Mosquito Repellent Market by Repellent Type (Spray, Vaporizer, Cream & Oil, Coil, Mat), After Bite Type (Lotion, Balm, Gel, Roll-on), Distribution Channel (Hypermarket & Supermarket, Independent Stores, E-commerce) and Region (2021 - 2026)

Updated on : September 03, 2025

Mosquito Repellent Market

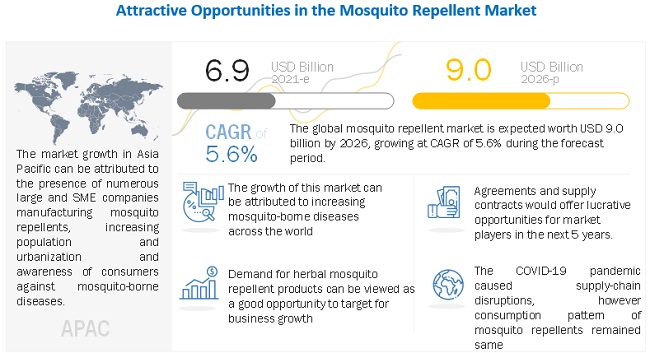

The global mosquito repellent market was valued at USD 6.9 billion in 2021 and is projected to reach USD 9.0 billion by 2026, growing at 5.6% cagr from 2021 to 2026. There is strong demand for mosquito repellants in developing countries due to rise in population and migration of people to urban areas. The demand is also driven by the evolution of rural areas to suburban areas which has caused the mosquitoes to adapt to changing environmental conditions. These mosquitoes are responsible for deadly diseases such as dengue, zika, and yellow fever not only in developed countries but also in developing nations of the world.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Mosquito Repellent Market

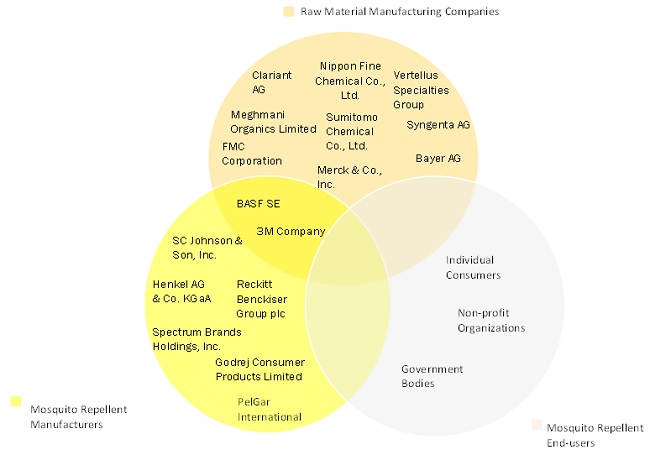

The mosquito repellent market includes major Tier I and II companies like SC Johnson & Son, Inc. (US), Reckitt Benckiser Group plc (UK), Henkel AG & Co. KGaA (Germany), Spectrum Brands Holdings Inc. (US), Godrej Consumer Products Limited (India), BASF SE (Germany), Natura & Co Holding SA (Brazil), 3M Company (US), Dabur India Ltd. (India), Jyothy Labs Limited (India), PelGar International (UK), AoGrand Group (China), Enesis Group (Indonesia), Herbal Strategi (India), Sawyer Products, Inc. (US), and Himalaya Global Holdings Ltd. (India). These manufacturers of mosquito repellent products faced a difficult time during 2020 due to the COVID-19 pandemic induced lockdowns and their businesses were impacted negatively during the year.

The department of Homeland Security of the US had deemed pest control services as ‘essential’ during the pandemic. As a result, vendors and manufacturers alike had to keep their services open even during the lockdown phase of the pandemic. With minimal movement of people and undisturbed conditions during the lockdown, mosquito breeding, cockroach infestation, and rodent activities were expected to rise and there was increased chance of pest proliferation in urban areas.

- In May 2020, SC Johnson contributed to different organizations across the South American region. The company provided their products to the most vulnerable communities of this region in an effort to stem the spread of COVID-19 infection. In Brazil, the company launched Lifeform brand hand sanitizers and donated over 300 thousand units to healthcare and community organizations. The company also partnered with the Red Cross Society in different countries of South America such as Chile, Colombia, Ecuador, Costa Rica and Mexico. In Argentina, the company provided personal protective equipment, disinfectants, and cleaning supplies to Banco de Alimentos, SI Foundation, Seamos UNO, Conciencia Association, TECHO, Sanitary Module, and Caritas San Isidro.

- In July 2020, Reckitt Benckiser Group plc supported the communities of Berkshire and Buckinghamshire in the UK that were affected by the COVID-19 pandemic. Employees of the company working in UK donated over over USD 0.5 million to the Berkshire Community Foundation (BCF). This donation allowed BCF to provide food products to over 2,000 families over a period of six months. The donation also helped the Slough Community Transport (SCT) to provide 3,400 medical prescriptions during the same period.

