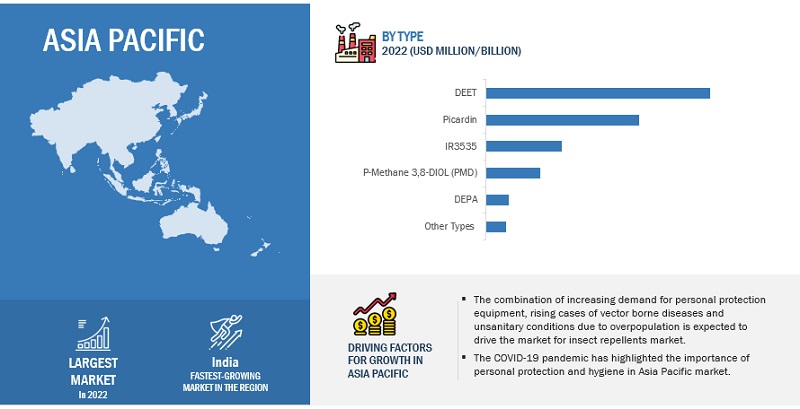

Based on type, DEET segment are anticipated to dominate the market.

Based on type, the market is segmented into DEET, Picardin,IR3535,P-Methane 3,8-DIOL (PMD),DEPA and other Types. DEET, also known by its chemical name N, N-diethyl-meta-toluamide, is a primary ingredient in many repellents. It is frequently used for repelling biting insects like ticks and mosquitoes. According to US EPA 2021, an estimated one-third of Americans use DEET annually to protect themselves against diseases spread by ticks and mosquitoes, such as Lyme disease and Rocky Mountain spotted fever and diseases transmitted by mosquitoes such as the West Nile virus, the Zika virus, or malaria. Currently, DEET-containing products can be purchased by the general public in a range of liquids, lotions, sprays, and impregnated materials (such as towelettes and roll-ons). DEET is present in formulas that can be applied directly to human skin in amounts ranging from 5 to 99%. DEET is approved for use by consumers, however it is not applied to food (apart from a few veterinary purposes).

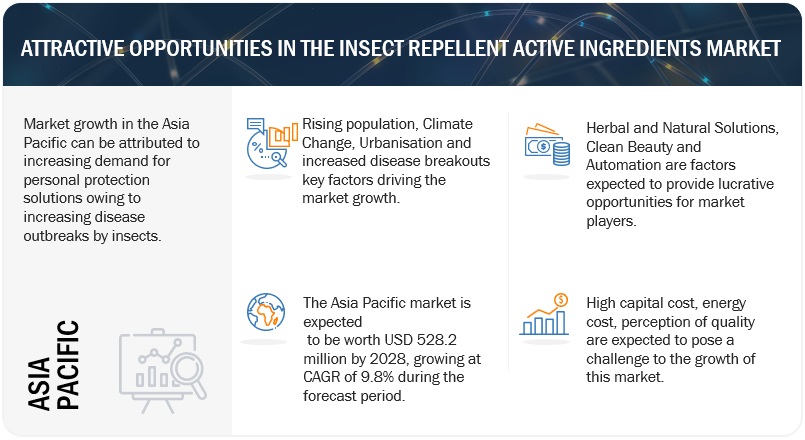

The Asia Pacific market is projected to contribute the largest share for the insect repellent active ingredients market.

Asia Pacific region is confronted with a significant challenge posed by vector-borne diseases, transmitted primarily by insects such as mosquitoes, ticks, and flies. These diseases, namely dengue fever, malaria, chikungunya, and Japanese encephalitis, have a profound impact on public health, resulting in substantial loss of life and economic burden. Each year, a considerable number of cases are reported across key countries in the region.

Mosquitoes, being prevalent insects in the Asia Pacific, are notorious for their role in spreading diseases like dengue fever, which affects millions of people annually. In 2021 according to the Ministry of Health and Family Welfare (MoHFW), India alone reported approximately 67,377 cases of dengue fever, indicating a rising trend in the country. Similarly, Japan faces the persistent threat of Japanese encephalitis, transmitted by mosquitoes, with thousands of cases reported each year. This is expected to drive the large market for insect repellents in the region.

Key Market Players

The key players in this include Sumitomo Chemical Co., Ltd(Japan),BASF SE (Germany), Spectrum Brands, Inc. (US), Reckitt Benckiser Group PLC (UK), Henkel Ag & Co. (Germany), Merck Kgaa (Germany), S C Johnson & Sons Inc. (US), Dabur (India), Godrej Consumer Products Limited (Us), Enesis Group (Indonesia), Sawyer (Us), Bugg Products Llc (US), Coghlan's (Canada), Aurorium (US),Tropical Labs Inc. (US), Pelgar International (US), Clariant (Switzerland), Lanxess (Germany), ,Citrefine (UK), Cangzhou Panoxi Chemical Co., Ltd. (China), Qingdao Benzo New Materials Co., Ltd. (China), Hefei Tnj Chemical Industry Co., Ltd. (China), Nk Chemiosys Private Limited (India), Shogun Organics (India) And Sarex (India).

