Lease Management Market by Component (Solutions and Services), End User (Housing, Corporate, and Property Managers), Deployment Mode, Organization Size, Vertical (Real Estate, Retail and Ecommerce, and BFSI), and Region - Global Forecast to 2025

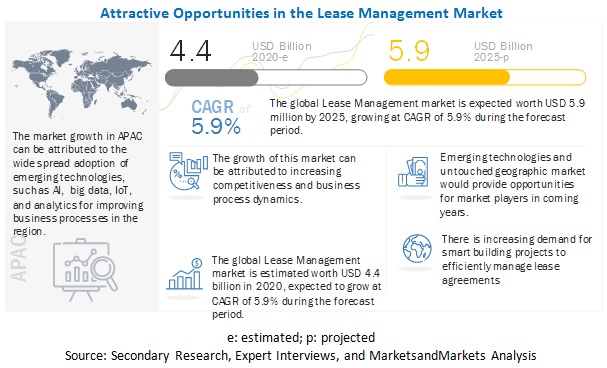

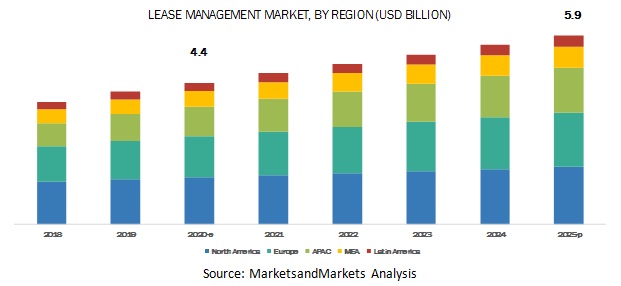

The Lease Management Market size was valued at USD 4.4 billion in 2020 and is anticipated to grow at CAGR of 5.9% between 2020 and 2025, attributed to the growing revenue of $5.9 billion by 2025. The demand for lease management is driven by the Increasing demand for SaaS model for effective management of lease, Increasing demand for smart building projects to efficiently manage lease, and Emerging technologies, such as IoT, AI, and mobility, for real-time data analysis.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID -19 Impact Analysis

In the current scenario, as the COVID-19 pandemic has been spreading all over the globe, most of the people prefer to work from home rather than from a local office, head office, or global branch of an organization and therefore require mobility in terms of access to office resources and data. Some organizations are considering the use of virtual workplaces for their employees to keep their physical infrastructure needs to a bare minimum, which would further assist these organizations in becoming more flexible and utilizing the office space in a better way.

Organizations are increasingly employing the current generation of youngsters who are technology-savvy and believe in the use of various technological devices at the workplace. To keep the flow and speed of work uninterrupted and manage such a workforce, various organizations are looking for management solutions, such as workplace management, project management, and other integrated facility management. These solutions help associated property managers and real estate agents to keep track of all the lease-related data they manage, and all the maintenance work related to it. Hence, the evolving trend of workplace mobility is driving the growth of the lease management market.

Lease Management Market Growth Dynamics

Driver: Increasing demand for SaaS model for effective management of lease

The advent of cloud technology is one of the major breakthroughs in the software industry. This technology affects the way software applications are run and delivered to clients. The shifting to the cloud has enabled software developers to focus more on the technology aspect of the lease management software while outsourcing the lease management aspect to cloud service providers. The SaaS software enables the user to pay per use and cancel services whenever they want. The software enables the big multifamily real estate organizations to easily integrate different kinds of software across the portfolio.

The SaaS model is instrumental in supporting multi-vendor software compatibility with legacy systems. SaaS platforms are allowing real estate managers to integrate their lease management software with advanced payment solutions for easy and seamless transactions. These platforms enable efficient energy utilization, easy process integration, and lease administration management. Owing to the aforementioned benefits, a large number of organizations are increasingly using the cloud platform for their daily needs. The deployment of SaaS-based solutions has helped several organizations meet the complex lease management challenges. Hence, the increasing adoption of cloud-based platforms is driving the growth of the lease management market globally.

Restraint: Budget constraints for implementation of advanced technological solutions

In recent years, the real estate industry has witnessed high fluctuation across the world. The impact of the global slowdown of 2008 has lasted for several years, especially in the real estate industry. Though the market has seen some stability and rise since 2012, it is still highly fluctuating due to the high imbalance in population versus real estate index. These factors are restraining investors from investing in this market. Today, several real estate organizations are adopting these advanced and upgraded technical solutions for lease management. However, the high cost of deploying these solutions, and the need for regular maintenance and updates are creating a problem for real estate managers.