- In April 2020, Henkel AG & Co. KGaA started producing hand disinfectants at its production unit in Dusseldorf, Germany which were then provided to nearby hospitals and health institutions. Henkel donated over USD 2 million to the COVID-19 Solidarity Response Fund launched by the WHO and the United Nations Foundation. The company also donated 5 million units of personal protective equipment and home hygiene products.

Mosquito Repellent Market Dynamics

Drivers: Rise in mosquito-borne diseases

The World Health Organization (WHO) estimates that every year approximately one million people die due to mosquito bites. The WHO also estimates that every year, around 300-500 million cases of malaria occur with a majority of the inflicted people succumbing to death due to this disease. Moreover, the instances of dengue have also increased with approximately 400 milion people getting infected every year. The US Centers for Disease Control and Prevention (CDC) stated that in 2018, cases of West Nile virus were much higher in the US than the average from 2008 to 2017. The Sub-Saharan African region is also inflicted by mosquito related diseases and approximately 400,000 people were killed in 2018. These stats clearly show the occurrence of mosquito related diseases across the world.

Restraints: Health hazards of pesticides used for mosquito control

Mosquito repellent products contain dangerous chemicals such as DEET, Cyfluthrin, Permethrin, and Pyrethoids. DEET is one of the most common insect repellents, however in large doses this chemical causes ailments to skin, brain, breathing and bones. The compound also affects motor skills during prolonged exposure and can lead to physiological and behavioral problems. Similarly, other chemicals such as cyfluthrin causes neurotoxicity during prolonged exposure. As a result, many consumers try to avoid products containing these harmful chemicals and opt for safer alternatives such as picaridin.

Opportunities: Demand for herbal mosquito repellent products

Traditionally, there are many plant-based repellents which can be used for protection against mosquitoes. Naturally plants contain different chemicals which act as a defense against plant-eating insects. These chemicals can also be used to repel mosquitoes. Plant-based extracts such as citronella genus is a common ingredient used in skin-friendly mosquito repellents and is used at concentrations ranging from 5-10%.

Challenges: Stringent regulations pertaining to manufacturing mosquito repellent products

dCountries such as US, Germany, UK, France, Japan, Australia, Malaysia, Vietnam and others classify mosquito repellents as pesticides. The Food and Agriculture Organization of the United Nations (FAO), World Health Organization (WHO), and United Nations Environment Programme (UNEP) also classify mosquito repellent products as pesticide. The US Environmental Protection Agency (EPA) also mandates the registration of such products before they can be marketed or commercialized across the country. Similarly, the European Union and developing countries like India have their own set of standards concerning manufacture, distribution and consumption of mosquito repellent products.

Mosquito Repellent Market Ecosystem

Based on repellent type, spray segment is expected to grow at a significant CAGR during the forecast period.

Mosquito repellent sprays or aerosols create a mist of liquid particles and are used with a can or bottle that contains the repellent liquid. This liquid is pressurized and when the nozzle is pressed, repellent is released in the form of a mist. These sprays are easier to use and can be applied on different fabrics and surfaces to the mosquito repelling effect. Sprays also work faster than other type of products such as coils, incense sticks, mats and liquids. Countries of North America and Europe are seen to have a preference for sprays, aerosols, and pump sprays.

Independent Stores is expected to be the fastest-growing distribution channel segment of the mosquito repellent market.

Independent stores focus on providing specific set of products rather than selling an array of goods. Different types of independent stores are department stores, specialty stores, pharmacies, convenience stores, and discount stores. Consumers generally prefer an independent store due to the level of personalized shopping experience it offers. The store also provides a conducive environment for shoppers by having a simple layout in which consumers can navigate easily.

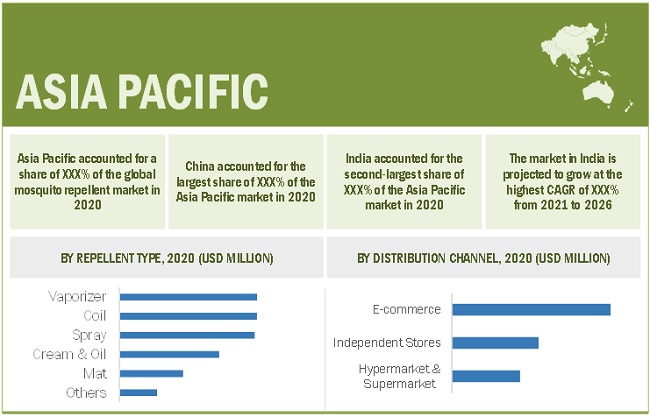

Asia Pacific is expected to be the fastest-growing regional segment in the mosquito repellent market.

