Connected Ship Market by Platform (Ships, Ports), Application (Vessel Traffic Management, Fleet Operation, Fleet Health Monitoring, Other Applications), Installation (Onboard, Onshore), Fit (Line Fit, Retrofit, Hybrid Fit) and Region- Global Forecast to 2028

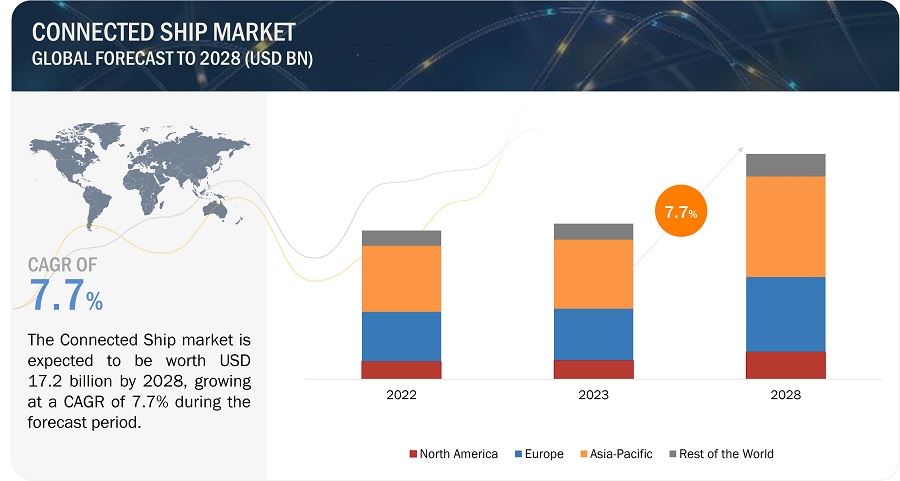

[239 Pages Report] The Connected Ship Market is projected to grow from USD 11.3 billion in 2022 to USD 17.2 billion by 2028, at a CAGR of 7.7 %.

Connected Ship Market Key Takeaways

-

By embracing digital transformation, shipowners are increasingly adopting connected technologies to improve operational efficiency, safety, and real-time decision-making at sea.

-

By integrating advanced systems such as vessel traffic management and fleet operations centers, naval defense and commercial operators are enhancing situational awareness and security.

-

By leading global demand, the commercial segment—especially in cargo and container ships—is seeing rapid adoption of connected systems to optimize route planning and fuel usage.

-

By strengthening maritime defense capabilities, naval forces are deploying connected technologies to improve communication, combat readiness, and data-sharing across fleets.

-

By enabling centralized monitoring and predictive maintenance, the vessel infrastructure segment is gaining momentum, helping reduce downtime and lifecycle costs.

-

By accounting for a significant market share, Europe is emerging as a key region, driven by its strong maritime presence and emphasis on technological upgrades in shipping fleets.

-

By advancing satellite and cloud-based communication systems, connected ships are now able to maintain continuous data exchange, even in remote ocean regions.

-

By supporting safer and more efficient maritime operations, the rise of cybersecurity and integrated platform management systems is transforming how ships are managed and maintained.

Market Size & Forecast Report

-

2023 Market Size: USD 11.3 Billion

-

2028 Projected Market Size: USD 17.2 Billion

-

CAGR (2023-2028): 7.7 %

-

Asia Pacific : Highest growth rate

The demand for enhanced safety and security in maritime industry is driving the market for Connected Ship. The maritime industry is developing rapidly by building digitalized vessels with all advanced technologies to improve the efficiency of ship in maritime . Government support and growing investments are propelling the development of advanced ships, further boosting the growth of the Connected Ship Industry. Increased adoption of big data, artificial intelligence (AI), the Industrial Internet of Things (IIoT), the Internet of Things (IoT), and data analytics in Connected Ship are democratizing maritime and making new marine applications a reality. These Connected ship systems help to collect and transmit the real time data and improve efficiency of ship and prevent accidents in maritime. They are now being developed in large volumes for enhancing navigation, communication, and IoT. Furthermore, the conncected ship uses new technologies to reduce emissions and improve fuel efficiency

Connected Ship Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Connected ship Market Dynamics

Driver: Increase in global seaborne trade

In the past 18 years, sea routes have seen a gradual rise in the amount of bulk cargo transported, as ships are a more cost-effective means of transportation than others. This has led to an increase in global seaborne trade. The top 20 carriers have almost doubled their market share in the past 25 years, now controlling more than half of the global container shipping capacity. According to the United Nations Conference on Trade and Development, global seaborne trade reached 11 billion tons in 2021, with Asia being the largest trading continent. In 2021, about 42% of goods were loaded, and around 64% were unloaded at Asian seaports, while other continents registered less than half of these volumes. Despite the current slump in the global shipbuilding industry, it is expected to grow in the future due to the increasing world population and rising demand for traded goods. Consequently, the demand for purchasing new ships and retrofitting existing ones is also expected to increase globally, leading to an increase in the number of connected ships that offer a high level of safety and enhanced operational efficiency.

