Motion Control Market Size, Share & Industry Trends Analysis Report by Offering (Actuators & Mechanical Systems, Drives, Motors, Motion Controllers, Sensors & Feedback Services, Software & Services), System (Open-loop, Closed-loop), End-user Industry and Region - Global Forecast to 2029

Updated on : Oct 22, 2024

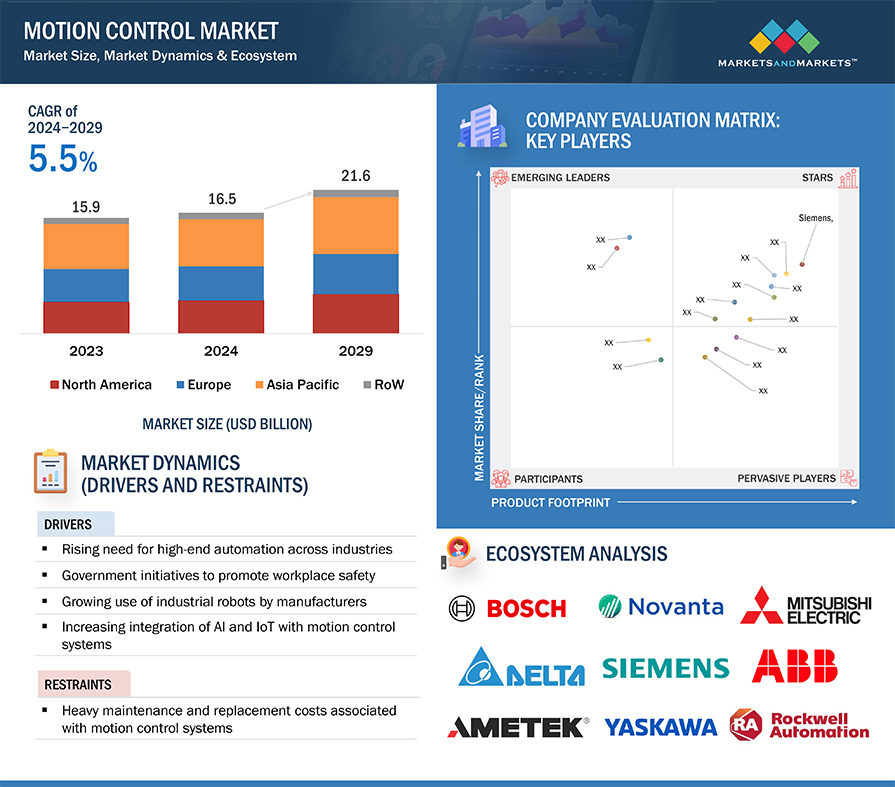

The global Motion Control Market was valued at USD 16.57 billion in 2024 and is projected to grow from USD 17.25 billion in 2025 to USD 21.63 billion by 2029, at a CAGR of 5.5% during the forecast period.

The increasing demand for high-end automation, integration of AI and IoT, and the adoption of Industry 4.0 principles are the primary drivers of this growth. Technological advancements, such as advanced sensors and communication protocols, are also enhancing the capabilities and adoption of motion control systems across various industries.

Key Takeaways:

• The global Motion Control Market was valued at USD 16.57 billion in 2024 and is projected to grow from USD 17.25 billion in 2025 to USD 21.63 billion by 2029, at a CAGR of 5.5% during the forecast period.

• By Product: Actuators and mechanical systems are seeing increased usage due to their efficiency, while servo motors are in demand for their high torque and acceleration capabilities.

• By Application: The demand for automation in manufacturing, particularly in robotics and material handling, is driving market growth as these applications require precise motion control.

• By Technology: Integration of AI and IoT with motion control systems is enhancing operational efficiency and productivity, contributing significantly to market growth.

• By End User: Industries such as electronics, food & beverages, and automotive are increasingly adopting motion control solutions to enhance production accuracy and efficiency.

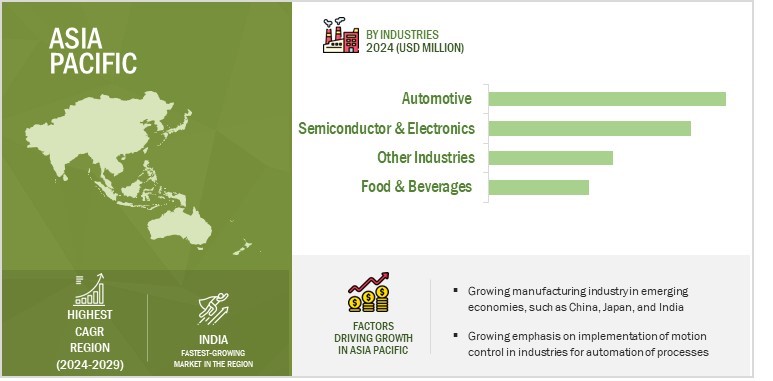

• By Region: ASIA-PACIFIC is expected to grow fastest at 6.4% CAGR, driven by rapid industrialization and the adoption of smart factory initiatives.