The market growth in the Asia Pacific region can be attributed to urbanization, shifting of population from rural areas to sub-urban areas and the prevalence of mosquito-related diseases. Countries such as China, India, Indonesia, and Australia have a climate which helps in breeding of mosquitoes during the monsoon. Moreover, government initiatives are also aiding market growth in this region.

APAC SNAPSHOT

To know about the assumptions considered for the study, download the pdf brochure

Mosquito Repellent Market Players

Some of the leading players operating in the mosquito repellent market include companies like SC Johnson & Son, Inc. (US), Reckitt Benckiser Group plc (UK), Henkel AG & Co. KGaA (Germany), Spectrum Brands Holdings Inc. (US), Godrej Consumer Products Limited (India), BASF SE (Germany), Natura & Co Holding SA (Brazil), 3M Company (US), Dabur India Ltd. (India), Jyothy Labs Limited (India), PelGar International (UK), AoGrand Group (China), Enesis Group (Indonesia), Herbal Strategi (India), Sawyer Products, Inc. (US), and Himalaya Global Holdings Ltd. (India). These players have expansions, acquisitions, new product launches, investment and partnerships as the major strategies to consolidate their position in the market.

Read More: Mosquito Repellent Companies

Recent Developments

- In September 2020, PelGar International launched a product called Cimetrol Super RFU. This is a water-based spray and is an effective repellent for crawling and flying insects. This product can be applied on hard surfaces, cracks, crevices and even mattresses. The product is a blend of synthetic and natural pyrethroids and is delivered in the form of an aerosol.

- In January 2020, Natura &Co acquired Avon Products, Inc. thereby creating the world’s fourth largest company delivering beauty products. Natura &Co aims to gain a strong foothold in the consumer space through a combination of different brands such as of Avon, Natura, The Body Shop, and Aesop.

- In August 2019, Henkel AG & Co. KGaA invested USD 130 million in its production facility to increase its output. The company also aims to improve its product offering by starting a new bottling station for its products.

Frequently Asked Questions (FAQ):

What are mosquito repellents?

Mosquito repellents are substance that are used to repel mosquitoes. These repellents have active ingredients which can be synthetic or natural and also have secondary ingredients such as absorbent paper, water, surfactants, fatty alcohol, fragrance, and other emollients.

What are the different types of mosquito repellents available in the market?

Different types of mosquito repellents are sprays, vaporizers, creams & oils, coils, mats, candles, incense sticks, cards, wet wipes and patches.

What are the key driving factors for the growth of the global mosquito repellent market?

Rising population, urbanization, migration of people to sub-urban and urban areas and adaption of mosquitoes to changing climatic conditions are the key driving factors responsible for the growth of the global mosquito repellent market.

What is the biggest challenge for the growth of the global mosquito repellent market?

Mosquito repellent products are categorized as pesticides in many developed countries of North America and Europe. There are stringent rules and regulations to be followed before these products can be marketed or commercialized.

What are the key regions in the global mosquito repellent market?

Asia Pacific is the key region in the global mosquito repellent market. Developing countries such as China, India, Australia, Indonesia, and Vietnam are expected to provide ample opportunities for growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MOSQUITO REPELLENT

1.2.2 MOSQUITO AFTER-BITE PRODUCTS

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 MOSQUITO REPELLENT MARKET, AFTER-BITE TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 MOSQUITO REPELLENT MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 3 MOSQUITO REPELLENT MARKET, BY DISTRIBUTION CHANNEL: INCLUSIONS & EXCLUSIONS

TABLE 4 MOSQUITO REPELLENT MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 MOSQUITO REPELLENT MARKET: SEGMENTATION

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 2 MOSQUITO REPELLENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

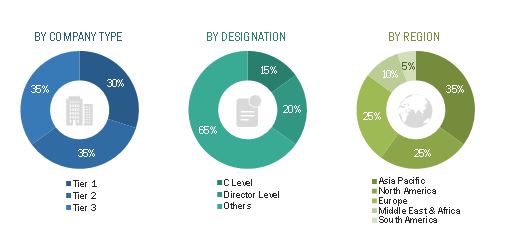

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 DEMAND-SIDE APPROACH

2.2.2 SUPPLY-SIDE APPROACH

2.3 MARKET ENGINEERING PROCESS

2.3.1 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 36)

TABLE 5 MOSQUITO REPELLENT MARKET SNAPSHOT, 2021 & 2026

FIGURE 5 SPRAY SEGMENT ACCOUNTED FOR LARGEST SHARE OF MOSQUITO REPELLENT MARKET IN 2020

FIGURE 6 E-COMMERCE DISTRIBUTION CHANNEL ACCOUNTED FOR LARGEST SHARE OF MOSQUITO REPELLENT MARKET IN 2020

3.1 MOSQUITO REPELLENT MARKET, BY REGION

FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 40)

