Insect Growth Regulators Market by Type (Chitin Synthesis Inhibitors, Juvenile Hormone Analogs & Mimics, Anti-juvenile Hormone Agents), Form, Application (Agricultural, Livestock Pests, Commercial Pest Control), and Region - Forecast to 2022

[124 Pages Report] The insect growth regulators market is estimated to be USD 736.3 million in 2016 and is projected to reach USD 1,054.3 million by 2023, at a CAGR of 6.16% during the forecast period.

The years considered for the study are as follows:

- Base year 2015

- Estimated year 2016

- Projected year 2022

- Forecast period 2016 to 2022

Objectives of the report

- To define, segment, and measure the insect growth regulators market on the basis of type, application, form, and region

- To provide an analysis of opportunities in the market for stakeholders through the identification of high-growth segments

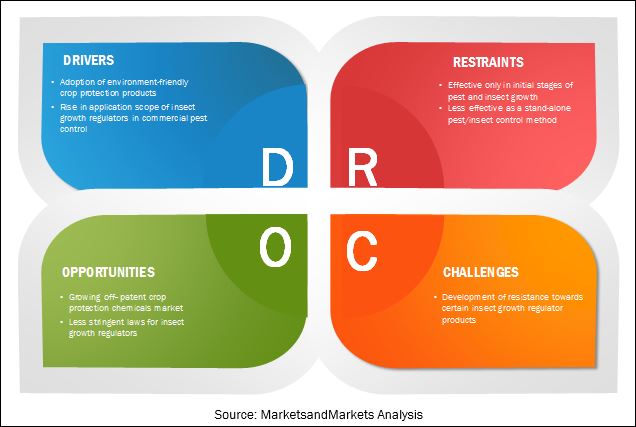

- To understand the drivers, restraints, opportunities, and challenges of the insect growth regulators market

- To profile key players in the insect growth regulators market, and a comprehensive analysis of their core competencies

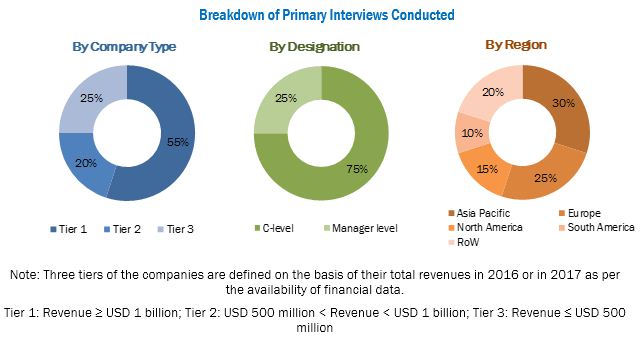

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of insect growth regulators market for regions such as North America, Europe, Asia Pacific, South America, and RoW.

- Key players were identified through secondary sources such as the Bloomberg Businessweek, Factiva, agricultural magazines, and companies annual reports while their market share in the respective regions was determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the insect growth regulators market.

To know about the assumptions considered for the study, download the pdf brochure

The global market for insect growth regulators is dominated by key players such as Bayer CropScience (Germany), The Dow Chemical Company (US), Sumitomo Chemical Company (Japan), Syngenta AG (Switzerland), and Adama (Canada). Some other key players in the market are Platform Specialty Products Corporation (US), Nufarm Limited (Australia), Valent U.S.A Corporation (US), Russell IPM Ltd. (UK), and Central Gardens & Pets Co (US).

Target Audience

The stakeholders for the report are as follows:

- Agrochemical importers/exporters

- Pesticide manufacturers/suppliers

- Crop growers and warehouse owners

- Intermediary supplies

- Wholesalers

- Traders

- Research Institutions and organizations

- Regulatory bodies

Scope of the Report

The research report categorizes the market broadly on the basis of type, application, form, and region.