• Market Dynamics: While high maintenance costs and susceptibility to cyberattacks pose challenges, opportunities lie in adopting emerging technologies and communication systems.

The motion control market is poised for robust growth, propelled by the increasing need for automation and precision in industrial operations. The ongoing trend of smart manufacturing and the use of advanced technologies like digital twin and predictive maintenance are expected to open new avenues for market expansion. As industries continue to embrace the principles of Industry 4.0, the motion control market is set to witness sustained growth, offering significant opportunities for stakeholders to innovate and capture market share.

Motion Control Market Statistics Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Motion Control Market Trends

Driver: Rising need for high-end automation across industries

The increased demand for energy-efficient solutions to enhance production processes in factories across the globe has fueled the demand for high-precision automated processes. Automated processes help companies increase productivity and lower product life cycle costs.

The adoption of motion control solutions is growing in many industries, but the major adoption is observed in the electronics & semiconductor, food & beverage, automotive, and chemical industries.

The demand for factory automation is expected to grow due to the increasing requirement for high-quality motion control products. This, as a result, is projected to increase the use of motion control solutions to minimize energy consumption and maximize production. For instance, in 2021, ADVANCED Motion Controls launched a small-sized panel-mount FlexPro servo drive with high power density. This device is used in the electronics manufacturing industry to offer high accuracy and precision while manufacturing sensitive electronics.

Restraint: Heavy maintenance and replacement costs associated with motion control systems

The complexity of troubleshooting and servicing motion control systems can lead to substantial expenses in terms of both time and resources. Additionally, the need for periodic upgrades or replacements to keep up with evolving technologies further contributes to the overall cost burden on businesses.

This financial challenge poses a significant barrier for some industries, particularly smaller enterprises, limiting their ability to fully embrace and invest in motion control solutions. As the market continues to address these cost-related challenges, finding more cost-effective maintenance models and exploring innovative approaches to mitigate replacement expenses will be crucial for broader and sustained adoption of motion control systems across diverse industrial sectors.

Opportunity: Adoption of Industry 4.0 principles for manufacturing

Industry 4.0 refers to the fourth industrial revolution, which means the merging of traditional automation with information technology. It is described as the computerization of manufacturing processes. Industry 4.0 is driving the demand for smarter motion control systems to meet the growing need for higher flexibility and maximize overall equipment effectiveness. The concept of Industry 4.0 evolved in Europe and has been extended to the manufacturing sector globally.

The introduction of Industrial Revolution 4.0 has led to the adoption of automated equipment and machinery, allowing plants to function 24/7. Industry 4.0 is characterized by the use of a number of modern technologies and highly automated production processes that require the installation of several sensors and components for efficient functioning. With the help of Industry 4.0, smarter motion control systems automatically adjust the changing demands of production processes by maintaining seamless real-time communication between devices and enterprise networks. Several manufacturing companies are using the Industry 4.0 concept to operate on a large scale and continuously without the necessity of human intervention. Hence, in cases where there is a requirement for human intervention, machines need to have a mechanism to detect human presence and take precautionary actions to avoid accidents.

Challenge: Designing flexible, scalable, and low-cost motion control systems

The demand for versatility in applications across various industries requires motion control systems to be adaptable to different environments, machinery, and operational requirements. Achieving scalability is crucial to accommodate the varying scales of industrial processes, from small-scale operations to large-scale manufacturing facilities.

Simultaneously, the imperative for cost-effectiveness in the design and implementation of motion control systems is essential for widespread adoption, especially among smaller enterprises with budget constraints.

Striking the right balance between flexibility, scalability, and affordability involves navigating technical complexities, optimizing manufacturing processes, and leveraging innovative design approaches to ensure that motion control systems can meet diverse industry needs while remaining economically viable for a broad range of users.

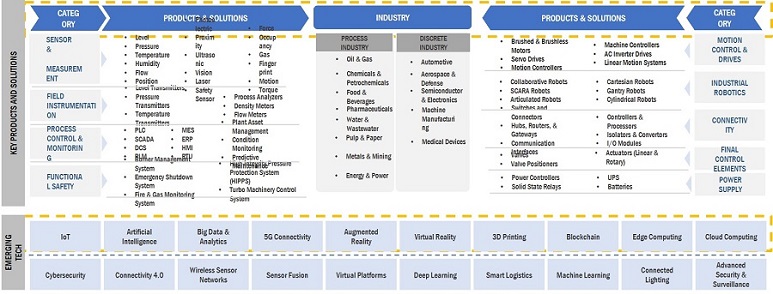

Motion Control Market Ecosystem

Motion Control Market Segmentation

Motion Control Companies: Key Trends

ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan) are the top players in the motion control market. These motion control companies boast motion control trends with a comprehensive motion control product portfolio and solid geographic footprint.

