Global Linerless Labels Market by Composition (Facestock, Adhesive, Topcoat), Product (Primary, Variable Information Print), Printing technology, Printing ink (Water-based, Solvent-based, UV Curable), End-use Industry, and Region - Global Forecast to 2026

The global linerless labels market was valued at USD 1.7 billion in 2021 and is projected to reach USD 2.2 billion by 2026, growing at a cagr 4.8% from 2021 to 2026. The market is expected to witness significant growth in the forecast period owing to increased demand across end use industries includes the food, beverage, and home & personal care industries.

Global Linerless Labels Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

The market is anticipated to expand in step with the rise in demand for linerless labels across a variety of end-use industries, particularly for applications in the food, beverage, and home & personal care industries internationally. It is anticipated that accelerated urbanisation, industrialisation, and rising consumer spending will further enhance the industry. Manufacturers of linerless labels are expected to benefit greatly from the growing demand for environmentally friendly labelling options.

Linerless labels Market Dynamics

Driver: Rise in demand for packed food and beverages

Increasing health awareness and per capita income are key factors that are driving growth for packaged food & beverages, in turn, increasing the demand in the linerless labels market. Several other factors such influence of the western world, changing lifestyle, compact, and confidence in packaged food are all driving the demand for packaged food. The fast-pace lifestyle, and long working hours, are results in greater reliability of consumers on ready-to-eat foods and increased snacking, in turn fueling the demand for linerless labels.

Linerless labels are becoming popular as they are superior alternative to traditional labeling methods. Linerless labels provides more information as well as graphics of vibrant photo-quality which helps to improve the presence of the brand and increase consumers' attention. Owing to charactertics such as 360° visibility on the packaging, and product presentation the linerless labels are increasing across the globe.

Restraint: Stringent government regulations

As per Packaging regulations all the industrial labels will be environment0friendly and produce according to the guidelines. The linerless labels are also multi-layered and requires plastic resins and other raw materials in the production. For instance, the concerns regarding raw materials and printing are ensure by the regulatory bodies of the Food and Drug Administration (US) and Fair Packaging and Labeling.

These regulatory authorities often check on the materials to be used in labeling and their applications. The manufacturers of linerless label are ensure that the essential requirements, such as legitimacy, durability, and sustainability of industrial labels, of the products adhere the madates of regulatory startdards. To use plastic resins for labels several other strict regulations and codes of practices are issued for the manufacturers to follow, which may hamper the production and operations of linerless labels products.

Opportunity: Increasing innovations for linerless labels

New technologies and innovations are rapidly rising in the labels industry. Multi-layer linerless labels manufactured by Coveris Holdings S.A. (US) and ETI linerless applicators are examples of some recent developments which are designed to produce labels of different shapes and sizes. The ETI adaptor is done in a printing press where they coverts the linerless tape into different shapes or sizes.The linerless labels market has exposed to innovations and developments w.r.t to the products, machinery, equipment, and printing technologies. The use of biodegradable material is also one of the leading trends in the market.

Challenge: Availability of substitutes in the market

Presence of substitutes, such as release liner labels, sleeve labels, shrink labels, in-mold labels, and many more in the linear packaging market. Also, Package printing that involves direct printing on the product package,is also crestes a challenge on market growth of linear package market. The cost of raw materials such as paper and the two-step printing process and applying the label is reduced by printing on the package. Direct printing is also provides more attractive packaging options than linerless labels. Presence of these alternatives available in the market may mitigate the demand and negatively influence the demand for linerless labels.

By Product

Variable Information Print linerless labels is widely used.

Based on product, the variable Information Print segment is projected to be the largest segment in the linerless labels market. These VIP label, is widely used in end user industries and it is manufactured using either paper or film-based fascestock materials. The VIP labels reduce wastage, time-efficient, improve resistance against scratches and abrasion, therefore, these are widely used in weigh scale systems, warehousing, transportation, and point of sale solutions.

By End-use Industry

Significant increase in the demand for linerless labels in food industry

food sector is projected to be the largest end use industry segment in the linerless labels market. Owing to the changing lifestyles and the busy schedules of the working population the demand of linerless level for on-the-go packaging products in the food sector is increased rapidly. In food and packaging industry, linerless labels are widely used in the food industry for fresh food, meat, fish, seafood, fresh produce, poultry, and ready meals. With the increasing areness regarding food quality food products and convienece, people opt for packed food includes product information and other necessary details (such as nutritional information and manufactured & expiry dates) about the products that are provided on the labels in the packaged food. Linerless labels are used for printing such information.

