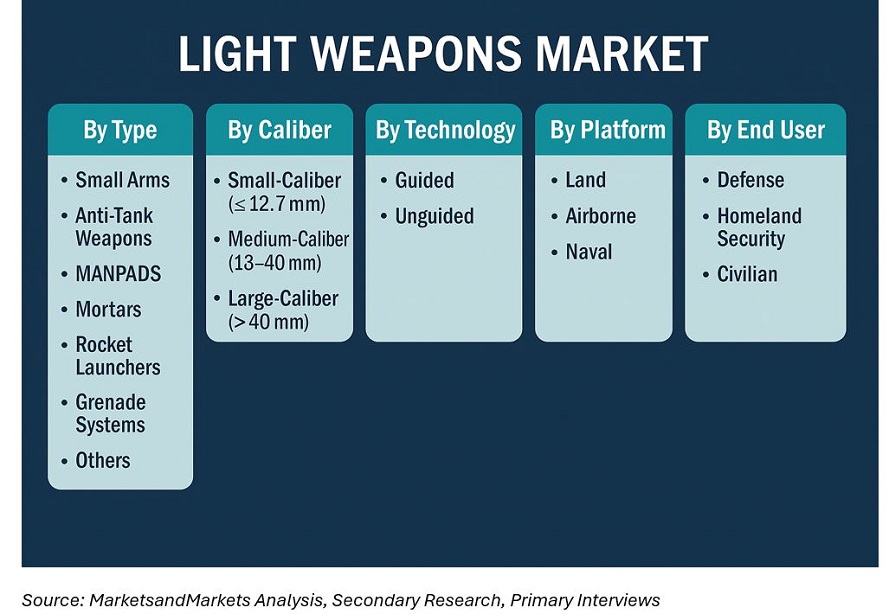

Light Weapons Market by Type (Small Arms, Anti-Tank Weapons, MANPADS, Mortars, Rocket Launchers, Grenade Systems, Others), by Caliber, by Technology (Guided, Unguided), by Platform (Land, Airborne, Naval), by End User (Defense, Homeland Security, Civilian), and by Region — Global Forecast to 2035

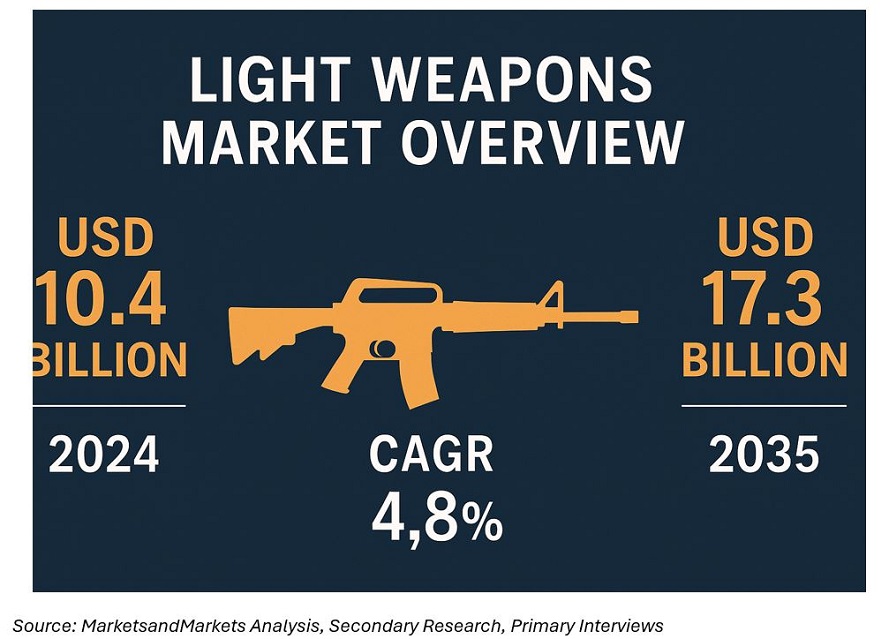

The light weapons market is experiencing steady expansion amid rising global defense expenditure, border-security modernization, and a surge in asymmetric and urban warfare. The market is estimated at USD 13.4 billion in 2024 and projected to reach approximately USD 19.7 billion by 2035, registering a CAGR of 3.7 % during the forecast period.

