Laser Cladding Market by Type (Fiber Laser, Diode Laser, YAG Laser, CO2 Laser), Revenue, End-use Industry (Oil & Gas, Aerospace & Defense, Automotive, Power Generation, Mining), and Region (2021-2026)

Updated on : October 22, 2024

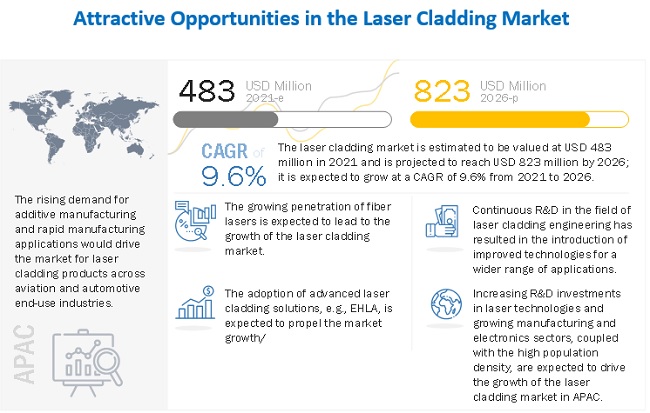

The global laser cladding market size is estimated to be valued at USD 483 million in 2021; it is expected to growing at a CAGR of 9.6% during 2021–2026 to reach USD 823 million by 2026.

Some of the major driving factors for the growth of this market include the growing penetration of fiber lasers in laser cladding applications and increasing requirement across additive manufacturing and rapid manufacturing, coupled with the gradual transition from conventional laser technologies to laser cladding.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on laser cladding Market

The impacts of COVID-19 on the laser cladding industry and consumer demand have an overall negative impact on the laser industry. It is believed that laser manufacturing would decline more than expected in the short term, as the majority of laser manufacturers and raw material providers is based in China. For laser manufacturing, including the manufacturing of subcomponents such as laser sources, galvanometers, output couplers, and others, the industry continues to rely heavily on China. There have been disruptions in component supplies due to the pandemic, which has led to a limited supply of laser products.

Some laser manufacturers may temporarily hike the price of lasers. The immediate impact is that the supply shortage might cause negative pressure on the prices of laser systems. Going forward, laser system manufacturers would need to look out for supply chain disruptions in China. The impact of supply chain disruption was visible from June 2020 onward as other countries, including the US, India, Germany, and the UK, are also significantly impacted by COVID-19. This had a potential negative impact on the laser cladding market in 2020–2021. However, with the improvements in the situation, it is expected that the manufacturing would gradually return to normal within the next couple of months, ensuring a regular supply of laser systems.

Laser cladding market

The laser cladding market share includes major Tier I and II players like TRUMPF (Germany), OC Oerlikon Management AG (Switzerland), Coherent, Inc (US), IPG Photonics Corporation (US), Han’s Laser Technology Industry Group Co., Ltd. (China) and others.

Laser cladding market dynamics

Driver: Growing penetration of fiber lasers in laser cladding applications

The industrial sector is now the largest market size for fiber lasers; much of the action right now is at the kilowatt-class power level. Particularly interesting is their use in automotive works. The automotive industry is moving to high-strength steel to produce cars that meet durability requirements but are relatively light for better fuel economy; the problem is how to cut the high-strength steel. This is where they turn to fiber lasers. It is very difficult, for example, for conventional machine tools to punch holes in this kind of steel; however, fiber lasers can easily cut these holes.

Restraint: High deployment costs and lack of personnel with required technical expertise

Lasers required for varying processes, systems, and applications are in the range of a few hundred to thousands of watts. High-power lasers are used in large-scale laser displays, medical, military, research, laser-induced nuclear fusion, and materials processing (welding, cutting, drilling, cladding, soldering, marking, and surface modification) applications. Although laser cladding helps reduce workforce and related costs in the automotive and manufacturing industries, its deployment involves a huge investment. Lasers are supported by various software, design files, durable parts, and laser sources. Additionally, these come with service packages and warranties to protect against expensive repairs in case of a malfunction. Hence, the growing demand for lasers for processing generates a requirement for low-cost solutions so that the technology can be adopted on a wide scale. Players in the laser cladding market are developing low-cost solutions to avail maximum benefits because of high-volume consumption.

Opportunity: Development of advanced laser cladding solutions

Over the years, new and more advanced variants of laser cladding technology have emerged, especially the extreme high-speed laser application (EHLA). EHLA is a novel technology born from laser cladding (also known as laser metal deposition (LMD) or directed energy deposition – laser beam (DED-LB)). Fraunhofer ILT has developed EHLA as an advanced form of laser cladding, a replacement for chrome plating, and an alternative to spraying technologies. EHLA coatings can be applied to small and large components at speeds 10–100x times faster than laser cladding.

The EHLA process has many potential capabilities for the manufacturing sector and is suitable for various applications. This novel technology is growing in popularity, particularly in the automotive sector for high-wear applications such as brake discs, as well as a replacement of hard chrome plating and thermal spray techniques for corrosion protection.