Restraints: Digitalization renders connected ships vulnerable to cyber threats

Digitalization of ships worldwide has led to an increase in the risk of cyber threats as they follow satellite routes during their voyages. These connected ships are the first step toward the complete automation of the marine vessels as they enable integration of crucial subsystems of marine vessels with each other through local networks. Use of Big Data analytics for the development of smart ships is expected to increase the operational efficiency of vessels and enhance their safety, but it is also expected to render ships vulnerable to threats from hackers. The Maritime Safety Committee (MSC) of the International Maritime Organization (IMO) has introduced temporary guidelines to prevent cyber attacks on ship systems as the instances of online threats and potential attacks on connected ships are increasing across the globe. Potential routes through which connected ships can be exposed to cyberattacks are shown in the following diagram.

While continuous advancements are being made in communication and data interchange technologies, several security measures need to be taken to ensure that systems and subsystems of connected ships and shore-based stations are protected from hackers. The risk of cybercriminals using the dark web to access private data, install malware, or launch debilitating denial-of-service attacks renders connected ships vulnerable. This leads to apprehensions among marine operators to digitalize their ships, thereby restraining the growth of the connected ship market across the globe.

Opportunities: Adoption of Vessel Traffic Services (VTS) by shipping companies

In order to ensure safe and secure navigation, the marine industry relies on effective real-time communication between ships and onshore stations. This is facilitated through the use of ICT, which connects vessels with stations and allows for uninterrupted flow of information. To improve interoperability and support new vessel operations, shipping companies are adopting advanced vessel traffic services (VTS). These services allow for the sharing of real-time data and intelligence between connected ships and ports, which is expected to drive demand for connected ships globally.

VTS are critical for coordinating maritime rescue efforts, managing incidents, and detecting oil pollution. To ensure high-performance and adherence to changing safety standards, VTS must be constantly updated. They provide real-time navigational and traffic information specific to the areas they cover, and are essential for detecting potential incidents through surveillance systems such as radar, sonar, automatic identification systems (AIS), and closed-circuit televisions (CCTVs). The adoption of VTS in the marine industry is expected to help control and mitigate potential accidents, leading to opportunities for growth in the connected ship market.

Challenges: Limited Internet facilities in connected ships

Internet connectivity is provided by satellites and similar modes, thereby limiting Internet data usage due to the high costs of the satellite data transfer. This acts as a challenge for the growth of the connected ships market. Even though the shipping companies across the globe are adopting connected ships for their smooth and safe operations, because of limited & high-priced internet access, the adoption rate of such systems in seafaring vessels is still limited. On the other hand, the manned labour is cheaper & traditionally been used to operate large vessels.

Further complicating the issue of connected ships are simple technological logistics. Connected ships are required to offer broadband connectivity and have ship-wide Wi-Fi capability. Several connected ships have limited Internet facilities, which can be accessed from mess decks and public areas only and not from individual cabins. This requirement of broad connectivity and Wi-Fi capability of connected ships still acts as a major challenge for shipowners from both, cost and installation aspects.

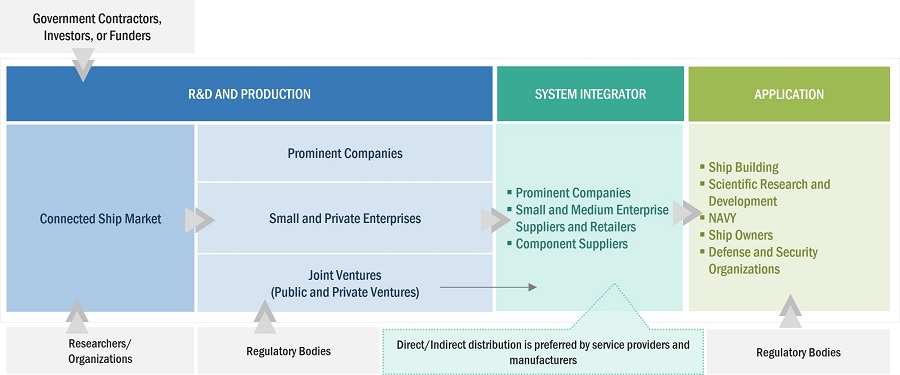

Connected Ship Market Ecosystem

Companies that design and manufacture Connected Ship, includes government firms, NAVY, & ship builders as key stakeholders in Connected Ship Market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include ABB (US), Emerson Electric Co. (US), Wartsila (Finland), Kongsberg Gruppen ASA (Norway), and Thales Group (US).

Based on the Application, the Fleet Operation segment is estimated to account for the largest market share of the Connected Ship market.

Based on the Application, the Fleet Operation segment is estimated to account for the largest market share. Application are a rising need in the maritime industry and are expected to grow by adopting advanced technological solutions. The objective of Fleet operation for connected ship is to adopt the use of advanced technologies and systems to optimize the management, safety, efficiency, and sustainability of a fleet of interconnected vessels. Fleet Operation accounts the largest market among fleet health monitoring, vessel traffic management and other applications based on application.

Based on Fit, the Line Fit is anticipated to dominate the market.

Based on the Fit, the Line Fit holds the largest market share. Line fit refers to equipment or systems that are installed on a ship during its construction. The primary objective of a Line fit is for connectivity which involves integrating various communication, sensor, and data management systems directly into the ship's design and construction. Line Fit ensures that the ship is equipped with the necessary technology from the beginning to enable efficient operations.

The Onboard segment of the Connected ship market by installation is projected to dominate the market.

