IV Equipment Market Size, Growth, Share & Trends Analysis

IV Equipment Market by Type (IV Catheter, IV Administration Set, Needle-free Connectors), Application (Medication Administration, Parenteral Nutrition, Diagnostic Testing, Blood & Blood Product Transfusion), End User (Hospital) - Global Forecast to 2031

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

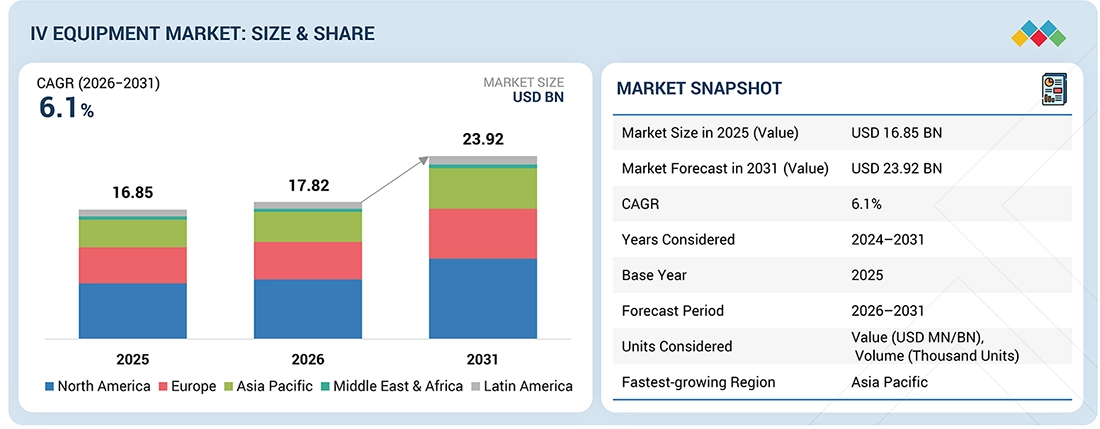

The IV Equipment market, valued at USD 16.85 billion in 2025, stood at USD 17.82 billion in 2026 and is projected to advance at a resilient CAGR of 6.1% from 2026 to 2031, culminating in a forecasted valuation of USD 23.92 billion by the end of the period. The IV equipment market is expected to grow significantly, driven by increasing cases of chronic diseases, rising hospitalizations, and an aging population. The demand for safe and reliable devices is driven by the growing use of IV therapy across hospitals, clinics, and home care settings. The introduction of needle-free connectors and smart infusion systems, together with advancements in the healthcare infrastructure in developing countries, is contributing to the enhanced growth of the market.

