Lithium-ion Battery Binders Market by Type (Anode and Cathode), Material (PVDF, CMC, PMMA, SBR), Battery Chemistry (LFP, LCO, NMC, LTO), End Use (Automotive, Consumer Electronics, Energy Storage, Industrial), and Region - Global Forecast to 2027

Updated on : November 11, 2025

Lithium-ion Battery Binders Market

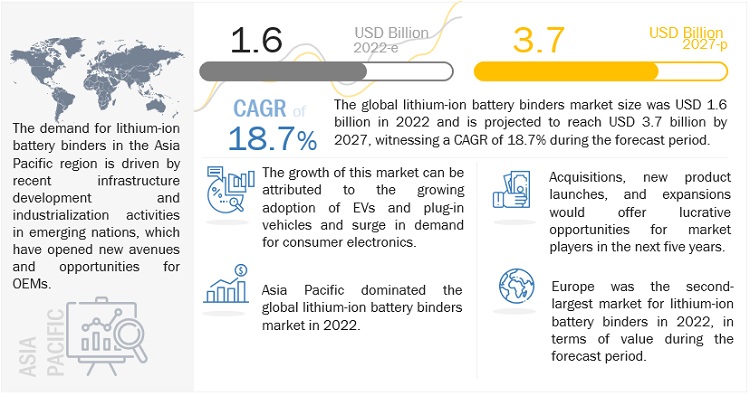

The global lithium-ion battery binders market was valued at USD 1.6 billion in 2022 and is projected to reach USD 3.7 billion by 2027, growing at 18.7% cagr from 2022 to 2027. Increased usage of batteries in key industries such as electric vehicles and consumer electronics along with the growing government initiatives to enhance the sale of electric vehicles is expected to drive the market during the forecast period.

Global Lithium-ion Battery Binders Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium-ion Battery Binders Market Dynamics

Driver: Growing demand for the electric vehicle, consumer electronics, and utility sectors

In recent years, there has been tremendous growth in demand for batteries, and this is expected to grow at a significant pace for at least the next couple of years. Globally, there is a focus on minimizing the use of conventional sources of energy in various sectors such as automotive and power. This has led to an increase in the overall production of lithium-ion batteries. Lithium-ion batteries have better electrochemical performance than lead-acid, nickel-cadmium, and nickel-metal hydride batteries. These batteries have a long life and offer increased power, excellent efficiency, and low self-discharge. Various players in the market are working toward improving the performance of lithium-ion batteries, which has made them an attractive option for stationary energy storage applications. Thus, the increasing use of lithium-ion batteries in renewable energy storage and electric vehicle is expected to create huge growth opportunities for lithium-ion batteries, boosting the market for battery binders.

Restraints: Availability of binder free electrodes

Binder-free electrodes can be prepared in various ways, such as template-free and template-assisted

methods. Binders are generally electrochemically inactive and insulating, which reduces the overall energy density and leads to poor cycling stability. Therefore, binder-free electrodes provide a great opportunity for high performance in terms of both improved electronic conductivity and electrochemical reaction reversibility. There is R&D on binder-free electrodes as it can solve problems such as weak interaction and interface problems between the binder and the active material. Thus, growth in demand for binder-free electrodes is expected to restrain the growth of lithium-ion battery binders.

Opportunity: Advancement in battery binder technology

Several R&D activities are being carried out by various institutes and leading companies to improve the characteristics of lithium-ion battery binders. The purpose of these activities is to enhance the properties of binders to make them more effective and increase the battery capacity substantially. Some research activities are specifically aimed at new forms of battery binders to make them more effective, which adds to the overall efficiency of the battery. There is also a growing inclination toward aqueous base materials such as modified styrene butadiene copolymer (SBR) hydrophilic binders. Aqueous base materials can be used for both the anode as well as cathode electrodes and have advantages such as lower cost of manufacturing and pollution-free compared to the use of PVDF, which uses NMP solvents. Hence, the development of battery binders will create growth opportunities for battery binder manufacturers.

Challenge: Underdeveloped infrastructure for electric vehicles

The international sales of EVs are increasing year after year, and many countries are focused on meeting their targets for sustainable surroundings. However, there may be an extended way for the automotive industry to seriously shift from conventional to electric vehicles. The elements that restrict the expansion of the EV industry are its upfront cost, lack of charging infrastructure, range anxiety, and lengthy charging time. The challenge of range anxiety may be dealt with if enough public and personal charging centers are developed for EV charging. The present scenario is completely different as the charging infrastructure is limited to accommodate the changing needs of an EV. Thus, there is a need for supportive infrastructure for the growth of electric vehicles, which can lead to a growth in demand for lithium-ion battery binders.

