Laminating Adhesives Market by Resin Type (Polyurethane, Acrylic, Others), Technology (Solvent-based, Water-Based, Solvent-less), End-Use Industry (Packaging (Food & Beverages, Pharmaceuticals, Consumer Products), Industrial, and Region (2023-2028)

Updated on : February 13, 2025

Laminating Adhesives Market

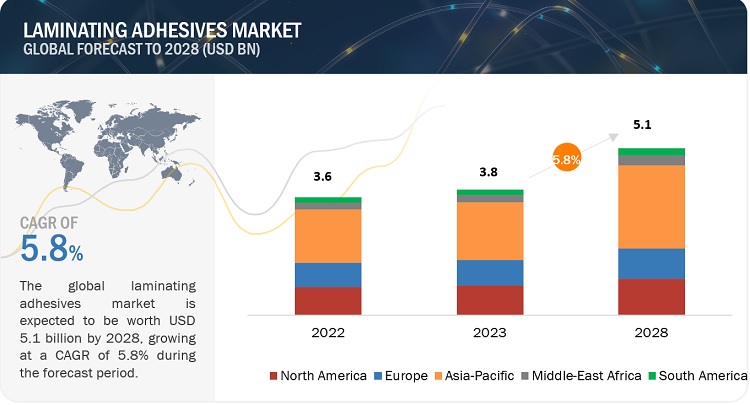

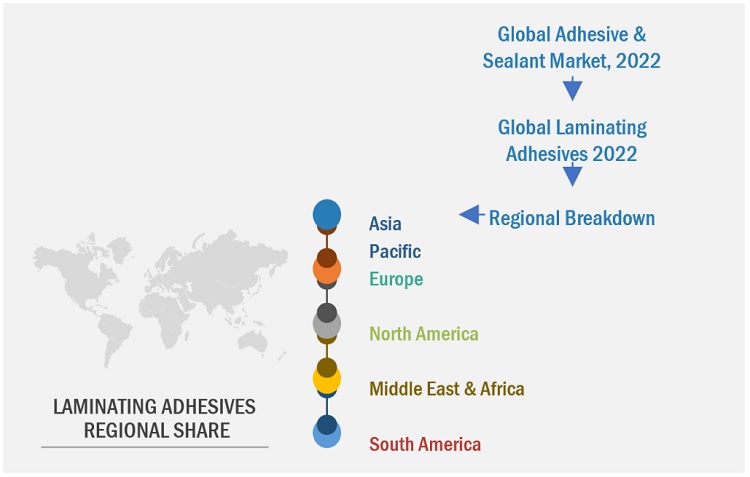

The laminating adhesives market was valued at USD 3.6 billion in 2022 and is projected to reach USD 5.1 billion by 2028, growing at 5.8% cagr from 2023 to 2028. The polyurethane, by resin segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for laminating adhesives.

Attractive Opportunities in the Laminating Adhesives Market

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Laminating Adhesives Market Dynamics

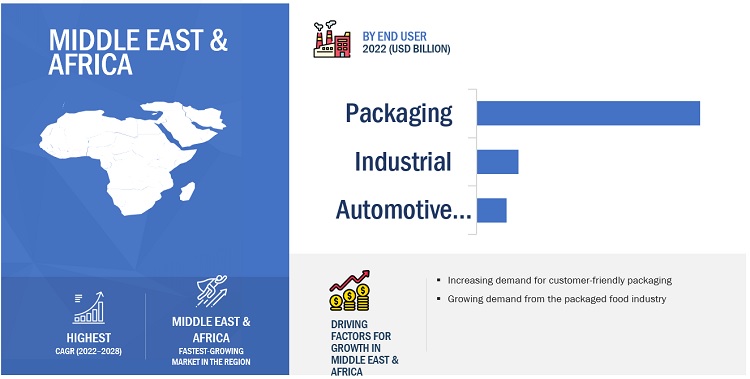

Drivers: Increasing demand for customer-friendly packaging

The use of laminating adhesives is driven by the rising demand for stand-up pouches for packaged meals and microwaveable food items. Glass bottles, boxes, and cans are not necessary when laminating adhesives are used. Due to shifting lifestyles and rising middle-class household wealth, microwaveable food is in high demand. Due to its qualities including aroma preservstion and odour resistance, laminating adhesives are popular for use in food product packaging.

Most food and pharmaceutical products experience quality changes over time. The variations in food's colour and textures make the change in food quality evident. Consumers place a high value on the way foods like dairy, poultry, vegetables, and fruits appearance. Transparent packaging is preferred by consumers over opaque packaging for food products.