Challenge: Slow industrial acceptance of laser cladding

Laser cladding is perceived as one of the more sophisticated industrial laser applications, requiring special skills. There is a limited number of people across the globe who have developed these skills and a limited number of suppliers that provide laser cladding equipment. In the automotive industry, the valves of a non-commercial vehicle are subject to 300 to 500 million thermal and mechanical cycles throughout the life of an automobile, and an exhaust valve is subject to a stream of hot gas that may contain soot particles and corrosive constituents. In the early days of laser technology, numerous research facilities showed pictures of laser-clad valves in their publications and literature. However, not many of them were put into production or commercialized. The chief reason for this lack of market penetration is the availability of less expensive equipment for coating valves using plasma transferred arc (PTA) welding, which produces deposits with low levels of dilution. However, in the long run, laser cladding would prove more economical and successful than traditional laser technologies such as cutting, welding, and others.

Market for diode lasers to hold the highest market share during the forecast period

The laser cladding market for diode lasers is estimated to hold the highest market share during the forecast period. In recent years, high-power direct diode lasers (DDL) have become increasingly popular and are mostly used for heat processing applications. The energy-saving offered by high-power DDLs is high compared with conventional types such as carbon dioxide (CO2) lasers and yttrium aluminum garnet (YAG) lasers. Hence, the diode lasers segment is expected to capture the highest market share.

Laser cladding market for laser revenue to hold the highest CAGR from 2021 to 2026

The market for the laser revenue is expected to grow at the highest CAGR during the forecast period. Laser revenue covers the revenue generated from the sales of several types of lasers, such as YAG lasers, fiber lasers, diode lasers, and CO2 lasers, for cladding applications. Each of these has applications across several end-user industries, such as aerospace & defense, automotive, and mining. Over the years, several laser manufacturers have received contracts for delivering lasers for cladding applications. For instance, in December 2019, TRUMPF delivered its billionth mini laser to STMicroelectronics, a French manufacturer of electronics and semiconductors for smartphones.

Laser cladding market across aerospace & defense end-use industry to grow at the highest CAGR from 2021 to 2026

The aerospace & defense end-use industry is expected to hold the highest CAGR between 2021 and 2026. The aerospace industry is one of the first industries to adopt laser cladding. In an aircraft engine, many vital components are laser-cladded. Leading engine manufacturers are introducing 3D printing, cold spray, and laser cladding in the aerospace industry. In March 2019, AMAG, a supplier of primary aluminum and premium cast and rolled aluminum products, introduced a new high-tech cladding station to improve the quality of coils and sheets for use in heat exchangers and the aircraft industry.

Laser cladding market in APAC to grow at the highest rate from 2021 to 2026

The laser cladding market share in APAC is expected to grow at the highest CAGR during the forecast period. The major countries contributing to the laser processing market in APAC include China, Japan, South Korea, and India. APAC has been ahead in terms of the adoption of laser processing solutions compared with other regions. Several government- and private-funded startups have emerged for the development of advanced laser cladding applications. For instance, Hornet, a laser-based surface solutions company based in China, offers advanced laser cladding such as EHLA cladding and wide beam cladding for oil & gas, mining, and agriculture industries. Increasing R&D investments in laser technologies and growing manufacturing and electronics sectors, coupled with the high population density, are expected to drive the growth of the laser cladding market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The laser cladding companies is dominated by players such as TRUMPF (Germany), OC Oerlikon Management AG (Switzerland), Coherent, Inc (US), IPG Photonics Corporation (US), and Han’s Laser Technology Industry Group Co., Ltd. (China)

Laser Cladding Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2021 | USD 483 Million |

| Revenue Forecast in 2026 | USD 298 Million |

| Growth Rate | 9.6% |

|

Market size available for years |

2017-2026 |

|

Base year considered |

2017 |

|

Market size available for years |

2017-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Growing penetration of fiber lasers in laser cladding applications |

| Key Market Opportunity | Development of advanced laser cladding solutions |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Diode lasers |

| Highest CAGR Segment | Aerospace & Defense |

The study categorizes the laser cladding market based on type, revenue, materials and end-use industry at the regional and global levels.

Laser cladding market, By Type

- Diode laser

- Fiber laser

- CO2 laser

- Acoustic laser

- Others

Laser cladding market, By Revenue

- System revenue

- Laser revenue

Laser cladding market, By Materials

- Cobalt-based alloys

- Nickel-based alloys

- Iron-based alloys

- Carbides & Carbide blends

Laser Cladding Market, By End-use Industry

- Oil & gas

- Mining

- Aerospace & Defense

- Automotive

- Power Generation

- Others

Laser cladding market, By Region

- North America

- Europe

- APAC

- RoW

Recent Developments in Laser cladding Industry :

- In August 2021 TRUMPF and STARMATIK, the Italian specialist for robotic automation of sheet metal processing machines, entered into a strategic partnership for bending machine automation.