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type (DEET,Picardin,IR3535,P-Methane 3,8-DIOL (PMD) and DEPA and |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Sumitomo Chemical Co., Ltd(Japan),BASF SE (Germany), Spectrum Brands, Inc. (US), Reckitt Benckiser Group PLC (UK), Henkel Ag & Co. (Germany), Merck Kgaa (Germany), S C Johnson & Sons Inc. (US), |

This research report categorizes the insect repellent active ingredients market based on type, concentration, insect type, end application and region.

|

Aspect |

Details |

|

By Type |

|

|

By Insect Type |

|

|

By Concentration |

|

|

By End Application |

|

|

By Region |

|

Recent Developments

- In 2022, In response to the Global Pest threat, Reckitt Benckiser Group Plc. (US) is anticipating future health threats and working to find new, non-toxic ways to reduce the transmission of disease by pests, whilst preserving beneficial insects and microbes. In collaboration with the London School of Hygiene the company is developing plant-based insect repellents to reduce pest resistance.

- In 2019, Spectrum partnered with AHS to help gain customer attention to its repellents, such as REPEL.

- In 2021, Citrefine had recently completed its new laboratory, which would serve as a climate-controlled room for its machines and would provide an expanded space to develop new formulations. This will provide best naturally derived insect repellent for company.

Frequently Asked Questions (FAQ):

Which are the major companies in the Insect Repellent Active Ingredients market? What are their major strategies to strengthen their market presence?

The key players in this includes BASF SE (Germany), Spectrum Brands, Inc. (US), Reckitt Benckiser Group PLC (UK), Henkel Ag & Co. (Germany), Merck Kgaa (Germany), S C Johnson & Sons Inc. (US), Dabur (India), Godrej Consumer Products Limited (Us), Enesis Group (Indonesia), Sawyer (Us), Bugg Products Llc (US)). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the Insect Repellent Active Ingredients market?

Major drivers of the Insect Repellent Active Ingredient Market is the rising cases of vector borne diseases, rapid urbanization, industrialization, unsanitary living conditions and rise in insect populations due to climate change. This has opened up new opportunities for insect repelelnts to promote safety, prevent disease breakouts and ensure consumer protection. The growth of natural and herbal cosmetic products with insect repellent protection is another opportunity that manufacturers will be looking at.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2022, showcasing strong demand from insect repellent active ingredients market in the region. This can be attributed to growing cases of disease vector borne insects such as Dengue and Malaria.

Which are the key technology trends prevailing in the insect repellent active ingredients market?

The insect repellent active ingredients market is expected to be driven by rising vector-borne disease outbreaks in humans and the increased adoption of digital applications and technology. Many insect repellent manufacturers purchase active ingredient raw materials from suppliers, such as DEET, EBAAP, Picaridin, and DEPA, and then manufacture various chemical insect repellents. Some companies also produce natural insect repellents made from natural oils such as citronella oil, lemon oil, eucalyptus oil, and so on. These chemicals and natural insect repellent products are used in a variety of end-user industries, including residential buildings, commercial and non-commercial institutions, livestock and dairy farms, public spaces, hospitals and medical centres, and industrial sectors.

What is the total CAGR expected to be recorded for the insect repellent active ingredients during 2023-2028?

The global CIEM market size is projected to grow from USD 1.2 billion in 2023 to USD 7.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 44.2% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSRISE IN INSECT INFESTATIONS DUE TO UNSANITARY LIVING CONDITIONS IN DENSELY POPULATED URBAN SLUMS

-

5.3 MARKET DYNAMICSINTRODUCTIONDRIVERS- Rise in vector-borne disease occurrence- Effects of climate change on insect proliferationRESTRAINTS- High interminable time for active ingredients and product approval- Health and environmental hazards related to insect repellents- Side effects on babiesOPPORTUNITIES- Increase in demand for insect repellent products in outdoor activities- Alternatives to chemical-based insect repellentsCHALLENGES- Development of active ingredient-resistance among insects to reduce effectiveness of chemical compounds

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCING AND MANUFACTURINGASSEMBLINGDISTRIBUTIONMARKETING AND SALES

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

-

6.4 TECHNOLOGY ANALYSISINSECT REPELLENT ACTIVE INGREDIENTS AND CRISPRINSECT REPELLENT ACTIVE INGREDIENTS AND MICROENCAPSULATION