Restraints: Environmental regulations in North America and Europe

The Control of Substances Hazardous to Health (COSHH), the European Union (EU), Registration, Evaluation, Authorization and Restrictio of Chemicals (REACH), the Globally Harmonised System (GHS), and the Environmental Protection Agency (EPA) in Europe and North America are among the regulatory authorities that pose challenges to the chemical industry. To lessen VOC emissions, manufacturers in Europe and North America have to comply by certain regulations regarding the production and application of laminating adhesives in various applications. The production of businesses that specialise in making laminating adhesives using solvent-based technology has been impacted by this. Manufacturers are forced to switch from solvent-based to water-based technologies in order to comply with these laws. This is the main barrier for market participants. Additionally, water-based technology has drawbacks including greater production costs.

Opportunities: Growing trend of water-based & solvent-less adhesives

Environmental regulations that are strict are a major factor in the market growth of water-based laminating adhesive. The growing concern over waste generation and emissions has led to an increase in the use of water-based laminating adhesives. In the automotive industry, one-part systems and high-performance laminations are both made with water-based laminating adhesives. The demand for acrylic and maleic resins, which make up the majority of all water-based adhesives produced globally, is anticipated to rise in response to the increased interest in water-based laminating adhesives.

Challenges: Health issues by formation of PAA

Primary aromatic amines (PAAs) are substances which can be transferred from food packaging materials into foods. These substances are possibly carcinogenic to humans. PAAs are formed from multilayer packaging materials which consists of aromatic polyurethane adhesives. PAAs occurs from the reaction between residual isocyanic monomers that have migrated to the surface of the inner layer of the package and water molecules contacting the same plastic surface.

However, acrylic dispersions can be used to produce multi-layer lamination of various films. These water-based adhesives offer high green strength, have short curing times and are free of primary aromatic amines.

Solvent-based, by technology accounted for the highest segment of laminating adhesives market

Solvent-based laminating adhesives have low demand in the developed regions owing to the stringent regulations on the use of these adhesives as they have high VOC emissions. The solvent-based technology segment is projected to register the highest CAGR in Asia Pacific as environmental regulations are not as stringent in this region as in the developed regions such as North America and Europe. There are strict regulations regarding the use of solvents such as toluene, methyl ethyl ketone, and acetone during the drying process because they emit VOC into the environment. The manufacturing of solvent-based adhesive in compliance with environmental norms leads to higher production costs.

To know about the assumptions considered for the study, download the pdf brochure

Middle east & Africa is the fastest-growing laminating adhesives market.

The second-fastest expanding Laminating Adhesive Industry is in Asia Pacific. High economic value and significant investment across industries like consumer goods & appliances, automotive, building & construction, and manufacturing are primarily responsible for an increase in demand for laminating adhesives. During the forecasted period, the demand for laminating adhesive is expected to be driven by significant variables including industrialization, an expanding middle-class population, increased disposable income, changing lifestyles, and an increase in the consumption of packaged goods.

Laminating Adhesives Market Players

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France) are the key players in the global laminating adhesives market.

Henkel AG is engaged in adhesive technologies and consumer brands. The company operates through various segments, including adhesive technologies (adhesives, sealants, and surface treatments for consumer and industrial purposes), laundry & home care (household cleaning products such as laundry detergent and dishwashing liquid), beauty care (beauty & oral care products such as shampoos, toothpaste, hair colorants, and shower products), and corporate.

Laminating Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments |

By Resin |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France). A total of 25 players have been covered. |

This research report categorizes the Laminating adhesives market based on Resin, Technology, End-use Industry, and Region.

Laminating Adhesives Market by Resin:

- Polyurethane

- Acrylic

- Others

Laminating Adhesives Market by Technology:

- Solvent-Based

- Water-Based

- Solvent-less

- Others

Laminating Adhesives Market by End-use Industry:

-

Packaging

- Food & Beverages

- Pharmaceuticals

- Consumer Products

-

Industrial

- Insulation

- Window Films

- Electronics

- Other Applications

- Automotive & Transportation

Laminating Adhesives Market by Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In November 2022, Henkel AG went into a strategic partnership cyclos-HTP Institute (CHI), a specialized company in classification, assessment, and certification of recyclability of packaging and goods. This will include access to in-house testing and certification, joint material science R&D.

- In Septembber 2022, Henkel acquires advanced materials start-up NBD Nanotechnologies Inc., US-based advanced materials company. This acquisition Henkel aims to strengthen the position of its Adhesive Technologies business unit in the area of functional coatings.

Frequently Asked Questions (FAQ):

What are the growth driving factors of laminating adhesives market?

Increasing demand for customer-friendly packaging.

What are the major end-use for laminating adhesives?

The major end-use industries of laminating adhesives are packaging, Industrial, and Automotives & Transportation.

Who are the major manufacturers?

Henkel AG (Germany), 3M (US), H.B. Fuller (US), The Dow Chemical Company (US), Arkema S.A. (France), are some of the leading players operating in the global laminating adhesives market.

