Autonomous Ships Market by Autonomy (Fully Autonomous, Remotely Operated, Partially Autonomous), Ship Type (Military, Commercial), Solution, End User, Propulsion and Region - Global Forecast to 2030

Update: 11/22/2024

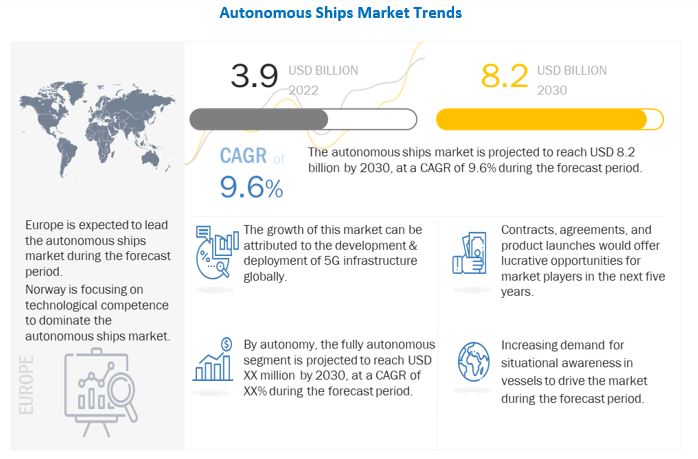

The Global Autonomous Ships Market Size was valued at USD 3.9 billion in 2022 and is estimated to reach USD 8.2 billion by 2030, growing at a CAGR of 9.6% during the forecast period. Factors that are expected to fuel the growth of the autonomous ships are surging investments on autonomous ships ventures from numerous nations across globe, adoption of fully autonomous commercial and military vessels and increase use of automated systems to reduce human error.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 has led to several challenges for many industries. The aerospace industry is no exception to that. The budget allotted to the aerospace sector has been reduced by several countries due to the COVID-19 pandemic. This puts most research projects on hold.

Autonomous Ships Market Dynamics

Driver :Development of next-generation autonomous vessels

Automation ships are the next generation vessels, with no crew members onboard. Shore engineers will be monitoring and controlling their navigation and performance through detectors, sensors, high-resolution cameras, and advanced satellite communication systems from a shore operating center. In recent years, developments of next-generation autonomous vessels have fueled the growth of the Autonomous Ships Industry. Major market players are focusing on a collaborative approach for the enhancement of autonomous ships. For example, in 2018, Fugro signed a joint development agreement with L3 ASV, a leader in the field of unmanned and autonomous vessel technology, to create the next generation of autonomous vessels for the commercial survey market. The partnership brings together the expertise of both companies for the joint development of a variety of fit-for-purpose unmanned surface vessels (USVs).

Opportunity: Initiatives for the development of autonomous ships

Increased R&D activities by leading ship manufacturers as well as system developers across the globe for the development of completely autonomous ships is an opportunity for the autonomous ships market. For example, companies such as Rolls-Royce and Kongsberg are developing fully autonomous ships. Both the companies are leading in the development of autonomous ships by integrating existing ship technologies with new digital technologies, such as for sensors and AI.

According to the Nippon Foundation's report-"Future 2040 — The Future of Japan Created by Unmanned ships", issued in April 2019, it is expected that the ships to be newly built in 2040 are mainly unmanned and that 50% of domestic ships will be unmanned. The countries such as Norway, China, Japan, South Korea are focusing on the development of autonomous ships, it is expected that pilot projects and the introduction of such ships will proceed gradually in accordance with technological developments.

Challenge: Vulnerability associated with cyber threats

Automation in ships worldwide increases the risks of cyber threats as these ships follow satellite routes during their voyages. In the coming years, the operators of marine vessels are expected to connect their ships to onshore networks. The installation of automation systems is the first step toward the complete automation of vessels as it enables the integration of crucial sub-systems of marine vessels with each other through local networks. The use of Big Data analytics for the development of smart ships is expected to enhance the vessels' operational efficiency and safety. However, this automation is also expected to render the ships vulnerable to threats from hackers. With instances of online threats and potential attacks increasing across the globe, the Maritime Safety Committee (MSC) of the International Maritime Organization (IMO) has introduced temporary guidelines to prevent cyberattacks on ships’ systems.

By end use, line fit segment to rise at highest CAGR.

Based on end use, the autonomous ships market is segmented into line fit and retrofit. The growth of the line fit segment can be attributed to the increased investments in naval defense by various countries and rise in seaborne trade activities across the globe. Companies such as ABB, Kongsberg, Siemens, and Wartsila are offering line fit autonomous ships. Several projects are undergoing for the development of line fit autonomous ships.

By propulsion, fully electric segment to rise at highest CAGR in forecast period

Based on propulsion, the autonomous ships market is segmented into fully electric, hybrid, and conventional. Electric propulsion is a fuel-efficient propulsion solution, where the load is a significant fraction of the propulsion power requirement, and the operating profile is diverse. The success of electrical propulsion in commercial ships and the drive to reduce running cost has increased the development programs, to enable electric propulsion for naval destroyers in the UK and US. These development programs were targeted to increase the power density with advanced technologies, consisting of new permanent magnet and high-temperature superconducting motor technologies to fit electric propulsion in frigates and meet military requirements.

In November 2019, Fischer Panda UK announced a contract to supply, install and commission a complete electric propulsion system for the Mayflower Autonomous Ship (MAS) project.

Asia-pacific region holds the largest market share.