By Region

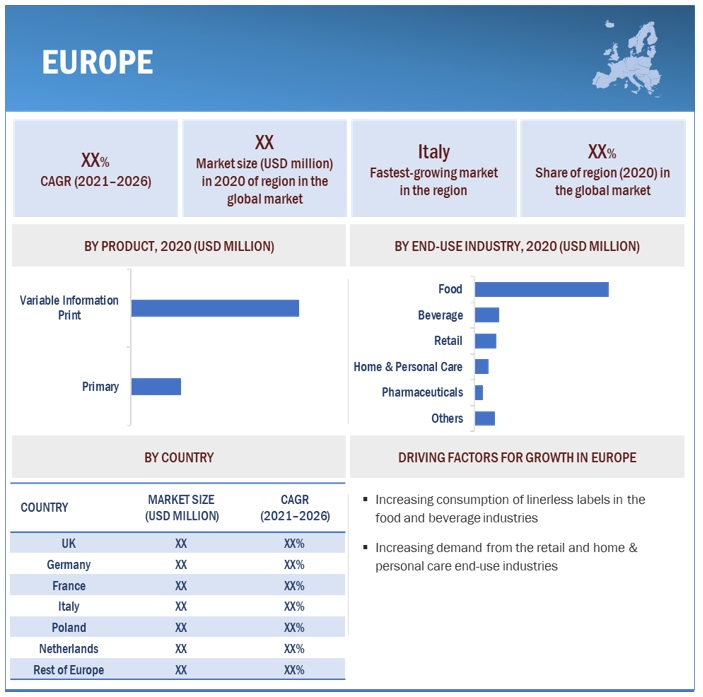

Europe region to lead the global linerless labels market by 2026.

Europe accounted for the largest market share of linerless lable market in 2020. Due to technological developments, Compared to the remaining European countries, the linerless labels market in countries includes Germany, the UK, Italy, and France is projected to grow steadily. The European labeling market is a fragmented market that consists of many small companies that responds quickly to changes in demand patterns. Factors such as environmental and governmental regulations and the increasing price of raw materials strongly influence the growth of linerless labels in the Europe.

To know about the assumptions considered for the study, download the pdf brochure

Linerless Labels Market Key Players

Key manufacturers in the linerless labels market are 3M (US), CCL Industries Inc (Canada), R.R. Donnelley & Sons Company (US), Avery Dennison Corporation (US), and Multi-Color Corporation (US), amongst others.

Linerless Labels Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.7 billion |

|

Revenue Forecast in 2026 |

USD 2.2 billion |

|

Growth Rate |

CAGR of 4.8% from 2021 to 2026 |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Meter) |

|

Segments covered |

Composition, Product, Printing Ink, Printing Technology, End-Use Industry, and Region |

|

Geographies Covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies profiled |

3M (US), CCL Industries Inc (Canada), R.R. Donnelley & Sons Company (US), Avery Dennison Corporation (US), and Multi-Color Corporation (US), among others.

|

This research report categorizes the linerless labels market based on composition, product, printing ink, printing technology, end-use industry, and region.

Based on Composition:

- Facestock

- Adhesive

- Topcoat

Based on Product:

- Primary

- Variable Information Print

Based on Printing Ink:

- Water-based

- Solvent-based

- UV Curable

- Others

Based on Printing Technology:

- Flexographic

- Digital

- Offset

- Letterpress

- Others

Based on End-use Industry

- Food

- Beverage

- Home & Personal Care

- Pharmaceuticals

- Retail

- Others (consumer durables and industrial lubricants & paints)

Based on Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments:

- In May 2021, CCL acquired Lux Global Label Asia Pte Ltd and changed its name to CCL Label Singapore.

- In Feb 2021, Avery Dennison launched its recycled polyethylene terephthalate (rPET) liners with four labeling constructions in Europe.

- In Jan 2020, SATO launched Printer CL4NX Plus for the development of auto-ID and labeling solutions.