KEY TAKEAWAYS

-

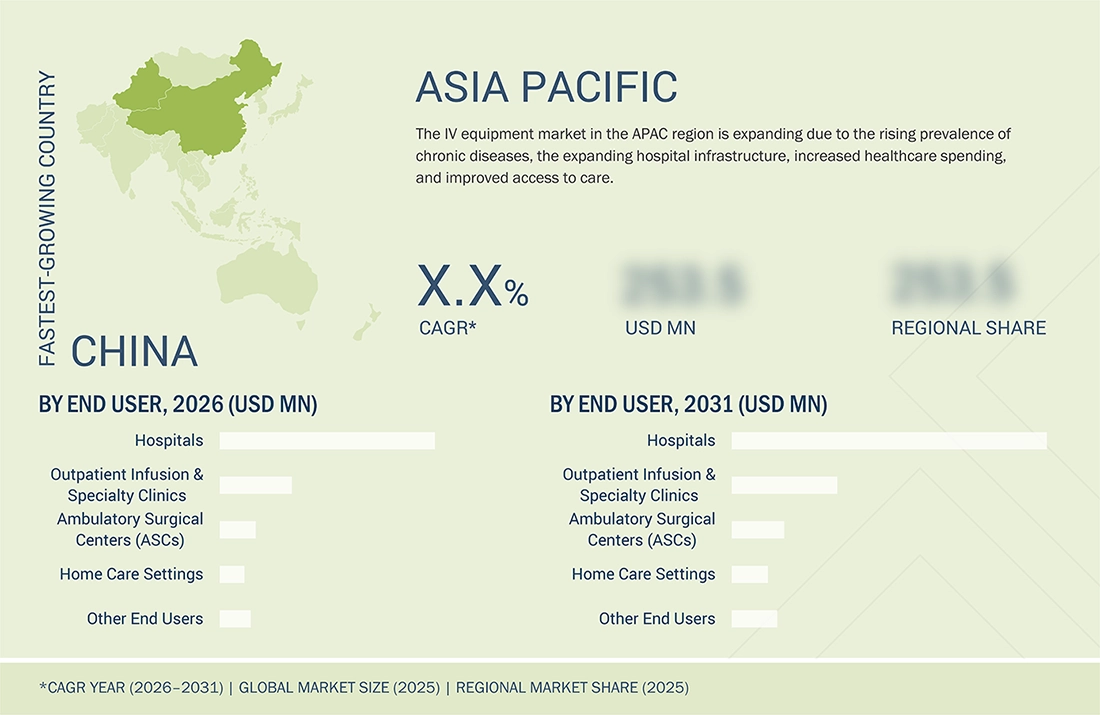

BY REGIONThe Asia Pacific is the fastest-growing regional market for IV equipment, at a CAGR of 6.5% during the forecast period.

-

BY TYPEBy type, the IV catheters segment accounted for the largest share of 37.0% of the market in 2025.

-

BY APPLICATIONBy application, the medication administration segment accounted for the largest share of 54.9% of the market in 2025.

-

BY END USERBy end user, the home care settings segment is projected to register the highest CAGR of 7.4% during the forecast period.

-

COMPETITIVE LANDSCAPEBecton, Dickinson and Company; B. Braun SE; and Fresenius SE & Co. KGaA are identified as Star players in the market. These industry leaders have very broad vaccine portfolios, large-scale manufacturing, strong R&D, and global distribution.

-

COMPETITIVE LANDSCAPEINTUVIE HOLDINGS LLC and EPIC Medical are identified as high-growth innovators/SMEs. These companies are carving out niches through regional specialization, novel vaccine technologies, and growing presence in emerging markets.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