What are the reasons behind laminating adhesives gaining market share?

Laminating Adhesives are gaining market share due to Increasing demand for customer-friendly packaging

Which is the largest region in the laminating adhesive market?

Asia Pacific is the largest region in laminating adhesive market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand from Asia Pacific- Increasing demand for customer-friendly packaging- Growing demand from packaged food industryRESTRAINTS- Environmental regulations in North America and EuropeOPPORTUNITIES- Growing demand for water-based and solventless adhesivesCHALLENGES- Health issues due to formation of PAA

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECAST

-

5.7 KEY INDUSTRY TRENDSTRENDS IN AUTOMOTIVE INDUSTRYTRENDS IN CONSUMER ELECTRONICS INDUSTRYTRENDS IN PACKAGING INDUSTRY

- 5.8 REGULATORY LANDSCAPE

- 5.9 PRICING ANALYSIS

-

5.10 ECOSYSTEM AND INTERCONNECTED MARKETS

-

5.11 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

-

5.12 TRADE DATA STATISTICS: KEY EXPORTING AND IMPORTING COUNTRIESLAMINATING ADHESIVES TRADE SCENARIO, 2020–2022

-

5.13 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Political instability in Germany- Energy crisis in Europe

-

5.14 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSLEGAL STATUS OF PATENTSTOP JURISDICTIONSTOP APPLICANTS

- 5.15 CASE STUDY

- 5.16 TECHNOLOGY ANALYSIS

- 5.17 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.18 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.1 INTRODUCTION

-

6.2 POLYURETHANEDOMINATES OVERALL LAMINATING ADHESIVES MARKET

-

6.3 ACRYLICDEMAND FROM FLEXIBLE PACKAGING APPLICATIONS TO BOOST MARKET

- 6.4 OTHERS

- 7.1 INTRODUCTION

-

7.2 SOLVENT-BASEDDOMINATES OVERALL LAMINATING ADHESIVES MARKET

-

7.3 WATER-BASEDGROWING DEMAND FOR GREEN AND SUSTAINABLE ADHESIVES

-

7.4 SOLVENTLESSPROJECTED TO BE FASTEST-GROWING SEGMENT

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 PACKAGINGLARGEST END-USE INDUSTRY OF LAMINATING ADHESIVESFOOD & BEVERAGE- Reduction in energy, material use, and packaging costs to drive demandPHARMACEUTICALS- Large population driving consumptionCONSUMER PRODUCTS- Growth of E-commerce industry and increase in consumer awareness

-

8.3 INDUSTRIALGROWING ELECTRONICS INDUSTRY DRIVING CONSUMPTIONINSULATION- Asia Pacific leads laminating adhesives market in insulation applicationWINDOW FILMS- Increasing demand from glazing applicationELECTRONICS- Laminating adhesives widely used in numerous electronic applicationsOTHER APPLICATIONS

-

8.4 AUTOMOTIVE & TRANSPORTATIONLAMINATING ADHESIVES USED TO IMPROVE VEHICLE EFFICIENCY

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Largest laminating adhesives marketJAPAN- Adhesive industry declining due to maturity of marketINDIA- India to register highest growth rateSOUTH KOREA- Growth in automotive industry to fuel demand for laminating adhesivesTAIWAN- Increase in domestic consumption s to drive marketTHAILAND- Easy availability of raw materials and low import taxes supporting market growthMALAYSIA- Growing food & beverage industry to drive demand for laminating adhesivesREST OF ASIA PACIFIC

-

9.3 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Technological leadership and strong R&D to drive marketFRANCE- Packaging industry to drive laminating adhesives marketUK- Existing industrial base and availability of raw materials to drive marketITALY- Food & beverages, healthcare, and consumer goods industries to be major consumers of laminating adhesivesRUSSIA- Financial sanctions and falling oil prices negatively affecting Russian economyTURKEY- Rapidly emerging as fast-growing market in EuropeREST OF EUROPE

-

9.4 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- US dominates North American laminating adhesives marketCANADA- Food & beverages and pharmaceutical applications to be major consumers of laminating adhesivesMEXICO- Automotive to be fastest-growing application of laminating adhesives

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Growing healthcare and food sectors to propel demand for laminating adhesivesSOUTH AFRICA- Growing industrialization and urbanization to drive laminating adhesives marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Brazil to be largest South American laminating adhesives marketARGENTINA- Strategic Industrial Plan 2020 to support market for laminating adhesivesCOLOMBIA- Automotive industry to drive demand for laminating adhesivesREST OF SOUTH AMERICA

- 10.1 OVERVIEW

-

10.2 COMPANY EVALUATION QUADRANT MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 10.3 STRENGTH OF PRODUCT PORTFOLIO

