Large Language Model (LLM) Market by Offering (Software (Domain-specific LLMs, General-purpose LLMs), Services), Modality (Code, Video, Text, Image), Application (Information Retrieval, Code Generation), End User and Region - Global Forecast to 2030

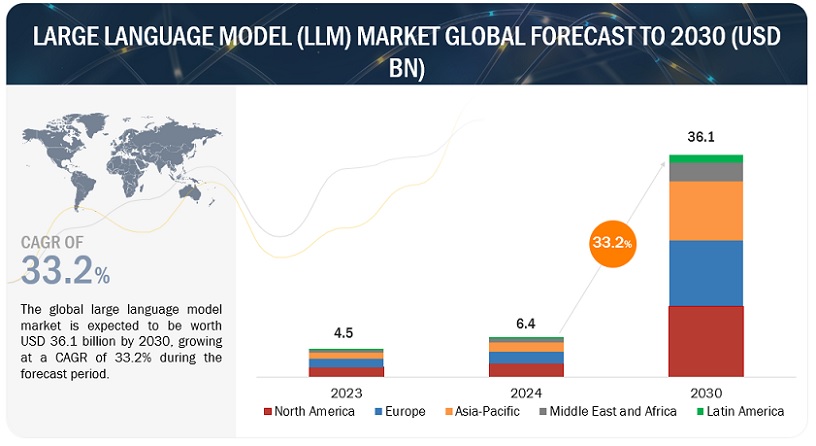

The global Large Language Model (LLM) Market is currently witnessing robust growth, with estimates indicating a substantial increase in market size. Projections suggest a notable expansion in market value, from USD 6.4 billion in 2024 to USD 36.1 billion by 2030, reflecting a substantial CAGR of 33.2% over the forecast period. The staggering growth rate is due to the increasing demand for advanced natural language processing (NLP) capabilities across various industries. LLMs have demonstrated remarkable prowess in tasks such as text generation, sentiment analysis, language translation, and content summarization, making them invaluable tools for enhancing customer experiences, automating content creation, and driving data-driven decision-making processes. Additionally, the advent of cloud computing and the availability of powerful computing resources have facilitated the training and deployment of these complex models on a larger scale. As businesses strive to leverage AI and machine learning technologies to gain a competitive edge, the adoption of large language models is surging, fueling their rapid market growth.

Technology Roadmap of Large Language Model Market

The large language model market report covers the technology roadmap, with insights into the short-term and long-term developments.

Short-term (1-5 Years):

- Trillion-parameter models enabled by specialized hardware accelerators

- Unsupervised multitask learning across diverse tasks

- Continual learning to update models with new knowledge

- Robust alignment and control techniques (debate, recursive reward modeling)

- On-device LLM deployments for edge computing and privacy

Long-term (5+ years):

- Human-level language understanding and generation

- Unified multimodal models integrating language, vision, and audio seamlessly

- Grounded commonsense reasoning and world knowledge

- Emergent linguistic capabilities beyond training data

- General AI assistants with open-ended conversation abilities

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: The rising demand for automated content creation and curation

The rising demand for automated content creation and curation is propelling the growth of the large language model (LLM) market. LLMs offer a compelling solution by leveraging their natural language generation capabilities to create human-like text at an unprecedented scale. These models can generate a wide range of content, from marketing materials and product descriptions to news articles and creative stories, tailored to specific audiences and contexts. LLMs excel at content curation and summarization, enabling businesses to distill insights from massive data sources efficiently. This capability is invaluable for industries such as research, journalism, and knowledge management, where sifting through and synthesizing information is crucial.

Restraint: High costs of large language model training and inference optimization

The high cost of training and inference associated with large language models (LLMs) poses a significant restraint on their widespread adoption and market growth. LLMs require massive computational resources, with some of the largest models like GPT-3 trained on thousands of high-performance GPUs, incurring costs running into millions of dollars. Additionally, LLMs demand vast amounts of diverse and high-quality training data, which can be resource-intensive and expensive to acquire and curate. It is estimated that the cost of acquiring and processing the training data for GPT-3 could range from USD 5 million to USD 12 million. Furthermore, the energy consumption during training and inference processes is extremely high, leading to substantial operational costs.

