IoT in Banking and Financial Services Market by Solution (Security, Monitoring, Customer Experience Management), Service, End-User (Banking, Insurance, and Investment and Wealth Management), Organization Size, and Region - Global Forecast to 2023

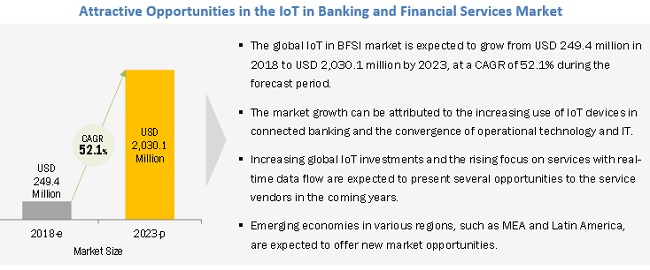

[119 Pages Report] The global IoT in BFSI market is expected to grow from USD 249.4 million in 2018 to USD 2,030 million by 2023, at a CAGR of 52.1% during the forecast period.

In today’s connected world, IoT has emerged as the most ubiquitous and advanced technological innovation of the century. According to a report published by Cisco, there will be 50 billion connected devices by 2020. With this progression in digitally connected devices, industrial sectors such as manufacturing, telecom, IT, energy and utility, healthcare, logistics, BFSI, media and entertainment, aerospace and defense, and government are expected to witness an upsurge in digital services. Within the BFSI sector, IoT is expected to have an enormous impact on all aspects, right from banking and insurance to financial planning and health and fitness. IoT enables financial institutions to track customers’ activities, life events, and needs with the help of the data generated by sensors. Moreover, IoT enables financial organizations to deliver usage-based differentiated offerings, such as Usage-Based Insurance (UBI), and influence the financial decision-making of individuals.

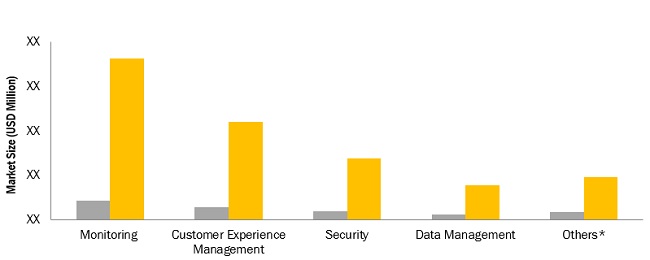

The monitoring solution has effectively reduced the error resolution time by providing accurate information of a failure’s occurrence to the financial institutions, thereby boosting the overall growth of the IoT in BFSI market.

By service, the professional services segment is expected to have the largest market size during the forecast period. It’s growth rate can be attributed to the increase in the complexity of operations and the growing adoption of IoT solutions among enterprises.

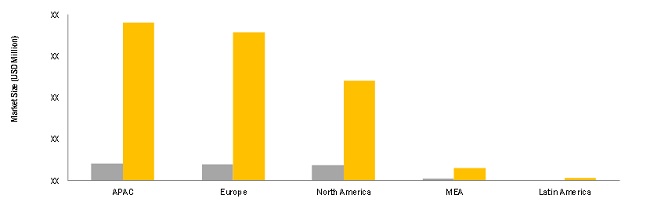

APAC is one of the early adopters of IoT technologies and hence is expected to hold the largest market share of the IoT in BFSI market and grow at the highest CAGR during during the forecast period.

Market Dynamics

Driver: Increasing use of IoT devices for connected banking

With the help of IoT devices, banks can provide holistic and connected banking solutions for customer finances in real-time. These IoT-enabled connected banking solutions help banks fulfill the needs of customers with the help of the data collected from various smart devices to facilitate smart financial decisions. The available customer data also helps banks provide value-added services, financial assistance, and customized products to individual customers. Moreover, it helps banks lower the cost of operations, due to the increased user and IT productivity and the reduced technology costs. For instance, a multinational UK bank implemented Capgemini’s Connected Banking solution to decommission its legacy core banking system, reduce operational costs, and gain the agility required to deliver next-generation innovative and customer-centric banking services.

Restraint: Lack of standards for interconnectivity and interoperability

The connectivity issue between IoT devices and products is one of the biggest restraining factors for all industries and their clients, as enterprises’ current systems do not meet the global connectivity standards. Interoperability is often articulated as being central to the growth and success of the products and services that leverage the IoT technology. Another important aspect of IoT enablement is the seamless interoperability between connections, wherein vendors share an interest in using standards that promote IoT development and interoperability. Financial industries seek the competitive and economic advantages of building exclusive IoT systems based on proprietary standards and protocols. Communication protocols and standards can be leveraged to ensure interoperability across heterogeneous hardware and software systems and platforms.