-

10.4 SMES EVALUATION QUADRANT MATRIX, 2022RESPONSIVE COMPANIESPROGRESSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.5 COMPETITIVE BENCHMARKING

-

10.6 COMPETITIVE SCENARIOMARKET EVALUATION MATRIX

- 10.7 MARKET SHARE ANALYSIS

- 10.8 MARKET RANKING ANALYSIS

-

10.9 REVENUE ANALYSISHENKEL AG3MH.B. FULLERTHE DOW CHEMICAL COMPANYARKEMA S.A.

- 10.10 COMPETITIVE SCENARIOS

-

11.1 MAJOR PLAYERSHENKEL AG- Business overview- Products offered- Recent developments- MnM view3M- Business overview- Products offered- Recent developments- MnM viewH.B. FULLER- Business overview- Products offered- Recent developments- MnM viewTHE DOW CHEMICAL COMPANY- Business overview- Products offered- Recent developments- MnM viewARKEMA S.A.- Business overview- Products offered- Recent developmentsSIKA AG- Business overview- Products offered- Recent developmentsDIC CORPORATION- Business overview- Products offered- Recent developmentsPIDILITE INDUSTRIES- Business overview- Products offeredDUPONT- Business overview- Products offered- Recent developmentsFLINT GROUP- Business overview- Products offered

-

11.2 OTHER PLAYERSCOIM GROUP- Business overview- Products offered- Recent developmentsVIMASCO CORPORATION- Business overview- Products offeredJUBILANT INDUSTRIES- Business overview- Products offeredFRANKLIN INTERNATIONAL- Business overview- Products offeredMASTER BOND INC.- Business overview- Products offeredFUJIFILM CORPORATION- Business overview- Products offeredDYMAX CORPORATION- Business overview- Products offeredBOND TECH INDUSTRIES- Business overview- Products offeredL.D. DAVIS- Business overview- Products offeredHUBER GROUP- Business overview- Products offeredWEILBURGER (GREBE HOLDING GMBH)- Business overview- Products offeredUFLEX LIMITED- Business overview- Products offeredTOYO-MORTON LTD.- Business overview- Products offeredPARAMELT B.V.- Business overview- Products offeredCHEMLINE INDIA LTD.- Business overview- Products offered

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 ADHESIVE FILMS MARKETMARKET DEFINITIONMARKET OVERVIEWADHESIVE FILMS MARKET ANALYSIS, BY RESIN TYPE- Acrylic adhesive films- Rubber adhesive films- Silicone adhesive films- Other adhesive filmsADHESIVE FILMS MARKET, BY FILM MATERIALADHESIVE FILMS MARKET, BY APPLICATIONADHESIVE FILMS MARKET, BY END-USE INDUSTRYADHESIVE FILMS MARKET, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 LAMINATING ADHESIVES MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 2 LAMINATING ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- TABLE 4 KEY BUYING CRITERIA FOR LAMINATING ADHESIVES

- TABLE 5 SUPPLY CHAIN ECOSYSTEM

- TABLE 6 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE

- TABLE 7 AUTOMOTIVE INDUSTRY PRODUCTION (2021–2022)

- TABLE 8 MOST COMMON FLEXIBLE PACKAGING STRUCTURES

- TABLE 9 COUNTRY-WISE EXPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE IMPORT DATA, 2020–2022 (USD THOUSAND)

- TABLE 11 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- TABLE 12 TOP 10 PATENT OWNERS, 2022

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 18 LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 19 LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 20 LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 21 POLYURETHANE LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 22 POLYURETHANE LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 23 POLYURETHANE LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 24 POLYURETHANE LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ACRYLIC LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 26 ACRYLIC LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 27 ACRYLIC LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 28 ACRYLIC LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 OTHER RESINS-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 30 OTHER RESINS-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 31 OTHER RESINS-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 32 OTHER RESINS-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 COMPARISON OF PROPERTIES OF MAJOR TECHNOLOGIES

- TABLE 34 LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 35 LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 36 LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 37 LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 38 SOLVENT-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 39 SOLVENT-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 40 SOLVENT-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 41 SOLVENT-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 WATER-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 43 WATER-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 44 WATER-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 45 WATER-BASED LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 SOLVENTLESS LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 47 SOLVENTLESS LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 48 SOLVENTLESS LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 49 SOLVENTLESS LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 LAMINATING ADHESIVES MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020–2022 (KILOTON)

- TABLE 51 LAMINATING ADHESIVES MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2023–2028 (KILOTON)

- TABLE 52 LAMINATING ADHESIVES MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2020–2022 (USD MILLION)

- TABLE 53 LAMINATING ADHESIVES MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 55 LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 56 LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 57 LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 59 LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 60 LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 61 LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 LAMINATING ADHESIVES MARKET IN PACKAGING, BY REGION, 2020–2022 (KILOTON)

