Lancets Market by Type (Safety Lancets (Manually & Pressure activated), Standard Lancets, Application (Glucose Testing, Cholesterol Testing), Gauze Size (22G and Below), Age Group (Adult, Pediatrics), End Users (Hospitals), Region- Global Forecast to 2028

Market Growth Outlook Summary

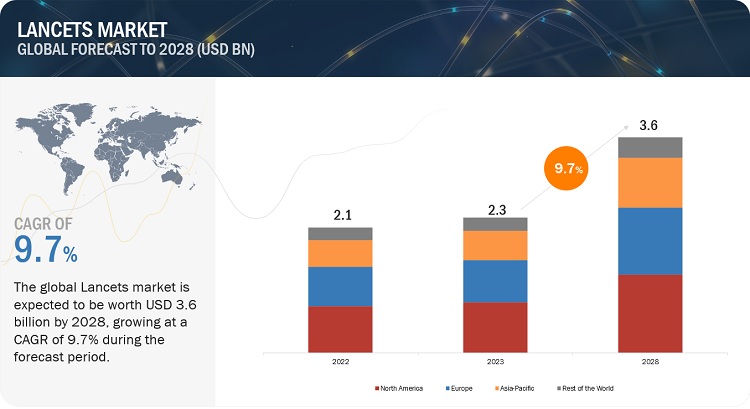

The global lancets market, valued at US$2.1 billion in 2022, stood at US$2.2 billion in 2023 and is projected to advance at a resilient CAGR of 9.7% from 2023 to 2028, culminating in a forecasted valuation of US$3.6 billion by the end of the period. Factors such as the increasing demand for painless lancets and growing awareness of novel technologies are driving the growth of this market. For instance, Owen Mumford introduced a 16-gauge (16G) safety lancet for high-volume capillary blood sampling within its leading Unistik product range. The new Unistik Touch 16G features one-touch activation and Comfort Zone Technology, which helps minimize the pain of finger sampling. Additionally, Greiner Bio-One expanded its portfolio by introducing the MiniCollect PIXIE Heel Incision Safety Lancet, a new safety lancet specifically designed for heel incisions.

Lancets Market – Global Forecast and Growth Insights to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Lancets Market – Global Forecast and Key Opportunities to 2028

Lancets Market Dynamics to 2028

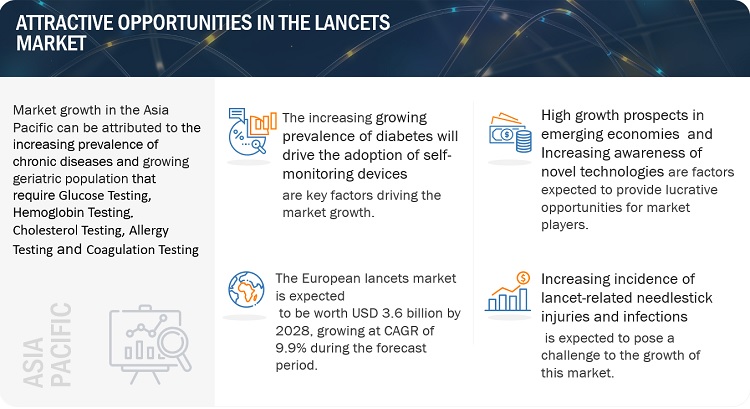

DRIVER: Growing prevalence of diabetes and increasing adoption of self-monitoring devices

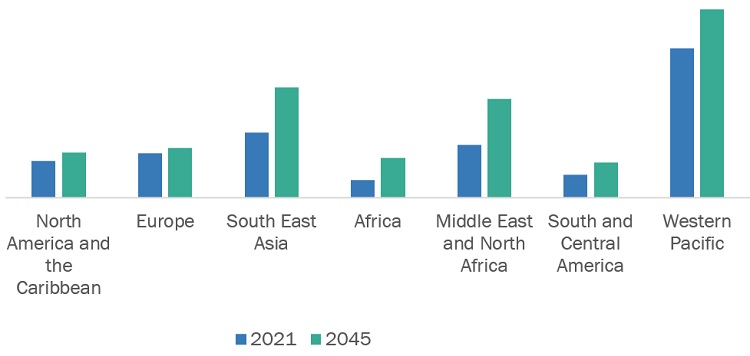

The prevalence of diabetes has increased significantly in the last few years. According to the IDF Diabetes Atlas, about 537 million adults (20–79 years) are living with diabetes. This number is projected to rise to 643 million by 2030 and 783 million by 2045. Over 3 in 4 adults with diabetes live in low- and middle-income countries. Diabetes was responsible for 6.7 million deaths in 2021 (1 every 5 seconds).

