Laminated Busbar Market by Material (Copper and Aluminum), Insulation Material (Epoxy Powder Coating, Polyester Film, Polyvinyl Fluoride Film, Polyester Resin, Heat-Resistant Fiber, Polyimide Film), End-User, and Region - Global Forecast to 2030

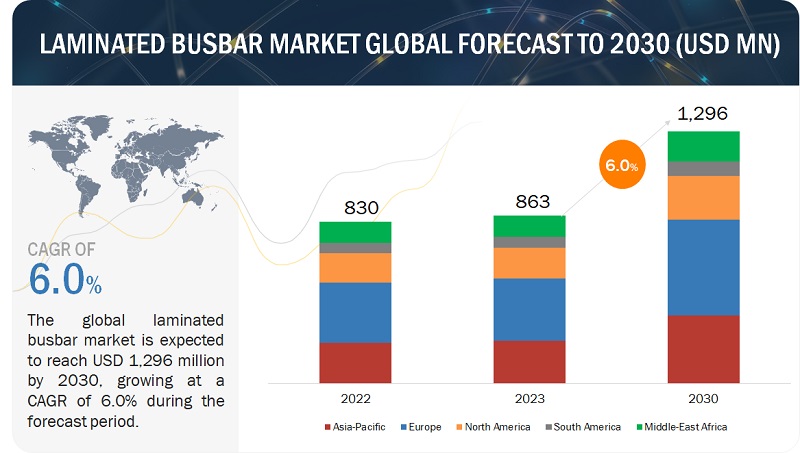

[192 Pages Report] The global laminated busbar market in terms of revenue was estimated to be worth $863 million in 2023 and is poised to reach $1,296 million by 2030, growing at a CAGR of 6.0% from 2023 to 2030. The infrastructure modernization, growing electricity demand, renewable energy projects, energy efficiency prioritization, technological advancements and adoption of electric vehicle are driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Laminated Busbar Market Dynamics

Driver: Increasing focus on renewable energy

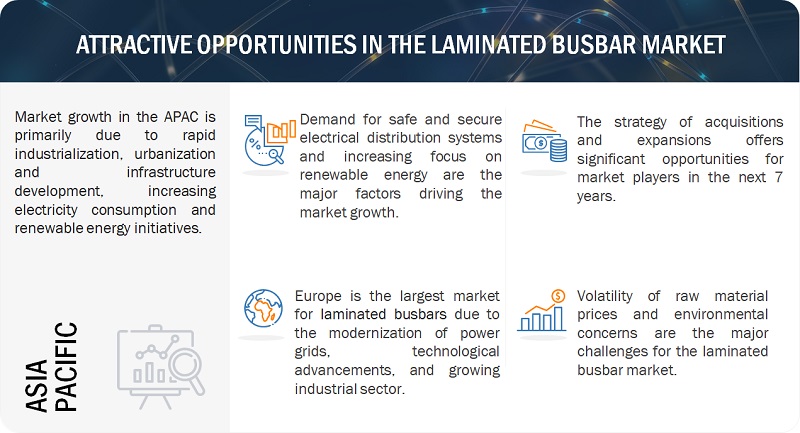

Countries, both developed and developing, are modifying their energy policies to incorporate a substantial portion of power generation from renewable sources such as solar and wind. Financial incentives provided by government entities, coupled with promising returns, are attracting investments in renewable energy projects. Photovoltaic and wind generators, key contributors to renewable power, necessitate a dedicated protection system. Laminated busbars play a crucial role in connecting power-generating stations to switchyards and electrical grids, emerging as a vital component within electrical systems. Functioning as a pivotal element, laminated busbars ensure power system protection, regulate power supply by de-energizing equipment, and address faults in the system, thereby ensuring a dependable power supply. The escalating demand for clean energy has propelled the market for renewable generation and distribution, subsequently driving the global laminated busbar market.

Restraints: High initial costs of laminated busbars

The manufacturing process of laminated busbar, which involves intricate steps such as shaping insulation materials like epoxy-glass or silicone rubber to specific dimensions, positioning copper or aluminum conductors precisely within insulation layers, and bonding these layers through heat, pressure, or adhesive resins, contributes to their higher cost compared to traditional busbar designs. Rigorous testing is performed on each laminated busbar to ensure both its electrical properties and mechanical integrity. The utilization of specialized materials and the complexity of the manufacturing process collectively contribute to the elevated cost of laminated busbars. This higher initial cost can pose a significant barrier to adoption, particularly in applications where pricing is a crucial factor or in regions with limited budgets. Consequently, this challenge may impede the widespread acceptance of laminated busbars and decelerate market growth.

