Property Management Market Size, Share, Industry Growth, Latest Trends, Analysis, Forecast

Property Management Market by Software Type (Lease Management (Portfolio Management, Document Storage & Management, AI Lease Abstraction, Lease Accounting & Administration), Facility Management, Reporting & Analytics), End User - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global property management software market is projected to grow from USD 26.49 billion in 2024 to USD 42.78 billion by 2030, registering a CAGR of 8.3%. The market is shifting from legacy systems to cloud-based, AI-integrated platforms that support multi-property portfolios, real-time decision-making, and tenant-centric innovation. Vendors are differentiating through automation, scalability, and data-driven personalization, aligning with broader trends in PropTech and smart infrastructure.

KEY TAKEAWAYS

- North America is set to hold the largest market share (33.8%) in 2025.

- By offering, Lease management software is projected to grow at the highest CAGR of 9.5% during the forecast period.

- By geographical location, Urban locations is expected to register a higher CAGR of 7.5% during the forecast period, 2024-2030.

- By property type, Apartment-style residential properties are expected to register the highest CAGR in the property management market.

- By end user, Government agencies are forecasted to showcase the fastest growth rate as end users of property management solutions.

- Companies such as IBM, Oracle and Appfolio were identified as some of the star players in the property management Market, given their strong market share and product footprint.

- Companies Propoerty Matrix, Condo Control, and HappyCo, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders

The property management market is gaining traction due to the benefits it offers real estate businesses and property managers. Property management software manages the complexities of handling various property types, such as residential, commercial, industrial, government, and military, and offers a solution to streamline the overall process from property maintenance to lease management, marketing, and operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The influence on consumers' businesses originates from shifts in customer behavior or disruptions. Hotbets, who are clients of property management software vendors, serve end users through target applications. When trends or disruptions occur, the resulting revenue changes for end users will cascade upwards, directly impacting the income of hotbets. This, in turn, will influence the overall revenue for property management software vendors as well.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Predictive Analytics for Maintenance

-

Smart Building Management

Level

-

Financial Constraints

-

Regulatory Compliance Risks

Level

-

Generative AI for Lease & Communication

-

AR/VR for Immersive Experiences

Level

-

Data Security Risks

-

AI Bias & Model Integrity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: AI & Predictive Analytics Integration

The integration of AI-driven predictive analytics is reshaping property management by enabling smarter, data-backed decisions. From forecasting tenant turnover to optimizing maintenance schedules, these tools help property managers proactively manage assets and reduce operational disruptions. Vendors embedding machine learning, big data, and real-time analytics into their platforms are delivering intelligent property insights that enhance asset lifecycle management and portfolio performance.

Restraint: Legal & Compliance Burdens

The deployment of property management software is constrained by the need to navigate complex legal frameworks, including tenant rights, eviction laws, and data privacy regulations. Mishandling sensitive tenant data—such as financial records or identification documents—can lead to regulatory penalties and loss of trust. These risks are especially burdensome for small and mid-sized property firms, which often lack dedicated compliance teams.

Opportunity: AR/VR for Immersive Experiences

The emergence of AR/VR technologies is unlocking new dimensions in tenant engagement and property visualization. Virtual tours, augmented maintenance instructions, and immersive staging experiences allow prospective tenants and buyers to explore properties remotely and interactively. This not only improves leasing efficiency but also supports lifestyle-driven decision-making in residential and commercial spaces.

Challenge: High Cost of Aging Property Maintenance

Managing aging infrastructure presents a persistent challenge, with frequent repairs and rising costs due to outdated plumbing, electrical systems, and structural wear. These issues strain budgets and reduce profitability, especially in legacy portfolios. Without predictive maintenance tools and automated diagnostics, property managers face reactive workflows and tenant dissatisfaction.