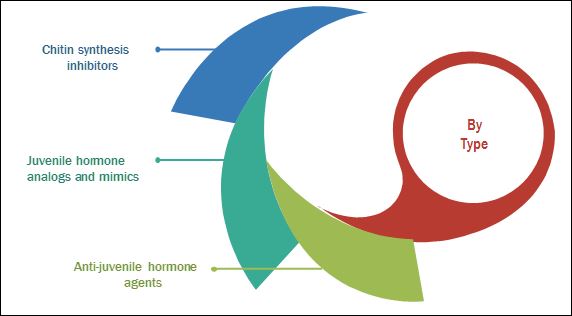

Based on type,the market has been segmented as follows:

- Chitin synthesis inhibitors

- Juvenile hormone analogs and mimics

- Anti-juvenile hormone agents

Based on application, the market has been studied as follows:

- Agricultural

- Field crops

- Horticultural crops

- Turf & ornamentals

- Others (lawns and gardens)

- Livestock pests

- Commercial pest control

- Based on form, the market has been segmented as follows:

- Bait

- Liquid

- Aerosols

Based on region the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (Africa and the Middle East)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for insect growth regulators market into Finland, Portugal, and Greece

- Further breakdown of the Rest of Asia Pacific market for insect growth regulators into Thailand and Malaysia

- Further breakdown of the Rest of South America market for insect growth regulators into Chile and Peru

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growing concerns over environmental toxicity and mammalian safety to increase the demand for biodegradable insect growth regulators

Insect growth regulators (IGRs) are insecticides that halt, slow, and disrupt an insects maturation process. These regulator products are mixed with other insecticides to slow the rate of pesticide resistance developed among insects. They help to eradicate insects at their early reproductive stage and reduce the risk of pest attacks on fully grown crops to increase the productivity and yield per unit. These attributes of IGRs have led to an increase in demand among producers across the globe.

The global market size is projected to reach USD 1,054.3 million by 2022, at a CAGR of 6.16% from 2017 to 2022. The global market has been witnessing strong growth over the last few years due to the growing shift from the development of neurotoxic, broad-spectrum insecticides toward less toxic and more environment-friendly products.

Low knockdown effect and less effectiveness in the elimination of adult insects are the major restraining factors for the market

IGRs are insecticides that mimic hormones in young insects. They interfere with the growth, development, and the metamorphosis process of insects. However, these regulators are less effective when insects complete one growth cycle and reach the next phase. Also, their effect is recorded negligible on adult insects and restricts their overall effect.

Since the active ingredient in an IGR targeted to work on reproductive processes specific to insects, the knockdown effect is visible after mixing it with the other crop protection chemicals, such as insecticides or pesticides. Hence, when insect growth regulators are used as a standalone method of treatment, a longer period is required for an IGR to be effective. Attributed to these factors, these regulators have low knockdown effect as compared to the other insect control chemicals.

The development of resistance by certain insect species toward insecticides or even to an insect growth regulator has been observed. This behavior is the result of a mutation in genes, which causes the inheritance of resistance toward certain active ingredients. For instance, in 1995, researchers discovered that a high level of resistance was developed by whiteflies toward the application of the insect growth regulator, pyriproxyfen, which is a juvenile hormone mimic. In later years, the results of biological tests showed that the alternative usage of compounds, such as buprofezin and diafenthiuron, lowered the resistance level of the insects, due to which the insect growth regulators were found to be considerably effective on whiteflies.

Market Dynamics

Leading manufacturers offer different types of insect growth regulators to control insects at different growth stages

Chitin synthesis inhibitors: Most widely used for controlling agricultural and livestock pests

Chitin is required for the formation of the exoskeleton in various insects. The chitin synthesis inhibitor compound restricts the growth of chitin, which helps in the growth of the exoskeleton among targeted insects. During the molting process, the insect is unable to develop the outer shell required, which helps in killing these insects. IGRs also affects and kills the eggs of these insects by restricting the development of their embryos. Thus, these continue to remain one of the widely used hormones for the development of insect growth regulator, such as chitin synthesis inhibitors. These are widely used by consumers to control fleas that live on pets and cattle.