Asia-pacific region holds the largest market share in autonomous ships market. The autonomous ships market in Asia Pacific is expected to witness high growth due to the growth of the shipbuilding industry. Countries such as China and South Korea are developing new ports, enhancing infrastructure, providing access to inexpensive associated facilities, and witnessing an increase in the customer base. According to the United Nations Conference on Trade and Development (UNCTAD) in 2019, Asia accounted for 64% of the global container throughput handled by the world’s top 30 container ports and nine of the world’s 10 busiest container ports. The shipping industry has been growing, with traditional large shipbuilders such as South Korea, China, and Japan enhancing their offshore capabilities and providing a single marine solution for both, shipbuilding and offshore. According to UNCTAD, South Korea, Japan, and China are the major players in the shipbuilding industry and are expected to account for 80% of the tanker orders during the forecast period.

The NA market is projected to contribute the largest share from 2022 to 2030

To know about the assumptions considered for the study, download the pdf brochure

Emerging Industry Trends

Revenue shift and new revenue pockets for autonomous ship market

The autonomous ships market is expected to grow at a CAGR of XX%, by value, during the forecast period. Advancements in high-density battery solutions and reduced emission and aircraft noise are expected to drive the autonomous ships market. Many OEMs are currently investing in the advancement of autonomous ships technology to cater to the demand for autonomous ships operating in extreme conditions. Increasing investments in R&D activities to reduce carbon emissions and unmanned vessels is also leading to technological advancements in autonomous ships. The expected rise in the development of AI, automation, and autonomy in the marine industry will drive the demand for autonomous ships.

Key Players

ABB: ABB is the leading player in the autonomous ships market. The company is undertaking the expansion of the existing activities through collaborations and contracts. The company is focusing on the development of autonomous shipping systems In 2018, ABB took an important step toward the development of more autonomous shipping systems with a groundbreaking remote control trial of a passenger ferry, piloted by a captain onshore. The trial in Helsinki harbor showed that as vessels become more electric, digital, and connected, ABB is able to equip seafarers with solutions that augment their skillsets and enhance the overall safety of marine operations.

Rolls-Royce PLC: Rolls-Royce PLC is ranked second in the autonomous ships market. The company is enhancing its business through its product portfolio. Rolls-Royce has provided a hybrid propulsion system at 690V for the Royal New Zealand Navy’s largest ever vessel, HMNZS Aotearoa auxiliary tanker, comprising Rolls-Royce active front end propulsion drives, switchboards, power management system, diesel generators, and main engines.

Kongsberg: Kongsberg provides marine systems through the Kongsberg Maritime segment. The company's core competencies include engineering cybernetics, signal processing, software development services, and system integration for various marine vehicles. The company's major subsidiaries are Kongsberg Defence & Aerospace AS, Kongsberg Maritime AS, and Kongsberg Next AS. The company has its presence in Europe, the Middle East, Africa, Asia Pacific, North America, and South America. The major competitors of the company are ABB, Wartsila, Emerson, and Sonardyne, among others.

Wartsila: Wartsila is major in the autonomous ships market. Wartsila focuses on the partnership to enhance its customer base across the globe. For example, in June 2020, Wartsila has partnered with a marine research organization, ProMare. Wartsila has announced that its RS24 radar system will be used by the Mayflower Autonomous Ship that is set to become one of the world’s first fully autonomous, unmanned vessels to cross the Atlantic. It has a significant presence in the autonomous ship market of the Asia Pacific region through joint ventures and has subsidiaries in China, Japan, and South Korea.

Honeywell International, Inc: Honeywell International, Inc. is another leading player in the autonomous ships market. The company's major strategies include improving the quality of services, increasing operational efficiency, and innovating products. New product developments in all segments of operations helped the company achieve a strong competitive position. In 2017, Honeywell received a contract worth USD 8.0 million from Daewoo Shipbuilding & Marine Engineering (DSME) and STX Offshore & Shipbuilding (STX) for supplying marine automation systems for five vessels commissioned by ship-owners in Norway, Russia, and the US.

The Autonomous Ships Companies are dominated by a few globally established players such as SELSAN A.ª. (Turkey), BAE Systems (U.K.), GE (U.S.), Honeywell International Inc. (U.S.), Kongsberg Maritime (Norway), L3Harris Technologies, Inc. (U.S.), Northrop Grumman (U.S.), Rolls-Royce plc (U.K), Siemens Energy (Germany), Wärtsilä (Finland) Fugro (Netherlands), and Hyundai Heavy Industries (South Korea), among others are among the companies that participate in this market. The report covers various industry trends and new technological innovations in the Autonomous ships market for the period, 2018-2027.

Scope of the report

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 3.9 Billion |

|

Revenue Forecast in 2030 |

USD 8.2 Billion |

|

Growth Rate |

9.6% |

|

Market size available for years |

2018 - 2030 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the autonomous ships market based on Ship Type, Seat Type, End User, Component, and Region.

Based on Ship Type, the autonomous ships market has been segmented as follows:

- Commercial

- Military

Based on Autonomy, the autonomous ships market has been segmented as follows:

- Fully Autonomous

- Remotely Operated

- Partially Autonomous

Based on the End User, the autonomous ships market has been segmented as follows:

- Line-fit & Newbuild

- Retrofit

Based on Solution, autonomous ships market has been segmented as follows:

- Systems

- Software

- Structures

Based on Propulsion, autonomous ships market has been segmented as follows:

- Fully Electric

- Hybrid

- Conventional

Based on the region, autonomous ships market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Report Objectives

- Identify and analyze major drivers, constraints, challenges, and opportunities driving the LEO Terminal market's growth.

- Analyze the market effect of macro and micro indicators

- To forecast market segment sizes for six regions, including North America, Europe, Asia Pacific, the Middle East, and Latin America, as well as significant nations within each of these areas.