- TABLE 63 LAMINATING ADHESIVES MARKET IN PACKAGING, BY REGION, 2023–2028 (KILOTON)

- TABLE 64 LAMINATING ADHESIVES MARKET IN PACKAGING, BY REGION, 2020–2022 (USD MILLION)

- TABLE 65 LAMINATING ADHESIVES MARKET IN PACKAGING, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 LAMINATING ADHESIVES MARKET IN FOOD & BEVERAGE APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 67 LAMINATING ADHESIVES MARKET IN FOOD & BEVERAGE APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 68 LAMINATING ADHESIVES MARKET IN FOOD & BEVERAGE APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 69 LAMINATING ADHESIVES MARKET IN FOOD & BEVERAGE APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 LAMINATING ADHESIVES MARKET IN PHARMACEUTICALS APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 71 LAMINATING ADHESIVES MARKET IN PHARMACEUTICALS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 72 LAMINATING ADHESIVES MARKET IN PHARMACEUTICALS APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 73 LAMINATING ADHESIVES MARKET IN PHARMACEUTICALS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 LAMINATING ADHESIVES MARKET IN CONSUMER PRODUCTS APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 75 LAMINATING ADHESIVES MARKET IN CONSUMER PRODUCTS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 76 LAMINATING ADHESIVES MARKET IN CONSUMER PRODUCTS APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 77 LAMINATING ADHESIVES MARKET IN CONSUMER PRODUCTS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 79 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 80 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 81 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY REGION, 2020–2022 (KILOTON)

- TABLE 83 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY REGION, 2023–2028 (KILOTON)

- TABLE 84 LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY REGION, 2020–2022 (USD MILLION)

- TABLE 85 LAMINATING ADHESIVES MARKET SIZE IN INDUSTRIAL, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 LAMINATING ADHESIVES MARKET IN INSULATION APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 87 LAMINATING ADHESIVES MARKET IN INSULATION APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 88 LAMINATING ADHESIVES MARKET IN INSULATION APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 89 LAMINATING ADHESIVES MARKET IN INSULATION APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 LAMINATING ADHESIVES MARKET IN WINDOW FILMS APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 91 LAMINATING ADHESIVES MARKET IN WINDOW FILMS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 92 LAMINATING ADHESIVES MARKET IN WINDOW FILMS APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 93 LAMINATING ADHESIVES MARKET IN WINDOW FILMS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 LAMINATING ADHESIVES MARKET IN ELECTRONICS APPLICATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 95 LAMINATING ADHESIVES MARKET IN ELECTRONICS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 96 LAMINATING ADHESIVES MARKET IN ELECTRONICS APPLICATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 97 LAMINATING ADHESIVES MARKET IN ELECTRONICS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 LAMINATING ADHESIVES MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2020–2022 (KILOTON)

- TABLE 99 LAMINATING ADHESIVES MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 100 LAMINATING ADHESIVES MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2020–2022 (USD MILLION)

- TABLE 101 LAMINATING ADHESIVES MARKET IN OTHER INDUSTRIAL APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 LAMINATING ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2020–2022 (KILOTON)

- TABLE 103 LAMINATING ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 104 LAMINATING ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2020–2022 (USD MILLION)

- TABLE 105 LAMINATING ADHESIVES MARKET IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (KILOTON)

