Laser Diode Market by Wavelength (Infrared, Green, Blue, Ultraviolet), Doping Material, Technology (Distributed Feedback, Quantum Cascade, VCSEL), Application (Industrial, Medical, Consumer Electronics, Telecommunication), Region -Global Forecast to 2032

Updated on : October 23, 2024

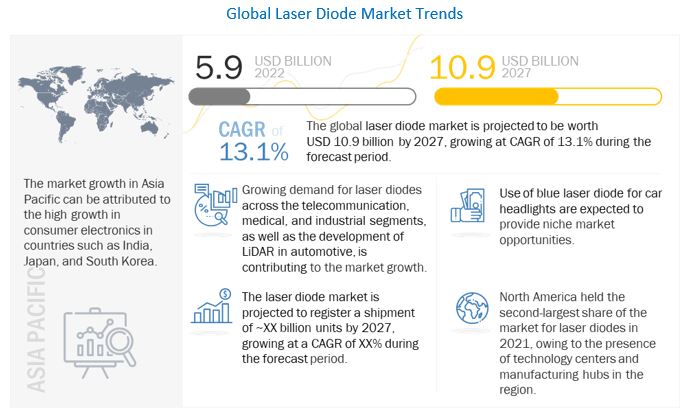

The laser diode market is experiencing substantial growth, driven by increasing demand across diverse applications such as telecommunications, healthcare, industrial manufacturing, and consumer electronics. Laser diodes are essential in fiber-optic communications, medical devices like laser surgery equipment, and various industrial applications including cutting, welding, and material processing. Key trends shaping the market include advancements in laser technology, such as higher power output and improved energy efficiency, as well as the growing use of laser diodes in emerging areas like autonomous vehicles, 3D sensing, and LiDAR systems. Additionally, the increasing adoption of laser diodes in consumer electronics, such as smartphones and gaming devices, and the push for miniaturization in electronics are fueling market expansion. Government initiatives to enhance telecommunication infrastructure and the growing need for high-speed data transmission further drive the demand for laser diodes globally.

Laser Diode Market Size & Growth

The global laser diode market size is expected to grow from USD 5.9 billion in 2022 to USD 10.9 billion by 2027, growing at a CAGR of 13.1% during the forecasted period from 2022 to 2027.

Growing application areas of laser diodes in various industries, expanding fiber laser market and surge in demand for high-power laser diodes for industrial applications are the few drivers for pertaining the growth of market.

To know about the assumptions considered for the study, Request for Free Sample Report

Laser Diode Market Trends and Dynamics

DRIVERS: Surge in demand for high-power laser diodes for industrial applications

High-power laser diodes are multimode laser diodes, which have an enlarged emitter that allows higher power than single-mode laser diodes. The output power varies depending on the wavelength required.

Laser diodes are available in wavelengths from the UV (~370 nm) through the mid IR (>2 um) wavelengths. High-power laser diodes can reach output powers of many watts in some wavelengths, and hundreds of milliwatts in other wavelengths. With the availability of high-power diode laser systems in the kilowatt range, industrial high-brightness systems are being used for welding applications, whereas low-brightness laser diodes are used in high-power applications such as cladding, additive manufacturing, brazing, and hardening.

RESTRAINT: High initial investment for industrial applications

The higher initial investment required for laser diodes as compared to other light emitting diodes is a major restraining factor for the overall laser diode market.

Lasers required for different processes, systems, and applications are in the range of a few hundred to thousands of watts. Although the use of laser products in industries such as automotive and manufacturing would reduce manpower costs, the cost of installing laser products is very high.

The cost incurred for installing laser-enabled products is generally 30–40% higher than the conventional method. To implement the latest laser-enabled products in industries such as automotive, a total revamp of the assembly line is required, which, in turn, needs a huge amount of capital investment.

OPPORTUNITIES: Increasing applications of laser diodes in biomedical field

As the market has matured, laser diodes of 660 nm wavelength have been adopted for various applications, such as industrial line lasers and measurement lasers.

Light in the 670–690 nm band, which is slightly longer than the wavelength mentioned above, is characterized by a particularly deep penetration depth into biological tissues among red light, which is about 2–3 mm in the case of human skin. Moreover, the existence of photosensitizers (porphyrin compound) that are highly bio-compatible, absorb red light, and generate reactive oxygen species has led to the use of red laser diodes as a method of therapeutic treatment.

Recently, laser manufacturing companies are developing red laser diodes in the 640 nm band, which is close to the He-Ne laser wavelength. These are used for fluorescence bio-imaging, for example, confocal microscopy and scattering measurements, such as flow cytometry and particle size measurement.

CHALLENGES: Environmental concerns over use of rare earth elements

The use of rare earth metals such as neodymium, chromium, erbium, or ytterbium involves processing and refining using solid-state and fiber lasers, which poses a major threat of radioactive pollution that is caused by slurry tailings.

The refining processes use toxic acids, which, when handled improperly, may result in extensive environmental damage. Also, the use of rare earth metals poses the risk of supply disruptions in the short term, and supply challenges for these metals may affect the deployment of clean energy technology in the years to come.

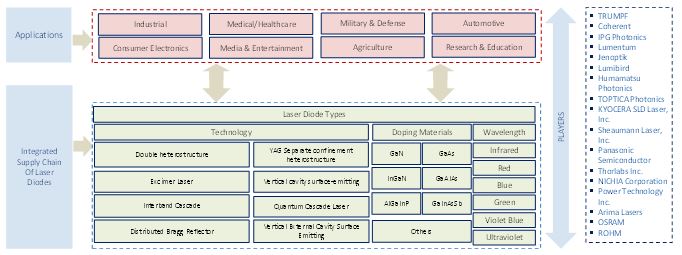

Laser Diode Market Ecosystem

Laser Diode Market Segment Overview

Red laser diode expected to hold the second largest share of laser diode market during forecasted period

Red laser diodes are used in various applications such as laser pointers for optical data recording or retrieval (e.g., on DVDs), laser projection displays, interferometers, military, industry, pumping of certain solid-state lasers, and in medical therapies (e.g., photodynamic therapy) among others.

