Intent-based Networking (IBN) Market by Component (Solution, Services (Professional Services and Managed Services)), Deployment Type (Cloud and On-premises), Vertical (IT & Telecom, BFSI, Healthcare), Organization Size, & Region - Global Forecast to 2027

Intent-based Networking Market Overview

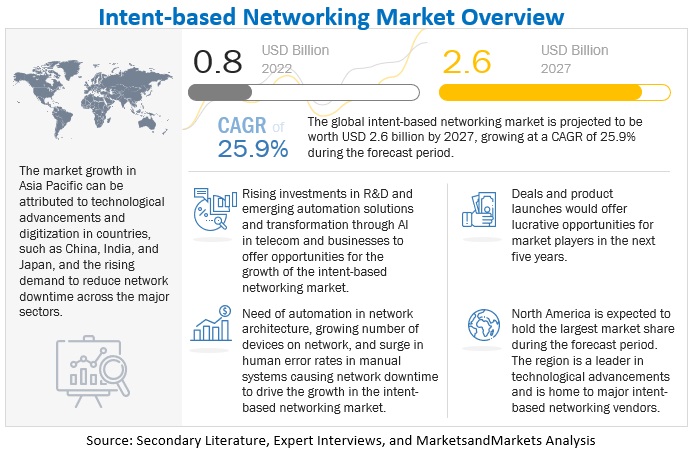

The global Intent-based Networking Market size is projected to reach $2.6 billion by 2027 from $0.8 billion in 2022 at a robust CAGR of 25.9%. The need for automation in network architecture, rising implementation of cloud-based and software-defined networking, growing need for efficient connectivity network to handle increasing traffic, growing number of devices on network, and surge in human error rates in manual systems causing network downtime are all expected to drive the intent-based networking market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Intent-based Networking Market Dynamics:

Driver: Growing number of devices on network

Due to the advances in Internet technology, there is a huge adoption of connected devices, smartphone penetration, and data sharing in the IoT-based connectivity arena. According to the Cisco Annual Internet Report, the number of devices connected to IP networks will be more than three times the global population by 2023 (there will be 29.3 billion networked devices by 2023, up from 18.4 billion in 2018). Also, 5G devices and connections will be over 10% of global mobile devices and connections by 2023. The increased adoption of connected devices is driving the demand for network automation solutions, which help in business process automation and increase productivity. Network automation solutions act on the network locally, automate the configuration of devices, ensure compliance, and leverage analytics for better business insights. These solutions have helped companies track the performance of devices, monitor data, and detect any unauthorized access. Also, automation ensures that the devices are connected and integrated properly into the network to ensure scalability and security.

Restraint: Lack of awareness among network administrators

Network automation solutions, with varied features and functionalities, are being offered by numerous vendors across the globe. Network admins need to understand their requirements to manage the network infrastructure and choose the appropriate solution. In the world of convergence, technology has been changing rapidly in the business system. Most of the network administrators are reluctant to modify the SOPs and are hesitant to automate their networks. Therefore, solution providers need to offer more training and education services to network admins so that they can gain more insights from unstructured network data. Many organizations, especially SMEs, do not have enough skilled workforce to manage the network infrastructure. Hence, the lack of awareness among network admins to distinguish between precise network automation solutions is a challenge for the growth of the intent-based networking market.

Opportunity: Growing adoption of Software-Defined Networking (SDN)

Due to the increased remote working facilities offered by most organizations worldwide, there is an increased need for high bandwidth networks. Thus, the adoption of virtual and software-defined networking has increased across various industry verticals. This growing adoption has direct consequences on intent-based network automation in terms of analyzing and managing the network traffic, network configuration, deployment of policies, and network bandwidth to streamline business continuity. This enhancement in network infrastructure helps in risk minimization and prevention over the network and data centers.

Challenge: Rising threats and vulnerabilities in networking

With the advancements in the communication industry, there is an increment in the adoption of variety and quantity of networking devices. Networking devices are widely used in smart wear, smart homes, smart cars, smart manufacturing, smart medical care, and many other life-related fields. Every internet-connected device, such as smartphones, laptops, and wearables, acts as a node within a global hazard-tracking system. Each networking device could act as a sensor that detects surrounding atmospheric conditions and transmits vital data to natural disaster researchers. With it, vulnerabilities of networking devices are continually emerging. The rise in vulnerabilities will bring severe risks if networking fails. According to the Cost of a Data Breach 2022 Report, Data breach costs surged 13% from 2020 to 2022. Organizations that had a fully deployed automation program such SDN, network automation, and IBN architecture, would face the risk of network vulnerability at minimal impact, compared to non-automated companies.

