Laser Sensor Market by Offering (Hardware & Software and Services), Type (Compact and Ultra-Compact), Application (Manufacturing Plant Management & Automation and Security & Surveillance), End-user Industry, and Geography - Global Forecast to 2035

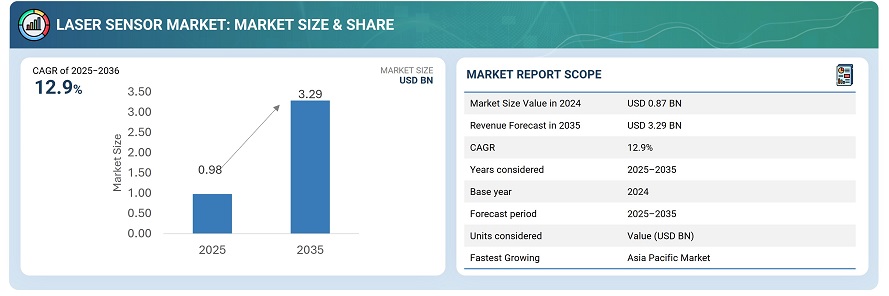

The global laser sensor market was valued at USD 0.87 billion in 2024 and is estimated to reach USD 3.29 billion by 2035, at a CAGR of 12.9% between 2025 and 2035.

The laser sensor market is experiencing robust growth driven by increasing automation across industrial and automotive sectors. Rising demand for high-precision measurement and detection systems is fueling adoption in manufacturing and robotics. Advancements in laser triangulation and time-of-flight technologies are enhancing accuracy and reliability. The integration of laser sensors with IoT and AI platforms is creating new opportunities for smart monitoring and predictive maintenance. Furthermore, expanding applications in autonomous vehicles and consumer electronics are expected to propel market growth.

The usage of laser sensors market is expanding rapidly as industries increasingly adopt these sensors for applications such as distance measurement, object detection, and positioning in manufacturing, robotics, and automotive systems. Their high accuracy and reliability make them essential in quality inspection, 3D modeling, and automation processes. Moreover, emerging applications in healthcare, agriculture, and environmental monitoring are expected to open new avenues for market growth.

Market by Offering

Hardware & Software

The laser sensor market comprises both hardware and software components that together enhance precision sensing and automation capabilities. The hardware segment, including laser diodes, detectors, optics, and signal processors, holds a major share driven by demand for high-performance sensing devices across industrial and automotive applications. Meanwhile, the software segment is gaining traction with the growing need for data analytics, calibration, and integration with IoT and AI platforms for real-time monitoring and process optimization. The synergy between advanced hardware and intelligent software solutions is creating new opportunities in smart manufacturing, robotics, and autonomous systems.

Services

The laser sensor market services segment plays a vital role in supporting the efficient deployment and operation of sensing systems. It includes installation, calibration, maintenance, integration, and consulting services that ensure optimal performance and accuracy. As industries shift toward automation and smart manufacturing, demand for customized sensor integration and data management services is increasing. Additionally, service providers are offering remote monitoring and predictive maintenance solutions through cloud-based platforms. These value-added services not only enhance system reliability but also create long-term opportunities for recurring revenue and customer retention.

Market by Type

Compact

With growing demand for smart and flexible production systems, the compact laser sensor segment is expected to register the highest CAGR during the forecast period. Compact laser sensors are widely adopted across industrial, automotive, and electronic manufacturing applications due to their high accuracy and easy integration in limited spaces. They enable precise measurement, positioning, and detection, supporting automation and quality control processes.

Ultra-compact

Ultra-compact laser sensors are designed for applications requiring minimal space and lightweight designs, such as robotics, semiconductor inspection, and portable devices. They offer high precision and efficiency, making them ideal for next-generation miniaturized systems. Although smaller in market size, this segment is expected to witness steady growth driven by increasing adoption in advanced electronics and micro-automation setups.

Market by Geography

The Asia-Pacific laser sensor market is growing rapidly, driven by expanding manufacturing, automotive, and electronics industries. Strong adoption of automation, robotics, and smart factory initiatives in China, Japan, South Korea, and India is fueling demand. Government support for Industry 4.0 and rising investments in precision inspection further strengthen market growth. The region is expected to record the highest CAGR globally, maintaining its leadership in the coming years.