-

6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

-

6.6 PATENT ANALYSIS

-

6.7 MARKET MAPSUPPLY SIDEDEMAND SIDE

- 6.8 TRADE SCENARIO

-

6.9 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- North America- Europe- Asia Pacific- South America

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 CASE STUDY ANALYSISSAWYER’S MICROENCAPSULATED INSECT REPELLENTS TO REDUCE HEALTH HAZARDS ASSOCIATED WITH INSECT REPELLENTSSC JOHNSON TO DEVELOP INNOVATIVE INSECT REPELLENT USING SYNTHETIC ACTIVE INGREDIENTS

- 6.13 KEY CONFERENCES & EVENTS IN 2023

- 7.1 INTRODUCTION

-

7.2 LESS THAN 10%REPELLENTS WITH LESS THAN 10% CONCENTRATION TO BE CONSIDERED SAFE FOR INFANTS AND CHILDREN

-

7.3 10%- 50%PRODUCTS WITH 10%- 50% CONCENTRATION TO BE DEEMED EFFECTIVE FOR USE IN TICK-INFESTED AREAS

-

7.4 MORE THAN 50%HEALTH CONCERNS ASSOCIATED WITH USAGE OF REPELLENTS WITH HIGHER CONCENTRATION TO POSE CHALLENGES

- 8.1 INTRODUCTION

-

8.2 PUMP-SPRAYSPUMP SPRAY TYPE OF APPLICATION TO BE PREFERRED AMONG CUSTOMERS DUE TO ITS EASE-OF-USE- Water-based formulations- Ethanol-free formulations- Microencapsulated formulations

-

8.3 GELSGELS INFUSED WITH NATURAL INGREDIENTS TO RISE IN DEMAND

-

8.4 WET WIPESWET WIPES NOT ONLY TO OFFER PROTECTION AGAINST INSECTS BUT ALSO PROVIDE SMOOTH AFTEREFFECTS

-

8.5 CREAMS & LOTIONSSTRONG BARRIER BETWEEN SKIN AND INSECTS TO DRIVE USAGE OF CREAMS AND LOTIONS- Water-based formulations- Ethanol-free formulation- Personal insect repellents with sun protection

-

8.6 AEROSOLSAEROSOLS TO BE PREFERRED INSECT REPELLENTS IN TERMS OF THEIR ABILITY

- 8.7 OTHER END APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 MOSQUITOESGROWING WIDESPREAD VIRUSES AND INFECTIONS TO DRIVE USAGE OF INSECT REPELLENTS

-

9.3 BUGSGROWING HOUSEHOLD TO PROPEL USAGE OF BUG REPELLENTS

-

9.4 FLIESRISING INCIDENCES OF BACTERIAL AND ENTERIC DISEASES TO DRIVE USAGE OF INSECT-REPELLING FLY PRODUCTS

-

9.5 TICKSINSECT REPELLENTS WITH MORE THAN 20% CONCENTRATIONS TO BE EFFECTIVE IN WARDING OFF TICKS

- 9.6 OTHER INSECTS

- 10.1 INTRODUCTION

-

10.2 DEETDEET TO BE COST-EFFECTIVE ACTIVE INGREDIENT WITH EXEMPLARY PROTECTION PROPERTIES

-

10.3 PICARIDIN/ICARIDIN/SALTIDINPROTECTIVE ADVANTAGES OFFERED BY PICARIDIN OVER OTHER ACTIVE INGREDIENTS TO FUEL GLOBAL DEMAND

-

10.4 EBAAP/ IR3535IR3535 INSECT REPELLENTS TO EFFECTIVELY PROTECT FROM MOSQUITOES AND TICKS

-

10.5 P-METHANE-3,8-DIOLEFFECTIVENESS, SAFETY, NATURAL ORIGIN, AND ALIGNMENT WITH CONSUMER PREFERENCES FOR ECO-FRIENDLY AND NATURAL OPTIONS TO INCREASE DEMAND FOR PMD

-

10.6 DEPADEPA INSECT REPELLENTS TO BE USED IN TROPICAL AND SUBTROPICAL REGIONS DUE TO ITS QUALITATIVE PROPERTIES AGAINST INSECT BITES AND DISEASES

- 10.7 OTHER TYPES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Rising temperature to increase demand for insect repellent active ingredients.CANADA- Increase in reported cases of lyme disease coupled with ongoing risk of west nile virus to drive demandMEXICO- High temperature and increasing urbanization to drive demand for insect-repellent active ingredients

-

11.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Rising efforts by government to reduce vector-borneINDIA- Growing public awareness about vector-borne diseases to drive marketJAPAN- Environmentally conscious population to drive usage of natural insect repellent formulationsAUSTRALIA & NEW ZEALAND- Awareness about importance of outdoor insect barrier to drive marketREST OF ASIA PACIFIC