Opportunity: Pressing demand for LLMs in knowledge discovery and management

The increasing adoption of LLMs in knowledge discovery and management presents a significant opportunity for the LLM market. As organizations generate vast amounts of data, the need to efficiently extract insights and manage information becomes crucial. LLMs offer advanced capabilities in natural language processing, allowing for the automation of tasks such as data categorization, sentiment analysis, and trend identification. For example, in the healthcare industry, LLMs can assist in analyzing medical literature and patient records to identify emerging trends in treatment efficacy or disease management. In financial institutions, LLMs can be utilized to sift through extensive regulatory documents and market reports for compliance purposes and investment decision-making.

Challenge: Computational inefficiency due to high memory requirements

High memory requirements in LLMs lead to computational inefficiency, posing a significant challenge to market growth. As these models become more complex and sophisticated, they demand larger memory capacities to store the vast number of parameters and data representations. Consequently, deploying and running LLMs becomes resource-intensive, requiring robust hardware infrastructure and substantial computational resources. This poses bottlenecks for smaller organizations or those with limited budgets, as they may struggle to afford the necessary hardware upgrades or cloud computing services. High memory requirements can also lead to longer processing times and slower model training, hindering real-time applications and responsiveness.

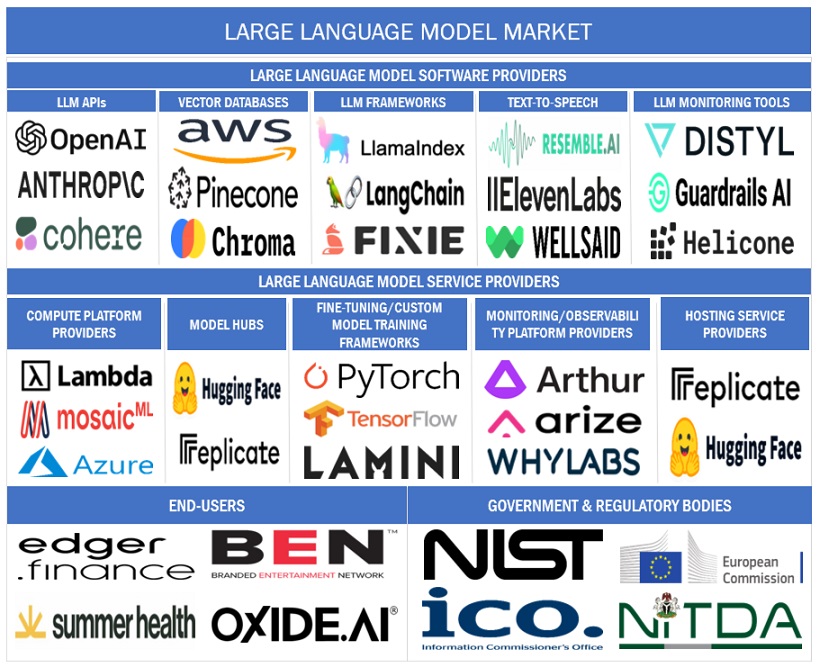

Large Language Model Market Ecosystem

By offering, domain-specific LLMs to register the fastest growth rate between 2024–2030