Market Dynamics

Driver: Rising Adoption of Industrial Automation

The increasing shift toward automation in manufacturing and process industries is a key driver for the laser sensor market. Laser sensors enable high-precision measurement, alignment, and quality inspection essential for automated operations. Their reliability and speed make them indispensable in robotics and production lines. This trend is accelerating demand across automotive, electronics, and packaging sectors.

Restraint: High Initial Installation and Calibration Costs

Despite their advantages, laser sensors often involve high setup and calibration costs, limiting adoption among small and medium enterprises. Integrating these sensors into existing systems requires specialized expertise and additional infrastructure investment. This cost barrier can delay automation initiatives in cost-sensitive industries. Consequently, price sensitivity remains a restraint for broader market penetration.

Opportunity: Integration with IoT and AI Platforms

The integration of laser sensors with IoT and AI technologies presents significant growth opportunities. Smart sensor networks enable real-time monitoring, predictive maintenance, and process optimization. These intelligent systems enhance operational efficiency and reduce downtime across industries. Growing demand for connected and data-driven manufacturing is expected to fuel this opportunity further.

Challenge Performance issues in harsh environments

Laser sensors can face challenges in environments with dust, vibrations, or fluctuating temperatures that affect accuracy and signal stability. Maintaining consistent performance under such conditions requires advanced protective housings and calibration techniques. Industries such as mining, oil & gas, and heavy manufacturing often encounter these issues. Overcoming such limitations is critical for expanding their use in demanding applications.

Future Outlook

Between 2025 and 2035, the laser sensor market is expected to expand significantly as growth will be fueled by the expanding adoption of automation, robotics, and precision measurement technologies across industrial, automotive, and electronics sectors. Integration with IoT, AI, and predictive analytics will transform laser sensors into intelligent systems capable of real-time monitoring and adaptive control. Advancements in miniaturization and ultra-compact designs will further broaden applications in healthcare, consumer electronics, and smart manufacturing. With continued industrialization and policy support, the Asia-Pacific region is expected to remain the fastest-growing and most dominant market globally.

Key Market Players

Top laser sensor companies Rockwell Automation (US), KEYENCE CORPORATION (Japan), OMRON Corporation (Japan), Panasonic Industry Co., Ltd. (Japan), ifm electronic gmbh (Germany).

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 27)