The Onboard Segment holds the major market share of the Connected Ship market by Installation segment. Onboard objective are to installed and integrated directly onto the ship to enable connectivity, data exchange, automation, and efficient operations which plays a crucial role in ensuring that the ship is equipped to operate as a part of a connected fleet.

The Ships segment of the Connected ship market by Platform is projected to dominate the market.

The Ships Segment holds the major market share of the Connected Ship market by Platfrom segment.The ships are majorly classified as Commercial and Defense types. The commercial ship type includes Passenger ships & Cruise, Cargo Vessels and Other Vessels. The Defense ship includes Submarine, Aircraft Carrier, Destroyer, Frigate, Amphibous ships and corvettes.

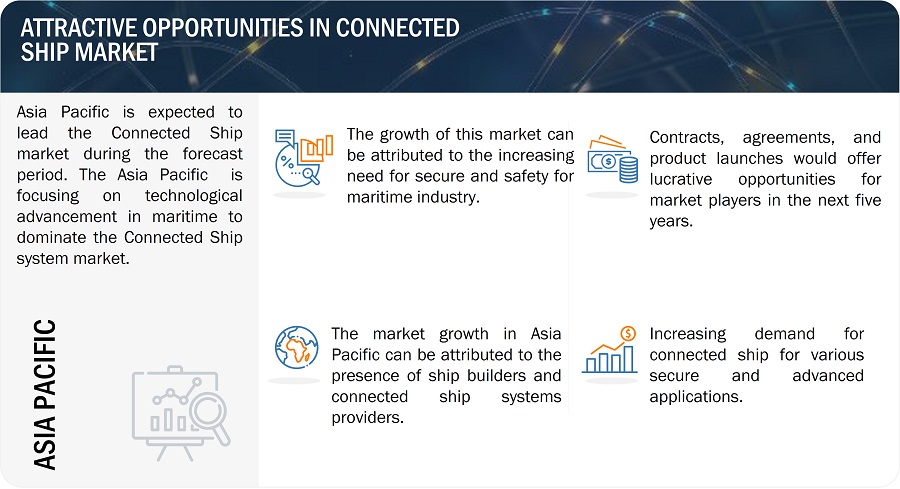

The Asia Pacific market is projected to witness the highest growth rate for Connected Ship market.

Asia Pacific is expected to hold the highest growth rate in the Connected Ship market during the forecast period. The Asia Pacific holds the highest market share. China is the largest market for the Connected Ship market in Asia Pacific. The growth of the Connected Ship market in Asia Pacific can be attributed to the increased demand for Advanced and Digitalized vessels. The Connected Ship market in Asia Pacific was predicted to develop and evolve in future years, owing to advancements in maritime and rising demand for Advanced ship applications and services.

Connected Ship Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Connected Ship Companies is dominated by a few globally established players such as ABB (Switzerland), Emerson Electric Co. (US), Kongsberg Gruppen ASA (Norway), Wartsila (Finland), and Thales (France) some of the leading players operating in the Connected ship market; they are the key manufacturers that secured Connected Ship contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of commercial, government and navy.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 11.3 Billion in 2022 |

|

Projected Market Size |

USD 17.2 Billion in 2028 |

|

Growth Rate (CAGR) |

7.7% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Application, By Installation, By Platform, By Fit |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

ABB (Switzerland), Emerson Electric Co. (US), Wartsila (Finland), Kongsberg Gruppen ASA (Norway), and Thales Group (France) and among others. |

Connected Ship Market Highlights

The study categorizes Connected Ship market based on Application, Installation, Platform, Fit, and Region.

|

Segment |

Subsegment |

|

By Application |

|

|

By Installation |

|

|

By Platform |

|

|

By Fit |

|

|

By Region |

|

Recent Developments

- In May 2023, ABB :- ABB is developing a revolutionary propulsion system concept to increase ship efficiency. It will be first electric propulsion system in the industry for ABB. These will give ultimate efficiency and new vessel design. The company estimated the first prototype of these product will be available in 2025..

- In May 2023, Kongsberg Gruppen ASA : - Kongsberg Maritime has successfully demonstrated a range of remote and autonomous technologies on a cargo vessel operating off the coast of Norway. These is one of the two vessels that are equipped for remote-operated and autonomous transport demonstrations for the Autoship project.

- In April 2022, Wartsila :- Wartsila launches Smart Realities, virtual and augmented simulation solutions for scalable and realistic training experience. These will be fully immersive extended reality (XR) training and assessment solution for ship handling, bridge and marine, engineering applications that allow mariners to develop their skills.

Frequently Asked Questions (FAQ):

Which are the major companies in the Connected Ship market? What are their major strategies to strengthen their market presence?

Some of the key players in the Connected Ship market are ABB (Switzerland), Emerson Electric Co. (US), Kongsberg Gruppen ASA (Norway), Wartsila (Finland) and Thales Group (France), among others, are the key manufacturers that secured Connected Ship system contracts in the last few years.

What are the drivers and opportunities for the Connected Ship market?

The market for Connected Ship has grown substantially across the globe, especially in Asia Pacific. With new capabilities, including faster data rates, better fleet operation, and increased efficiency, maritime is growing vigorously quickly. Due to this increased demand, there is an increased need for connected ship market with the necessary capabilities. Several advancements in connected ship have been made recently, and the creation of cutting-edge ship technologies such as Internet Of Things (IOT). Because of these developments, ship can now access the real time data and support more advanced sophisticated applications.