- TABLE 107 LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 108 LAMINATING ADHESIVES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 109 LAMINATING ADHESIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 111 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 112 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 115 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 116 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 119 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 120 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 123 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 124 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 127 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 128 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 131 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 132 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 134 CHINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 135 CHINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 136 CHINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 137 CHINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 138 JAPAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 139 JAPAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 140 JAPAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 141 JAPAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 142 INDIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 143 INDIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 144 INDIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 145 INDIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 147 SOUTH KOREA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 148 SOUTH KOREA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 149 SOUTH KOREA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 150 TAIWAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 151 TAIWAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 152 TAIWAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 153 TAIWAN: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 154 THAILAND: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 155 THAILAND: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 156 THAILAND: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 157 THAILAND: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 158 MALAYSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 159 MALAYSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 160 MALAYSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 161 MALAYSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 163 REST OF ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 164 REST OF ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 166 EUROPE: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 167 EUROPE: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 168 EUROPE: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 169 EUROPE: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 170 EUROPE: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 171 EUROPE: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 172 EUROPE: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 173 EUROPE: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 174 EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 175 EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 176 EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 177 EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 178 EUROPE: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 179 EUROPE: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 180 EUROPE: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 181 EUROPE: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 182 EUROPE: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 183 EUROPE: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 184 EUROPE: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 185 EUROPE: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 186 EUROPE: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 187 EUROPE: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 188 EUROPE: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 189 EUROPE: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 GERMANY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 191 GERMANY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 192 GERMANY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 193 GERMANY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 194 FRANCE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 195 FRANCE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 196 FRANCE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 197 FRANCE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 198 UK: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 199 UK: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 200 UK: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 201 UK: LAMINATING ADHESIVES MARKET SIZE, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 202 ITALY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 203 ITALY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 204 ITALY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 205 ITALY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 206 RUSSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 207 RUSSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 208 RUSSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 209 RUSSIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 210 TURKEY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 211 TURKEY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 212 TURKEY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 213 TURKEY: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 215 REST OF EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 216 REST OF EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 217 REST OF EUROPE: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 218 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 219 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 220 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 221 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 222 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 223 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 224 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 225 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 227 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 228 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 229 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 230 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 231 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 232 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 233 NORTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 234 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 235 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 236 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 237 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 238 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 239 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 240 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 241 NORTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 242 US: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 243 US: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 244 US: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 245 US: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 246 CANADA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 247 CANADA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 248 CANADA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 249 CANADA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 250 MEXICO: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 251 MEXICO: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 252 MEXICO: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 253 MEXICO: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 255 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 259 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 263 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 267 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 275 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 276 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 278 SAUDI ARABIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 279 SAUDI ARABIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 280 SAUDI ARABIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 281 SAUDI ARABIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 282 SOUTH AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 283 SOUTH AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 284 SOUTH AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 285 SOUTH AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 286 REST OF MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 287 REST OF MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 288 REST OF MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 290 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 291 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 292 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 293 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 294 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (KILOTON)

- TABLE 295 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (KILOTON)

- TABLE 296 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 297 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 298 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 299 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 300 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 301 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 302 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 303 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 304 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 305 SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 306 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 307 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 308 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 309 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN PACKAGING, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 310 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (KILOTON)

- TABLE 311 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 312 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 313 SOUTH AMERICA: LAMINATING ADHESIVES MARKET IN INDUSTRIAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 314 BRAZIL: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 315 BRAZIL: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 316 BRAZIL: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 317 BRAZIL: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 318 ARGENTINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 319 ARGENTINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 320 ARGENTINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 321 ARGENTINA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 322 COLOMBIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 323 COLOMBIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 324 COLOMBIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 325 COLOMBIA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 326 REST OF SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (KILOTON)

- TABLE 327 REST OF SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (KILOTON)

- TABLE 328 REST OF SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2020–2022 (USD MILLION)

- TABLE 329 REST OF SOUTH AMERICA: LAMINATING ADHESIVES MARKET, BY RESIN TYPE, 2023–2028 (USD MILLION)

- TABLE 330 OVERVIEW OF STRATEGIES ADOPTED BY KEY LAMINATING ADHESIVE PLAYERS (2019–2023)

- TABLE 331 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 332 COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

- TABLE 333 COMPANY EVALUATION MATRIX

- TABLE 334 PRODUCT FOOTPRINT OF COMPANIES

- TABLE 335 INDUSTRY FOOTPRINT OF COMPANIES

- TABLE 336 REGION FOOTPRINT OF COMPANIES

- TABLE 337 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 338 MOST FOLLOWED STRATEGIES

- TABLE 339 GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 340 DEGREE OF COMPETITION, 2022

- TABLE 341 PRODUCT LAUNCHES, 2018–2023

- TABLE 342 DEALS, 2018–2023

- TABLE 343 HENKEL AG: COMPANY OVERVIEW

- TABLE 344 HENKEL AG: PRODUCT LAUNCHES

- TABLE 345 HENKEL AG: DEALS

- TABLE 346 3M: COMPANY OVERVIEW

- TABLE 347 3M: DEALS

- TABLE 348 H.B. FULLER: COMPANY OVERVIEW

- TABLE 349 H.B. FULLER: PRODUCT LAUNCHES

- TABLE 350 H.B. FULLER: DEALS

- TABLE 351 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 352 THE DOW CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 353 THE DOW CHEMICAL COMPANY: DEALS

- TABLE 354 ARKEMA S.A.: COMPANY OVERVIEW

- TABLE 355 ARKEMA S.A.: DEALS

- TABLE 356 SIKA AG: COMPANY OVERVIEW

- TABLE 357 SIKA AG: DEALS

- TABLE 358 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 359 DIC CORPORATION: DEALS

- TABLE 360 PIDILITE INDUSTRIES: COMPANY OVERVIEW

- TABLE 361 DUPONT: COMPANY OVERVIEW

- TABLE 362 DUPONT: DEALS

- TABLE 363 FLINT GROUP: COMPANY OVERVIEW

- TABLE 364 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (USD MILLION)

