Liquid Milk Replacers Market by Type (Medicated and Non-Medicated), Livestock (Calves, Piglets, Kittens, Puppies, Foals, Kids & Lambs), and Region (North America, Europe, Asia Pacific and Rest of the World) - Global Forecast to 2023

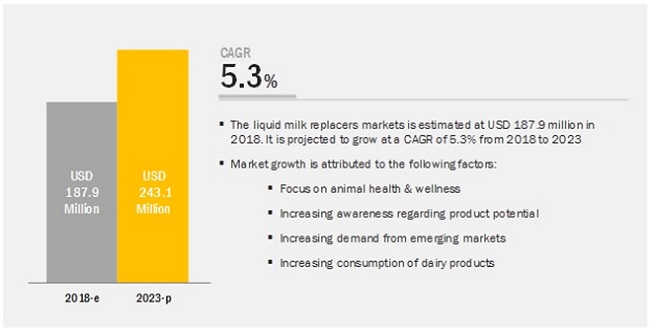

[245 Pages Report] The liquid milk replacers market size is expected to reach USD 243 million by 2023, at a compound annual growth rate (CAGR) of 5.3% during the forecast period. The rising consumption of dairy products and the adoption of precision techniques are the key factors driving the growth of this market.

By type, the medicated segment is expected to be the faster growing in the liquid milk replacers market during the forecast period.

The medicated segment is projected to grow at the higher CAGR between 2018 and 2023. Medicated liquid milk replacers provide various health benefits and improve the performance of infant livestock. These milk replacers are mainly fed to infant livestock that has physical and nutritional deficiencies, weaknesses, or diseases; and requires an enhanced nutritional diet. This has led livestock rearers to use medicated liquid milk replacers.

By livestock, the calves segment is growing at the fastest rate during the forecast period.

The calves segment, by livestock, is projected to be the fastest-growing store type in the global market. Calves are born with only the abomasum, i.e., the fourth stomach functioning; and their digestion is only dependent on the enzymes existing in the abomasum. For this reason, infant animals are fed with high-quality milk replacers, as they fulfill their nutritional needs and boost their immunity toward diseases. Liquid milk replacers for calves are nutritious concentrate mixes and contain nutrients such as protein, fats, vitamins, and minerals in the optimum required ratio to ensure optimal growth.

Scope of the Liquid Milk Replacers Market Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Values (USD thousands), and Volume (MT) |

|

Segments covered |

Type, Livestock, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Liprovit (Netherlands), Calva Products LLC (US), and PetAg Inc. (US) |

This research report categorizes the market based on type, livestock, and region.

Based on type, the market is segmented as follows:

- Medicated

- Non-medicated

Based on livestock, the market is segmented as follows:

- Calves

- Piglets

- Others (foals, kitten, kids, lambs, and puppies)

Based on region, the market is segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

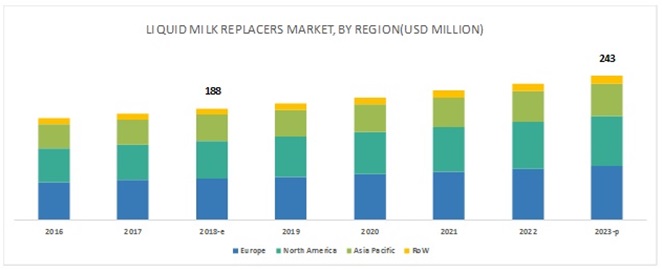

Europe is expected to account for the largest market share during the forecast period.

Europe is the major revenue-generating region in the global liquid milk replacers market. The consumption of liquid milk replacers in the region is further driven by the growing focus of the European Commission on health and nutrition of animals during their early growth stages. The European legislation dictates that all calves are required to have access to their mothers for a minimum of two weeks after their birth, for colostrum consumption. To be able to substitute this colostrum successfully, they are then transferred to specialized calf rearing farms, where they are provided with milk replacers that successfully help mimic cow’s milk. The usage of different liquid milk replacers extensively depends on factors such as cost-effectiveness, ingredient availability, and different feed regulations prevalent in the country. These factors are expected to impact the market growth for liquid milk replacers in Europe.

The major vendors in the global market are Liprovit, BV (Netherlands), Calva products LLC (US), PETAG Inc. (US), Cargill (US), Archer Daniels Midland Company (ADM) (US), CHS Inc. (US), Land O’Lakes Inc. (US), Glanbia Plc (Ireland), Nutreco N.V. (Netherlands), and Lactalis Group (France).