Juvenile hormone analogs & mimics: Higher application in commercial pest control

Juvenile hormone analogs & mimics are known to disrupt the insect development. When the normal course of molting converts the larvae to the pupal stage, an abnormally high level of juvenilizing agent would produce another larval stage or larval-pupal intermediate stages. Leading manufacturers are focusing on developing a range of IGRs, such as juvenoid insect growth regulators to reduce the growth of these insects. Manufacturers are developing juvenoid insect growth regulators that can also act on the eggs of these insects. Application of these IGRs can cause sterilization, disrupt behavior, and disrupt diapause (the process that triggers dormancy). Methoprene is a juvenile hormone analog, which is most widely used for controlling horn fly and is available under a number of different brand names.

Pyriproxyfen was introduced in 1980 by Sumitomo Chemical (Japan), which is used as a larvicide to control fleas, mosquitoes, carpet beetles, and ants.

Anti-juvenile hormone agents: Suppresses the effect of juvenile hormone

Anti-juvenile hormone agents in the IGR lowers the effect of juvenile hormones by blocking juvenile hormone production. For instance, an early instar can be treated with an anti-juvenile hormone agent, which molts prematurely into a non-functional adult. However, as IGRs are selective in action and may not be economical for the manufacturers to develop, these factors are likely to remain a headwind for the market growth.

Key Questions

- What are the upcoming substitutes and trends that will have a significant impact on the market growth in the future?

- Insect growth regulators are gaining importance in the market as larvicides; how will this impact its role in different sectors such as agriculture, pest control service, and public health in the next five years?

- What will be the prominent revenue-generating pockets for the market in the next five years?

- Most suppliers have opted for key strategies, such as mergers & acquisition as could be seen from the recent developments. Where will it take the industry in the mid to long-term in terms of growth?

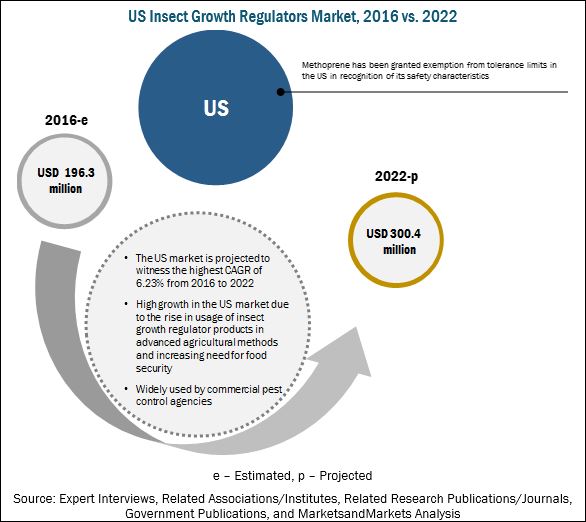

The insect growth regulators (IGRs) market is estimated to be USD 736.3 million in 2016 and is projected to reach USD 1,054.3 million by 2022, at a CAGR of 6.16%. The insect growth regulators market is mainly driven by the growing adoption of environmentally safe crop protection products. Furthermore, these compounds are highly convenient for use on crops such as cotton, tomatoes, wheat, and corn, among others.

There is a growing demand for insect growth regulators in commercial pest control management, indoors as well as outdoors. It can be mixed with insecticides to control mosquitoes, fleas, and other insects. Insect growth regulators interrupt the development of juvenile stages of targeted insects such as ants, cockroaches, fleas, ticks, mosquitoes, litter beetles, and flying insects to prevent them from becoming egg-laying adults. Additionally, they have low toxicity levels, and some are even approved to be used in food establishments.

The chitin synthesis inhibitors segment accounted for the largest share among all the types of insect growth regulators, in 2016. The large share of this segment is due to their ability to restrict the early growth among insects by inactivating chitin synthesis, which is responsible for exoskeleton development.

The insect growth regulators market, by application, is estimated to be dominated by the agricultural segment in 2018. This dominance is attributed to the higher use of IGRs on field crops to control the infestation of insects and pests. These are also used for stored grains in warehouses. The crops on which insect growth regulator products are used include soybean and cotton.