- To conduct a strategic analysis of micro markets regarding particular technical trends, prospects, and their contribution to the total market.

- To profile key market participants strategically and thoroughly study their market ranking and essential skills.

- To give a complete market competitive landscape, as well as an examination of the company and corporate strategies such as contracts, collaborations, partnerships, expansions, and new product developments.

- Identifying comprehensive financial positions, key products, unique selling points, and key developments of industry leaders.

Frequently Asked Questions (FAQ’s)

What are your views on the growth prospect of the Autonomous ships market?

Response: The autonomous ships market is expected to grow substantially owing to the high demand for autonomous ships, development of next generation of autonomous vessels and increasing software adoption in maritime.

What are the key sustainability strategies adopted by leading players operating in the Autonomous ships market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Autonomous ships market. Major players in the autonomous ships market include BAE Systems (U.K.), GE (U.S.), Honeywell International Inc. (U.S.), Kongsberg Maritime (Norway), L3Harris Technologies, and others have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

Who are the key players and innovators in the ecosystem of the Autonomous ships market?

Response: Major players in the autonomous ships market are BAE Systems (U.K.), GE (U.S.), Honeywell International Inc. (U.S.), Kongsberg Maritime (Norway), L3Harris Technologies.

Which region is expected to hold the highest market share in the Autonomous ships market?

Response: Autonomous ships market in The NA region is estimated to account for the largest share of 3.9 of the market in 2022 and is expected to grow at the highest CAGR of 9.6% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 MARKETS SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 AUTONOMOUS SHIPS MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

1.5 CURRENCY CONSIDERED

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key primary sources

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 DEMAND-SIDE INDICATORS

2.2.2 SUPPLY-SIDE ANALYSIS

2.3 MARKET SIZE ESTIMATION

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

TABLE 1 AUTONOMOUS SHIPS MARKET ESTIMATION PROCEDURE

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.6 GROWTH RATE ASSUMPTIONS

2.7 ASSUMPTIONS FOR RESEARCH STUDY

2.8 RISKS

3 EXECUTIVE SUMMARY (Page No. - 61)

FIGURE 8 BY SHIP TYPE, COMMERCIAL SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE THAN DEFENSE SEGMENT DURING FORECAST PERIOD

FIGURE 9 BY AUTONOMY, FULLY AUTONOMOUS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 10 BY SOLUTION, SYSTEMS SEGMENT ESTIMATED TO LEAD AUTONOMOUS SHIPS MARKET DURING FORECAST PERIOD

FIGURE 11 BY END USER, LINE-FIT & NEWBUILD SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 BY PROPULSION, HYBRID SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 AUTONOMOUS SHIPS MARKET IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS SHIPS MARKET FROM 2022 TO 2030

FIGURE 14 INCREASING INVESTMENTS IN AUTONOMOUS SHIPS TECHNOLOGY TO DRIVE MARKET

4.2 AUTONOMOUS SHIPS MARKET, BY AUTONOMY

FIGURE 15 PARTIALLY AUTONOMOUS SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4.3 AUTONOMOUS SHIPS MARKET, BY SHIP TYPE

FIGURE 16 COMMERCIAL SEGMENT ESTIMATED TO LEAD MARKET FROM 2022 TO 2030

4.4 AUTONOMOUS SHIPS MARKET, BY SOLUTION

FIGURE 17 SYSTEMS SEGMENT ESTIMATED TO DOMINATE MARKET DURING FORECAST PERIOD

4.5 AUTONOMOUS SHIPS MARKET, BY END USER

FIGURE 18 LINE-FIT & NEWBUILD SEGMENT ESTIMATED TO LEAD MARKET DURING FORECAST PERIOD

4.6 AUTONOMOUS SHIPS MARKET, BY PROPULSION

FIGURE 19 CONVENTIONAL SEGMENT ESTIMATED TO DOMINATE MARKET DURING FORECAST PERIOD

4.7 AUTONOMOUS SHIPS MARKET, BY COUNTRY

FIGURE 20 AUTONOMOUS SHIPS MARKET IN SOUTH KOREA TO REGISTER HIGHEST CAGR FROM 2022 TO 2030

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 AUTONOMOUS SHIPS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Development of next-generation autonomous vessels

5.2.1.2 Increasing development of software

5.2.1.3 Growing use of automated systems to reduce human errors and risks

FIGURE 22 NUMBER OF MARINE ACCIDENTS, BY GEOGRAPHY

5.2.1.4 Increased budgets of shipping companies to incorporate ICT in vessels

5.2.1.5 Rising demand for situational awareness in vessels

5.2.2 RESTRAINTS

5.2.2.1 Vulnerability associated with cyber threats

FIGURE 23 POTENTIAL CYBERATTACK ROUTES FOR MARINE VESSELS

5.2.3 OPPORTUNITIES

5.2.3.1 Initiatives to develop autonomous ships

FIGURE 24 TIMELINE AND DESIGN DEVELOPMENT TARGETS FOR AUTONOMOUS SHIPS

5.2.3.2 Revision and formulation of marine safety regulations in several countries

5.2.3.3 Advancements in sensor technology for improved navigation in autonomous ships

5.2.3.4 Development of propulsion systems for autonomous ships

5.2.4 CHALLENGES

5.2.4.1 Cost-intensive customization of marine automation systems

5.2.4.2 Lack of skilled personnel to handle and operate marine automation systems

5.2.4.3 Lack of common standards for data generated from different subsystems in ships

5.2.4.4 Regulatory barriers to autonomous ships

5.3 DEMAND-SIDE IMPACT

5.3.1 KEY DEVELOPMENTS FROM JANUARY 2019 TO AUGUST 2022

TABLE 2 KEY DEVELOPMENTS IN AUTONOMOUS SHIPS MARKET IN 2022

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 25 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.5 MARKET ECOSYSTEM