Opportunity: Increasing focus on services with real-time data flow

Nowadays, data is constantly collected by smartphones, smartwatches, sports trackers, smart devices, and even smart houses. All these connected devices generate a constant flow of data that needs to be stored, processed, and analyzed to bring value. Moreover, this data can be used further for near real-time data processing and enables organizations to scale up their productivity and enhance business operations. It would also enable service providers to use the generated data for research, marketing campaign effectiveness analysis, and additional proactive solutions. In the BFSI vertical, real-time data flow can be used for risk management, fraud detection, application monitoring, and transaction cost analysis. Furthermore, real-time data processing would prevent finance-related issues such as risky trades and stock exchange meltdowns.

Challenge: Data migration challenges

Data migration is a key component to consider while adopting any new system, either via integration with a new system or a new deployment. Migrating data from legacy systems to new systems, and the resources consumed in the migration process increase the operational costs for organizations. Moreover, data migration causes serious issues if the system design and process collaboration are not carried out properly, business rules are interpreted incorrectly, or data standardization is not followed. Additionally, it is difficult to transfer unstructured data, as it has to be cleaned and reviewed before processing. Furthermore, the main issues during data migration are the completion of the implementation process within the specified deadline and the elimination of risks associated with it, as most data migration projects suffer from implementation delays. As maintaining the data quality is also an important factor in data migration, a lot of planning is required before commencing the data migration process.

Scope of the IoT in BFSI Market Report

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD Million |

|

Segments covered |

Component, Solution, Service, End User, Organization Size, and Region |

|

Geographies covered |

North America, Europe, MEA, APAC and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Capgemini (France), Cisco (US), SAP (Germany), Oracle (US), Accenture (Ireland), Infosys (India), Software AG (Germany), and Vodafone (UK) |

The research report segments the IoT in Banking and Financial Services market into the following submarkets:

IT BFSI Market By Component

- Solutions

- Services

By Solution

- Security

- Customer Experience Management

- Monitoring

- Data Management

- Others

By Service

- Professional Services

- Integration and Deployment

- Support and Maintenance

- Business Consulting

- Managed Services

By End-User

- Banking

- Insurance

- Others

By Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Note: Other solutions include risk and compliance, account management, analytics, asset management, and network management

Note: Others in end-users include capital market, investment and wealth management, and commercial real estate

Key Market Players

IBM (US), Microsoft (US), SAP (Germany), Oracle (US), Infosys (India)

Recent Developments

- In April 2018, Microsoft partnered with C3 IoT to deliver new technology developments and go-to-market initiatives that accelerate enterprise AI and IoT application development. This partnership would enable banking and financial organizations to rapidly develop and deploy AI-based applications for transformative use cases, such as AI predictive maintenance, fraud detection, investment planning, and customer engagement.

- In March 2018, Capgemini partnered with Indosuez Wealth Management, the global wealth management brand of the Crédit Agricole Group, to develop a unique technology and banking operations platform. This partnership enabled Capgemini to provide IT and digital transformation services to further develop, and expand Crédit Agricole-Private Banking Services’ (CA-PBS’) portfolio.

- In February 2018, SAP partnered with Banco Atlántida to provide a digitalized banking model for greater analytics insights. With this partnership, Banco Atlántida implemented the SAP Performance Management for Financial Services application to obtain greater analytics insights into key performance indicators, such as branch-level profitability.

- In January 2018, Cisco signed an agreement with the government of Luxembourg to speed up digitalization in the Grand Duchy of Luxembourg. This partnership would enable Cisco to provide highly secure systems that enable financial service providers to reduce the risk of cyber-attacks and improve customer experience.

- In November 2017, IBM acquired Vivant Digital Business, a boutique digital and innovation agency based in Australia. This acquisition helped IBM deliver digital reinvention and experience design to consumers in the financial and distribution sectors, by creating an exceptional customer experience through an innovative approach that combines insights from behavioral science, data, and technology.