On the basis of form, the insect growth regulators market has been segmented into bait, liquid, and aerosol. Liquid insect growth regulators are usually in the form of concentrates and have a longer shelf life. The insect growth regulator products available in the form of concentrates are usually juvenile hormone analogs & mimics. They restrict the larvae from advancing into the adult form. Hence, the liquid form segment is estimated to account for the largest share in 2016.

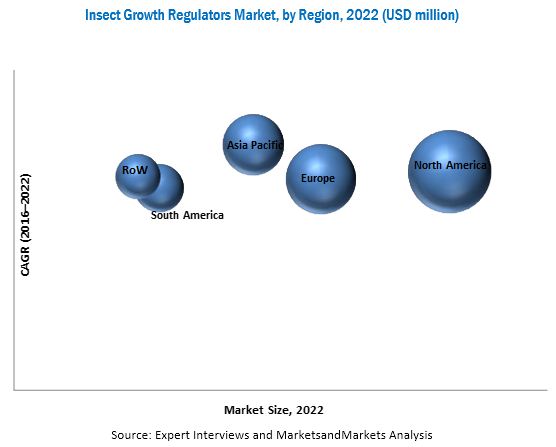

North America is estimated to dominate the insect growth regulators market in 2016. The regions high adoption of modern and less toxic pest control products for different applications is likely to contribute to the growth of this market.

The Asia Pacific insect growth regulators market is projected to have the highest CAGR from 2016 to 2022. The growth in this region can be attributed to the high production of cereals and grains to meet the domestic consumption requirements and the growing usage in warehouses and grain storage units in order to minimize wastage. In terms of market share, the European region was subsequent to North America in 2015.

The major factors restraining the growth of the insect growth regulators market are its less effectiveness as a standalone control method and inability to kill adult insects. However, the market has strong prospects in the coming years, as the market for off-patent crop protection chemicals is growing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in this Market

4.2 Market, By Type

4.3 North America Insect Growth Regulators Market, By Type & Country

4.4 Major Countries

4.5 Market, By Application

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 By Form

5.2.3 By Application

5.2.4 By Region

5.3 Macro Indicators

5.3.1 Reducing Arable Land

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Adoption of Environmentally Safe Crop Protection Products

5.4.1.2 Rise in Application Scope of Insect Growth Regulators in Commercial Pest Control

5.4.2 Restraints

5.4.2.1 Effective Only in Initial Stages of Pest and Insect Growth

5.4.2.2 Less Effective as A Stand-Alone Control Method

5.4.3 Opportunities

5.4.3.1 Growing Off-Patent Crop Protection Chemicals Market

5.4.3.2 Less Stringent Laws for Insect Growth Regulators

5.4.4 Challenges

5.4.4.1 Development of Resistance Towards Certain Insect Growth Regulator Products

5.5 Value Chain

5.6 Supply Chain

6 Insect Growth Regulators Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Chitin Synthesis Inhibitors

6.3 Juvenile Hormone Analogs & Mimics

6.4 Anti-Juvenile Hormone Agents

7 Insect Growth Regulators Market, By Form (Page No. - 47)

7.1 Introduction

7.2 Bait

7.3 Liquid

7.4 Aerosol

8 Insect Growth Regulators Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Agricultural Applications

8.3 Livestock Pest

8.4 Commercial Pest Control

9 Insect Growth Regulators Market, By Region (Page No. - 59)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 Germany

9.3.3 Spain

9.3.4 Italy

9.3.5 U.K.

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia

9.4.5 New Zealand

9.4.6 Rest of Asia-Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Rest of the World (RoW)

9.6.1 Africa

9.6.2 Middle East

10 Competitive Landscape (Page No. - 87)

10.1 Overview

10.2 Ranking Analysis

10.3 Competitive Situation & Trends

10.3.1 Mergers & Acquisitions

10.3.2 Agreements & Collaborations

10.3.3 Investments & Expansions

10.3.4 New Product Launches & Product Approvals

11 Company Profiles (Page No. - 93)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Bayer Cropscience AG

11.2 The DOW Chemical Company

11.3 Sumitomo Chemical Company Limited

11.4 Syngenta AG

11.5 Adama Agricultural Solutions Ltd. (Makhteshim-Agan)

11.6 Nufarm Limited

11.7 Platform Specialty Products Corporation

11.8 Central Garden & Pets Co.

11.9 Valent U.S.A Corporation

11.10 Russell IPM Ltd.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 116)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (64 Tables)