Based on component, the solution segment to hold a larger market size during the forecast period

Solution segment is expected to hold a larger market size during the forecast period. The intent-based networking market is a solution-driven market. The rising number of connected devices in various verticals is the major factor driving the growth of the solution segment of the intent-based networking market.

Based on service, the managed services segment to grow at a higher CAGR during the forecast period

Managed services are estimated to register a higher growth rate during the forecast period, compared to professional services. Managed services offer IT assistance to improve the client experience. Businesses outsource certain IT functions to third-party providers referred to as managed service providers. These outsourced tasks could be as simple as maintaining the functionality of IT infrastructure and other services by outsourcing the IT team. Businesses find it challenging to manage these services while focusing on their primary business operations. As a result, businesses rely heavily on third parties to provide managed services.

Based on deployment type, the cloud segment to hold a larger market size during the forecast period

The cloud segment is estimated to hold a larger market size during the forecast period. Cloud plays a significant role in the transformation of remote assets from manual to automated network processes. With cloud deployment, dedicated and high-availability setups are created to run instances of IBN solutions. Cloud-based IBN solution providers also take the responsibility of managing the service.

Based on vertical, the healthcare segment to grow at the highest CAGR during the forecast period

IBN has played a major part in the technological revamping of healthcare, whether it is integrating digital technology, advancing procedures, or introducing otherwise unthinkable competence and productivity. In the healthcare industry, cloud and AI offer the required security and are compliant with HIPAA and other government regulations, thus driving the intent-based networking market. In the healthcare industry, the IBN technology can benefit patients by reducing time in the identification of diseases, delivering superior patient care, quick fault detection, and reduction in risks without network connection failure.

To know about the assumptions considered for the study, download the pdf brochure

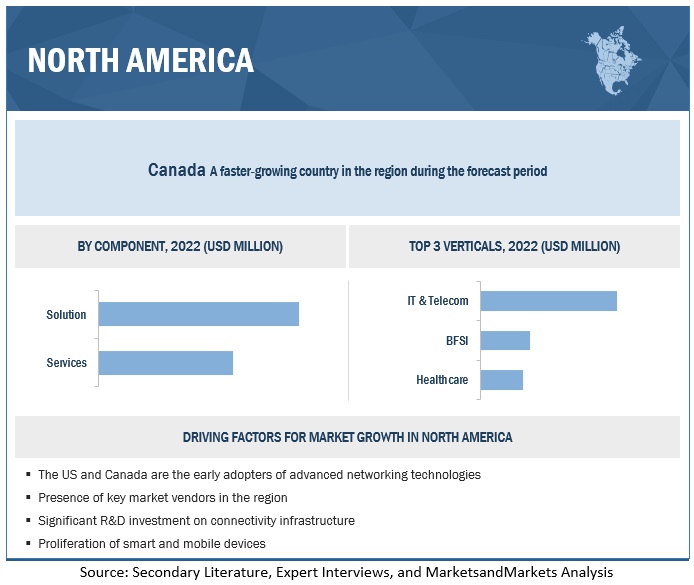

Based on region, North America to account for the largest market size during the forecast period

The intent-based networking market in North America is expected to provide maximum revenue opportunities to vendors, as it is likely to benefit from its technological advancements and its position as a developed region. North America has witnessed significant growth in the market as most IBN solution and service providers belong to North America. Government initiatives for the implementation of advanced networking technologies such as 5G, cloud, and IoT technology in intent-based networking are expected to drive the market in the region.

Key Market Players

Key and emerging intent-based networking market players include Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), Wipro (India), Gluware (US), Forward Networks (US), NetBrain Technologies (US), Frinx (Slovakia), and Indeni (US). These players have adopted various strategies to grow in the intent-based networking market. The companies are focused on inorganic and organic growth strategies to strengthen their market position.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Component (Solution and Services), Deployment type (Cloud and On-premises), Organization Size (Small and Medium-sized Enterprises [SMEs] and Large Enterprises), Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & Consumer Goods, and Other Verticals), and Region |

|

Geographies covered |

North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America |

|

Companies covered |

Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), Wipro (India), Gluware (US), Forward Networks (US), NetBrain Technologies (US), Frinx (Slovakia), and Indeni (US) |

Intent-based Networking (IBN) Market Highlights

This research report categorizes the Intent-based Networking (IBN) Market to forecast revenues and analyze trends in each of the following submarkets:

|

Segment |

Subsegment |

|

By Offering |

|

|

By Deployment Type |

|

|

By Organization Size |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments

- In January 2023, Indeni launched Indeni 8.0, which comes with new Zscaler App Connector support and network security automation. It also has new auto-detect elements for checkpoint Maestro and Cisco ASA.

