Intelligent Process Automation Market by Component, Technology, Application, Business Function, Deployment Mode (On-premises, Cloud), Organization Size (Large Enterprises, SMEs), Vertical and Region - Global Forecast to 2027

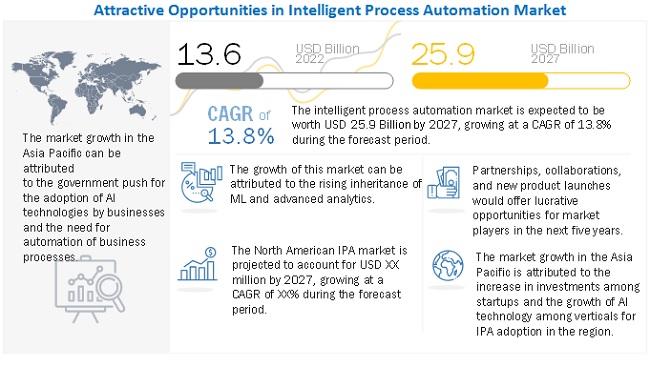

The global intelligent process automation size as per revenue surpassed $13.6 billion in 2022 and is anticipated to exhibit a CAGR of 13.8% to reach over $25.9 billion by the end of 2027. An industry trend analysis of the market is part of the latest research report. The latest research study includes market buying trends, pricing analysis, patent analysis, conference and webinar materials, and important stakeholders.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The ongoing COVID-19 pandemic has led financial institutions to re-think their digital transformation strategy as the laggards have been facing a lot of complexities in managing the regulatory compliance. The regulatory documents are not moving due to their dependency on on-premises systems, which might lead to several instances of non-compliance and additional penalties. Financial institutions that were early adopters of Intelligent process automation will be able to sail through these kinds of economic turmoil, and the subsequent impact will be the rising focus on adopting new technologies across finance and non-finance verticals.

Intelligent Process Automation Market Growth Dynamics

Driver: Rising adoption of RPA

RPA technology is used for automating manual data entry tasks in enterprises, which eradicates the need for human effort. AI uses neural nets with self-learning networks that take in information and make intelligent decisions by analyzing past data models and learning from them. ML, AI, cognitive learning, and RPA together make up IPA workflow. Therefore, the rise in RPA leads to the increasing demand for IPA. RPA provides speed and efficiency. Implementing robots that mimic human actions helps lower manual, labor-intensive tasks, such as re-keying data from one system to another. sAI then contributes great intelligence and decisions. AI brings another level of thinking to automation as it can analyze data in a way that a human could not, recognizing patterns in data and learning from past decisions to make increasingly intelligent choices. IPA provides minimizing document processing time by eliminating the human element of document sorting, data entry, and information validation, decreasing the amount of time spent in the underwriting stage.

Restraint: Absence of highly sophisticated and skilled manpower

To operate a newly automated operational model, skilled labor is needed, but finding people with RPA and AI skills is critical. This includes technical skills, understanding organization’s business processes, and change in the management expertise to guide the organization to the future. Bringing on or upskilling talent to develop automation is usually top of mind; however, assigning people to ongoing maintenance, support, and troubleshooting is also important. As per McKinsey, there is a shortage of 25% of skilled labor in the US, 27% in Europe, and 31% in Asia regions to implement IPA solutions.

Opportunity: Increasing investment in intelligent process automation market

Enterprises are forced to implement work from home policies, inducing high investments in the automation of business activities. The rise in application areas, such as virtual healthcare management, telemedicine, and predictive maintenance, are further fueling the growth of the market. Most non-IT verticals have seen increased adoption of IPA solutions. As per the survey conducted by Bain, more than a 50% increase in automation is expected in healthcare, life sciences, and manufacturing verticals. A 2020 global survey of business leaders from a wide cross-section of industries conducted by McKinsey & Co. found that 66% were piloting solutions to automate at least one business process, up from 57% two years earlier.

Challenge: Hike in cybersecurity threats

One of the most important issues concerns in the digital era is cybersecurity. Organized cybercrime in malware and ransomware attacks is on the rise. The total number of daily security notifications that businesses receive is steadily increasing. Over 6.07 lakh cybersecurity incidents were reported in the first six months of 2021, according to CERT-In. As a result, developing an effective security architecture that protects the organization from growing risks necessitates the use of Cybersecurity for IPA. In fact, according to a Cisco survey, 77% of companies aim to boost automation in their security ecosystems in the upcoming years.

By Component, the solution segment to have a higher growth during the forecast period

Organizations across all industries are increasingly adopting IPA solutions to improve operational efficiency and minimize human work processes. IPA is the application of AI and related emerging technologies to robotic process automation, such as computer vision, cognitive automation, and ML. These solutions are enhanced with cognitive capabilities that enable programs to earn, interpret, and respond. It provides smart technologies and exile processes to users, enabling them to make faster and more informed decisions. Increased price efficiency and improved customer experience are two major advantages of IPA solutions. According to a survey, many companies across industries have been experimenting with IPA, with impressive results; automation of 50 – 70% of tasks, which has translated into 20 – 35% annual run-rate cost efficiencies

By Deployment Type, the on-premises segment to dominate the market during the forecast period