Table 1 Market Size, By Type , 20142022 (USD Million)

Table 2 Chitin Synthesis Inhibitors Market Size, By Region, 20142022 (USD Million)

Table 3 Juvenile Hormone Analogs & Mimics Market Size, By Region, 20142022 (USD Million)

Table 4 Anti-Juvenile Hormone Agents Market Size, By Region, 20142022 (USD Million)

Table 5 Market Size, By Form, 20142022 (USD Million)

Table 6 Bait Insect Growth Regulators Market Size, By Region, 20142022 (USD Million)

Table 7 Liquid Insect Growth Regulators Market Size, By Region, 20142022 (USD Million)

Table 8 Aerosol Insect Growth Regulators Market Size, By Region, 20142022 (USD Million)

Table 9 Market Size for Insect Growth Regulators, By Application, 20142022 (USD Million)

Table 10 Agricultural: Market Size for Insect Growth Regulators, By Region, 20142022 (USD Million)

Table 11 Agricultural Application Market Size, By Crop Type, 20142022 (USD Million)

Table 12 Field Crops Market Size, By Region, 20142022 (USD Million)

Table 13 Horticultural Crops Market Size, By Region, 20142022 (USD Million)

Table 14 Turf & Ornamentals Market Size, By Region, 20142022 (USD Million)

Table 15 Others Agricultural Applications Market Size, By Region, 20142022 (USD Million)

Table 16 Livestock Pests Market Size, By Region, 20142022 (USD Million)

Table 17 Commercial Pest Control Market Size, By Region, 20142022 (USD Million)

Table 18 Market Size for Insect Growth Regulators, By Region, 20142022 (USD Million)

Table 19 North America: Market Size for Insect Growth Regulators, By Country, 20142022 (USD Million)

Table 20 North America: Market Size, By Type, 20142022 (USD Million)

Table 21 North America: Market Size, By Form, 20142022 (USD Million)

Table 22 North America: Market Size, By Application, 20142022 (USD Million)

Table 23 North America: Market Size, By Crop Type, 20142022 (USD Million)

Table 24 U.S.: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 25 Canada: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 26 Mexico: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 27 Europe: Market Size for Insect Growth Regulators, By Country, 20142022 (USD Million)

Table 28 Europe: Market Size, By Type, 20142022 (USD Million)

Table 29 Europe: Market Size, By Form, 20142022 (USD Million)

Table 30 Europe: Market Size, By Application, 20142022 (USD Million)

Table 31 Europe: Market Size, By Crop Type, 20142022 (USD Million)

Table 32 France: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 33 Germany: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 34 Spain: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 35 Italy: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 36 U.K.: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 37 Rest of Europe: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 38 Asia-Pacific: Market Size for Insect Growth Regulators, By Country, 20142022 (USD Million)

Table 39 Asia-Pacific: Market Size, By Type, 20142022 (USD Million)

Table 40 Asia-Pacific: Market Size, By Form, 20142022 (USD Million)

Table 41 Asia-Pacific: Market Size, By Application, 20142022 (USD Million)

Table 42 Asia-Pacific: Market Size, By Crop Type, 20142022 (USD Million)

Table 43 China: Insect Growth Regulators Market Size, By Form, 20142022 (USD Million)

Table 44 Japan: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 45 India: Insect Growth Regulators Market Size, By Form, 20142022 (USD Million)

Table 46 Australia: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 47 New Zealand: Insect Growth Regulators Market Size, By Form, 20142022 (USD Million)

Table 48 Rest of Asia-Pacific: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 49 South America: Insect Growth Regulators Market Size, By Country, 20142022 (USD Million)

Table 50 South America: Market Size, By Type, 20142022 (USD Million)