There are a lot of regulatory changes related to leasing and contract management, which enforce software vendors to update related applications in the software provided to customers. For these regular updates, vendors charge an additional amount from customers. As several organizations are facing economic challenges, spending on the lease management software would be an additional financial burden for them. Hence, budget constraints are restraining the growth of the overall lease management market.

Opportunity : Emerging technologies, such as IoT, AI, and mobility, for real-time data analysis

Currently, the market is gaining momentum around technologies, such as Internet of Things (IoT), advanced analytics, cutting-edge new sensors, mobility, SaaS, and new development environments, enabling more demand for enterprise integration than ever before, which, in turn, is impacting the deployment of the lease management software across real estate firms. Lease management software providers offer integrated solutions so that users can connect over social media, impacting project collaboration and space utilization. The lease management software is able to support device data from sensors, meters, and smartphones, thereby driving operations, decisions, and facilities automation. Unlike traditional analytic tools, the lease management software is already integrated with the Real Estate Financial Modeling (REFM) business process as well as is pre-configured for business use. This solution is able to offer real-time analytics, predictive analytics, and newly emerging cognitive analytics and presence analytics.

Emerging technologies, such as IoT, are considered to be one of the biggest opportunities, as they can act as a game-changer technology for real estate managers. The adoption of IoT will significantly simplify operations, as lease data can be automatically collected through sensors, which can later be analyzed for maintenance operations at the maximum efficiency. The use of IoT will significantly lessen the pressure on lease management tools and help in getting accurate results in minimum time. IoT is still in the nascent stage but holds immense growth potential in the future. Hence, as the market of IoT evolves, it will definitely impact the market of the lease management software across the globe.

Challenge: Rising demand for outsourcing services

As organizations are progressing, complexities related to tackling a huge amount of lease data are also increasing. To combat this issue, companies need cutting-edge technology solutions, such as cloud-based and AI-based solutions. However, managing them in-house would be a big challenge for the company as this involves a high cost for hiring technically aware staff and spending on their training for the respected software and their updates from time to time. To save the cost, most of the real estate and other organizations are outsourcing these services to lease management service providers.

The challenges related to regulatory compliance can also be tackled with the help of an outsourced agency, shifting the liabilities associated with environmental compliance and healthcare coverage to the outsourcing firm. The outsourcing of the lease management function to a low-cost vendor allows the organization to save costs and comply with organizational goals. Outsourcing vendors are increasingly providing web-based solutions that have facilitated easy tracking of lease management related services. Hence, the increasing adoption of outsourcing services is anticipated to provide growth opportunities for the lease management market.

System integration segment to hold the largest market share among services during the forecast period

The system integration services segment growth is mainly attributed to the growing focus of organizations to achieve optimized workload management with greater agility, speed, and security without having the need to worry about hassles associated with training, integration and deployment, and support and maintenance.

By vertical, real estate vertical to register the largest market size during the forecast period

The real estate vertical is expected to hold the largest market size in the lease management market. Number of construction sites are running so property managers do not just manage one or two properties but a lot of properties at different locations in or out of the city. Lease maangeemnt solutions help property managers manage the leasing processes.

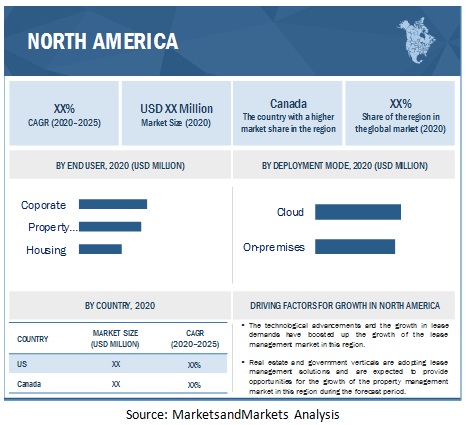

North America to hold the largest market size during the forecast period

The North American lease management market is already mature for lease management, and a significant number of new installations of lease management and upgrade of the existing data center infrastructure systems have taken place to date. Currently, the United States (US) holds the highest share in the lease management market as it is home to large telecom giants, well-established suppliers, as well as end-user industries that continuously adapt to newer technologies for improved business productivity and work efficiency.