Global Motion Control Market Segment Overview

Drives to grow at the highest CAGR in the industrial motion control market offering segment during 2024-2029.

The surge in demand for motion control solutions across various industries, coupled with the rapid evolution of manufacturing processes toward automation and smart technologies, is driving the prominence of drives. Specifically, servo drives, and variable frequency drives are witnessing increased adoption due to their pivotal role in achieving precision, speed, and energy efficiency in motion control applications. These drives play a crucial role in regulating and controlling the speed and torque of motors, facilitating seamless automation in diverse industrial settings.

As industries prioritize the optimization of production processes and seek to enhance overall operational efficiency, the demand for advanced drive motion control technologies within the Motion Control Industry is expected to escalate, making it the focal point for significant growth within the offering segment.

Pharmaceuticals and cosmetics industries grew at the highest CAGR during the forecast period.

In pharmaceuticals and cosmetics sectors, stringent regulatory requirements and a growing emphasis on precision and quality control are steering the adoption of advanced motion control solutions. The pharmaceutical industry is leveraging motion control technologies to enhance the efficiency of manufacturing processes, ensuring accurate dosage formulations and minimizing errors.

Similarly, the cosmetics industry is embracing motion control for the precise handling and packaging of products, responding to the demand for intricate and customized cosmetic formulations.

The integration of automation, robotics, and precise motion control mechanisms in these industries not only ensures compliance with stringent standards but also contributes to increased production throughput and motion control product innovation. As both sectors continue to prioritize technological advancements and operational excellence, the Motion Control market is set to experience robust growth fueled by the unique requirements and opportunities presented by pharmaceuticals and cosmetics manufacturing.

Asia Pacific is expected to grow at the highest CAGR in the industrial motion control industry during the forecast period.

The Motion Control Market is set for robust expansion, with the Asia Pacific region emerging as the focal point for the highest growth.

The dynamic industrial landscape, rapid technological advancements, and an increase in manufacturing activities across nations such as China, India, Japan, and South Korea are key factors propelling this growth. As industries in the region increasingly adopt automation and Industry 4.0 initiatives, there is an unprecedented upswing in the demand for motion control solutions.

The automotive, electronics, and manufacturing sectors are propelling the adoption of motion control technologies to improve production efficiency and maintain a competitive edge. Additionally, the rising demand for consumer electronics, along with the growth in e-commerce and logistics, further drives the need for precise motion control systems.

The Asia Pacific's strategic focus on innovation, combined with the expanding industrial infrastructure, establishes the region as a crucial player in the accelerated growth of the Motion Control Market, positioning it as a key hub for technological advancements and market expansion.

Motion Control Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Motion Control Companies and Market Players

The major motion control companies in the motion control companies include

- ABB (Switzerland),

- FANUC Corporation (Japan),

- Siemens (Germany),

- Yaskawa Electric Corporation (Japan), and

- Mitsubishi Electric Corporation (Japan). These companies have used both organic and inorganic growth strategies such as motion control product launches, acquisitions, and partnerships to strengthen their position in the motion control market.

Motion Control Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 16.5 billion |

| Projected Market Size | USD 21.6 billion |

| Motion Control Market Growth Rate | CAGR of 5.5% |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Offering, System, and Industry |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan). |

Motion Control Industry Highlights

In this report, the overall motion control market has been segmented based on offering, system, industry and region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By System |

|

|

By End-User Industry |

|

|

By Region |

|

Recent Developments in Motion Control Industry

- In March 2023, Regal Rexnord Corporation successfully finalized the acquisition of Altra Industrial Motion Corp. Through this acquisition, Regal Rexnord's Power Transmission Technologies business experienced a substantial augmentation of its existing power transmission portfolio, notably in the industrial powertrain sector. The addition of complementary motion control products such as brakes, gears, and clutches enhances the overall capabilities and offerings of the business.

- In May 2023, Mitsubishi Electric Corporation and MOVENSYS Inc. forged a strategic business alliance to enhance cooperation in their individual AC servo and motion control endeavors. This partnership is designed to enable Mitsubishi Electric to broaden its AC servo business, specifically focusing on semiconductor manufacturing equipment and other applications.

- In February 2022, Siemens launched a Simatic Drive Controller for CPUs. This new controller combines a Simatic S7-1500 controller with motion control technology and safety functionality with a Sinamics S120 drive control in one device, thereby saving space.

Frequently Asked Questions (FAQs):

What is the current size of the global industrial motion control market?

The motion control market is estimated to be worth USD 16.5 billion in 2024 and is projected to reach USD 21.6 billion by 2029 at a CAGR of 5.5% during the forecast period.

Who are the global motion control market winners?

Motion control companies such as ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan) fall under the winners’ category.

Which region is expected to hold the highest share of the motion control market?

Asia Pacific is expected to hold the highest share of motion control market due to its robust industrial infrastructure, technological innovation, and strong presence of key motion control solution providers, driving the adoption of advanced motion control systems across various sectors, including manufacturing, automobile, and healthcare.