- In July 2019, Multi-Color Corporation merged with a subsidiary of WS Packaging (US), a label supplier under Platinum Equity's portfolio of companies. WS Packaging is expected to operate as a Multi-Color Corporation business unit and create new growth opportunities for the company to expand geographically and better serve customers with innovative labeling solutions.

- In Feb 2019, Coveris opened a sustainable Development Center in Leeds (UK) to cater to all the end markets. It aims to achieve sustainability, adopt new trends, and technologies for the products & solutions offered by the company. This is expected to help the company in offering innovative label solutions as well.

Frequently Asked Questions (FAQ):

What is the current size of the global linerless labels market?

The global linerless labels market size is projected to grow from USD 1.7 billion in 2021 to USD 2.2 billion by 2026, at a CAGR of 4.8% from 2021 to 2026.

How is the linerless labels market aligned?

The linerless labels market is competitive and the cumulative share of the top five companies was 45% - 50% of the total market in 2020.

Who are the key players in the global linerless labels market?

Key manufacturers in the linerless labels market are 3M (US), CCL Industries Inc (Canada), R.R. Donnelley & Sons Company (US), Avery Dennison Corporation (US), and Multi-Color Corporation (US), amongst others.

What are the factors driving the growth of the linerless labels market?

The growth of the linerless labels market is attributed to the increase in demand for linerless labels in numerous end-use industries, particularly for food industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 LINERLESS LABELS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.3.2 REGIONAL SCOPE

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 LINERLESS LABELS MARKET: RESEARCH DESIGN

2.2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

FIGURE 3 DATA TRIANGULATION

2.2.2.1 key market insights

FIGURE 4 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.3 MARKET SIZE ESTIMATION

FIGURE 5 APPROACH 1: BASED ON GLOBAL SELF-ADHESIVE LABELS MARKET

2.3.1 APPROACH – 2

FIGURE 6 LINERLESS LABELS MARKET: SUPPLY-SIDE APPROACH

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

FIGURE 7 LIMITATIONS

2.4.2 RISK ASSESSMENT

TABLE 1 TABLE 2 LIMITATIONS & ASSOCIATED RISKS

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 VARIABLE INFORMATION PRINT SEGMENT TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 9 DIGITAL TO BE FASTEST-GROWING PRINTING TECHNOLOGY

FIGURE 10 APAC TO BE FASTEST-GROWING LINERLESS LABELS MARKET FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 APAC TO EXHIBIT HIGHER GROWTH RATE DUE TO RAPID INDUSTRIALIZATION AND INCREASING NUMBER OF END-USE INDUSTRIES

FIGURE 11 INCREASING DEMAND FROM FOOD INDUSTRY WILL DRIVE DEMAND FOR LINERLESS LABELS

4.2 LINERLESS LABELS MARKET, BY PRINTING INK

FIGURE 12 UV CURABLE TO BE FASTEST-GROWING SEGMENT

4.3 LINERLESS LABELS MARKET, BY END-USE INDUSTRY

FIGURE 13 FOOD SEGMENT TO LEAD LINERLESS LABELS MARKET

4.4 GLOBAL LINERLESS LABELS MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 14 FOOD AND EUROPE SEGMENTS LED LINERLESS LABELS MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE LINERLESS LABELS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise in demand for packed food and beverages

5.2.1.2 Increasing demand for sustainable labels

5.2.1.3 Increasing demand for linerless labels for logistic applications

5.2.1.4 Rise in demand for consumer durables

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating raw material prices

5.2.2.2 Stringent government regulations

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing innovations for linerless labels

5.2.3.2 Potential demand for linerless labels in emerging economies

5.2.4 CHALLENGES

5.2.4.1 Availability of substitutes in the market

6 IMPACT OF COVID-19 ON LINERLESS LABELS MARKET (Page No. - 50)

6.1 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO CONTINUOUS SPREAD OF COVID-19

6.2 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 LINERLESS LABELS MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 3 LINERLESS LABELS MARKET: PORTER'S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

6.3 VALUE CHAIN ANALYSIS

FIGURE 17 LINERLESS LABELS: VALUE CHAIN ANALYSIS

6.3.1 INTRODUCTION

6.3.2 RAW MATERIALS

6.3.3 MANUFACTURING

6.3.4 DISTRIBUTION & END-USE

TABLE 4 LINERLESS LABELS MARKET: VALUE CHAIN

6.3.5 IMPACT OF COVID-19 ON SUPPLY CHAIN

6.4 YC & YCC SHIFT

6.4.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR LINERLESS LABELS MANUFACTURERS