-

11.4 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Increased government initiatives to control insect infestation and drive growthFRANCE- High domestic demand for insect repellent products to drive growthUK- Increase in hygiene standards, awareness level, and health consciousness to drive demandSPAIN- Rising population and temperature to promote growth of insectsITALY- Rising west nile virus cases to drive demandREST OF EUROPE

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rising temperature to increase demand for insect repellent active ingredientsARGENTINA- Poor sanitation conditions to drive demand for insect repellent productsREST OF SOUTH AMERICA

-

11.6 ROWROW: RECESSION IMPACT ANALYSISAFRICA- Unfavorable climatic conditions to increase demandMIDDLE EAST- Rapid urbanization to drive demand

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS

- 12.5 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.6 KEY PLAYERS: ANNUAL REVENUE VS GROWTH

- 12.7 KEY PLAYERS EBITDA

-

12.8 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.9 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMESCOMPANY EVALUATION QUADRANT - PRODUCT FOOTPRINT

-

12.10 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY PLAYERS (INSECT REPELLENT MANUFACTURERS)BASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSPECTRUM BRANDS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRECKITT BENCKISER GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewSC JOHNSON & SON INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDABUR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGODREJ CONSUMER PRODUCTS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENESIS GROUP- Business overview- Products/Solutions/Services offereds- Recent developments- MnM viewSAWYER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBUGG PRODUCTS LLC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOGHLAN’S- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAURORIUM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTROPICAL LABS INC.- Business overview- Products/Solutions/Services offered- Recent developmentsPELGAR INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSCLARIANT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLANXESS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUMITOMO CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCITREFINE.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCANGZHOU PANOXI CHEMICAL CO., LTD. (JIANGSU PANOXI CHEMICAL CO., LTD.)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewQINGDAO BENZO NEW MATERIALS CO., LTD.HEFEI TNJ CHEMICAL INDUSTRY CO., LTD.NK CHEMIOSYS PRIVATE LIMITEDSHOGUN ORGANICSSAREX

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 RODENTICIDES MARKETMARKET DEFINITIONMARKET OVERVIEWRODENTICIDES MARKET, BY TYPE- IntroductionRODENTICIDES MARKET, BY REGION- Introduction

-

14.4 INSECT PEST CONTROL MARKETMARKET DEFINITIONMARKET OVERVIEWINSECT PEST CONTROL MARKET, BY INSECT TYPE- IntroductionINSECT PEST CONTROL MARKET, BY REGION- Introduction

- 15.1 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.2 CUSTOMIZATION OPTIONS

- 15.3 RELATED REPORTS

- 15.4 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019-2021

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- TABLE 4 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 5 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: AVERAGE SELLING PRICE, BY TYPE & REGION, 2022 (USD/TON)

- TABLE 6 DEET: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 7 PICARIDIN: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 8 IR 3535: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 9 P-METHANE 3,8-DIOL (PMD): AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 10 DEPA: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 11 OTHER TYPES: AVERAGE SELLING PRICE, BY REGION, 2020–2022 (USD/TON)

- TABLE 12 KEY PATENTS PERTAINING TO INSECT REPELLENT ACTIVE INGREDIENTS, 2019–2022

- TABLE 13 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: ECOSYSTEM

- TABLE 14 IMPORT DATA OF INSECTICIDES FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 15 EXPORT DATA OF INSECTICIDES FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 US REGISTRATION FEES FOR INSECTICIDES

- TABLE 22 CANADA: REGISTRATION FEES FOR PEST CONTROL PRODUCTS (OTHER THAN SEMIOCHEMICAL OR MICROBIAL AGENTS)

- TABLE 23 CANADA: REGISTRATION FEES FOR SEMIOCHEMICAL OR MICROBIAL AGENT-BASED PEST CONTROL PRODUCTS

- TABLE 24 CANADA: REGISTRATION FEES FOR OTHER APPLICATIONS OF PEST CONTROL PRODUCTS

- TABLE 25 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END APPLICATIONS

- TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 28 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023