Many companies are developing red laser diodes for medical purposes. For instance, in February 2020, Ushio Opto Semiconductors launched a 660 nm red laser diode for sensing and bio-medical applications.

Gallium aluminum arsenide (GaAlAs) to hold the second largest share in laser diode market in 2021

Gallium aluminum arsenide (GaAlAs) based laser diodes can be easily integrated with other optical devices to produce gallium arsenide (GaAs) heterostructure lasers.

GaAlAs-based laser diodes are ultra-small size and can effectively reduce size and weight of laser diodes to meet various practical applications. The companies offering GaAlAs laser diodes are Frankfurt Lasers, AKELA Laser, Micro Laser Systems, Sheaumann, and Leonardo Electronics, among others

Quantum cascade laser diode is expected to be the second fastest growing segment of the laser diode market during the forecasted period

Quantum cascade laser diode is a form of heterojunction laser diode, in which the difference between well energy levels is used to provide the laser light generation.

This allows the laser diode to generate relatively long wavelength light and the actual wavelength can be regulated during fabrication by changing the laser diode layer thickness. Quantum cascade laser diodes are used in spectroscopy, communication, and missile countermeasure applications. The major players in this market are Hamamatsu Photonics, Thorlabs, Alpes Laser, Power Technologies, and others.

Healthcare & medical application is expected to be the second fastest growing segment of the laser diode market during the forecasted period

Laser diodes are used for a wide range of medical applications, including surgery, dermatology, gynecology, cardiology, otology, ophthalmology, angioplasty, photodynamic therapy (PDT), diagnostic image processing, and others.

Other medical applications of laser diodes include early cancer detection by computed tomography, laser mammography, and the treatment of carpal tunnel syndrome and musculature strain with the use of low-level laser therapy.

Laser diodes, especially red, green, and blue laser diodes, are also used in cosmetic applications such as hair removal. Laser diode technology has proven to be an essential surgical tool for improving eyesight, repairing torn retinas, treating kidney stones, and for the removal of spinal tumors. The wavelength range of laser diodes for medical applications varies from 635 nm to 2000 nm.

Laser Diode Industry Regional Analysis

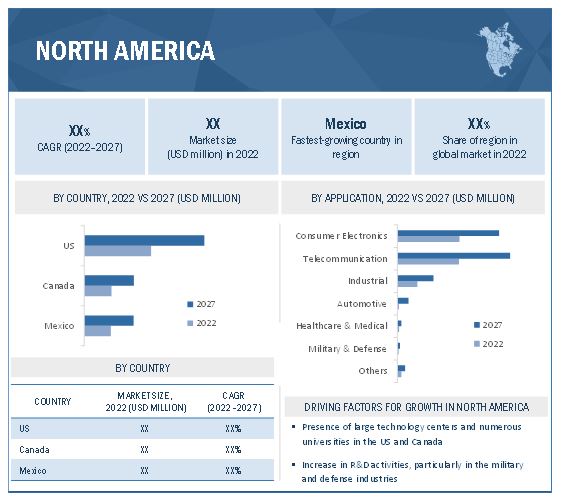

North America is expected to hold the second largest market of laser diode during forecasted period

The growth of the laser diode market in North America is due to the growing number of technological innovations in field of laser technology for various application areas such as medical, telecommunication, military & defense, and automotive.

The increase in R&D activities, particularly in the military and defense industries, has propelled the demand for laser diodes in the region. As of 2021, the annual military expenditure in the US was about 3.6% of the global GDP of the country. This will create lucrative growth opportunities for laser diodes in military applications. Apart from this, increasing application of laser diodes in the healthcare sector is one of the major market drivers.

To know about the assumptions considered for the study, download the pdf brochure

Top Laser Diode Companies - Key Market Players

The laser diode companies is dominated by a few globally established players such as

- II-VI Incorporated (US),

- Lumentum Holding Inc. (US),

- Ams-OSRAM AG (Austria),

- ROHM Co., Ltd. (Japan),

- Hamamatsu Photonics K.K. (Japan),

- MKS Instruments (US),

- IPG Photonics Inc. (US),

- Jenoptik AG (Germany),

- Sharp Corp. (Japan),

- Ushio, Inc. (US), among others.

Laser Diode Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 5.9 billion |

| Projected Market Size | USD 10.9 billion |

| Growth rate | 13.1% |

|

Market size availability for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Million Units) |

|

Segments covered |

|

|

Geographies covered |

|

|

Market Leaders |

Jenoptik AG (Germany), Ams-OSRAM AG (Austria), ROHM Co., Ltd. (Japan), Sharp Corp. (Japan), Hamamatsu Photonics K.K. (Japan) and others. |

|

Top Companies in North America |

The major market player includes II-VI Incorporated (US), Lumentum Holding Inc. (US), MKS Instruments (US), Ushio, Inc. (US). |

|

Key Market Driver |

Surge in demand for high-power laser diodes for industrial applications |

|

Key Market Opportunity |

Increasing applications of laser diodes in biomedical field |

|

Largest Growing Region |

North America |

|

Largest Market Share Segment |

Gallium aluminum arsenide (GaAlAs) |

The study categorizes the laser diode market share based on wavelength, doping material, technology, and region at the global level.