FIGURE 26 AUTONOMOUS SHIPS MARKET ECOSYSTEM

5.5.1 PROMINENT COMPANIES

5.5.2 PRIVATE AND SMALL ENTERPRISES

5.5.3 END USERS

TABLE 3 AUTONOMOUS SHIPS MARKET ECOSYSTEM

5.6 PRICING ANALYSIS

5.6.1 AVERAGE SELLING PRICE ANALYSIS OF AUTONOMOUS SYSTEMS, 2021

FIGURE 27 AVERAGE SELLING PRICE OF AUTONOMOUS SHIPS OFFERED BY TOP PLAYERS

5.7 TARIFF REGULATORY LANDSCAPE

5.7.1 NORTH AMERICA

TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.2 EUROPE

TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.3 ASIA PACIFIC

TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.4 MIDDLE EAST

TABLE 7 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.7.5 REST OF THE WORLD

TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

5.8 TRADE DATA

TABLE 9 COUNTRY-WISE IMPORTS, 2019–2021 (USD THOUSAND)

TABLE 10 COUNTRY-WISE EXPORTS, 2019-2021 (USD THOUSAND)

5.9 PATENT ANALYSIS

FIGURE 28 LIST OF MAJOR PATENTS FOR AUTONOMOUS SHIPS

TABLE 11 LIST OF MAJOR PATENTS FOR AUTONOMOUS SHIPS

5.10 VALUE CHAIN ANALYSIS OF AUTONOMOUS SHIPS MARKET

FIGURE 29 VALUE CHAIN ANALYSIS

5.10.1 RESEARCH & DEVELOPMENT

5.10.2 RAW MATERIALS

5.10.3 COMPONENT/PRODUCT MANUFACTURERS (OEMS)

5.10.4 ASSEMBLERS & INTEGRATORS

5.10.5 END USERS

5.11 TECHNOLOGY ANALYSIS

5.11.1 KEY TECHNOLOGY

5.11.1.1 Autonomous navigation systems for marine vessels

5.11.1.2 AI-based marine autonomous systems

5.11.2 SUPPORTING TECHNOLOGY

5.11.2.1 Sensor fusion solutions

5.11.2.2 Voyage data recorders

5.12 PORTER’S FIVE FORCES ANALYSIS

TABLE 12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF NEW ENTRANTS

5.12.2 THREAT OF SUBSTITUTES

5.12.3 BARGAINING POWER OF SUPPLIERS

5.12.4 BARGAINING POWER OF BUYERS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING AUTONOMOUS SHIPS, BY SHIP TYPE

TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING AUTONOMOUS SHIPS, BY SHIP TYPE (%)

5.13.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR AUTONOMOUS SHIPS, BY AUTONOMY

TABLE 14 KEY BUYING CRITERIA FOR AUTONOMOUS SHIPS, BY AUTONOMY

5.14 USE CASES

5.14.1 USE OF 5G COMMUNICATION SYSTEMS IN ENVIRONMENTALLY FRIENDLY, AUTONOMOUS MOBILITY CHAIN FOR LOCAL PUBLIC TRANSPORT IN KIEL, GERMANY

5.14.2 CHINA LAUNCHES FIRST AUTONOMOUS CONTAINER SHIP INTO COMMERCIAL SERVICE

5.14.3 AUTONOMOUS MARINE SURVEYING

5.15 KEY CONFERENCES AND EVENTS, 2022–23

TABLE 15 AUTONOMOUS SHIPS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.16 OPERATIONAL DATA

TABLE 16 NEW COMMERCIAL SHIP DELIVERIES, BY SHIP TYPE, 2017–2020

6 INDUSTRY TRENDS (Page No. - 92)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 33 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

TABLE 17 ADVANCEMENTS IN AUTONOMOUS SHIPS IN KEY NATIONS

6.3.1 DIGITAL MARINE AUTOMATION SYSTEMS

6.3.2 CONTROL ALGORITHMS

6.3.3 CONNING SYSTEMS

6.3.4 CONNECTIVITY SOLUTIONS

6.3.5 AUTOPILOT

6.3.6 MOORING CONTROL AND MONITORING SYSTEMS

6.3.7 AUTOMATED RADAR PLOTTING AID/NAVIGATION RADAR SERVERS (NRS)

6.3.8 ELECTRONIC CHART DISPLAY AND INFORMATION SYSTEMS

6.3.9 COMMUNICATION SYSTEMS

6.3.10 DECISION SUPPORT SYSTEMS

6.3.11 VESSEL TRAFFIC MANAGEMENT SYSTEMS

6.3.12 AUTONOMOUS SHIPS

6.3.13 INTEGRATED SHIP AUTOMATION SYSTEMS

6.4 IMPACT OF MEGATRENDS

6.4.1 ARTIFICIAL INTELLIGENCE

6.4.2 BIG DATA ANALYTICS

6.4.3 INTERNET OF THINGS (IOT)

6.4.4 INCREASING FOCUS ON SATELLITE-BASED POSITIONING USING SPACE TECHNOLOGIES

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 18 INNOVATIONS AND PATENT REGISTRATIONS, 2014–2021

7 AUTONOMOUS SHIPS MARKET, BY AUTONOMY (Page No. - 100)

7.1 INTRODUCTION

FIGURE 34 AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022 & 2030 (USD MILLION)

TABLE 19 AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2018–2021 (USD MILLION)

TABLE 20 AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022–2030 (USD MILLION)