FIGURE 18 REVENUE SHIFT FOR LINERLESS LABEL MANUFACTURERS

6.5 REGULATORY LANDSCAPE

6.6 TECHNOLOGY ANALYSIS

6.6.1 NEW INNOVATIVE SELF-ADHESIVE TECHNOLOGY FOR PRESSURE-SENSITIVE LABELS

6.7 ETI CONVERTING EQUIPMENT SUPPLIES NEW COHESIO LINERLESS TECHNOLOGY TO HUB LABELS

6.8 ECOSYSTEM

FIGURE 19 ECOSYSTEM FOR LINERLESS LABELS MARKET

6.9 PRICING ANALYSIS

TABLE 5 COST OF LINERLESS LABELS IN USD/METER FOR FOLLOWING END-USE INDUSTRY

6.10 PATENT ANALYSIS

6.10.1 INTRODUCTION

6.10.2 METHODOLOGY

6.11 DOCUMENT TYPE

FIGURE 20 PUBLICATION TRENDS - LAST 10 YEARS

6.11.1 INSIGHT

FIGURE 21 JURISDICTION ANALYSIS

6.12 TOP COMPANIES/APPLICANTS

TABLE 6 LIST OF PATENTS BY AVERY DENNISON:

TABLE 7 THE LIST OF PATENTS BY FLEX R&D INC. ARE:

TABLE 8 THE LIST OF PATENTS BY RICOH CO LTD. ARE:

TABLE 9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

7 LINERLESS LABELS MARKET, BY COMPOSITION (Page No. - 65)

7.1 INTRODUCTION

7.2 FACESTOCK

7.3 ADHESIVE

7.3.1 HOT-MELT

7.3.2 ACRYLIC

7.4 TOPCOAT

8 LINERLESS LABELS MARKET, BY PRODUCT (Page No. - 67)

8.1 INTRODUCTION

FIGURE 22 VARIABLE INFORMATION PRINT SEGMENT EXPECTED TO BE FASTEST-GROWING SEGMENT

TABLE 10 MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 11 MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METER)

8.2 PRIMARY

8.2.1 INCREASING DEMAND FROM END-USE INDUSTRIES TO DRIVE SEGMENT

TABLE 12 MARKET SIZE IN PRIMARY SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 MARKET SIZE IN PRIMARY SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

8.3 VARIABLE INFORMATION PRINT

8.3.1 WIDE APPLICABILITY ACROSS VARIED END-USE INDUSTRIES SUPPORTS MARKET GROWTH

TABLE 14 MARKET SIZE IN VARIABLE INFORMATION PRINT SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 15 MARKET SIZE IN VARIABLE INFORMATION PRINT SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

9 LINERLESS LABELS MARKET, BY PRINTING INK (Page No. - 71)

9.1 INTRODUCTION

FIGURE 23 UV CURABLE SEGMENT EXPECTED TO BE FASTEST-GROWING SEGMENT

TABLE 16 MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METER)

9.2 WATER-BASED

9.2.1 HIGH LEVEL OF COMPLIANCE OF WATER-BASED INKS WITH CURRENT ENVIRONMENTAL PROTECTION STANDARDS

TABLE 18 MARKET SIZE IN WATER-BASED SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 19 MARKET SIZE IN WATER-BASED SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

9.3 SOLVENT-BASED

9.3.1 DURABILITY AND WATERPROOF PRINTING PROPERTIES OF SOLVENT-BASED INKS

TABLE 20 MARKET SIZE IN SOLVENT-BASED SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 MARKET SIZE IN SOLVENT-BASED SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

9.4 UV CURABLE

9.4.1 INCREASING APPLICATIONS IN VARIOUS END-USE INDUSTRIES TO DRIVE MARKET GROWTH

TABLE 22 MARKET SIZE IN UV-CURABLE SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 23 MARKET SIZE IN UV-CURABLE SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

9.5 OTHERS

TABLE 24 MARKET SIZE IN OTHER PRINTING INK SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 25 LINERLESS LABELS MARKET SIZE IN OTHER PRINTING INK SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METER)