Light weapons — encompassing small arms, anti-tank guided weapons (ATGWs), man-portable air defense systems (MANPADS), mortars, grenade systems, and lightweight rocket launchers — remain indispensable to both conventional and irregular military forces. Their adaptability across land, airborne, and maritime operations, combined with modular designs and extended precision ranges, continues to sustain demand worldwide.

Modernization initiatives by NATO members, regional procurement drives in Asia and the Middle East, and ongoing conflicts in Eastern Europe have accelerated the replacement of legacy inventories with smart, lightweight, and guided weapon systems.

Market Dynamics

Drivers

-

Defense Modernization and Indigenization Programs

Governments are increasing investments in soldier modernization projects that emphasize lethality, mobility, and survivability. Programs such as the US Army’s Next Generation Squad Weapon (NGSW), India’s Make-II initiatives, and European defense fund allocations for precision munitions are major demand catalysts. -

Rising Demand for Precision-Guided and Lightweight Systems

The shift toward man-portable guided systems with low signature and reduced recoil is transforming battlefield logistics. Advanced electro-optical sights, laser designators, and smart fuzes are now integrated into standard infantry weapons, boosting accuracy and operational versatility. -

Regional Security Tensions and Counter-Terrorism Operations

Persistent conflicts in Eastern Europe, the Middle East, and parts of Africa have intensified procurement of MANPADS, RPGs, and grenade launchers by both state and allied defense forces.

Restraints

Export restrictions under Arms Trade Treaty (ATT) provisions and complex licensing regulations continue to limit cross-border supply. Additionally, proliferation concerns and illicit trade channels in conflict zones remain obstacles for legitimate manufacturers.

Opportunities

The rise of network-enabled and AI-assisted targeting systems, 3D-printed weapon components, and composite materials for lighter frames presents long-term innovation opportunities. The transition from conventional optics to augmented-reality (AR) aiming devices will further expand aftermarket revenues.

Market Segmentation

By Type

The market covers small arms, anti-tank weapons, man-portable air-defense systems (MANPADS), grenade systems, mortars, rocket and recoilless launchers, and others (flame weapons, demolition kits).

- Small arms — including assault rifles, machine guns, pistols, and carbines — constitute the most significant share due to continuous demand from military, paramilitary, and law-enforcement agencies.

- Anti-tank weapons are the fastest-growing segment, driven by active replacement of legacy ATGMs with lightweight, fire-and-forget models.

- MANPADS remain critical for tactical air-defense modernization programs globally.

By Caliber

The market is segmented by small-caliber (≤ 12.7 mm), medium-caliber (13–40 mm), and large-caliber (> 40 mm) systems. Small-caliber weapons dominate production volumes, while medium calibers are gaining importance in support and mounted roles.

By Technology

Light weapons are categorized as guided and unguided systems.

- Guided systems are increasingly favored for their precision, minimizing collateral damage and enabling operator survivability.

- Unguided systems, while mature, continue to serve in low-intensity operations and cost-sensitive procurement programs.

By Platform

The land platform accounts for over 70 % of total demand, encompassing infantry, armored vehicles, and special forces. Airborne and naval platforms are expected to grow steadily as aircraft and naval assets integrate precision-launch modules for multi-domain flexibility.

By End User

- Defense segment: Represents the dominant share, supported by the modernization of infantry and special operations units.

- Homeland security: Increasing border-control budgets and counter-insurgency missions sustain steady procurement of non-lethal and adaptable systems.

- Civilian/commercial: Limited to law enforcement and licensed sporting applications, mainly in North America and parts of Europe.

Regional Analysis

North America

North America remains the largest regional market, driven by continuous US Army and Marine Corps modernization, and Canada’s investments in soldier systems. Major OEMs such as Lockheed Martin, Northrop Grumman, and RTX Corporation supply guided lightweight weapons, while SMEs and domestic manufacturers sustain ammunition and optics value chains.

Europe

Europe ranks second, led by defense rearmament initiatives under NATO Support and Procurement Agency (NSPA) frameworks. The Russia–Ukraine conflict has significantly boosted demand for ATGMs, mortars, and shoulder-fired rockets. France, Germany, and the UK continue to expand domestic production under the EU’s Strategic Compass policy.

Asia Pacific

Asia Pacific shows the fastest CAGR, reflecting expanding defense budgets in India, China, South Korea, and Japan. Indigenous production under “Make in India”, China’s PLA modernization, and joint-venture manufacturing in South Korea are key growth levers.

