This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the pen needles market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the pen needles market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

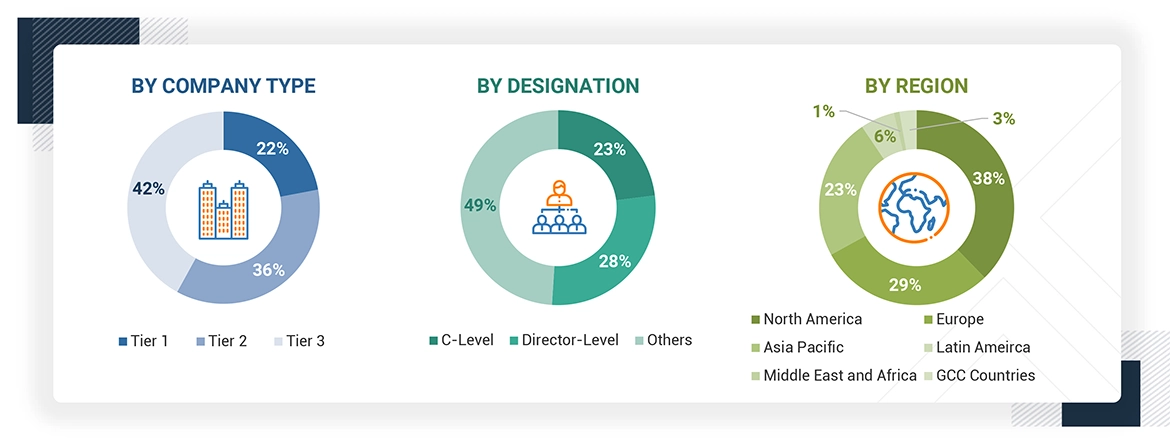

A breakdown of the primary respondents for pen needles market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

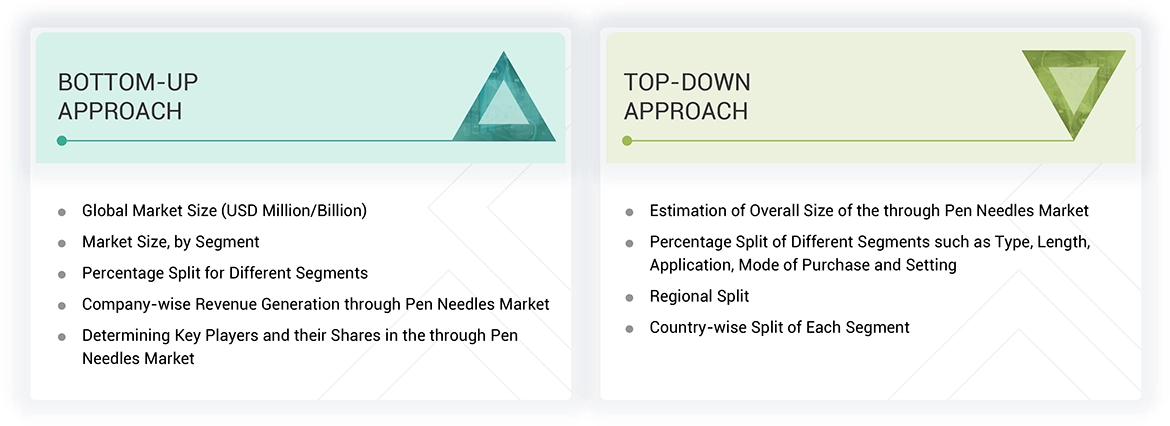

The market size for pen needles market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for pen needles market was calculated using data from three distinct sources, as will be discussed below:

Data Triangulation

The entire market was split up into five segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of pen needles. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

A pen needle is a hollow needle entrenched in a plastic hub and attached to injectable pens. Pen needles are available in a wide range of lengths and diameters and can be used by healthcare professionals and patients to deliver injectable medications into the patient’s body. Pen needles are electro-polished for smooth, thin, and fine-point tips and provide comfort and ease in penetration; they serve as an alternative drug delivery technique to the traditional method of injecting drugs.

Stakeholders

-

Manufacturers of pen needles, insulin pens, injectable drug delivery devices, and diabetes supplies

-

Original equipment manufacturing companies

-

Suppliers and distributors of pen needles, insulin pens, injectable drug delivery devices, and diabetes supplies

-

Healthcare service providers

-

Teaching hospitals and academic medical centers

-

Health insurance players

-

Government bodies/municipal corporations

-

Regulatory bodies

-

Business research and consulting service providers

-

Authorities framing reimbursement policies for pen needles

-

Venture capitalists

-

Market research and consulting firms

Report Objectives

-

To define, describe, and forecast the pen needles market based on type, length, application, mode of purchase, setting and region.

-

To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall pen needles market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the pen needles market in North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries

-

To profile the key players and comprehensively analyze their market shares and core competencies in the pen needles market

-

To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, product launches, agreements, and other developments in the pen needles market

-

To benchmark players within the pen needles market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offerings.

User

Nov, 2019

how about Owen Mumford pen needle market? any chance their able grow more than others?.