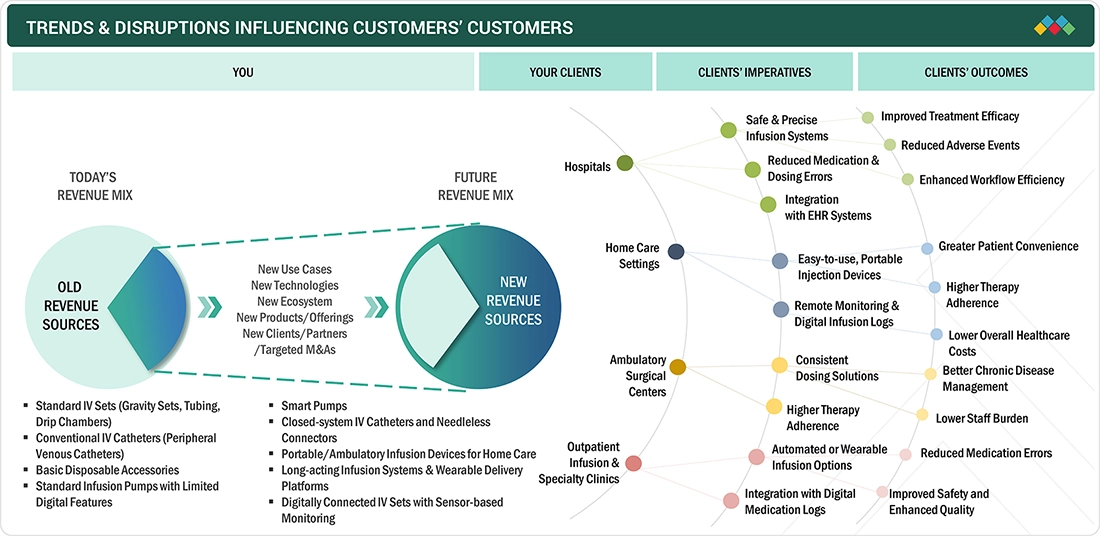

The IV equipment market is undergoing a significant transformation, shifting from traditional delivery methods in hospitals to alternatives such as home care, ambulatory surgery centers, and outpatient infusion centers. Traditionally profitable revenue streams are now being replaced by advanced technologies that emphasize digital enhancement and safety, which are relatively new to the market. There is an increasing demand for smart infusion systems, closed-system catheters, portable ambulatory devices, and IV sets with digital monitoring. Providers are focusing on precise dosing, reducing errors, enhancing infection safety, and achieving seamless integration with EHRs. Additionally, emerging use cases such as remote monitoring, specialty drug infusion, and chronic disease management are altering customer expectations and creating opportunities for ecosystem partnerships, new product categories, and targeted mergers & acquisitions. Collectively, these disruptions are setting the stage for strong and diversified revenue growth over the next decade.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising disease burden and subsequent surge in geriatric population globally

-

Shift toward home and ambulatory infusion

Level

-

Product recalls and failures

Level

-

Untapped growth potential in emerging markets

-

Technological advancements and vendor collaborations

Level

-

Device reliability, maintenance requirements, and user-related errors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

IV EQUIPMENT MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Used in routine peripheral IV access and medication delivery across emergency departments, inpatient wards, and outpatient settings, particularly where high patient throughput and staff safety are critical. | Minimizes needlestick injuries, ensures reliable vascular access, and supports standardized IV practices across hospitals. |

|

Deployed in continuous and long-duration infusion therapy (ICU, oncology, anesthesia, and surgical recovery), where precise dosing and infection control are essential. | Enables integrated IV workflows, reduces catheter-related infections, and improves infusion accuracy in critical care. |

|

Applied in high-risk infection environments (ICUs, NICUs, oncology units) to support closed IV systems and needle-free medication administration. | Lowers bloodstream infection rates, enhances clinician safety, and supports hospital infection-prevention protocols. |

|

Used in acute and chronic infusion treatments, including dialysis centers, ICUs, and long-term care facilities requiring consistent and controlled drug delivery. | Optimizes drug delivery over extended periods and supports continuity of care for chronic patients. |

|

Utilized for advanced vascular access procedures, including difficult IV insertions, emergency access, and specialty catheter placement in critical care and surgical settings. | Improves insertion success, reduces access-related complications, and shortens procedure time. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The IV equipment market functions within a highly interconnected ecosystem that includes product innovation, regulatory oversight, manufacturing, distribution, and end-user adoption across various care settings. At the heart of this ecosystem are manufacturers, which consist of global device leaders, regional OEMs, and specialized small and medium-sized enterprises (SMEs). These manufacturers create infusion pumps, IV sets, catheters, connectors, and safety-engineered disposables. The innovation efforts of these manufacturers are enhanced by collaborations with academic institutions, clinical research organizations, and technology partners. These collaborations contribute to advancements in material science, smart infusion algorithms, antimicrobial coatings, and interoperable system architectures. Surrounding this network are regulatory agencies such as the FDA, EMA, and national health authorities that enforce strict compliance with safety, sterility, performance standards, and post-market surveillance of medical devices. Ultimately, this ecosystem serves a diverse group of end users, including hospitals, ICUs, oncology centers, surgical departments, ambulatory infusion clinics, and home care providers. The clinical needs, workflow requirements, and safety priorities of these end users directly influence product selection, adoption rates, and the long-term evolution of technology within the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

REGION

Asia Pacific to be fastest-growing region in global IV equipment market during forecast period

The Asia Pacific is the fastest-growing market for IV equipment. This growth is driven by several factors, including rising healthcare expenditures, rapidly improving hospital infrastructure, and an increasing prevalence of both chronic and acute diseases. Additionally, rapid urbanization, a growing elderly population, and the greater adoption of advanced IV therapies, such as smart infusion systems and needle-free connectors, are contributing to the surge in demand. Emerging economies in countries like China, India, and other Southeast Asian nations present significant growth opportunities due to enhanced access to healthcare and rising patient volumes.