The on-premises deployment comprises the deployment of software and hardware at clients’ premises. It is an expensive model as compared to the cloud model. The on-premises deployment is the traditional approach to implementing the IPA solution in enterprises. The on-premises IPA solution provides organizations full control of their applications, platforms, data, and systems, all of which are handled and managed by their internal IT staff. Organizations wherein user credentials are critical for business operations prefer the on-premises deployment, as they control their own systems. The government and BFSI industry verticals are expected to prefer the on-premises IPA solution because these industry verticals deal with critical and sensitive data related to national security and financial transactions. Data-sensitive enterprises prefer on-premises advanced AI and ML tools to be used in IPA solutions. Another important factor is the real-time availability of data for extracting insights; hence, IPA solutions are expected to remain on-premises in some regions despite the speedy developments of cloud-based solutions. However, the increasing dominance of the cloud and the rising cost of support and maintenance of on-premises solutions are expected to drive the adoption of hosted solutions. The on-premises deployment of IPA solutions offers significant improvements in terms of data validation, standardization, and robust matching as it is done manually.

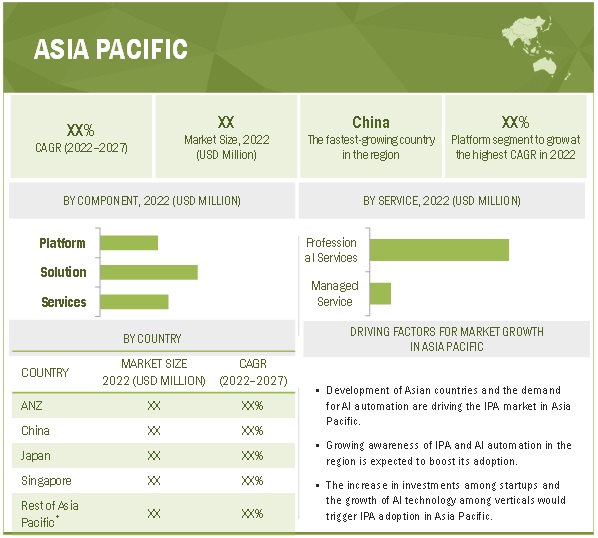

APAC to grow at the highest CAGR during the forecast period

The Asia Pacific region is expected to have the highest CAGR in the intelligent process automation market during the forecast period due to its growing technology adoption. In India, with Amplify.ai’s powerful conversational AI, MyGov managed to create an effective campaign that helped deliver accurate and relevant information to citizens promptly, bridging the information gap that fake news was creating. Further to this, MyGov also manages to deploy the robust conversation AI technology on Google’s Business Messages that helped discover approximately 11,000 shelters in 700 cities amid COVID-19. In Japan, a tech start-up, Bespoke, launched a chatbot called Bebot to provide the latest and reliable updates on the COVID-19 outbreak to travellers. India developed the Aarogya Setu App linked with the Sahyog application to collect geotagged data that will help government agencies make location-specific decisions while responding to the outbreak.

To know about the assumptions considered for the study, download the pdf brochure

Key Companies in Intelligent Process Automation Market

The report includes the study of key players Intelligent process automation market. It profiles major vendors in the market. The major Companies in the Intelligent process automation market include Atos (France), IBM (US), Genpact (US), HCL Technologies (India), Pegasystems (US), Blue Prism (UK), Capgemini (France), CGI (Canada), Nice (Israel), Cognizant (US). These players have adopted various strategies to grow in the global offering market. The study includes an in-depth competitive analysis of these key players in the offering market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 13.6 Billion |

|

Revenue Forecast by 2027 |

USD 25.9 Billion |

|

Growth Rate (CAGR) |

CAGR of 13.8% from 2022 to 2027 |

|

Market size available for years |

2016-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Component, Technology, Application, Business Function, Deployment Mode, Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle east and Africa, and Latin America |

|

Companies covered |

Atos (France), IBM (US), Genpact (US), HCL Technologies (India), Pegasystems (US), Blue Prism (UK), Capgemini (France), CGI (Canada), Nice (Israel), Cognizant (US), Infobip (England), Accenture (Ireland), Infosys (India), TCS (India), Tech Mahindra (India), UIPath (US), Wipro (India), Xerox (US), Happiest Minds (India), WorkFusion (US), Automation Anywhere (US), Virtual Operations (UK), Hive (US), HyperScience (US), Laiye (China), Cognigy (Germany), Jiffy.ai (US), Infinitus (US), ElectroNeek (US), Snorkel AI (US), Vianai (US), Kryon (Israel), Rossom (UK), Autologyx (UK), Automation Edge (US). |

This research report categorizes the Intelligent Process Automation market to forecast revenues and analyze trends in each of the following subsegments:

By Offering:

- Platform

- Solution

-

Services

- Professional Services

- Managed Services

By Technology:

- Natural Language Processing

- Machine and Deep Learning

- Neural Networks

- Virtual Agents

- Mini Bots

- Computer Vision

- Others

By Organization Size:

- Large enterprises

- SMEs

By Application:

- Contact Center Management

- Business Process Automation

- Application Management

- Content Management

- Security Management

- Other Applications

By Business Function:

- Information Technology

- Finance & Accounts

- Human Resources

- Operations & Supply Chain

By Deployment Mode:

- On-premises

- Cloud

By Organization Size:

- Large Enterprises

- Small and Medium Sized Enterprises

By Vertical:

- BFSI

- Telecommunications and IT

- Manufacturing & Logistics

- Media & Entertainment

- Retail & eCommerce

- Healthcare & Life Sciences

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Ireland

- Rest of Europe

-

Asia Pacific

- ANZ

- China

- Japan

- Singapore

- Rest of Asia Pacific

-

Middle East and Africa

- Israel

- UAE

- Rest of Middle East and Africa

-

Latin America

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2021, IBM and Cisco collaborated to help orchestrate and manage 5G networks

- In September 2021, HCL Technologies announced it had made DRYiCE iAutomate available on Google Cloud Marketplace.