Opportunities: Adoption of High-Voltage Direct Current (HVDC) technology

Governments, driven by escalating environmental concerns, are increasingly investing in power generation based on renewable energy sources. Facilities generating renewable power—such as solar, onshore and offshore wind, biomass, hydroelectric, and geothermal plants—are often situated in remote areas. To connect these distant power generation sites and mitigate transmission losses, companies employ High Voltage Direct Current (HVDC) systems, known for their efficiency in long-distance power transmissions. The IEEE Transmission and Distribution Committee has compiled a list of HVDC projects, indicating plans for over five 800 kV HVDC projects to be commissioned globally by 2019. A growing trend in new or developing projects involves integrating renewable power generation sources with HVDC transmission links. The seamless operation of these HVDC projects necessitates laminated busbars for HVDC converter stations, ensuring a consistent power supply to the entire system, minimizing losses, and providing protection against faults. This trend presents a notable opportunity for manufacturers of laminated busbars in the market.

Challenges: Environmental concerns

Like other electrical components, environmental considerations arise in the manufacturing, usage, and disposal phases of laminated busbars. The production process of laminated busbars may involve the utilization of potentially hazardous materials like solvents, resins, and adhesives. If not managed correctly, these materials can release volatile organic compounds (VOCs), impacting air quality and contaminating water sources. Furthermore, the energy consumption associated with manufacturing can contribute to greenhouse gas emissions. In operational phases, laminated busbars, like all electrical conductors, generate heat, potentially contributing to overall energy consumption and causing thermal pollution that affects the surrounding environment. When reaching the end of their useful life, responsible disposal of laminated busbars is crucial. Improper disposal methods, such as landfilling, can result in the leaching of hazardous materials into the environment.

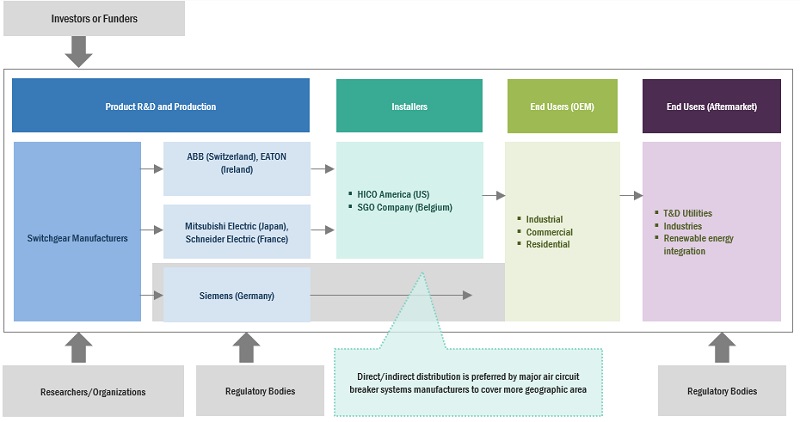

Laminated Busbar Market Value Chain

The market is characterized by the involvement of prominent companies that are well-established, financially sound, and possess considerable expertise in laminated busbar production. These firms exhibit a substantial market presence and offer a diverse range of products. Leveraging advanced technologies, they maintain extensive global sales and marketing networks. Key players in this market include Amphenol Corporation (US), Methode Electronics, Inc. (US), Mersen Group (France), Rogers Corporation (US), Sun.King Technology Group Limited (China), and Zhuzhou CRRC Times Electric Co., Ltd. (China).

Polyester film segment, by insulation material, to capture the second-largest market share from 2023 to 2030.

In 2022, the polyester film category constituted an 18.4% share of the laminated busbar market in terms of insulation material. Polyester film, characterized as a crystalline thermoplastic polyester, serves various purposes such as a wrapping material for food and drugs and a functional material for industrial components. Primarily utilized as a blending material to enhance the performance of polyethylene terephthalate (PET), it offers improved moisture barrier, gas barrier, heat resistance, and UV ray absorption. Polyester film finds applications in cosmetic and medical product containers due to its scratch- and heat-resistant properties. Notably, it possesses anti-hydrolysis and low oligomer extraction characteristics, factors that are anticipated to propel the polyester film segment throughout the forecast period.

Commercial segment, by end user, to emerge as third-largest segment of laminated busbar market.

In 2022, the commercial sector constituted a 23.6% share of the laminated busbar market. Laminated busbars find widespread application in power distribution equipment across various commercial establishments, including shopping malls, hotels, hospitals, office buildings, and data centers. Their preference over power cables is notable, especially in layouts where space is limited. Laminated busbars exhibit lower inductance compared to conventional wiring and cables, resulting in reduced power supply noise. This characteristic makes them particularly suitable for applications in low-noise operational environments, such as hospitals and hotels. Consequently, a high demand for laminated busbars is anticipated within the commercial segment.