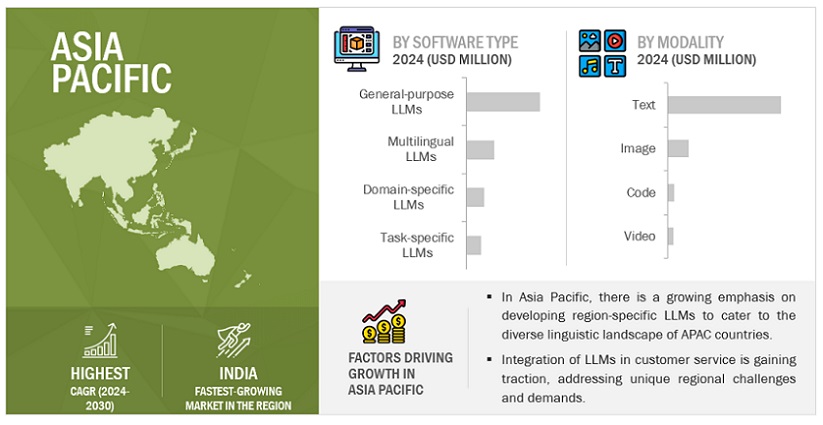

Domain-specific LLMs are experiencing rapid growth in the market due to their specialized focus and ability to deliver targeted solutions across various industries. These models, trained on data specific to particular domains such as healthcare, finance, or law, offer superior performance compared to generic LLMs. Their tailored training enables them to understand the nuances of domain-specific language, resulting in more accurate and contextually relevant outputs. Domain-specific LLMs often require fewer resources and less data for fine-tuning, making them cost-effective and efficient business solutions. They excel in zero-shot, one-shot, and few-shot learning scenarios, allowing them to generalize knowledge and adapt quickly to new tasks with minimal training data.

By modality, text segment to capture the highest market share in 2024

Text modality is expected to dominate the LLM market due to its ubiquity and versatility across industries. With the exponential growth of textual data from sources like social media, emails, and documents, the demand for text focused LLMs has surged. These models excel in tasks like sentiment analysis, content generation, and document classification, catering to diverse business needs. Moreover, text-based LLMs offer scalability, interpretability, and cost-effectiveness, making them highly attractive to businesses.

By model size, 1 billion to 10 billion parameters segment is slated to hold the largest market share in 2024

The 1-10 billion parameters segment leads the LLM market due to its optimal balance between model complexity and computational efficiency. Models within this size range, such as LLaMA Pro (8.3 billion parameters), GAIA-1 (9 billion parameters), and BlenderBot 2.0 (9.4 billion parameters), strike a chord by offering high performance while remaining manageable in terms of memory and processing requirements. They excel in various tasks like natural language understanding, generation, and translation, appealing to various industries. Also, these models offer scalability, affordability, and versatility, making them accessible to businesses of all sizes.

By architecture, autoencoding LLMs are poised to experience fastest growth during the forecast period

Autoencoding LLMs are set to witness rapid growth in the market due to their unique architecture and versatile applications. These models, leveraging autoencoder frameworks, excel in tasks like text reconstruction, feature extraction, and unsupervised learning. Their ability to learn meaningful representations from raw data makes them highly effective in data preprocessing and dimensionality reduction. Additionally, autoencoding LLMs offer enhanced privacy and data security, appealing to businesses concerned with sensitive information.

By application, language translation & localization is slated to witness the highest growth rate during the forecast period

Language translation and localization is expected to stand out as the fastest-growing application segment in the LLM market due to globalization's increasing demand. Businesses seek to expand their reach globally, requiring accurate and culturally relevant translations across various languages. LLMs excel in this domain by offering efficient and accurate translation services, catering to diverse linguistic needs. This segment's growth is further fueled by advancements in machine learning techniques, enabling LLMs to deliver high-quality translations with minimal human intervention.

By end-user, media & entertainment segment will account for the largest market share in 2024

The media & entertainment segment is estimated to command the largest market share in the LLM market in 2024, due to the industry's immense reliance on content creation, curation, and personalization. LLMs offer unprecedented capabilities in automating tasks like content generation, recommendation systems, and sentiment analysis, enhancing user engagement and satisfaction. LLMs facilitate efficient content moderation, ensuring compliance with regulatory standards and safeguarding brand reputation. With the proliferation of streaming platforms, social media, and digital content, the demand for LLM-powered solutions to optimize content delivery and audience interaction continues to soar.

By region, Asia Pacific is set to experience the fastest growth rate during the forecast period

Asia Pacific is expected to stand out as the fastest-growing market in large language model market between 2024–2030. The region's diverse linguistic landscape necessitates advanced language processing technologies to cater to the multitude of languages spoken across countries. LLMs offer the capability to understand, generate, and translate content in multiple languages, making them highly relevant in this context. For example, Sarvam, an Indian AI startup, released its first LLM called OpenHathi-Hi-v0.1 in February 2024, which is built on Meta’s open-source Llama2-7B architecture and delivers performance on par with GPT-3.5 for Indic languages.