Which region is expected to grow at the highest rate in the next five years?

The market in the Asia Pacific region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for Connected Ship in the region. Several Asia Pacific countries and organizations are also actively investing in the deployment of Connected Ship around the region.

What is the CAGR of the Connected Ship Market?

The CAGR of the Connected Ship Market is 7.7%

Which function of Connected Ship is expected to significantly lead in the coming years?

The Application segment of the Connected Ship market is projected to witness the highest CAGR. There have been various application of Connected ship for different purposes such as Fleet Health Monitoring, Fleet Operation, Vessel Traffic Management and other applications for various end-user. The market will be driven by the widespread usage of Connected Ship to improve Maritime.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Incorporation of ICT in marine industry- Increased spending on digitalization of vessels- Surge in global seaborne trade- Need for situational awareness in fleet operations- Growing maritime tourism industryRESTRAINTS- High cost of marine broadband connectivity- Vulnerability of connected ships to cyber threatsOPPORTUNITIES- Rigorous development of connected autonomous ships- Adoption of vessel traffic services by shipping companies- Development of new port cities in emerging economiesCHALLENGES- Limited Internet facilities in connected ships- Shortage of skilled personnel

- 5.3 IMPACT OF RECESSION ON CONNECTED SHIP MARKET

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 TECHNOLOGICAL EVOLUTION IN CONNECTED SHIP MARKET

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESRESEARCH ORGANIZATIONS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.11 TRADE ANALYSIS

-

5.12 PATENT ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 TECHNOLOGY ANALYSISKEY TECHNOLOGY- Artificial Intelligence (AI)SUPPORTING TECHNOLOGY- Internet of Things (IoT)

-

5.16 CASE STUDY ANALYSISADVANCED CONNECTIVITY SOLUTIONSSEAVISION BY KONGSBERG MARITIME

- 5.17 OPERATIONAL DATA

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSGLOBAL NAVIGATION SATELLITE SYSTEMSHIGH THROUGHPUT SATELLITESDIGITAL MARINE AUTOMATION SYSTEMS- Sensor fusion solutions- Control algorithms- Conning systems- Connectivity solutions- Autopilot- Mooring control and monitoring systems- Automated radar plotting aids- Electronic chart display and information systems- Communications systems- Voyage data recorders- Decision support systemsVESSEL TRAFFIC MANAGEMENT SYSTEMSAUTONOMOUS MARINE VESSELSINTEGRATED SHIP AUTOMATION SYSTEMS

-

6.4 IMPACT OF MEGATRENDSCLOUD-BASED SOLUTIONSSATELLITE COMMUNICATIONS

- 7.1 INTRODUCTION

-

7.2 VESSEL TRAFFIC MANAGEMENTEMPHASIS ON SAFETY AND EFFICIENCY OF VESSELS TO DRIVE GROWTH

-

7.3 FLEET OPERATIONNEED FOR REAL-TIME SITUATIONAL AWARENESS TO DRIVE GROWTH

-

7.4 FLEET HEALTH MONITORINGDEMAND FOR REMOTE ENGINE MONITORING SYSTEMS TO DRIVE GROWTH

-

7.5 OTHER APPLICATIONSPASSENGER INTERACTIONCARGO TRACKING

- 8.1 INTRODUCTION

-

8.2 ONBOARDINCREASED ADOPTION OF AUTOMATION SYSTEMS IN NAVAL AND CARGO VESSELS TO DRIVE GROWTHNAVIGATION POSITIONING AND TRACKING- Navigation systemsSHIP INFORMATION MANAGEMENT SYSTEMS- Voyage data recorders- Data processorsCOMMUNICATIONS MANAGEMENT SYSTEMS- Very small aperture terminals- Mobile satellite systemsAUTOMATION- Surveillance and safety systems- Power management systems- Propulsion control systems- Machinery management systems- Alarm management systems- Ballast management systems- Thruster control systemsINTER-SHIP COMMUNICATIONS SYSTEMSINTEGRATED BRIDGE SYSTEMS

-

8.3 ONSHOREWIDESPREAD USE OF ARTIFICIAL INTELLIGENCE AND DATA ANALYTICS IN MARITIME INDUSTRY TO DRIVE GROWTHSERVERSSHIP DATA ANALYSIS AND MANAGEMENT- Software- Services

- 9.1 INTRODUCTION

-

9.2 SHIPSDEMAND FOR ADVANCED SHIP HEALTH MONITORING SYSTEMS AND AUTOMATION SYSTEMS TO DRIVE GROWTHCOMMERCIAL- Passenger ships- Cargo ships- Other shipsDEFENSE- Aircraft carriers- Corvettes- Frigates- Submarines- Destroyers- Amphibious ships

-

9.3 PORTSTRADE AND TRANSPORTATION APPLICATIONS TO DRIVE GROWTHGREENFIELD PORTSBROWNFIELD PORTS

- 10.1 INTRODUCTION

-

10.2 LINE FITRISE IN NEW SHIP DELIVERIES TO DRIVE GROWTH

-

10.3 RETROFITACTIVE REPLACEMENT OF OLD CONNECTED SYSTEMS TO DRIVE GROWTH

-

10.4 HYBRID FITRAPID INTEGRATION OF ADVANCED SYSTEMS IN CONNECTED SHIPS TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAPESTLE ANALYSISRECESSION IMPACT ANALYSISUS- Rise in naval shipbuilding to drive growthCANADA- Emphasis on developing indigenous marine industry to drive growth