Middle East & Africa

Sustained procurement by Saudi Arabia, the UAE, and Israel for infantry and counter-UAS operations underpins the regional market. African nations are focusing on UN-backed modernization of peacekeeping forces and logistics units.

Latin America

Latin America’s light-weapons market is stabilizing, driven by Brazil’s domestic small-arms industry and counter-narcotics operations across Mexico and Colombia. Localized assembly partnerships are increasing to reduce import dependency.

Competitive Landscape

The market is characterized by a mix of global OEMs and regional producers catering to defense, paramilitary, and homeland security needs. Leading players include Lockheed Martin Corporation, Thales Group, Saab AB, BAE Systems plc, Rheinmetall AG, Raytheon Technologies (RTX), FN Herstal, Heckler & Koch GmbH, Israel Weapon Industries (IWI), and Nammo AS.

Companies focus on developing modular, lighter, and digitally-aided weapon systems with integrated fire-control optics. Strategic collaborations between Western and Asian manufacturers—such as technology transfers and co-production—are accelerating domestic capability building in emerging economies.

Recent industry trends include long-term ammunition supply contracts, life-extension programs for MANPADS, and R&D partnerships for shoulder-launched precision weapons with AI-assisted targeting systems.

Sustainability and Future Outlook

Sustainability initiatives are emerging across production lines, focusing on recyclable propellant materials, lead-free ammunition, and reduced-toxicity primers. Digital simulation for training and logistics also helps reduce live-fire emissions and ammunition waste.

By 2035, the integration of network-enabled fire control, electro-optical seekers, and AI-driven targeting aids will transform the light-weapons ecosystem from standalone hardware to connected tactical systems.

Forecast Summary (2024 – 2035)

|

Year |

Market Size (USD Billion) |

CAGR (2024–2035) |

|

2024 |

13.4 |

|

|

2030 |

16.4 |

|

|

2035 |

19.7 |

3.7 % |

The light weapons market will continue to expand steadily over the next decade as defense agencies emphasize mobility, accuracy, and integration within digital command networks. Regional manufacturing programs, combined with rapid advancements in optics, guidance, and materials, are reshaping how modern forces procure and deploy light-class weaponry. Manufacturers capable of aligning innovation with regulatory compliance and export controls will secure long-term competitive advantage.

Frequently Asked Questions (FAQs)

Q1. What is the size of the global light weapons market?

The market is valued at USD 13.4 billion in 2024 and is expected to reach USD 19.7 billion by 2035.

Q2. Which type of light weapon dominates the market?

Small arms hold the largest share, while anti-tank guided weapons are projected to grow fastest through 2035.

Q3. Which region will witness the highest growth?

Asia Pacific is forecast to register the highest CAGR, supported by local production and modernization programs.

Q4. Who are the major players?

Lockheed Martin, Thales Group, Saab AB, Rheinmetall AG, and IWI are among the leading companies active globally.

Q5. What technological trends are shaping the market?

Competent guidance, lightweight materials, modular weapon architectures, and networked fire-control systems define the next phase of innovation.

Table Of Contents

1 Introduction (Page No. - 22)

1.1 Objectives Of The Study

1.2 Markets Definition

1.3 Market Scope

1.3.1 Geographic Scope

1.3.2 Years Taken For The Study

1.4 Currency

1.5 Stakeholders

1.5.1 Limitations

2 Research Methodology (Page No. - 26)

2.1 Description Of Light Weapon Demand Side Analysis

2.1.1 Modernization Of Light Weapons

2.1.2 Legality Of Light Weapons

2.1.3 Illicit Firearms As A Threat To Global Security

2.1.4 Agile, Reliable, And Compact Weapons

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Market Share Estimation

2.4.1 Key Data From Secondary Sources

2.4.2 Key Data From Primary Sources

2.4.3 Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 37)