Key Market Players

Key Lease Management Market players profiled in this report include Accruent (US), IBM (US), Oracle (US), RealPage (US), SAP (Germany), Trimble (US), AppFolio (US), Odessa (US), CoStar Group (US), Nakisa (Canada), LeaseAccelerator (US), LeaseQuery (Singapore), Spacebase (US), RAAMP (US). These players offer various lease management solutions to cater to the demands and needs of the market. Major growth strategies adopted by the players include partnerships, acquisitions, collaborations and agreements, and new product launches/product enhancements.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 4.4 billion |

|

Revenue forecast for 2025 |

USD 5.9 billion |

|

Growth Rate |

5.9% CAGR |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Billion |

|

Segments covered |

Type, Deployemnt mode, enterprise Size, end user, Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Companies covered |

Accruent (US), IBM (US), Oracle (US), RealPage (US), SAP (Germany), Trimble (US), AppFolio (US), Odessa (US), CoStar Group (US), Nakisa (Canada), LeaseAccelerator (US), LeaseQuery (Singapore), Spacebase (US), RAAMP (US) |

The research report categorizes the lease management market to forecast revenues and analyze trends in each of the following submarkets:

By type:

- Software

-

Services

- Consilting

- System Integration

- Training, Support, and Maintenance

By Deployment mode:

- Cloud

- On-premises

By Enterprise size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End user:

- Housing

- Corporates

- Property Managers

By vertical:

- Retail and eCommerce

- Government and Public Sector

- BFSI

- Education

- Real Estate

- Transportation and Logistics

- Manufacturing

- Others (Healthcare and Pharmaceuticals, IT and Telecommunications, Oil and Gas, Hospitality, and NPO)

By region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- India

- Japan

- China

- Rest of APAC

-

MEA

- Saudi Arabia

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2020, IBM released novel AI-powered technologies to help health and research communities in accelerating the discovery of medical insights and treatments for COVID-19. This tool uses advanced AI and allows researchers to extract critical COVID-19 knowledge quickly.

- In February 2019, Oracle announced to update its E-business suite that provides support for IFRS16 and ASC842 accounting standards changes for equipment leases. The new capability would help users in managing the new lease accounting and disclosures, including the Lease Analysis Report, Lease Detail Report, Portfolio Detail Report, and Portfolio Summary Report.

- In December 2019, RealPage acquired Buildium, a leading SaaS real estate property management solution provider. The acquisition would integrate RealPage capabilities into the Buildium platform and rapidly expand the value that the company offers to customers. This strategy would help the company scale and enhance SME platform across the real estate industry.

- In June 2020, AppFolio announced to enhance its Property Manager product by expanding its capabilities in light of the evolving needs of its customers, given the unique challenges brought on by the COVID-19 crisis. The enhanced features not only provide relief to residents and homeowners but give property management professionals increased visibility into the amounts owed and the timing of repayments.

Frequently Asked Questions (FAQ):

What is Lease Management?

What is the projected market value of Lease Management Market?

What is the estimated growth rate (CAGR) of the global Lease Management Market?

What are the major revenue pockets in the global Lease Management Market currently?

Which are Top Companies in Lease Management Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 FACTORS IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 6 LEASE MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 LEASE MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE GENERATION FROM LEASE MANAGEMENT SOLUTION AND SERVICE VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATIVE EXAMPLE OF REALPAGE (2019)

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 10 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 11 LEASE MANAGEMENT MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 ATTRACTIVE OPPORTUNITIES IN LEASE MANAGEMENT MARKET

FIGURE 13 INCREASING STRINGENT REGULATORY MANDATES AND RISING ADOPTION OF CLOUD-BASED SOLUTIONS DRIVING MARKET GROWTH

4.2 GLOBAL MARKET, BY REGION AND END USER, 2020

FIGURE 14 NORTH AMERICA AND CORPORATE TO HOLD HIGH MARKET SHARES IN 2020

4.3 MARKET, BY COUNTRY

FIGURE 15 JAPAN TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY VERTICAL, 2020–2025

FIGURE 16 REAL ESTATE VERTICAL TO LEAD MARKET DURING FORECAST PERIOD

4.5 MARKET: MARKET INVESTMENT SCENARIO (2020–2025)

FIGURE 17 ASIA PACIFIC TO BE BEST MARKET TO INVEST DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: LEASE MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for SaaS model for effective management of lease