- In July 2021, Lumibird signed an exclusive agreement with AREVA to acquire its 37% stake in CILAS. This acquisition would strengthen Lumibird’s key position in Europe in the defense and civil markets.s

- In June 2021, II-VI Incorporated and Coherent announced that II-VI’s shareholders and Coherent’s stockholders have each voted overwhelmingly to adopt and approve the merger agreement for II-VI to acquire Coherent.

- In March 2021, Lumibird signed an agreement with the Swedish company Saab to acquire its defense laser rangefinder business. This acquisition would contribute to consolidating the Lumibird Group’s position in the European defense market.

- In March 2021, Oerlikon Metco Coating Services (MCS) focused its US thermal spray and laser cladding activities and joined Oerlikon AM in Huntersville, NC. By combining Oerlikon AM’s additive manufacturing capabilities with Oerlikon Metco’s coating capabilities under one roof, the company can now offer “Print & Coat” parts.

- In January 2021, Lumibird announced a worldwide agreement with GWU-LASERTECHNIK for the commercialization of GWU’s optical parametric oscillator (OP) with Lumibird’s solid-state lasers. This agreement expanded Lumibird’s offering for pulsed Nd: YAG lasers to include tunable OPO systems.

Frequently Asked Questions (FAQ):

What is the market size for the laser cladding market?

The laser cladding market is estimated to be valued at USD 483 million in 2021; it is expected to grow at a CAGR of 9.6% during 2021–2026 to reach USD 823 million by 2026.

What are the major driving factors and opportunities in the laser cladding market?

Some of the major driving factors for the growth of this market include the growing penetration of fiber lasers in laser cladding applications and increasing requirement across additive manufacturing and rapid manufacturing, coupled with the gradual transition from conventional laser technologies to laser cladding. Adoption of laser cladding applications across aviation and automotive industries and development of advanced laser cladding solutions serve as growth opportunities for the market players.

Who are the leading players in the global laser cladding market?

Companies such are TRUMPF (Germany), OC Oerlikon Management AG (Switzerland), Coherent, Inc (US), IPG Photonics Corporation (US), and Han’s Laser Technology Industry Group Co., Ltd. (China) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What is the COVID-19 impact on the laser cladding market?

The laser cladding market witnessed a revenue decline of ~15% in 2020 due to the COVID-19 pandemic. The US–China trade war and the slowdown in the industrial ecosystem due to the COVID-19 pandemic have been the key reasons for this decline.

What are some of the technological advancements in the market?

Over the years, new and more advanced variants of laser cladding technology have emerged, especially the extreme high-speed laser application (EHLA). EHLA is a novel technology born from laser cladding (also known as laser metal deposition (LMD) or directed energy deposition – laser beam (DED-LB)). Fraunhofer ILT has developed EHLA as an advanced form of laser cladding, a replacement for chrome plating, and an alternative to spraying technologies. EHLA coatings can be applied to small and large components at speeds 10–100x times faster than laser cladding. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

1.5 INCLUSIONS AND EXCLUSIONS

1.6 CURRENCY

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 LASER CLADDING MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—IDENTIFICATION OF REVENUES GENERATED BY COMPANIES FROM LASER CLADDING OFFERINGS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size through bottom-up analysis (demand side)

FIGURE 6 LASER CLADDING MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 LASER CLADDING MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 10 GLOBAL PROPAGATION OF COVID-19

TABLE 2 RECOVERY SCENARIOS FOR GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 11 GROWTH PROJECTIONS OF LASER CLADDING MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 12 DIODE LASER TO HOLD LARGEST SHARE OF LASER CLADDING MARKET DURING FORECAST PERIOD

FIGURE 13 MARKET FOR LASER REVENUE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

FIGURE 14 MARKET FOR AEROSPACE AND DEFENSE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 15 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN LASER CLADDING MARKET

FIGURE 16 RISING DEMAND FOR ADDITIVE MANUFACTURING AND RAPID MANUFACTURING APPLICATIONS WOULD DRIVE IMPLEMENTATION OF LASER CLADDING PRODUCTS ACROSS AVIATION AND AUTOMOTIVE END-USE INDUSTRIES

4.2 MARKET IN NORTH AMERICA, BY COUNTRY AND BY TYPE

FIGURE 17 US AND DIODE LASER ARE EXPECTED TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.3 LASER CLADDING MARKET IN APAC, BY END-USE INDUSTRY

FIGURE 18 OIL & GAS END-USE INDUSTRY TO HOLD LARGEST SHARE OF MARKET IN APAC DURING FORECAST PERIOD

4.4 LASER CLADDING MARKET, BY COUNTRY

FIGURE 19 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 21 DRIVERS AND THEIR IMPACT ON LASER CLADDING MARKET

FIGURE 22 OPPORTUNITIES AND THEIR IMPACT ON MARKET

FIGURE 23 RESTRAINTS AND CHALLENGES, AND THEIR IMPACT ON LASER CLADDING MARKET

5.2.1 DRIVERS

5.2.1.1 Growing penetration of fiber lasers in laser cladding applications

5.2.1.2 Gradual transition from conventional laser technologies to laser cladding

5.2.1.3 Increasing requirement across additive manufacturing and rapid manufacturing

5.2.2 RESTRAINTS

5.2.2.1 High deployment costs and lack of personnel with required technical expertise

5.2.2.2 Environmental concerns over use of rare earth elements

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of laser cladding applications across aviation and automotive industries