4.1 ATTRACTIVE OPPORTUNITIES IN GLOBAL MOSQUITO REPELLENT MARKET

FIGURE 8 INCREASING MOSQUITO-BORNE DISEASES AND RISING POPULATION DRIVING MARKET GROWTH

4.2 GLOBAL MOSQUITO REPELLENT MARKET, BY REPELLENT TYPE

FIGURE 9 SPRAY SEGMENT TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

4.3 ASIA PACIFIC MOSQUITO REPELLENT MARKET, BY REPELLENT TYPE AND COUNTRY

FIGURE 10 CHINA TO BE LARGEST MOSQUITO REPELLENT MARKET IN 2021

4.4 MOSQUITO REPELLENT MARKET, BY MAJOR COUNTRIES

FIGURE 11 INDIA, CHINA, INDONESIA, AND BRAZIL TO OFFER LUCRATIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 MOSQUITO REPELLENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rise in mosquito-borne diseases

TABLE 6 LIST OF MOSQUITO-BORNE DISEASES

FIGURE 13 GLOBAL RISE IN DENGUE CASES – 2000 TO 2019

5.2.1.2 Rising population and urbanization in developing countries

FIGURE 14 POPULATION GROWTH, 2010-2020

FIGURE 15 WORLD URBANIZATION GROWTH, 1990-2030

5.2.1.3 Increasing consumer awareness related to mosquito repellent products

5.2.2 RESTRAINTS

5.2.2.1 Health hazards of pesticides used for mosquito control

5.2.2.2 Use of unconventional mosquito-repelling/attracting products

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for herbal mosquito repellent products

5.2.4 CHALLENGES

5.2.4.1 Rise in counterfeit mosquito repellent products

FIGURE 16 INDUSTRIES HIT BY CIRCULATION OF COUNTERFEIT GOODS, 2018

5.2.4.2 Stringent regulations pertaining to manufacturing mosquito repellents

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES ANALYSIS: MOSQUITO REPELLENT MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 DEGREE OF COMPETITION

5.4 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS: MAXIMUM VALUE IS ADDED DURING MARKETING & SALES PROCESS

5.4.1 PROMINENT COMPANIES

5.4.2 SMALL & MEDIUM ENTERPRISES

TABLE 8 MOSQUITO REPELLENT MARKET: ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 19 REVENUE SHIFT & NEW REVENUE POCKETS FOR MOSQUITO REPELLENT MANUFACTURERS

5.6 ECOSYSTEM FOR MOSQUITO REPELLENT MARKET

FIGURE 20 ECOSYSTEM MAP FOR MOSQUITO REPELLENT MARKET

5.7 TECHNOLOGY ANALYSIS

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 INSIGHTS

FIGURE 21 PUBLICATION TRENDS (2010-2021)

TABLE 9 TOP 10 OWNERS OF MOSQUITO REPELLENT PATENTS

FIGURE 22 NO. OF MOSQUITO REPELLENT PATENTS – TOP 10 COUNTRIES (2010-2021)

5.8.3 TOP APPLICANTS

FIGURE 23 NO. OF PATENT APPLICATIONS (2010-2021)

5.9 AVERAGE SELLING PRICE TRENDS

TABLE 10 AVERAGE PRICES OF MOSQUITO REPELLENT PRODUCTS, BY REGION (USD) (2020)

5.10 REGULATORY LANDSCAPE

5.10.1 US

5.10.2 EUROPE

5.10.3 CHINA

5.10.4 BRAZIL

5.11 MACROECONOMIC INDICATORS

5.11.1 POPULATION DENSITY

TABLE 11 POPULATION DENSITY OF IMPORTANT COUNTRIES, 2020

5.12 COVID-19 IMPACT ON MOSQUITO REPELLENT MARKET

5.12.1 COVID-19 HEALTH ASSESSMENT

FIGURE 24 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 25 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

FIGURE 26 THREE SCENARIO-BASED ANALYSIS OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.12.2 COVID-19 IMPACT ON MOSQUITO REPELLENT MARKET

5.12.3 COVID-19 TO DRIVE DEMAND FOR PEST CONTROL SOLUTIONS AS AN ‘ESSENTIAL SERVICE’

5.12.4 COVID-19 IMPACT ON MOSQUITO REPELLENT ACTIVE INGREDIENTS SUPPLY CHAIN

6 INSECT ATTRACTANTS (Page No. - 77)

6.1 INTRODUCTION

6.2 PHEROMONES

TABLE 12 COMMONLY DEPLOYED PHEROMONES FOR ATTRACTING PESTS

6.3 PLANT VOLATILES & FLOWER OILS

TABLE 13 COMMONLY DEPLOYED PLANT VOLATILES & FLOWER OILS FOR ATTRACTING INSECTS

6.4 SUGARS

6.5 PROTEINS

7 MOSQUITO REPELLENT MARKET, BY AFTER-BITE TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 27 MOSQUITO REPELLENT MARKET, BY AFTER-BITE TYPE, BY REGION, 2021 VS 2026 (USD MILLION)