10 LINERLESS LABELS MARKET, BY PRINTING TECHNOLOGY (Page No. - 78)

10.1 INTRODUCTION

FIGURE 24 DIGITAL SEGMENT EXPECTED TO BE FASTEST-GROWING SEGMENT

TABLE 26 LINERLESS LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 27 LINERLESS LABELS MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

10.2 FLEXOGRAPHIC

10.2.1 COST-EFFECTIVENESS AND FLEXIBILITY OF FLEXOGRAPHIC PRINTING

TABLE 28 LINERLESS LABELS MARKET SIZE IN FLEXOGRAPHIC SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 29 LINERLESS LABELS MARKET SIZE IN FLEXOGRAPHIC SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

10.3 DIGITAL

10.3.1 LOWER PRODUCTION COST AND HIGH-QUALITY PRINTING OF DIGITAL PRINTING

TABLE 30 LINERLESS LABELS MARKET SIZE IN DIGITAL SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 LINERLESS LABELS MARKET SIZE IN DIGITAL SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

10.4 OFFSET

10.4.1 ABILITY TO PRINT HIGH AND CONSISTENT IMAGE QUALITY

TABLE 32 LINERLESS LABELS MARKET SIZE IN OFFSET SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 33 LINERLESS LABELS MARKET SIZE IN OFFSET SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

10.5 LETTERPRESS

10.5.1 CAN PRODUCE LARGE NUMBER OF IMAGE COPIES

TABLE 34 LINERLESS LABELS MARKET SIZE IN LETTERPRESS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 LINERLESS LABELS MARKET SIZE IN LETTERPRESS SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

10.6 OTHERS

TABLE 36 LINERLESS LABELS MARKET SIZE IN OTHER PRINTING TECHNOLOGY SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 LINERLESS LABELS MARKET SIZE IN OTHER PRINTING TECHNOLOGY SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

11 LINERLESS LABELS MARKET, BY END-USE INDUSTRY (Page No. - 86)

11.1 INTRODUCTION

FIGURE 25 FOOD SEGMENT EXPECTED TO LEAD THE LINERLESS LABELS MARKET

TABLE 38 MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 39 LINERLESS LABELS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

11.2 FOOD

11.2.1 CHANGING CONSUMER SENTIMENTS AND RISING DEMAND FOR GROCERIES

TABLE 40 LINERLESS LABELS MARKET SIZE IN FOOD SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 MARKET SIZE IN FOOD SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 42 MARKET SIZE IN FOOD SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 43 LINERLESS LABELS MARKET SIZE IN FOOD SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

11.3 BEVERAGE

11.3.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE SEGMENT

TABLE 44 LINERLESS LABELS MARKET SIZE IN BEVERAGE SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 LINERLESS LABELS MARKET SIZE IN BEVERAGE SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 46 LINERLESS LABELS MARKET SIZE IN BEVERAGE SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 47 LINERLESS LABELS MARKET SIZE IN BEVERAGE SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

11.4 HOME & PERSONAL CARE

11.4.1 INCREASING APPLICATION OF LINERLESS LABELS IN HOME & PERSONAL CARE INDUSTRY TO DRIVE THE SEGMENT

TABLE 48 LINERLESS LABELS MARKET SIZE IN HOME & PERSONAL CARE SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 LINERLESS LABELS MARKET SIZE IN HOME & PERSONAL CARE SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 50 LINERLESS LABELS MARKET SIZE IN HOME & PERSONAL CARE SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 51 LINERLESS LABELS MARKET SIZE IN HOME & PERSONAL CARE SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

11.5 PHARMACEUTICALS

11.5.1 ABILITY OF LINERLESS LABELS IN ENHANCING OPERATIONAL EFFICIENCY, SECURITY, AND COMPLIANCE TO DRIVE THE SEGMENT

TABLE 52 LINERLESS LABELS MARKET SIZE IN PHARMACEUTICAL SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 53 LINERLESS LABELS MARKET SIZE IN PHARMACEUTICAL SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 54 LINERLESS LABELS MARKET SIZE IN PHARMACEUTICAL SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 55 LINERLESS LABELS MARKET SIZE IN PHARMACEUTICAL SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

11.6 RETAIL

11.6.1 GROWTH OF RETAIL INDUSTRY IN EMERGING COUNTRIES

TABLE 56 LINERLESS LABELS MARKET SIZE IN RETAIL SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 57 MARKET SIZE IN RETAIL SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 58 LINERLESS LABELS MARKET SIZE IN RETAIL SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 59 MARKET SIZE IN RETAIL SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