5.2.3.2 Development of advanced laser cladding solutions

5.2.4 CHALLENGES

5.2.4.1 Slow industrial acceptance of laser cladding

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS OF LASER CLADDING MARKET

5.4 ECOSYSTEM

FIGURE 25 LASER CLADDING MARKET: ECOSYSTEM

TABLE 3 LASER CLADDING MARKET: SUPPLY CHAIN

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 LASER CLADDING MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 DEGREE OF COMPETITION

5.5.2 BARGAINING POWER OF SUPPLIERS

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 THREAT OF SUBSTITUTES

5.5.5 THREAT OF NEW ENTRANTS

5.6 CASE STUDIES

5.6.1 ALPHA LASER FIXES DIMENSION OF HYDRAULIC SHAFT USING LASER CLADDING

5.6.2 EXTREME HIGH-SPEED LASER MATERIAL DEPOSITION PROVES RELIABLE, EFFICIENT, AND EFFECTIVE FOR SEALING GRAY IRON CASTINGS FOR BRAKE DISCS

5.6.3 SMART DIODE LASER CLADDING OFFERED CORROSION-RESISTANCE TO NAVAL DESTROYERS

5.6.4 LASER CLADDINGS WITH ADVANCED MATERIALS RETURNED RAM TO BETTER THAN OEM STANDARD AT LESS COST

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGY

5.7.2 COMPLEMENTARY TECHNOLOGY

5.7.3 ADJACENT TECHNOLOGIES

TABLE 5 COMPARISON OF LASER CLADDING AND ADJACENT TECHNOLOGIES

5.8 AVERAGE SELLING PRICE (ASP) TREND ANALYSIS

TABLE 6 AVERAGE SELLING PRICES OF LASER CLADDING MACHINES BASED ON TYPE OF LASERS

5.9 TRADE ANALYSIS

5.9.1 EXPORTS SCENARIO

TABLE 7 EXPORTS DATA FOR HS CODE: 901320, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 26 EXPORTS DATA FOR LASERS, EXCLUDING LASER DIODES, FOR TOP FIVE COUNTRIES, 2016–2020 (USD THOUSAND)

5.9.2 IMPORTS SCENARIO

TABLE 8 IMPORTS DATA FOR HS CODE: 901320, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 27 IMPORTS DATA FOR LASERS, EXCLUDING LASER DIODES, FOR TOP FIVE COUNTRIES, 2016–2020 (USD THOUSAND)

5.10 PATENTS ANALYSIS

TABLE 9 PATENTS RELATED TO LASER CLADDING, 2019–2021

5.11 TARIFFS AND REGULATIONS

5.11.1 TARIFFS RELATED TO LASER CLADDING MARKET

TABLE 10 TARIFFS IMPOSED BY CHINA ON EXPORTS OF LASERS, EXCLUDING LASER DIODES, BY COUNTRY, 2020

TABLE 11 TARIFFS IMPOSED BY US ON EXPORTS OF LASERS, EXCLUDING LASER DIODES, BY COUNTRY, 2020

TABLE 12 TARIFFS IMPOSED BY GERMANY ON EXPORTS OF LASERS, EXCLUDING LASER DIODES, BY COUNTRY, 2020

5.11.2 STANDARDS AND REGULATIONS RELATED TO LASER CLADDING MARKET

5.11.2.1 IEC

TABLE 13 IEC LASER CLASSIFICATIONS

5.11.2.2 CDRH

5.11.3 REGIONAL STANDARDS

5.11.3.1 US

TABLE 14 LASER STANDARDS DEFINED BY ANSI

5.11.3.2 Europe

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 28 REVENUE SHIFT FOR LASER CLADDING MARKET

6 LASER CLADDING MARKET, BY TYPE (Page No. - 78)

6.1 INTRODUCTION

FIGURE 29 DIODE LASER TO HOLD LARGEST SHARE OF LASER CLADDING MARKET DURING FORECAST PERIOD

TABLE 15 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 16 MARKET, BY TYPE, 2021–2026 (USD MILLION)

6.2 DIODE LASER

6.2.1 DIODE LASER CLADDING OFFERS HIGH-QUALITY CLADDING WITH LOW DILUTION, LOW POROSITY, AND GOOD SURFACE FINISH

TABLE 17 MARKET FOR DIODE LASER, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 MARKET FOR DIODE LASER, BY REGION, 2021–2026 (USD MILLION)