4 Premium Insight (Page No. - 32)

4.1 Attractive Opportunities in Laser Sensor Market

4.2 Laser Sensor Market, By Application

4.3 Market, By Country

4.4 Market in APAC in 2019, By Country & End-User Industry

4.5 Market, By Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Laser Industry Standards and Regulations Analysis

5.4 Laser Sensor Market, By Class

5.4.1 Class 1

5.4.2 Class 2

5.5 Response Time of Laser Sensors

5.5.1 1 Ms/10 Ms/25 Ms/100 Ms/1,000 Ms

5.5.2 2 Ms/20 Ms/50 Ms/200 Ms/2,000 Ms

5.6 Market Dynamics

5.6.1 Drivers

5.6.1.1 Increasing Demand for Laser Sensors in Food Manufacturing Industry

5.6.1.2 Advent of Industry 4.0 and Smart Manufacturing

5.6.1.3 Increasing Government Initiatives

5.6.2 Restraints

5.6.2.1 Lack of Technological Advancements

5.6.3 Opportunities

5.6.3.1 Growing Demand for Miniaturization in Sensor Technologies

5.6.4 Challenge

5.6.4.1 Requirement of High Power and Energy Density for Measurement of Smaller Beams

6 Laser Sensor Market, By Offering (Page No. - 43)

6.1 Introduction

6.2 Hardware & Software

6.2.1 Hardware

6.2.1.1 Components

6.2.1.1.1 Laser Sensors Uses Critical Components to Perform Necessary Applications

6.2.1.2 Accessories

6.2.1.2.1 Laser Sensors Use A Limited Set of Accessories When Put to Use

6.2.2 Software

6.2.2.1 Use of Software Enables Users' to Set Measurement Parameters

6.3 Services

6.3.1 Installation/Integration

6.3.1.1 Installation/ Integration First and Most Critical Stage

6.3.2 Maintenance & Support

6.3.2.1 Repair Service Enables Laser Sensors to Ensure Quality Service, Speed, and Optimal Performance

7 Laser Sensor Market, By Type (Page No. - 50)

7.1 Introduction

7.2 Compact

7.2.1 Compact Laser Sensors are Ideal Solution for Automation, Integration and Robotics Applications

7.3 Ultra-Compact

7.3.1 Triangulation and Cmos Technology Improve the Usefulness of Ultra-Compact Laser Sensors

8 Laser Sensor Market, By Application (Page No. - 55)

8.1 Introduction

8.2 Manufacturing Plant Management and Automation

8.2.1 Manufacturing

8.2.1.1 Machine Building

8.2.1.1.1 Miniaturized Design of Laser Sensors Enables Easy Integration Into Machines

8.2.1.2 Product Manufacturing

8.2.1.2.1 Increasing Technological Sophistication Increases Complexity in Product Manufacturing

8.2.2 Handling and Assembly

8.2.2.1 Proximity and Count Measurements are Significant Applications of Laser Sensors in Handling and Assembly

8.3 Security and Surveillance

8.3.1 Location Mapping and Height Measurement are Critical to Military, Homeland, and Private Security Applications for Which Laser Sensors are Deployed

8.4 Motion and Guidance

8.4.1 Shipping and Aerospace Industries Largely Use Laser Sensors for Precise Height Measurement Applications

9 Laser Sensor Market, By End-User Industry (Page No. - 61)

9.1 Introduction

9.2 Automotive

9.2.1 Vehicle Guidance and Automation

9.2.1.1 Vehicle Guidance and Automation are Prominent Applications of Laser Sensors in Automotive Industry

9.2.2 Traffic Management

9.2.2.1 Increasing Demand for Efficient Traffic Management Through Data Collection is Largely Driven With Use of Laser Sensors

9.3 Aviation

9.3.1 Laser Sensors are Used Extensively for Designing and Building of Aircraft

9.4 Food & Beverages

9.4.1 Packaging, Distribution, and Warehousing Applications are Performed Using Laser Sensors

9.5 Electronics Manufacturing

9.5.1 High Focus of Electronics Manufacturing Industry on Using Automation to Improve Plant Productivity and Efficiency Drives Adoption of Laser Sensors

9.6 Building and Construction

9.6.1 Growing Infrastructure Projects Require Laser Sensors to Perform Critical Measurement Tasks

9.7 Chemicals Manufacturing

9.7.1 Non-Contact Displacement Sensors are More Preferred for Dimensional Measurements in Chemicals Manufacturing

10 Geographic Analysis (Page No. - 74)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Increasing Deployment of Laser Weapons in Aerospace & Defense Industry

10.2.2 Canada

10.2.2.1 Initiatives By Canadian Government to Support Development, Production, and Sale of Electric Vehicles

10.2.3 Mexico

10.2.3.1 Rising Foreign Direct Investments (FDIS)

10.3 Europe

10.3.1 Germany

10.3.1.1 Rapid Implementation and Adoption of Digital Technologies in Germany

10.3.2 UK

10.3.2.1 Increasing Focus on Use of Energy-Efficient Devices and Low-Carbon Emission Products

10.3.3 France

10.3.3.1 Increasing Demand for Manufacturing Operations to Cater to Growing Number of Commercial and Defense Aviation Projects