- TABLE 29 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 30 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 31 LESS THAN 10%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 LESS THAN 10%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 10%- 50%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 34 10%- 50%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MORE THAN 50%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 MORE THAN 50%: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 INSECT REPELLENT ACTIVE INGREDIENT MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 38 INSECT REPELLENT ACTIVE INGREDIENT MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 39 PUMP-SPRAYS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 PUMP-SPRAYS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 GELS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 42 GELS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 WET WIPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 WET WIPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 CREAMS & LOTIONS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 CREAMS & LOTIONS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 AEROSOLS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 AEROSOLS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OTHER END APPLICATIONS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 50 OTHER END APPLICATIONS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 52 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 53 MOSQUITOES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 54 MOSQUITOES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 BUGS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 BUGS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 FLIES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 58 FLIES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 TICKS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 TICKS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 OTHER INSECTS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 OTHER INSECTS: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 64 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 66 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 67 DEET: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 DEET: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 DEET: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 70 DEET: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 71 PICARIDIN/ICARIDIN/SALTIDIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 PICARIDIN/ICARIDIN/SALTIDIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 PICARIDIN/ICARIDIN/SALTIDIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 74 PICARIDIN/ICARIDIN/SALTIDIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 75 EBAAP/IR3535: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 76 EBAAP/IR3535: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 EBAAP/IR3535: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 78 EBAAP/IR3535: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 79 P- METHANE-3, 8- DIOL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 P- METHANE-3, 8- DIOL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 P- METHANE-3, 8- DIOL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 82 P- METHANE-3, 8- DIOL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 83 DEPA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 DEPA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 DEPA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 86 DEPA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 87 OTHER TYPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 OTHER TYPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 OTHER TYPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 90 OTHER TYPES: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 91 KEY VECTOR-BORNE DISEASES (VBD) AFFECTING HUMANS

- TABLE 92 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2019–2022 (TONS)

- TABLE 95 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 96 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 101 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 102 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 TOP FIVE US CITIES WITH CHANGE IN NUMBER OF ‘ DISEASE-DANGER DAYS’ SINCE 1970

- TABLE 109 US: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 110 US: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 CANADA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 112 CANADA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 MEXICO: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 114 MEXICO: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 120 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 121 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 CHINA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 128 CHINA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 INDIA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 130 INDIA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 JAPAN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 132 JAPAN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 AUSTRALIA & NEW ZEALAND: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 138 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 142 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 143 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 GERMANY: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 150 GERMANY: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 151 FRANCE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 FRANCE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 UK: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 154 UK: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 SPAIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 156 SPAIN: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 ITALY: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 158 ITALY: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 REST OF EUROPE: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 162 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 163 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 164 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 166 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 167 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 168 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 169 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 170 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 172 SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 BRAZIL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 174 BRAZIL: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 175 ARGENTINA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 176 ARGENTINA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 REST OF SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 178 REST OF SOUTH AMERICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 179 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 180 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 181 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 182 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (TONS)

- TABLE 184 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (TONS)

- TABLE 185 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2019–2022 (USD MILLION)

- TABLE 186 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023–2028 (USD MILLION)

- TABLE 187 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2019–2022 (USD MILLION)

- TABLE 188 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023–2028 (USD MILLION)

- TABLE 189 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2019–2022 (USD MILLION)

- TABLE 190 ROW: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023–2028 (USD MILLION)

- TABLE 191 AFRICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 AFRICA: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 MIDDLE EAST: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 194 MIDDLE EAST: INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 195 MARKET: DEGREE OF COMPETITION (COMPETITIVE)

- TABLE 196 COMPANY FOOTPRINT, BY TYPE

- TABLE 197 COMPANY FOOTPRINT, BY INSECT TYPE

- TABLE 198 COMPANY FOOTPRINT, BY REGION

- TABLE 199 OVERALL, COMPANY FOOTPRINT

- TABLE 200 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 201 COMPANY TYPE FOOTPRINT (ACTIVE INGREDIENT MANUFACTURERS)