6.3 FIBER LASER

6.3.1 FIBER LASER IS AVAILABLE IN VARYING POWER MODES, INCLUDING CONTINUOUS WAVE (CW) AND MODULATED MODES

FIGURE 30 FIBER LASER CLADDING MARKET TO GROW AT HIGHEST CAGR IN APAC DURING FORECAST PERIOD

TABLE 19 MARKET FOR FIBER LASER, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 MARKET FOR FIBER LASER, BY REGION, 2021–2026 (USD MILLION)

6.4 YAG LASER

6.4.1 YAG LASER CAN REACH DEEPER LAYERS OF SKIN TISSUES

TABLE 21 MARKET FOR YAG LASER, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 MARKET FOR YAG LASER, BY REGION, 2021–2026 (USD MILLION)

6.5 CO2 LASER

6.5.1 CO2 LASER OFFERS HIGH POWER, PERFORMANCE, AND COMPACT SIZE

TABLE 23 MARKET FOR CO2 LASER, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 MARKET FOR CO2 LASER, BY REGION, 2021–2026 (USD MILLION)

6.6 OTHERS

TABLE 25 MARKET FOR OTHER LASERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 MARKET FOR OTHER LASERS, BY REGION, 2021–2026 (USD MILLION)

7 LASER CLADDING MARKET, BY REVENUE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 31 LASER CLADDING MARKET, BY REVENUE

FIGURE 32 MARKET FOR LASER REVENUE TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY REVENUE, 2021–2026 (USD MILLION)

7.2 LASER REVENUE

7.2.1 LASER REVENUE COVERS REVENUE GENERATED FROM SALES OF DIFFERENT TYPES OF LASERS

TABLE 29 MARKET FOR LASER REVENUE, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 MARKET FOR LASER REVENUE, BY REGION, 2021–2026 (USD MILLION)

7.3 SYSTEM REVENUE

7.3.1 EXTENSIVE APPLICABILITY OF LASER CLADDING SYSTEMS EXPANDS THEIR UTILITY ACROSS VARIOUS END-USE INDUSTRIES

TABLE 31MARKET FOR SYSTEM REVENUE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR SYSTEM REVENUE, BY REGION, 2021–2026 (USD MILLION)

8 LASER CLADDING MARKET, BY MATERIAL (Page No. - 91)

8.1 INTRODUCTION

8.2 COBALT-BASED ALLOYS

8.3 NICKEL-BASED ALLOYS

8.4 IRON-BASED ALLOYS

8.5 CARBIDES & CARBIDE BLENDS

9 LASER CLADDING MARKET, BY END-USE INDUSTRY (Page No. - 92)

9.1 INTRODUCTION

FIGURE 33 LASER CLADDING MARKET FOR AEROSPACE AND DEFENSE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 33 MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 34 MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

9.2 OIL & GAS

9.2.1 LASER CLADDING COMBATS CORROSION IN OIL & GAS INDUSTRY

TABLE 35 MARKET FOR OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

9.3 MINING

9.3.1 LASER CLADDING IMPROVES DURABILITY OF TOOLS AND DEVICES USED IN MINING INDUSTRY

TABLE 37 MARKET FOR MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

9.4 AEROSPACE & DEFENSE

9.4.1 LASER CLADDING IS USED FOR IMPROVING AIRCRAFT STRUCTURES

TABLE 39 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

9.5 AUTOMOTIVE

9.5.1 LASER CLADDING HELPS BOOST OPERATING EFFICIENCY OF VEHICLES AND REDUCE ENVIRONMENTAL IMPACT

FIGURE 34 APAC TO ACCOUNT FOR LARGEST SHARE OF LASER CLADDING MARKET FOR AUTOMOTIVE END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 41 MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

9.6 POWER GENERATION

9.6.1 LASER CLADDING IS IDEAL FOR NUMEROUS PROBLEMS IN POWER GENERATION INDUSTRY

TABLE 43 MARKET FOR POWER GENERATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR POWER GENERATION, BY REGION, 2021–2026 (USD MILLION)

9.7 OTHERS

TABLE 45 LASER CLADDING MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

10 LASER CLADDING MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 35 LASER CLADDING MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 47 LASER CLADDING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 36 NORTH AMERICA: LASER CLADDING MARKET SNAPSHOT

TABLE 49 NORTH AMERICA LASER CLADDING MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 50 NORTH AMERICA LASER CLADDING MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 51 NORTH AMERICA LASER CLADDING MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 52 NORTH AMERICA LASER CLADDING MARKET, BY REVENUE, 2021–2026 (USD MILLION)

TABLE 53 MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 54 MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

FIGURE 37 US TO CAPTURE LARGEST SHARE OF NORTH AMERICAN LASER CLADDING MARKET THROUGHOUT FORECAST PERIOD

TABLE 55 NORTH AMERICA LASER CLADDING MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 56 NORTH AMERICA LASER CLADDING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.1 US