What are the major drivers and opportunities related to the motion control market?

Rising need for high-end automation across industries and adoption of industry 4.0 principles for manufacturing are some of the major drivers and opportunities for the motion control market.

What are the major strategies adopted by motion control companies?

The agitator companies have adopted motion control product launches, acquisitions, expansions, and contracts to strengthen their position in the motion control market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for high-end automation across industries- Government initiatives to promote workplace safety- Growing use of industrial robots by manufacturers- Increasing integration of AI and IoT with motion control systemsRESTRAINTS- Heavy maintenance and replacement costs associated with motion control systems- Susceptibility of motion control systems to cyberattacksOPPORTUNITIES- Adoption of Industry 4.0 principles for manufacturing- Integration of emerging technologies with motion control systems- Implementation of integrated communication systems across various sectorsCHALLENGES- Designing flexible, scalable, and low-cost motion control systems- Shortage of skilled and experienced workforce

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF SERVO MOTORS FOR KEY PLAYERS, BY POWER RATINGAVERAGE SELLING PRICE TREND, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPING

-

5.7 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCESIMULATION & DIGITAL TWINNINGFRAMELESS MOTORSPREDICTIVE MAINTENANCEIIOT SENSORSMOTION OUT-OF-THE-BOX

-

5.8 PATENT ANALYSIS

-

5.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS, 2024–2025

- 5.11 CASE STUDY ANALYSIS

-

5.12 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDSIEC 61508IEC 61511IEC 62061IEC 62443

- 5.13 PORTER’S FIVE FORCES ANALYSIS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TRENDS RELATED TO MOTION CONTROL TECHNOLOGYADVANCED ROBOTICS AND COBOTSHUMAN-MACHINE INTERFACE (HMI)AUTONOMOUS VEHICLES AND DRONES3D PRINTING AND ADDITIVE MANUFACTURING

-

6.3 EMERGING APPLICATIONS RELATED TO MOTION CONTROL TECHNOLOGYREHABILITATION ROBOTICSDIGITAL TWIN TECHNOLOGYAUTONOMOUS UNDERWATER VEHICLES (AUVS)ADVANCED PACKAGING AND MATERIAL HANDLING

- 7.1 INTRODUCTION

- 7.2 METAL CUTTING

- 7.3 METAL FORMING

- 7.4 MATERIAL HANDLING

- 7.5 PACKAGING & LABELLING

- 7.6 ROBOTICS

- 7.7 OTHER IMPLEMENTATION AREAS

- 8.1 INTRODUCTION

-

8.2 ACTUATORS AND MECHANICAL SYSTEMSINCREASING USE DUE TO GREATER EFFICIENCY TO DRIVE MARKETELECTRICHYDRAULICPNEUMATICOTHERS

-

8.3 DRIVESAUTOMATION IN MANUFACTURING INDUSTRY TO DRIVE MARKET

-

8.4 MOTORSSERVO MOTORS- High torque and acceleration to drive marketSTEPPER MOTORS- Compact design to drive market

-

8.5 MOTION CONTROLLERSRAPID REAL-TIME RESPONSE AND MINIMIZED ERRORS TO DRIVE MARKET

-

8.6 SENSORS AND FEEDBACK DEVICESCONTACTLESS SWITCHING, POSITION DETECTION, AND PRESSURE DETECTION APPLICATIONS TO DRIVE MARKET

-

8.7 SOFTWARE AND SERVICESUTILIZATION IN NETWORKING MANAGEMENT SOFTWARE TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 OPEN-LOOP SYSTEMSLOW MAINTENANCE COST TO DRIVE MARKET

-

9.3 CLOSED-LOOP SYSTEMSCAPABILITIES TO REDUCE SENSITIVITY AND IMPROVE STABILITY OF SYSTEMS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 AEROSPACENEED FOR PRECISE AIRCRAFT COMPONENT MANUFACTURING TO DRIVE MARKET

-

10.3 AUTOMOTIVEADVANCED DRIVER ASSISTANCE SYSTEMS TO DRIVE MARKET

-

10.4 SEMICONDUCTOR & ELECTRONICSINSPECTION, WAFER TEST, AND DICING APPLICATIONS TO DRIVE MARKET

-

10.5 METALS & MACHINERYNEED FOR EFFICIENT ASSEMBLY LINES AND AUTOMATION IN MANUFACTURING HUBS TO DRIVE MARKET

-

10.6 FOOD & BEVERAGESFILLING, CAPPING, LABELING, PACKING, AND PALLETIZING ACTIVITIES TO DRIVE MARKET

-

10.7 MEDICAL DEVICESDIAGNOSTIC IMAGING AND SURGICAL ROBOTICS TO DRIVE MARKET

-

10.8 PRINTING & PAPER3D PRINTING TECHNOLOGY TO DRIVE MARKET

-

10.9 PHARMACEUTICALS & COSMETICSRETRIEVAL, PLACEMENT, AND FILLING OF CONTAINERS TO DRIVE MARKET

- 10.10 OTHER INDUSTRIES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Smart manufacturing and Industry 4.0 initiatives to drive marketCANADA- Integration of robotics with collaborative technologies and other smart safety products and appliances to drive marketMEXICO- Association for Advancing Automation to drive market