- TABLE 365 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (USD MILLION)

- TABLE 366 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (USD MILLION)

- TABLE 367 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2018–2021 (MILLION SQUARE METER)

- TABLE 368 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2022–2027 (MILLION SQUARE METER)

- TABLE 369 ADHESIVE FILMS MARKET, BY FILM MATERIAL, 2028–2030 (MILLION SQUARE METER)

- TABLE 370 ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 371 ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 372 ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (USD MILLION)

- TABLE 373 ADHESIVE FILMS MARKET, BY APPLICATION, 2018–2021 (MILLION SQUARE METER)

- TABLE 374 ADHESIVE FILMS MARKET, BY APPLICATION, 2022–2027 (MILLION SQUARE METER)

- TABLE 375 ADHESIVE FILMS MARKET, BY APPLICATION, 2028–2030 (MILLION SQUARE METER)

- TABLE 376 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 377 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (USD MILLION)

- TABLE 378 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (USD MILLION)

- TABLE 379 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2018–2021 (MILLION SQUARE METER)

- TABLE 380 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2022–2027 (MILLION SQUARE METER)

- TABLE 381 ADHESIVE FILMS MARKET, BY END-USE INDUSTRY, 2028–2030 (MILLION SQUARE METER)

- TABLE 382 ADHESIVE FILMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 383 ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 384 ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (USD MILLION)

- TABLE 385 ADHESIVE FILMS MARKET BY REGION, 2018–2021 (MILLION SQUARE METER)

- TABLE 386 ADHESIVE FILMS MARKET, BY REGION, 2022–2027 (MILLION SQUARE METER)

- TABLE 387 ADHESIVE FILMS MARKET, BY REGION, 2028–2030 (MILLION SQUARE METER)

- FIGURE 1 LAMINATING ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 LAMINATING ADHESIVES MARKET SIZE ESTIMATION, BY VOLUME

- FIGURE 5 LAMINATING ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 6 ASIA PACIFIC TO LEAD GLOBAL LAMINATING ADHESIVES MARKET

- FIGURE 7 PACKAGING INDUSTRY TO DOMINATE OVERALL LAMINATING ADHESIVES MARKET

- FIGURE 8 SOLVENTLESS TECHNOLOGY SEGMENT TO REGISTER HIGHEST CAGR

- FIGURE 9 POLYURETHANE LAMINATING ADHESIVES ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 10 ASIA PACIFIC WAS LARGEST MARKET FOR LAMINATING ADHESIVES IN 2022

- FIGURE 11 LAMINATING ADHESIVES MARKET TO WITNESS HIGH GROWTH BETWEEN 2023 AND 2028

- FIGURE 12 POLYURETHANE TO BE DOMINATING SEGMENT IN OVERALL LAMINATING ADHESIVES MARKET

- FIGURE 13 INDIA TO WITNESS HIGHEST GROWTH IN GLOBAL LAMINATING ADHESIVES MARKET

- FIGURE 14 PACKAGING WAS LARGEST END-USE INDUSTRY OF LAMINATING ADHESIVES IN 2022

- FIGURE 15 MARKET IN DEVELOPING COUNTRIES TO GROW FASTER THAN IN DEVELOPED COUNTRIES

- FIGURE 16 INDIA EMERGING AS LUCRATIVE MARKET FOR LAMINATING ADHESIVES

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LAMINATING ADHESIVES MARKET

- FIGURE 18 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 20 KEY BUYING CRITERIA FOR LAMINATING ADHESIVES

- FIGURE 21 VALUE CHAIN ANALYSIS OF LAMINATING ADHESIVES MARKET

- FIGURE 22 CONSUMER ELECTRONICS INDUSTRY REVENUE, BY SEGMENT (2018–2028)

- FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN LAMINATING ADHESIVES MARKET, BY REGION

- FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN LAMINATING ADHESIVES MARKET, BY RESIN TYPE

- FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN LAMINATING ADHESIVES MARKET, BY TECHNOLOGY

- FIGURE 26 AVERAGE PRICE COMPETITIVENESS IN LAMINATING ADHESIVES MARKET, BY END-USE INDUSTRY

- FIGURE 27 AVERAGE PRICING FOR KEY INDUSTRIES, BY MAJOR PLAYERS

- FIGURE 28 LAMINATING ADHESIVES ECOSYSTEM

- FIGURE 29 YC AND YCC SHIFT

- FIGURE 30 PATENT PUBLICATION TRENDS: DOCUMENT COUNT

- FIGURE 31 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 32 NUMBER OF PATENTS PUBLISHED, BY JURISDICTION

- FIGURE 33 PATENTS PUBLISHED BY MAJOR APPLICANTS

- FIGURE 34 POLYURETHANE TO BE DOMINANT SEGMENT IN OVERALL LAMINATING ADHESIVES MARKET

- FIGURE 35 SOLVENT-BASED TECHNOLOGY TO LEAD OVERALL LAMINATING ADHESIVES MARKET

- FIGURE 36 PACKAGING INDUSTRY TO DOMINATE LAMINATING ADHESIVES MARKET

- FIGURE 37 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 39 EUROPE: LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: LAMINATING ADHESIVES MARKET SNAPSHOT