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific liquid milk replacers market, by key country

- Further breakdown of the Rest of Europe liquid milk replacers market, by key country

Frequently Asked Questions (FAQ):

What is the leading type in the liquid milk replacers market?

The non-medicated segment was the highest revenue contributor to the market, with USD 135,143.0 million in 2017, and is estimated to reach USD 179,499.3 million by 2023, with a CAGR of 4.9%.

What is the estimated industry size of liquid milk replacers?

The global liquid milk replacers market was valued at USD 179,444.3 million in 2017, and is projected to reach USD 243,075.1 million by 2023, registering a CAGR of 5.3% from 2018 to 2023.

What is the leading livestock of the market?

The calves segment was the highest revenue contributor to the market, with USD 100,545.9 million in 2017, and is estimated to reach USD 139,368.2 million by 2023, with a CAGR of 5.7%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Segmentation

1.4 Periodization Considered

1.5 Currency Considered

1.6 Units

1.7 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Research Assumptions

2.4.2 Research Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Global Liquid Milk Replacers Market

4.2 Market, By Key Country

4.3 Market for Liquid Milk Replacers in Europe, By Livestock & Key Country

4.4 Market, By Livestock & Region

4.5 Market, By Type & Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Consumption of Dairy Products

5.2.1.2 Adoption of Precision Nutrition Techniques

5.2.2 Restraints

5.2.2.1 Logistical and Preservation Advantages Associated With Powdered Milk Replacers

5.2.3 Opportunities

5.2.3.1 Usage of Milk Replacers for Piglets, Foals, Lambs, and Kids

5.2.4 Challenges

5.2.4.1 Pricing & Lack of Awareness Leading to Distributional Hindrances

5.3 Value Chain Analysis

6 Liquid Milk Replacers Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Medicated Liquid Milk Replacers

6.2.1 Preventing Infant Livestock From Bacterial Enteritis and Bacterial Pneumonia Diseases Fueling the Demand for Medicated Liquid Milk Replacers

6.3 Non-Medicated Liquid Milk Replacers

6.3.1 Rise in the Demand for Non-Medicated Liquid Milk Replacers is Attributed Due to Low Price and Increasing Organized Dairy Farming Industry in Emerging Countries

7 Liquid Milk Replacers Market, By Livestock (Page No. - 44)

7.1 Introduction

7.2 Calves

7.2.1 Nutritional Needs and Boost Their Immunity Toward Diseases in Calves has Lead the Usage of Liquid Milk Replacers in Calves

7.3 Piglets

7.3.1 Protection From Invading Pathogens to Piglets has Driven the Usage of Liquid Milk Replacers in Piglets

7.4 Others

7.4.1 Liquid Milk Replacer is A Substitute Made for Infant Animals to Meet Their Nutritional Needs

8 Liquid Milk Replacers Market, By Region (Page No. - 51)

8.1 Introduction

8.2 North America

8.2.1 Us

8.2.1.1 Irreplaceable Dietary Value and Ease of Access Have Led to A Robust Market for Liquid Milk Replacers in the Country

8.2.2 Mexico

8.2.2.1 The Calves Segment is Projected to Grow at the Highest From 2018 to 2023

8.2.3 Canada

8.2.3.1 The Calves Segment Dominated the Livestock Market in 2017

8.3 Europe

8.3.1 Germany

8.3.1.1 The Consumption of Liquid Milk Replacers in Germany is Majorly Driven By the Rising Demand for Milk Products Among Consumers

8.3.2 UK

8.3.2.1 The Calves Segment Dominated This Market in 2017

8.3.3 France

8.3.3.1 Market for Liquid Milk Replacers in the Country is Driven By Increasing Adoption of Precision Nutrition Technique

8.3.4 Spain

8.3.4.1 The Calves Segment is Projected to Grow at the Highest CAGR During the Forecast Period

8.3.5 Italy

8.3.5.1 The Market for Piglets is Projected to Grow at the Second-Highest CAGR During the Forecast Period

8.3.6 Rest of Europe

8.3.6.1 The Calves Segment Dominated This Market in 2017, and It is Projected to Grow at the Highest CAGR Between 2018 and 2023

8.4 Asia Pacific

8.4.1 China

8.4.1.1 A Gradual Rise in the Adoption of Precision Nutrition Techniques in the Country has Driven the Market for Liquid Milk Replacers