Based on Wavelength, the Laser Diode Market been Segmented as below:

- Infrared Laser Diodes

- Red Laser Diodes

- Blue Laser Diodes

- Blue Violet Laser Diodes

- Green Laser Diodes

- Ultraviolet Laser Diodes

Based on Doping Material, the Laser Diode Market been Segmented as below:

- Gallium Aluminum Arsenide (GaAIAs)

- Gallium Arsenide (GaAs)

- Gallium Indium Arsenic Antimony (GaInAsSb)

- Aluminum Gallium Indium Phosphide (AIGaInP)

- Indium Gallium Nitride (InGaN)

- Gallium Nitride (GaN)

- Others (Indium Gallium Arsenide Phosphide (InGaAsP), Gallium Phosphide (GaP), and Gallium Antimonide (GaSb))

Based on Technology, the Laser Diode Market been Segmented as below:

- Double Hetero Structure Laser Diodes

- Quantum Well Laser Diodes

- Quantum Cascade Laser Diodes

- Distributed Feedback Laser Diodes

- SCH Laser Diodes

- Vertical Cavity Surface Emitting Laser (VCSEL) Diodes

- Vertical External Cavity Surface Emitting Laser (VECSEL) Diodes

Based on Application, the Laser Diode Market been Segmented as below:

- Telecommunication

- Industrial

- Medical & Healthcare

- Military & Defense

- Consumer Electronics

- Automotive

- Others (Media & Entertainment, Research & Education, Agriculture)

Based on Region, the Laser Diode Market been Segmented as below:

- North America

- Europe

- Asia Pacific

-

Rest of the World

- Middle East & Africa

- South America

Recent Developments in Laser Diode industry

- In April 2022, Lumentum introduced the FemtoBlade laser system, which is the second generation of the company’s portfolio of high-precision ultrafast industrial lasers. The new system features a modular design, which offers high power at high repetition rates, thus ensuring better flexibility and faster processing speed.

- In April 2022, MKS Instruments announced an agreement with Atotech Limited to extend the date for completing previously announced and pending acquisition of Atotech to September 30, 2022.

- In March 2022, Ushio launched deep red color (670~690 nm) laser diodes for biomedical applications. These laser diodes have been used for many applications, such as industrial and measurement.

- In August 2022, Lumentum acquired NeoPhotonics Corporation with the aim to expand its business in the areas of optoelectronics, lasers, and cloud networking infrastructures.

Frequently Asked Questions (FAQs):

What is the market size of the laser diode market?

The size of the global laser diode market was valued at around 5.9 billion USD in 2022 and is expected to grow 10.9 billion by 2027, at a CAGR of 13.1%.

What are the key applications of laser diodes market?

Laser diodes are used in a wide range of applications, including medical devices, optical communication, industrial processing, and consumer electronics.

What are the factors driving the growth of the laser diode market size?

The growth of the laser diode market is driven by factors such as increasing demand for high-speed data transfer, rising demand for consumer electronics and the growing demand for laser-based medical devices.

Who are the major players in the laser diode market share?

Some of the major players in the laser diode market include Coherent, Inc., IPG Photonics, OSRAM Licht AG, Mitsubishi Electric, and Lumentum Holdings.

What is the future outlook for the laser diode market share?

The future outlook for the laser diode market is positive, with increasing demand from various end-user industries, such as consumer electronics and medical devices. Additionally, the development of new laser diode technologies and the increasing demand for high-speed data transfer is expected to drive the market growth in the future.

What are some of the technology trends of laser diode market?

The recent trends of the laser diode market include 3D sensing and LiDAR in automotive application.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 LASER DIODE MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 LASER DIODE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 LASER DIODE MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 6 INFRARED LASER DIODES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 7 AUTOMOTIVE SEGMENT EXPECTED TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

FIGURE 8 GALLIUM ARSENIDE (GAAS) TO CONTINUE TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

FIGURE 9 VCSEL TECHNOLOGY SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LASER DIODE MARKET

FIGURE 11 SIGNIFICANT INCREASE IN MILITARY R&D EXPENDITURE TO BOOST ADOPTION OF LASER DIODES

4.2 MARKET, BY WAVELENGTH

FIGURE 12 RED LASER DIODES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY DOPING MATERIAL

FIGURE 13 GALLIUM NITRIDE (GAN) SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.4 MARKET, BY TECHNOLOGY

FIGURE 14 DISTRIBUTED FEEDBACK LASER DIODE TO HOLD LARGEST SHARE OF MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

4.5 MARKET, BY APPLICATION

FIGURE 15 CONSUMER ELECTRONICS APPLICATION TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.6 MARKET, BY REGION

FIGURE 16 ASIA PACIFIC TO GROW AT FASTEST RATE IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 53)

5.1 MARKET DYNAMICS

FIGURE 17 GROWING APPLICATION AREAS OF LASER DIODES EXPECTED TO BOOST LASER DIODE MARKET

5.1.1 DRIVERS

5.1.1.1 Growing application areas of laser diodes in various industries

5.1.1.2 Expanding fiber laser market

5.1.1.3 Surge in demand for high-power laser diodes for industrial applications

5.1.1.4 Increasing investments in military & defense leading to high demand for laser technology

TABLE 1 MILITARY EXPENDITURE BY MAJOR COUNTRIES, 2021

FIGURE 18 DRIVERS AND THEIR IMPACT ON MARKET

5.1.2 RESTRAINTS

5.1.2.1 High initial investment required for industrial applications

FIGURE 19 RESTRAINTS AND THEIR IMPACT ON MARKET

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing applications of laser diodes in biomedical field