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISUK- Made Smarter initiative and government funding to drive marketFRANCE- Industrie du Futur initiative and Industrial Plants of the Future plan to drive marketGERMANY- Growing use of industrial robots in assembling, machine tending, painting, and welding to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Made in China 2025 initiative to drive marketJAPAN- Shift toward EV and adoption of motion control solutions in assembly lines to drive marketINDIA- SAMARTH Udyog Bharat 4.0 initiative and improved infrastructure to drive marketSOUTH KOREA- Increased adoption of hybrid electric vehicles to drive marketREST OF ASIA PACIFIC

-

11.5 REST OF THE WORLDREST OF THE WORLD: RECESSION IMPACT ANALYSISSOUTH AMERICA- Growing mining sector and rising demand for AI and IIoT-based solutions and software to drive marketGCC- Expansion of oil & gas and automotive sectors to drive marketAFRICA & REST OF MIDDLE EAST- Assistance from International Monetary Fund to drive market

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- 12.3 REVENUE ANALYSIS, 2018–2022

- 12.4 MARKET SHARE ANALYSIS, 2023

-

12.5 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 START-UP/SME EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 12.7 COMPETITIVE SCENARIO

-

13.1 KEY PLAYERSABB- Business overview- Products offered- Recent developments- MnM viewFANUC CORPORATION- Business overview- Products offered- MnM viewMITSUBISHI ELECTRIC CORPORATION- Business overview- Products offered- Recent developments- MnM viewSIEMENS- Business overview- Products offered- Recent developments- MnM viewYASKAWA ELECTRIC CORPORATION- Business overview- Products offered- Recent developments- MnM viewREGAL REXNORD CORPORATION- Business overview- Products offered- Recent developmentsROBERT BOSCH GMBH- Business overview- Products offeredPARKER HANNIFIN CORP- Business overview- Products offered- Recent developmentsROCKWELL AUTOMATION- Business overview- Products offered- Recent developmentsNOVANTA INC.- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSDOVER MOTIONOMRON CORPORATIONALLIED MOTION, INC.AMETEK, INC.ADTECH (SHENZHEN) TECHNOLOGY CO., LTD.POWERTECDELTA ELECTRONICS, INC.BAUMÜLLERMOONS’ELMO MOTION CONTROL LTD.ABSOLUTE MACHINE TOOLSIQ MOTION CONTROLAPPTRONIKGALILANALOG DEVICES, INC.

- 14.1 ENCODER MARKET

- 14.2 INTRODUCTION

-

14.3 INDUSTRIALINCREASING USE OF ENCODERS IN ROBOTICS AND FACTORY AUTOMATION TO DRIVE MARKET

-

14.4 HEALTHCAREADOPTION OF SURGICAL ROBOTS IN MEDICAL APPLICATIONS TO DRIVE MARKET

-

14.5 CONSUMER ELECTRONICSPROLIFERATION OF LINEAR MOTOR ENCODERS IN ELECTRICAL APPLIANCES TO DRIVE MARKET

-

14.6 AUTOMOTIVETREND OF AUTOMATION IN AUTOMOBILES TO DRIVE MARKET

-

14.7 POWERCOMPLEXITIES IN SOLAR AND WIND ENERGY APPLICATIONS TO DRIVE MARKET

-

14.8 FOOD & BEVERAGEINTEGRATION OF IO-LINK TECHNOLOGY INTO ENCODERS TO DRIVE MARKET

-

14.9 AEROSPACENEED FOR PRECISION CONTROL TECHNOLOGY IN AIRBORNE SYSTEMS TO DRIVE MARKET

-

14.10 PRINTINGHIGH DEMAND FOR ROTARY ENCODERS IN PRINTING APPLICATIONS AND OFFICE EQUIPMENT TO DRIVE MARKET

-

14.11 TEXTILEINTEGRATION OF ENCODERS IN WEAVING & KNITTING PROCESSES TO DRIVE MARKET

- 14.12 OTHER APPLICATIONS

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE OF MOTION CONTROL DEVICES, BY TYPE

- TABLE 2 AVERAGE SELLING PRICE OF SERVO MOTORS, BY POWER RATING FOR KEY PLAYERS (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF SERVO MOTORS, BY REGION

- TABLE 4 COMPANIES AND THEIR ROLE IN MOTION CONTROL ECOSYSTEM

- TABLE 5 MOTION CONTROL MARKET: TOP 20 PATENT OWNERS, 2014–2023

- TABLE 6 LIST OF PATENTS RELATED TO MOTION CONTROL SYSTEMS

- TABLE 7 MOTION CONTROL MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 8 NIDEC MOTOR PROVIDES IMPROVED TEMPERATURE CONTROL, WITH SAVINGS OF NEARLY 7,500 KWH