4.1 Attractive Market Opportunities in The Light Weapons Market

4.2 Light Weapons Market By Manpats Type

4.3 Asia-Pacific : Light Weapons Market By Type

4.4 Light Weapons Market, By Region

4.5 Light Weapons Market By Guided Technology

4.6 Light Weapons Market: Emerging V/S Matured Markets

4.7 Light Weapons Market: Defense And Homeland Security Applications in APAC

4.8 Life Cycle Analysis By Geography

5 Market Overview (Page No. - 43)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Type

5.2.2 Light Weapons Market, By Technology

5.2.3 Light Weapons Market, By Application

5.2.4 Light Weapons Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Change in Nature Of Warfare

5.3.1.2 Low Cost Of Weapons

5.3.1.3 Increasing Demand By Civilians For Light Weapons

5.3.1.4 Increase in Drug Trafficking

5.3.1.5 Arming Of Civilians By Governments

5.3.2 Restraints

5.3.2.1 Stringent Licensing Procedure & Regulation Policies

5.3.2.2 Demobilizing Activities

5.3.3 Opportunities

5.3.3.1 Adaptation Of Laser Technology

5.3.3.2 Rising Demand For Anti-Tank Guided Weapons

5.3.4 Challenges

5.3.4.1 Illicit Trading Of Light Weapons

5.3.4.2 Light Weapons Brokering

5.3.4.3 Changing Customer Needs

5.4 Burning issues

5.4.1 Integrated Weapons Systems

5.4.2 Modification & Transfiguration Of Existing Weapons

5.4.3 Increasing Demand For Light Weapon Accessories

6 Industry Trends (Page No. - 58)

6.1 Introduction

6.2 Value-Chain Analysis

6.3 Supply-Chain Analysis

6.3.1 End Users:

6.3.2 Key Influencers

6.4 Industry Trends

6.5 Porter’s Five Forces Analysis

6.5.1 Threat From New Entrants

6.5.2 Threat From Substitutes

6.5.3 Bargaining Power Of Suppliers

6.5.4 Bargaining Power Of Buyers

6.5.5 Intensity Of Competitive Rivalry

6.6 Strategic Benchmarking

6.6.1 Technological Integration & Product Enhancement

7 Light Weapons Market, By Technology (Page No. - 65)

7.1 Introduction

7.2 Guided Weapons Technology Market

7.2.1 Manpads

7.2.2 Anti-Aircraft Missile

7.2.3 Light Anti-Tank Weapons

7.3 Unguided Weapons Technology Market

7.3.1 Heavy Machine Guns

7.3.2 Manpats

7.3.3 Grenades

7.3.4 Mortars

8 Light Weapons Market, By Type (Page No. - 77)

8.1 Introduction

8.2 Heavy Machine Guns

8.2.1 12.77 Mm

8.2.2 14.50-20 Mm

8.3 Light Cannons

8.3.1 Small

8.3.2 Medium

8.3.3 Large

8.4 Manpads

8.4.1 Infrared

8.4.2 Laser Beam Rider

8.4.3 Command Line-Of-Sight

8.5 Manpats

8.5.1 Anti-Tank Rifles

8.5.2 Rocket-Propelled Grenades

8.5.3 Bazooka

8.5.4 Anti-Tank Missiles

8.5.5 Recoilless Rifles

8.5.5.1 > 57 MM

8.5.5.2 75 MM

8.5.5.3 84 MM

8.5.5.4 90 MM

8.5.5.5 < 105 MM

8.6 Launchers

8.6.1 Grenade Launchers

8.6.1.1 Muzzle-Fired

8.6.1.2 Shoulder-Fired

8.6.1.3 Under Slung

8.6.1.4 Automatic

8.6.2 Anti-Tank Launcher

8.6.3 Anti-Aircraft Launcher

8.6.4 Rocket Systems

8.7 Infantry Mortars

8.7.1 Light

8.7.2 Medium

8.7.3 Heavy

8.8 Grenades

8.8.1 Chemical & Gas

8.8.1.1 Smoke

8.8.1.2 Riot Control

8.8.1.3 Incendiary

8.8.1.4 Molotov Cocktail

8.8.2 Concussion

8.8.3 Anti-Tank

8.8.4 Anti-Personnel Fragmentation

8.8.5 Stun Grenade

8.8.5.1 Sting

8.8.5.2 Impact Stun

8.9 Anti-Aircraft/Anti-Submarine Missiles

8.9.1 Heat-Seeking

8.9.2 Laser-Guided

8.9.3 Command Guided

8.10 Light Anti-Tank Weapons

8.10.1 Manual Command Line-Of-Sight

8.10.2 Semi-Automatic Command Line-Of-Sight

8.10.3 Fire & Forget

8.11 Landmines

8.11.1 Anti-Personnel Landmines

8.11.2 Anti-Tank Landmines

9 Light Weapons Market, By Application (Page No. - 93)

9.1 Introduction

9.2 Defense Application Market