10.2.1.1 Presence of oil & gas, automotive, and aerospace & defense industries in US to propel market growth

TABLE 57 NORTH AMERICA LASER CLADDING MARKET IN US, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 58 MARKET IN US, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Demand from automotive and aerospace industries to fuel market growth in Canada

TABLE 59 NORTH AMERICA LASER CLADDING MARKET IN CANADA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 60 MARKET IN CANADA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 Government investments in expanding oil and gas fields are expected to offer lucrative opportunities for laser cladding solutions providers

TABLE 61 NORTH AMERICA LASER CLADDING MARKET IN MEXICO, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 62 NORTH AMERICA LASER CLADDING MARKET FOR MEXICO, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 38 EUROPE: LASER CLADDING MARKET SNAPSHOT

TABLE 63 EUROPE LASER CLADDING MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 64 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 65 MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 66 EUROPE LASER CLADDING MARKET, BY REVENUE, 2021–2026 (USD MILLION)

TABLE 67 MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 68 EUROPE LASER CLADDING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 69 MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 70 MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Investments and initiatives by key players would drive laser cladding market in Germany

TABLE 71 EUROPE LASER CLADDING MARKET IN GERMANY, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 72 MARKET IN GERMANY, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Increased domestic demand for energy could create lucrative opportunities for laser cladding solutions in UK

TABLE 73 EUROPE LASER CLADDING MARKET IN UK, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR UK, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Automotive industry in France to propel market growth in future

TABLE 75 EUROPE LASER CLADDING MARKET IN FRANCE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 76 EUROPE LASER CLADDING MARKET FOR FRANCE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.3.4 REST OF EUROPE (ROE)

TABLE 77 EUROPE LASER CLADDING MARKET IN ROE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 78 EUROPE LASER CLADDING MARKET IN ROE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4 APAC

FIGURE 39 APAC: LASER CLADDING MARKET SNAPSHOT

FIGURE 40 FIBER LASER TO CAPTURE LARGEST SHARE OF APAC LASER CLADDING MARKET DURING FORECAST PERIOD

TABLE 79 APAC LASER CLADDING MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 82 MARKET, BY REVENUE, 2021–2026 (USD MILLION)

TABLE 83 MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 84 MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 85 MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 86 APAC LASER CLADDING MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China held largest share of APAC laser cladding market in 2020

FIGURE 41 AEROSPACE & DEFENSE TO GROW AT HIGHEST CAGR IN LASER CLADDING MARKET IN CHINA DURING FORECAST PERIOD

TABLE 87 APAC LASER CLADDING MARKET IN CHINA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 88 APAC LASER CLADDING MARKET IN CHINA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Increasing demand for electric and hybrid cars would aid growth of laser cladding in automotive industry

TABLE 89 APAC LASER CLADDING MARKET IN JAPAN, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 90 APAC LASER CLADDING MARKET IN JAPAN, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Expansion of oil and gas facilities to boost demand for laser cladding solutions from oil & gas industry in India

TABLE 91 APAC LASER CLADDING MARKET IN INDIA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 92 APAC LASER CLADDING MARKET IN INDIA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4.4 SOUTH KOREA

10.4.4.1 South Korea has emerged as third-largest laser cladding market in APAC

TABLE 93 APAC LASER CLADDING MARKET IN SOUTH KOREA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 94 APAC LASER CLADDING MARKET IN SOUTH KOREA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.4.5 REST OF APAC (ROAPAC)

TABLE 95 APAC LASER CLADDING MARKET IN ROAPAC, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 96 APAC LASER CLADDING MARKET IN ROAPAC, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.5 ROW

TABLE 97 ROW LASER CLADDING MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 98 MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 99 MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 100 ROW LASER CLADDING MARKET, BY REVENUE, 2021–2026 (USD MILLION)

TABLE 101 MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 102 MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 103 ROW LASER CLADDING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Mining and automotive industries to drive market growth in South America

TABLE 105 ROW LASER CLADDING MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 106 MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Presence of oil & gas and mining industries in Middle East & Africa to drive market growth

TABLE 107 ROW LASER CLADDING MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 108 MARKET IN MIDDLE EAST & AFRICA, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 136)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 109 OVERVIEW OF STRATEGIES DEPLOYED BY KEY LASER CLADDING PLAYERS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 REVENUE ANALYSIS OF LEADING PLAYERS (2016–2020)

FIGURE 42 FIVE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN LASER CLADDING MARKET

11.4 MARKET SHARE ANALYSIS: LASER CLADDING MARKET, 2020

TABLE 110 DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 43 LASER CLADDING MARKET: COMPANY EVALUATION QUADRANT, 2020

11.6 STARTUP EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 44 LASER CLADDING MARKET: STARTUP (SME) EVALUATION QUADRANT, 2020

11.7 COMPANY FOOTPRINT

TABLE 111 PRODUCT FOOTPRINT OF COMPANIES

TABLE 112 TYPE FOOTPRINT OF COMPANIES

TABLE 113 END-USE INDUSTRY FOOTPRINT OF COMPANIES

TABLE 114 REGIONAL FOOTPRINT OF COMPANIES

11.8 COMPETITIVE SITUATIONS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 115 PRODUCT LAUNCHES, NOVEMBER 2018–JANUARY 2020