- TABLE 9 MITSUBISHI ELECTRIC OFFERS IMPROVED RELIABILITY, EXPANDED CUSTOMER FEATURES, AND OVERWRAPPING ACCURACY WITHOUT LABEL DISTORTION

- TABLE 10 MOTION CONTROL MOTORS AND DRIVES DESIGNED WITH CUTTING-EDGE TECHNOLOGY ACCELERATE BOTTLE LABELING

- TABLE 11 TROUBLESHOOTING MOTION CONTROL SYSTEMS USING MOOG ANIMATICS SMARTMOTOR DATA

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MOTION CONTROL MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 18 MOTION CONTROL MARKET: KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 19 MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 20 MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 21 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 22 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 23 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 24 ACTUATORS AND MECHANICAL SYSTEMS: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 25 DRIVES: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 26 DRIVES: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 27 DRIVES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 28 DRIVES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 29 MOTORS: MOTION CONTROL MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 30 MOTORS: MOTION CONTROL MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 31 MOTORS: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 32 MOTORS: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 33 MOTORS: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 34 MOTORS: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 SERVO MOTORS: MOTION CONTROL MARKET, 2020–2023 (THOUSAND UNITS)

- TABLE 36 SERVO MOTORS: MOTION CONTROL MARKET, 2024–2029 (THOUSAND UNITS)

- TABLE 37 STEPPER MOTORS: MOTION CONTROL MARKET, 2020–2023 (THOUSAND UNITS)

- TABLE 38 STEPPER MOTORS: MOTION CONTROL MARKET, 2024–2029 (THOUSAND UNITS)

- TABLE 39 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 40 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 41 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 42 MOTION CONTROLLERS: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 44 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 45 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 46 SENSORS AND FEEDBACK DEVICES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 47 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 48 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 49 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 SOFTWARE AND SERVICES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 MOTION CONTROL MARKET, BY SYSTEM, 2020–2023 (USD MILLION)

- TABLE 52 MOTION CONTROL MARKET, BY SYSTEM, 2024–2029 (USD MILLION)

- TABLE 53 MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 54 MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 55 AEROSPACE: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 56 AEROSPACE: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 57 AEROSPACE: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 58 AEROSPACE: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 AUTOMOTIVE: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 60 AUTOMOTIVE: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 61 AUTOMOTIVE: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 62 AUTOMOTIVE: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 63 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 64 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 65 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 SEMICONDUCTOR & ELECTRONICS: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 METALS & MACHINERY: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 68 METALS & MACHINERY: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 69 METALS & MACHINERY: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 70 METALS & MACHINERY: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 72 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 73 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 FOOD & BEVERAGES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 MEDICAL DEVICES: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 76 MEDICAL DEVICES: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 77 MEDICAL DEVICES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 78 MEDICAL DEVICES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 79 PRINTING & PAPER: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 80 PRINTING & PAPER: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 81 PRINTING & PAPER: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 82 PRINTING & PAPER: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 83 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 84 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 85 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 86 PHARMACEUTICALS & COSMETICS: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 87 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 88 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 89 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 90 OTHER INDUSTRIES: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 91 MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 92 MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 93 NORTH AMERICA: MOTION CONTROL MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 94 NORTH AMERICA: MOTION CONTROL MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 96 NORTH AMERICA: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 97 EUROPE: MOTION CONTROL MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 98 EUROPE: MOTION CONTROL MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 EUROPE: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 100 EUROPE: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MOTION CONTROL MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MOTION CONTROL MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 105 REST OF THE WORLD: MOTION CONTROL MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 106 REST OF THE WORLD: MOTION CONTROL MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 107 REST OF THE WORLD: MOTION CONTROL MARKET, BY INDUSTRY, 2020–2023 (USD MILLION)

- TABLE 108 REST OF THE WORLD: MOTION CONTROL MARKET, BY INDUSTRY, 2024–2029 (USD MILLION)

- TABLE 109 STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2023

- TABLE 110 MOTION CONTROL MARKET: DEGREE OF COMPETITION

- TABLE 111 KEY COMPANIES: COMPANY FOOTPRINT

- TABLE 112 KEY COMPANIES: OFFERING FOOTPRINT

- TABLE 113 KEY COMPANIES: INDUSTRY FOOTPRINT

- TABLE 114 KEY COMPANIES: REGION FOOTPRINT

- TABLE 115 KEY START-UPS/SMES

- TABLE 116 START-UPS/SMES: OFFERING FOOTPRINT

- TABLE 117 START-UPS/SMES: INDUSTRY FOOTPRINT

- TABLE 118 START-UPS/SMES: REGION FOOTPRINT

- TABLE 119 PRODUCT LAUNCHES, 2020–2023

- TABLE 120 DEALS, 2020–2023

- TABLE 121 OTHERS, 2020–2023

- TABLE 122 ABB: COMPANY OVERVIEW

- TABLE 123 ABB: PRODUCTS OFFERED

- TABLE 124 ABB: PRODUCT LAUNCHES

- TABLE 125 ABB: OTHERS

- TABLE 126 FANUC CORPORATION: COMPANY OVERVIEW

- TABLE 127 FANUC CORPORATION: PRODUCTS OFFERED

- TABLE 128 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 129 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 130 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 131 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 132 MITSUBISHI ELECTRIC CORPORATION: OTHERS