IV EQUIPMENT MARKET: COMPANY EVALUATION MATRIX

In the IV equipment market matrix, Becton, Dickinson and Company (Star) stands out as the global leader, boasting a strong international presence and a comprehensive range of intravenous systems and accessories. Its advanced technologies facilitate rapid adoption in hospitals, clinics, and home care settings. Meanwhile, Moog Inc. (Emerging Leader) is on an accelerated growth trajectory, focusing on innovative and cost-effective IV solutions. The company is working to enhance its presence in emerging markets while also strengthening its position in critical care and home-based infusion therapies.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Becton, Dickinson and Company (US)

- B. Braun SE (Germany)

- Fresenius SE & Co. KGaA (Germany)

- Baxter (US)

- ICU Medical, Inc. (US)

- Terumo Corporation (Japan)

- Moog Inc. (US)

- Teleflex Incorporated (US)

- Cardinal Health (US)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

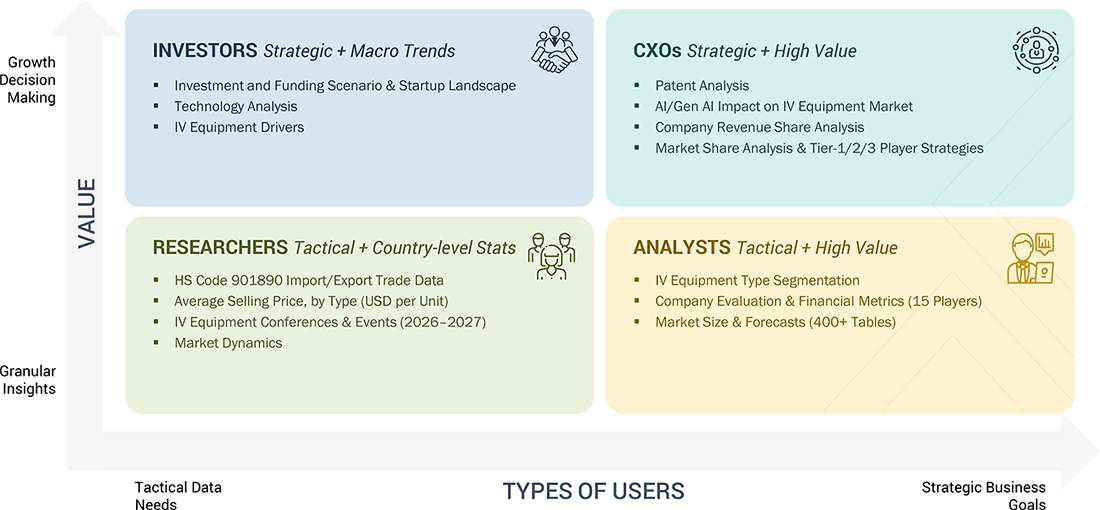

WHAT IS IN IT FOR YOU: IV EQUIPMENT MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis | In-depth assessment of IV equipment by product type (IV catheters, infusion pumps, IV sets, connectors, needleless systems), application (medication delivery, fluid management, parenteral nutrition, blood transfusion), and end user (hospitals, ambulatory surgical centers, home healthcare). | Analysis of emerging trends such as smart infusion pumps, closed IV systems, needleless and anti-reflux connectors, antimicrobial-coated catheters, and safety-engineered devices aimed at reducing medication errors and hospital-acquired infections. |

| Company Information | Comprehensive profiles of major global players such as Becton, Dickinson and Company (BD), Baxter International, B. Braun, Fresenius Kabi, ICU Medical, Terumo, and others. | Identification of strategic partnerships, product innovations, regulatory approvals, manufacturing expansions, and mergers & acquisitions shaping competition and technological advancement in the global IV equipment market. |

| Geographic Analysis |

|

Regional market outlook highlighting growth opportunities driven by rising hospitalization rates, increasing chronic disease burden, expansion of home infusion therapy, healthcare infrastructure development in emerging economies, and stricter safety regulations for IV delivery systems worldwide. |