9.3 Homeland Security Application Market

10 Geographic Analysis (Page No. - 98)

10.1 Introduction

10.2 North America: The Leading Light Weapons Market

10.2.1 By Country

10.2.2 By Technology

10.2.3 By Type

10.2.4 By Application

10.2.5 U.S.: Major Light Weapons Exporter

10.2.6 By Technology

10.2.7 By Type

10.2.8 By Application

10.3 Europe: A Declining Light Weapon Market

10.3.1 By Country

10.3.2 By Technology

10.3.3 By Type

10.3.4 By Application

10.3.5 U.K.: Focus On Anti-Tank Guided Weapons

10.3.6 By Technology

10.3.7 By Type

10.3.8 By Application

10.3.9 Russia: Bazalt, A Leading Market Player

10.3.10 By Technology

10.3.11 By Type

10.3.12 By Application

10.3.13 Germany: Important Heavy Machine Guns Market In Europe

10.3.14 Germany: Light Weapons Market, By Technology

10.3.15 Germany: Light Weapons Market, By Type

10.3.16 Germany: Light Weapons Market, By Application

10.3.17 France: Prime Importer For Saudi Arabia

10.3.18 Technology

10.3.19 By Type

10.3.20 By Application

10.4 Asia Pacific (APAC): The Fastest Growing Market

10.4.1 By Country

10.4.2 By Technology

10.4.3 By Type

10.4.4 Application

10.4.5 India: The Biggest Importer Globally

10.4.6 By Technology

10.4.7 By Type

10.4.8 By Application

10.4.9 Japan: The Largest Asian Weapons Importer

10.4.10 By Technology

10.4.11 By Type

10.4.12 By Application

10.4.13 China: A Major Light Weapons Exporter

10.4.14 By Technology

10.4.15 By Type

10.4.16 By Application

10.5 The Middle East: A Major Market Player

10.5.1 By Country

10.5.2 By Technology

10.5.3 By Type

10.5.4 By Application

10.5.5 israel: A Prime Exporter Of Mortars

10.5.6 By Technology

10.5.7 By Type

10.5.8 By Application

10.5.9 Saudi Arabia: A Leading Market Player

10.5.10 By Technology

10.5.11 By Type

10.5.12 By Application

10.5.13 UAE: A Rising Procurer

10.5.14 By Technology

10.5.15 By Type

10.5.16 By Application

10.6 Row: Upcoming Light Weapons Market

10.6.1 By Region

10.6.2 By Technology

10.6.3 By Type

10.6.4 By Application

11 Competitive Landscape (Page No. - 193)

11.1 Overview

11.2 Market Share Analysis, Light Weapon Market

11.3 Competetive Situation And Trends

11.3.1 New Product Launches

11.3.2 Agreements, Partnerships, And Acquistions

11.3.3 Other Developments

12 Company Profiles (Overview, Products & Services, Strategies & Insights, Developments And Mnm View)* (Page No. - 201)

12.1 Introduction

12.2 Lockheed Martin Corporation

12.3 Raytheon Company

12.4 General Dynamics Corporation

12.5 BAE Systems Plc

12.6 Thales Group

12.7 Alliant Techsystems Inc.

12.8 Saab Ab

12.9 Rheinmetall AG

12.10 Cockerill Maintenance & Ingénierie

12.11 Heckler & Koch Defense, Inc

12.12 FN Herstal S.A.

*Details On Overview, Products & Services, Strategies & Insights, Developments And Mnm View Might Not Be Captured in Case Of Unlisted Companies.

13 Appendix (Page No. - 239)

13.1 Discussion Guide

13.2 Introducing Rt: Real Time Market Intelligence

13.3 Available Customizations

13.4 Related Reports

List Of Tables (224 Tables)

Table 1 Low Procurement Cost Of Light Weapons is Propelling The Growth Of Light Weapons Market

Table 2 Stringent Licensing Procedures & Regulation Policies is Posing To Be A Major Restraint

Table 3 Rising Demand For Anti-Tank Guided Weapons Offer Opportunities To The Market

Table 4 Light Weapon Brokering Pose An Important Challenge To The Market

Table 5 Light Weapons Market Size, By Guided Weapons Technology, 2012–2020 ($Million)

Table 6 Light Weapons Market Size, By Unguided Weapons Technology, 2012-2020 ($Million)