Property Management Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Commercial Property Partners (CPP) replaced manual spreadsheets and Sage with Re-Leased, a cloud-based property management software integrated with Xero accounting. The solution automated invoicing, centralized lease data, and delivered real-time insights to support seamless remote and in-office operations. | Administrative tasks like invoicing were reduced from a full day to 30 minutes. Cloud scalability improved flexibility, while automation enhanced accuracy and productivity, enabling CPP to expand operations without additional manual overheads. |

|

Siemens Real Estate (SRE), managing 15 million square meters across 2,400 sites, deployed Planon’s cloud-based Real Estate Management (REM) software. The solution integrated facility management and lifecycle management into a centralized platform for global portfolio oversight. | The platform standardized processes across locations, reduced IT costs, and enhanced efficiency. Real-time data and analytics improved decision-making, delivering productivity gains and cost savings across Siemens’ global real estate operations. |

|

JG Capital Realty Inc., facing limited international exposure, adopted CoStar and LoopNet to strengthen market reach. Leveraging digital platforms, the firm expanded visibility and tapped into international investors, particularly across the US market. | Using CoStar and LoopNet significantly increased the firm's visibility, resulting in a 25% revenue boost and a 70% increase in listings. The solution also saved time, reduced research effort, and enabled faster deal closures, thus enhancing the company's competitiveness. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Property management market ecosystem comprises a diverse range of stakeholders. Key players include providers of facility management, lease management, portfolio management, system integrators, service providers, and end users. These entities collaborate to develop, deliver, and utilize property management tools to drive innovation and growth in the market.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Property Managment market, By Offering

Facility property management software holds the largest market share in 2024, driven by enterprise demand for integrated platforms that unify lease administration, tenant engagement, energy optimization, and predictive maintenance. Vendors are rapidly innovating with cloud-native, AI-powered, and IoT-enabled solutions to deliver real-time operational intelligence across diverse property portfolios. As organizations prioritize automation, compliance, and cost efficiency, facility management software has emerged as the cornerstone of smart property operations, making it the most dominant offering in the market.

Property Managment market, By Channel Mode

App-based property management platforms are projected to achieve the highest CAGR, reflecting the industry's pivot toward mobile-first experiences. Tenants, property managers, and service providers increasingly rely on real-time communication, digital leasing, and mobile payment solutions. Vendors are enhancing apps with AI chatbots, push notifications, and maintenance tracking, enabling seamless engagement and operational agility. The transition from web-based to app-based models underscores the market’s focus on instant access, user convenience, and urban mobility, positioning mobile solutions as a key growth engine.

Property Managment market, By Geographic Location

Suburban markets are expected to register the highest CAGR, fueled by hybrid work trends, rising housing development, and lifestyle-driven leasing. Property management vendors are customizing platforms for multi-family housing, gated communities, and mixed-use suburban developments, integrating features like community engagement portals, security automation, and localized compliance tools. As suburban real estate expands, providers offering scalable cloud-based solutions with region-specific capabilities are well-positioned to capture growth in this dynamic segment.

Property Managment market, By Property Type

Educational institutes are projected to register the highest CAGR in property management software adoption, driven by the sector’s accelerated push toward digital campus transformation. Universities, colleges, and schools are investing in platforms that support student housing management, lease automation, facilities scheduling, and energy optimization. Vendors offering education-specific modules, mobile-first student engagement tools, and smart campus solutions are well-positioned to capture this growth. The increasing focus on sustainability, compliance, and cost efficiency makes the education segment a strategic expansion area within the broader property management market.

Property Management Market, By End User

Property managers and real estate agents are expected to hold the largest market share in 2025, as they remain the core users of advanced property management platforms. These professionals rely on software for tenant onboarding, digital lease workflows, automated payments, and predictive maintenance to enhance operational efficiency and tenant satisfaction. Vendors are embedding AI-driven analytics, CRM integrations, and mobile-first tools tailored for agents managing diverse portfolios. With rising pressure to accelerate leasing cycles, boost occupancy, and ensure regulatory compliance, this segment continues to drive platform adoption and innovation.

REGION

Asia Pacific to be fastest-growing region in global Property Management Market during forecast period

The Asia Pacific property management market is expanding rapidly, driven by accelerated urbanization, large-scale residential and commercial developments, and rising digital transformation in real estate operations. Governments and private developers are investing heavily in smart property platforms, while tenant expectations for digital leasing, mobile-first engagement, and automated service delivery are reshaping vendor strategies. The region’s focus on technology-led housing, smart city initiatives, and cloud-based property management solutions positions Asia Pacific as a strategic growth hub for global and regional vendors.