5.1.3.2 Development of vertical cavity surface-emitting laser (VCSEL) technology

FIGURE 20 OPPORTUNITIES AND THEIR IMPACT ON MARKET

5.1.4 CHALLENGES

5.1.4.1 Environmental concerns over use of rare earth elements

FIGURE 21 CHALLENGES AND THEIR IMPACT ON MARKET

5.2 VALUE CHAIN ANALYSIS

FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING MANUFACTURING PHASE

5.3 ECOSYSTEM ANALYSIS

FIGURE 23 GLOBAL LASER DIODE MARKET: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE OF LASER SYSTEMS OFFERED BY TOP THREE MARKET PLAYERS, BY WAVELENGTH

FIGURE 24 AVERAGE SELLING PRICE OF LASER DIODE OFFERED BY TOP THREE MARKET PLAYERS, BY WAVELENGTH

TABLE 3 AVERAGE SELLING PRICE OF LASER DIODES OFFERED BY TOP THREE MARKET PLAYERS, BY WAVELENGTH

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 25 REVENUE SHIFT FOR MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 LIDAR

5.6.2 3D SENSING

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.1 THREAT OF NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 APPLICATION

TABLE 5 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS, BY TOP 3 APPLICATION (%)

5.8.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 6 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.9 CASE STUDIES

5.9.1 3D PRINTING FOR MANUFACTURING

5.9.2 MEDICAL LASERS

5.10 TRADE ANALYSIS

FIGURE 28 IMPORT DATA FOR HS CODE 854110, BY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 29 EXPORT DATA FOR HS CODE 854110, BY COUNTRY, 2017–2021 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 30 ANALYSIS OF PATENTS GRANTED IN MARKET

TABLE 7 PATENTS RELATED TO LASER DIODE, 2022

5.12 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 8 MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 STANDARDS AND REGULATIONS RELATED TO MARKET

5.13.1.1 International Electrotechnical Commission (IEC)

TABLE 9 IEC LASER CLASSIFICATIONS

5.13.1.2 Center for Devices and Radiological Health (CDRH)

5.13.2 REGIONAL STANDARDS

5.13.2.1 US

TABLE 10 ANSI LASER STANDARDS

5.13.2.2 Europe

6 LASER DIODE, BY MODE OF OPERATION (Page No. - 76)

6.1 INTRODUCTION

FIGURE 31 LASER DIODE MARKET, BY MODE OF OPERATION

6.2 SINGLE-MODE LASER DIODES

6.2.1 PREFERRED IN LOW-POWER APPLICATIONS

6.3 MULTIMODE LASER DIODES

6.3.1 USED FOR HIGH-POWER APPLICATIONS

7 LASER DIODE MARKET, BY WAVELENGTH (Page No. - 79)

7.1 INTRODUCTION

FIGURE 32 MARKET SEGMENTATION: BY WAVELENGTH

TABLE 11 MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 12 MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

7.2 INFRARED LASER DIODES

7.2.1 USED FOR LONG-DISTANCE TIME-OF-FLIGHT OR PHASE-SHIFT RANGE-FINDING SYSTEMS

TABLE 13 INFRARED MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 14 INFRARED MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.3 RED LASER DIODES

7.3.1 OFFER HIGH STABILITY, EFFICIENCY, AND RELIABILITY

TABLE 15 RED LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.4 BLUE LASER DIODES

7.4.1 USED IN AUTOMOTIVE HEAD LAMPS, AND PROJECTION, TELECOMMUNICATION, AND MEDICAL APPLICATIONS

TABLE 17 BLUE LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.5 GREEN LASER DIODES

7.5.1 USED BY ASTRONOMERS TO IDENTIFY STARS AND PATTERNS

TABLE 19 GREEN LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 20 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.6 BLUE VIOLET LASER DIODES

7.6.1 USED IN 3D PRINTING, BIOMEDICAL, AND INDUSTRIAL APPLICATIONS

TABLE 21 BLUE VIOLET LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 22 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.7 UV LASER DIODES

7.7.1 PULSED HIGH-POWER UV LASER DIODES USED FOR EFFICIENT CUTTING AND DRILLING APPLICATIONS

TABLE 23 ULTRAVIOLET LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8 LASER DIODE MARKET, BY DOPING MATERIAL (Page No. - 89)

8.1 INTRODUCTION

FIGURE 33 MARKET SEGMENTATION: BY DOPING MATERIAL

TABLE 25 MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 26 MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

8.2 GALLIUM ALUMINUM ARSENIDE (GAALAS)

8.2.1 USED IN COMMUNICATION AND RESEARCH APPLICATIONS

TABLE 27 GALLIUM ALUMINUM ARSENIDE (GAALAS): MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 28 GALLIUM ALUMINUM ARSENIDE (GAALAS): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.3 GALLIUM ARSENIDE (GAAS)

8.3.1 OFFERS BETTER OPTICAL COMPETENCY THAN OTHER SEMICONDUCTOR MATERIALS

TABLE 29 GALLIUM ARSENIDE (GAAS): LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 30 GALLIUM ARSENIDE (GAAS): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.4 ALUMINUM GALLIUM INDIUM PHOSPHIDE (ALGAINP)

8.4.1 PRIMARILY USED IN OPTICAL DISC READERS, DVD PLAYERS, AND COMPACT DISC PLAYERS

TABLE 31 ALUMINUM GALLIUM INDIUM PHOSPHIDE (ALGAINP): MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 32 ALUMINUM GALLIUM INDIUM PHOSPHIDE (ALGAINP): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.5 INDIUM GALLIUM NITRIDE (INGAN)

8.5.1 USED TO DEVELOP GREEN, BLUE, AND WHITE LASERS

TABLE 33 INDIUM GALLIUM NITRIDE (INGAN): LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 34 INDIUM GALLIUM NITRIDE (INGAN): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.6 GALLIUM NITRIDE (GAN)