Additionally, governments in the region are investing heavily in AI research and development, fostering a conducive environment for LLM innovation and deployment. For instance, more than 70 LLMs with over 1 billion parameters have already been released in China, and more applications are filed every day. Measures are being implemented by China to support its AI startups, as they have trouble accessing high-performance Nvidia GPUs for LLM training due to U.S. export rules. 'Computing vouchers' are being offered by several city governments, including Shanghai, to AI startups to subsidize the training cost of their LLMs.

Key Market Players

The large language model solution and service providers have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships, and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some major players in the large language model market include Google (US), OpenAI (US), Anthropic (US), Meta (US), Microsoft (US), along with SMEs and startups such as Mosaic ML (US), Stability AI (UK), LightOn (France), Cohere (Canada), and Turing (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

USD (Million) |

|

Segments covered |

Offering, Architecture, Modality, Model Size, Application, End-user, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Google (US), OpenAI (US), Anthropic (US), Meta (US), Microsoft (US), NVIDIA (US), AWS (US), IBM (US), Oracle (US), HPE (US), Tencent (China), Yandex (Russia), Naver (South Korea), AI21 Labs (Israel), Hugging Face (US), Baidu (China), SenseTime (Hong Kong), Huawei (China), FedML (US), DynamoFL (US), Together AI (US), Upstage (South Korea), Mistral AI (France), Adept (US), Neuralfinity (Germany), Mosaic ML (US), Stability AI (UK), LightOn (France), Cohere (Canada), Turing (US), Lightning AI (US), and WhyLabs (US) |

This research report categorizes the large language model market based on offering, architecture, modality, model size, application, end-user, and region

By Offering:

-

Software

-

Software, By Type

- General-purpose LLMs

-

Domain-specific LLMs

- Zero Shot

- One Shot

- Few Shot

- Multilingual LLMs

- Task-specific LLMs

-

Software, By Source Code

- Open-source LLMs

- Closed-source LLMs

-

Software, By Deployment Mode

- On-premises

- Cloud

-

Software, By Type

-

Services

- Consulting

- LLM Development

- Integration

-

LLM Fine-tuning

- Full Fine-tuning

- Retrieval-augmented Generation (RAG)

- Adapter-based Parameter Efficient Tuning

- LLM-backed App Development

- Prompt Engineering

- Support and Maintenance

By Architecture

-

Autoregressive Language Models

- Single-headed Autoregressive Language Models

- Multi-headed Autoregressive Language Models

-

Autoencoding Language Models

- Vanilla Autoencoding Language Models

- Optimized Autoencoding Language Models

-

Hybrid Language Models

- Text-to-Text Language Models

- Pretraining-finetuning Models

By Modality

- Text

- Code

- Image

- Video

By Model Size

- Below 1 Billion Parameters

- 1 Billion to 10 Billion Parameters

- 10 Billion to 50 Billion Parameters

- 50 Billion to 100 Billion Parameters

- 100 Billion to 200 Billion Parameters

- 200 Billion to 500 Billion Parameters

- Above 500 Billion Parameters

By Application

- Information Retrieval

-

Language Translation And Localization

- Multilingual Translation

- Localization Services

-

Content Generation And Curation

- Automated Journalism And Article Writing

- Creative Writing

- Code Generation

-

Customer Service Automation

- Chatbots And Virtual Assistants

- Sales And Marketing Automation

- Personalized Recommendation

-

Data Analysis And Bi

- Sentiment Analysis

- Business Reporting And Market Analysis

- Other Applications

By End-user

- IT/ITeS

- Healthcare & Life Sciences

- Law Firms

- BFSI

- Manufacturing

- Education

- Retail

- Media & Entertainment

- Other End-users

By Region

-

North America

- United States

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

Middle East And Africa

- GCC

- South Africa

- Turkey

- Rest of Middle East And Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2024, Google made a notable LLM announcement, unveiling Gemini 1.5 with significant advancements. The search giant unveiled Gemini 1.5, an updated AI model that comes with long context understanding across different modalities. Google also launched Gemma, a new family of lightweight open-weight models. Starting with Gemma 2B and Gemma 7B, these new models were “inspired by Gemini” and are available for commercial and research usage.