Property Management Market: COMPANY EVALUATION MATRIX

In the property management market, Oracle is a leading player positioned in the Stars quadrant, showcasing strong market presence and innovation. Yardi, currently categorized under Emerging Leaders, is rapidly advancing with strategic investments and product expansions, making it well-positioned to transition into the Stars quadrant. This analysis underscores dynamic vendor competition and evolving market opportunities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 26.49 Billion |

| Market Forecast in 2030 (Value) | USD 42.78 Billion |

| Growth Rate | 8.3% |

| Years Considered | 2019–2030 |

| Base Year | 2023 |

| Forecast Period | 2024 – 2030 |

| Units Considered | USD Mn |

| Report Coverage | Company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Property Management Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading property management software vendor | Conducted innovation gap analysis, developed tailored go-to-market strategies, and performed comparative adoption benchmarking. Profiled decision-makers and mapped adoption trends across property managers, real estate agents, and institutional end-users. | Enabled the client to benchmark product capabilities, refine sales messaging, and build differentiated value propositions aligned to specific buyer personas and operational needs. |

| Top-tier vendor | Delivered in-depth regional segmentation with growth forecasts across APAC, North America, and Europe. Provided tailored insights into high-growth property types including student housing, gated communities, and smart campuses. | Helped the client identify untapped growth hubs, align offerings with localized demand, and prioritize property verticals with the highest revenue potential for strategic market entry. |

RECENT DEVELOPMENTS

- October 2024 : Oracle introduced enhanced lease management capabilities, including automated lease liability accounting for SFFAS 54 leases, streamlined lease expiry tracking, and payment integration with purchase orders. These updates improve compliance, financial reporting, and workflow automation for federal property portfolios.

- October 2024 : Yardi partnered with Engrain to integrate SightMap interactive mapping technology into RentCafe websites. This enables multifamily operators to offer visual property navigation, enhancing the rental search experience and boosting tenant engagement.

- August 2024 : RealPage partnered with Flex to embed flexible rent payment options into the LOFT resident portal. Residents can split rent into smaller payments, improving financial wellness and resident satisfaction, while property managers benefit from predictable cash flow and operational efficiency.

- July 2024 : Trimble extended its strategic partnership with Esri to advance GIS software, location intelligence, and automated mapping workflows. The collaboration supports greener infrastructure planning, construction optimization, and smart property operations.

- April 2024 : RealPage launched a new resident-facing technology platform for multifamily housing, featuring fraud detection, a move-in marketplace, financial wellness tools, and a resident loyalty program. The platform streamlines leasing, enhances payment flexibility, and improves tenant retention.

Table of Contents

Methodology

This research study involves the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the property management market. The primary sources are mainly industry experts from the core and related industries, preferred property management systems, software, and service providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews have been conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the growth prospects. The following figure highlights the market research methodology applied to make the property management market report.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for the study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations have also been referred to, such as the Journal of Property Management (JPM), Journal of Real Estate Research (JRER), Building Owners and Managers Association (BOMA) International and National Apartment Association (NAA).

Secondary research has been mainly used to obtain key information about industry insights, the market's monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

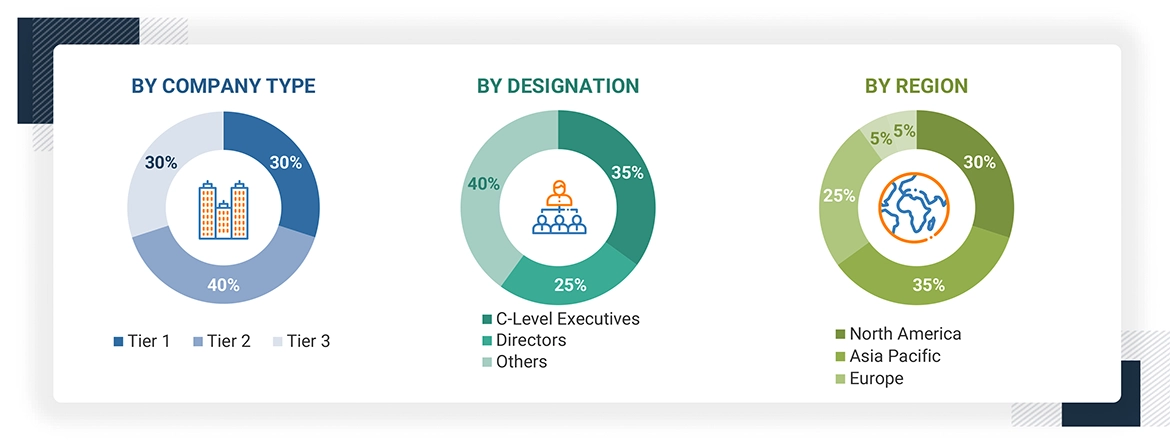

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side include various industry experts, including Chief Technology Officers (CTOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from property management solution and service vendors, system integrators, professional and managed service providers, industry associations, and consultants; and key opinion leaders.