10.3.4 Italy

10.3.4.1 Shift From Off-Line Quality Inspection to Near-Line Or In-Line Measurement Techniques

10.3.5 Rest of Europe

10.4 APAC

10.4.1 China

10.4.1.1 Shift Toward Automation Technologies to Replace the Aging Workforce and Outdated Technologies

10.4.2 Japan

10.4.2.1 Increasing Fdi in Manufacturing Sector of Japan

10.4.3 India

10.4.3.1 Government Initiatives Likely to Promote Automation in Manufacturing Sector

10.4.4 South Korea

10.4.4.1 Huge Potential in Automotive Sector of Country

10.4.5 Australia

10.4.5.1 Rising Demand for New Structures in Both Residential and Commercial Sectors

10.4.6 Rest of APAC

10.5 RoW

10.5.1 South America

10.5.1.1 Increasing Demand for Laser Sensors in Packaging Industry in South America

10.5.2 Middle East and Africa

10.5.2.1 Significant Investments and Tie-Ups With the Companies Leading to Growth of Automation Industry in Region

11 Competitive Landscape (Page No. - 111)

11.1 Introduction

11.2 Market Ranking Analysis: Laser Sensor Market

11.3 Competitive Situations and Trends

11.3.1 Product/Solution Launches

11.3.2 Partnerships/Collaborations

12 Company Profiles (Page No. - 115)

12.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.2 Key Players

12.2.1 Keyence

12.2.2 Rockwell Automation

12.2.3 Panasonic

12.2.4 OMRON

12.2.5 IFM Electronic

12.2.6 Banner Engineering

12.2.7 Smartray

12.2.8 Micro-Epsilon

12.2.9 Laser Technology

12.2.10 Acuity Laser

12.2.11 Waycon PositionSMEsstechnik

12.3 Other Important Players

12.3.1 Baumer

12.3.2 Optex

12.3.3 Technos Instruments

12.3.4 LAP GmbH

12.3.5 First Sensor

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 142)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 Laser Sensor Market Size, By Offering, 2016–2024 (USD Million)

Table 2 Market for Hardware & Software, By Offering, 2016–2024 (USD Million)

Table 3 Market for Services, By Offering, 2016–2024 (USD Million)

Table 4 Laser Sensor Market Size, By Type, 2016–2024 (USD Million)

Table 5 Market Size for Compact Laser Sensors, By End-User Industry, 2016–2024 (USD Million)

Table 6 Market Size for Ultra-Compact Laser Sensors, By End-User Industry, 2016–2024 (USD Million)

Table 7 Laser Sensor Market, By Application, 2016–2024 (USD Million)

Table 8 Market, By End-User Industry, 2016–2024 (USD Million)

Table 9 Market for Automotive Industry, By Type, 2016–2024 (USD Million)

Table 10 Market for Automotive Industry, By Region, 2016–2024 (USD Million)

Table 11 Laser Sensor Market for Aviation Industry, By Type, 2016–2024 (USD Million)

Table 12 Market for Aviation Industry, By Region, 2016–2024 (USD Million)

Table 13 Laser Sensor Market for Food & Beverages Industry, By Type, 2016–2024 (USD Million)

Table 14 Market for Food & Beverages Industry, By Region, 2016–2024 (USD Million)

Table 15 Laser Sensor Market for Electronics Manufacturing Industry, By Type, 2016–2024 (USD Million)

Table 16 Market for Electronics Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 17 Laser Sensor Market for Building and Construction Industry, By Type, 2016–2024 (USD Million)

Table 18 Market for Building and Construction Industry, By Region, 2016–2024 (USD Million)

Table 19 Laser Sensor Market for Chemicals Manufacturing Industry, By Type, 2016–2024 (USD Million)

Table 20 Market for Chemicals Manufacturing Industry, By Region, 2016–2024 (USD Million)

Table 21 Laser Sensor Market, By Region, 2016–2024 (USD Million)

Table 22 Market in North America, By End-User Industry, 2016–2024 (USD Million)

Table 23 Market in North America, By Country, 2016–2024 (USD Million)

Table 24 Market in North America for Automotive, By Country, 2016–2024 (USD Million)

Table 25 Market in North America for Food & Beverages, By Country, 2016–2024 (USD Million)

Table 26 Market in North America for Aviation, By Country, 2016–2024 (USD Thousand)

Table 27 Market in North America for Electronics Manufacturing, By Country, 2016–2024 (USD Million)

Table 28 Market in North America for Building & Construction, By Country, 2016–2024 (USD Million)

Table 29 Market in North America for Chemicals Manufacturing, By Country, 2016–2024 (USD Million)

Table 30 Market in Us, By End-User Industry, 2016–2024 (USD Million)

Table 31 Market in Canada, By End-User Industry, 2016–2024 (USD Million)

Table 32 Market in Mexico, By End-User Industry, 2016–2024 (USD Thousand)

Table 33 Laser Sensor Market in Europe, By End-User Industry, 2016–2024 (USD Million)

Table 34 Market in Europe, By Country, 2016–2024 (USD Million)

Table 35 Market in Europe for Automotive, By Country, 2016–2024 (USD Million)

Table 36 Market in Europe for Food & Beverages, By Country, 2016–2024 (USD Million)

Table 37 Market in Europe for Aviation, By Country, 2016–2024 (USD Million)

Table 38 Market in Europe for Electronics Manufacturing, By Country, 2016–2024 (USD Million)

Table 39 Market in Europe for Building and Construction, By Country, 2016–2024 (USD Thousand)