- In June 2021, IBM announced the launch of IBM Cloud Pak for Network Automation.

- In June 2021, Atos and du extended the contract for five years to continue their collaboration. This collaboration will help du in the digital transformation and application modernization.

- In April 2020, Pegasystems announced a new enhancement to its Pega Platform. A new capability Pega Process AI has been added to help organizations optimize their business and customer operations in real-time.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global Intelligent Process Automation (IPA) market?

The global Intelligent Process Automation (IPA) market boasts a total revenue value of $25.9 billion by 2027.

What is the estimated growth rate (CAGR) of the global Intelligent Process Automation (IPA) market?

The global market for Intelligent Process Automation (IPA) has an estimated compound annual growth rate (CAGR) of 13.8% and a revenue size in the region of $13.6 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR, EXCHANGE RATES, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 GLOBAL INTELLIGENT PROCESS AUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

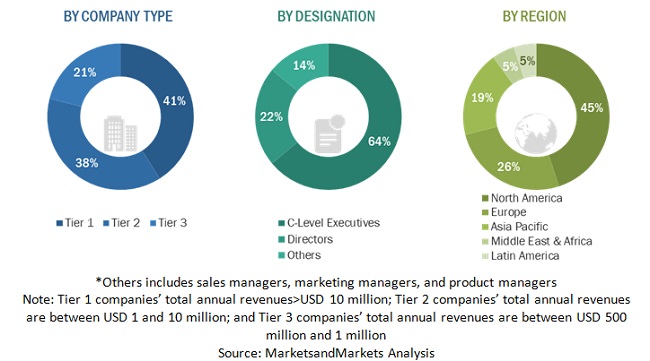

FIGURE 2 BREAKUP OF PROFILES OF PRIMARY PARTICIPANTS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES OF INTELLIGENT PROCESS AUTOMATION MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (BOTTOM-UP) (SUPPLY-SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES OF MARKET

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR STUDY

TABLE 3 INTELLIGENT PROCESS AUTOMATION: ASSUMTIONS CONSIDERED

2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 MARKET SIZE, 2022–2027

FIGURE 8 LARGEST SEGMENTS IN MARKET, 2022

FIGURE 9 MARKET ANALYSIS

FIGURE 10 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN INTELLIGENT PROCESS AUTOMATION MARKET

FIGURE 11 FASTER DECISION-MAKING ACROSS ORGANIZATIONS TO DRIVE MARKET GROWTH

4.2 MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 12 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 NORTH AMERICAN MARKET, 2022

FIGURE 13 SOLUTION SEGMENT AND US TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2022

4.4 ASIA PACIFIC MARKET, 2022

FIGURE 14 SOLUTION SEGMENT AND CHINA TO ACCOUNT FOR HIGH MARKET SHARES IN ASIA PACIFIC IN 2022

4.5 MARKET, BY COUNTRY

FIGURE 15 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.2.1 DRIVERS

5.2.1.1 Rising adoption of RPA

5.2.1.2 Increasing inheritance of ML and advanced analytics

5.2.1.3 Faster decision-making across organizations

5.2.1.4 Rising demand for automated solutions for business continuity planning

5.2.2 RESTRAINTS

5.2.2.1 Massive data handling and cost computation

5.2.2.2 Absence of highly sophisticated and skilled manpower

5.2.2.3 High cost of investment

5.2.3 OPPORTUNITIES

5.2.3.1 Effective monitoring of data and fraud detection

5.2.3.2 Increasing investment in intelligent process automation market

5.2.4 CHALLENGES

5.2.4.1 Hike in cybersecurity threats

5.2.4.2 Difficulties in rising in maturity chain

5.2.4.3 Poor communication infrastructure to restrict growth

5.3 INDUSTRY TRENDS

5.3.1 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 17 INTELLIGENT PROCESS AUTOMATION MARKET: VALUE CHAIN ANALYSIS

5.3.2 ECOSYSTEM/MARKET MAP

TABLE 4 MARKET: ECOSYSTEM

5.3.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES MODEL

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: IMARKET

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of buyers

5.3.3.4 Bargaining power of suppliers

5.3.3.5 Rivalry among existing competitors

5.3.4 KEY STAKEHOLDERS AND BUYING CRITERIA

5.3.4.1 Key stakeholders in buying process

FIGURE 19 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.3.4.2 Buying Criteria

FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.3.5 TECHNOLOGY ANALYSIS

5.3.5.1 ML and AI

5.3.5.2 RPA

5.3.5.3 NLP

5.3.5.4 Neural network

5.3.5.5 Virtual agents

5.3.5.6 Mini bots

5.3.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS

FIGURE 21 REVENUE SHIFT FOR INTELLIGENT PROCESS AUTOMATION MARKET

5.3.7 PATENT ANALYSIS

FIGURE 22 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 8 TOP TWENTY PATENT OWNERS