Asia Pacific to capture the second-largest market size during forecast period.

In 2022, the Asia Pacific region held a significant 25.2% share in the laminated busbar market. This region, comprising China, India, Japan, South Korea, and the Rest of Asia Pacific (including Australia, Indonesia, and Singapore), is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) of 6.9% during the forecast period. The robust growth is attributed to the coexistence of developing economies like China and India alongside advanced economies such as Japan and Australia. China, a pivotal global manufacturing hub, has sustained industrial output constituting 45% of its GDP since the 1990s. The market in Asia Pacific is flourishing due to escalating transmission & distribution network expansions and the progression of industrialization initiatives, particularly in emerging nations like India and China. According to the Indian Electrical and Electronics Manufacturer Association (IEEMA), India's electricity generation capacity is projected to surge from 200 GW in 2010 to surpass 800 GW by 2032 to meet escalating demands, necessitating an investment of approximately USD 300 billion in the next 3-4 years. India is actively engaged in numerous smart grid and substation projects to address the rising energy needs, thereby fostering demand for laminated busbars in the Asia Pacific region.

Key Market Players

Amphenol Corporation (US), Methode Electronics, Inc. (US), Mersen Group (France), Rogers Corporation (US), Sun.King Technology Group Limited (China), Zhuzhou CRRC Times Electric Co., Ltd. (China), Ryoden Kasei Co., Ltd. (Japan), Shanghai Eagtop Electronics Technology Co., Ltd. (China), Shenzhen Busbar Sci-Tech Development Co., Ltd. (China), Storm Power Components (US)

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Material, By End User, By Insulation Material |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

Amphenol Corporation (US), Methode Electronics, Inc. (US), Mersen Group (France), Rogers Corporation (US), Sun.King Technology Group Limited (China), Zhuzhou CRRC Times Electric Co., Ltd. (China), Ryoden Kasei Co., Ltd. (Japan), Shanghai Eagtop Electronics Technology Co., Ltd. (China), Shenzhen Busbar Sci-Tech Development Co., Ltd. (China), Storm Power Components (US), Suzhou West Deane Machinery (India), Electronics Systems Packaing LLC (US), Jans Copper Private Limited (India), Molex (US), Shenzhen Woer Electric Technology Co., Ltd. (China), Raychem RPG Private Limited (India), Zhejiang RHI Electric Co., Ltd. (China), Segue Electronics, Inc. (US), Kinto Group (China), EMS Industrial & Service Company (US) |

The market is classified in this research report based on material, insulation material, end-user, and region.

Based on material, the laminated busbar market has been segmented as follows:

- Copper

- Aluminium

Based on insulation material, the market has been segmented as follows:

- Epoxy Powder Coating

- Polyester Film

- PVF Films

- Polyester Resin

- Heat-Resistant Fiber

- Polymide Film

Based on end user, the market has been segmented as follows:

- Utilities

- Industrial

- Commercial

- Residential

Based on regions, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In April 2023, Amphenol acquired the North American Cable and related Services Business from Radio Frequency Systems (RFS).

- In April 2023, Methode Electronics acquired Nordic Lights Group Corporation, a premium provider of high-quality lighting solutions.

- In September 2022, Amphenol acquired ICA (Integrated Cable Assembly), a manufacturer of cable assemblies.

- In July 2020, Mersen Group acquired the felt insulation business assets of the American company Americarb.

Frequently Asked Questions (FAQ):

What is the current size of the global laminated busbar market?

The global laminated busbar market is estimated to be USD 863 million in 2023.

What are the major challenges for laminated busbar market?

Volatility of raw material prices, especially copper, is a major challenge for laminated busbar market. The cost of raw materials is influenced by market dynamics specific to that industry segment. This holds substantial implications for the laminated busbar manufacturing sector. Given the absence of product differentiation and the pivotal role of product pricing in establishing supplier dominance, manufacturers face a critical challenge in absorbing cost fluctuations at the upstream level of the supply chain. An illustrative example is the susceptibility of companies to fluctuations in copper prices, a crucial raw material for laminated busbar production. Inability to pass on increased copper prices to end consumers may adversely impact their profit margins.

Which Insulation Material has the largest market share in the laminated busbar market?

Epoxy powder coating segment holds the largest market share. Epoxy powder coating, a thermosetting dry powder with exceptional dielectric strength, is recognized for its superior adhesion, resistance to chemicals and heat, impressive mechanical attributes, and electrical insulation properties. Its cost-effectiveness compared to alternative insulation materials enhances its appeal. Epoxy powder-coated laminated busbars find primary applications in switchgear and motor drive scenarios. The combination of these desirable properties positions epoxy powder-coated laminated busbars as increasingly favored by end-use industries, contributing to the anticipated surge in demand throughout the forecast period.