-

11.3 EUROPEPESTLE ANALYSISRECESSION IMPACT ANALYSISGERMANY- Predominance of maritime industry to drive growthITALY- Retrofitting of connected ship technologies in vessels to drive growthUK- Increased investments in marine systems to drive growthRUSSIA- Procurement of new naval warships and submarines to drive growthFRANCE- High demand for advanced autonomous systems to drive growthREST OF EUROPE

-

11.4 ASIA PACIFICPESTLE ANALYSISRECESSION IMPACT ANALYSISCHINA- Expanding domestic ship production to drive growthSOUTH KOREA- Increasing adoption of connected ship systems by domestic shipbuilders to drive growthJAPAN- Government investments in maritime industry to drive growthINDIA- Rapid development of naval ship components to drive growthAUSTRALIA- Rising demand for maritime safety to drive growthREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLDPESTLE ANALYSISRECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- National shipbuilding companies to drive growthLATIN AMERICA- Development of smart ports to drive growth

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 RANKING ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS, 2022

- 12.5 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

12.9 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALSOTHER DEALS/DEVELOPMENTS

-

13.1 KEY PLAYERSABB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEMERSON ELECTRIC CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKONGSBERG GRUPPEN ASA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWARTSILA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsHYUNDAI HEAVY INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsJASON MARINE GROUP- Business overview- Products/Solutions/Services offeredMARLINK- Business overview- Products/Solutions/Services offered- Recent developmentsRH MARINE- Business overview- Products/Solutions/Services offered- Recent developmentsROCKWELL AUTOMATION- Business overview- Products/Solutions/Services offered- Recent developmentsSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsSIEMENS- Business overview- Products/Solutions/Services offered- Recent developmentsULSTEIN- Business overview- Products/Solutions/Services offered- Recent developmentsVALMET- Business overview- Products/Solutions/Services offered- Recent developmentsSAAB AB- Business overview- Products/Solutions/Services offered- Recent developmentsST ENGINEERING- Business overview- Products/Solutions/Services offered- Recent developmentsHUNTINGTON INGALLS INDUSTRIES- Business overview- Products/Solutions/Services offered- Recent developmentsHANWHA SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsFURUNO ELECTRIC CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsROLLS ROYCE PLC- Business overview- Products/Solutions/Services offered- Recent developmentsGARMIN INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSIRIDIUMINMARSATINTELSAT

- 14.1 INTRODUCTION

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE

- TABLE 2 PARAMETRIC ASSUMPTIONS FOR MARKET FORECASTING

- TABLE 3 COMPARISON OF HARDWARE AND BROADBAND PLANS

- TABLE 4 DESIGN DEVELOPMENT TARGETS FOR CONNECTED AUTONOMOUS SHIPS

- TABLE 5 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 6 PORTER’S FIVE FORCE ANALYSIS

- TABLE 7 AVERAGE PRICE OF CONNECTED SHIP EQUIPMENT PER DEFENSE VESSEL

- TABLE 8 AVERAGE PRICE OF CONNECTED SHIP EQUIPMENT PER COMMERCIAL VESSEL

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 14 COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 15 COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 16 KEY PATENT REGISTRATIONS, 2023

- TABLE 17 OTHER PATENT REGISTRATIONS, 2021–2022

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED SHIPS, BY SHIP TYPE (%)

- TABLE 19 KEY BUYING CRITERIA FOR CONNECTED SHIPS, BY APPLICATION

- TABLE 20 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 21 NEW SHIP DELIVERIES, BY DEFENSE SHIP, 2019–2022

- TABLE 22 NEW SHIP DELIVERIES, BY COMMERCIAL SHIP, 2019–2022

- TABLE 23 MOBILE SATELLITE GROUND STATION VOLUME, BY PLATFORM, 2019–2028

- TABLE 24 COMPARISON BETWEEN MANUAL SHIP SYSTEMS AND INTEGRATED MARINE AUTOMATION SYSTEMS

- TABLE 25 CONNECTED SHIP MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 28 MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 29 ONBOARD: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 30 ONBOARD: CONNECTED SHIPS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY PLATFORM, 2019–2022 (USD MILLION)

- TABLE 32 MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 33 SHIPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 34 SHIPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 35 COMMERCIAL: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 COMMERCIAL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 CARGO SHIPS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 38 CARGO SHIPS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 39 DEFENSE: CONNECTED SHIPS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 DEFENSE: CONNECTED SHIP MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 PORTS: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 42 PORTS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 43 ARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 44 MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 45 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 46 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- TABLE 48 NORTH AMERICA: CONNECTED SHIP MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: MARKET, BY ONBOARD SYSTEM, 2019–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 58 US: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 59 US: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 60 US: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 61 US: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 62 US: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 US: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 CANADA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 65 CANADA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 66 CANADA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 67 CANADA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 68 CANADA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 CANADA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: RECESSION IMPACT ANALYSIS

- TABLE 71 EUROPE: CONNECTED SHIP MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 72 EUROPE: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 74 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 EUROPE: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: MARKET, BY ONBOARD SYSTEM, 2019–2022 (USD MILLION)