- In February 2024, Kyndryl announced an expanded partnership with Google Cloud to develop responsible generative AI solutions. The partnership will focus on coupling Google Cloud’s in-house AI capabilities, including Gemini, Google’s most advanced Large Language Model (LLM), with Kyndryl’s expertise and managed services to develop and deploy generative AI solutions for customers.

- In January 2024, Capgemini and AWS expanded their strategic collaboration to enable broad enterprise generative AI adoption. Through this collaboration, Capgemini and AWS are focused on helping clients realize the business value of adopting generative AI while navigating challenges, including cost, scale, and trust.

- In December 2023, Microsoft launched InsightPilot, an automated data exploration system powered by a Large Language Model (LLM). This innovative system is specifically designed to simplify the data exploration process. InsightPilot incorporates a set of meticulously designed analysis actions to simplify data exploration.

- In December 2023, Google unveiled an unprecedented Large Language Model (LLM) named VideoPoet, which is multimodal and capable of generating videos. This groundbreaking model introduces video generation functionalities previously unseen in LLMs.

- In December 2023, Axel Springer and OpenAI announced a global partnership to strengthen independent journalism in the age of artificial intelligence (AI). The initiative will enrich users’ experience with ChatGPT by adding recent and authoritative content on various topics and explicitly values the publisher’s role in contributing to OpenAI’s products

- In November 2023, OpenAI announced the launch of GPT-4 Turbo, a next-generation model of GPT-4. GPT-4 Turbo is more capable and has knowledge of world events up to April 2023. It has a 128k context window to fit the equivalent of more than 300 pages of text in a single prompt.

- In October 2023, Dell and Meta partnered to bring Llama 2 open-source AI to enterprise users on-premises. Dell announced that it is adding support for Llama 2 models to its lineup of Dell Validated Design for Generative AI hardware and its generative AI solutions for on-premises deployments

Frequently Asked Questions (FAQ):

What is a large language model?

A large language model (LLM) is a neural network-based artificial intelligence system trained on vast amounts of text data to understand and generate human-like language. It uses deep learning techniques to learn patterns and relationships, allowing coherent and contextually relevant text output. LLMs are called “large” as they consist of billions or trillions of parameters, enabling them to capture extensive knowledge and language patterns. This massive parameter count allows LLMs to perform a wide range of natural language processing tasks with human-like proficiency, such as text generation, summarization, translation, and question-answering.

What is the total CAGR expected to be recorded for the large language model market during 2024-2030?

The large language model market is expected to record a CAGR of 33.2% from 2024-2030.

Which are the major growth enablers catalyzing the large language model market?

The large language model market is being majorly driven by factors such as the growing availability of large datasets, advancements in deep learning algorithms, need for enhanced human-machine communication, and rising demand for automated content creation and curation.

Which are the top three applications prevailing in the large language model market?

Content generation and curation, customer service automation, and information retrieval are the top three applications of large language models due to their ability to generate human-like text, understand natural language queries, and efficiently process and summarize vast amounts of data.

Who are the key vendors in the large language model market?

Some major players in the large language model market include Google (US), OpenAI (US), Anthropic (US), Meta (US), Microsoft (US), NVIDIA (US), AWS (US), IBM (US), Oracle (US), HPE (US), Tencent (China), Yandex (Russia), Naver (South Korea), AI21 Labs (Israel), Hugging Face (US), Baidu (China), SenseTime (Hong Kong), Huawei (China), FedML (US), DynamoFL (US), Together AI (US), Upstage (South Korea), Mistral AI (France), Adept (US), Neuralfinity (Germany), Mosaic ML (US), Stability AI (UK), LightOn (France), Cohere (Canada), Turing (US), Lightning AI (US), and WhyLabs (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