7.2 PARTIALLY AUTONOMOUS

7.2.1 INCREASING DEMAND FOR ONBOARD AUTOMATION SYSTEMS TO DRIVE SEGMENT

7.3 REMOTELY OPERATED

7.3.1 INCREASING INVESTMENTS IN REMOTELY OPERATED SHIPS TO DRIVE SEGMENT

7.4 FULLY AUTONOMOUS

7.4.1 INCREASING INVESTMENTS IN DEVELOPMENT OF AUTONOMOUS SHIPS TO FUEL SEGMENT

8 AUTONOMOUS SHIPS MARKET, BY SOLUTION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 35 AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022 & 2030 (USD MILLION)

TABLE 21 AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 22 AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

8.2 SYSTEMS

FIGURE 36 SYSTEMS IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022 & 2030 (USD MILLION)

TABLE 23 SYSTEMS IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 24 SYSTEMS IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

8.2.1 COMMUNICATION & CONNECTIVITY

8.2.1.1 Rising demand for satellite connectivity and mobile satellite devices to drive segment

TABLE 25 COMMUNICATION & CONNECTIVITY IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 26 COMMUNICATION & CONNECTIVITY IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

8.2.1.2 Satellite systems

8.2.1.2.1 Use of satellite systems to achieve safe operation in deep sea drives segment’s growth

8.2.1.3 Very small aperture terminals

8.2.1.3.1 Increasing use of VSAT systems in ship-to-shore communication to drive segment

8.2.1.4 Terrestrial communication systems

8.2.1.4.1 Use of terrestrial communication systems for ship-to-ship connectivity to drive demand

8.2.1.5 5G mobile communication networks

8.2.1.5.1 Increasing popularity and benefits of 5G mobile communication networks in maritime industry to drive segment

8.2.2 INTELLIGENT AWARENESS SYSTEM

8.2.2.1 Increasing use of advanced sensor technology in surveillance & safety systems to drive segment

TABLE 27 INTELLIGENT AWARENESS SYSTEM IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 28 INTELLIGENT AWARENESS SYSTEM IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

8.2.2.2 Alarm management systems

8.2.2.2.1 Need to avoid system failures & accidents to drive demand for alarm management systems in autonomous ships

8.2.2.3 Surveillance and safety systems

8.2.2.3.1 Integration of visual data with surveillance command and control systems responsible for technological advancement and increasing use of surveillance and safety systems

8.2.2.3.2 Radar

8.2.2.3.3 Automatic identification system

8.2.2.3.4 Optical and infra-red cameras

8.2.2.3.5 High-resolution sonar

8.2.2.4 Navigation systems

8.2.2.4.1 Need for safe navigation of autonomous vessels to drive demand for navigation systems

8.2.2.4.2 LiDAR

8.2.2.4.3 GPS

8.2.2.4.4 Inertial navigation systems

8.2.2.5 Machinery management systems

8.2.2.5.1 Importance of monitoring health and functions of vessel systems fuels demand for machinery management systems

8.2.2.6 Power management systems

8.2.2.6.1 Importance of power supply in vessels boosts PMS market

8.2.2.7 Propulsion control systems

8.2.2.7.1 Optimum performance of propulsion systems drives demand for propulsion control systems

8.2.2.8 Other systems

8.2.2.8.1 Reliability, health, and safety management systems

8.2.2.8.2 Ship information management systems

8.2.2.8.3 Ballast management systems

8.2.2.8.4 Thruster control systems

8.3 SOFTWARE

FIGURE 37 SOFTWARE IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022 & 2030 (USD MILLION)

TABLE 29 SOFTWARE IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 30 SOFTWARE IN AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

8.3.1 FLEET MANAGEMENT SOFTWARE

8.3.1.1 Increase in marine vessel deliveries to boost demand for fleet management software

8.3.2 DATA ANALYSIS SOFTWARE

8.3.2.1 Increasing need for voyage planning to drive data analysis software demand

8.3.3 ARTIFICIAL INTELLIGENCE

8.3.3.1 Increasing adoption of autonomous ships to drive demand for artificial intelligence

8.3.3.2 Machine learning

8.3.3.3 Computer vision

8.4 STRUCTURES

8.4.1 INCREASING DEPLOYMENT OF FULLY AUTONOMOUS SHIPS TO DRIVE DEMAND FOR STRUCTURES

9 AUTONOMOUS SHIPS MARKET, BY SHIP TYPE (Page No. - 115)

9.1 INTRODUCTION

FIGURE 38 AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022 & 2030 (USD MILLION)

TABLE 31 AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 32 AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

9.2 COMMERCIAL

FIGURE 39 COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 33 COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 34 COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

9.2.1 PASSENGER VESSELS

TABLE 35 PASSENGER AUTONOMOUS VESSELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 36 PASSENGER AUTONOMOUS VESSELS MARKET, BY TYPE, 2022–2030 (USD MILLION)

9.2.1.1 Cruise ships

9.2.1.1.1 Growth in international sea travel to boost demand for passenger ships & cruises

9.2.1.2 Passenger ferries

9.2.1.2.1 Development in small autonomous inland passenger ferries to drive segment

9.2.1.3 Yachts & motorboats

9.2.1.3.1 Growing demand for yachts for luxury sailing in North America and Europe

9.2.2 CARGO VESSELS

TABLE 37 CARGO AUTONOMOUS VESSELS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 38 CARGO AUTONOMOUS VESSELS MARKET, BY TYPE, 2022–2030 (USD MILLION)

