Linear Motion Market by Component (Linear Guide, Actuators, Ball Screws, Linear Motors), Industry (Medical & Pharmaceuticals, Semiconductors & Electronics, Aerospace, Food & Beverages, Machining Tools, Automotive), Geography - Global Forecast to 2024-2035

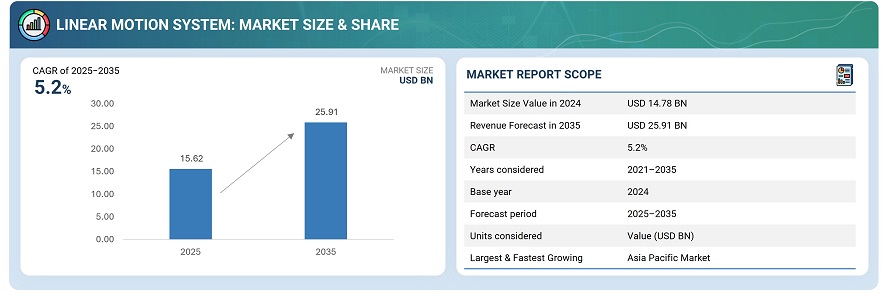

The global linear motion system market was valued at USD 14.78 billion in 2024 and is estimated to reach USD 25.91 billion by 2035, at a CAGR of 5.2% between 2025 and 2035.

The global linear motion system market is growing steadily, driven by the rising adoption of automation and precision technologies across various industries. These systems are crucial for ensuring the accurate and smooth operation of machinery used in robotics, packaging, semiconductor manufacturing, and medical equipment. Key factors driving market growth include the increasing focus on operational efficiency, high-speed production, and the reduction of human error. The demand for energy-efficient and maintenance-free components such as actuators, motors, and guides is also increasing. Moreover, advancements in smart sensors, IoT-enabled motion control, and mechatronic integration are enhancing system performance, accuracy, and reliability. As industries continue to embrace intelligent manufacturing, the demand for linear motion systems is expected to grow significantly in the coming years.

Linear motion systems are precision-engineered solutions designed to provide smooth, accurate, and controlled movement in industrial applications. They play a crucial role in automation, robotics, packaging, semiconductor manufacturing, and medical equipment, ensuring high accuracy and repeatability. These systems comprise components such as actuators, ball screws, and linear guides, which enable precise positioning and motion control. Modern linear motion systems incorporate smart sensors, digital control, and energy-efficient designs to enhance performance and reliability. By improving productivity, precision, and operational efficiency, they have become essential in semiconductor manufacturing, robotics, packaging, and medical equipment industries.

Market by Industry

Medical

The medical industry is a key segment in the linear motion system market, holding the largest market share, driven by the need for precision, reliability, and smooth operation in medical devices and equipment. Linear motion systems are widely used in imaging machines, surgical robots, diagnostic instruments, and laboratory automation to ensure accurate positioning and controlled movement. These systems enable high-precision operations, such as patient positioning, sample handling, and robotic-assisted procedures, where even minor deviations can have a significant impact on outcomes. Advanced features, such as smart sensors, digital controls, and energy-efficient actuators, enhance performance, safety, and repeatability. Growing investment in medical technology continues to drive adoption and innovation in this segment.

Automotive

The automotive industry is the fastest-growing segment in the linear motion system market, driven by the increasing integration of automation and advanced manufacturing technologies. Linear motion systems play a vital role in robotic assembly, precision machining, material handling, and testing processes, providing high-speed, accurate, and repeatable movement. These systems are essential for vehicle assembly, component inspection, and quality assurance, where precision and efficiency are critical. Equipped with smart sensors, digital controls, and energy-efficient actuators, they enhance performance, reliability, and operational safety. Growing demand for electric vehicles and the adoption of smart factory solutions are further accelerating growth in this segment.