Table 7 Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 8 Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 9 Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 10 Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 11 Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 12 Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 13 Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 14 Light Weapons Market Size, By Anti-Aircraft/Anti-Submarine Missiles Type, 2012-2020 ($Million)

Table 15 Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 16 Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 17 Light Weapons Market Size, By Defense Application, 2012–2020 ($Million)

Table 18 Light Weapons Market Size, By Region, 2012-2020 ($Million)

Table 19 North America: Light Weapons Market Size, By Country, 2012-2020 ($Million)

Table 20 North America: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 21 North America: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 22 North America: Light Weapons Market Size, By Heavy Machine Guns Type, 2014-2020 ($Million)

Table 23 North America: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 24 North America: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 25 North America: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 26 North America: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 27 North America: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 28 North America: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 29 North America: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 30 North America: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 31 North America: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 32 North America: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 33 U.S.: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 34 U.S.: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 35 U.S.: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 36 U.S.: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 37 U.S.: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 38 U.S.: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 39 U.S.: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 40 U.S.: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 41 U.S.: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 42 U.S.: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 43 U.S.: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 44 U.S.: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 45 U.S.: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 46 Europe: Light Weapons Market Size, By Country, 2012-2020 ($Million)

Table 47 Europe: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 48 Europe: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 49 Europe: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 50 Europe: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 51 Europe: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 52 Europe: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 53 Europe: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 54 Europe: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 55 Europe: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 56 Europe: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 57 Europe: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 58 Europe: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 59 Europe: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 60 U.K.: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 61 U.K.: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 62 U.K.: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 63 U.K.: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 64 U.K.: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 65 U.K.: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 66 U.K.: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 67 U.K.: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 68 U.K.: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 69 U.K.: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 70 U.K.: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 71 U.K.: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 72 U.K.: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 73 Russia: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 74 Russia: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 75 Russia: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 76 Russia: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 77 Russia: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 78 Russia: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 79 Russia: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 80 Russia: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 81 Russia: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 82 Russia: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 83 Russia: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 84 Russia: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 85 Russia: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 86 Germany: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 87 Germany: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 88 Germany: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 89 Germany: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 90 Germany: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 91 Germany: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 92 Germany: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 93 Germany: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 94 Germany: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 95 Germany: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 96 Germany: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 97 Germany: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 98 Germany: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 99 France: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 100 France: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 101 France: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 102 France: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 103 France: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 104 France: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 105 France: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 106 France: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 107 France: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 108 France: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 109 France: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 110 France: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 111 France: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 112 APAC: Light Weapons Market Size, By Country, 2012–2020 ($Million)

Table 113 APAC: Light Weapons Market Size, By Technology, 2012–2020 ($Million)

Table 114 APAC: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 115 APAC: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 116 APAC: Light Weapons Market Size, By Light Cannons Type , 2012-2020 ($Million)

Table 117 APAC: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 118 APAC: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 119 APAC: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 120 APAC: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 121 APAC: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 122 APAC: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 123 APAC: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 124 APAC: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 125 APAC: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 126 India: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 127 India: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 128 India: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 129 India: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 130 India: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 131 India: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 132 India: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 133 India: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 134 India: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 135 India: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 136 India: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 137 India: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 138 India: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 139 Japan: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 140 Japan: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 141 Japan: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 142 Japan: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 143 Japan: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 144 Japan: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 145 Japan: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 146 Japan: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 147 Japan: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 148 Japan: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 149 Japan: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 150 Japan: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 151 Japan: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 152 China: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 153 China: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 154 China: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 155 China: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 156 China: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 157 China: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 158 China: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 159 China: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 160 China: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 161 China: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 162 China: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 163 China: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 164 China: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 165 The Middle East: Light Weapons Market Size, By Country, 2012-2020 ($Million)

Table 166 The Middle East: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 167 The Middle East: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 168 The Middle East: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 169 The Middle East: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 170 The Middle East: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 171 The Middle East: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 172 The Middle East: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 173 The Middle East: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 174 The Middle East: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 175 The Middle East: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 176 The Middle East: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 177 The Middle East: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 178 The Middle East: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 179 israel: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 180 israel: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 181 israel: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 182 israel: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 183 israel: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 184 israel: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 185 israel: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 186 israel: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 187 israel: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 188 israel: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 189 israel: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 190 israel: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 191 israel: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 192 Saudi Arabia: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 193 Saudi Arabia: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 194 Saudi Arabia: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 195 Saudi Arabia: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 196 Saudi Arabia: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 197 Saudi Arabia: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 198 Saudi Arabia: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 199 Saudi Arabia: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 200 Saudi Arabia: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 201 Saudi Arabia: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 202 Saudi Arabia: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 203 Saudi Arabia: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 204 Saudi Arabia: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 205 UAE: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 206 UAE: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 207 UAE: Light Weapons Market Size, By Heavy Machine Guns Type, 2012-2020 ($Million)