FIGURE 23 NUMBER OF PATENTS GRANTED IN ONE YEAR, 2012-2021

5.3.8 PRICING ANALYSIS

TABLE 9 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED INTELLIGENT PROCESS AUTOMATION

5.3.9 MARKET ASSESSMENT BY DATA TYPE

5.3.9.1 Structured data

5.3.9.2 Unstructured data

5.3.10 USE CASES

5.3.10.1 Contact center management

5.3.10.1.1 Use case 1: KE Holdings inherited Laiye’s RPA deployment to accelerate data transmission

5.3.10.1.2 Use case 2: E.ON chose Cognigy.ai as a solution for its high modularity and custom integration capabilities

5.3.10.2 Business process automation

5.3.10.2.1 Use case 3: FlowForma managed multi-cloud infrastructure of Global Pharma Organization

5.3.10.2.2 Use case 4: Bizagi automation platform automated Audi Japan KK’S finance processes

5.3.10.3 Application management

5.3.10.3.1 Use case 5: Laiye built AI-powered conversational robot for AstraZeneca

5.3.10.4 Content management

5.3.10.4.1 Use case 6: Deutsche Bank selected WorkFusion to streamline processes

5.3.10.4.2 Use case 7: Kofax selected Cognigy.ai to enhance its search engine for its knowledge base

5.3.10.5 Security management

5.3.10.5.1 Use case 8: Future-proofing a captive auto finance organization with Pegasystems

5.3.11 TARIFF & REGULATORY IMPACT

5.3.11.1 Regulatory bodies, government agencies, and other organizations

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.3.12 KEY CONFERENCES & EVENTS IN 2022

TABLE 15 INTELLIGENT PROCESS AUTOMATION MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.4 COVID-19 MARKET OUTLOOK FOR MARKET

5.4.1 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN COVID-19 ERA

5.4.2 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN COVID-19 ERA

5.4.3 CUMULATIVE GROWTH ANALYSIS

TABLE 16 MARKET: CUMULATIVE GROWTH ANALYSIS

6 INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT (Page No. - 77)

6.1 INTRODUCTION

6.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 24 PLATFORM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 17 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 18 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 19 COMPONENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 COMPONENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2 PLATFORM

6.2.1 PLATFORM: MARKET DRIVERS

TABLE 21 PLATFORM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 PLATFORM: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SOLUTION

6.3.1 SOLUTION: MARKET DRIVERS

TABLE 23 SOLUTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 SOLUTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES: INTELLIGENT PROCESS AUTOMATION MARKET DRIVERS

FIGURE 25 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 25 MARKET, BY SERVICES, 2016–2021 (USD MILLION)

TABLE 26 MARKET, BY SERVICES, 2022–2027 (USD MILLION)

TABLE 27 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2 PROFESSIONAL SERVICES

FIGURE 26 ADVISORY AND CONSULTING SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 29 MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 30 MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 31 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.1 Advisory/consulting

TABLE 33 ADVISORY/CONSULTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 ADVISORY/CONSULTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.2 Design & implementation

TABLE 35 DESIGN & IMPLEMENTATION: INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 DESIGN & IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.3 Training

TABLE 37 TRAINING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 TRAINING: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.2.4 Support & maintenance

TABLE 39 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4.3 MANAGED SERVICES

TABLE 41 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 INTELLIGENT PROCESS AUTOMATION MARKET, BY TECHNOLOGY (Page No. - 92)

7.1 INTRODUCTION

7.1.1 TECHNOLOGY: MARKET DRIVERS

7.1.2 TECHNOLOGY: COVID-19 IMPACT

7.2 NATURAL LANGUAGE PROCESSING

7.3 MACHINE AND DEEP LEARNING

7.4 NEURAL NETWORKS

7.5 VIRTUAL AGENTS

7.6 MINI BOTS

7.7 COMPUTER VISION

7.8 OTHER TECHNOLOGIES

8 INTELLIGENT PROCESS AUTOMATION MARKET, BY APPLICATION (Page No. - 95)

8.1 INTRODUCTION

8.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 27 CONTACT CENTER MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 43 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 44 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 45 APPLICATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 APPLICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 CONTACT CENTER MANAGEMENT

8.2.1 CONTACT CENTER MANAGEMENT: MARKET DRIVERS

TABLE 47 CONTACT CENTER MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 CONTACT CENTER MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 BUSINESS PROCESS AUTOMATION

8.3.1 BUSINESS PROCESS AUTOMATION: MARKET DRIVERS

TABLE 49 BUSINESS PROCESS AUTOMATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 BUSINESS PROCESS AUTOMATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 APPLICATION MANAGEMENT

8.4.1 APPLICATION MANAGEMENT: MARKET DRIVERS

TABLE 51 APPLICATION MANAGEMENT: INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 APPLICATION MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 CONTENT MANAGEMENT

8.5.1 CONTENT MANAGEMENT: MARKET DRIVERS

TABLE 53 CONTENT MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 CONTENT MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 SECURITY MANAGEMENT

8.6.1 SECURITY MANAGEMENT: MARKET DRIVERS

TABLE 55 SECURITY MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 SECURITY MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.7 OTHER APPLICATIONS