- According to the Centers for Disease Control and Prevention (CDC), in 2020, more than 34 million Americans had diabetes, which is nearly 11% of the US population.There are 1.5 million new cases of diabetes in the United States each year.

Lancets Market: Incidence of Diabetes, 2021 vs. 2045 (in Millions)

Source: International Diabetes Federation

The treatment for diabetes includes regular monitoring of glucose levels. Lancets are small and sharp medical devices used to draw a small drop of blood on the surface to test blood glucose with the help of a blood glucose monitor. The growing prevalence of diabetes has resulted in the increased adoption of lancets to effectively handle the growing patient pool.

OPPORTUNITY: High growth prospects in emerging countries

Emerging markets, such as India, China, and countries in Southeast Asia, showcase promising opportunities for the lancets industry due to their huge patient populations and increasing disposable incomes. The penetration of lancets is currently low in these countries. This is due to the limited product acceptance and lack of awareness in these countries. The scarcity of financial resources is another factor limiting the adoption of lancets in these countries. The introduction of cost-effective products and extensive promotional and awareness campaigns to improve the adoption of lancets can effectively overcome these challenges and help increase the penetration of lancets in developing countries.

In 2019, Sanofi India Limited launched the KiDS (Kids & Diabetes in Schools) program that provides diabetes education and promotes a healthy lifestyle in the school environment and the communities. The aim is to ensure a healthy tomorrow for future generations.

CHALLENGE: Increasing incidence of lancet-related needlestick injuries and infections

Needlestick injuries (NSIs) remain a global threat, with an estimated 44.5% of healthcare workers experiencing at least one occurrence annually. In Europe, steps have been taken to combat sharps injuries. The EU Directive 2010/32/EU has sparked greater conversation around implementing safer work environments and practices to help protect healthcare workers from needlestick injuries and infections.

Needlestick injuries are one of the major risks associated with personal lancet usage. According to the American Medical Association, in the US, around 600,000 to 800,000 needlestick injuries are reported every year. Approximately 5.6 million healthcare workers in the US alone are at risk of occupational exposure to bloodborne pathogens via needlestick or other sharps-related injuries (Source: Occupational Safety and Health Administration). The CDC estimates that an average of 385,000 needlestick injuries occur annually in US hospital settings.

The increasing number of needlestick injuries (NSIs) and infections arising from contaminated lancets is a major concern faced by both patients and doctors across the globe. Needlestick injuries are one of the most serious health and safety threats associated with the use of lancet needles.

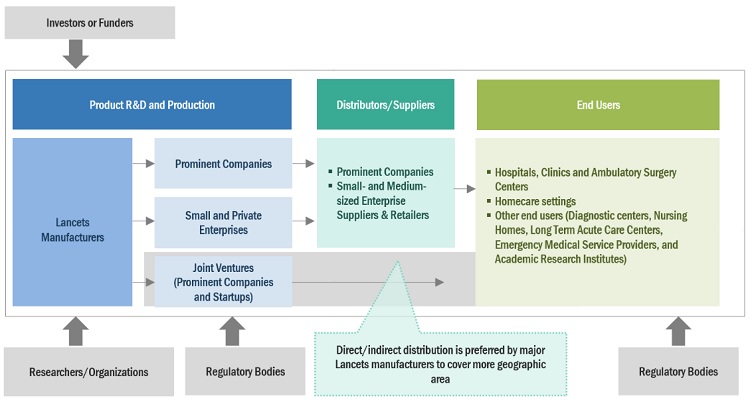

Lancets Market Map & Ecosystem Overview

Prominent companies in this market include well-established, financially stable manufacturers of lancets, safety lancets and standard lancets. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks.

In 2022, safety lancets segment to observe highest growth rate of the lancets market, by type

Based on the type, the global market is broadly segmented into safety and standard lancets. Safety lancets segment to raising demand for painless lancets and the treatment of testing of diabetes and other chronic disease in geriatric patients. For instance, In the US, the population of individuals aged 65 years and above is estimated to increase from 44.4 million in 2013 to 72.8 million by 2030, representing an increase of 64%; this figure is further expected to reach 89 million by 2050 (Source: US Census Bureau and Population Reference Bureau, Vol. 66, No. 1). It is estimated that one in three people in Japan will be aged 65 years and above by 2035 (Source: Japan’s National Institute of Population and Social Security Research).