5.2.1.2 Growing trend of workplace mobility due to COVID-19 pandemic

5.2.1.3 Increasing demand for smart building projects to efficiently manage lease

5.2.2 RESTRAINTS

5.2.2.1 Budget constraints for implementation of advanced technological solutions

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging technologies, such as IoT, AI, and mobility, for real-time data analysis

5.2.3.2 Rising demand for outsourcing services

5.2.4 CHALLENGES

5.2.4.1 Integration of lease management software with legacy systems

5.2.4.2 Lack of technical expertise and skills

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY 1: NONI B

5.3.2 CASE STUDY 2: GLOBAL PAPER PRODUCTS MANUFACTURING COMPANY

5.3.3 CASE STUDY 3: COMMERCIAL PROPERTY PARTNERS (CPP) LLP

5.3.4 CASE STUDY 4: GLOBAL REAL ESTATE FIRM

5.4 PRICING MODELS: LEASE MANAGEMENT MARKET

5.5 ECOSYSTEM

FIGURE 19 ECOSYSTEM: MARKET

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE

5.6.2 ROBOTIC PROCESS AUTOMATION

5.6.3 BLOCKCHAIN

5.7 REGULATORY POLICIES

5.7.1 INTRODUCTION

5.7.2 SARBANES–OXLEY ACT

5.7.3 INTERNATIONAL ACCOUNTING STANDARDS BOARD

5.7.4 FINANCIAL ACCOUNTING STANDARDS BOARD

5.7.5 GENERAL DATA PROTECTION REGULATION

5.7.6 WORLD INTELLECTUAL PROPERTY ORGANIZATION

5.7.7 FREEDOM OF INFORMATION ACT

5.8 IMPACT OF COVID-19 ON MARKET

TABLE 3 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN THE COVID-19 ERA

TABLE 4 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.8.1 CUMULATIVE GROWTH ANALYSIS

TABLE 5 MARKET: CUMULATIVE GROWTH ANALYSIS

6 LEASE MANAGEMENT MARKET, BY TYPE (Page No. - 52)

6.1 INTRODUCTION

6.1.1 TYPE: MARKET DRIVERS

6.1.2 TYPE: COVID-19 IMPACT ON MARKET

FIGURE 20 SOLUTION SEGMENT TO HAVE LARGER MARKET SIZE IN 2020

TABLE 6 MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

6.2 SOLUTION

TABLE 7 SOLUTION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3 SERVICES

TABLE 8 SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 9 MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

6.3.1 CONSULTING

TABLE 10 CONSULTING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3.2 SYSTEM INTEGRATION

TABLE 11 SYSTEM INTEGRATION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3.3 TRAINING, SUPPORT, AND MAINTENANCE

TABLE 12 TRAINING SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 LEASE MANAGEMENT MARKET, BY DEPLOYMENT MODE (Page No. - 58)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODE: MARKET DRIVERS

7.1.2 DEPLOYMENT MODE: COVID-19 IMPACT ON MARKET

FIGURE 21 CLOUD SEGMENT TO HAVE LARGER MARKET SIZE IN 2020

TABLE 13 MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

7.2 CLOUD

TABLE 14 CLOUD: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 ON-PREMISES

TABLE 15 ON-PREMISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 LEASE MANAGEMENT MARKET, BY ENTERPRISE SIZE (Page No. - 62)

8.1 INTRODUCTION

8.1.1 ENTERPRISE SIZE: MARKET DRIVERS

8.1.2 ENTERPRISE SIZE: COVID-19 IMPACT ON MARKET

FIGURE 22 LARGE ENTERPRISES SEGMENT TO HAVE LARGER MARKET SIZE IN 2020

TABLE 16 MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 17 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 18 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 LEASE MANAGEMENT MARKET, BY END USER (Page No. - 66)

9.1 INTRODUCTION

9.1.1 END USER: MARKET DRIVERS

9.1.2 END USER: COVID-19 IMPACT ON MARKET

FIGURE 23 CORPORATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 19 MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

9.2 HOUSING

TABLE 20 HOUSING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 CORPORATE

TABLE 21 CORPORATE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.4 PROPERTY MANAGERS

TABLE 22 PROPERTY MANAGERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 LEASE MANAGEMENT MARKET, BY VERTICAL (Page No. - 71)