9.2.2.1 Bulk carriers

9.2.2.1.1 Growth in world seaborne trade to drive demand for bulk carriers

9.2.2.2 Gas tankers

9.2.2.2.1 Increasing LPG trade to drive segment

9.2.2.3 Tankers

9.2.2.3.1 Transportation of chemicals and liquid assets in bulk drives demand for tankers

9.2.2.4 Dry cargo vessels

9.2.2.4.1 Growing demand for dry cargo ships for international maritime trade to drive market

9.2.2.5 Container vessels

9.2.2.5.1 Increasing seaborne trade to drive demand for container ships

9.2.2.6 Barges and tugboats

9.2.2.6.1 Growing demand for oil exploration and construction work to drive segment

9.2.3 OTHERS

9.2.3.1 Research vessels

9.2.3.1.1 Increasing demand for research vessels for various applications to drive autonomous ships market

9.2.3.2 Dredgers

9.2.3.2.1 Increasing demand for dredgers to remove debris and sediments

9.3 DEFENSE

FIGURE 40 DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 39 DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 40 DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

9.3.1 AIRCRAFT CARRIERS

9.3.1.1 Upgrading of aircraft carriers with new autonomous systems to drive market

9.3.2 AMPHIBIOUS SHIPS

9.3.2.1 Increasing demand for amphibious warfare ships by various countries to drive autonomous ships market

9.3.3 DESTROYERS

9.3.3.1 Destroyers protect large vessels against small but powerful short-range attackers

9.3.4 FRIGATES

9.3.4.1 Increasing use of autonomous systems on frigates to drive market

9.3.5 SUBMARINES

9.3.5.1 Increasing investment in submarine developments to drive market

9.3.6 NUCLEAR SUBMARINES

9.3.6.1 Increasing use of automation in nuclear submarines to drive market

10 AUTONOMOUS SHIPS MARKET, BY END USER (Page No. - 125)

10.1 INTRODUCTION

FIGURE 41 AUTONOMOUS SHIPS MARKET, BY END USER, 2022 & 2030

TABLE 41 AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 42 AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

10.2 LINE-FIT & NEWBUILD

10.2.1 INCREASING DEMAND FOR AUTOMATED SYSTEMS IN NEW SHIPS TO DRIVE SEGMENT

10.3 RETROFIT

10.3.1 RETROFITTING INVOLVES INTEGRATING COMPONENTS AND SYSTEMS IN EXISTING SHIPS DURING MAINTENANCE, REPAIR, AND OVERHAUL

11 AUTONOMOUS SHIPS MARKET, BY PROPULSION (Page No. - 128)

11.1 INTRODUCTION

FIGURE 42 AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022 & 2030 (USD MILLION)

TABLE 43 AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 44 AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022–2030 (USD MILLION)

11.2 FULLY ELECTRIC

11.2.1 TECHNOLOGICAL DEVELOPMENTS RESULT IN ADOPTION OF ELECTRIC PROPULSION IN NAVAL DESTROYERS IN UK AND US

11.3 HYBRID

11.3.1 HYBRID PROPULSION SYSTEMS HELP REDUCE SIGNIFICANT GREENHOUSE GASES

11.4 CONVENTIONAL

11.4.1 INCREASING R&D ACTIVITIES IN MARINE INDUSTRY TO DRIVE SEGMENT

12 REGIONAL ANALYSIS (Page No. - 131)

12.1 INTRODUCTION

FIGURE 43 EUROPE ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

TABLE 45 AUTONOMOUS SHIPS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 AUTONOMOUS SHIPS MARKET, BY REGION, 2022–2030 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 44 NORTH AMERICA AUTONOMOUS SHIPS MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 49 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 51 NORTH AMERICA: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 53 NORTH AMERICA: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 55 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2018–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022–2030 (USD MILLION)

TABLE 57 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 59 NORTH AMERICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 61 NORTH AMERICA: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 63 NORTH AMERICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 65 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 67 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 68 NORTH AMERICA: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022–2030 (USD MILLION)

12.2.2 US

12.2.2.1 Increase in naval shipbuilding to drive market

TABLE 69 US: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 70 US: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 71 US: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 72 US: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 73 US: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 74 US: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 75 US: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 76 US: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 77 US: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 78 US: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increased trade activities to drive market

TABLE 79 CANADA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 80 CANADA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 81 CANADA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 82 CANADA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 83 CANADA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 84 CANADA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 85 CANADA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 86 CANADA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 87 CANADA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 88 CANADA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

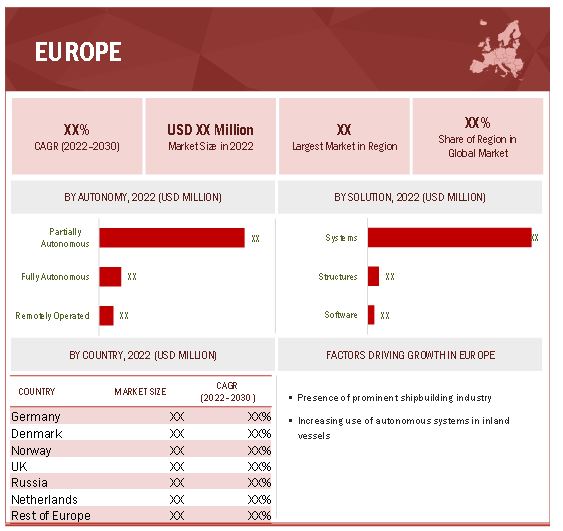

12.3 EUROPE

12.3.1 PESTLE ANALYSIS: EUROPE

FIGURE 45 EUROPE AUTONOMOUS SHIPS MARKET SNAPSHOT

TABLE 89 EUROPE: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 90 EUROPE: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 91 EUROPE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 92 EUROPE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 93 EUROPE: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 EUROPE: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 95 EUROPE: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 96 EUROPE: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 97 EUROPE: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2018–2021 (USD MILLION)