Table 40 Market in Europe for Chemicals Manufacturing, By Country, 2016–2024 (USD Million)

Table 41 Market in Germany, By End-User Industry, 2016–2024 (USD Million)

Table 42 Market in Uk, By End-User Industry, 2016–2024 (USD Million)

Table 43 Market in France, By End-User Industry, 2016–2024 (USD Million)

Table 44 Market in Italy, By End-User Industry, 2016–2024 (USD Thousand)

Table 45 Market in Rest of Europe, By End-User Industry, 2016–2024 (USD Million)

Table 46 Laser Sensor Market in APAC, By End-User Industry, 2016–2024 (USD Million)

Table 47 Market in APAC, By Country, 2016–2024 (USD Million)

Table 48 Market in APAC for Automotive, By Country, 2016–2024 (USD Million)

Table 49 Market in APAC for Food & Beverages, By Country, 2016–2024 (USD Million)

Table 50 Market in APAC for Aviation, By Country, 2016–2024 (USD Thousand)

Table 51 Market in APAC for Electronics Manufacturing, By Country, 2016–2024 (USD Thousand)

Table 52 Market in APAC for Building and Construction, By Country, 2016–2024 (USD Million)

Table 53 Market in APAC for Chemicals Manufacturing, By Country, 2016–2024 (USD Million)

Table 54 Market in China, By End-User Industry, 2016–2024 (USD Million)

Table 55 Market in Japan, By End-User Industry, 2016–2024 (USD Million)

Table 56 Market in India, By End-User Industry, 2016–2024 (USD Million)

Table 57 Market in South Korea, By End-User Industry, 2016–2024 (USD Million)

Table 58 Market in Australia, By End-User Industry, 2016–2024 (USD Million)

Table 59 Market in Rest of APAC, By End-User Industry, 2016–2024 (USD Thousand)

Table 60 Laser Sensor Market in RoW, By End-User Industry, 2016–2024 (USD Million)

Table 61 Market in RoW, By Region, 2016–2024 (USD Million)

Table 62 Market in RoW for Automotive, By Region, 2016–2024 (USD Million)

Table 63 Market in RoW for Food & Beverages, By Region, 2016–2024 (USD Million)

Table 64 Market in RoW for Aviation, By Region, 2016–2024 (USD Million)

Table 65 Market in RoW for Electronics Manufacturing, By Region, 2016–2024 (USD Million)

Table 66 Market in RoW for Building and Construction, By Region, 2016–2024 (USD Thousand)

Table 67 Market in RoW for Chemicals Manufacturing, By Region, 2016–2024 (USD Million)

Table 68 Market in South America, By End-User Industry, 2016–2024 (USD Million)

Table 69 Market in Middle East and Africa, By End-User Industry, 2016–2024 (USD Million)

Table 70 Product Launch, 2017 & 2018

Table 71 Partnership/Collaboration, 2017 & 2018

List of Figures (52 Figures)

Figure 1 Laser Sensor Market

Figure 2 Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Data Triangulation

Figure 5 APAC to Hold Largest Size for Food & Beverages During Forecast Period

Figure 6 Services to Grow at Higher CAGR From 2019 to 2024

Figure 7 Market for Automotive in APAC to Hold Largest Size During 2019–2024

Figure 8 Market for Electronics Manufacturing in APAC to Grow at Highest CAGR During Forecast Period

Figure 9 Laser Sensor Market in RoW Expected to Grow at Highest CAGR During 2019–2024

Figure 10 Growing Demand for Miniaturization in Sensor Technologies Acts as Potential Opportunity for Market

Figure 11 Manufacturing Plant Management and Automation to Lead Market During Forecast Period

Figure 12 Laser Sensor Market in Australia to Grow at Highest CAGR During Forecast Period

Figure 13 Automotive Held Largest Share of Laser Sensor Market in China in 2019

Figure 14 Compact Laser Sensor to Grow at Higher CAGR During Forecast Period

Figure 15 Laser Sensor Market: Value Chain Analysis

Figure 16 Market Dynamics: Overview

Figure 17 Laser Sensor Market Segmentation, By Offering

Figure 18 Hardware & Software Expected to Lead the Market During the Forecast Period

Figure 19 Components and Accessories Forms Major Hardware Sub-Segments

Figure 20 Market for Accessories Expected to Grow at Highest Rate During the Forecast Period