8.6.1 WIDELY USED FOR PRODUCTION OF SEMICONDUCTOR OPTOELECTRONIC DEVICES

TABLE 35 GALLIUM NITRIDE (GAN): MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 36 GALLIUM NITRIDE (GAN): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.7 GALLIUM INDIUM ARSENIC ANTIMONY (GAINASSB)

8.7.1 EMITS WAVELENGTH IN INFRARED REGION AND USED IN SPECTROSCOPY

TABLE 37 GALLIUM INDIUM ARSENIC ANTIMONY (GAINASSB): MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 38 GALLIUM INDIUM ARSENIC ANTIMONY (GAINASSB): MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.8 OTHERS

TABLE 39 OTHERS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 40 OTHERS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9 LASER DIODE MARKET, BY TECHNOLOGY (Page No. - 100)

9.1 INTRODUCTION

FIGURE 34 MARKET SEGMENTATION: BY TECHNOLOGY

TABLE 41 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 42 MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

9.2 DISTRIBUTED FEEDBACK LASER DIODES

9.2.1 USED AS OPTICAL SIGNALS FOR HIGH-CAPACITY LONG-DISTANCE OPTICAL COMMUNICATION

TABLE 43 DISTRIBUTED FEEDBACK LASER DIODES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 44 DISTRIBUTED FEEDBACK LASER DIODES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 DOUBLE HETEROSTRUCTURE LASER DIODES

9.3.1 USED FOR HIGH OPTICAL AMPLIFICATION IN TELECOMMUNICATION

TABLE 45 DOUBLE HETEROSTRUCTURE LASER DIODES: LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 46 DOUBLE HETEROSTRUCTURE LASER DIODES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 QUANTUM CASCADE LASER DIODES

9.4.1 SUITABLE FOR APPLICATIONS IN SPECTROSCOPY, COMMUNICATION, AND MISSILE COUNTERMEASURE

TABLE 47 QUANTUM CASCADE LASER DIODES: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 48 QUANTUM CASCADE LASER DIODES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 QUANTUM WELL LASER DIODES

9.5.1 USED FOR MEDICAL THERAPY, MATERIAL PROCESSING, AND LASER PRINTING

TABLE 49 QUANTUM WELL LASER DIODES: LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 50 QUANTUM WELL LASER DIODES: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.6 SEPARATE CONFINEMENT HETEROSTRUCTURE (SCH) LASER DIODES

9.6.1 EFFECTIVELY CONFINE LIGHT AND OFFER HIGH LIGHT INTENSITY

TABLE 51 SCH: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 52 SCH: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.7 VERTICAL CAVITY SURFACE-EMITTING LASER (VCSEL) DIODES

9.7.1 VCSEL HAS HIGH GROWTH OPPORTUNITY IN 3D SENSING APPLICATIONS

TABLE 53 VCSEL: LASER DIODE MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 54 VCSEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.8 VERTICAL EXTERNAL CAVITY SURFACE EMITTING LASER (VECSEL) DIODES

9.8.1 HAVE HIGHER POWER AND EFFICIENCY AS COMPARED TO OTHER LASER DIODE TECHNOLOGIES

TABLE 55 VECSEL: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 56 VECSEL: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10 LASER DIODE MARKET, BY APPLICATION (Page No. - 111)

10.1 INTRODUCTION

FIGURE 35 MARKET, BY APPLICATION

TABLE 57 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 58 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 59 MARKET SHIPMENTS, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 60 MARKET SHIPMENTS, BY APPLICATION, 2022–2027 (MILLION UNITS)

TABLE 61 AVERAGE SELLING PRICE (ASP) OF LASER DIODE, BY APPLICATION, 2018–2021 (USD)

TABLE 62 AVERAGE SELLING PRICE (ASP) OF LASER DIODE, BY APPLICATION, 2022–2027 (USD)

10.2 AUTOMOTIVE

TABLE 63 AUTOMOTIVE: LASER DIODE MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 64 AUTOMOTIVE: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 65 AUTOMOTIVE: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 66 AUTOMOTIVE: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 67 AUTOMOTIVE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 68 AUTOMOTIVE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 69 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 70 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2.1 IN-CABIN APPLICATIONS

10.2.1.1 Used in vehicle interior monitoring systems, Time of Flight (ToF) 3D sensing, driver assistance systems, and gesture recognition

10.2.2 AUTOMOTIVE HEADLIGHTS

10.2.2.1 Laser diodes offer higher luminance for automotive headlights as compared with LEDs

10.2.3 AUTOMOTIVE LIDAR

10.2.3.1 Edge emitting diodes and VCSEL diodes used for automotive LiDAR applications

10.2.4 HEAD-UP DISPLAYS

10.2.4.1 Visible laser diodes preferred for head-up displays in automobiles

10.3 CONSUMER ELECTRONICS

TABLE 71 CONSUMER ELECTRONICS: MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 72 CONSUMER ELECTRONICS: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 73 CONSUMER ELECTRONICS: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 74 CONSUMER ELECTRONICS: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 75 CONSUMER ELECTRONICS: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 76 CONSUMER ELECTRONICS: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 77 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3.1 SMART DISPLAYS