Which is the fastest-growing region during the forecast period in the laminated busbar market?

Anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) of 6.9% throughout the forecast period, the Asia Pacific market stands out for its robust growth. This growth is attributed to the coexistence of developing economies like China and India alongside advanced economies such as Japan and Australia. China, renowned as a major global manufacturing hub, has sustained industrial output constituting 45% of its GDP since the 1990s. The pivotal drivers for laminated busbar market growth in the region include escalating transmission & distribution network expansions and the progression of industrialization projects, particularly in emerging countries like India and China.

Which is the largest segment, by material in the laminated busbar market during the forecast period?

In 2022, the copper segment dominated the laminated busbar market by material. Recognized as the technically superior and extensively utilized material for laminated busbars, copper surpasses aluminum due to its heightened conductivity and superior load surge withstand capacity. Specifically designed for industrial and commercial facilities, copper-laminated busbars aim to minimize initial costs while ensuring safety. However, it's noteworthy that copper, despite its advantages, comes with a higher density, resulting in increased weight compared to aluminum-laminated busbars. Additionally, the cost of copper-laminated busbars is higher than their aluminum counterparts. Despite these considerations, the widespread adoption of copper conductors prevails due to their lower lifetime costs and relatively reduced maintenance requirements compared to aluminum alternatives, contributing to the anticipated rise in demand for copper-laminated busbars during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand for safe and secure electrical distribution systems- Significant operational benefits and cost-efficiency of laminated busbars- Strong focus on generating power using renewable energy- High adoption of electric vehiclesRESTRAINTS- Growing competition from local firms or unorganized sector- High initial cost of laminated busbarsOPPORTUNITIES- Aging electrical infrastructure and rising electricity demand- Increasing adoption of HVDC technology- Ongoing advancements in insulation materialsCHALLENGES- Volatility in raw material prices, especially copper- Environmental impact of improper disposal

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.4 TRADE ANALYSISTRADE SCENARIO FOR ELECTRICAL APPARATUS COVERED UNDER HS CODE 853690IMPORT SCENARIOEXPORT SCENARIO

-

5.5 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSCOMPONENT MANUFACTURERSLAMINATED BUSBAR MANUFACTURERSDISTRIBUTORSEND USERS

- 6.1 INTRODUCTION

-

6.2 COPPERABILITY OF COPPER TO WITHSTAND LOAD SURGES TO DRIVE DEMAND

-

6.3 ALUMINUMCOST-EFFICIENCY OF ALUMINUM-LAMINATED BUSBARS TO BOOST DEMAND IN PRICE-SENSITIVE REGIONS

- 7.1 INTRODUCTION

-

7.2 EPOXY POWDER COATINGGROWING USE OF BUSBARS IN SWITCHGEAR AND MOTOR DRIVE APPLICATIONS TO DRIVE MARKET

-

7.3 POLYESTER FILMINCREASING DEMAND FROM COSMETIC AND MEDICAL INDUSTRIES TO FUEL MARKET GROWTH

-

7.4 POLYVINYL FLUORIDE FILMRISING ADOPTION IN AEROSPACE, TRANSPORTATION, ARCHITECTURE INDUSTRIES TO FOSTER MARKET GROWTH

-

7.5 POLYESTER RESINHIGH DURABILITY OF POLYESTER RESINS TO BOOST DEMAND

-

7.6 HEAT-RESISTANT FIBERHIGH RESISTANCE TO HEAT TO BOOST DEMAND FOR HEAT-RESISTANT FIBER-INSULATED LAMINATED BUSBARS IN HEAVY-DUTY APPLICATIONS

-

7.7 POLYIMIDE FILMEXCELLENT HEAT-RESISTANCE PROPERTY OF POLYAMIDE FILMS TO INCREASE DEMAND

- 8.1 INTRODUCTION

-

8.2 UTILITIESINCREASING SPENDING ON POWER INFRASTRUCTURE DEVELOPMENT TO BOOST DEMAND

-

8.3 INDUSTRIALRISING NEED FOR RELIABLE POWER SUPPLY IN VARIOUS INDUSTRIES TO DRIVE MARKET

-

8.4 COMMERCIALLOW NOISE AND INDUCTANCE OF LAMINATED BUSBARS TO INCREASE ADOPTION IN HOSPITALS AND HOTELS

-

8.5 RESIDENTIALINCREASING FOCUS ON ENHANCING ENERGY EFFICIENCY IN RESIDENTIAL SECTOR TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTBY MATERIALBY END USERBY INSULATION MATERIALBY COUNTRY- US- Canada- Mexico

-

9.3 EUROPEEUROPE: RECESSION IMPACTBY MATERIALBY END USERBY INSULATION MATERIALBY COUNTRY- UK- Germany- Russia- France- Rest of Europe