- In January 2023, HPE acquired Pachyderm and integrated Pachyderm’s software with its existing supercomputing and AI solutions to automate reproducible machine learning pipelines for large scale AI applications.

- In December 2022, Cisco released the latest version i.e., 2.3.5.0 of DNA Centre.

- In September 2022, Wipro partnered with Cisco to accelerate cloud transformation for customers and enabled to deploy Wipro FullStride Cloud Service to enable a fully automated hybrid-cloud stack, reducing the implementation time and enhancing the user experience.

- In July 2022, Forward Networks partnered with Arista CloudVision to automate network and security verification.

Frequently Asked Questions (FAQ):

How big is the Intent-based Networking Market?

The Intent-based Networking Market size was valued $0.8 billion in 2022 and is projected to reach USD 2.6 billion by 2027.

Which region has the largest market share in the intent-based networking market?

North America is estimated to hold the largest market share in intent-based networking in 2022.

Which industry vertical is expected to hold a larger market size during the forecast period?

Among verticals, IT & telecom segment is expected to hold a larger market size during 2022–2027.

Which deployment type is expected to hold the largest market size during the forecast period?

Between cloud and on-premises deployment type, the cloud segment is estimated to hold a larger market size during 2022–2027.

Which are the major compnies in the Intent-based Networking Market?

Major compnies in the intent-based networking market are Cisco (US), Juniper Networks (US), IBM (US), Huawei (China), HPE (US), Nokia (Finland), and Wipro (India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Need of automation in network architecture- Rising implementation of cloud-based and software-defined networking- Growing need for efficient connectivity network to handle increasing traffic- Growing number of devices on network- Surge in human error rates in manual systems causing network downtimeRESTRAINTS- Lack of awareness among network administrators- Availability of open-source automation toolsOPPORTUNITIES- Growing adoption of software-defined networking- Transformation through AI in telecom and businesses- Rising investments in R&D and emerging automation solutions- Increasing number of startups offering network automation solutionsCHALLENGES- Rising threats and vulnerabilities in networking- Increasing complexities in network operation- Rising security issues

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEM ANALYSISDISRUPTIONS IMPACTING BUYERS/CLIENTS IN INTENT-BASED NETWORKING MARKETCASE STUDY ANALYSIS- Case study 1: Yahoo! Japan simplified data center operations- Case study 2: Vodafone Turkey modernized and automated its multivendor data centers- Case study 3: Gluware implemented automation in Merck network- Case study 4: MasterCard network automated security and agility- Case study 5: Xelya modernized its on-premises architecture- Case study 6: Transformation and automation of network segmentation through Cisco DNA and Cisco SD-AccessPRICING ANALYSIS- Average selling price of key players- Average selling price trendPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Artificial intelligence/Machine learning- 5G network and Wi-Fi 6- Cloud computing- SD-WANPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East & Africa- Latin AmericaKEY CONFERENCES AND EVENTS IN 2022–2023

-

6.1 INTRODUCTIONCOMPONENT: INTENT-BASED NETWORKING MARKET DRIVERS

-

6.2 SOLUTIONGUI-BASED AUTOMATION OF CONFIGURATION IN NETWORKING

-

6.3 SERVICESSERVICES ARE BACKBONE FOR MOST NETWORKING SOLUTIONSPROFESSIONAL SERVICES- Need to provide specialized, knowledge-based servicesMANAGED SERVICES- Services to fulfill pre- and post-deployment needs

- 7.1 INTRODUCTION

-

7.2 ON-PREMISESADVANCEMENT IN IT INFRASTRUCTURE TO DRIVE GROWTH OF ON-PREMISES-BASED SOLUTIONSON-PREMISES: INTENT-BASED NETWORKING MARKET DRIVERS

-

7.3 CLOUDCREASED SCALABILITY AND FLEXIBILITY TO MONITOR NETWORK PERFORMANCE REMOTELY TO DRIVE ADOPTION OF CLOUD-BASED SOLUTIONSCLOUD: MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 LARGE ENTERPRISESGROWING NEED TO MANAGE COMPLEX NETWORK INFRASTRUCTURESLARGE ENTERPRISES: MARKET DRIVERS