Table 208 UAE: Light Weapons Market Size, By Light Cannons Type, 2012-2020 ($Million)

Table 209 UAE: Light Weapons Market Size, By Manpads Type, 2012-2020 ($Million)

Table 210 UAE: Light Weapons Market Size, By Manpats Type, 2012-2020 ($Million)

Table 211 UAE: Light Weapons Market Size, By Launchers Type, 2012-2020 ($Million)

Table 212 UAE: Light Weapons Market Size, By Infantry Mortars Type, 2012-2020 ($Million)

Table 213 UAE: Light Weapons Market Size, By Grenades Type, 2012-2020 ($Million)

Table 214 UAE: Light Weapons Market Size, By Anti-Aircraft Missiles Type, 2012-2020 ($Million)

Table 215 UAE: Light Weapons Market Size, By Light Anti-Tank Weapons Type, 2012-2020 ($Million)

Table 216 UAE: Light Weapons Market Size, By Landmines Type, 2012-2020 ($Million)

Table 217 UAE: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 218 ROW: Light Weapons Market Size, By Region, 2012-2020 ($Million)

Table 219 ROW: Light Weapons Market Size, By Technology, 2012-2020 ($Million)

Table 220 ROW: Light Weapons Market Size, By Type, 2012-2020 ($Million)

Table 221 ROW: Light Weapons Market Size, By Application, 2012-2020 ($Million)

Table 222 New Product Launches, 2010–2014

Table 223 Agreements, Partnerships & Acquisitions, 2010–2014

Table 224 Other Developments, 2010-2014

List Of Figures (81 Figures)

Figure 1 Global Light Weapons Market, By Type

Figure 2 Limitations Of The Research Study

Figure 3 Light Weapon Market : Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Break Down Of Primary Interviews: By Company Type, Designation, & Region

Figure 7 Data Triangulation Methodology

Figure 8 Heavy Machine Guns To Lead Light Weapons Market From 2014-2020

Figure 9 Light Weapons Market Snapshot (2014 V/S 2020): China To Witness The Highest Growth

Figure 10 North American Region To Hold The Largest Light Weapons Market Share In 2014

Figure 11 Emerging Economies Will Create Attractive Market Opportunities in The Light Weapons Market, 2014-2020

Figure 12 Anti-Tank Rifles Has The Largest Market Share in The Light Weapons Market in Terms Of Type, 2012-2020

Figure 13 China is Expected To Possess The Highest Potential in The Light Weapons Market in The Asia-Pacific Region, 2014

Figure 14 APAC Will Be Growing At The Highest Cagr in The Light Weapons Market By 2020

Figure 15 North America is Expected To Dominate The Market For Manpads, Anti-Tank Weapon, And Anti-Aircraft Missile During The Forecast Period

Figure 16 Emerging Markets To Grow At A Faster Rate Than Matured Markets During The Forecast Period

Figure 17 Defense Applications Will Hold A Larger Market Share in The Developing Economies Of The APAC Region By 2020

Figure 18 Latin American Market is Projected To Enter Growth Phase in The Coming Years

Figure 19 Market Segmentation- By Type

Figure 20 Market Segmentation: By Type, Heavy Machine Guns

Figure 21 Market Segmentation: By Type, Light Cannons

Figure 22 Market Segmentation: By Type, Manpads

Figure 23 Market Segmentation: By Type, Manpats

Figure 24 Market Segmentation: By Type, Launchers

Figure 25 Market Segmentation: By Type, infantry Mortars

Figure 26 Market Segmentation: By Type, Grenades

Figure 27 Market Segmentation: By Type, Anti-Aircraft Missiles

Figure 28 Market Segmentation: By Type, Light Anti-Tank Weapons

Figure 29 Market Segmentation: By Type, Landmines

Figure 30 Market Segmentation: By Technology

Figure 31 Market Segmentation: By Application

Figure 32 Market Segmentation: By Geography

Figure 33 Low Procurement Cost Of Light Weapons Will Drive The Light Weapons Market