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTBY MATERIALBY END USERBY INSULATION MATERIALBY COUNTRY- China- Japan- India- South Korea- Rest of Asia Pacific

-

9.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBY MATERIALBY END USERBY INSULATION MATERIALBY COUNTRY- Brazil- Argentina- Rest of South America

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTBY MATERIALBY END USERBY INSULATION MATERIALBY COUNTRY- Saudi Arabia- UAE- Qatar- South Africa- Rest of Middle East & Africa

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 10.6 COMPETITIVE SCENARIO

-

11.1 KEY PLAYERSAMPHENOL CORPORATION- Business overview- Products offered- Recent developments- MnM viewMETHODE ELECTRONICS, INC.- Business overview- Products offered- MnM viewMERSEN GROUP- Business overview- Products offered- Recent developments- MnM viewROGERS CORPORATION- Business overview- Products offered- Recent developments- MnM viewSUN.KING TECHNOLOGY GROUP LIMITED- Business overview- Products offered- MnM viewZHUZHOU CRRC TIMES ELECTRIC CO., LTD.- Business overview- Products offeredRYODEN KASEI CO., LTD.- Business overview- Products offeredSHANGHAI EAGTOP ELECTRONIC TECHNOLOGY CO., LTD. (EAGTOP)- Business overview- Products offeredSHENZHEN BUSBAR SCI-TECH DEVELOPMENT CO., LTD.- Business overview- Products offeredSTORM POWER COMPONENTS- Business overview- Products offeredSUZHOU WEST DEANE MACHINERY INC.- Business overview- Products offeredELECTRONIC SYSTEMS PACKAGING LLC- Business overview- Products offeredJANS COPPER PRIVATE LIMITED- Business overview- Products offeredMOLEX- Business overviewSHENZHEN WOER ELECTRIC TECHNOLOGY CO., LTD.- Business overview- Products offered

-

11.2 OTHER PLAYERSRAYCHEM RPG PRIVATE LIMITEDZHEJIANG RHI ELECTRIC CO., LTD.SEGUE ELECTRONICS, INC.KINTO GROUPEMS INDUSTRIAL & SERVICE COMPANY

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 LAMINATED BUSBAR MARKET: INDUSTRY-/COUNTRY-WISE ANALYSIS

- TABLE 2 MARKET SNAPSHOT

- TABLE 3 FAILURE RATE OF EQUIPMENT USED IN INDUSTRIES

- TABLE 4 SOLAR AND WIND RENEWABLE ENERGY TARGETS, BY MAJOR COUNTRY

- TABLE 5 LAMINATED BUSBAR MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 COMPARISON OF POTENTIAL SUBSTITUTES FOR LAMINATED BUSBARS

- TABLE 7 IMPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853690, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 8 EXPORT SCENARIO FOR PRODUCTS COVERED UNDER HS CODE 853690, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 9 MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 10 LAMINATED BUSBAR MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 11 COPPER: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 12 COPPER: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 13 ALUMINUM: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 14 ALUMINUM: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 15 MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 16 LAMINATED BUSBAR MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 17 EPOXY POWDER COATING: LAMINATED BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 EPOXY POWDER COATING: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 19 POLYESTER FILM: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 POLYESTER FILM: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 21 POLYVINYL FLUORIDE FILM: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 POLYVINYL FLUORIDE FILM: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 23 POLYESTER RESIN: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 POLYESTER RESIN: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 25 HEAT-RESISTANT FIBER: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 HEAT-RESISTANT FIBER: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 27 POLYIMIDE FILM: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 POLYIMIDE FILM: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 29 MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 30 LAMINATED BUSBAR MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 31 UTILITIES: LAMINATED BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 UTILITIES: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 33 INDUSTRIAL: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 INDUSTRIAL: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 35 COMMERCIAL: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 COMMERCIAL: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 37 RESIDENTIAL: BUSBAR MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 RESIDENTIAL: BUSBAR MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 39 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 41 MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 42 LAMINATED BUSBAR MARKET, BY REGION, 2023–2030 (KILOTON)

