The study involved four major activities in estimating the current size of the tunable diode laser analyzer (TDLA) market-exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

Primary Research

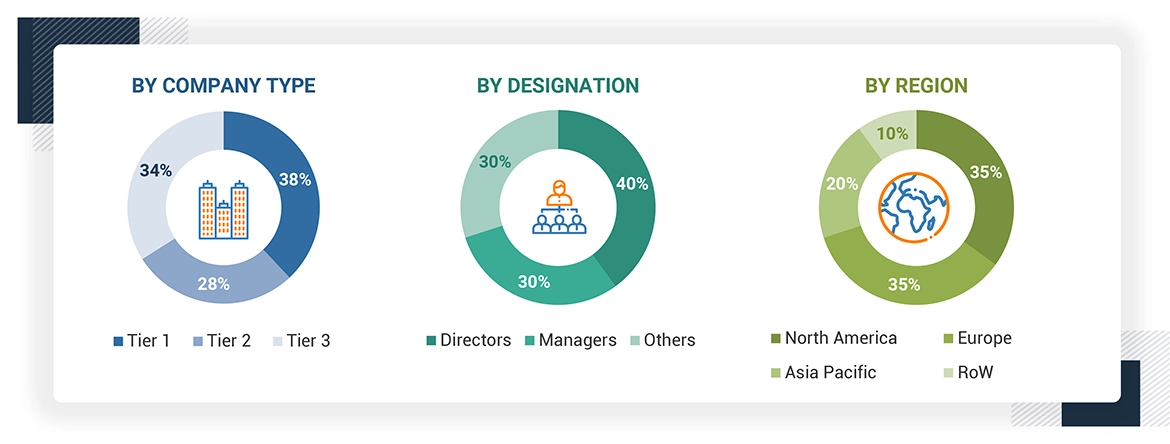

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the blockchain market. After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of blockchain solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Note: Other designations include sales managers, marketing managers, and product managers.

The three tiers of the companies have been defined based on their total revenue as of 2023: tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Tunable Diode Laser Analyzer (TDLA) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the market has been split into several segments and subsegments. The data triangulation procedure has been employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size has been validated using top-down and bottom-up approaches.

Market Definition

TDLAS, or Tunable Diode Laser Analyzer, uses a technique of gas analysis that operates by emitting an infrared laser through a gas sample to detect specific molecules. A laser and detector are set up at one end of the sample cell, with a reflective surface on the other side; through light bouncing back, absorption patterns can be captured. These patterns, or "absorption lines," reflect the amount of light energy absorbed by molecules such as water and correspond to concentration in the vapor. Initially constrained by cryogenic laser technologies, TDLAS advanced with innovations from telecom lasers and has since achieved ppm-level sensitivity, stability, and reliability for critical applications such as natural gas processing.

The market for extended reality spans across multiple sectors such as games and entertainment, healthcare, education, retail, automotive, and industrial training, among others. It serves for various purposes including training and simulation, teamwork done through the internet, going on virtual tours, playing computer games, surgeries, etc. This shifts the paradigm on the way people perceive and use technology, while it is as well embraced by businesses for the purpose of enhancing productivity, developing customer relationships and optimizing processes.

Key Stakeholders

-

Tunable diode laser analyzer (TDLA) companies

-

Raw material suppliers

-

Component manufacturers and providers

-

Sensor manufacturers and providers

-

Original equipment manufacturers

-

ODM and OEM technology and solution providers

-

Software service providers

-

TDLA devices suppliers and distributors

-

Market research and consulting firms

-

Associations, organizations, forums, and alliances related to the gas sensor industry

-

Technology investors

-

Governments and financial institutions

-

Venture capitalists, private equity firms, and startups

-

End users

Report Objectives

-

To define, describe, and forecast the tunable diode laser analyzer (TDLA) market, in terms of value, segmented by methodology, gas analyzer type, device type, technology, application, end-user industry, and region.

-

To describe and forecast the market, in terms of value, for various segments with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

-

To study different type, component, and mode of operation used in tunable diode laser analyzer (TDLA) market with the scope limited to qualitative research only

-

To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the tunable diode laser analyzer (TDLA) market

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze opportunities for stakeholders by identifying high-growth segments of the tunable diode laser analyzer (TDLA) market

-

To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for market leaders

-

To analyze competitive developments, such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches and developments; in the tunable diode laser analyzer (TDLA) market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Additional country-level analysis of the tunable diode laser analyzer (TDLA) market

Product Analysis

-

Product matrix provides a detailed comparison of the product portfolio of each company in the tunable diode laser analyzer (TDLA) market.

Growth opportunities and latent adjacency in Tunable Diode Laser Analyzer (TDLA) Market