Market by Type

Multi Process Systems

The multi process systems segment holds the largest share in the linear motion system market due to its flexibility and efficiency. These systems combine several motion functions into a single unit, enabling precise, smooth, and reliable operations. They are widely used in automation, robotics, packaging, and assembly, where integrating tasks such as positioning, handling, and processing reduces time and equipment requirements. With advanced features such as digital controls, smart sensors, and energy-efficient actuators, multi-process systems deliver high accuracy, consistency, and operational flexibility. Their ability to handle complex, high-precision tasks makes them a preferred choice for industries seeking efficient and cost-effective motion solutions.

Single Process Systems

Single process systems are a key product type in the linear motion system market and hold a notable share due to their focused application in industries such as packaging, assembly, robotics, and laboratory automation. They are designed to perform a single motion function, such as positioning, lifting, or transferring, with high precision and reliability. Advanced features, including digital controls, linear guides, and energy-efficient actuators, ensure accurate, consistent, and repeatable operations. The increasing demand for precise, reliable, and cost-effective motion solutions in industrial and research applications is driving the adoption of single-process systems, making them a significant contributor to the global linear motion system market.

Market by Geography

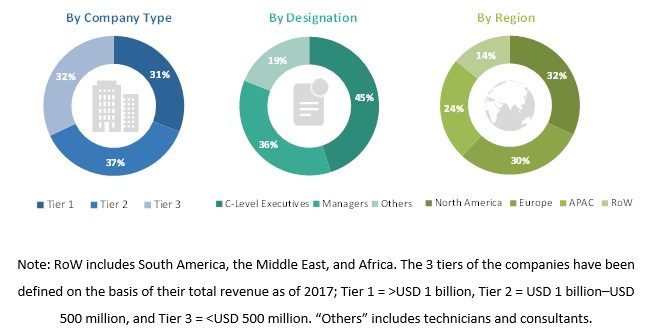

The Asia Pacific region is the largest and fastest-growing market for linear motion systems, driven by significant investments in automation, robotics, and precision manufacturing across key industries. Countries such as China, Japan, and South Korea are leading in the adoption of advanced linear motion technologies in sectors like automotive, electronics, and healthcare. The region’s focus on smart manufacturing and precision-driven operations is fueling the demand for high-performance and reliable motion solutions. Strong industrial infrastructure, continuous technological advancements, and the growing adoption of automated systems are further accelerating market growth, establishing the Asia Pacific region as a central hub for innovation and expansion in the global linear motion system market.

Market Dynamics

Driver: Growing Adoption of Automation and Precision Manufacturing

The increasing focus on automation, robotics, and precision-driven operations is driving growth in the linear motion system market. Industries such as automotive, medical, packaging, and electronics require high-accuracy and reliable motion solutions for assembly, material handling, and testing. Linear motion systems enable smooth, precise, and repeatable movement, improving operational efficiency, reducing errors, and supporting advanced manufacturing processes. As companies invest in smart factories and automated production lines, the demand for high-performance actuators, guides, and motion controllers continues to increase, driving global market expansion.

Restraint: High Costs and Maintenance Requirements

The growth of the linear motion system market is restrained by high initial investment and ongoing maintenance requirements. Precision components, such as actuators, ball screws, linear guides, and digital controllers, require a substantial capital outlay, making adoption challenging for small and medium-sized enterprises. Additionally, regular maintenance, calibration, and skilled operation are crucial for maintaining system accuracy and reliability. The complexity of integrating these systems into existing production lines further increases costs and limits accessibility. As a result, industries with budget constraints or limited technical expertise may delay or avoid adopting linear motion systems, slowing overall market growth despite rising demand.

Opportunity: Integration of Smart and IoT-enabled Motion Solutions

The development of IoT-enabled and smart motion systems presents significant growth opportunities. These systems provide real-time monitoring, predictive maintenance, and enhanced control, enabling industries to optimize productivity, minimize downtime, and enhance overall efficiency. Adoption of connected and intelligent linear motion systems is expected to increase across robotics, medical devices, and high-precision manufacturing applications.