8.4.2 India

8.4.2.1 Rising Consumption of Milk Product Have Driven the Use of Liquid Milk Replacers By Livestock Rearers in Their Rearing Systems

8.4.3 Australia

8.4.3.1 The Calves Segment Dominated This Market in 2017

8.4.4 Japan

8.4.4.1 Adoption of Nutritional Dietary Components to Help Improve Dietary Well-Being, and Health of Pre-Weaning Livestock has Driven the Market in the Country

8.4.5 Rest of Asia Pacific

8.4.5.1 The Calves Segment is Projected to Grow at the Highest CAGR During the Forecast Period

8.5 Rest of the World (RoW)

8.5.1 South America

8.5.1.1 The Calves Segment Dominated South American Market, By Livestock in 2017

8.5.2 Middle East

8.5.2.1 It is Projected to Grow at the Highest CAGR During the Forecast Period

8.5.3 Africa

8.5.3.1 The Calves Segment Have Dominated the African Market for Liquid Milk Replacers By Livestock

9 Competitive Landscape (Page No. - 84)

9.1 Overview

9.2 Market Ranking Analysis

9.3 Market Share Analysis

9.4 Competitive Scenario for Powder Milk Replacers

9.4.1 Expansions and Investments

9.4.2 Acquisitions

9.4.3 New Product Launches

10 Company Profiles (Page No. - 87)

10.1 Cargill

(Business Overview, Products Offered, Recent Developemnt, SWOT Analysis, and MnM View)*

10.2 Archer Daniels Midland Company

10.3 CHS Inc.

10.4 Land O’lakes Inc.

10.5 Liprovit Bv

10.6 Glanbia, PLC

10.7 Nutreco N.V.

10.8 Lactalis Group

10.9 Calva Products, LLC

10.10 Petag Inc.

*Details on Business Overview, Products Offered, Recent Developemnt, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 105)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (80 Tables)

Table 1 US Dollar Exchange Rate Considered for the Study, 2013–2017

Table 2 Liquid Milk Replacers Market Snapshot (Value), 2018 vs 2023

Table 3 Market for Liquid Milk Replacers Size, By Type, 2016-2023 (USD Thousand)

Table 4 Market for Liquid Milk Replacers Size, By Type, 2016-2023 (MT)

Table 5 Medicated: Lqiuid Milk Replacers Market Size, By Region, 2016-2023 (USD Thousands)

Table 6 Medicated: Market for Liquid Milk Replacers Size, By Region, 2016-2023 (MT)

Table 7 Non-Medicated: Market Size, By Region, 2016-2023 (USD Thousands)

Table 8 Non-Medicated: Market Size, By Region, 2016-2023 (MT)

Table 9 Market for Liquid Milk Replacers Size, By Livestock, 2016–2023 (USD Thousands)

Table 10 Liquid Milk Replacers Market Size, By Livestock, 2016–2023 (MT)

Table 11 Calves: Liquid Milk Replacer Market Size, By Region, 2016–2023 (USD Thousands)

Table 12 Piglets: Liquid Milk Replacer Market Size, By Region, 2016–2023 (USD Thousands)

Table 13 Piglets: Market Size, By Region, 2016–2023 (MT)

Table 14 Others: Liquid Milk Replacer Market Size, By Region, 2016–2023 (USD Thousands)

Table 15 Others: Market Size, By Region, 2016–2023 (MT)

Table 16 Milk Replacers Market Size, By Form, 2016–2023 (USD Thousand)

Table 17 Milk Replacers Market Size, By Form, 2016–2023 (MT)

Table 18 Liquid Milk Replacers Market Size, By Region, 2016–2023 (USD Thousand)

Table 19 Market for Liquid Milk Replacers Size, By Region, 2016–2023 (MT)

Table 20 North America: Market for Liquid Milk Replacers Size, By Country, 2016–2023 (USD Thousand)

Table 21 North America: Market Size, By Country, 2016–2023 (MT)

Table 22 North America: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 23 North America: Market Size, By Livestock, 2016–2023 (MT)

Table 24 North America: Market Size, By Type, 2016–2023 (USD Thousand)

Table 25 North America: Market Size, By Type, 2016–2023 (MT)

Table 26 US: Liquid Milk Replacers Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 27 US: Market Size, By Livestock, 2016–2023 (MT)

Table 28 Mexico: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 29 Mexico: Market Size, By Livestock, 2016–2023 (MT)