Figure 34 Value-Chain Analysis (2014): Major Value is Added During Research & Development Of Products And The Manufacturing Phase

Figure 35 Supply Chain: Direct Distribution is The Most Preferred Strategy Followed By Prominent Players

Figure 36 Porter’s Five Forces Analysis (2013): High Capital Requirement in Light Weapon Affects This Market Positively

Figure 37 Strategic Benchmarking: Lockheed Martin, BAE System, And Atk Adopted Growth Strategies For Technology integration And Product Enhancement

Figure 38 Guided Technology Market Of Light Weapons is Expected To Show Higher Cagr From 2014 To 2020

Figure 39 Light Weapons Market Size, By Guided & Unguided Technology, 2014-2020 ($Million)

Figure 40 Guided Weapons Market Size, By Region, 2014 ($Million)

Figure 41 Manpads Market Size, By Region, 2014-2020 ($Million)

Figure 42 Anti-Aircraft Missile Market Size, By Region, 2014-2020 ($Million)

Figure 43 Light Anti-Tank Weapons Market Size, By Region, 2014-2020 ($Million)

Figure 44 Unguided Weapons Market Size, By Region, 2014 ($Million)

Figure 45 Heavy Machine Guns Market Size, By Region, 2014-2020 ($Million)

Figure 46 Manpats Market Size, By Region, 2014-2020 ($Million)

Figure 47 Grenade Market Size, By Region, 2014-2020 ($Million)

Figure 48 Mortars Market Size, By Region, 2014-2020 ($Million)

Figure 49 Light Weapons Market Size, By Recoilless Rifles Type, 2012-2020 ($Million)

Figure 50 Light Weapons Market Size, By Grenade Launchers Type, 2012-2020 ($Million)

Figure 51 Light Weapons Market Size, By Chemical & Gas Grenade Type, 2012-2020 ($Million)

Figure 52 Light Weapons Market Size, By Stun Grenade Type, 2012-2020 ($Million)

Figure 53 Comparsion Between Landmine Types Based On Specifications

Figure 54 Defense Application Of Light Weapons is Expected To Show Highest Cagr From 2014 To 2020

Figure 55 Defense Application is Expected To Dominate The Market During The Forecast Period

Figure 56 Light Weapons Market Size, By Region For Defense Application in 2014

Figure 57 Light Weapons Market Size, By Homeland Security Application, 2012–2020

Figure 58 Geographic Snapshot (2014) – Rapid Growth Markets Are Emerging As New Hot Spots

Figure 59 China – An Attractive Market For Light Weapons By 2020

Figure 60 Company Adopted Partnerhips & Agreements As The Key Growth Strategy Over The Last 5 Years

Figure 61 BAE System And Lockheed Martin Company Grew At The Fastest Rate Between 2011 And 2013

Figure 62 Light Weapons Market Share, By Key Players, 2013

Figure 63 Market Evolution Frameworks, 2011-2013

Figure 64 Light Weapon Market Share: Partnerships Agreements & Acquisitions Was The Key Strategy

Figure 65 Geographic Revenue Mix Of Top 5 Market Players

Figure 66 Competitive Benchmarking Of Key Market Players (2010-2013): Raytheon Company Has Emerged As The Champion And is Expected To Grow At The Highest Cagr

Figure 67 Lockheed Martin Corporation: Business Overview

Figure 68 Lockheed Martin Corporation: Swot Analysis

Figure 69 Raytheon Company: Business Overview

Figure 70 Raytheon Company: Swot Analysis

Figure 71 General Dynamics Corporation: Business Overview

Figure 72 General Dynamics Corporation: Swot Analysis

Figure 73 BAE Systems: Business Overview

Figure 74 BAE Systems Plc: Swot Analysis

Figure 75 Thales Group: Business Overview

Figure 76 Thales Group: Swot Analysis

Figure 77 Alliant Techsystems inc.: Business Overview

Figure 78 Alliant Techsystems Inc.: Swot Analysis

Figure 79 SAAB AB: Business Overview

Figure 80 Rheinmetall Ag: Business Overview

Figure 81 Cockerill Maintenance & Ingénierie: Business Overview

Growth opportunities and latent adjacency in Light Weapons Market