Primary interviews have been conducted to gather insights, such as market statistics, data of revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helps understand various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), and Chief Strategy Officers (CSOs), and the installation team of end users who use property management solutions, have been interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current usage of property management solutions, which is expected to affect the overall property management market growth.

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range

between USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

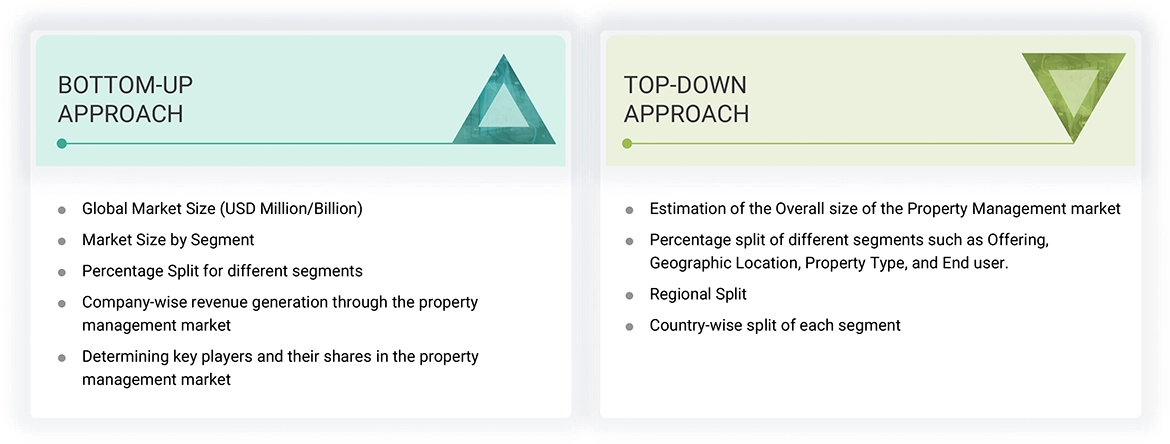

Multiple approaches were adopted for estimating and forecasting the property management market. The first approach involves estimating the market size by companies’ revenue generated through the sale of property management products.

Market Size Estimation Methodology- Top-down approach

In the top-down approach, an exhaustive list of all the vendors offering products in the property management market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of product type, deployment mode, architecture, and end user. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of property management products among different verticals in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of property management products among enterprises, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the property management market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major property management providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall property management market size and segments’ size were determined and confirmed using the study.

Property Management Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Property management software is designed to help property managers and landlords efficiently manage various aspects of their real estate properties, including tenant management, maintenance tracking, and financial management for both residential and commercial spaces. This software streamlines and automates tasks related to property operations, financial management, tenant engagement, and overall lease administration. Moreover, property management software provides a broad view of property operations, and lease management software focuses on the details of individual leases.

Stakeholders

- Property management vendors

- Property Owners

- Tenants

- Real Estate Technology Providers

- Real Estate Developers

- Regulatory Bodies and Governments

- Service Providers

- Financial Institutions and Investors

- Consultants and Advisors

- Insurance Providers

- Industry Associations and Advocacy Groups

Report Objectives

- To define, describe, and predict the property management market by offering, geographic location, property type, end user, and region

- To describe and forecast the market, in terms of value, by region—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To profile key players and comprehensively analyze their market positions in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as mergers and acquisitions, partnerships, collaborations, product launches and enhancements, and ongoing research and development (R&D) in the market

- To provide the illustrative segmentation, analysis, and projection of the main regional markets.

Note 1: Micromarkets refer to further segments and subsegments of the property management market included in the report.

Note 2:Companies' core competencies were captured in terms of their key developments and key strategies for sustaining their position in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the property management market

- Further breakup of the European property management Market

- Further breakup of the Asia Pacific property management Market

- Further breakup of the Middle East & Africa property management Market

- Further breakup of the Latin American logistics property management Market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Property Management Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Property Management Market