- TABLE 133 SIEMENS: COMPANY OVERVIEW

- TABLE 134 SIEMENS: PRODUCTS OFFERED

- TABLE 135 SIEMENS: PRODUCT LAUNCHES

- TABLE 136 SIEMENS: DEALS

- TABLE 137 YASKAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 138 YASKAWA ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 139 YASKAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 140 YASKAWA ELECTRIC CORPORATION: OTHERS

- TABLE 141 REGAL REXNORD CORPORATION: COMPANY OVERVIEW

- TABLE 142 REGAL REXNORD CORPORATION: PRODUCTS OFFERED

- TABLE 143 REGAL REXNORD: PRODUCT LAUNCHES

- TABLE 144 REGAL REXNORD: DEALS

- TABLE 145 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 146 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 147 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 148 PARKER HANNIFIN CORP: PRODUCTS OFFERED

- TABLE 149 PARKER HANNIFIN CORP: PRODUCT LAUNCHES

- TABLE 150 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 151 ROCKWELL AUTOMATION: PRODUCTS OFFERED

- TABLE 152 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- TABLE 153 ROCKWELL AUTOMATION: DEALS

- TABLE 154 NOVANTA INC.: COMPANY OVERVIEW

- TABLE 155 NOVANTA INC.: PRODUCTS OFFERED

- TABLE 156 NOVANTA INC.: DEALS

- TABLE 157 ENCODER MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 INDUSTRIAL: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 INDUSTRIAL: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 INDUSTRIAL: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 162 INDUSTRIAL: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 163 HEALTHCARE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 164 HEALTHCARE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 HEALTHCARE: ENCODER MARKET, BY REGION, 2019–2022(USD MILLION)

- TABLE 166 HEALTHCARE: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 167 CONSUMER ELECTRONICS: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 168 CONSUMER ELECTRONICS: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 CONSUMER ELECTRONICS: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 170 CONSUMER ELECTRONICS: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 171 AUTOMOTIVE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 172 AUTOMOTIVE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 AUTOMOTIVE: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 174 AUTOMOTIVE: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 175 POWER: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 176 POWER: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 POWER: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 178 POWER: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 179 FOOD & BEVERAGE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 180 FOOD & BEVERAGE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 181 FOOD & BEVERAGE: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 182 FOOD & BEVERAGE: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 183 AEROSPACE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 AEROSPACE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 AEROSPACE: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 186 AEROSPACE: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 187 PRINTING: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 188 PRINTING: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 189 PRINTING: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 190 PRINTING: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 191 TEXTILE: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 TEXTILE: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 TEXTILE: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 194 TEXTILE: ENCODER MARKET, BY REGION, 2023–2028(USD MILLION)

- TABLE 195 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 196 OTHER APPLICATIONS: ENCODER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 198 OTHER APPLICATIONS: ENCODER MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 MOTION CONTROL MARKET SEGMENTATION

- FIGURE 2 MOTION CONTROL MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PRODUCTS/SOLUTIONS/SERVICES IN MOTION CONTROL MARKET

- FIGURE 4 MOTION CONTROL MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MOTION CONTROL MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 RISK ASSESSMENT OF RESEARCH STUDY

- FIGURE 8 MOTION CONTROL MARKET, 2020−2029 (USD MILLION)

- FIGURE 9 MOTORS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 CLOSED-LOOP SYSTEMS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 PHARMACEUTICALS & COSMETICS TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 GROWING ADOPTION OF AUTOMATION ACROSS VARIOUS MANUFACTURING PROCESSES TO DRIVE MARKET

- FIGURE 14 DRIVES SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 15 CLOSED-LOOP SYSTEMS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 AUTOMOTIVE SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 MOTION CONTROL MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 MOTION CONTROL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 MOTION CONTROL MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 MOTION CONTROL MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 MOTION CONTROL MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 MOTION CONTROL MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 MOTION CONTROL MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF SERVO MOTORS, 2020−2029 (USD)

- FIGURE 25 AVERAGE SELLING PRICE OF SERVO MOTORS, BY POWER RATING FOR KEY PLAYERS (USD)

- FIGURE 26 MOTION CONTROL MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 MOTION CONTROL MARKET: ECOSYSTEM MAP

- FIGURE 28 MOTION CONTROL MARKET: TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2014–2023