- FIGURE 41 SAUDI ARABIA TO WITNESS HIGHEST GROWTH IN LAMINATING ADHESIVES MARKET

- FIGURE 42 BRAZIL DOMINATED LAMINATING ADHESIVES MARKET IN SOUTH AMERICA

- FIGURE 43 COMPANY EVALUATION QUADRANT MATRIX, 2022

- FIGURE 44 SMES EVALUATION QUADRANT MATRIX, 2022

- FIGURE 45 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 46 MARKET RANKING ANALYSIS, 2022

- FIGURE 47 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2021

- FIGURE 48 HENKEL AG: COMPANY SNAPSHOT

- FIGURE 49 3M: COMPANY SNAPSHOT

- FIGURE 50 H.B. FULLER: COMPANY SNAPSHOT

- FIGURE 51 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 52 ARKEMA S.A.: COMPANY SNAPSHOT

- FIGURE 53 SIKA AG: COMPANY SNAPSHOT

- FIGURE 54 DIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 PIDILITE INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 56 DUPONT: COMPANY SNAPSHOT

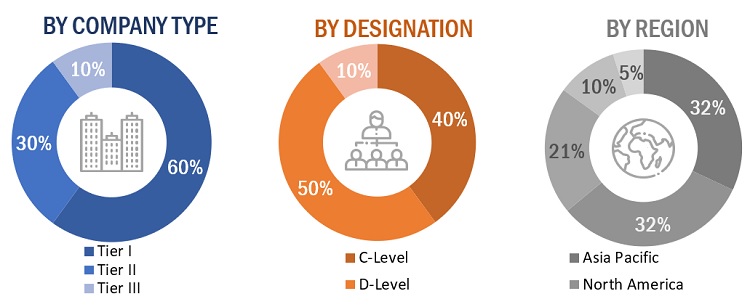

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg L.P., Factiva, ICIS, and OneSource, to identify and collect information useful for this technical, market-oriented, and commercial study of the global laminating adhesives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the value chain of this industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess growth prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases & investor presentations of companies, white papers, regulatory bodies, trade directories, certified publications, articles from recognized authors, gold and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

In the primary research process, various sources from both, the supply and demand sides were interviewed to obtain and verify qualitative and quantitative information for this report as well as analyze prospects. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various leading companies and organizations operating in the laminating adhesives market. Primary sources from the demand side include experts and key persons from the application segment. Extensive primary research has been conducted after understanding and analyzing the current scenario of the Laminating Adhesive Industry through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the laminating adhesives market size and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market shares in the key regions have been determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top players and extensive interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters affecting the markets covered in this study were accounted for, viewed in detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The three figures below represent the overall market size estimation process through the study.

Global Laminating Adhesives Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been used wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both, the demand and supply sides. The market has been validated using both, the top-down and bottom-up approaches.

Market Definition

Laminating adhesives are adhesives used to fix two or more layers of materials. They offer optical clarity, flame resistance, gas permeability, electrical insulation, thermoforming ability, and resistance from heat and chemical substances. These adhesives are used in packaging materials for snacks, confectionery, meat, cheese, agricultural chemicals, and medical products. They are also widely used in flexible packaging and industrial and automotive applications. Laminating adhesives for flexible packaging provide superior properties as compared to rigid packaging. Hence, lamination adhesives for flexible packaging are highly preferred in the industry.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, forecast, and analyze laminating adhesives market based on resin, technology, and end-use industry in terms of value

- To describe and forecast the size of the market based on five regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America, along with their respective countries in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing market growth

- To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s five forces analysis, key stakeholders and buying criteria, key conferences and events, regulatory bodies, government agencies, and regulations pertaining to the market under study

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2

- To analyze competitive developments such as product launches, acquisitions, agreements, investment & expansions, and partnerships in the market

Note: 1. Micromarkets are defined as the subsegments of the global laminating adhesives market included in the report.

2. Core competencies of companies are determined in terms of the key developments and strategies adopted by them to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Laminating adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laminating Adhesives Market

Research methodology and data required

Market trends of laminating adhesive market for specific applications

Market information for laminating adhesive for flexible packaging application in South Asia for each technology

Specific information on usage of laminating adhesives for flexible packaging market in North America

Laminating adhesive market report with concentration on USA and Canada

Report title not mentioned