10.1 INTRODUCTION

10.1.1 VERTICAL: MARKET DRIVERS

10.1.2 VERTICAL: COVID-19 IMPACT ON MARKET

FIGURE 24 REAL ESTATE VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

10.2 RETAIL AND ECOMMERCE

TABLE 24 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.3 GOVERNMENT AND PUBLIC SECTOR

TABLE 25 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.4 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 26 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.5 EDUCATION

TABLE 27 EDUCATION: LEASE MANAGEMENT MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.6 REAL ESTATE

TABLE 28 REAL ESTATE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.7 TRANSPORTATION AND LOGISTICS

TABLE 29 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.8 MANUFACTURING

TABLE 30 MANUFACTURING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.9 OTHERS

TABLE 31 OTHERS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11 LEASE MANAGEMENT MARKET, BY REGION (Page No. - 79)

11.1 INTRODUCTION

FIGURE 25 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 32 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 IMPACT ON MARKET

11.2.3 NORTH AMERICA: TARIFFS AND REGULATIONS

TABLE 33 NORTH AMERICA: TARIFFS AND REGULATIONS

FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

TABLE 34 NORTH AMERICA: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.2.4 UNITED STATES

TABLE 41 UNITED STATES: LEASE MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 42 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 43 UNITED STATES: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.2.5 CANADA

TABLE 44 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 46 CANADA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: LEASE MANAGEMENT MARKET DRIVERS

11.3.2 EUROPE: COVID-19 IMPACT ON MARKET

11.3.3 EUROPE: TARIFFS AND REGULATIONS

TABLE 47 EUROPE: TARIFFS AND REGULATIONS

TABLE 48 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 50 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

TABLE 52 EUROPE: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.3.4 UNITED KINGDOM

TABLE 55 UNITED KINGDOM: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 57 UNITED KINGDOM: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.3.5 GERMANY

TABLE 58 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 60 GERMANY: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.3.6 FRANCE

TABLE 61 FRANCE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 FRANCE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 63 FRANCE: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.3.7 REST OF EUROPE

TABLE 64 REST OF EUROPE: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 66 REST OF EUROPE: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 IMPACT ON LEASE MANAGEMENT MARKET

11.4.3 ASIA PACIFIC: TARIFFS AND REGULATIONS

TABLE 67 ASIA PACIFIC: TARIFFS AND REGULATIONS

FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 68 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.4.4 CHINA

TABLE 75 CHINA: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 77 CHINA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.4.5 JAPAN

TABLE 78 JAPAN: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 JAPAN: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 80 JAPAN: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.4.6 INDIA

TABLE 81 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 INDIA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 83 INDIA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.4.7 REST OF ASIA PACIFIC

TABLE 84 REST OF APAC: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 REST OF APAC: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 86 REST OF APAC: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT ON LEASE MANAGEMENT MARKET

TABLE 87 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 89 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 90 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

TABLE 91 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 92 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 93 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.5.3 UNITED ARAB EMIRATES

TABLE 94 UNITED ARAB EMIRATES: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 96 UNITED ARAB EMIRATES: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.5.4 SAUDI ARABIA

TABLE 97 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 SAUDI ARABIA MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 99 SAUDI ARABIA: LEASE MANAGEMENT MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 100 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 101 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 102 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: LEASE MANAGEMENT MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 IMPACT ON MARKET

TABLE 103 LATIN AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

TABLE 107 LATIN AMERICA: MARKET SIZE, BY END USER, 2018–2025 (USD MILLION)

TABLE 108 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2018–2025 (USD MILLION)

TABLE 109 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

11.6.3 BRAZIL

TABLE 110 BRAZIL: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 111 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 112 BRAZIL: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.6.4 MEXICO

TABLE 113 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 MEXICO MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 115 MEXICO: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

11.6.5 REST OF LATIN AMERICA

TABLE 116 REST OF LATIN AMERICA: LEASE MANAGEMENT MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2025 (USD MILLION)

TABLE 118 REST OF LATIN AMERICA: MARKET SIZE, BY ENTERPRISE SIZE, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 117)

12.1 INTRODUCTION

12.2 RANKING OF KEY PLAYERS IN LEASE MANAGEMENT MARKET, 2020

FIGURE 28 RANKING OF KEY PLAYERS, 2020

12.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 119 REVENUE ANALYSIS OF MARKET IN 2020

13 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 118)