-

8.3 SMALL AND MEDIUM-SIZED ENTERPRISESNEED TO MANAGE NETWORK INFRASTRUCTURE TO ENHANCE PRODUCTIVITY AND REDUCE IT OPERATIONAL COSTSSMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

-

9.1 INTRODUCTIONVERTICAL: INTENT-BASED NETWORKING MARKET DRIVERS

-

9.2 IT & TELECOMINTENT-BASED CAPABILITIES MAKE IT ECOSYSTEMS MORE RELIABLE

-

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCENEW GENERATION NETWORKS TO IMPROVE DIGITAL BUSINESS RESILIENCY

-

9.4 HEALTHCAREINTENT-BASED NETWORKING TO DELIVER ACCURATE AND LOGICAL DIAGNOSIS

-

9.5 MANUFACTURINGINTENT-BASED NETWORKING SOLUTIONS REDUCE OPEX AND INCREASE BANDWIDTH

-

9.6 RETAIL & CONSUMER GOODSIBN HELPS RETAIL INDUSTRY IN REDUCING EMPLOYEES’ WORKLOAD THROUGH AUTOMATION

- 9.7 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: PESTLE ANALYSISUS- Government’s continuous initiatives toward technology-infused infrastructure developmentCANADA- Need to automate network complexity due to increasing addition of devices on network

-

10.3 EUROPEEUROPE: INTENT-BASED NETWORKING MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: PESTLE ANALYSISUK- Government regulatory initiatives for telecom vendorsGERMANY- Strong growth in connectivity domainFRANCE- French policy on strong IT and telecommunicationREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: INTENT-BASED NETWORKING MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: PESTLE ANALYSISCHINA- Shift toward cloud and AI technologiesJAPAN- Government initiatives for telecom regulatory adherenceINDIA- Regulatory and policy trends in digital transformationREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: INTENT-BASED NETWORKING MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: PESTLE ANALYSISUAE- Rapid growth and digital transformationKINGDOM OF SAUDI ARABIA- Increase in smartphones and internet penetrationSOUTH AFRICA- Africa to promote smart and sustainable logisticsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: INTENT-BASED NETWORKING MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: PESTLE ANALYSISBRAZIL- Government initiatives and increasing demand in network securityMEXICO- Rising internet usageREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHESDEALS

- 11.4 HISTORICAL REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANT: METHODOLOGY AND DEFINITIONSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 11.7 MARKET SHARE ANALYSIS, 2022

- 11.8 COMPANY MARKET RANKING ANALYSIS, 2022

-

12.1 CISCOBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.2 JUNIPER NETWORKSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.3 IBMBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.4 HUAWEIBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.5 HPEBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.6 NOKIABUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.7 WIPROBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.8 GLUWAREBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.9 FORWARD NETWORKSBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.10 NETBRAIN TECHNOLOGIESBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.11 FRINXBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

12.12 INDENIBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Key strengths- Strategic choices- Weaknesses and competitive threats

-

13.1 INTRODUCTIONLIMITATIONS

-

13.2 SELF-HEALING NETWORKS MARKET– GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Self-healing networks market, by component- Self-healing networks market, by professional services- Self-healing networks market, by network type- Self-healing networks market, by application

-

13.3 NETWORK AUTOMATION MARKET–GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEW- Network automation market, by component- Network automation market, by network type- Network automation market, by end user

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 INTENT-BASED NETWORKING MARKET: ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF KEY PLAYERS

- TABLE 5 MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

- TABLE 6 PATENTS FILED, 2020–2022

- TABLE 7 LIST OF PATENTS IN MARKET, 2020–2022

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INTENT-BASED NETWORKING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 16 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 17 INTENT-BASED NETWORKING SOLUTION MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 18 INTENT-BASED NETWORKING SOLUTION MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 20 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 21 INTENT-BASED NETWORKING SERVICES MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 22 INTENT-BASED NETWORKING SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 MANAGED SERVICES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 28 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 29 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 30 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 34 INTENT-BASED NETWORKING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 35 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 40 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 41 IT & TELECOM: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 42 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 HEALTHCARE: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 MANUFACTURING: INTENT-BASED NETWORKING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 RETAIL & CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 54 MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 67 US: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 68 US: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 69 US: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 70 US: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 71 US: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 72 US: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 73 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 74 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 75 US: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 76 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 77 CANADA: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 78 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 79 CANADA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 80 CANADA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 81 CANADA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 82 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 83 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 84 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 85 CANADA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 86 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 87 EUROPE: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 88 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 89 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 90 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 91 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 92 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 93 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 99 UK: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 100 UK: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 101 UK: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 102 UK: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 103 UK: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 104 UK: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 105 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 106 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 107 UK: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 108 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 121 CHINA: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 122 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 123 CHINA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 124 CHINA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 125 CHINA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 126 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 127 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 128 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 129 CHINA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 130 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: INTENT-BASED NETWORKING MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 144 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