Based on type, anode binders segment is the largest market during the forecast period

Based on type, lithium-ion battery binders are segmented into anode lithium-ion battery binders and cathode lithium-ion battery binders. Lithium-ion batteries have anode that has binders for better performance of the battery. There is a significant growth in demand for lithium-ion batteries in consumer electronics, electric vehicles, and other industries. This has created a boost in demand for lithium-ion batteries which has led to an increase in demand for lithium-ion battery binders.

Based on battery chemistry, lithium cobalt oxide segment is expected to account for the largest market share during the forecast period

The lithium cobalt oxide segment accounted for the largest segment, by battery chemistry during the forecast period, in terms of value. The lithium cobalt oxide (LCO) battery is one of the most popular types of lithium-ion batteries due to its high energy density. It is majorly used as a power source for smartphones, tablets, laptops, and digital cameras, among others. Lithium cobalt oxide batteries are mainly used in consumer electronics due to their high energy. A short life span (two to three years), low thermal stability, and limited power density make them unsuitable for most other applications. Growing usage of lithium cobalt oxide in consumer electronics is expected to fuel the demand for lithium-ion battery binders.

Based on material, styrene butadiene copolymer segment is expected to hold the highest CAGR during the forecast period

The styrene butadiene copolymer segment is expected to hold the highest CAGR, by material during the forecast period, in terms of value. Styrene butadiene copolymer is a hydrophilic binder consisting of styrene and butadiene in an approximate proportion. Compared to natural rubber, styrene butadiene copolymer has better processability; heat aging; abrasion resistance; and environment-friendliness, cleanliness, and pollution-free. Styrene butadiene copolymer is a water-based binder mainly used to prepare anode electrodes for lithium-ion batteries. There is no need for environmental control in the preparation of styrene butadiene copolymer hydrophilic binder, and no recovery equipment is needed, resulting in lower facility requirements and costs.

Based on end-use, automotive segment is the fastest growing market during the forecast period

The automotive sector is expected the fastest growing market, by end-use during the forecast period, in terms of value. In recent years, lithium-ion batteries have become the primary choice for use in electric and hybrid vehicles. They are lower in weight and require less maintenance than other automotive batteries. The demand for lithium-ion batteries in the automotive industry is increasing due to the rapid growth and development of electric vehicles. According to EV-Volumes, there has been a significant growth in demand for electric vehicles in the past few years. Thus, growth in demand for electric vehicles will enhance the market for lithium-ion battery binders.

Asia Pacific is the largest lithium-ion battery binders market in terms of value

Asia Pacific accounted for the largest share in terms of value, in 2021. There is a significant growth in demand for consumer electronics such as phones, tablets, and laptops along with a surge in demand for electric vehicles. Government initiatives in order to boost the demand for electric vehicles in major economies such as India, China, and South Korea has fueled the demand for lithium-ion battery, this has led to an increase in demand for lithium-ion battery binders. Data centers have also witnessed growth due to an increase in telecom sector. Data centers are shifting their preference from lead acid batteries to lithium-ion batteries which is expected to enhance the market for lithium-ion battery binders in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Lithium-ion Battery Binders Market Players

Major companies in the lithium-ion battery binders market include Arkema (US), Solvay (Belgium), LG Chem (South Korea), ENEOS Corporation (Japan), and Zeon Corporation (Japan), among others. A total of 21 major players have been covered. These players have adopted joint ventures, expansions, agreements, partnerships, and contracts as the major strategies to consolidate their position in the market.

Lithium-ion Battery Binders Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.6 billion |

|

Revenue Forecast in 2027 |

USD 3.7 billion |

|

CAGR |

18.7% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (Ton) |

|

Segments Covered |

Type, Material, Battery Chemistry, End-use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Arkema (US), Solvay (Belgium), LG Chem (South Korea), ENEOS Corporation (Japan), and Zeon Corporation (Japan), among others. |

This research report categorizes the Lithium-ion battery binders Industry based on material, battery type, end-use, and region.

Based on type, the lithium-ion battery binders market has been segmented as follows:

- Anode Binders

- Cathode Binders

Based on battery chemistry, the lithium-ion battery binders market has been segmented as follows:

- Lithium iron phosphate

- Lithium iron phosphate

- Lithium nickel manganese cobalt

- Lithium titanate oxide

- Others

Based on material, the lithium-ion battery binders market has been segmented as follows:

- Polyvinylidene fluoride

- Carboxymethyl cellulose

- Polymethyl Methacrylate

- Styrene Butadiene Copolymer

- Others

Based on end-use, the lithium-ion battery binders market has been segmented as follows:

- Automotive

- Consumer electronics

- Industrial

- Energy Storage

- Others

Based on Region, the lithium-ion battery binders market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In December 2022, Fujian Blue Ocean & Black Stone Technology Co., Ltd. launched a new range of BATTBOND binders to serve customers outside China. These include both cathode and anode binders.