Figure 21 Prominent Services Provided in the Laser Sensor Market

Figure 22 Maintenance & Support Expected to Hold Largest Size During the Forecast Period

Figure 23 Laser Sensor Market Segmentation, By Type

Figure 24 Compact Laser Sensors Expected to Lead the Market During the Forecast Period

Figure 25 Ultra-Compact Laser Sensors to Hold Largest Size in Automotive During the Forecast Period

Figure 26 Applications of Laser Sensors

Figure 27 Manufacturing Plant Management and Automation Application Likely to Command Market During Forecast Period

Figure 28 Sub-Applications of Manufacturing Plant Management and Automation Application of Laser Sensors

Figure 29 Machine Building and Product Manufacturing are Prominent Applications of Laser Sensors

Figure 30 Laser Sensor Market Segmentation, By End-User Industry

Figure 31 Automotive Industry to Hold Largest Size of Market During Forecast Period

Figure 32 Applications of Laser Sensors in Automotive Industry

Figure 33 Ultra-Compact Laser Sensor Market for Aviation Industry Expected to Grow at Higher Car During Forecast Period

Figure 34 APAC to Exhibit Highest CAGR in Market for Electronics Manufacturing Industry During Forecast Period

Figure 35 APAC Expected to LeadMarket for Chemicals Manufacturing Industry During Forecast Period

Figure 36 Laser Sensor Market Segmentation, By Geography

Figure 37 Geographic Snapshot: Laser Sensor Market in RoW to Grow at Highest CAGR During Forecast Period

Figure 38 Laser Sensor Market in Middle East and Africa to Grow at Highest CAGR From 2019 to 2024

Figure 39 Segmentation of Laser Sensor Market in North America, By Country

Figure 40 North America: Market Snapshot

Figure 41 Segmentation of Laser Sensor Market in Europe, By Country

Figure 42 Europe: Market Snapshot

Figure 43 Segmentation of Laser Sensor Market in APAC, By Country

Figure 44 APAC: Laser Sensor Market Snapshot

Figure 45 Segmentation of Market in RoW, By Region

Figure 46 Key Growth Strategies Adopted By Top Companies, 2016–2018

Figure 47 Ranking of Key Players in Laser Sensor Market (2018)

Figure 48 Keyence: Company Snapshot

Figure 49 Rockwell Automation: Company Snapshot

Figure 50 Panasonic: Company Snapshot

Figure 51 OMRON: Company Snapshot

Figure 52 Acuity Laser: Company Snapshot

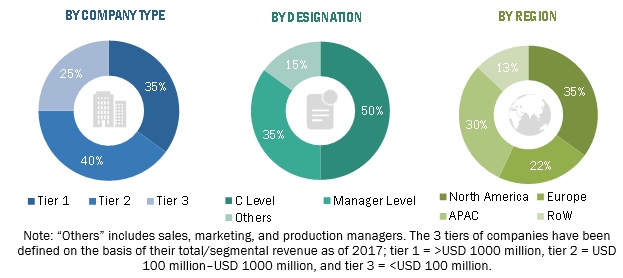

The study involved 4 major activities to estimate the current size of the laser sensor market. Exhaustive secondary research has been done to collect information on the market, including the peer market and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. The top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation procedures have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for the identification and collection of relevant information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information regarding the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data has been collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information relevant to this report. Several primary interviews have been conducted with market experts from both the demand (product and component manufacturer across industries) and supply sides (laser sensors providing companies). This primary data has been collected through questionnaires, emails, and telephonic interviews. Primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related executives from various key companies and organizations operating in the laser sensor market. Approximately 40% and 60% of the primary interviews have been conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been implemented to estimate and validate the total size of the laser sensor market. These methods have also been used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- Key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides across different end-user industries.

Study Objectives

- To describe and forecast the laser sensor market, in terms of value, by type, offering, application, end-user industry, and geography

- To describe and forecast the market, in terms of value, for various segments, by region—North America, Europe, Asia Pacific, and RoW

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of laser sensor market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide a detailed overview of the laser sensor value chain

- To strategically profile key players and comprehensively analyze their market ranking in terms of revenue and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze strategies such as product launches and developments, partnerships, and collaborations adopted by market players

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional 5 market players

- Country-level break-up for the market based on end-use industries

Growth opportunities and latent adjacency in Laser Sensor Market