TABLE 57 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION (Page No. - 106)

9.1 INTRODUCTION

9.1.1 BUSINESS FUNCTIONS: COVID-19 IMPACT

FIGURE 28 INFORMATION TECHNOLOGY TO LEAD INTELLIGENT PROCESS AUTOMATION DURING FORECAST PERIOD

TABLE 59 MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 60 MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 61 BUSINESS FUNCTION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 62 BUSINESS FUNCTION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 INFORMATION TECHNOLOGY

9.2.1 INFORMATION TECHNOLOGY: MARKET DRIVERS

TABLE 63 INFORMATION TECHNOLOGY: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 INFORMATION TECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 FINANCE & ACCOUNTS

9.3.1 FINANCE & ACCOUNTS: MARKET DRIVERS

TABLE 65 FINANCE & ACCOUNTS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 FINANCE & ACCOUNTS: INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 HUMAN RESOURCES

9.4.1 HUMAN RESOURCES: MARKET DRIVERS

TABLE 67 HUMAN RESOURCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 68 HUMAN RESOURCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 OPERATIONS & SUPPLY CHAIN

9.5.1 OPERATIONS & SUPPLY CHAIN: MARKET DRIVERS

TABLE 69 OPERATIONS & SUPPLY CHAIN: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 OPERATIONS & SUPPLY CHAIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE (Page No. - 115)

10.1 INTRODUCTION

10.1.1 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 29 ON-PREMISES DEPLOYMENT MODE TO LEAD INTELLIGENT PROCESS AUTOMATION DURING FORECAST PERIOD

TABLE 71 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 72 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 73 DEPLOYMENT MODE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 DEPLOYMENT MODE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 ON-PREMISES

10.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 75 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 CLOUD

10.3.1 CLOUD: MARKET DRIVERS

TABLE 77 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 INTELLIGENT PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE (Page No. - 122)

11.1 INTRODUCTION

11.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 30 LARGE ENTERPRISES SEGMENT TO LEAD INTELLIGENT PROCESS AUTOMATION DURING FORECAST PERIOD

TABLE 79 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 80 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 81 ORGANIZATION SIZE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 82 ORGANIZATION SIZE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 LARGE ENTERPRISES

11.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 83 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 84 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 85 SMALL AND MEDIUM ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 86 SMALL AND MEDIUM ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL (Page No. - 128)

12.1 INTRODUCTION

12.1.1 VERTICAL: COVID-19 IMPACT

FIGURE 31 BFSI TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 87 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 88 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 89 VERTICAL: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 VERTICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

12.2.1 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET DRIVERS

TABLE 91 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 92 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.3 TELECOMMUNICATIONS & IT

12.3.1 TELECOMMUNICATIONS & IT: MARKET DRIVERS

TABLE 93 TELECOMMUNICATIONS & IT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 94 TELECOMMUNICATIONS & IT: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.4 MANUFACTURING & LOGISTICS

12.4.1 MANUFACTURING & LOGISTICS: MARKET DRIVERS

TABLE 95 MANUFACTURING & LOGISTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 96 MANUFACTURING & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.5 MEDIA & ENTERTAINMENT

12.5.1 MEDIA & ENTERTAINMENT: MARKET DRIVERS

TABLE 97 MEDIA & ENTERTAINMENT: INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 98 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.6 RETAIL & ECOMMERCE

12.6.1 RETAIL & ECOMMERCE: MARKET DRIVERS

TABLE 99 RETAIL & ECOMMERCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 100 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.7 HEALTHCARE & LIFE SCIENCES

12.7.1 HEALTHCARE & LIFE SCIENCES: MARKET DRIVERS

TABLE 101 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 102 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

12.8 OTHER VERTICALS

TABLE 103 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 104 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

13 INTELLIGENT PROCESS AUTOMATION MARKET, BY REGION (Page No. - 142)

13.1 INTRODUCTION

13.1.1 REGION: COVID-19 IMPACT

FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 105 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 106 MARKET, BY REGION, 2022–2027 (USD MILLION)

13.2 NORTH AMERICA

13.2.1 NORTH AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET DRIVERS

13.2.2 NORTH AMERICA: REGULATIONS

13.2.2.1 Health Insurance Portability and Accountability Act (HIPAA)

13.2.2.2 Gramm–Leach–Bliley Act (GLB Act)

13.2.2.3 Health Information Technology for Economic and Clinical Health (HITECH) Act

13.2.2.4 Sarbanes Oxley (SOX) Act

13.2.2.5 United States Securities and Exchange Commission (SEC)

13.2.2.6 California Consumer Privacy Act (CCPA)

13.2.2.7 Federal Information Security Management Act (FISMA)

13.2.2.8 Federal Information Processing Standards (NIST)

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 107 NORTH AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.2.3 UNITED STATES

13.2.3.1 Rapid growth in technology innovations and need for business process automation to drive market growth

TABLE 125 UNITED STATES: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 126 UNITED STATES: INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 127 UNITED STATES: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 128 UNITED STATES: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 129 UNITED STATES: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 130 UNITED STATES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 131 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 132 UNITED STATES: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 133 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 134 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.2.4 CANADA