Critical questions the report answers:

- Which segment in the market provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the IoT in Banking and Financial Services Market

4.2 Market Top 3 Services and Regions

4.3 Market By Component, 2018–2023

4.4 Market By Organization Size, 2018 vs 2023

4.5 Market By Region, 2018–2023

4.6 Market Investment Scenario

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of IoT Devices for Connected Banking

5.2.1.2 Convergence of Operational Technology and Information Technology

5.2.2 Restraints

5.2.2.1 Data Protection and Privacy Concerns

5.2.2.2 Lack of Standards for Interconnectivity and Interoperability

5.2.3 Opportunities

5.2.3.1 Increasing Global Investments in IoT

5.2.3.2 Increasing Focus on Services With Real-Time Data Flow

5.2.4 Challenges

5.2.4.1 Legacy Systems and Processes

5.2.4.2 Data Migration Challenges

6 IoT in Banking and Financial Services Market, By Component (Page No. - 36)

6.1 Introduction

6.2 Solutions

6.3 Services

7 Market By Solution (Page No. - 40)

7.1 Introduction

7.2 Security

7.3 Customer Experience Management

7.4 Monitoring

7.5 Data Management

7.6 Others

8 Market By Service (Page No. - 47)

8.1 Introduction

8.2 Professional Services

8.2.1 Integration and Deployment

8.2.2 Support and Maintenance

8.2.3 Business Consulting

8.3 Managed Services

9 Market, By End-User (Page No. - 53)

9.1 Introduction

9.2 Banking

9.3 Insurance

9.4 Others

10 Market By Organization Size (Page No. - 58)

10.1 Introduction

10.2 Large Enterprises

10.3 Small and Medium-Sized Enterprises

11 IoT in Banking and Financial Services Market, By Region (Page No. - 62)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 85)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Scenario

12.3.1 New Product Launches and Product Upgradations

12.3.2 Partnerships, Collaborations, and Agreements

12.3.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 90)

(Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis and MnM View)*

13.1 IBM

13.2 Microsoft

13.3 Capgemini

13.4 Cisco

13.5 SAP

13.6 Accenture

13.7 Oracle

13.8 Infosys

13.9 Software AG

13.10 Vodafone

13.11 Key Innovators

13.11.1 Mulesoft

13.11.2 Carriots

13.11.3 Ewave Mobile

13.11.4 Allerin Technologies

13.11.5 Tibbo Systems

13.11.6 Mindbowser

13.11.7 Suntec

13.11.8 Ranosys Technologies

13.11.9 Zerone Consulting

13.11.10 Paragyte Technologies

13.11.11 Hitachi Vantara

13.11.12 Concirrus

13.11.13 Gizmosupport

13.11.14 Cabot Technology

13.11.15 Colan Infotech

*Details on Business Overview, Products and Solutions Offered, Recent Developments, SWOT Analysis and MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 136)

14.1 Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: MarketsandMarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (64 Tables)

Table 1 IoT in Banking and Financial Services Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size By Component, 2016–2023 (USD Million)

Table 3 Solutions: Market Size By Region, 2016–2023 (USD Million)

Table 4 Services: Market Size By Region, 2016–2023 (USD Thousand)

Table 5 Market Size By Solution, 2016–2023 (USD Million)

Table 6 Security: Market Size By Region, 2016–2023 (USD Thousand)

Table 7 Customer Experience Management: Market Size By Region, 2016–2023 (USD Thousand)

Table 8 Monitoring: Market Size By Region, 2016–2023 (USD Thousand)

Table 9 Data Management: Market Size By Region, 2016–2023 (USD Million)

Table 10 Others: Market Size By Region, 2016–2023 (USD Thousand)

Table 11 Market Size By Service, 2016–2023 (USD Million)

Table 12 Professional Services: Market Size By Type, 2016–2023 (USD Million)

Table 13 Integration and Deployment: Market Size By Region, 2016–2023 (USD Thousand)

Table 14 Support and Maintenance: Market Size By Region, 2016–2023 (USD Thousand)

Table 15 Business Consulting: Market Size By Region, 2016–2023 (USD Thousand)

Table 16 Managed Services: Market Size By Region, 2016–2023 (USD Thousand)

Table 17 Market Size By End-User, 2016–2023 (USD Million)

Table 18 Banking: Market Size By Region, 2016–2023 (USD Thousand)

Table 19 Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 20 Others: Market Size By Region, 2016–2023 (USD Thousand)

Table 21 IoT in Banking and Financial Services Market Size, By Organization Size, 2016–2023 (USD Million)

Table 22 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 23 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Thousand)

Table 24 Market Size By Region, 2016–2023 (USD Million)

Table 25 North America: Market Size By Component, 2016–2023 (USD Million)

Table 26 North America: Market Size By Solution, 2016–2023 (USD Million)

Table 27 North America: Market Size By Service, 2016–2023 (USD Million)

Table 28 North America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 29 North America: Market Size By End-User, 2016–2023 (USD Million)

Table 30 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 31 North America: Market Size By Country, 2016–2023 (USD Million)

Table 32 United States: Market Size By Component, 2016–2023 (USD Million)

Table 33 Europe: IoT in Banking and Financial Services Market Size, By Component, 2016–2023 (USD Million)