- TABLE 78 EUROPE: MARKET, BY ONBOARD SYSTEM, 2023–2028 (USD MILLION)

- TABLE 79 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: CONNECTED SHIP MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 GERMANY: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 82 GERMANY: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 83 GERMANY: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 84 GERMANY: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 86 GERMANY: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 87 ITALY: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 88 ITALY: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 89 ITALY: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 90 ITALY: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 91 ITALY: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 ITALY: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 UK: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 94 UK: CONNECTED SHIP MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 95 UK: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 96 UK: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 97 UK: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 UK: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 RUSSIA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 100 RUSSIA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 101 RUSSIA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 102 RUSSIA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 103 RUSSIA: CONNECTED SHIP MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 RUSSIA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 FRANCE: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 106 FRANCE: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 107 FRANCE: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 108 FRANCE: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 109 FRANCE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 FRANCE: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 114 REST OF EUROPE: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 REST OF EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- TABLE 118 ASIA PACIFIC: CONNECTED SHIP MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY ONBOARD SYSTEM, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY ONBOARD SYSTEM, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CONNECTED SHIP MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 129 CHINA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 130 CHINA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 131 CHINA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 132 CHINA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 133 CHINA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH KOREA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH KOREA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH KOREA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH KOREA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: CONNECTED SHIP MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 141 JAPAN: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 142 JAPAN: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 143 JAPAN: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 144 JAPAN: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 JAPAN: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 INDIA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 147 INDIA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 148 INDIA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 149 INDIA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 150 INDIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 151 INDIA: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 AUSTRALIA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 153 AUSTRALIA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 154 AUSTRALIA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 155 AUSTRALIA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 156 AUSTRALIA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 AUSTRALIA: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- TABLE 165 REST OF THE WORLD: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 166 REST OF THE WORLD: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 167 REST OF THE WORLD: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 REST OF THE WORLD: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 REST OF THE WORLD: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 170 REST OF THE WORLD: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 171 REST OF THE WORLD: MARKET, BY ONBOARD SYSTEM, 2019–2022 (USD MILLION)

- TABLE 172 REST OF THE WORLD: MARKET, BY ONBOARD SYSTEM, 2023–2028 (USD MILLION)

- TABLE 173 REST OF THE WORLD: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 174 REST OF THE WORLD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY INSTALLATION, 2019–2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY INSTALLATION, 2023–2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY FIT, 2019–2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: MARKET, BY FIT, 2023–2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 CONNECTED SHIP MARKET: DEGREE OF COMPETITION

- TABLE 188 STRATEGIES ADOPTED BY KEY PLAYERS IN CONNECTED SHIP MARKET, 2019–2023

- TABLE 189 SOLUTION FOOTPRINT

- TABLE 190 REGION FOOTPRINT

- TABLE 191 KEY START-UPS/SMES

- TABLE 192 PRODUCT LAUNCHES, 2019–2023

- TABLE 193 DEALS, 2019–2023

- TABLE 194 OTHER DEALS/DEVELOPMENTS, 2019–2023

- TABLE 195 ABB: COMPANY OVERVIEW

- TABLE 196 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ABB: PRODUCT LAUNCHES

- TABLE 198 ABB: DEALS

- TABLE 199 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 200 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 202 EMERSON ELECTRIC CO.: DEALS

- TABLE 203 KONGSBERG GRUPPEN ASA: COMPANY OVERVIEW

- TABLE 204 KONGSBERG GRUPPEN ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 KONGSBERG GRUPPEN ASA: PRODUCT LAUNCHES

- TABLE 206 KONGSBERG GRUPPEN ASA: DEALS

- TABLE 207 WARTSILA: COMPANY OVERVIEW

- TABLE 208 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 WARTSILA: PRODUCT LAUNCHES

- TABLE 210 WARTSILA: DEALS

- TABLE 211 THALES GROUP: COMPANY OVERVIEW

- TABLE 212 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 THALES GROUP: PRODUCT LAUNCHES

- TABLE 214 THALES GROUP: DEALS

- TABLE 215 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 216 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 218 GENERAL ELECTRIC: DEALS

- TABLE 219 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 220 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 222 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 223 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 224 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 226 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 227 HYUNDAI HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 228 HYUNDAI HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 HYUNDAI HEAVY INDUSTRIES: PRODUCT LAUNCHES

- TABLE 230 HYUNDAI HEAVY INDUSTRIES: DEALS

- TABLE 231 JASON MARINE GROUP: COMPANY OVERVIEW

- TABLE 232 JASON MARINE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 MARLINK: COMPANY OVERVIEW

- TABLE 234 MARLINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 MARLINK: PRODUCT LAUNCHES

- TABLE 236 MARLINK: DEALS

- TABLE 237 RH MARINE: COMPANY OVERVIEW

- TABLE 238 RH MARINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 RH MARINE: PRODUCT LAUNCHES

- TABLE 240 RH MARINE: DEALS

- TABLE 241 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 242 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 244 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 245 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 247 SCHNEIDER ELECTRIC: DEALS

- TABLE 248 SIEMENS: COMPANY OVERVIEW

- TABLE 249 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 SIEMENS: PRODUCT LAUNCHES