13.2.4.1 Government initiatives and adoption of automation-based technologies to drive market growth

TABLE 135 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 136 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 137 CANADA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 138 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 139 CANADA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 140 CANADA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 141 CANADA: INTELLIGENT PROCESS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 142 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 143 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 144 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.3 EUROPE

13.3.1 EUROPE: INTELLIGENCE PROCESS AUTOMATION MARKET DRIVERS

13.3.2 EUROPE: REGULATIONS

13.3.2.1 European Market Infrastructure Regulation (EMIR)

13.3.2.2 General Data Protection Regulation (GDPR)

13.3.2.3 European Committee for Standardization (CEN)

13.3.2.4 European Technical Standards Institute (ETSI)

TABLE 145 EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 149 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 150 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 151 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 152 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 153 EUROPE: INTELLIGENT PROCESS AUTOMATION MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 154 EUROPE: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 155 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 156 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 157 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 158 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 159 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 160 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 161 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 162 EUROPE: INTELLIGENT PROCESS AUTOMATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.3.3 UNITED KINGDOM

13.3.3.1 Increased investments and presence of major IPA vendors to drive market growth

TABLE 163 UNITED KINGDOM: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 164 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 165 UNITED KINGDOM: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 166 UNITED KINGDOM: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 167 UNITED KINGDOM: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 168 UNITED KINGDOM: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 169 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 170 UNITED KINGDOM: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 171 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 172 UNITED KINGDOM: INTELLIGENT PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.3.4 GERMANY

13.3.4.1 Technological advancements and increased adoption of AI-based solutions to drive market growth

13.3.5 FRANCE

13.3.5.1 Significant surge in demand for IPA solutions in various sectors to drive market growth

13.3.6 IRELAND

13.3.6.1 Increased government awareness and adoption of new technologies to drive market growth

13.3.7 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 ASIA PACIFIC: INTELLIGENCE PROCESS AUTOMATION MARKET DRIVERS

13.4.2 ASIA PACIFIC: REGULATIONS

13.4.2.1 Privacy Commissioner for Personal Data (PCPD)

13.4.2.2 Act on the Protection of Personal Information (APPI)

13.4.2.3 Critical Information Infrastructure (CII)

13.4.2.4 International Organization for Standardization (ISO) 27001

13.4.2.5 Personal Data Protection Act (PDPA)

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 173 ASIA PACIFIC: INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 183 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 185 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 187 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 188 ASIA PACIFIC: INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 189 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 190 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.4.3 CHINA

13.4.3.1 Increased investment by government in adopting new technologies to drive market growth

TABLE 191 CHINA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 192 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 193 CHINA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 194 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 195 CHINA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 196 CHINA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 197 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 198 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 199 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 200 CHINA: INTELLIGENT PROCESS AUTOMATION MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.4.4 AUSTRALIA AND NEW ZEALAND

13.4.4.1 Increased adoption of AI-based technologies and need for automating business processes to drive market growth

13.4.5 JAPAN

13.4.5.1 Advanced infrastructure and government investments in latest technologies to drive market growth

13.4.6 SINGAPORE

13.4.6.1 Hugh market growth due to increased need for automation across different verticals

13.4.7 REST OF ASIA PACIFIC

13.5 MIDDLE EAST & AFRICA

13.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

13.5.2 MIDDLE EAST & AFRICA: REGULATIONS

13.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777–2017

13.5.2.2 Cloud Computing Framework (CCF)

13.5.2.3 GDPR Applicability in the KSA

13.5.2.4 Protection of Personal Information (POPI) Act

TABLE 201 MIDDLE EAST & AFRICA: INTELLIGENT PROCESS AUTOMATION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 207 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 211 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 213 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 214 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 215 MIDDLE EAST & AFRICA: INTELLIGENT PROCESS AUTOMATION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 216 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 217 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.5.3 ISRAEL

13.5.3.1 Growing penetration of new technologies to drive market growth

13.5.4 UNITED ARAB EMIRATES

13.5.4.1 Growing policies and regulations to drive market growth

13.5.5 REST OF MIDDLE EAST & AFRICA

13.6 LATIN AMERICA

13.6.1 LATIN AMERICA: MARKET DRIVERS

13.6.2 LATIN AMERICA: REGULATIONS

13.6.2.1 Brazil Data Protection Law

13.6.2.2 Federal Law on Protection of Personal Data Held by Individuals

TABLE 219 LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 222 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 223 LATIN AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

TABLE 228 LATIN AMERICA: MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 234 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 236 LATIN AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

13.6.3 MEXICO

13.6.3.1 Government awareness toward making digitally advanced country to drive market growth

13.6.4 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE (Page No. - 202)

14.1 OVERVIEW

14.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK, 2019–2021

14.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 237 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS

14.4 COMPETITIVE SCENARIO AND TRENDS

14.4.1 PRODUCT LAUNCHES

TABLE 238 INTELLIGENT PROCESS AUTOMATION MARKET: PRODUCT LAUNCHES, 2019–2021

14.4.2 DEALS

TABLE 239 MARKET: DEALS, 2019-2021

14.4.3 OTHERS

TABLE 240 MARKET: OTHERS, 2019

14.5 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 241 MARKET: DEGREE OF COMPETITION