- TABLE 202 INSECT REPELLENT ACTIVE INGREDIENTS: PRODUCT LAUNCHES

- TABLE 203 INSECT REPELLENT ACTIVE INGREDIENTS: DEALS

- TABLE 204 INSECT REPELLENT ACTIVE INGREDIENTS: OTHERS

- TABLE 205 BASF SE: BUSINESS OVERVIEW

- TABLE 206 BASF SE: PRODUCTS OFFERED

- TABLE 207 SPECTRUM BRANDS, INC.: BUSINESS OVERVIEW

- TABLE 208 SPECTRUM BRANDS, INC.: PRODUCTS OFFERED

- TABLE 209 SPECTRUM BRANDS, INC.: PRODUCT LAUNCHES

- TABLE 210 SPECTRUM BRANDS, INC: DEALS

- TABLE 211 SPECTRUM BRANDS, INC.: OTHERS

- TABLE 212 RECKITT BENCKISER GROUP PLC: BUSINESS OVERVIEW

- TABLE 213 RECKITT BENCKISER GROUP PLC.: PRODUCTS OFFERED

- TABLE 214 RECKITT BENCKISER GROUP PLC.: OTHERS

- TABLE 215 HENKEL AG & CO. KGAA: BUSINESS OVERVIEW

- TABLE 216 HENKEL AG & CO. KGAA: PRODUCTS OFFERED

- TABLE 217 MERCK KGAA: BUSINESS OVERVIEW

- TABLE 218 MERCK KGAA: PRODUCTS OFFERED

- TABLE 219 SC JOHNSON & SON INC.: BUSINESS OVERVIEW

- TABLE 220 SC JOHNSON & SON INC.: PRODUCTS OFFERED

- TABLE 221 SC JOHNSON & SON INC.: PRODUCT LAUNCHES

- TABLE 222 DABUR: BUSINESS OVERVIEW

- TABLE 223 DABUR: PRODUCTS OFFERED

- TABLE 224 GODREJ CONSUMER PRODUCTS LIMITED: BUSINESS OVERVIEW

- TABLE 225 GODREJ CONSUMER PRODUCTS LIMITED: PRODUCTS OFFERED

- TABLE 226 GODREJ CONSUMER PRODUCT LIMITED.: PRODUCT LAUNCHES

- TABLE 227 ENESIS GROUP: BUSINESS OVERVIEW

- TABLE 228 ENESIS GROUP: PRODUCTS OFFERED

- TABLE 229 SAWYER.: BUSINESS OVERVIEW

- TABLE 230 SAWYER.: PRODUCTS OFFERED

- TABLE 231 BUGG PRODUCTS LLC: BUSINESS OVERVIEW

- TABLE 232 BUGG PRODUCTS LLC.: PRODUCTS OFFERED

- TABLE 233 COGHLAN’S: BUSINESS OVERVIEW

- TABLE 234 COGHLAN’S: PRODUCTS OFFERED

- TABLE 235 AURORIUM: BUSINESS OVERVIEW

- TABLE 236 AURORIUM.: PRODUCTS OFFERED

- TABLE 237 TROPICAL LABS INC.: BUSINESS OVERVIEW

- TABLE 238 TROPICAL LABS INC: PRODUCTS OFFERED

- TABLE 239 PELGAR INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 240 PELGAR INTERNATIONAL: PRODUCTS OFFERED

- TABLE 241 CLARIANT: BUSINESS OVERVIEW

- TABLE 242 CLARIANT: PRODUCTS OFFERED

- TABLE 243 LANXESS: BUSINESS OVERVIEW

- TABLE 244 LANXESS: PRODUCTS OFFERED

- TABLE 245 SUMITOMO CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 246 SUMITOMO CHEMICAL CO., LTD, ACTIVE INGREDIENTS: PRODUCTS OFFERED

- TABLE 247 SUMITOMO CHEMICAL CO., LTD, MANUFACTURING USE PRODUCTS: PRODUCTS OFFERED

- TABLE 248 SUMITOMO CHEMICAL CO., LTD, READY-TO-USE FORMULATED PRODUCTS: PRODUCTS OFFERED

- TABLE 249 CITREFINE: BUSINESS OVERVIEW

- TABLE 250 CITREFINE: PRODUCTS OFFERED

- TABLE 251 CITREFINE.: OTHERS

- TABLE 252 CANGZHOU PANOXI CHEMICAL CO., LTD. (JIANGSU PANOXI CHEMICAL CO., LTD.).: BUSINESS OVERVIEW

- TABLE 253 CANGZHOU PANOXI CHEMICAL CO., LTD. (JIANGSU PANOXI CHEMICAL CO., LTD.).: PRODUCTS OFFERED

- TABLE 254 RODENTICIDES MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 255 RODENTICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 256 RODENTICIDES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 257 RODENTICIDES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 258 RODENTICIDES MARKET, BY REGION, 2016–2021 (KT)

- TABLE 259 RODENTICIDES MARKET, BY REGION, 2022–2027 (KT)

- TABLE 260 INSECT PEST CONTROL MARKET, BY INSECT TYPE, 2017–2020 (USD MILLION)

- TABLE 261 INSECT PEST CONTROL MARKET, BY INSECT TYPE, 2021–2026 (USD MILLION)

- TABLE 262 INSECT PEST CONTROL MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 263 INSECT PEST CONTROL MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 264 INSECT PEST CONTROL MARKET, BY REGION, 2017–2020 (TONS)

- TABLE 265 INSECT PEST CONTROL MARKET, BY REGION, 2021–2026 (TONS)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY REGION

- FIGURE 3 RESEARCH DESIGN

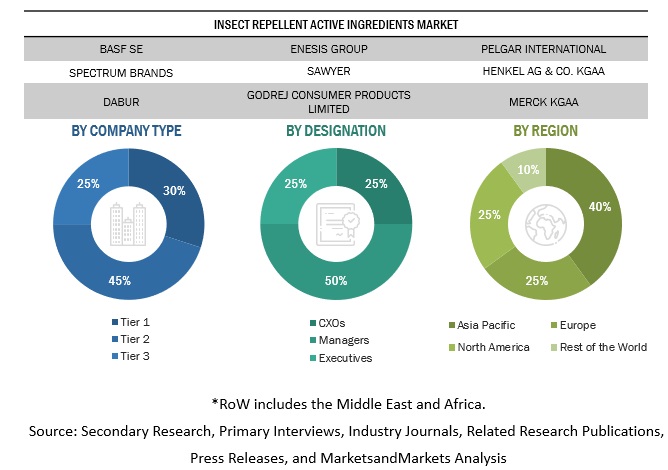

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 7 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 INDICATORS OF RECESSION