In 2022, Hospitals, Clinics and Ambulatory Surgery Centers segment to dominate the lancets market, by end user

Based on end user, the market is segmented into Hospitals, Clinics and Ambulatory Surgery Centers, Homecare settings and other end users. into Hospitals, Clinics and Ambulatory Surgery Centers to dominate the market due to increasing number of geriatric populations which will increase the demand of rising number of hospitals and surgical centers. The number of hospitals and surgical centers is increasing across the globe due to the rising demand for regular glucose testing, hemoglobin testing, cholesterol testing, allergy testing, coagulation testing, and neonatal screening. The number of hospitals and surgical centers is increasing in both developed and emerging countries. The demand for medical or surgical devices (including lancets) is high in these newly established surgical centers and hospitals, owing to the increasing patient population base

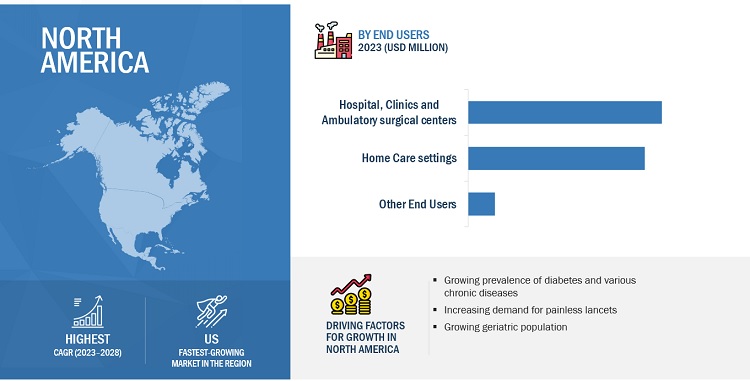

In 2022, North America to dominate in Lancets market

Based on the region segmentation, the lancets market is divided into North America, Europe, Asia Pacific and the Rest of the World. North America holds the largest share and expects to dominate the lancets market. Growth in the North American market is mainly driven by development and awareness of novel technologies, growing geriatric population and increasing number of hospitals and surgical centers. For instance, In 2021, FUJIFILM Corporation opened NURA, a medical screening center focusing on cancer screening in Bangalore, India. This medical screening center is operated by FUJIFILM DKH LLP (FUJIFILM DKH) and Dr. Kutty’s Healthcare (DKH). FUJIFILM DKH LLP (FUJIFILM DKH) is a joint venture of FUJIFILM and Dr. Kutty’s Healthcare (DKH), which runs hospitals and screening centers in India and the Middle East.

Lancets Market by Region – Forecast to 2028

To know about the assumptions considered for the study, download the pdf brochure

The global lancets market is dominated by players such as Becton, Dickinson and Company (US), F. Hoffmann-La Roche Ltd. (Switzerland), B. Braun SE (Germany), Abbott Laboratories (US), Greiner Bio-One International GmbH (Austria), Ypsomed (Switzerland), and Terumo Corporation (Japan).

Lancets Market Report Scope and Insights

Lancets Market Segmentation and Analysis

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

By Product

- Standard Lancets

- Safety Lancets

-

Manually Activated

- Push Button Lancets

- Side Button Lancets

- Automatically activated/Pressure activated

By Application

- Glucose Testing

- Hemoglobin Testing

- Coagulation Testing

- Cholesterol Testing

- Allergy Testing

- Neonatal Screening

- Other Applications

By Gauze Size

- 22G and below

- 23G-33G

- Above 33G

By Age Group

- Adult

- Pediatrics

By End User

- Hospitals, Clinics and Ambulatory Surgery Centers

- Homecare settings

- Other end users (Diagnostic centers, Nursing Homes, Long Term Acute Care Centers, Emergency Medical Service Providers, and Academic Research Institutes)

Lancets Market Recent Developments and Insights

- In 2023, Astellas Pharma announced that it has entered into an agreement with Roche Diabetes Care Japan Co., Ltd. for the development and commercialization of Roche Diabetes Care’s world-renowned Accu-Chek Guide Me blood glucose monitoring system with advanced accuracy as a combined medical product with BlueStar.