Table 34 Europe: Market Size By Solution, 2016–2023 (USD Million)

Table 35 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 36 Europe: Market Size By Professional Service, 2016–2023 (USD Million)

Table 37 Europe: Market Size By End-User, 2016–2023 (USD Million)

Table 38 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 39 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 40 Asia Pacific: IoT in Banking and Financial Services Market Size, By Component, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size By Solution, 2016–2023 (USD Thousand)

Table 42 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market Size By Professional Service, 2016–2023 (USD Million)

Table 44 Asia Pacific: Market Size By End-User, 2016–2023 (USD Million)

Table 45 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 46 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 47 Middle East and Africa: IoT in Banking and Financial Services Market Size, By Component, 2016–2023 (USD Million)

Table 48 Middle East and Africa: Market Size By Solution, 2016–2023 (USD Thousand)

Table 49 Middle East and Africa: Market Size By Service, 2016–2023 (USD Thousand)

Table 50 Middle East and Africa: Market Size By Professional Service, 2016–2023 (USD Thousand)

Table 51 Middle East and Africa: Market Size By End-User, 2016–2023 (USD Thousand)

Table 52 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 53 Middle East and Africa: Market Size By Country, 2016–2023 (USD Thousand)

Table 54 Latin America: IoT in Banking and Financial Services Market Size, By Component, 2016–2023 (USD Thousand)

Table 55 Latin America: Market Size By Solution, 2016–2023 (USD Thousand)

Table 56 Latin America: Market Size By Service, 2016–2023 (USD Thousand)

Table 57 Latin America: Market Size By Professional Service, 2016–2023 (USD Thousand)

Table 58 Latin America: Market Size By End-User, 2016–2023 (USD Thousand)

Table 59 Latin America: Market Size By Organization Size, 2016–2023 (USD Thousand)

Table 60 Latin America: Market Size By Country, 2016–2023 (USD Thousand)

Table 61 Market Ranking for the Market 2018

Table 62 New Product Launches and Product Upgradations, 2016–2018

Table 63 Partnerships, Collaborations, and Agreements, 2014–2018

Table 64 Mergers and Acquisitions, 2016–2018

List of Figures (52 Figures)

Figure 1 IoT in Banking and Financial Services Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Assumptions

Figure 8 Market By Region, 2018–2023

Figure 9 Market Top 4 Segments, 2018

Figure 10 Increasing Use of IoT Devices for Connected Banking, and the Convergence of Operational Technology and Information Technology are Expected to Drive the Market Growth

Figure 11 Integration and Deployment Services Segment, and Asia Pacific are Estimated to Have the Largest Market Shares in 2018

Figure 12 Services Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 13 Large Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 14 Asia Pacific is Expected to Hold the Largest Market Size During the Forecast Period

Figure 15 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 16 IoT in Banking and Financial Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Services Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 18 Europe is Expected to Have the Largest Market Size During the Forecast Period

Figure 19 Asia Pacific is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 Monitoring Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 Europe is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Europe is Expected to Have the Largest Market Size During the Forecast Period

Figure 23 Professional Services Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 24 Integration and Deployment Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 25 Europe is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Insurance Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 27 Europe is Expected to Have the Second Highest CAGR During the Forecast Period

Figure 28 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Europe is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 31 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 32 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 33 Asia Pacific is Expected to Be an Attractive Destination for Investments

Figure 34 North America: Market Snapshot

Figure 35 Solutions Segment is Expected to Dominate the IoT in Banking and Financial Services Market in North America During the Forecast Period

Figure 36 Services Segment is Expected to Dominate the Market in Europe During the Forecast Period

Figure 37 Asia Pacific: Market Snapshot

Figure 38 Services Segment is Expected to Dominate the Market in Asia Pacific During the Forecast Period

Figure 39 Solutions Segment is Expected to Dominate the Market in Middle East and Africa During the Forecast Period

Figure 40 Solutions Segment is Expected to Dominate the Market in Latin America During the Forecast Period

Figure 41 Key Developments By the Leading Players in the Market During 2015–2018

Figure 42 IBM: Company Snapshot

Figure 43 Microsoft: Company Snapshot

Figure 44 Capgemini: Company Snapshot

Figure 45 Cisco: Company Snapshot

Figure 46 SAP: Company Snapshot

Figure 47 Accenture: Company Snapshot

Figure 48 Oracle: Company Snapshot

Figure 49 Infosys: Company Snapshot

Figure 50 Software AG: Company Snapshot

Figure 51 Vodafone: Company Snapshot

Figure 52 Mulesoft: Company Snapshot

Growth opportunities and latent adjacency in IoT in Banking and Financial Services Market