FIGURE 36 MARKET SHARE ANALYSIS OF COMPANIES IN INTELLIGENT PROCESS AUTOMATION MARKET

14.6 HISTORICAL REVENUE ANALYSIS

FIGURE 37 HISTORICAL REVENUE ANALYSIS, 2017–2021

14.7 COMPANY EVALUATION MATRIX OVERVIEW

14.8 COMPANY EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

TABLE 242 PRODUCT FOOTPRINT WEIGHTAGE

14.8.1 STAR

14.8.2 EMERGING LEADERS

14.8.3 PERVASIVE

14.8.4 PARTICIPANTS

FIGURE 38 INTELLIGENT PROCESS AUTOMATION MARKET, COMPANY EVALUATION MATRIX, 2022

14.9 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 243 COMPANY OVERALL FOOTPRINT

TABLE 244 COMPANY COMPONENT FOOTPRINT

TABLE 245 VERTICAL FOOTPRINT

TABLE 246 COMPANY REGION FOOTPRINT

14.10 COMPANY MARKET RANKING ANALYSIS

FIGURE 39 RANKING OF KEY PLAYERS IN MARKET, 2022

14.11 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

FIGURE 40 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

TABLE 247 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

14.11.1 PROGRESSIVE COMPANIES

14.11.2 RESPONSIVE COMPANIES

14.11.3 DYNAMIC COMPANIES

14.11.4 STARTING BLOCKS

FIGURE 41 INTELLIGENT PROCESS AUTOMATION MARKET, STARTUP EVALUATION MATRIX, 2022

14.12 COMPETITIVE BENCHMARKING FOR SME/STARTUP

TABLE 248 MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 249 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

15 COMPANY PROFILES (Page No. - 222)

15.1 KEY PLAYERS

(Business overview, Products/solutions/services offered, Recent developments & MnM View)*

15.1.1 ATOS

TABLE 250 ATOS: BUSINESS OVERVIEW

FIGURE 42 ATOS: COMPANY SNAPSHOT

TABLE 251 ATOS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 252 ATOS: PRODUCT LAUNCHES

TABLE 253 ATOS: DEALS

TABLE 254 ATOS: OTHERS

15.1.2 IBM

TABLE 255 IBM: BUSINESS OVERVIEW

FIGURE 43 IBM: COMPANY SNAPSHOT

TABLE 256 IBM: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 257 IBM: PRODUCT LAUNCHES

TABLE 258 IBM: DEALS

15.1.3 GENPACT

TABLE 259 GENPACT: BUSINESS OVERVIEW

FIGURE 44 GENPACT: COMPANY SNAPSHOT

TABLE 260 GENPACT: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 261 GENPACT: PRODUCT LAUNCHES

TABLE 262 GENPACT: DEALS

15.1.4 HCL TECHNOLOGIES

TABLE 263 HCL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 45 HCL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 264 HCL TECHNOLOGIES: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 265 HCL TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 266 HCL TECHNOLOGIES: DEALS

15.1.5 PEGASYSTEMS

TABLE 267 PEGASYSTEMS: BUSINESS OVERVIEW

FIGURE 46 PEGASYSTEMS: COMPANY SNAPSHOT

TABLE 268 PEGASYSTEMS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 269 PEGASYSTEMS: PRODUCT LAUNCHES

TABLE 270 PEGASYSTEMS: DEALS

15.1.6 BLUE PRISM

TABLE 271 BLUE PRISM: BUSINESS OVERVIEW

FIGURE 47 BLUE PRISM: COMPANY SNAPSHOT

TABLE 272 BLUE PRISM: PRODUCT/SOLUTIONS/SERVICES OFFERINGS

TABLE 273 BLUE PRISM: PRODUCT LAUNCHES

TABLE 274 BLUE PRISM: DEALS

15.1.7 CAPGEMINI

TABLE 275 CAPGEMINI: BUSINESS OVERVIEW

FIGURE 48 CAPGEMINI: COMPANY SNAPSHOT

TABLE 276 CAPGEMINI: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 277 CAPGEMINI: PRODUCT LAUNCHES

TABLE 278 CAPGEMINI: DEALS

15.1.8 CGI

TABLE 279 CGI: BUSINESS OVERVIEW

FIGURE 49 CGI: COMPANY SNAPSHOT

TABLE 280 CGI: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 281 CGI: DEALS

15.1.9 NICE

TABLE 282 NICE: BUSINESS OVERVIEW

FIGURE 50 NICE: COMPANY SNAPSHOT

TABLE 283 NICE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 284 NICE: PRODUCT LAUNCHES

TABLE 285 NICE: DEALS

15.1.10 COGNIZANT

TABLE 286 COGNIZANT: BUSINESS OVERVIEW

FIGURE 51 COGNIZANT: COMPANY SNAPSHOT

TABLE 287 COGNIZANT: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 288 COGNIZANT: DEALS

15.1.11 ACCENTURE

15.1.12 INFOBIP

15.1.13 INFOSYS

15.1.14 TCS

15.1.15 TECH MAHINDRA

15.1.16 UIPATH

15.1.17 WIPRO

15.1.18 XEROX CORPORATION

15.1.19 HAPPIEST MINDS

15.1.20 WORKFUSION

15.1.21 AUTOMATION ANYWHERE

*Details on Business overview, Products/solutions/services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15.2 SMES/ STARTUPS