Table 51 South America: Market Size, By Form, 20142022 (USD Million)

Table 52 South America: Market Size, By Application, 20142022 (USD Million)

Table 53 South America: Market Size, By Crop Type, 20142022 (USD Million)

Table 54 Brazil: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 55 Argentina: Insect Growth Regulators Market Size, By Form, 20142022 (USD Million)

Table 56 Rest of South America: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 57 RoW: Insect Growth Regulators Market Size, By Region, 20142022 (USD Million)

Table 58 RoW: Market Size, By Type, 20142022 (USD Million)

Table 59 RoW: Market Size, By Form, 20142022 (USD Million)

Table 60 RoW: Market Size, By Application, 20142022 (USD Million)

Table 61 RoW: Market Size, By Crop Type, 20142022 (USD Million)

Table 62 Africa: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 63 Middle East: Market Size for Insect Growth Regulators, By Form, 20142022 (USD Million)

Table 64 Ranking Based on Insect Growth Regulators Sales, 2015

List of Figures (39 Figures)

Figure 1Research Design

Figure 2 Market Size Estimation Methodology: Top-Down Approach

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Data Triangulation

Figure 5 North America is Expected to Dominate the Global Market From 2016 to 2022

Figure 6 Market Size, By Type, 2016 vs 2022

Figure 7 Agricultural Segment is Projected to Hold the Largest Market Share By 2022

Figure 8 Liquid Segment is Projected to Hold the Largest Market Share By 2022

Figure 9 Increasing Applicability of Insect Growth Regulators Provides Opportunities for This Market

Figure 10 Juvenile Hormone Analogs & Mimics Segment to Grow at the Highest Rate

Figure 11 U.S. Was the Largest Market for Insect Growth Regulators in 2015

Figure 12 India is Projected to Be the Fastest-Growing Country-Level Market for Insect Growth Regulators From 2016 to 2022

Figure 13 North America Dominated the Global Market in 2015

Figure 14 Arable Land, 2010-2050 (Hectares Per Person)

Figure 15 Drivers, Restraints, Opportunities, and Challenges

Figure 16 Value Chain Analysis for Insect Growth Regulators Market: Major Value is Added During Registration and Formulation

Figure 17 Supply Chain of Insect Growth Regulators Market

Figure 18 Juvenile Hormone Analogs & Mimics Segment Projected to Grow at the Highest Rate Throughout the Forecast Period

Figure 19 Liquid Form Segment is Expected to Dominate the Insect Growth Regulator Market Throughout the Forecast Period

Figure 20 Agricultural Application Segment is Expected to Dominate the Global Market Throughout the Forecast Period

Figure 21 North America to Dominate the Global Market Throughout the Forecast Period

Figure 22 Asia-Pacific, Market is Projected to Grow at the Highest CAGR During 2016 to 2022

Figure 23 North America: Insect Growth Regulators Market Snapshot

Figure 24 Asia-Pacific: Insect Growth Regulators Market Snapshot

Figure 25 Companies Adopted Mergers & Acquisitions as the Key Growth Strategy

Figure 26 Mergers & Acquisitions Was the Key Strategy 20122016

Figure 27 Bayer Cropscience AG Company Snapshot

Figure 28 Bayer Crop Science: SWOT Analysis

Figure 29 The DOW Chemical Company: Company Snapshot

Figure 30 The DOW Chemical Company: SWOT Analysis

Figure 31 Sumitomo Chemical Co. Ltd: Company Snapshot

Figure 32 Sumitomo Chemical Company Ltd.: SWOT Analysis

Figure 33 Syngenta AG: Company Snapshot

Figure 34 Syngenta AG: SWOT Analysis

Figure 35 Adama Agricultural Solutions Ltd.: Company Snapshot

Figure 36 Adama Agricultural Solutions Ltd.: SWOT Analysis

Figure 37 Nufarm Limited: Business Snapshot

Figure 38 Platform Specialty Products Corporation: Company Snapshot

Figure 39 Central Garden & Pets Co.: Business Snapshot

Growth opportunities and latent adjacency in Insect Growth Regulators Market