11.8.2 DEALS

TABLE 116 DEALS, MARCH 2018– AUGUST 2021

11.8.3 OTHERS

TABLE 117 OTHERS, NOVEMBER 2018– MAY 2021

12 COMPANY PROFILES (Page No. - 152)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

12.2.1 TRUMPF

TABLE 118 TRUMPF: BUSINESS OVERVIEW

FIGURE 45 TRUMPF: COMPANY SNAPSHOT

TABLE 119 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 120 TRUMPF: PRODUCT LAUNCHES

TABLE 121 TRUMPF: DEALS

TABLE 122 TRUMPF: OTHERS

12.2.2 OERLIKON

TABLE 123 OERLIKON: BUSINESS OVERVIEW

FIGURE 46 OERLIKON: COMPANY SNAPSHOT

TABLE 124 OERLIKON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 125 OERLIKON: PRODUCT LAUNCHES

TABLE 126 OERLIKON: DEALS

TABLE 127 OERLIKON: OTHERS

12.2.3 COHERENT

TABLE 128 COHERENT: BUSINESS OVERVIEW

FIGURE 47 COHERENT: COMPANY SNAPSHOT

TABLE 129 COHERENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 130 COHERENT: DEALS

12.2.4 IPG PHOTONICS

TABLE 131 IPG PHOTONICS: BUSINESS OVERVIEW

FIGURE 48 IPG PHOTONICS: COMPANY SNAPSHOT

TABLE 132 IPG PHOTONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 133 IPG PHOTONICS: PRODUCT LAUNCHES

TABLE 134 IPG PHOTONICS: DEALS

12.2.5 HAN’S LASER

TABLE 135 HAN’S LASER: BUSINESS OVERVIEW

FIGURE 49 HAN’S LASER: COMPANY SNAPSHOT

TABLE 136 HAN’S LASER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 137 HAN’S LASER: PRODUCT LAUNCHES

12.2.6 HOGANAS AB

TABLE 138 HOGANAS AB: BUSINESS OVERVIEW

TABLE 139 HOGANAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.7 LUMIBIRD

TABLE 140 LUMIBIRD: BUSINESS OVERVIEW

FIGURE 50 LUMIBIRD: COMPANY SNAPSHOT

TABLE 141 LUMIBIRD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 142 LUMIBIRD: PRODUCT LAUNCHES

TABLE 143 LUMIBIRD: DEALS

12.2.8 LUMENTUM

TABLE 144 LUMENTUM: BUSINESS OVERVIEW

FIGURE 51 LUMENTUM: COMPANY SNAPSHOT

TABLE 145 LUMENTUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 LUMENTUM: PRODUCT LAUNCHES

TABLE 147 LUMENTUM: DEALS

12.2.9 CURTISS-WRIGHT CORPORATION

TABLE 148 CURTISS-WRIGHT CORPORATION: BUSINESS OVERVIEW

FIGURE 52 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

TABLE 149 CURTISS-WRIGHT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 CURTISS-WRIGHT CORPORATION: DEALS

12.2.10 JENOPTIK

TABLE 151 JENOPTIK: BUSINESS OVERVIEW

FIGURE 53 JENOPTIK: COMPANY SNAPSHOT

TABLE 152 JENOPTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 153 JENOPTIK: DEALS

TABLE 154 JENOPTIK: OTHERS

12.3 OTHER KEY PLAYERS

12.3.1 ALABAMA SPECIALTY PRODUCTS

12.3.2 EFESTO

12.3.3 FRAUNHOFER USA CENTER MIDWEST CMW

12.3.4 GRAVOTECH

12.3.5 HAYDEN CORPORATION

12.3.6 KONDEX CORPORATION

12.3.7 LASERBOND

12.3.8 LASERSTAR

12.3.9 LASERLINE

12.3.10 LASER CLADDING TECHNOLOGIES

12.3.11 LINCOLN LASER SOLUTIONS

12.3.12 OPTOMEC

12.3.13 PRECO

12.3.14 TECHNOGENIA

12.3.15 TLM LASER

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 199)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