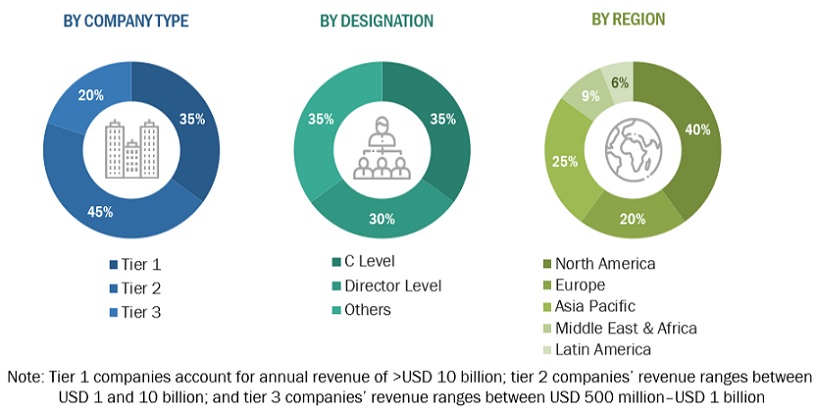

The Large Language Model (LLM) market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred large language model providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors websites. Additionally, large language model spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to software, hardware, services, technology, applications, warehouse sizes, verticals, and regions, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and large language models expertise; related key executives from large language models solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using large language models solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of large language models solutions and services, which would impact the overall large language model market.

To know about the assumptions considered for the study, download the pdf brochure

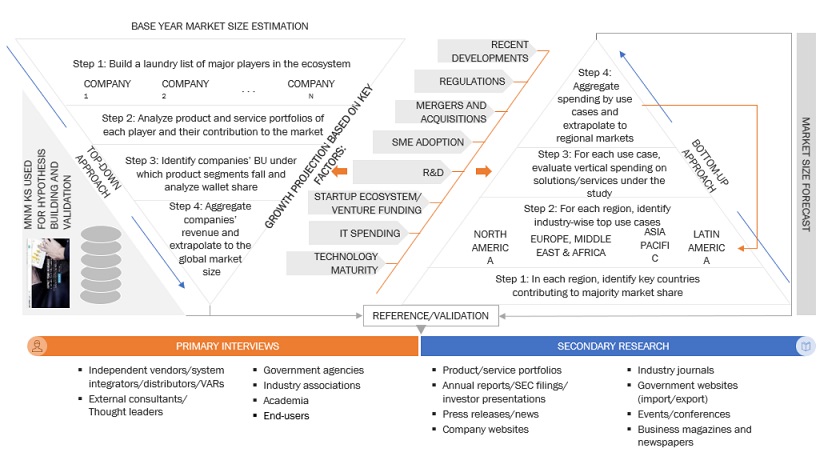

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the large language model market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Market Size Estimation Methodology-Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the large language model market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of software and services according to data types, business functions, deployment models, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of large language model solutions and services among different end users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of large language models solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the large language model market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major large language models providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primary interviews, the exact values of the overall large language model market size and segments’ size were determined and confirmed using the study.

Global Large Language Model Market Size: Bottom-Up and Top-Down Approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

A large language model (LLM) is a neural network-based artificial intelligence system trained on vast amounts of text data to understand and generate human-like language. It uses deep learning techniques to learn patterns and relationships, allowing coherent and contextually relevant text output. LLMs are called “large” as they consist of billions or trillions of parameters, enabling them to capture extensive knowledge and language patterns. This massive parameter count allows LLMs to perform a wide range of natural language processing tasks with human-like proficiency, such as text generation, summarization, translation, and question-answering.

Stakeholders

- Generative AI software developers

- Large language model software vendors

- Business analysts

- Cloud service providers

- Consulting service providers

- Enterprise end-users

- Distributors and Value-added Resellers (VARs)

- Government agencies

- Independent Software Vendors (ISV)

- Managed service providers

- Market research and consulting firms

- Support & maintenance service providers

- System Integrators (SIs)/migration service providers

- Language service providers

- Technology providers

Report Objectives

- To define, describe, and predict the large language model market by offering (software and services), architecture, modality, model size, application, end-user, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies.

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of recession across all the regions across the large language model market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American large language model market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Large Language Model (LLM) Market