- TABLE 43 NORTH AMERICA: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 51 US: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 52 US: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 53 US: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 54 US: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 55 CANADA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 56 CANADA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 57 CANADA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 58 CANADA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 59 MEXICO: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 60 MEXICO: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 61 MEXICO: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 62 MEXICO: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 63 EUROPE: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 65 EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 67 EUROPE: MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 69 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 71 UK: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 72 UK: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 73 UK: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 74 UK: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 75 GERMANY: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 76 GERMANY: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 77 GERMANY: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 78 GERMANY: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 79 RUSSIA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 80 RUSSIA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 81 RUSSIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 82 RUSSIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 83 FRANCE: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 84 FRANCE: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 85 FRANCE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 86 FRANCE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 87 REST OF EUROPE: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 88 REST OF EUROPE: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 89 REST OF EUROPE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 90 REST OF EUROPE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 91 ASIA PACIFIC: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 99 CHINA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 100 CHINA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 101 CHINA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 102 CHINA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 103 JAPAN: BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 104 JAPAN: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 105 JAPAN: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 106 JAPAN: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 107 INDIA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 108 INDIA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 109 INDIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 110 INDIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 111 SOUTH KOREA: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 113 SOUTH KOREA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 117 REST OF ASIA PACIFIC: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 119 SOUTH AMERICA: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 120 SOUTH AMERICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 121 SOUTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 122 SOUTH AMERICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 123 SOUTH AMERICA: MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 124 SOUTH AMERICA: MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 125 SOUTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 126 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 127 BRAZIL: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 128 BRAZIL: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 129 BRAZIL: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 130 BRAZIL: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 131 ARGENTINA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 132 ARGENTINA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 133 ARGENTINA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 134 ARGENTINA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 135 REST OF SOUTH AMERICA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 136 REST OF SOUTH AMERICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 137 REST OF SOUTH AMERICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 138 REST OF SOUTH AMERICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: LAMINATED BUSBAR MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY INSULATION MATERIAL, 2018–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY INSULATION MATERIAL, 2023–2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 147 SAUDI ARABIA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 148 SAUDI ARABIA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 149 SAUDI ARABIA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 150 SAUDI ARABIA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 151 UAE: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 152 UAE: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 153 UAE: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 154 UAE: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 155 QATAR: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 156 QATAR: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 157 QATAR: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 158 QATAR: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 159 SOUTH AFRICA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 160 SOUTH AFRICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 162 SOUTH AFRICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2018–2022 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: MARKET, BY MATERIAL, 2023–2030 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2023–2030 (USD MILLION)

- TABLE 167 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, APRIL 2019–MARCH 2023

- TABLE 168 LAMINATED BUSBAR MARKET: DEGREE OF COMPETITION

- TABLE 169 MARKET: DEALS, JANUARY 2020–OCTOBER 2023

- TABLE 170 MARKET: OTHERS, MARCH 2020–OCTOBER 2023

- TABLE 171 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 172 AMPHENOL CORPORATION: PRODUCTS OFFERED

- TABLE 173 AMPHENOL CORPORATION: DEALS

- TABLE 174 AMPHENOL CORPORATION: OTHERS

- TABLE 175 METHODE ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 176 METHODE ELECTRONICS, INC.: PRODUCTS OFFERED

- TABLE 177 METHODE ELECTRONICS, INC: DEALS

- TABLE 178 MERSEN GROUP: COMPANY OVERVIEW

- TABLE 179 MERSEN GROUP: PRODUCTS OFFERED

- TABLE 180 MERSEN GROUP: DEALS

- TABLE 181 MERSEN GROUP: OTHERS

- TABLE 182 ROGERS CORPORATION: COMPANY OVERVIEW

- TABLE 183 ROGERS CORPORATION: PRODUCTS OFFERED

- TABLE 184 ROGERS CORPORATION: DEALS

- TABLE 185 ROGERS CORPORATION: OTHERS

- TABLE 186 SUN.KING TECHNOLOGY GROUP LIMITED: COMPANY OVERVIEW

- TABLE 187 SUN.KING TECHNOLOGY GROUP LIMITED: PRODUCTS OFFERED

- TABLE 188 ZHUZHOU CRRC TIMES ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 189 ZHUZHOU CRRC TIMES ELECTRIC CO., LTD: PRODUCTS OFFERED

- TABLE 190 RYODEN KASEI CO., LTD.: COMPANY OVERVIEW

- TABLE 191 RYODEN KASEI CO., LTD.: PRODUCTS OFFERED

- TABLE 192 EAGTOP: COMPANY OVERVIEW

- TABLE 193 EAGTOP: PRODUCTS OFFERED

- TABLE 194 SHENZHEN BUSBAR SCI-TECH DEVELOPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 195 SHENZHEN BUSBAR SCI-TECH DEVELOPMENT CO., LTD.: PRODUCTS OFFERED