11.7 OTHERS

TABLE 60 LINERLESS LABELS MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 61 MARKET SIZE IN OTHERS SEGMENT, BY REGION, 2019–2026 (MILLION SQUARE METERS)

TABLE 62 LINERLESS LABELS MARKET SIZE IN OTHERS SEGMENT, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 63 MARKET SIZE IN OTHERS SEGMENT, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

12 LINERLESS LABELS MARKET, BY REGION (Page No. - 99)

12.1 INTRODUCTION

TABLE 64 INTERIM ECONOMIC OUTLOOK FORECAST, 2019–2021

FIGURE 26 APAC TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 65 LINERLESS LABELS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METERS)

12.2 APAC

12.2.1 IMPACT OF COVID-19 IN APAC

FIGURE 27 APAC: GLOBAL LINERLESS LABELS MARKET SNAPSHOT

TABLE 67 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 68 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 69 APAC: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 70 APAC: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 71 APAC: MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 72 APAC: MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

TABLE 73 APAC: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 74 APAC: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

TABLE 75 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.2 CHINA

12.2.2.1 Increasing industrial activities and high growth of the food sector to boost the market

TABLE 77 CHINA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 78 CHINA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 79 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 80 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.3 INDIA

12.2.3.1 Growing demand for FMCG and convenience products drive the market

TABLE 81 INDIA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 82 INDIA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 83 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 84 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.4 JAPAN

12.2.4.1 Increasing demand from pharmaceutical industry propels the market

TABLE 85 JAPAN: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 86 JAPAN: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 87 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 88 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.5 SOUTH KOREA

12.2.5.1 Increasing government investments for research on the use of linerless labels across industries boost the market

TABLE 89 SOUTH KOREA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 90 SOUTH KOREA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 91 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 92 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.6 INDONESIA

12.2.6.1 Food and beverage industries drive the market

TABLE 93 INDONESIA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 94 INDONESIA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 95 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 96 INDONESIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.2.7 REST OF APAC

TABLE 97 REST OF APAC: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 98 REST OF APAC: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 99 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 REST OF APAC:MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.3 NORTH AMERICA

12.3.1 IMPACT OF COVID-19 IN NORTH AMERICA

FIGURE 28 NORTH AMERICA: GLOBAL LINERLESS LABELS MARKET SNAPSHOT

TABLE 101 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

TABLE 107 NORTH AMERICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

TABLE 109 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.3.2 US

12.3.2.1 US dominated the linerless labels market in North America

TABLE 111 US: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 112 US: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 113 US: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 US: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.3.3 CANADA

12.3.3.1 Increasing disposable income and growth in food industry significantly contributing to market growth

TABLE 115 CANADA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 117 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.3.4 MEXICO

12.3.4.1 Increasing demand for convenience and ready-to-go products to drive demand for linerless labels

TABLE 119 MEXICO: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 120 MEXICO: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 121 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 122 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4 EUROPE

12.4.1 IMPACT OF COVID-19 IN EUROPE

FIGURE 29 EUROPE: GLOBAL LINERLESS LABELS MARKET SNAPSHOT

TABLE 123 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 125 EUROPE: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 127 EUROPE: MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

TABLE 129 EUROPE: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

TABLE 131 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.2 GERMANY

12.4.2.1 Demand for linerless labels to grow in food and beverage segments

TABLE 133 GERMANY: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 134 GERMANY: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 135 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 136 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.3 UK

12.4.3.1 Increased demand for convenience food to boost the market

TABLE 137 UK: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 138 UK: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 139 UK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 140 UK: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.4 ITALY

12.4.4.1 Growing demand for processed and packaged food to drive demand for linerless labels

TABLE 141 ITALY: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 142 ITALY: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 143 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 144 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.5 FRANCE

12.4.5.1 Increasing use of linerless labels in personal care & cosmetic products

TABLE 145 FRANCE: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 146 FRANCE: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 147 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 148 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.6 POLAND

12.4.6.1 Growing food industry propels the market

TABLE 149 POLAND: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 150 POLAND: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 151 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 152 POLAND: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.7 NETHERLANDS