10.3.1.1 Laser diodes can be used to provide 3D effects in display devices

10.3.2 SMARTPHONES

10.3.2.1 Smartphones use VCSELs for facial recognition

10.3.3 SMART GLASSES

10.3.3.1 Laser diodes can be used in AR/VR applications such as smart glasses

10.3.4 3D PRINTING & SCANNING

10.3.4.1 Laser diodes have become preferred technology in 3D scanning and printing applications

10.4 HEALTHCARE & MEDICAL

TABLE 79 HEALTHCARE & MEDICAL: MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 80 HEALTHCARE & MEDICAL: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 81 HEALTHCARE & MEDICAL: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 82 HEALTHCARE & MEDICAL: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 83 HEALTHCARE & MEDICAL: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 84 HEALTHCARE & MEDICAL: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 85 HEALTHCARE & MEDICAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 86 HEALTHCARE & MEDICAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4.1 WOUND HEALING

10.4.1.1 Use of laser diodes with multiple wavelengths most reliable in wound healing

10.4.2 PATIENT ALIGNMENT

10.4.2.1 Red and green laser diodes used in patient alignment systems

10.4.3 CLINICAL TREATMENTS

10.4.3.1 Wide range of laser diodes used in hair removal treatment

10.5 INDUSTRIAL

TABLE 87 INDUSTRIAL: LASER DIODE MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 88 INDUSTRIAL: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 89 INDUSTRIAL: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 90 INDUSTRIAL: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 91 INDUSTRIAL: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 92 INDUSTRIAL: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 93 INDUSTRIAL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 INDUSTRIAL: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5.1 INDUSTRIAL INSPECTION & METROLOGY

10.5.1.1 Laser diodes used in measurement of length, velocity, and roughness

10.5.2 INDUSTRIAL PROCESSING

10.5.2.1 Near-infrared laser diodes preferred

10.5.3 LIGHTING

10.5.3.1 Factory production lines, parking areas, outer premises major lighting applications of laser diodes

10.5.3.2 Indoor lighting

10.5.3.3 Outdoor lighting

TABLE 95 LASER DIODE MARKET, BY INDUSTRIAL APPLICATION, 2018–2021 (USD MILLION)

TABLE 96 MARKET, BY INDUSTRIAL APPLICATION, 2022–2027 (USD MILLION)

TABLE 97 MARKET, BY LIGHTING APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 MARKET, BY LIGHTING APPLICATION, 2022–2027 (USD MILLION)

TABLE 99 INDOOR LIGHTING: MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 100 INDOOR LIGHTING: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 101 INDOOR LIGHTING: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 102 INDOOR LIGHTING: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 103 INDOOR LIGHTING: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 104 INDOOR LIGHTING: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 105 INDOOR LIGHTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 106 INDOOR LIGHTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 107 OUTDOOR LIGHTING: MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 108 OUTDOOR LIGHTING: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 109 OUTDOOR LIGHTING: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 110 OUTDOOR LIGHTING: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 111 OUTDOOR LIGHTING: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 112 OUTDOOR LIGHTING: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 113 OUTDOOR LIGHTING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 114 OUTDOOR LIGHTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 MILITARY AND DEFENSE

TABLE 115 MILITARY & DEFENSE: MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 116 MILITARY & DEFENSE: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 117 MILITARY & DEFENSE: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 118 MILITARY & DEFENSE: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 119 MILITARY & DEFENSE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 120 MILITARY & DEFENSE: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 121 MILITARY & DEFENSE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 122 MILITARY & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6.1 RANGE FINDER

10.6.1.1 High-power laser diodes used in defense range finding applications

10.6.2 LIVE COMBAT SIMULATION AND TRAINING

10.6.2.1 Laser diodes used as pump sources for solid-state systems for live training and battlefield simulation

10.6.3 HOMELAND SECURITY

10.6.3.1 Mid-infrared laser diodes can be used in early warning systems for detecting chemical weapons

10.7 TELECOMMUNICATION

TABLE 123 TELECOMMUNICATION: LASER DIODE MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 124 TELECOMMUNICATION: MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 125 TELECOMMUNICATION: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 126 TELECOMMUNICATION: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 127 TELECOMMUNICATION: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 128 TELECOMMUNICATION: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 129 TELECOMMUNICATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 130 TELECOMMUNICATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7.1 TELECOM OPERATIONS

10.7.1.1 Laser diodes used in tower placement applications

10.8 OTHERS

TABLE 131 OTHERS: DIODE MARKET, BY WAVELENGTH, 2018–2021 (USD MILLION)

TABLE 132 OTHERS: LASER DIODE MARKET, BY WAVELENGTH, 2022–2027 (USD MILLION)

TABLE 133 OTHERS: MARKET, BY DOPING MATERIAL, 2018–2021 (USD MILLION)

TABLE 134 OTHERS: MARKET, BY DOPING MATERIAL, 2022–2027 (USD MILLION)

TABLE 135 OTHERS: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 136 OTHERS: MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

TABLE 137 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 138 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8.1 MEDIA & ENTERTAINMENT

10.8.2 EDUCATION & RESEARCH

10.8.3 AGRICULTURE

11 LASER DIODE MARKET, BY REGION (Page No. - 149)

11.1 INTRODUCTION

FIGURE 36 ASIA PACIFIC IS EXPECTED TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 139 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 140 MARKET, BY REGION, 2022–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 37 NORTH AMERICA: LASER DIODE MARKET SNAPSHOT

TABLE 141 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 142 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 143 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 144 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Military applications to underpin market growth

11.2.2 CANADA

11.2.2.1 Presence of small and medium-sized medical firms to create opportunities for market

11.2.3 MEXICO

11.2.3.1 Demand from telecommunication industry to spur market growth

11.3 EUROPE

FIGURE 38 EUROPE: LASER DIODE MARKET SNAPSHOT

TABLE 145 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 147 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 148 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Technological advancements to drive demand for laser diodes