- TABLE 196 STORM POWER COMPONENTS: COMPANY OVERVIEW

- TABLE 197 STORM POWER COMPONENTS: PRODUCTS OFFERED

- TABLE 198 SUZHOU WEST DEANE MACHINERY INC.: COMPANY OVERVIEW

- TABLE 199 SUZHOU WEST DEANE MACHINERY INC.: PRODUCTS OFFERED

- TABLE 200 ELECTRONIC SYSTEMS PACKAGING LLC: COMPANY OVERVIEW

- TABLE 201 ELECTRONIC SYSTEMS PACKAGING LLC: PRODUCTS OFFERED

- TABLE 202 JANS COPPER: COMPANY OVERVIEW

- TABLE 203 JANS COPPER PRIVATE LIMITED: PRODUCTS OFFERED

- TABLE 204 MOLEX: COMPANY OVERVIEW

- TABLE 205 MOLEX: PRODUCTS OFFERED

- TABLE 206 SHENZEN WOER ELECTRIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 207 SHENZEN WOER ELECTRIC TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- FIGURE 1 LAMINATED BUSBAR MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR LAMINATED BUSBAR

- FIGURE 5 LAMINATED BUSBAR MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 LAMINATED BUSBAR MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF LAMINATED BUSBARS

- FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 COPPER SEGMENT TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 10 UTILITIES SEGMENT TO LEAD LAMINATED BUSBAR MARKET IN 2029

- FIGURE 11 EPOXY POWDER COATING SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET IN 2029

- FIGURE 12 EUROPE LED BUSBAR MARKET IN 2022

- FIGURE 13 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL DISTRIBUTION SYSTEMS TO DRIVE MARKET

- FIGURE 14 COPPER MATERIAL SEGMENT TO DOMINATE BUSBAR MARKET

- FIGURE 15 UTILITIES SEGMENT TO DOMINATE BUSBAR MARKET

- FIGURE 16 EPOXY POWDER COATING SEGMENT AND GERMANY LED EUROPEAN BUSBAR MARKET IN 2022

- FIGURE 17 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 LAMINATED BUSBAR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL ELECTRIC VEHICLE SALES, BY TYPE, 2020–2030

- FIGURE 20 COPPER GRADE A CATHODE: PRICE TREND (IN USD PER METRIC TON), NOVEMBER 2018–SEPTEMBER 2023

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS FOR BUSBAR MARKET

- FIGURE 22 IMPORT TRADE VALUES FOR TOP FIVE COUNTRIES (HS CODE 853690), 2018–2022 (USD THOUSAND)

- FIGURE 23 EXPORT TRADE VALUES FOR TOP FIVE COUNTRIES (HS CODE 853690), 2018–2022 (USD THOUSAND)

- FIGURE 24 LAMINATED BUSBAR VALUE CHAIN ANALYSIS

- FIGURE 25 BUSBAR MARKET, BY MATERIAL, 2022

- FIGURE 26 MARKET, BY INSULATION MATERIAL, 2022

- FIGURE 27 MARKET, BY END USER, 2022

- FIGURE 28 ASIA PACIFIC TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 29 LAMINATED BUSBAR MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 30 EUROPE: BUSBAR MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: BUSBAR MARKET SNAPSHOT

- FIGURE 32 LAMINATED BUSBAR MARKET SHARE ANALYSIS, 2022

- FIGURE 33 REVENUE OF TOP PLAYERS IN MARKET, 2018–2022

- FIGURE 34 COMPANY EVALUATION MATRIX: BUSBAR MARKET, 2022

- FIGURE 35 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 METHODE ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 37 MERSEN GROUP: COMPANY SNAPSHOT

- FIGURE 38 ROGERS CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 SUN.KING TECHNOLOGY GROUP LIMITED: COMPANY SNAPSHOT

- FIGURE 40 ZHUZHOU CRRC TIMES ELECTRIC CO., LTD: COMPANY SNAPSHOT

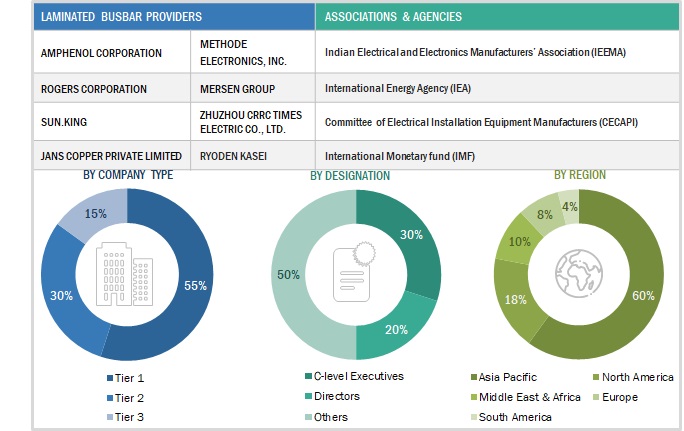

This study involved substantial endeavors to ascertain the current dimensions of the laminated busbar market. The process initiated with an extensive secondary research phase, collecting data concerning the market, related markets, and the broader industry. Subsequently, these findings, assumptions, and market size calculations underwent rigorous validation through primary research, consulting industry experts across the complete value chain. The overall market size was evaluated by conducting a country-specific analysis. Further segmentation of the market and cross-referencing of data were carried out to estimate the sizes of various segments and sub-segments within the market.