- In 2022, BD announced the completion of the spinoff of Embecta Corp., which holds BD’s former Diabetes Care business and is one of the largest diabetes management companies in the world.

- In 2021, Greiner Bio-One introduced MiniCollect PIXIE Heel Incision Safety Lancet to expand its portfolio. The new safety lancet is specially designed for heel incisions.

Frequently Asked Questions (FAQ):

What is the projected growth and market value of the global lancets market?

The global lancets market is projected to grow from US$ 2.3 billion in 2023 to US$ 3.6 billion by 2028, demonstrating a robust CAGR of 9.7%.

What are the major factors driving the growth of the lancets market?

The growth of the lancets market is driven by factors such as the increasing diabetic population, rising prevalence of chronic diseases, the aging population, and the demand for painless lancet solutions. Technological advancements like safety lancets with minimal pain and discomfort also contribute to market expansion.

What types of lancets are available in the market?

Lancets are categorized into safety and standard lancets. Safety lancets include manually activated and automatically activated (pressure activated) types, with push button safety lancets seeing the highest demand due to their user-friendly design and pain-minimizing features. Standard lancets are commonly used for traditional blood sampling.

Which application segment is expected to drive growth in the lancets market?

The glucose testing application segment is expected to witness the highest growth due to the rising number of diabetes cases globally. Lancets are widely used for daily glucose monitoring, contributing to the growing demand for specialized lancet products, especially in the diabetes care market.

What are the end-user segments driving the lancets market?

The largest share of the lancets market is held by hospitals, clinics, and ambulatory surgery centers. The demand is increasing for lancets due to the rise in chronic diseases such as diabetes, heart disease, and cancer, which require regular testing. Homecare settings are also growing as a significant end-user segment.

Which regions are expected to dominate the lancets market?

North America is expected to dominate the lancets market due to its advanced healthcare infrastructure, increased awareness of novel lancet technologies, and the rising geriatric population. Europe and the Asia Pacific regions also show significant growth potential, particularly in emerging markets with increasing healthcare investments.

What are the key players in the lancets market?

Major players in the lancets market include Becton, Dickinson and Company, F. Hoffmann-La Roche Ltd., B. Braun, Abbott Laboratories, Greiner Bio-One International GmbH, and Terumo Corporation. These companies focus on product launches, strategic partnerships, and innovations to strengthen their market presence.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing prevalence of diabetes and increasing adoption of self-monitoring devices- Rising prevalence of various chronic diseases- Increasing demand for painless lancets- Growing geriatric population- Rising number of hospitals and surgical centersRESTRAINTS- Increasing incidence of lancet-related needlestick injuries and infections- Pricing pressure owing to reimbursement cuts and budget constraintsOPPORTUNITIES- High growth prospects in emerging countries- Increasing awareness of novel technologiesCHALLENGES- Reuse of lancets

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTES

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

- 5.8 TRADE ANALYSIS

-

5.9 ECOSYSTEM ANALYSIS

-

5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE OF KEY PRODUCTS

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.14 TECHNOLOGY ANALYSIS

- 6.1 INTRODUCTION

-

6.2 SAFETY LANCETSMANUALLY ACTIVATED LANCETS- Side-button lancets- Push-button lancetsAUTOMATICALLY ACTIVATED/PRESSURE-ACTIVATED LANCETS- Available in number of gauge sizes and penetration depths

-

6.3 STANDARD LANCETSINCREASING PREVALENCE OF DIABETES TO DRIVE ADOPTION

- 7.1 INTRODUCTION

-

7.2 22G AND BELOWBENEFICIAL FOR MEDICAL TESTS THAT REQUIRE LARGER SAMPLE SIZE

-

7.3 23G–33GWIDE AVAILABILITY OF 23G–33G LANCETS TO AID MARKET GROWTH

-

7.4 ABOVE 33GLESS PAIN AND DISCOMFORT TO DRIVE ADOPTION

- 8.1 INTRODUCTION

-

8.2 ADULTLARGEST AND FASTEST-GROWING SEGMENT

-

8.3 PEDIATRICINCREASING PREVALENCE OF TYPE 1 DIABETES IN PEDIATRIC PATIENTS TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 GLUCOSE TESTINGRISING PREVALENCE OF DIABETES TO DRIVE MARKET