Table 30 Canada: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 31 Canada: Market Size, By Livestock, 2016–2023 (MT)

Table 32 Europe: Liquid Milk Replacers Market Size, By Country, 2016–2023 (USD Thousand)

Table 33 Europe: Market Size, By Country, 2016–2023 (MT)

Table 34 Europe: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 35 Europe: Market Size, By Livestock, 2016–2023 (MT)

Table 36 Europe: Market Size, By Type, 2016–2023 (USD Thousand)

Table 37 Europe: Liquid Milk Replacers Market Size, By Type, 2016–2023 (MT)

Table 38 Germany: Market for Liquid Milk Replacers Size, By Livestock, 2016–2023 (USD Thousand)

Table 39 Germany: Market Size, By Livestock, 2016–2023 (MT)

Table 40 UK: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 41 UK: Market for Liquid Milk Replacers Size, By Livestock, 2016–2023 (MT)

Table 42 France: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 43 France: Market Size, By Livestock, 2016–2023 (MT)

Table 44 Spain: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 45 Spain: Market Size, By Livestock, 2016–2023 (MT)

Table 46 Italy: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 47 Italy: Market Size, By Livestock, 2016–2023 (MT)

Table 48 Rest of Europe: Liquid Milk Replacer Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 49 Rest of Europe: Market Size, By Livestock, 2016–2023 (MT)

Table 50 Asia Pacific: Liquid Milk Replacer Market Size, By Country, 2016–2023 (USD Thousand)

Table 51 Asia Pacific: Liquid Milk Replacers Market Size, By Country, 2016–2023 (MT)

Table 52 Asia Pacific: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 53 Asia Pacific: Market Size, By Livestock, 2016–2023 (MT)

Table 54 Asia Pacific: Market Size, By Type, 2016–2023 (USD Thousand)

Table 55 Asia Pacific: Market Size, By Type, 2016–2023 (MT)

Table 56 China: Market for Liquid Milk Replacers Size, By Livestock, 2016–2023 (USD Thousand)

Table 57 China: Market Size, By Livestock, 2016–2023 (MT)

Table 58 India: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 59 India: Market Size, By Livestock, 2016–2023 (MT)

Table 60 Australia: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 61 Australia: Market Size, By Livestock, 2016–2023 (MT)

Table 62 Japan: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 63 Japan: Market Size, By Livestock, 2016–2023 (MT)

Table 64 Rest of Asia Pacific: Liquid Milk Replacers Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 65 Rest of Asia Pacific: Market Size, By Livestock, 2016–2023 (MT)

Table 66 RoW: Market for Liquid Milk Replacers Size, By Region, 2016–2023 (USD Thousand)

Table 67 RoW: Market Size, By Region, 2016–2023 (MT)

Table 68 RoW: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 69 RoW: Market Size, By Livestock, 2016–2023 (MT)

Table 70 RoW: Market Size, By Type, 2016–2023 (USD Thousand)

Table 71 RoW: Market Size, By Type, 2016–2023 (MT)

Table 72 South America: Liquid Milk Replacers Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 73 South America: Market Size, By Livestock, 2016–2023 (MT)

Table 74 Middle East: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 75 Middle East: Market Size, By Livestock, 2016–2023 (MT)

Table 76 Africa: Market Size, By Livestock, 2016–2023 (USD Thousand)

Table 77 Africa: Market for Liquid Milk Replacers Size, By Livestock, 2016–2023 (MT)

Table 78 Expansions and Investments, 2014-2016

Table 79 Acquisitions, 2016

Table 80 New Product Launches, 2017

List of Figures (38 Figures)

Figure 1 Market Snapshot

Figure 2 Liquid Milk Replacers Market by Region

Figure 3 Market for Liquid Milk Replacers : Research Design

Figure 4 Market for Liquid Milk Replacers Estimation Methodology: Bottom-Up Approach

Figure 5 Market for Liquid Milk Replacers Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market Size, By Type, 2018 vs 2023 (USD Million)

Figure 8 Liquid Milk Replacers Market Size, By Livestock, 2018 vs 2023 (USD Million)

Figure 9 Market for Liquid Milk Replacers Share (Value), By Region, 2017

Figure 10 Focus on Animal Health & Wellness to Drive the Market Growth During the Forecast Period

Figure 11 US is Projected to Be the Fastest-Growing Market for Liquid Milk Replacers During the Forecast Period

Figure 12 Calves Accounted for the Largest Share of the European Liquid Milk Replacers Market