TABLE 14 MOSQUITO REPELLENT MARKET, BY AFTER-BITE TYPE, BY REGION, 2018–2026 (USD MILLION)

7.2 LOTION

7.3 BALM

7.4 GEL

7.5 ROLL-ON

7.6 OTHERS

7.6.1 SPRAY

7.6.2 WET WIPES

8 MOSQUITO REPELLENT MARKET, BY REPELLENT TYPE (Page No. - 87)

8.1 INTRODUCTION

TABLE 15 CHEMICALS EFFECTIVE IN REPELLING YELLOW FEVER MOSQUITO

TABLE 16 MOSQUITO SPECIES COMMONLY FOUND ACROSS THE GLOBE

FIGURE 28 MOSQUITO REPELLENT MARKET, BY REPELLENT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 17 MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

8.2 SPRAY

8.2.1 SPRAY SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 18 MOSQUITO REPELLENT SPRAY MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.3 VAPORIZER

8.3.1 TO RECORD SECOND-FASTEST GROWTH DURING FORECAST PERIOD

TABLE 19 MOSQUITO REPELLENT VAPORIZER MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.4 CREAM & OIL

8.4.1 POPULAR IN DEVELOPED COUNTRIES OF NORTH AMERICA AND EUROPE

TABLE 20 MOSQUITO REPELLENT CREAM & OIL MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.5 COIL

8.5.1 CONSUMED HIGHEST IN COUNTRIES SUCH AS CHINA, INDIA, AND BRAZIL

TABLE 21 MOSQUITO REPELLENT COIL MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.6 MAT

8.6.1 MOSQUITO REPELLENT MATS ARE WITNESSING DECREASED USAGE DUE TO HEALTH HAZARDS

TABLE 22 MOSQUITO REPELLENT MAT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.7 OTHERS

8.7.1 INCENSE STICKS

8.7.2 CANDLES

8.7.3 CARDS

8.7.4 ROLL-ONS

8.7.5 WET WIPES

8.7.6 PATCHES

TABLE 23 MOSQUITO REPELLENT OTHERS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9 MOSQUITO REPELLENT MARKET, BY DISTRIBUTION CHANNEL (Page No. - 98)

9.1 INTRODUCTION

FIGURE 29 MOSQUITO REPELLENT MARKET, BY DISTRIBUTION CHANNEL, 2021 VS. 2026 (USD MILLION)

TABLE 24 MOSQUITO REPELLENT MARKET, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

9.2 HYPERMARKET & SUPERMARKET

9.2.1 TO WITNESS GROWTH IN DEVELOPED

9.2.2 COVID-19 IMPACT ON HYPERMARKET & SUPERMARKET

TABLE 25 MOSQUITO REPELLENT MARKET SIZE IN HYPERMARKET & SUPERMARKET, BY REGION, 2018–2026 (USD MILLION)

9.3 INDEPENDENT STORES

9.3.1 TO RECORD SECOND-FASTEST GROWTH IN DEVELOPING COUNTRIES

9.3.2 COVID-19 IMPACT ON INDEPENDENT STORES

TABLE 26 MOSQUITO REPELLENT MARKET SIZE IN INDEPENDENT STORES, BY REGION, 2018–2026 (USD MILLION)

9.4 E-COMMERCE

9.4.1 TO GROW AT FASTEST RATE DURING FORECAST PERIOD

9.4.2 COVID-19 IMPACT ON E-COMMERCE

TABLE 27 MOSQUITO REPELLENT MARKET SIZE IN E-COMMERCE, BY REGION, 2018–2026 (USD MILLION)

10 MOSQUITO REPELLENT MARKET, BY REGION (Page No. - 104)

10.1 INTRODUCTION

TABLE 28 KEY VECTOR-BORNE DISEASES (VBD) AFFECTING HUMANS

TABLE 29 KEY VECTOR-BORNE DISEASES (VBD) AFFECTING ANIMALS

FIGURE 30 GEOGRAPHIC SNAPSHOT (2021–2026): MOSQUITO REPELLENT MARKET IN INDIA TO GROW AT HIGHEST CAGR

TABLE 30 MOSQUITO REPELLENT MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MOSQUITO REPELLENT MARKET SNAPSHOT

TABLE 31 ASIA PACIFIC: MOSQUITO REPELLENT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 32 ASIA PACIFIC: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 33 ASIA PACIFIC: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.1 CHINA