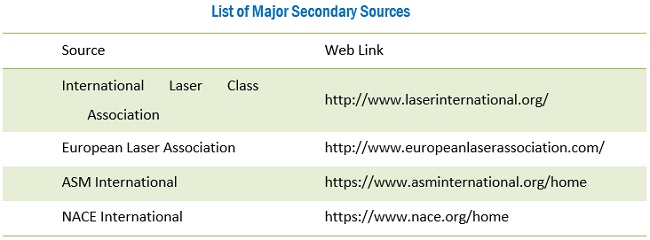

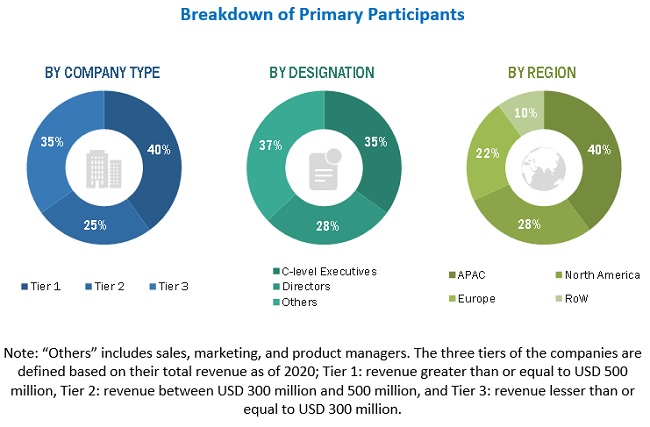

This research study involved extensive use of secondary sources, directories, and databases (e.g., Hoovers, Bloomberg Business, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the laser cladding market. Primary sources include several industry experts from the core and related industries and suppliers, manufacturers, distributors, technology developers, IP vendors, and standards organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess the prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; articles from recognized authors; and websites, directories, and databases. Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the market’s value chain, major players, market classification and segmentation according to the industry trends to the bottommost level, geographic markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

To know about the assumptions considered for the study, download the pdf brochure

Primary Research

Extensive primary research was conducted after acquiring knowledge about the laser cladding market scenario through secondary research. Several primary interviews were conducted with market experts from supply (manufacturers of laser claddings) and demand (end-use industries) sides across four major regions—North America, Europe, APAC, and RoW, which includes South America, the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with the demand side and 70% with the supply side. Primary data was mainly collected through telephonic interviews, which consist of approximately 80% of the overall primary interviews. Questionnaires and e-mails were also used to collect the data.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches were used along with several data triangulation methods to perform the market estimation and forecasting for the overall market segments and subsegments listed in this report. The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. The entire procedure included the study of annual and financial reports of top market players and extensive interviews for key insights from industry experts, such as CEOs, VPs, directors, and marketing executives.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The bottom-up approach was used to arrive at the overall size of the laser cladding market from the revenue of the key players and their market share. The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Identifying key participants that influence the overall laser cladding market, along with related component providers

- Analyzing key providers of laser cladding components, along with raw material providers, and studying their portfolios to understand the different components and products offered by them

- Examine the developments undertaken by the key players during the pre-COVID-19 period, as well as studying the measures/steps undertaken by them to deal with COVID-19

- Predicting the anticipated change in demand for laser cladding equipment and their components in the post-COVID-19 scenario

- Analyzing trends pertaining to the use of laser cladding in different end-use industries such as oil & gas, mining, aerospace & defense, automotive, and power generation

- Tracking the ongoing and identifying the upcoming developments in the market in the form of investments, R&D activities, product launches, collaborations, and partnerships, and forecasting the market on the basis of these developments

- Carrying out multiple discussions with key opinion leaders to understand the various types of laser cladding solutions used in different applications and recent trends in the market, thereby analyzing the scope of the work carried out by the leading companies

- Arriving at the market estimates by analyzing the revenues generated by companies and combining the revenues to get the market estimates

- Segmenting the overall market into different segments

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. To calculate the size of specific market segments, the size of the most appropriate parent market was considered to implement the top-down approach. Data from interviews was consolidated, checked for consistency and accuracy, and inserted into a data model to arrive at the market numbers following the top-down approach. The market size in different regions was identified and analyzed through secondary research.

Upon the estimation and validation of the size of the laser cladding market, further segmentation was carried out based on consolidated inputs from key players with respect to regional adoption trends of laser claddings and pervasiveness of the different types of laser claddings across different end-use industries and regions.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing on top-line investments and expenditures made in the laser cladding market ecosystem

- Calculating the market size by adding the revenues generated by the key players through the sales of laser cladding components, estimating the market size for 2020 by considering the impact of COVID-19 across the value chain of the laser cladding market, and analyzing recovery scenarios across the world to further forecast the market size

- Conducting multiple discussions with key opinion leaders from the key companies operating in the laser cladding market to understand the pre-COVID-19 and post-COVID-19 scenarios

- Estimating the geographic split using secondary sources on the basis of factors such as the demand for laser cladding in a specific country and region and adoption rate of different types of lasers across end-use industries such as aerospace & defense, automotive, oil & gas, and others

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the overall market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, market breakdown and data triangulation procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the laser cladding market on the basis of type, revenue, end-use industry, and region

- To provide an impact analysis of the drivers, restraints, opportunities, and challenges affecting the market dynamics

- To provide an overall view of the global laser cladding market through illustrative segmentation, analyses, and market size estimations of major geographic segments

- To forecast the size of various segments of the laser cladding market for four regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective countries

- To strategically analyze micromarkets of the laser cladding market with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To provide the competitive landscape of the market

- To analyze strategic developments such as mergers & acquisitions and new product developments in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laser Cladding Market