Figure 13 Calves Segment to Dominate the Market for Liquid Milk Replacers Across Regions Through 2023

Figure 14 Medicated to Be A Faster-Growing Segment During the Forecast Period

Figure 15 Liquid Milk Replacers Market Dynamics

Figure 16 Global Milk Production, 2013–2016 (MT)

Figure 17 Liquid Milk Replacers: Value Chain

Figure 18 Medicated Segment is Projected to Witness the Fastest Growth in the Market From 2018 to 2023

Figure 19 The Calves Segment is Projected to Be the Fastest-Growing Segment Between 2018 & 2023 (USD Thousands)

Figure 20 Calves: Market for Liquid Milk Replacers Size, By Region, 2018 vs 2023 (USD Thousands)

Figure 21 Regional Snapshot: US is Projected to Grow at the Highest CAGR in the Market

Figure 22 North America: Market Size, By Country, 2016–2023 (USD Thousand)

Figure 23 Europe: Market Size, By Country, 2016–2023 (USD Thousand)

Figure 24 Key Developments of the Leading Players in the Powder Milk Replacers Market, 2014–2018

Figure 25 Market Ranking Analysis of Players in theMarket

Figure 26 Market Share of Key Players in the Powder Milk Replacers Market

Figure 27 Cargill: Company Snapshot

Figure 28 Cargill: SWOT Analysis

Figure 29 Archer Daniels Midland Company: Company Snapshot

Figure 30 Archer Daniels Midland Company: SWOT Analysis

Figure 31 CHS Inc.: Company Snapshot

Figure 32 CHS Inc.: SWOT Analysis

Figure 33 Land O’lakes Inc.: Company Snapshot

Figure 34 Land O’lakes Inc.: SWOT Analysis

Figure 35 Liprovit Bv: SWOT Analysis

Figure 36 Glanbia, PLC: Company Snapshot

Figure 37 Nutreco N.V.: Company Snapshot

Figure 38 Lactalis Group: Company Snapshot

Factors such as a focus on animal health & wellness, increasing awareness regarding product potential, increasing demand from emerging markets, and increasing consumption of dairy products have helped drive the liquid milk replacers market globally. A growing focus on animal health and nutrition has gradually given rise to the adoption of precision nutrition techniques amongst farmers. The primary objective of these precision nutrition techniques is the effective utilization of available feed resources, with the aim of maximizing livestock response to nutrients.

Precision nutrition techniques include improved feed processing techniques, precise ration formulation, implementation of phase feeding processes, and the usage of nutritive feed components. The growing adoption of milk replacers amongst farmers has also been majorly influenced by a shift toward healthier feed formulation practices. For instance, most livestock rearers in the UK have shifted to a milk replacer diet from a whole milk-based diet, to help abate potential disease transfers from the parent livestock. Additionally, ingredients of milk replacers are designed in such a manner that it is suitable for the digestive system of the infant livestock. Milk replacers have lower fat levels, in comparison to that of whole milk, and the fat present in these milk replacers is also laced and encased in protein, with added vitamins and acids, which could help improve feed digestibility and ensure optimum animal health. Furthermore, higher consumption and absorption of milk replacer concentrates help produce faster growth rates, resulting in the faster development of rumen, and speed up the weaning process. These improvements in animal health and productivity have further enabled the usage of milk replacers amongst livestock rearers.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to, so as to identify and collect information useful for a technical, market-oriented, and commercial study of the market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The global market comprises several stakeholders such as raw material suppliers, manufacturers of liquid milk replacers, and regulatory organizations in the supply chain. The demand side of this market is characterized by consumers of liquid milk replacers and livestock farms. The supply side is characterized by liquid milk replacer manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the feed industry and owners of livestock farms. The primary sources from the supply side include research institutions involved in R&D for the introduction and development of milk replacers, key opinion leaders, distributors, and liquid milk replacer manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players have been identified through extensive secondary research.

- The liquid milk replacer industry’s value chain and market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the liquid milk replacer industry.

Report Objectives

- To define, segment, and project the global market size for liquid milk replacers

- To understand the structure of the liquid milk replacers market by identifying its various sub-segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To project the size of the market and its sub-markets, in terms of value and volume, with respect to 4 regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by players across key regions.

- To analyze the competitive developments such as expansions & investments, new product launches, and acquisitions in the global liquid milk replacers market.

Growth opportunities and latent adjacency in Liquid Milk Replacers Market