11.3.2 UK

11.3.2.1 Rising demand for high-power industrial laser systems to drive market

11.3.3 FRANCE

11.3.3.1 Advanced processing applications such as imaging and printing to fuel demand for laser diodes

11.3.4 ITALY

11.3.4.1 Medical research applications to boost laser diode market

11.3.5 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 149 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Extensive R&D in laser technology to favor market growth

11.4.2 JAPAN

11.4.2.1 High demand for laser diodes for development and fabrication of semiconductor devices and medical applications

11.4.3 INDIA

11.4.3.1 Government initiatives to boost manufacturing to generate demand for laser diodes

11.4.4 SOUTH KOREA

11.4.4.1 Extensive use of laser diodes in medical applications to boost market

11.4.5 REST OF ASIA PACIFIC

11.5 REST OF THE WORLD

TABLE 153 REST OF THE WORLD: LASER DIODE MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 154 REST OF THE WORLD: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 155 REST OF THE WORLD: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 156 REST OF THE WORLD: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Medical, industrial, and consumer electronics applications to encourage market growth

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Extensive R&D activities to substantiate market growth

12 COMPETITIVE LANDSCAPE (Page No. - 166)

12.1 OVERVIEW

12.2 MARKET EVALUATION FRAMEWORK

TABLE 157 OVERVIEW OF STRATEGIES DEPLOYED BY LASER DIODE COMPANIES

12.3 FIVE-YEAR COMPANY REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 40 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

12.4 MARKET SHARE ANALYSIS: LASER DIODE MARKET, 2021

TABLE 158 SHARE OF LEADING COMPANIES IN MARKET, 2021

TABLE 159 NORTH AMERICA: SHARE OF LEADING COMPANIES IN MARKET, 2021

TABLE 160 EUROPE: SHARE OF LEADING COMPANIES IN MARKET, 2021

TABLE 161 ASIA PACIFIC: SHARE OF LEADING COMPANIES IN MARKET, 2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 41 LASER DIODE COMPANY EVALUATION QUADRANT, 2021

12.6 SME EVALUATION QUADRANT

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 DYNAMIC COMPANIES

12.6.4 STARTING BLOCKS

FIGURE 42 MARKET, SME EVALUATION MATRIX, 2021

12.7 LASER DIODE MARKET: COMPANY FOOTPRINT

TABLE 162 WAVELENGTH: COMPANY FOOTPRINT

TABLE 163 APPLICATION: COMPANY FOOTPRINT

TABLE 164 REGION: COMPANY FOOTPRINT

TABLE 165 COMPANY FOOTPRINT

12.8 COMPETITIVE BENCHMARKING

12.8.1 SME EVALUATION MATRIX: LASER DIODE MARKET

TABLE 166 MARKET: LIST OF KEY SMES

TABLE 167 MARKET: COMPETITIVE BENCHMARKING OF KEY SMES

12.9 COMPETITIVE SCENARIOS AND TRENDS

12.9.1 PRODUCT LAUNCHES

TABLE 168 PRODUCT LAUNCHES, 2020–2022

12.9.2 DEALS

TABLE 169 DEALS, 2022

12.9.3 OTHERS

TABLE 170 OTHERS

13 COMPANY PROFILES (Page No. - 184)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

13.1.1 II-VI INCORPORATED

TABLE 171 II-VI: BUSINESS OVERVIEW

FIGURE 43 II-VI: COMPANY SNAPSHOT

13.1.2 AMS-OSRAM AG

TABLE 172 AMS-OSRAM: BUSINESS OVERVIEW

FIGURE 44 AMS-OSRAM: COMPANY SNAPSHOT

13.1.3 HAMAMATSU PHOTONICS

TABLE 173 HAMAMATSU PHOTONICS: BUSINESS OVERVIEW

FIGURE 45 HAMAMATSU PHOTONICS: COMPANY SNAPSHOT

13.1.4 IPG PHOTONICS

TABLE 174 IPG PHOTONICS: BUSINESS OVERVIEW

FIGURE 46 IPG PHOTONICS: COMPANY SNAPSHOT

13.1.5 LUMENTUM

TABLE 175 LUMENTUM: BUSINESS OVERVIEW

FIGURE 47 LUMENTUM: COMPANY SNAPSHOT

13.1.6 JENOPTIK

TABLE 176 JENOPTIK: BUSINESS OVERVIEW

FIGURE 48 JENOPTIK: COMPANY SNAPSHOT

13.1.7 MKS INSTRUMENTS

TABLE 177 MKS INSTRUMENTS: BUSINESS OVERVIEW

FIGURE 49 MKS INSTRUMENTS: COMPANY SNAPSHOT

13.1.8 ROHM CO., LTD.

TABLE 178 ROHM: BUSINESS OVERVIEW

FIGURE 50 ROHM: COMPANY SNAPSHOT

13.1.9 SHARP CORPORATION

TABLE 179 SHARP: BUSINESS OVERVIEW

FIGURE 51 SHARP: COMPANY SNAPSHOT

13.1.10 USHIO INC.

TABLE 180 USHIO: BUSINESS OVERVIEW

FIGURE 52 USHIO: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 BLUGLASS LIMITED

13.2.2 TRUMPF

13.2.3 THORLABS INC.

13.2.4 PANASONIC INDUSTRY CO., LTD.

13.2.5 POWER TECHNOLOGIES INC.

13.2.6 NICHIA CORPORATION

13.2.7 SHEAUMANN LASER, INC.

13.2.8 KYOCERA SLD LASER, INC.

13.2.9 FRANKFURT LASER CO.

13.2.10 RPMC LASERS

13.2.11 ARIMA LASERS CORP.

13.2.12 TOPTICA PHOTONICS

13.2.13 LUMIBIRD

13.2.14 LUMICS GMBH

13.2.15 ALPES LASERS S.A.

14 ADJACENT & RELATED MARKETS (Page No. - 232)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 LASER CLADDING MARKET, BY REVENUE