12.4.7.1 Increasing demand from end-use industries supporting market growth

TABLE 153 NETHERLANDS: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 154 NETHERLANDS: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 155 NETHERLANDS: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 156 NETHERLANDS: LINERLESS LABELS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.4.8 REST OF EUROPE

TABLE 157 REST OF EUROPE: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 158 REST OF EUROPE: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 159 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 160 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.5 MIDDLE EAST & AFRICA

12.5.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

FIGURE 30 MIDDLE EAST & AFRICA: GLOBAL LINERLESS LABELS MARKET SNAPSHOT

TABLE 161 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 163 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 165 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

TABLE 167 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

TABLE 169 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.5.2 SAUDI ARABIA

12.5.2.1 Increasing manufacturing activities to drive market

TABLE 171 SAUDI ARABIA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 172 SAUDI ARABIA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 173 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 174 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.5.3 SOUTH AFRICA

12.5.3.1 High demand from takeaway and fast-food outlets

TABLE 175 SOUTH AFRICA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 176 SOUTH AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 177 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 178 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 179 REST OF MIDDLE EAST & AFRICA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 180 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 181 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 182 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.6 SOUTH AMERICA

12.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

FIGURE 31 SOUTH AMERICA: GLOBAL LINERLESS LABELS MARKET SNAPSHOT

TABLE 183 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 184 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 185 SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 186 SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 187 SOUTH AMERICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (USD MILLION)

TABLE 188 SOUTH AMERICA: MARKET SIZE, BY PRINTING INK, 2019–2026 (MILLION SQUARE METERS)

TABLE 189 SOUTH AMERICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 190 SOUTH AMERICA: MARKET SIZE, BY PRINTING TECHNOLOGY, 2019–2026 (MILLION SQUARE METERS)

TABLE 191 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 192 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.6.2 BRAZIL

12.6.2.1 Government's efforts for the country's fiscal sustainability to drive market

TABLE 193 BRAZIL: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 194 BRAZIL: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 195 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 196 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.6.3 ARGENTINA

12.6.3.1 Food industry to be the largest segment of linerless labels market

TABLE 197 ARGENTINA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 198 ARGENTINA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 199 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 200 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

12.6.4 REST OF SOUTH AMERICA

TABLE 201 REST OF SOUTH AMERICA: GLOBAL LINERLESS LABELS MARKET SIZE, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 202 REST OF SOUTH AMERICA: MARKET SIZE, BY PRODUCT, 2019–2026 (MILLION SQUARE METERS)

TABLE 203 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 204 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (MILLION SQUARE METERS)

13 COMPETITIVE LANDSCAPE (Page No. - 163)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 32 COMPANIES ADOPTED EXPANSIONS AS THE KEY GROWTH STRATEGY, 2019–2021

13.3 MARKET RANKING

FIGURE 33 MARKET RANKING OF KEY PLAYERS, 2020

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 34 REVENUE ANALYSIS FOR KEY COMPANIES IN THE LINERLESS LABELS MARKET 2020