- TABLE 149 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

- TABLE 150 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 151 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

- TABLE 152 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 153 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 155 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MARKET

- TABLE 156 MARKET: PRODUCT LAUNCHES, MARCH 2022–JANUARY 2023

- TABLE 157 INTENT-BASED NETWORKING MARKET: DEALS, SEPTEMBER 2021–JANUARY 2023

- TABLE 158 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 159 COMPANY PRODUCT FOOTPRINT

- TABLE 160 COMPANY VERTICAL FOOTPRINT

- TABLE 161 COMPANY COMPONENT FOOTPRINT

- TABLE 162 COMPANY REGIONAL FOOTPRINT

- TABLE 163 MARKET: DEGREE OF COMPETITION

- TABLE 164 CISCO: COMPANY OVERVIEW

- TABLE 165 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 CISCO: PRODUCT LAUNCHES

- TABLE 167 CISCO: DEALS

- TABLE 168 JUNIPER NETWORKS: COMPANY OVERVIEW

- TABLE 169 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 JUNIPER NETWORKS: PRODUCT LAUNCHES

- TABLE 171 JUNIPER NETWORKS: DEALS

- TABLE 172 IBM: COMPANY OVERVIEW

- TABLE 173 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 IBM: PRODUCT LAUNCHES

- TABLE 175 IBM: DEALS

- TABLE 176 HUAWEI: COMPANY OVERVIEW

- TABLE 177 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HPE: COMPANY OVERVIEW

- TABLE 179 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 HPE: PRODUCT LAUNCHES

- TABLE 181 HPE: DEALS

- TABLE 182 NOKIA: COMPANY OVERVIEW

- TABLE 183 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 NOKIA: PRODUCT LAUNCHES

- TABLE 185 NOKIA: DEALS

- TABLE 186 WIPRO: COMPANY OVERVIEW

- TABLE 187 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 WIPRO: PRODUCT LAUNCHES

- TABLE 189 WIPRO: DEALS

- TABLE 190 GLUWARE: COMPANY OVERVIEW

- TABLE 191 GLUWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 GLUWARE: PRODUCT LAUNCHES

- TABLE 193 GLUWARE: DEALS

- TABLE 194 FORWARD NETWORKS: COMPANY OVERVIEW

- TABLE 195 FORWARD NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 FORWARD NETWORKS: DEALS

- TABLE 197 NETBRAIN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 198 NETBRAIN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 NETBRAIN TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 200 FRINX: COMPANY OVERVIEW

- TABLE 201 FRINX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 FRINX: DEALS

- TABLE 203 INDENI: COMPANY OVERVIEW

- TABLE 204 INDENI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 INDENI: PRODUCT LAUNCHES

- TABLE 206 INDENI: DEALS

- TABLE 207 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2019–2021 (USD MILLION)

- TABLE 208 SELF-HEALING NETWORKS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 209 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2019–2021 (USD MILLION)

- TABLE 210 SELF-HEALING NETWORKS MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 211 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2019–2021 (USD MILLION)

- TABLE 212 SELF-HEALING NETWORKS MARKET, BY NETWORK TYPE, 2022–2027 (USD MILLION)

- TABLE 213 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 214 SELF-HEALING NETWORKS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 215 NETWORK AUTOMATION MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

- TABLE 216 NETWORK AUTOMATION MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

- TABLE 217 NETWORK AUTOMATION MARKET SIZE, BY NETWORK TYPE, 2014–2019 (USD MILLION)

- TABLE 218 NETWORK AUTOMATION MARKET SIZE, BY NETWORK TYPE, 2020–2025 (USD MILLION)

- TABLE 219 NETWORK AUTOMATION MARKET SIZE, BY END USER, 2014–2019 (USD MILLION)

- TABLE 220 NETWORK AUTOMATION MARKET SIZE, BY END USER, 2020–2025 (USD MILLION)