TABLE 98 EUROPE: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022–2030 (USD MILLION)

TABLE 99 EUROPE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 100 EUROPE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 101 EUROPE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 102 EUROPE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 103 EUROPE: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 104 EUROPE: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 105 EUROPE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 106 EUROPE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 107 EUROPE: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 108 EUROPE: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 109 EUROPE: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 110 EUROPE: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022–2030 (USD MILLION)

12.3.2 GERMANY

12.3.2.1 Upgrading of ship equipment to boost demand for autonomous ship systems

TABLE 111 GERMANY: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 112 GERMANY: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 113 GERMANY: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 114 GERMANY: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 115 GERMANY: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 116 GERMANY: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 117 GERMANY: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 118 GERMANY: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 119 GERMANY: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 120 GERMANY: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.3 DENMARK

12.3.3.1 Increasing demand for naval vessels to drive market

TABLE 121 DENMARK: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 122 DENMARK: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 123 DENMARK: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 124 DENMARK: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 125 DENMARK: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 126 DENMARK: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 127 DENMARK: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 128 DENMARK: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 129 DENMARK: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 130 DENMARK: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.4 NORWAY

12.3.4.1 Increasing investment by major automation companies in fully autonomous vessels to drive market

TABLE 131 NORWAY: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 132 NORWAY: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 133 NORWAY: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 134 NORWAY: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 135 NORWAY: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 136 NORWAY: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 137 NORWAY: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 138 NORWAY: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 139 NORWAY: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 140 NORWAY: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.5 UK

12.3.5.1 Increasing investment to upgrade marine systems to drive market

TABLE 141 UK: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 142 UK: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 143 UK: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 144 UK: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 145 UK: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 146 UK: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 147 UK: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 148 UK: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 149 UK: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 150 UK: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.6 RUSSIA

12.3.6.1 Introduction of automation technologies in naval ships to boost demand for automation systems

TABLE 151 RUSSIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 152 RUSSIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 153 RUSSIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 154 RUSSIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 155 RUSSIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 156 RUSSIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 157 RUSSIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 158 RUSSIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 159 RUSSIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 160 RUSSIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.7 NETHERLANDS

12.3.7.1 Increasing use of autonomous inland vessels to drive market

TABLE 161 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 162 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 163 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 164 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 165 NETHERLANDS: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 166 NETHERLANDS: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 167 NETHERLANDS: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 168 NETHERLANDS: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 169 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 170 NETHERLANDS: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.3.8 REST OF EUROPE

12.3.8.1 Increasing investment in autonomous ship projects to fuel market growth

TABLE 171 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 172 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 173 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 174 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 175 REST OF EUROPE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 176 REST OF EUROPE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 177 REST OF EUROPE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 178 REST OF EUROPE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 179 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 180 REST OF EUROPE: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 46 ASIA PACIFIC AUTONOMOUS SHIPS MARKET SNAPSHOT

TABLE 181 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 182 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

TABLE 183 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 184 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 185 ASIA PACIFIC: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 186 ASIA PACIFIC: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 187 ASIA PACIFIC: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 188 ASIA PACIFIC: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 189 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2018–2021 (USD MILLION)

TABLE 190 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022–2030 (USD MILLION)

TABLE 191 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 192 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 193 ASIA PACIFIC: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 194 ASIA PACIFIC: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 195 ASIA PACIFIC: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 196 ASIA PACIFIC: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 197 ASIA PACIFIC: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 198 ASIA PACIFIC: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 199 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 200 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 201 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 202 ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022–2030 (USD MILLION)

12.4.2 CHINA

12.4.2.1 Increase in naval spending and rise in domestic ship production to drive market

TABLE 203 CHINA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 204 CHINA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 205 CHINA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 206 CHINA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 207 CHINA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 208 CHINA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 209 CHINA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 210 CHINA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 211 CHINA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 212 CHINA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Upgrading of old ships with new systems to drive market

TABLE 213 INDIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 214 INDIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 215 INDIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 216 INDIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 217 INDIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 218 INDIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 219 INDIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 220 INDIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 221 INDIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 222 INDIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.4 JAPAN

12.4.4.1 Increasing delivery of commercial ships to fuel market growth

TABLE 223 JAPAN: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 224 JAPAN: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 225 JAPAN: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 226 JAPAN: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 227 JAPAN: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 228 JAPAN: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 229 JAPAN: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 230 JAPAN: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 231 JAPAN: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 232 JAPAN: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.5 SINGAPORE

12.4.5.1 Retrofitting of autonomous technologies in vessels to drive market

TABLE 233 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 234 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 235 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 236 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 237 SINGAPORE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 238 SINGAPORE: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 239 SINGAPORE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 240 SINGAPORE: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 241 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 242 SINGAPORE: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.6 SOUTH KOREA

12.4.6.1 Integration of automated ship systems by various shipbuilding players to drive market

TABLE 243 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 244 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 245 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 246 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 247 SOUTH KOREA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 248 SOUTH KOREA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 249 SOUTH KOREA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 250 SOUTH KOREA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 251 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 252 SOUTH KOREA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.7 MALAYSIA

12.4.7.1 Increasing use of autonomous systems in offshore vessels to drive market

TABLE 253 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 254 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 255 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 256 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 257 MALAYSIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 258 MALAYSIA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 259 MALAYSIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 260 MALAYSIA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 261 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 262 MALAYSIA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.4.8 REST OF ASIA PACIFIC