-

9.3 HEMOGLOBIN TESTINGHIGH PREVALENCE OF ANEMIA TO DRIVE DEMAND

-

9.4 COAGULATION TESTINGRISING PREVALENCE OF LIVER DISEASES, THROMBOPHILIA, AND HEMOPHILIA TO DRIVE MARKET

-

9.5 CHOLESTEROL TESTINGRISING DEMAND FOR CHOLESTEROL HOME TEST KITS TO SUPPORT MARKET GROWTH

-

9.6 ALLERGY TESTINGHIGH DEMAND FOR SPT TO PROPEL MARKET

-

9.7 NEONATAL SCREENINGGROWING NEED FOR DRY BLOOD SPOT TESTS TO DRIVE MARKET

- 9.8 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 HOSPITALS, CLINICS, AND AMBULATORY SURGERY CENTERSINCREASING INCIDENCE OF CHRONIC DISEASES TO DRIVE ADOPTION OF LANCETS

-

10.3 HOME CARE SETTINGSTECHNOLOGICAL ADVANCEMENTS IN SELF/HOME CARE GLUCOSE MONITORING SYSTEMS TO DRIVE MARKET

- 10.4 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Increasing incidence and prevalence of lifestyle diseases to drive marketCANADA- Rising incidence of allergies to drive market

-

11.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Germany to dominate European lancets marketFRANCE- Growing public-private collaborations for product development to support market growthUK- Increasing prevalence of lifestyle diseases to drive marketITALY- Slower growth in healthcare sector to restrain market growthSPAIN- Increasing funding for research to boost market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONJAPAN- Well-established healthcare system to support market growthCHINA- Fastest-growing market for lancetsINDIA- High burden of chronic diseases to support market growthSOUTH KOREA- Increasing government initiatives to aid market growthREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLDLATIN AMERICA- Rising prevalence of diabetes and cancer to support market growth- Latin America: Impact of recessionMIDDLE EAST AND AFRICA- Rising geriatric population and increasing prevalence of chronic diseases to drive market- Middle East & Africa: Impact of recession

- 12.1 OVERVIEW

- 12.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.3 MARKET SHARE ANALYSIS

-

12.4 COMPETITIVE LEADERSHIP MAPPINGSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPANY EVALUATION QUADRANT FOR SMES/STARTUPSPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 12.6 COMPETITIVE BENCHMARKING

- 12.7 COMPANY FOOTPRINT ANALYSIS

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developments- MnM viewF. HOFFMANN-LA ROCHE LTD.- Business overview- Products offered- Recent developments- MnM viewYPSOMED- Business overview- Products offered- Recent developments- MnM viewB. BRAUN SE- Business overview- Products offered- Recent developments- MnM viewTERUMO CORPORATION- Business overview- Products offered- Recent developments- MnM viewGREINER BIO-ONE INTERNATIONAL GMBH- Business overview- Products offered- Recent developmentsABBOTT LABORATORIES- Business overview- Products offered- Recent developmentsOWEN MUMFORD- Business overview- Products offered- Recent developmentsHTL-STREFA S.A.- Business overview- Products offered- Recent developmentsARKRAY, INC.- Business overview- Products offered- Recent developmentsSARSTEDT AG & CO. KG- Business overview- Products offered- Recent developmentsSTERILANCE MEDICAL (SUZHOU) INC.- Business overview- Products offered- Recent developmentsMEDLINE INDUSTRIES- Business overview- Products offered- Recent developmentsAGAMATRIX, INC.- Business overview- Products offered- Recent developmentsACON LABORATORIES, INC.- Business overview- Products offered- Recent developmentsSANLI MEDICAL & HEALTH SERVICE- Business overview- Products offered- Recent developmentsALLISON MEDICAL, INC.- Business overview- Products offered- Recent developmentsGLUCORX LIMITED- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSFL MEDICAL S.R.LMHC MEDICAL PRODUCTS, LLCNEOMEDICCML BIOTECH LTD.DISERA TIBBI MALZEME LOJISTIK SANAYI VE TICARET A.S.A. MENARINI DIAGNOSTICS S.R.L

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 LANCETS MARKET: COUNTRY-LEVEL ANALYSIS (1/2)

- TABLE 2 RISK ASSESSMENT

- TABLE 3 GLOBAL GERIATRIC POPULATION, BY REGION, 2019 VS. 2030

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS (%)