10.2.1.1 High domestic consumption and presence of numerous mosquito repellent manufacturers

10.2.1.2 COVID-19 impact on China

TABLE 34 CHINA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 35 CHINA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.2 JAPAN

10.2.2.1 Growth in population and urbanization boosting mosquito population

10.2.2.2 COVID-19 impact on Japan

TABLE 36 JAPAN: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 37 JAPAN: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.3 INDIA

10.2.3.1 Increasing awareness about mosquito-borne diseases

10.2.3.2 COVID-19 impact on India

TABLE 38 INDIA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 39 INDIA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Prevalence of mosquitoes to drive market

10.2.4.2 COVID-19 impact on South Korea

TABLE 40 SOUTH KOREA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 41 SOUTH KOREA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.5 INDONESIA

10.2.5.1 Government initiatives and support aiding market growth

10.2.5.2 COVID-19 impact on Indonesia

TABLE 42 INDONESIA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 43 INDONESIA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.6 AUSTRALIA

10.2.6.1 Demand for mosquito repellents due to high pest infestation

10.2.6.2 COVID-19 impact on Australia

TABLE 44 AUSTRALIA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 45 AUSTRALIA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.2.7 REST OF ASIA PACIFIC

10.2.7.1 COVID-19 impact on Rest of Asia Pacific

TABLE 46 REST OF ASIA PACIFIC: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 47 REST OF ASIA PACIFIC: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 32 NORTH AMERICA: MOSQUITO REPELLENT MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.3.1 US

10.3.1.1 Prevalence of mosquito-borne diseases and high consumer awareness

10.3.1.2 COVID-19 impact on US

TABLE 51 US: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 52 US: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Increasing focus on controlling vector-borne diseases

10.3.2.2 COVID-19 impact on Canada

TABLE 53 CANADA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 54 CANADA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.3.3 MEXICO

10.3.3.1 High temperature and increasing urbanization driving mosquito repellent market

10.3.3.2 COVID-19 impact on Mexico

TABLE 55 MEXICO: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 56 MEXICO: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4 EUROPE

FIGURE 33 EUROPE: MOSQUITO REPELLENT MARKET SNAPSHOT

TABLE 57 EUROPE: MOSQUITO REPELLENT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 58 EUROPE: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 59 EUROPE: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.1 GERMANY

10.4.1.1 Increased government initiatives to control insect infestation

10.4.1.2 COVID-19 impact on Germany

TABLE 60 GERMANY: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 61 GERMANY: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.2 FRANCE

10.4.2.1 High domestic demand for mosquito repellent products

10.4.2.2 COVID-19 impact on France

TABLE 62 FRANCE: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 63 FRANCE: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.3 UK

10.4.3.1 Increase in hygiene standards, awareness level, and health consciousness to aid mosquito repellent market growth

10.4.3.2 COVID-19 impact on UK

TABLE 64 UK: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 65 UK: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.4 ITALY

10.4.4.1 Increasing mosquito population to drive mosquito repellent market

10.4.4.2 Covid-19 impact on Italy

TABLE 66 ITALY: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 67 ITALY: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.5 TURKEY

10.4.5.1 Rising temperature to increase mosquito population

10.4.5.2 COVID-19 impact on Turkey

TABLE 68 TURKEY: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 69 TURKEY: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.6 RUSSIA

10.4.6.1 High mosquito density in warmer regions to drive mosquito repellent market

10.4.6.2 COVID-19 impact on Russia

TABLE 70 RUSSIA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 71 RUSSIA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.4.7 REST OF EUROPE

10.4.7.1 COVID-19 impact on Rest of Europe

TABLE 72 REST OF EUROPE: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 73 REST OF EUROPE: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.5 SOUTH AMERICA

TABLE 74 SOUTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 75 SOUTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 76 SOUTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 High prevalence of mosquito-borne diseases

10.5.1.2 COVID-19 impact on Brazil

TABLE 77 BRAZIL: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 78 BRAZIL: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.5.2 ARGENTINA

10.5.2.1 Dengue outbreaks boosting demand for mosquito repellent products

10.5.2.2 COVID-19 impact on Argentina

TABLE 79 ARGENTINA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 80 ARGENTINA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.5.3 REST OF SOUTH AMERICA

10.5.3.1 COVID-19 impact on Rest of South America

TABLE 81 REST OF SOUTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 82 REST OF SOUTH AMERICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

TABLE 83 MIDDLE EAST & AFRICA MOSQUITO REPELLENT MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 84 MIDDLE EAST & AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 85 MIDDLE EAST & AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.6.1 NIGERIA