- FIGURE 11 WORLD INFLATION RATE: 2011-2021

- FIGURE 12 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 13 RECESSION INDICATORS AND THEIR IMPACT ON INSECT REPELLENT ACTIVE INGREDIENTS MARKET

- FIGURE 14 GLOBAL INSECT REPELLENT ACTIVE INGREDIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 15 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023 VS. 2028 (VALUE)

- FIGURE 17 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

- FIGURE 19 INCREASING CASES OF VECTOR-BORNE DISEASES TO DRIVE MARKET

- FIGURE 20 10-50%CONCENTRATION SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 21 AEROSOLS SEGMENT TO LEAD MARKET IN 2023 IN TERMS OF VALUE

- FIGURE 22 PICARIDIN SEGMENT TO BE DOMINANT MARKET BY 2028

- FIGURE 23 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 24 MALARIA CASE INCIDENCE (CASES PER 1000 POPULATION AT RISK), 2022

- FIGURE 25 COUNTRY WISE MALARIA CASES IN EASTERN MEDITERRANEAN REGION, 2022

- FIGURE 26 INSECT REPELLENT ACTIVE INGREDIENTS MARKET DYNAMICS

- FIGURE 27 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: VALUE CHAIN

- FIGURE 28 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: TRENDS IMPACTING BUYERS

- FIGURE 29 PATENTS GRANTED FOR INSECT REPELLENT ACTIVE INGREDIENTS MARKET, 2012-2022

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED FOR INSECT REPELLENT ACTIVE INGREDIENTS MARKET, 2012-2022

- FIGURE 31 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: MARKET MAP

- FIGURE 32 INSECTICIDES: IMPORT VALUE, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 33 INSECTICIDES: EXPORT VALUE, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END APPLICATIONS

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 36 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY CONCENTRATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY END APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY INSECT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 INSECT REPELLENT ACTIVE INGREDIENTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 INSECT REPELLENT ACTIVE INGREDIENTS MARKET SHARE (VALUE), BY KEY COUNTRY, 2022

- FIGURE 41 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 42 ASIA PACIFIC:RECESSION IMPACT ANALYSIS

- FIGURE 43 EUROPE:RECESSION IMPACT ANALYSIS

- FIGURE 44 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2019–2022 (USD BILLION)

- FIGURE 47 INSECT REPELLENT ACTIVE INGREDIENTS: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 48 ANNUAL REVENUE, 2022 (USD BILLION) VS.REVENUE GROWTH, 2020-2022 (%)

- FIGURE 49 EBITDA, 2022 (USD BILLION)

- FIGURE 50 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 51 INSECT REPELLENT ACTIVE INGREDIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 52 BASF SE: COMPANY SNAPSHOT

- FIGURE 53 SPECTRUM BRANDS, INC.: COMPANY SNAPSHOT

- FIGURE 54 RECKITT BENCKISER GROUP PLC: COMPANY SNAPSHOT

- FIGURE 55 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 56 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 57 DABUR: COMPANY SNAPSHOT

- FIGURE 58 GODREJ CONSUMER PRODUCTS LIMITED: COMPANY SNAPSHOT

- FIGURE 59 CLARIANT: COMPANY SNAPSHOT

- FIGURE 60 LANXESS: COMPANY SNAPSHOT

- FIGURE 61 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the insect repellent active ingredients market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The insect repellent active ingredients market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, and regulatory organizations. The demand side of the market is characterized by the manufacturing companies and startups. Key technology and service providers and suppliers of raw materials characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the insect repellents sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the insect repellent active ingredients market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