TABLE 181 LASER CLADDING MARKET, BY REVENUE, 2017–2020 (USD MILLION)

TABLE 182 LASER CLADDING MARKET, BY REVENUE, 2021–2026 (USD MILLION)

14.3.1 LASER REVENUE

14.3.1.1 Laser revenue covers revenue generated from sales of different types of lasers

TABLE 183 LASER CLADDING MARKET FOR LASER REVENUE, BY REGION, 2017–2020 (USD MILLION)

TABLE 184 LASER CLADDING MARKET FOR LASER REVENUE, BY REGION, 2021–2026 (USD MILLION)

14.3.2 SYSTEM REVENUE

14.3.2.1 Extensive applicability of laser cladding systems expands their utility across various end-use industries

TABLE 185 LASER CLADDING MARKET FOR SYSTEM REVENUE, BY REGION, 2017–2020 (USD MILLION)

TABLE 186 LASER CLADDING MARKET FOR SYSTEM REVENUE, BY REGION, 2021–2026 (USD MILLION)

14.4 LASER CLADDING MARKET, BY END-USE INDUSTRY

TABLE 187 LASER CLADDING MARKET, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 188 LASER CLADDING MARKET, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

14.4.1 OIL & GAS

14.4.1.1 Laser cladding used for corrosion resistance in oil & gas industry

TABLE 189 LASER CLADDING MARKET FOR OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 190 LASER CLADDING MARKET FOR OIL & GAS, BY REGION, 2021–2026 (USD MILLION)

14.4.2 MINING

14.4.2.1 Laser cladding improves durability of tools and devices used in mining industry

TABLE 191 LASER CLADDING MARKET FOR MINING, BY REGION, 2017–2020 (USD MILLION)

TABLE 192 LASER CLADDING MARKET FOR MINING, BY REGION, 2021–2026 (USD MILLION)

14.4.3 AEROSPACE & DEFENSE

14.4.3.1 Laser cladding is used for improving aircraft structures

TABLE 193 LASER CLADDING MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2020 (USD MILLION)

TABLE 194 LASER CLADDING MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2021–2026 (USD MILLION)

14.4.4 AUTOMOTIVE

14.4.4.1 Laser cladding helps boost operating efficiency of vehicles and reduce environmental impact

TABLE 195 LASER CLADDING MARKET FOR AUTOMOTIVE, BY REGION, 2017–2020 (USD MILLION)

TABLE 196 LASER CLADDING MARKET FOR AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

14.4.5 POWER GENERATION

14.4.5.1 Laser cladding is ideal for numerous problems in power generation industry

TABLE 197 LASER CLADDING MARKET FOR POWER GENERATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 198 LASER CLADDING MARKET FOR POWER GENERATION, BY REGION, 2021–2026 (USD MILLION)

14.4.6 OTHERS

TABLE 199 LASER CLADDING MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 200 LASER CLADDING MARKET FOR OTHER END-USE INDUSTRIES, BY REGION, 2021–2026 (USD MILLION)

15 APPENDIX (Page No. - 243)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 CUSTOMIZATION OPTIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

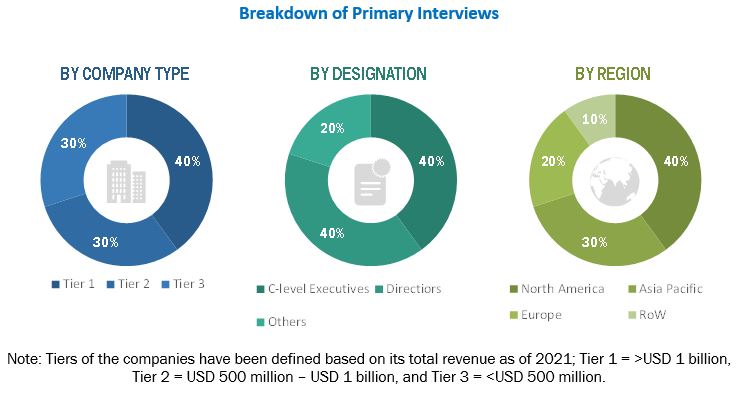

The study involved four major activities in estimating the current size of the laser diode market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the laser diode market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Indian Laser Association, International Laser Class Association, Victorian Laser Association, and International Laser Display Association among others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall laser diode market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the present scenario of the laser diode market through secondary research. Several primary interviews have been conducted with market experts from both the demand (adopters of laser diode used for various laser-based systems and its applications) and supply (laser diode manufacturers, integrators, and distributors) sides across 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% and 75% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the laser diode market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the laser diode market.

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of sizes of segments of the laser diode market, the market size obtained by implementing the bottom-up approach has been used in the top-down approach. This has been later confirmed with primary respondents across different geographies.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the size of various market segments.

- The market share of each company has been estimated to verify revenue shares used in the bottom-up approach earlier.

- The sizes of the overall parent and peer markets (laser technology market laser marking market) and each individual market have been determined and confirmed in this study with the help of a data triangulation procedure and validation of data through primary interviews.

Global Laser Diode Market Size: Top-down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the laser diode market size, by wavelength, technology, doping material, and application, in terms of value

- To describe and forecast the laser diode market size, by application, in terms of volume

- To describe and forecast the laser diode market size, in terms of value and volume, with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the laser diode market

- To provide a detailed overview of the supply chain of the laser diode ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, partnerships, expansions, and collaborations, undertaken in the laser diode market

Available Customizations

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Additional country level analysis of laser diode market

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Laser Diode Market