12.4.8.1 Focus on enhancing coastal security to drive market

TABLE 263 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 264 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 265 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 266 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 267 REST OF ASIA PACIFIC: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 268 REST OF ASIA PACIFIC: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 269 REST OF ASIA PACIFIC: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 270 REST OF ASIA PACIFIC: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 271 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 272 REST OF ASIA PACIFIC: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.5 REST OF THE WORLD

12.5.1 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 47 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET SNAPSHOT

TABLE 273 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 274 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY REGION, 2022–2030 (USD MILLION)

TABLE 275 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 276 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 277 REST OF THE WORLD: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 278 REST OF THE WORLD: COMMERCIAL AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 279 REST OF THE WORLD: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 280 REST OF THE WORLD: DEFENSE AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 281 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2018–2021 (USD MILLION)

TABLE 282 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY AUTONOMY, 2022–2030 (USD MILLION)

TABLE 283 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 284 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 285 REST OF THE WORLD: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 286 REST OF THE WORLD: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 287 REST OF THE WORLD: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 288 REST OF THE WORLD: INTELLIGENT AWARENESS SYSTEM FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 289 REST OF THE WORLD: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 290 REST OF THE WORLD: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 291 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 292 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

TABLE 293 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2018–2021 (USD MILLION)

TABLE 294 REST OF THE WORLD: AUTONOMOUS SHIPS MARKET, BY PROPULSION, 2022–2030 (USD MILLION)

12.5.2 MIDDLE EAST & AFRICA

12.5.2.1 Increasing development of autonomous vessels to fuel market growth

TABLE 295 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 298 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 300 MIDDLE EAST & AFRICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 301 MIDDLE EAST & AFRICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 302 MIDDLE EAST & AFRICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 303 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 304 MIDDLE EAST & AFRICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

12.5.3 LATIN AMERICA

12.5.3.1 Rise in maritime trade and ship overhauling to drive demand for autonomous ships

TABLE 305 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2018–2021 (USD MILLION)

TABLE 306 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY SHIP TYPE, 2022–2030 (USD MILLION)

TABLE 307 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

TABLE 308 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY SOLUTION, 2022–2030 (USD MILLION)

TABLE 309 LATIN AMERICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2018–2021 (USD MILLION)

TABLE 310 LATIN AMERICA: SYSTEMS FOR AUTONOMOUS SHIPS MARKET, BY CATEGORY, 2022–2030 (USD MILLION)

TABLE 311 LATIN AMERICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 312 LATIN AMERICA: SOFTWARE FOR AUTONOMOUS SHIPS MARKET, BY TYPE, 2022–2030 (USD MILLION)

TABLE 313 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2018–2021 (USD MILLION)

TABLE 314 LATIN AMERICA: AUTONOMOUS SHIPS MARKET, BY END USER, 2022–2030 (USD MILLION)

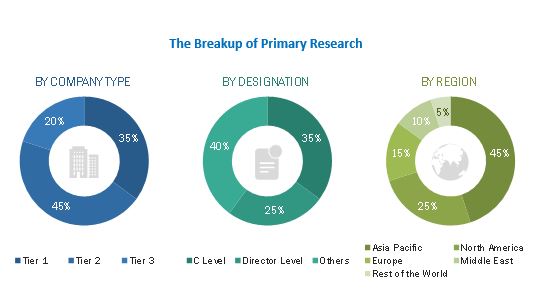

The study involved four major activities in estimating the current size of the autonomous ships market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from autonomous ships developers; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using autonomous ships were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of autonomous ships and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

AUTONOMOUS SHIPS OEM |

OTHERS |

|

Kongsberg Maritime |

BAE Systems |

|

Hyundai Heavy Industries |

L3Harris ASV |

|

Rolls-Royce PLC |

Siemens |

|

Fugro |

Honeywell International Inc. |

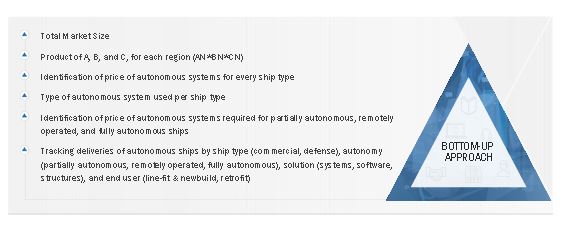

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the autonomous ships market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global autonomous ships market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the autonomous ships market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the autonomous ships market.

Report Objectives

- To define, describe, and forecast the autonomous ships market size based on ship type, autonomy, end user, solution, Propulsion, and region

- To forecast the size of different segments of the market with respect to 4 major regions: North America, Europe, Asia Pacific, and the Rest of the World (Middle East & Africa and Latin America), along with their respective key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify industry trends and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the overall market

- To profile companies operating in the autonomous ships market based on their product portfolios, market share, and key growth strategies

- To analyze the degree of competition among players in the market by identifying and analyzing their business overview, products offered, and recent developments and ranking them based on these parameters

- To analyze competitive developments such as deals, new product developments, and partnerships/acquisitions undertaken by key market players

- To strategically profile key players and comprehensively analyze their share and core competencies2 in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Autonomous Ships Market

I am working on a new autonomous vessels venture and I want to make sure this report is the report I'm looking for, the one that provides the required analysis and data on the market.

The business potential, Market size and segmentation, Market adoption, Stakeholders, Timelines. Thank you.

In Maritime Cluster Funen, one of our strategic focus areas is autonomous technologies. Therefore, I am interested in your market insights and analysis on this area.

Westray develops advanced maritime aiding systems for tomorrow's officer. I would like to find out if this document will be useful and to see how the forecast in this new and exciting industry will be, allowing me to better understand and discuss it with potential clients and investors.