- TABLE 5 KEY BUYING CRITERIA FOR HOSPITALS, CLINICS, AND AMBULATORY SURGERY CENTERS

- TABLE 6 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 7 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- TABLE 8 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 9 IMPORT DATA FOR HS CODE 901839, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 901839, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 ROLE IN ECOSYSTEM

- TABLE 12 LIST OF CONFERENCES AND EVENTS

- TABLE 13 PRICE RANGE OF KEY PRODUCTS IN THE LANCETS MARKET (USD)

- TABLE 14 LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 15 SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 16 SAFETY LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 17 MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 18 MANUALLY ACTIVATED LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 SIDE-BUTTON LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 PUSH-BUTTON LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 AUTOMATICALLY ACTIVATED/PRESSURE-ACTIVATED LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 STANDARD LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 24 22G AND BELOW LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 23G–33G LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 26 ABOVE 33G LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 28 ADULT LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 PEDIATRIC LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 31 LANCETS MARKET FOR GLUCOSE TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 LANCETS MARKET FOR HEMOGLOBIN TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 LANCETS MARKET FOR COAGULATION TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 LANCETS MARKET FOR CHOLESTEROL TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 LANCETS MARKET FOR ALLERGY TESTING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 LANCETS MARKET FOR NEONATAL SCREENING, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 LANCETS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 39 LANCETS MARKET FOR HOSPITALS, CLINICS, AND AMBULATORY SURGERY CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 LANCETS MARKET FOR HOME CARE SETTINGS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 LANCETS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: LANCETS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 51 US: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 US: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 US: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 US: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 55 US: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 56 US: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 57 US: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 58 CANADA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 CANADA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 CANADA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 CANADA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 62 CANADA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 63 CANADA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 64 CANADA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: LANCETS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 69 EUROPE: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 73 GERMANY: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 GERMANY: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 GERMANY: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 GERMANY: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 78 GERMANY: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 79 GERMANY: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 80 FRANCE: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 FRANCE: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 FRANCE: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 FRANCE: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 84 FRANCE: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 85 FRANCE: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 FRANCE: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 UK: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 88 UK: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 UK: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 UK LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 91 UK: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 92 UK: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 UK: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 94 ITALY: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 ITALY: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 ITALY: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 ITALY: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 98 ITALY: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 99 ITALY: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 100 ITALY: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 SPAIN: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 SPAIN: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 SPAIN: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 SPAIN: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 105 SPAIN: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 106 SPAIN: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 107 SPAIN: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: LANCETS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 123 JAPAN: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 JAPAN: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 JAPAN: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 128 JAPAN: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 JAPAN: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 130 CHINA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 CHINA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 CHINA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 CHINA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 134 CHINA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 135 CHINA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 136 CHINA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 INDIA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 INDIA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 INDIA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 INDIA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 141 INDIA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 142 INDIA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 INDIA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 144 SOUTH KOREA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 SOUTH KOREA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 SOUTH KOREA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 148 SOUTH KOREA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 149 SOUTH KOREA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 150 SOUTH KOREA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 158 REST OF THE WORLD: LANCETS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 159 REST OF THE WORLD: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 163 REST OF THE WORLD: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 165 REST OF THE WORLD: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 LATIN AMERICA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 171 LATIN AMERICA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST AND AFRICA: LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST AND AFRICA: SAFETY LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST AND AFRICA: MANUALLY ACTIVATED LANCETS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: LANCETS MARKET, BY GAUGE SIZE, 2021–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST AND AFRICA: LANCETS MARKET, BY AGE GROUP, 2021–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST AND AFRICA: LANCETS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST AND AFRICA: LANCETS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 180 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LANCETS MARKET

- TABLE 181 LANCETS MARKET: DEGREE OF COMPETITION

- TABLE 182 LANCETS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 183 FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 184 REGIONAL FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 185 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 186 KEY PRODUCT LAUNCHES, JANUARY 2020–MAY 2023

- TABLE 187 KEY DEALS, JANUARY 2020–MAY 2023

- TABLE 188 OTHER KEY DEVELOPMENTS, JANUARY 2020–MAY 2023

- TABLE 189 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- TABLE 190 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