10.6.1.1 Government initiatives and several funds for reducing malaria burden

10.6.1.2 COVID-19 impact on Nigeria

TABLE 86 NIGERIA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 87 NIGERIA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.6.2 SOUTH AFRICA

10.6.2.1 Increased malaria control activities to drive mosquito repellent market

10.6.2.2 COVID-19 impact on South Africa

TABLE 88 SOUTH AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 89 SOUTH AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

10.6.3 REST OF MIDDLE EAST & AFRICA

10.6.3.1 COVID-19 impact on Rest of Middle East & Africa

TABLE 90 REST OF MIDDLE EAST & AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY REPELLENT TYPE, 2018–2026 (USD MILLION)

TABLE 91 REST OF MIDDLE EAST & AFRICA: MOSQUITO REPELLENT MARKET SIZE, BY DISTRIBUTION CHANNEL, 2018–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 157)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

FIGURE 34 OVERVIEW OF STRATEGIES DEPLOYED BY MOSQUITO REPELLENT MANUFACTURERS

FIGURE 35 COMPANIES ADOPTED ORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND APRIL 2021

11.3 MARKET EVALUATION FRAMEWORK

FIGURE 36 MARKET EVALUATION FRAMEWORK: 2020 SAW NEW PRODUCT LAUNCHES LEADING THIS SPACE

11.4 MARKET SHARE ANALYSIS: MOSQUITO REPELLENT MARKET (2020)

11.4.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN MOSQUITO REPELLENT MARKET

FIGURE 37 TOP 5 PLAYERS IN THE MOSQUITO REPELLENT MARKET (2020)

TABLE 92 MOSQUITO REPELLENT MARKET: DEGREE OF COMPETITION

FIGURE 38 SC JOHNSON & SON, INC. CAPTURED THE LARGEST SHARE IN THE MOSQUITO REPELLENT MARKET IN 2020

11.4.2 REVENUE ANALYSIS OF TOP PLAYERS IN MOSQUITO REPELLENT MARKET

FIGURE 39 TOP PLAYERS – REVENUE ANALYSIS (2017–2020)

11.5 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2020

11.5.1 STAR

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE

11.5.4 PARTICIPANTS

FIGURE 40 MOSQUITO REPELLENT MARKET: COMPETITIVE LANDSCAPE MAPPING, 2020

11.6 COMPETITIVE BENCHMARKING

11.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MOSQUITO REPELLENT MARKET

11.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MOSQUITO REPELLENT MARKET

11.7 SME MATRIX, 2020

11.7.1 PROGRESSIVE COMPANIES

11.7.2 DYNAMIC COMPANIES

11.7.3 RESPONSIVE COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 43 MOSQUITO REPELLENT MARKET: COMPETITIVE LEADERSHIP MAPPING OF EMERGING COMPANIES, 2020

TABLE 93 COMPANY PRODUCT FOOTPRINT, 2020

TABLE 94 COMPANY DISTRIBUTION FOOTPRINT, 2020

TABLE 95 COMPANY REGIONAL FOOTPRINT, 2020

TABLE 96 COMPANY OVERALL FOOTPRINT, 2020

11.8 KEY MARKET DEVELOPMENTS

TABLE 97 MOSQUITO REPELLENT MARKET: NEW PRODUCT LAUNCH, JANUARY 2017 –APRIL 2021

TABLE 98 MOSQUITO REPELLENT MARKET: DEALS, JANUARY 2017 – APRIL 2021

TABLE 99 MOSQUITO REPELLENT MARKET: OTHERS, JANUARY 2017 – APRIL 2021

12 COMPANY PROFILES (Page No. - 177)

12.1 KEY PLAYERS

(Business Overview, Products offered & strategies, Key Insights, Financial, Operational assessment, COVID-19-related developments, Winning imperatives, MnM View)*

12.1.1 SC JOHNSON & SON, INC.

TABLE 100 SC JOHNSON & SON, INC.: COMPANY OVERVIEW

12.1.2 RECKITT BENCKISER GROUP PLC

TABLE 101 RECKITT BENCKISER GROUP PLC: COMPANY OVERVIEW

FIGURE 44 RECKITT BENCKISER GROUP PLC: COMPANY SNAPSHOT

12.1.3 HENKEL AG & CO. KGAA

TABLE 102 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 45 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

12.1.4 SPECTRUM BRANDS HOLDINGS, INC.

TABLE 103 SPECTRUM BRANDS HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 46 SPECTRUM BRANDS HOLDINGS, INC.: COMPANY SNAPSHOT