- TABLE 251 SIEMENS: DEALS

- TABLE 252 ULSTEIN: COMPANY OVERVIEW

- TABLE 253 ULSTEIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 ULSTEIN: PRODUCT LAUNCHES

- TABLE 255 ULSTEIN: DEALS

- TABLE 256 VALMET: COMPANY OVERVIEW

- TABLE 257 VALMET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 VALMET: PRODUCT LAUNCHES

- TABLE 259 VALMET: DEALS

- TABLE 260 SAAB AB: COMPANY OVERVIEW

- TABLE 261 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 SAAB AB: PRODUCT LAUNCHES

- TABLE 263 SAAB AB: DEALS

- TABLE 264 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 265 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 ST ENGINEERING: PRODUCT LAUNCHES

- TABLE 267 ST ENGINEERING: DEALS

- TABLE 268 HUNTINGTON INGALLS INDUSTRIES: COMPANY OVERVIEW

- TABLE 269 HUNTINGTON INGALLS INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 HUNTINGTON INGALLS INDUSTRIES: PRODUCT LAUNCHES

- TABLE 271 HUNTINGTON INGALLS INDUSTRIES: DEALS

- TABLE 272 HANWHA SYSTEMS: COMPANY OVERVIEW

- TABLE 273 HANWHA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 HANWHA SYSTEMS: PRODUCT LAUNCHES

- TABLE 275 HANWHA SYSTEMS: DEALS

- TABLE 276 FURUNO ELECTRIC CO. LTD.: COMPANY OVERVIEW

- TABLE 277 FURUNO ELECTRIC CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 FURUNO ELECTRIC CO. LTD.: PRODUCT LAUNCHES

- TABLE 279 FURUNO ELECTRIC CO. LTD.: DEALS

- TABLE 280 ROLLS ROYCE PLC: COMPANY OVERVIEW

- TABLE 281 ROLLS ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 ROLLS ROYCE PLC: PRODUCT LAUNCHES

- TABLE 283 ROLLS ROYCE PLC: DEALS

- TABLE 284 GARMIN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 285 GARMIN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 GARMIN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 287 GARMIN INTERNATIONAL: DEALS

- FIGURE 1 CONNECTED SHIP MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ONBOARD SEGMENT TO HOLD MAXIMUM MARKET SHARE IN 2028

- FIGURE 9 LINE FIT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 VESSEL TRAFFIC MANAGEMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 INCREASING USE OF AUTONOMOUS SYSTEMS AND INTER-SHIP COMMUNICATIONS SYSTEMS IN LARGE SEAFARING VESSELS

- FIGURE 13 SHIPS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 14 COMMERCIAL SHIPS TO SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 GREENFIELD PORTS TO SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 CHINA TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

- FIGURE 17 CONNECTED SHIP MARKET DYNAMICS

- FIGURE 18 POTENTIAL CYBERATTACK ROUTES FOR CONNECTED SHIPS

- FIGURE 19 VALUE CHAIN ANALYSIS

- FIGURE 20 TECHNOLOGICAL EVOLUTION IN CONNECTED SHIP MARKET

- FIGURE 21 REVENUE SHIFT FOR PLAYERS IN CONNECTED SHIP MARKET

- FIGURE 22 ECOSYSTEM MAPPING

- FIGURE 23 TOP 10 PATENT OWNERS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED SHIPS, BY SHIP TYPE

- FIGURE 25 KEY BUYING CRITERIA FOR CONNECTED SHIPS, BY APPLICATION

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 KEY MILESTONES IN CONNECTED SHIP TECHNOLOGY DEVELOPMENT

- FIGURE 28 CONNECTED SHIP MARKET, BY APPLICATION, 2023–2028

- FIGURE 29 MARKET, BY INSTALLATION, 2023–2028

- FIGURE 30 AUTOMATION TO HOLD LEADING MARKET POSITION IN 2028

- FIGURE 31 MARKET, BY PLATFORM, 2023–2028

- FIGURE 32 MARKET, BY SHIP TYPE, 2023–2028

- FIGURE 33 CARGO SHIPS TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 34 CONTAINER SHIPS TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 35 SUBMARINES TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 36 CONNECTED SHIP MARKET, BY PORT TYPE, 2023–2028

- FIGURE 37 MARKET, BY FIT, 2023–2028

- FIGURE 38 CONNECTED SHIP MARKET, BY REGION, 2023–2028

- FIGURE 39 NORTH AMERICA: NAVAL BUDGET TREND, BY COUNTRY, 2019–2022

- FIGURE 40 NORTH AMERICA: CONNECTED SHIP MARKET SNAPSHOT

- FIGURE 41 EUROPE: NAVAL BUDGET TREND, BY COUNTRY, 2019–2022

- FIGURE 42 EUROPE: MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: NAVAL BUDGET TREND, BY COUNTRY, 2019–2022

- FIGURE 44 ASIA PACIFIC: CONNECTED SHIP MARKET SNAPSHOT

- FIGURE 45 REST OF THE WORLD: NAVAL BUDGET TREND, BY COUNTRY, 2019–2022

- FIGURE 46 REST OF THE WORLD: CONNECTED SHIP MARKET SNAPSHOT

- FIGURE 47 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 48 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- FIGURE 50 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 51 SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 54 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- FIGURE 55 WARTSILA: COMPANY SNAPSHOT

- FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 57 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 58 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 HYUNDAI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 61 JASON MARINE GROUP: COMPANY SNAPSHOT

- FIGURE 62 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 64 SIEMENS: COMPANY SNAPSHOT

- FIGURE 65 VALMET: COMPANY SNAPSHOT

- FIGURE 66 SAAB AB: COMPANY SNAPSHOT

- FIGURE 67 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 68 HUNTINGTON INGALLS INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 69 HANWHA SYSTEMS: COMPANY SNAPSHOT

- FIGURE 70 FURUNO ELECTRIC CO. LTD.: COMPANY SNAPSHOT

- FIGURE 71 ROLLS ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 72 GARMIN INTERNATIONAL: COMPANY SNAPSHOT

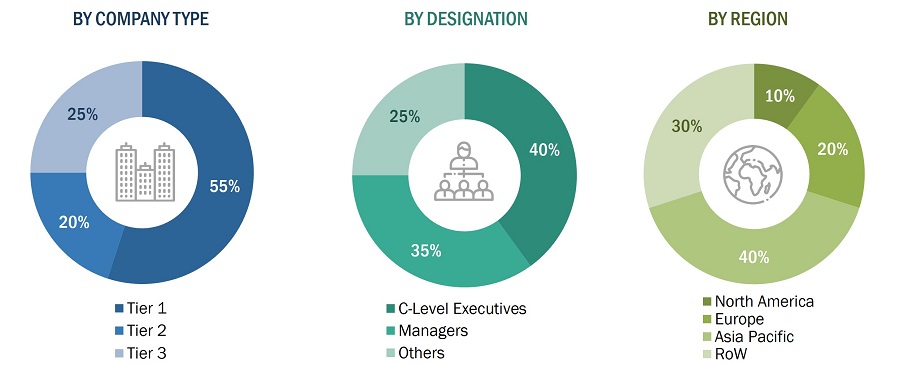

The study involved four major activities in estimating the current size of the Connected ship market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Connected Ship market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the the United Nations Conference on Trade and Development (UNCTAD),corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Connected Ship market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Connected ship vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using Connected Ship, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Connected Ship and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Connected Ship market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Connected Ship market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Connected Ship market size: Bottom-Up Approach

- The bottom-up approach was employed to arrive at the overall size of the connected ship market from the revenues of the key players in the market.

- Calculations based on the revenues of key players identified in the market led to the estimation of the overall size of the connected ship market

- The bottom-up approach was also implemented for extracting data from the secondary research to validate the revenues of different market segments

- With the data triangulation procedure and validation of data through primaries, the overall sizes of the parent market and each individual segment of the market were determined and confirmed in this study

Global Connected Ship Market Size: Top-Down Approach

In the top-down approach, the size of the connected ship market was used to estimate the sizes of individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate immediate parent market was used to implement the top-down approach. The bottom-up approach was also implemented for the data extracted from secondary research to validate the market segment revenues obtained. With the data triangulation procedure and validation of data through primaries, the sizes of the overall parent market and each individual market were determined and confirmed in this study. Companies manufacturing Connected Ship are included in the report.

- Companies’ total revenue was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees using sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to Connected ship were mapped and summed up.

- Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), each segment’s share of connected ship was estimated.

Data Triangulation

After arriving at the size of the connected ship market from the market size estimation process explained above, the total market was split into several segments and subsegments. The market breakdown & data triangulation procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for the market segments and subsegments. The data was triangulated by studying various factors and trends from both, demand- and supply-side. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the connected ship market based on ship type, installation type, application, fit, and region

- To forecast the size of different segments of the connected ship market with respect to 4 major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), along with their respective key countries

- To identify and analyze drivers, restraints, opportunities, and challenges influencing the growth of the connected ship market

- To identify the industry trends, market trends, and technology trends that are currently prevailing in the connected ship market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the connected ship market

- To provide company profiles of the leading players in the connected ship market based on their product portfolios, market shares, and key growth strategies

- To provide detailed information on the financial positions, key products, and key developments of the leading companies operating in the connected ship market

- To track and analyze competitive developments such as joint ventures, mergers, and new product launches carried out by the key players in the connected ship market

Market Definition

Connected ships enable interconnection between various systems and subsystems of ships to provide a common operating picture to ship operators and shipping companies to help them organize and operate their ship fleets in an efficient manner. Connected ships are the evolution of ship automation solutions as they integrate disparate systems of ships to shore platforms to facilitate effective management of ship fleets. These ships use different techniques of Big Data analytics for monitoring the performance of ships.

The use of integrated and autonomous systems are major part of connected ships which makes it automated and gives fast solutions. Advanced technologies like Artificial Intelligence (AI), Data analytics, Cyber Security are being used and developed in connected ships.

Market Stakeholders

- Suppliers of Ship Systems

- Shipbuilders

- Shipping Companies

- Software/Hardware/Services, and Solution Providers

- Original Equipment Manufacturers (OEMs)

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Connected Ship market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Connected Ship market

Growth opportunities and latent adjacency in Connected Ship Market

I was wondering if your market research report included any information on shipments associated with the country France. More specifically, the number of importers/exporters and the frequency of shipments per year, and, that said, the importers/exporters engaged in, the top markets for importing/exporting, etc. Email correspondence works best, if and when possible. Thank you for your time.