- TABLE 191 YPSOMED: BUSINESS OVERVIEW

- TABLE 192 B. BRAUN SE: BUSINESS OVERVIEW

- TABLE 193 TERUMO CORPORATION: BUSINESS OVERVIEW

- TABLE 194 GREINER BIO-ONE INTERNATIONAL GMBH: BUSINESS OVERVIEW

- TABLE 195 ABBOTT LABORATORIES: BUSINESS OVERVIEW

- TABLE 196 OWEN MUMFORD: BUSINESS OVERVIEW

- TABLE 197 HTL-STREFA S.A.: BUSINESS OVERVIEW

- TABLE 198 ARKRAY, INC.: BUSINESS OVERVIEW

- TABLE 199 SARSTEDT AG & CO. KG: BUSINESS OVERVIEW

- TABLE 200 STERILANCE MEDICAL (SUZHOU): BUSINESS OVERVIEW

- TABLE 201 MEDLINE INDUSTRIES: BUSINESS OVERVIEW

- TABLE 202 AGAMATRIX, INC.: BUSINESS OVERVIEW

- TABLE 203 ACON LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 204 SANLI MEDICAL & HEALTH SERVICE: BUSINESS OVERVIEW

- TABLE 205 ALLISON MEDICAL, INC.: BUSINESS OVERVIEW

- TABLE 206 GLUCORX LIMITED: BUSINESS OVERVIEW

- FIGURE 1 LANCETS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND- SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 7 LANCETS MARKET: COUNTRY-LEVEL ANALYSIS (2/2)

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 TOP-DOWN APPROACH

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 LANCETS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 LANCETS MARKET, BY GAUGE SIZE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 LANCETS MARKET, BY AGE GROUP, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 LANCETS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 LANCETS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF LANCETS MARKET

- FIGURE 17 INCREASING INCIDENCE OF DIABETES TO DRIVE MARKET

- FIGURE 18 SAFETY LANCETS HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 LANCETS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 INCIDENCE OF DIABETES, 2021 VS. 2045 (MILLION)

- FIGURE 22 US: NUMBER OF PEOPLE WITH CHRONIC CONDITIONS, 1995–2030 (MILLION)

- FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- FIGURE 24 DIRECT DISTRIBUTION—PREFERRED STRATEGY FOR PROMINENT COMPANIES

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HOSPITALS, CLINICS, AND AMBULATORY SURGERY CENTERS

- FIGURE 26 KEY BUYING CRITERIA FOR HOSPITALS, CLINICS, AND AMBULATORY SURGERY CENTERS

- FIGURE 27 KEY PLAYERS OPERATING IN LANCETS MARKET

- FIGURE 28 LANCETS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 29 LANCETS MARKET, BY GAUGE SIZE, 2023 VS. 2028 (USD MILLION)

- FIGURE 30 LANCETS MARKET, BY AGE GROUP, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 LANCETS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 LANCETS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 NORTH AMERICA: LANCETS MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: LANCETS MARKET SNAPSHOT

- FIGURE 35 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN LANCETS MARKET

- FIGURE 36 LANCETS MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 37 LANCETS MARKET: COMPANY EVALUATION MATRIX FOR SMES/STARTUPS, 2022

- FIGURE 38 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- FIGURE 39 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 40 YPSOMED: COMPANY SNAPSHOT (2022)

- FIGURE 41 B. BRAUN SE: COMPANY SNAPSHOT (2022)

- FIGURE 42 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 43 GREINER BIO-ONE INTERNATIONAL GMBH: COMPANY SNAPSHOT (2021)

- FIGURE 44 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2022)