- FIGURE 1 INTENT-BASED NETWORKING: MARKET SEGMENTATION

- FIGURE 2 MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 INTENT-BASED NETWORKING MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE OF SOLUTION/SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTION/SERVICES

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MARKET, 2020–2027

- FIGURE 11 KEY MARKET GROWTH SEGMENTS, 2022

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 13 RISING INVESTMENTS IN R&D TO PROVIDE GROWTH OPPORTUNITIES FOR MARKET DURING FORECAST PERIOD

- FIGURE 14 SOLUTION SEGMENT AND US TO LEAD INTENT-BASED NETWORKING MARKET IN 2022

- FIGURE 15 SOLUTION SEGMENT AND CHINA TO LEAD MARKET IN 2022

- FIGURE 16 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARKET

- FIGURE 18 INCREASED GLOBAL INTERNET USERS, 2016–2021

- FIGURE 19 INCREASED AVERAGE SPEED OF INTERNET GLOBALLY, 2016–2021

- FIGURE 20 GLOBAL AVERAGE TRAFFIC INCREASE PER CAPITA PER MONTH, 2016–2021

- FIGURE 21 GLOBAL DEVICES AND CONNECTIONS PER CAPITA INCREASE

- FIGURE 22 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 INTENT-BASED NETWORKING MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 24 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2022

- FIGURE 25 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 MANAGED SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 NORTH AMERICA TO LEAD MARKET IN 2027

- FIGURE 34 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING 2022–2027

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 38 INTENT-BASED NETWORKING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 39 RANKING OF KEY PLAYERS IN MARKET, 2022

- FIGURE 40 CISCO: COMPANY SNAPSHOT

- FIGURE 41 JUNIPER NETWORKS: COMPANY SNAPSHOT

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 HUAWEI: COMPANY SNAPSHOT

- FIGURE 44 HPE: COMPANY SNAPSHOT

- FIGURE 45 NOKIA: COMPANY SNAPSHOT

- FIGURE 46 WIPRO: COMPANY SNAPSHOT

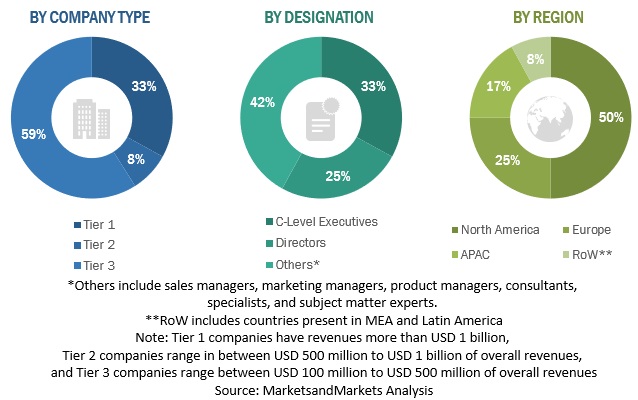

The study involved four major activities in estimating the current size of the Intent-based Networking (IBN) market. An extensive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of segments and subsegments of the intent-based networking market.

Secondary Research

In the secondary research process, various secondary sources, including D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, for identifying and collecting information for this study. These secondary sources included annual reports; press releases and investor presentations of companies; whitepapers, articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; and regulatory bodies. The data was also collected from secondary sources, such as such as Open Network Infrastructure Association (Switzerland), The Wireless Infrastructure Association (US), the Research & Educational Networking Association of Moldova, the Network Professional Association (NPA) (US), and the Open Networking Foundation (ONF) (US).

Primary Research

Various primary sources from both the supply and demand sides of the intent-based networking market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing intent-based networking in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The following is the breakup of the primary respondents’ profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make market estimations and forecast the intent-based networking market and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall size of the global intent-based networking market using the revenues and offerings of the key companies in the market. The research methodology used to estimate the market size included the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

ong>Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To determine, segment, and forecast the global intent-based networking market by component, deployment type, organization size, vertical, and region in terms of value

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the intent-based networking market

- To study the complete value chain and related industry segments and perform a value chain analysis of the intent-based networking market landscape

- To analyze the industry trends, pricing data, patents, and innovations related to the intent-based networking market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the intent-based networking market

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & enhancements, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific requirements. The following customization options are available for the report:

Product Analysis

- Product matrix provides detailed product information and comparisons

Geographic Analysis

- Further breakdown of India intent-based networking market

- Further breakdown of KSA intent-based networking market

- Further breakdown of Mexico intent-based networking market

- Further breakdown of Germany intent-based networking market

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Intent-based Networking (IBN) Market