13.5 MARKET SHARE ANALYSIS

FIGURE 35 SHARE OF THE LEADING COMPANIES IN THE LINERLESS LABELS MARKET

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STAR

13.6.2 PERVASIVE

13.6.3 EMERGING LEADER

FIGURE 36 LINERLESS LABELS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

13.7 COMPETITIVE BENCHMARKING

TABLE 205 COMPANY PRODUCT FOOTPRINT BY PRINTING TECHNOLOGY

TABLE 206 COMPANY PRODUCT FOOTPRINT BY END-USE INDUSTRY

TABLE 207 COMPANY REGION FOOTPRINT

13.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 STARTING BLOCKS

13.8.4 DYNAMIC COMPANIES

FIGURE 37 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES

TABLE 208 LINERLESS LABELS MARKET: PRODUCT LAUNCHES, FEBRUARY 2021

13.9.2 DEALS

TABLE 209 LINERLESS LABELS MARKET: DEALS, JULY 2016-JANUARY 2021

14 COMPANY PROFILES (Page No. - 173)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 MAJOR PLAYERS

14.1.1 3M

TABLE 210 3M: BUSINESS OVERVIEW

FIGURE 38 3M: COMPANY SNAPSHOT

14.1.2 CCL INDUSTRIES INC

TABLE 211 CCL INDUSTRIES INC: COMPANY OVERVIEW

FIGURE 39 CCL INDUSTRIES INC: COMPANY SNAPSHOT

14.1.3 R.R. DONNELLEY & SONS COMPANY

TABLE 212 R.R. DONNELLEY & SONS COMPANY : COMPANY OVERVIEW

FIGURE 40 R.R. DONNELLEY & SONS COMPANY: COMPANY SNAPSHOT

14.1.4 VERY DENNISON CORPORATION

FIGURE 41 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

14.1.5 MULTI-COLOR CORPORATION

TABLE 213 MULTI-COLOR CORPORATION: BUSINESS OVERVIEW

FIGURE 42 MULTI-COLOR CORPORATION: COMPANY SNAPSHOT

14.1.6 COVERIS

TABLE 214 COVERIS: BUSINESS OVERVIEW

14.1.7 SATO HOLDINGS CORPORATION

TABLE 215 SATO HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 43 SATO HOLDINGS CORPORATION: COMPANY SNAPSHOT

14.1.8 SKANEM AS

TABLE 216 SKANEM AS: BUSINESS OVERVIEW

14.1.9 HUB LABELS, INC

TABLE 217 HUB LABELS, INC: BUSINESS OVERVIEW

14.1.10 GIPAKO

TABLE 218 GIPAKO: BUSINESS OVERVIEW

14.1.11 RAVENWOOD PACKAGING LTD

14.1.12 INNOVIA FILMS

14.1.13 NASTAR INC

14.1.14 OPTIMUM GROUP

14.1.15 LEXIT GROUP NORWAY

14.1.16 CENVEO WORLDWIDE LIMITED

14.1.17 L & N LABEL COMPANY INC

14.1.18 PROPRINT GROUP

14.1.19 BOSTIK

14.1.20 EMERSON

14.1.21 BELONA

14.1.22 RAPID LABELS

14.1.23 SATO EUROPE GMBH

14.1.24 HERMA

14.1.25 WEBER PACKAGING SOLUTIONS

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 203)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

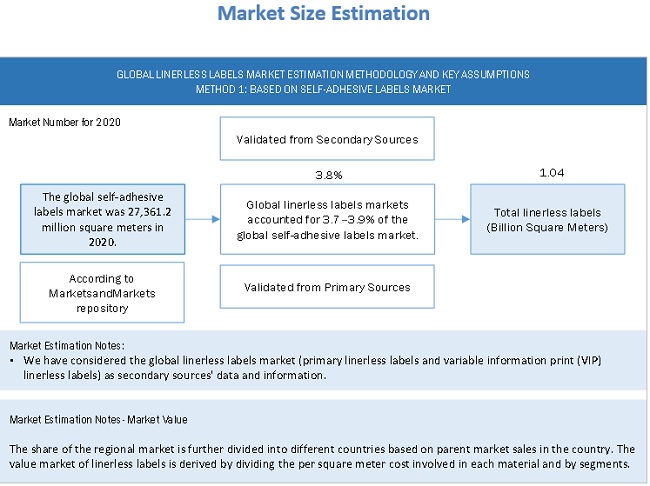

The study involved four major activities for estimating the current global size of the linerless labels market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of linerless labels through primary research. The top-down approach was employed to estimate the overall size of the linerless labels market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the linerless labels market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

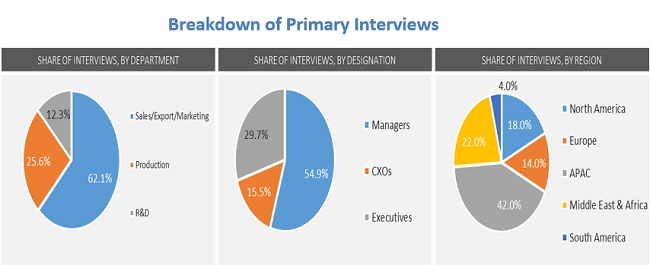

Primary Research

Various primary sources from both the supply and demand sides of the linerless labels market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the linerless labels industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

To know about the assumptions considered for the study, Request for Free Sample Report

The above approach was used to estimate and validate the global size of the linerless labels market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the linerless labels market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the linerless labels market in terms of value and volume based on type, end-use industry and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the linerless labels report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies.

Regional Analysis

- Further analysis of the linerless labels market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Global Linerless Labels Market