Secondary Research

In conducting this research, a diverse array of secondary sources was employed, encompassing directories, databases, and reputable references such as the Indian Electrical and Electronics Manufacturers' Association (India), The Organisation for Economic Co-operation and Development (OECD) (US), Factiva, World Bank, the US Department of Energy (DOE), International Wrought Copper Council (US), and the International Energy Agency (IEA). These sources played a pivotal role in acquiring valuable data for a comprehensive analysis of the global laminated busbar market, addressing technical, market-oriented, and commercial aspects. Additional secondary sources comprised annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by esteemed experts, information from industry associations, trade directories, and diverse database resources.

Primary Research

The market encompasses diverse stakeholders, including raw material suppliers, manufacturers, distributors, and end-users within the supply chain. The utility sector predominantly propels market demand, with additional contributions from growing industrial needs. To obtain comprehensive qualitative and quantitative insights, interviews were conducted with various primary sources representing both the supply and demand sides of the market. The breakdown below outlines the primary respondents engaged in the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

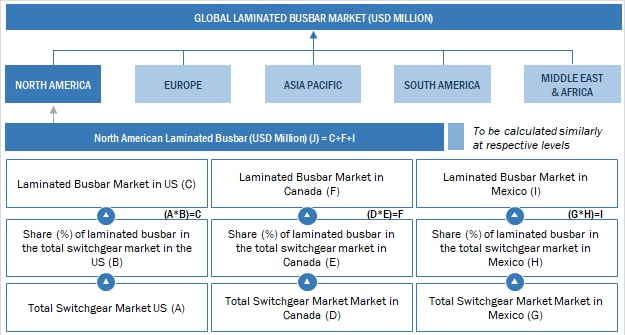

Both top-down and bottom-up methodologies were employed to determine and validate the dimensions of the global laminated busbar market and its associated submarkets. Through secondary research, key application areas within the market were identified, and their regional market shares were assessed using a combination of primary and secondary research methods. The information integrated into the study is derived from the annual and financial reports of leading market players, along with insights from interviews with industry experts such as CEOs, VPs, directors, sales managers, and marketing executives. These interactions provided essential quantitative and qualitative perspectives on the market. The subsequent sections detail the comprehensive process utilized to estimate the overall market size in this study.

Global Laminated Busbar Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of establishing the overall market size followed the earlier described methodologies, incorporating the segmentation of the market into multiple segments and subsegments. To conclude the comprehensive market analysis and garner precise statistics for each market segment and subsegment, the application of data triangulation and market segmentation techniques was deemed appropriate. Data triangulation was achieved by scrutinizing various factors and trends from both demand and supply perspectives within the switchgear market ecosystem.

Market Definition

A busbar serves as a strip of either aluminum or copper conductor, upheld by insulators, facilitating the connection between electrical loads and power supplies in an electrical network. Predominantly present in distribution panels, switchboards, and switchgears, its application extends to nearly all establishments requiring electricity. Various types of busbars exist, including single conductor busbars, multiple conductor busbars, rigid busbars, flexible busbars, strain busbars, insulated phase busbars, and laminated busbars. A laminated busbar results from multiple layers of conductive metal (either copper or aluminum) separated by paper-thin dielectric layers, heated and compressed into an integrated component. Renowned for providing heightened safety and reliability compared to counterparts, laminated busbars also offer a more cost-effective solution than alternative busbars.

Key Stakeholders

- Assembly and testing vendors

- Consulting companies in the energy and power sector

- Copper and aluminum raw material suppliers

- Electric control panel manufacturing companies

- Energy management, audit, and green building consulting companies

- Environmental and industrial associations

- Government and research organizations

- Investment banks

- Laminated busbar manufacturers, dealers, and suppliers

- Organizations, forums, alliances, and associations

- Renewable power generation and equipment manufacturing companies

- Public & private power generation, transmission & distribution companies (utilities)

- Substation equipment manufacturing companies

- Smart grid project developers

- Switchgear and power cable manufacturing companies

- State and national regulatory authorities

- Venture capital firms

Objectives of the Study

- To define, describe, segment, and forecast the laminated busbar market based on material, end-user, insulation material, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To analyze the value chain of the market

- To forecast the growth of the market with respect to the main regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To strategically profile key players and comprehensively analyze their market ranking and core competencies*

- To track and analyze competitive developments such as contracts & agreements, investments & expansions, new product developments, and mergers & acquisitions in the market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Laminated Busbar Market

Hi. We want to avail market opportunities in laminated and powder-costed busbar products. Kindly assist.