RECENT DEVELOPMENTS

- Heading : Content

- April 2025 : ICU Medical Inc. announced 510(k) regulatory clearance from the US Food and Drug Administration (FDA) for the Plum Solo precision IV pump, a single-channel complement to the dual-channel Plum Duo. ICU Medical also received 510(k) clearance for updated versions of the Plum Duo precision IV pump and LifeShield infusion safety software, completing the initial launch of the ICU Medical IV Performance Platform.

- April 2025 : The US FDA cleared the BD Alaris Infusion System with Guardrails Suite MX (including modules like PC Unit, Pump, Syringe, PCA, EtCO2, Auto-ID, and System Manager) as safe & effective for market use. This clearance, granted on April 25, 2025, confirms the system is substantially equivalent to previously approved devices and can now be legally sold in the US.

- September 2024 : B. Braun received the US FDA-granted 510(k) clearance for the Introcan Safety 2 Deep Access IV Catheter, the newest addition to the Introcan Safety 2 IV Catheter portfolio.

- April 2024 : Baxter received the US FDA approval for the new Novum IQ syringe infusion pump (SYR) with Dose IQ Safety Software. These include commercial operations for the most comprehensive infusion system available in the US.

Table of Contents

Methodology

This study relied heavily on both primary and secondary sources. The research process involved studying various factors affecting the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and company SEC filings. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the IV equipment market. It was also used to obtain important information on key players, market classification & segmentation aligned with industry trends, and key developments from market and technology perspectives, down to the bottom-most level. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply & demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources on the supply side include industry experts such as CEOs, vice presidents, marketing & sales directors, technology & innovation directors, and other key executives from leading companies and organizations in the IV equipment market. The primary demand-side sources include medical OEMs, medical device ISOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends & key market dynamics.

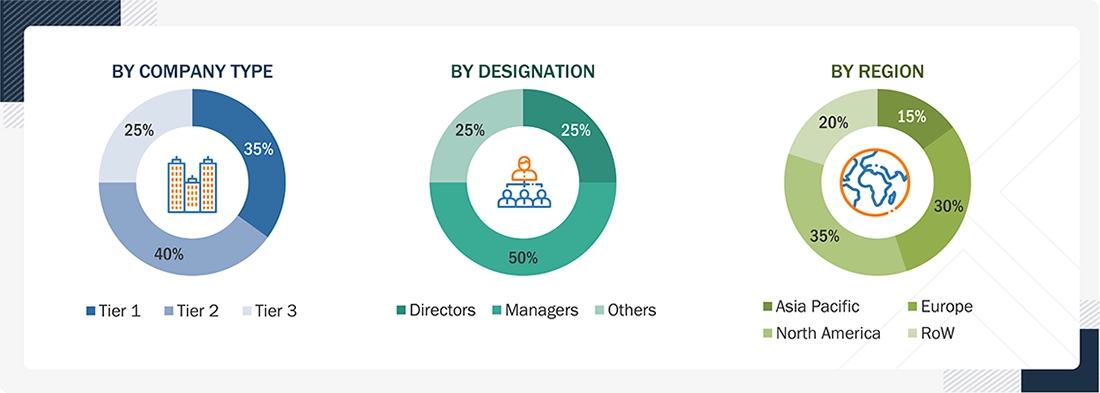

Breakdown of Primary Interviews:

A breakdown of the primary respondents for the IV equipment market (supply side) is provided below:

Note 1: Others include sales, marketing, and product managers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2025, Tier 1 = >USD 2 billion,

Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

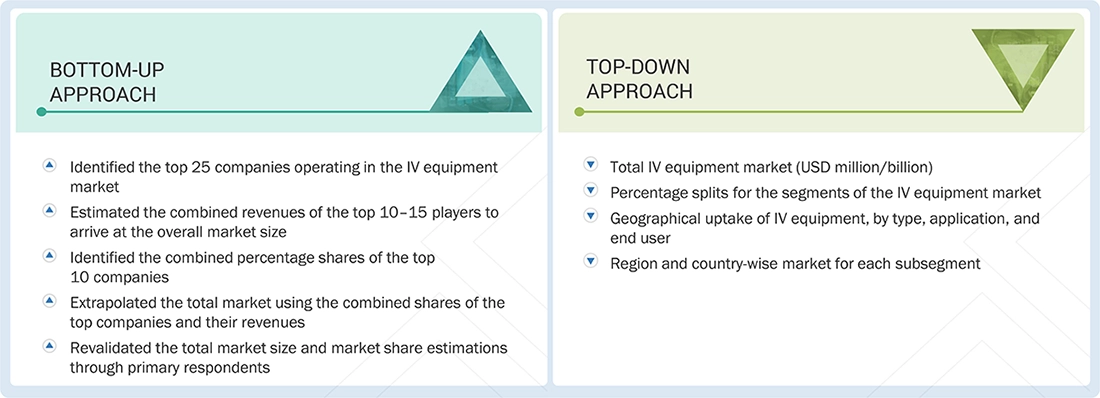

Market Size Estimation

In this report, the global IV equipment market size was determined using the revenue share analysis of leading players. For this purpose, key market players were identified, and their revenues from the IV equipment business were determined using insights gathered during the primary and secondary research phases. Secondary research included analyzing the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, including CEOs, directors, and senior marketing executives.

To calculate the global market value, segmental revenues were derived from the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the IV equipment market

- Mapping annual revenues generated by major global players from the IV equipment segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global market as of 2024

- Extrapolating the global value of the IV equipment industry

Global IV Equipment Market Size: Top-down & Bottom-up Approach

IV Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the market size estimation process explained above, the global IV equipment market was segmented and subsegmented. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and obtain exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the IV equipment market was validated using both top-down and bottom-up approaches.

Market Definition

IV equipment refers to the complete set of medical devices, accessories, and consumables used to deliver fluids, medications, nutrients, and blood products directly into a patient’s bloodstream through intravenous (IV) access. It includes infusion pumps, IV administration sets, catheters and cannulas, needle-free connectors, extension sets, securement devices, and related safety components designed to ensure accurate, controlled, and sterile delivery of therapies in hospitals, outpatient centers, and home care settings. IV equipment is essential for hydration, drug infusion, chemotherapy, parenteral nutrition, anesthesia, critical care, and emergency treatment.

Key Stakeholders

- Manufacturers of IV equipment

- Distributors of IV equipment

- Hospitals, clinics, and infusion centers

- Ambulatory surgery centers

- Non-government organizations

- Government regulatory authorities

- Contract manufacturers & third-party suppliers

- Research laboratories & academic institutes

- Clinical research organizations (CROs)

- Government & non-governmental regulatory authorities

- Market research & consulting firms

Report Objectives

- To define, describe, and forecast the IV equipment market based on type, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global IV equipment market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global IV equipment market

- To analyze key growth opportunities in the global IV equipment market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the global IV equipment market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global IV equipment market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global IV equipment market, such as agreements, collaborations, partnerships, expansions, and acquisitions

Customization Options

Based on the market data provided, MarketsandMarkets offers customizations tailored to your company’s specific needs. The following customization options are available for the present global IV equipment market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top twelve companies

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Geographic Analysis

- Further breakdown of the Rest of Europe IV equipment market into Russia, Finland, Switzerland, Turkey, the Czech Republic, the Netherlands, Norway, Poland, Portugal, Romania, Estonia, Austria, and Belgium

- Further breakdown of the Rest of Asia Pacific IV equipment market into Taiwan, New Zealand, and Sri Lanka

- Further breakdown of the Rest of Latin America IV equipment market into Uruguay, Costa Rica, Bolivia, Venezuela, and Paraguay

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the IV Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in IV Equipment Market