15.2.1 VIRTUAL OPERATIONS

15.2.2 HIVE

15.2.3 HYPERSCIENCE

15.2.4 LAIYE

15.2.5 COGNIGY

15.2.6 JIFFY.AI

15.2.7 INFINITUS

15.2.8 ELECTRONEEK

15.2.9 SNORKEL AI

15.2.10 VIANAI

15.2.11 KRYON

15.2.12 ROSSUM

15.2.13 AUTOLOGYX

15.2.14 AUTOMATION EDGE

16 ADJACENT/RELATED MARKET (Page No. - 279)

16.1 INTRODUCTION

16.1.1 LIMITATIONS

16.2 BUSINESS PROCESS AUTOMATION MARKET – GLOBAL FORECAST 2026

16.2.1 MARKET DEFINITION

16.2.2 MARKET OVERVIEW

16.2.2.1 Business process automation market, by component

TABLE 289 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 290 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 291 COMPONENTS: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 292 COMPONENTS: BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

16.2.2.2 Business process automation market, by deployment type

TABLE 293 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 294 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

16.2.2.3 Business process automation market, by organization size

TABLE 295 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 296 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

16.2.2.4 Business process automation market, by vertical

TABLE 297 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 298 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

16.2.2.5 Business process automation market, by region

TABLE 299 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 300 BUSINESS PROCESS AUTOMATION MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

16.3 ARTIFICIAL INTELLIGENCE MARKET — GLOBAL FORECAST 2026

16.3.1 MARKET DEFINITION

16.3.2 MARKET OVERVIEW

16.3.2.1 Artificial Intelligence market, by offering

TABLE 301 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY OFFERING, 2015–2020 (USD BILLION)

TABLE 302 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY OFFERING, 2021–2026 (USD BILLION)

16.3.2.2 Artificial intelligence market, by technology

TABLE 303 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY TECHNOLOGY, 2015–2020 (USD BILLION)

TABLE 304 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD BILLION)

16.3.2.3 Artificial intelligence market, by deployment mode

TABLE 305 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD BILLION)

TABLE 306 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD BILLION)

16.3.2.4 Artificial intelligence market, by organization size

TABLE 307 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD BILLION)

TABLE 308 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

16.3.2.5 Artificial intelligence market, by business function

TABLE 309 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2015–2020 (USD BILLION)

TABLE 310 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD BILLION)

16.3.2.6 Artificial intelligence market, by vertical

TABLE 311 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY VERTICAL, 2015–2020 (USD BILLION)

TABLE 312 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY VERTICAL, 2021–2026 (USD BILLION)

16.3.2.7 Artificial intelligence market, by region

TABLE 313 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 314 ARTIFICIAL INTELLIGENCE MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

16.4 INTELLIGENT DOCUMENT PROCESSING MARKET – GLOBAL FORECAST TO 2026

16.4.1 MARKET DEFINITION

16.4.2 MARKET OVERVIEW

16.4.2.1 Intelligent document processing market, by component

TABLE 315 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 316 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

16.4.2.2 Intelligent document processing market, by organization size

TABLE 317 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 318 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

16.4.2.3 Intelligent document processing market, by deployment type

TABLE 319 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 320 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

16.4.2.4 Intelligent document processing market, by vertical

TABLE 321 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 322 INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

16.4.2.5 Intelligent document processing market, by region

TABLE 323 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 324 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 325 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 326 EUROPE: INTELLIGENT DOCUMENT PROCESSING MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

17 APPENDIX (Page No. - 299)

17.1 DISCUSSION GUIDE

17.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

17.3 AVAILABLE CUSTOMIZATIONS

17.4 RELATED REPORTS

17.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the intelligent process automation market. Exhaustive secondary research was done to collect information on the industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Intelligent Process Automation market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals and various associations have also been referred to for consolidating the report.

Secondary research was mainly used to obtain key information about industry insights, market’s monetary chain, the overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing IPA software, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. After the complete market engineering (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Intelligent Process Automation Market Size Estimation

Multiple approaches were adopted for the estimation and forecasting of the intelligent process automation market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the IPA solutions and services. This entire procedure has studied the annual and financial reports of top market players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives of leading companies, for key insights. All percentage splits and breakups have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets.

Top-down and bottom-up approaches were used to estimate and validate the size of the global intelligent process automation market and various other dependent subsegments. The key players, such as Atos (France), IBM (US), Genpact (US), HCL technologies (India), Pegasystems (US), Blue Prism (England), Capgemini (France), CGI (Canada), NICE (Israel), Cognizant (US), Accenture (Ireland), Infosys (India), TCS (India) Tech Mahindra (India), UIPath (US), Wipro (India), Xerox (US), Happiest Minds (India) Workfusion (US) and AutomatioAnywhere (US), contribute almost 60% to the global intelligent process automation market. The major players in the market were identified through extensive secondary research, and their revenue contribution in the respective regions was determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To determine and forecast the global Intelligent Process Automation market by component, technology, application, business function, deployment mode, organization size, vertical, and region from 2022 to 2027, and analyze various macroeconomic and microeconomic factors that affect the intelligent process automation market growth

- To forecast the size of the market’s segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle east and Africa (MEA), and Latin America.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall digital payment market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the intelligent process automation market

- To profile key market players and provide a comparative analysis based on their business overviews, service offerings, regional presence, business strategies, and key financials

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Intelligent Process Automation Market