13.1 COMPANY EVALUATION MATRIX

13.1.1 VISIONARY LEADERS

13.1.2 INNOVATORS

13.1.3 DYNAMIC DIFFERENTIATORS

13.1.4 EMERGING COMPANIES

FIGURE 29 LEASE MANAGEMENT MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13.2 COMPANY PROFILES

(Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

13.3 IBM

FIGURE 30 IBM: COMPANY SNAPSHOT

FIGURE 31 IBM: SWOT ANALYSIS

13.4 ORACLE

FIGURE 32 ORACLE: COMPANY SNAPSHOT

FIGURE 33 ORACLE: SWOT ANALYSIS

13.5 REALPAGE

FIGURE 34 REALPAGE: COMPANY SNAPSHOT

FIGURE 35 REALPAGE: SWOT ANALYSIS

13.6 ACCRUENT

13.7 SAP

FIGURE 36 SAP: COMPANY SNAPSHOT

FIGURE 37 SAP: SWOT ANALYSIS

13.8 TRIMBLE

FIGURE 38 TRIMBLE: COMPANY SNAPSHOT

FIGURE 39 TRIMBLE: SWOT ANALYSIS

13.9 APPFOLIO

FIGURE 40 APPFOLIO: COMPANY SNAPSHOT

13.10 ODESSA

13.11 COSTAR GROUP

FIGURE 41 COSTAR GROUP: COMPANY SNAPSHOT

13.12 NAKISA

13.13 LEASEACCELERATOR

13.14 MRI SOFTWARE

13.15 RENTEC DIRECT

13.16 LEASEQUERY

13.17 SPACEBASE

13.18 RAAMP

13.19 NOMOS ONE

13.20 LEASEEAGLE

13.21 HEMLANE

13.22 AMTDIRECT

13.23 TANGO

13.24 PROPERTY WORKS

13.25 MANAGECASA

13.26 BUILDIUM

13.27 ARCHIBUS

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13.28 RIGHT TO WIN

14 ADJACENT MARKET (Page No. - 151)

14.1 INTRODUCTION

14.2 PROPERTY MANAGEMENT MARKET

TABLE 120 PROPERTY MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2023 (USD MILLION)

TABLE 121 PROPERTY MANAGEMENT MARKET SIZE, BY END USER, 2016–2023 (USD MILLION)

TABLE 122 PROPERTY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

14.3 FACILITY MANAGEMENT MARKET

TABLE 123 FACILITY MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODE, 2016–2023 (USD MILLION)

TABLE 124 FACILITY MANAGEMENT MARKET SIZE, BY VERTICAL, 2016–2023 (USD MILLION)

TABLE 125 FACILITY MANAGEMENT MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

15 APPENDIX (Page No. - 154)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

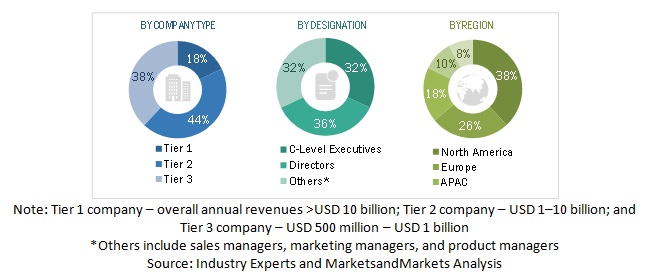

The study involved four major activities in estimating the current size of the Lease management market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the lease management market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Factiva, have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, and articles by recognized authors, industry standard organizations and associations.

Primary Research

The lease management market comprises several stakeholders, such as lease management vendors, cloud solution providers, system integrators, professional service providers, resellers and distributors, government and research organizations, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the lease management market consists of enterprises from different verticals, such as Banking, Financial Services and Insurance (BFSI), government and public sector, education, retail and eCommerce, manufacturing, transportation and Logistics, and others (Healthcare and Pharmaceuticals, IT and Telecommunications, Oil and Gas, Hospitality, and NPO). The supply-side includes lease management providers, offering lease management software, and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Lease Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the lease management market. The methods were also used extensively to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the lease management market based on type (solution and services), deployment mode, enterprise size, end users, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market<.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape of key players

- To comprehensively analyze the core competencies of key players in the market

- To track and analyze the competitive developments, such as product/solution launches and enhancements; business expansions; and acquisitions and partnerships in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Lease Management Market