Challenge: Compatibility and Standardization Issues

A key challenge in the market is ensuring compatibility between different system components and adhering to standardization across applications. Variations in actuator types, control systems, and software can complicate integration into existing production lines, affecting performance and limiting seamless deployment. Manufacturers must address these issues to encourage wider adoption and efficient system implementation.

Future Outlook

Between 2025 and 2035, the global linear motion system market is expected to witness substantial growth as industries increasingly demand high-precision, efficient, and reliable motion solutions. Advancements in smart actuators, digital control systems, and energy-efficient linear guides will enhance accuracy, repeatability, and overall operational performance. The growing adoption of automation and robotics across the automotive, medical, packaging, and electronics industries will further accelerate market expansion. The integration of IoT-enabled monitoring, predictive maintenance, and adaptive motion control will improve system efficiency and reduce downtime. As industries continue to focus on precision manufacturing, productivity, and quality assurance, linear motion systems will play a critical role in enabling advanced industrial operations and supporting innovation worldwide.

Key Market Players

Top linear motion system companies include Bosch Rexroth AG (Germany), SCHNEEBERGER Group (Switzerland), Hiwin Corporation (Taiwan), Thomson Industries Inc. (a Regal Rexnord brand) (US), and The Timken Company (US).

Key Questions addressed in this report:

- What is the current market size of the linear motion system market, and how is it expected to grow between 2025 and 2035?

- Which regions are leading in the adoption of linear motion systems, and which regions are showing the fastest growth?

- What are the key industries and applications driving the demand for linear motion systems?

- Who are the leading players in the linear motion system market, and what strategies are they adopting for expansion?

TABLE 1 Linear Motion System Market, by Type (USD Million)

|

Type |

2023 |

2025 |

2027 |

2029 |

2031 |

2033 |

2035 |

CAGR (2025–2035) |

|

Single Process Systems |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Multi Process Systems |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 2 Linear Motion System MARKET by Industry (USD Million)

|

Industry |

2023 |

2025 |

2027 |

2029 |

2031 |

2033 |

2035 |

CAGR (2025–2035) |

|

Medical |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Semiconductor & Electronics |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Aerospace |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Food & Beverages |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Machining Tools |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Automotive |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Others |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

TABLE 3 Linear Motion System Market, By Region (USD Million)

|

Region |

2023 |

2025 |

2027 |

2029 |

2031 |

2033 |

2035 |

CAGR (2025–2035) |

|

North America |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Europe |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Asia Pacific |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

RoW |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

|

Total |

XX |

XX |

XX |

XX |

XX |

XX |

XX |

XX% |

The study has involved 4 major activities to estimate the linear motion market at present. Exhaustive secondary research has been conducted to collect information on the market, peer market, and parent market. Validation of these findings, assumptions with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation procedures have been used to estimate the market size of each segment and subsegment.

Secondary Research

In the secondary research process, secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, research magazines, and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard and silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

The linear motion market comprises several stakeholders, such as component manufacturers, solution and service providers, associations, and regulatory organizations in the supply chain. The demand side of this market is characterized by government organizations, end users, universities, and others. The supply side is characterized by components manufacturers, OEMs, integrators, end-to-end solution providers, system integrators and concessionaires. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the linear motion market. These methods have also been used extensively to estimate the size of various subsegments in the market. Following is the method to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes as explained above the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the global linear motion market, in terms of value, segmented on the basis of industry, and geography

- To forecast the market for various segments, in terms of value, with regard to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the linear motion market

- To strategically analyze the micromarkets1 with regard to individual growth trends, prospects, and contribution to the global market

- To provide the linear motion value chain analysis

- To strategically profile key players in the market and comprehensively analyze their market positions in terms of ranking and core competencies,2 along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as product launches, acquisitions, collaborations, partnerships, and expansions in the linear motion market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Linear Motion Market