12.1.5 GODREJ CONSUMER PRODUCTS LIMITED

TABLE 104 GODREJ CONSUMER PRODUCTS LIMITED: COMPANY OVERVIEW

FIGURE 47 GODREJ CONSUMER PRODUCTS LIMITED: COMPANY SNAPSHOT

12.1.6 BASF SE

TABLE 105 BASF SE: COMPANY OVERVIEW

FIGURE 48 BASF SE: COMPANY SNAPSHOT

12.1.7 NATURA &CO HOLDING SA

TABLE 106 NATURA & CO HOLDING SA: COMPANY OVERVIEW

FIGURE 49 NATURA & CO HOLDING SA: COMPANY SNAPSHOT

12.1.8 3M COMPANY

TABLE 107 3M COMPANY: COMPANY OVERVIEW

FIGURE 50 3M COMPANY: COMPANY SNAPSHOT

12.1.9 DABUR INDIA LIMITED

TABLE 108 DABUR INDIA LIMITED: COMPANY OVERVIEW

FIGURE 51 DABUR INDIA LIMITED: COMPANY SNAPSHOT

12.1.10 JYOTHY LABS LIMITED

TABLE 109 JYOTHY LABS LIMITED: COMPANY OVERVIEW

FIGURE 52 JYOTHY LABS LIMITED: COMPANY SNAPSHOT

12.2 STARTUP/SME PLAYERS

12.2.1 PELGAR INTERNATIONAL

TABLE 110 PELGAR INTERNATIONAL: COMPANY SNAPSHOT

12.2.2 AOGRAND GROUP INC.

TABLE 111 AOGRAND GROUP INC.: COMPANY OVERVIEW

12.2.3 ENESIS GROUP

TABLE 112 ENESIS GROUP: COMPANY OVERVIEW

12.2.4 HERBAL STRATEGI

TABLE 113 HERBAL STRATEGI: COMPANY OVERVIEW

12.2.5 SAWYER PRODUCTS, INC.

TABLE 114 SAWYER PRODUCTS, INC.: COMPANY OVERVIEW

12.2.6 HIMALAYA GLOBAL HOLDINGS LTD.

TABLE 115 HIMALAYA GLOBAL HOLDINGS LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products &, Key Insights, Financial, Operational assessment, COVID-19-related developments, Winning imperatives, MnM View might not be captured in case of unlisted companies.

12.3 OTHER COMPANIES

12.3.1 SAREX CHEMICALS

12.3.2 J.K. FRAGRANCES

12.3.3 SOORYA INDUSTRIES

12.3.4 REPELLERS INDIA LLP

12.3.5 GUANGZHOU TOPONE CHEMICAL CO., LTD.

12.3.6 FUJIAN GAOKE INDUSTRY AND TRADE CO., LTD.

12.3.7 JIMO QUÍMICA INDUSTRIAL LTDA

12.3.8 SYNVITA CC

12.3.9 PEACEFUL SLEEP

12.3.10 DERMATANICAL PTY LTD.

12.3.11 TANATEX CHEMICALS B.V.

12.3.12 HELAN COSMESI DI LABORATORIO S.R.L.

12.3.13 JUNO LABORATORIES PTY LTD.

12.3.14 INDUSTRIAS QUÍMICAS MEGAR

12.3.15 HANNOX INTERNATIONAL CORPORATION

13 APPENDIX (Page No. - 239)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involved four major activities in estimating the current market size for mosquito repellents. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from publications by entities such as American Mosquito Control Association (AMCA), European Mosquito Control Association (EMCA), Pan-African Mosquito Control Association, Northeastern Mosquito Control Association (NMCA), Innovative Vector Control Consortium (IVCC), and others.

Primary Research

The mosquito repellent market comprises several stakeholders in the value chain, including raw material suppliers, product manufacturers, contractors, and end users. In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the mosquito repellent market. Primary sources from the demand side included consumers.

Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the mosquito repellent market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market were identified through extensive secondary research

- The supply chain of the industry and the market size in terms of value were determined through primary and secondary research

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

Data Triangulation

After arriving at the total market size, the overall market was split into several segments. A data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data was triangulated by studying various factors and trends from the demand and supply sides. It was then verified through primary interviews.

Report Objectives

- To define, describe, and forecast the size of the mosquito repellent market in terms of value

- To analyze and forecast the size of the market based on repellent type, distribution channel, and region

- To define, describe, and forecast the market size of mosquito after-bite products at a global level

- To define and describe insect attractant products and their types

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To forecast the size of the various segments of the mosquito repellent market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa— along with their key countries

- To analyze opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To analyze recent developments, such as acquisitions, expansions, investments, new product launch, and partnerships in the mosquito repellent market

- To strategically profile key players in the market and comprehensively analyze their core competencies*

Note: Core competencies of the companies are determined in terms of product offerings and business strategies adopted by them to sustain in the market.

The following customization options are available for the report

MarketsandMarkets offers customizations according to the specific needs of companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mosquito Repellent Market