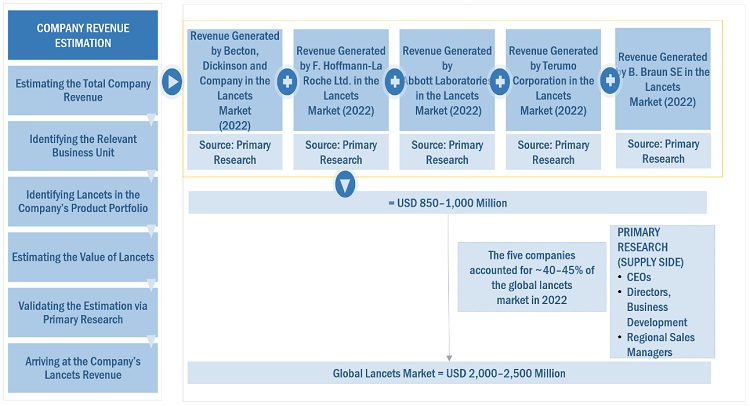

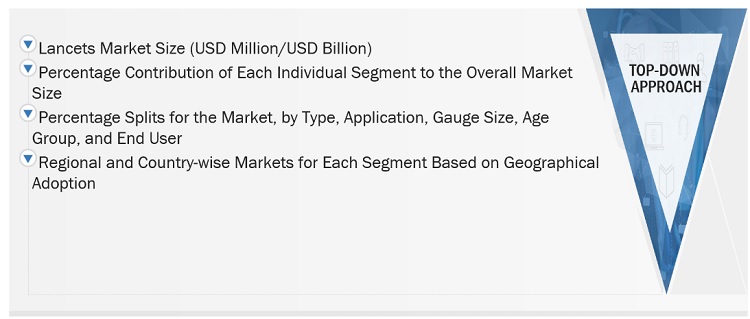

The objective of the study is analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track companies developments such as acquisitions, product launches, expansions, collaborations, agreements and partnerships of the leading players, the competitive landscape of the Lancets market to analyzes market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches were use to estimate the market size. To estimate the market size of segments and subsegments the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), annual reports, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the lancets market. A database of the key industry leaders was also prepared using secondary research.

Collecting Primary Data

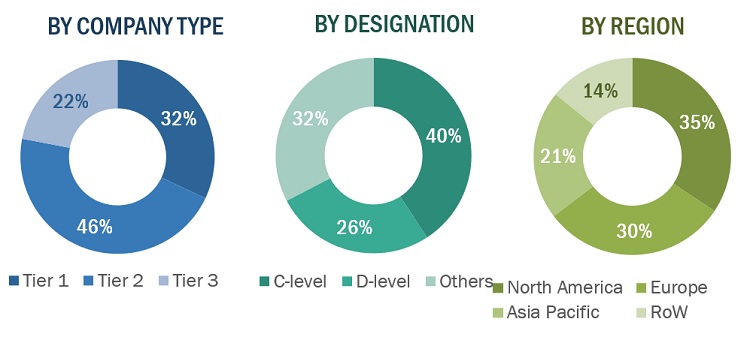

The primary research data was conducted after acquiring knowledge about the Lancets market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand side (such clinical laboratories, hospitals, and academic & research institutes) and supply-side (such as included various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers, wholesalers, channel partners, and distributors) across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Approximately 45% of the primary interviews were conducted with stakeholders from the demand side while those from the supply side accounted for the remaining 55%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

Breakdown of Primary Participants:

Note 1: *Others include sales managers, marketing managers, and product managers.

Note 2: Tiers are defined based on a company’s total revenue as of 2022: Tier 1=> USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3=< USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Becton, Dickinson and Company (US) |

General Manager of Sales |

|

F. Hoffmann-La Roche Ltd. (Switzerland) |

Senior Product Manager |

|

B. Braun SE (Germany) |

Regional Manager |

|

Abbott Laboratories (US) |

General Manager |

Market Size Estimation

All major product manufacturers offering various lancets were identified at the global/regional level. Revenue mapping was done for the major players and was extrapolated to arrive at the global market value of each type of segment. The market value lancets market was also split into various segments and subsegments at the region and country level based on:

- Product mapping of various manufacturers for each type of lancets market at the regional and country-level

- Relative adoption pattern of each lancets market among key application segments at the regional and/or country-level

- Detailed primary research to gather qualitative and quantitative information related to segments and subsegments at the regional and/or country-level.

- Detailed secondary research to gauge the prevailing market trends at the regional and/or country-level

Global Lancets Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global lancets market Size: Top Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the lancets industry.

Market Definition

A lancet is a pointed piece of surgical steel encased in plastic used to puncture the skin to draw a blood sample. Lancets are also used for making small incisions for the draining of boils and abscesses. Lancets for blood sampling are available in different gauges depending on the width of the metal point. The higher the gauge, the smaller the perforation the lancet makes. These blood specimens can be used for various tests, such as blood glucose testing, hemoglobin testing, coagulation testing, cholesterol testing, allergy testing, and neonatal screening.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To define, describe, segment, and forecast the Lancets market by product, application, end user, and region

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Lancets market

- To forecast the size of the lancets market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific and Rest of the world

- To profile key players in the lancets market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions; product launches; expansions; collaborations, agreements, & partnerships; and R&D activities of the leading players in the Lancets market

- To benchmark players within the Lancets market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Lancets market

- Profiling of additional market players (up to 5) Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Lancets Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lancets Market