- FIGURE 29 MOTION CONTROL MARKET: NUMBER OF GRANTED PATENTS RELATED TO MOTION CONTROL SYSTEMS, 2014–2023

- FIGURE 30 MOTION CONTROL MARKET: IMPORT DATA FOR HS CODE 8501, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 MOTION CONTROL MARKET: EXPORT DATA FOR HS CODE 8501, BY KEY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 MOTION CONTROL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 34 MOTION CONTROL MARKET: KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 35 MOTION CONTROL MARKET SEGMENTATION, BY OFFERING

- FIGURE 36 MOTORS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO LEAD MARKET FOR DRIVES DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE OF MOTION CONTROLLERS DURING FORECAST PERIOD

- FIGURE 39 CLOSED-LOOP SYSTEMS TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 40 MOTION CONTROL MARKET, BY INDUSTRY

- FIGURE 41 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF MOTION CONTROL MARKET DURING FORECAST PERIOD

- FIGURE 42 EUROPE TO ACCOUNT FOR LARGEST MARKET SHARE OF AUTOMOTIVE INDUSTRY DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE OF FOOD & BEVERAGES INDUSTRY DURING FORECAST PERIOD

- FIGURE 44 MOTION CONTROL MARKET IN INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MOTION CONTROL MARKET SNAPSHOT

- FIGURE 46 EUROPE: MOTION CONTROL MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: MOTION CONTROL MARKET SNAPSHOT

- FIGURE 48 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 49 MARKET SHARE ANALYSIS, 2023

- FIGURE 50 COMPANY EVALUATION MATRIX, 2023

- FIGURE 51 START-UP/SME EVALUATION MATRIX, 2023

- FIGURE 52 ABB: COMPANY SNAPSHOT

- FIGURE 53 FANUC CORPORATION: COMPANY SNAPSHOT

- FIGURE 54 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 SIEMENS: COMPANY SNAPSHOT

- FIGURE 56 YASKAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 REGAL REXNORD CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 59 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

- FIGURE 60 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 61 NOVANTA INC.: COMPANY SNAPSHOT

- FIGURE 62 ENCODER MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

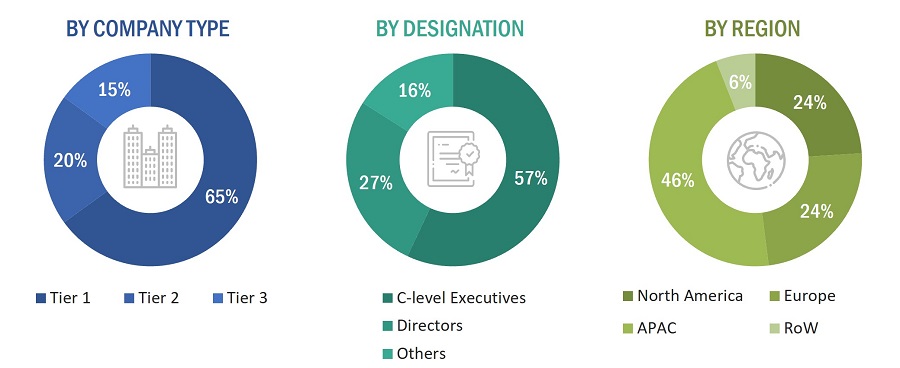

The study involves four major activities that estimate the size of the motion control market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the motion control market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from motion control system providers, such as ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Motion Control Market: Bottom-Up Approach

Motion Control Market: Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Motion control refers to the field of engineering and technology dedicated to the precise management and regulation of the movement of machinery, equipment, and automated systems. It involves the utilization of various motion control systems, sensors, and actuators to govern the speed, position, and acceleration of mechanical components. Motion control is integral to a diverse array of industries, including manufacturing, robotics, automotive, aerospace, and healthcare, where exact and coordinated movement is essential for operational efficiency. The goal is to achieve accurate and reliable control over the motion of machinery, ensuring optimal performance, increased productivity, and enhanced overall operational effectiveness. Motion control systems can range from basic open-loop systems to more sophisticated closed-loop systems that incorporate feedback mechanisms to continuously adjust and refine the control process.

Stakeholders

- Semiconductor product designers and fabricators

- Connectivity providers

- Application providers

- Automation consultants

- Automation system integrators

- Platform providers

- Business providers

- Motion control distributors and providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

The main objectives of this study are as follows:

- To define, describe, and forecast the motion control market based on offering, system, and industry

- To estimate and forecast the market size, in terms of value, of various segments with regard to four main regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the motion control market (drivers, restraints, opportunities, industry-specific challenges)

- To study and analyze Trends and Emerging Applications of Motion Control Technology and Trends and Emerging Implementation Areas of Motion Control Systems

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the motion control market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 and provide a detailed competitive landscape for the market leaders

- To analyze various development strategies such as mergers and acquisitions, new product launches and developments, and research and development implemented by the key market players in the motion control markets

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Motion Control Market