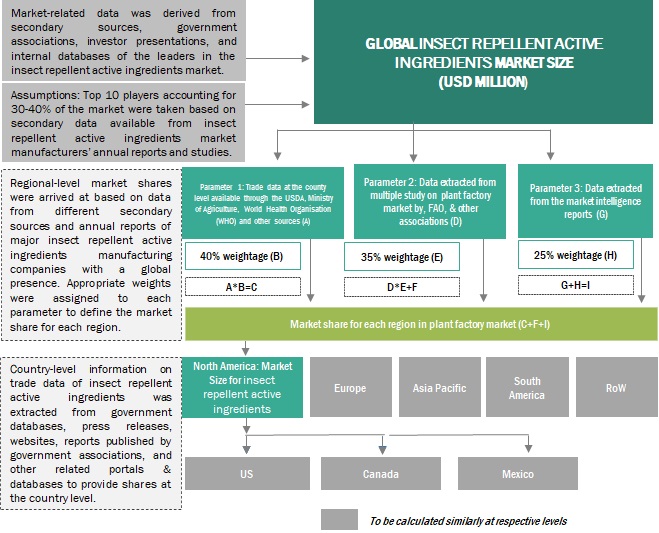

The top-down and bottom-up approaches were used to estimate and validate the total size of the insect repellent active ingredients market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

Top-down Approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the rodenticides market and pest control market—were considered to validate further the market details of insect repellent active ingredients.

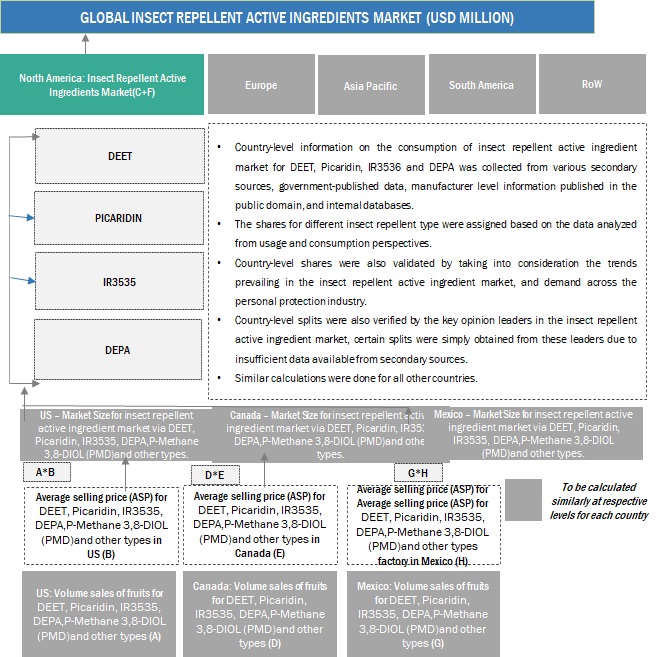

Bottom-up Approach:

- The market size was analyzed based on the share of each type of insect repellent and growing system at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include demand for insect repellents produced through different growing systems across various facility types; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the insect repellent market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global insect repellent active ingredients market Size: Bottom Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. The approach was employed to determine the overall size of the insect repellent active ingredients market in particular regions. Its share in the insect repellent active ingredients market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

Global Insect Repellent Active Ingredients Market Size: Top Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the global insect repellent active ingredients market, related secondary sources such as US Department of Agriculture (USDA) Ministry of Agriculture, Forestry and Fisheries (MAFF), World Health Organisation (WHO) Annual Reports of all major players were considered to arrive at the global market size.

- The global number for Insect Repellent Active Ingredients Market was arrived upon after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for Insect Repellent Active Ingredients Market in the last four years was used to arrive at the country-wise market size. CAGR estimation of type and application segments was used and then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall insect repellent active ingredients market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the Environmental Protection Agency (EPA), “Insect repellent active ingredients are defined as ingredients used to repel mosquitoes, bugs, ticks, flies, and other biting insects, to protect humans from as Zika, Malaria, Lyme disease, Rocky Mountain spotted fever, West Nile virus, and other diseases. Repellents are not meant to kill insects, but to keep them away to prevent bites and spread.

Key Stakeholders

- Insect repellent active ingredient manufacturers

- Insect repellent active ingredient importers and exporters

- Insect repellent manufactures

- Insect repellent importers and exporters

- Intermediary suppliers, such as traders and distributors of Insect repellent active ingredients, such as DEET, PICARIDIN/ICARIDIN/SALTIDIN, EBAAP/ IR3535, P-Methane-3,8-Diol (PMD), DEPA, nootkatone, diethyl carbate, and ethyl hexanediol

-

Associations and industry bodies:

- The World Health Organization (WHO)

- Environmental Protection Agency (EPA)

- Pest Management Regulatory Agency (PMRA)

Report Objectives

Market Intelligence

- Determining and projecting the size of the Insect Repellent Active Ingredients Market based on type, concentration, insect type, end application and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the marketapplication

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Insect Repellent Active Ingredients Market

Competitive Intelligence

- Identifying and profiling the key market players in the Insect Repellent Active Ingredients Market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the Insect Repellent Active Ingredients Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe insect repellent active ingredients market, by key country

- Further breakdown of the Rest of Asia Pacific insect repellent active ingredients market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of Insect Repellent Active Ingredients Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insect Repellent Active Ingredients Market