- In June 2022, BASF SE extended its series of Licity anode binders for lithium-ion battery manufacturing. The second-generation styrene butadiene rubber (SBR) binder Licity 2698 X F enables higher capacity, increased number of charge/discharge cycles, and reduced charging times.

- In June 2021, Arkema announced a new range of renewable PVDF grades for lithium-ion batteries, Kynar CTO PVDF grades, which will be produced first in Arkema's Pierre-Bénite factory in France.

Frequently Asked Questions (FAQ):

What is the current size of the global lithium-ion battery binders market?

The lithium-ion battery binders market is projected to grow from USD 1.6 billion in 2022 to USD 3.7 billion by 2027, at a CAGR of 18.7% during the forecast period.

Who are the leading players in the global lithium-ion battery binders market?

Some of the key players operating in the lithium-ion battery binders market are Arkema (US), Solvay (Belgium), LG Chem (South Korea), ENEOS Corporation (Japan), and Zeon Corporation (Japan), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Growing demand in electric vehicle, consumer electronics, and utility sectors- Increasing government initiatives to enhance sales of electric vehiclesRESTRAINTS- Availability of binder-free electrodesOPPORTUNITIES- Advancement of battery binder technology- Declining prices of lithium-ion batteries enhancing adoption rateCHALLENGES- Underdeveloped infrastructure for electric vehicles- Safety related to battery use

-

5.2 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.3 VALUE CHAIN ANALYSISRAW MATERIALSMANUFACTURING LITHIUM-ION BATTERY BINDERSDISTRIBUTION TO END USERS

-

5.4 ECOSYSTEM MAPPING

- 5.5 TECHNOLOGY ANALYSIS

-

5.6 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSMARKET REGULATIONS AND STANDARDS

-

5.7 PATENT ANALYSISINSIGHTS

-

5.8 CASE STUDYBASF SE’S LICITY ANODE BINDERS TO ENHANCE PERFORMANCE METRICS OF LITHIUM-ION BATTERIES- Problem statement- Solutions offered- Outcome

- 5.9 KEY CONFERENCES AND EVENTS (2023–2024)

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 TRADE DATA

-

5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 PRICING ANALYSIS

- 6.1 INTRODUCTION

-

6.2 ANODE BINDERSAUTOMOTIVE AND INDUSTRIAL SECTORS TO INCREASE DEMAND

-

6.3 CATHODE BINDERSGROWING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 LITHIUM IRON PHOSPHATECOST-EFFECTIVENESS TO ENHANCE DEMAND

-

7.3 LITHIUM COBALT OXIDEGROWING USE IN CONSUMER ELECTRONICS TO BOOST DEMAND

-

7.4 LITHIUM NICKEL MANGANESE COBALTAUTOMOTIVE SECTOR TO PROPEL DEMAND

-

7.5 LITHIUM TITANATE OXIDELONGER LIFECYCLE TO BE DEMAND DRIVER

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 POLYVINYLIDENE FLUORIDEPROVIDES HIGH ELECTROCHEMICAL AND THERMAL STABILITY

-

8.3 CARBOXYMETHYL CELLULOSEHAS LOW-COST AND ENVIRONMENT-FRIENDLY CHARACTERISTICS

-

8.4 POLYMETHYL METHACRYLATEEXHIBITS HIGH THERMAL STABILITY

-

8.5 STYRENE BUTADIENE COPOLYMEROFFERS BETTER PROCESSABILITY THAN NATURAL RUBBER

- 8.6 OTHERS

- 9.1 INTRODUCTION

-

9.2 CONSUMER ELECTRONICSHIGH ENERGY DENSITY AND LESS RECHARGE TIME OF LITHIUM-ION BATTERIES TO PROPEL DEMAND

-

9.3 AUTOMOTIVEINCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET

-

9.4 ENERGY STORAGEGROWING INDUSTRIALIZATION TO PROPEL MARKET

-

9.5 INDUSTRIALGROWING USE OF LITHIUM-ION BATTERIES IN CONSTRUCTION AND AEROSPACE INDUSTRIES TO BOOST MARKET

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICIMPACT OF RECESSION- China- South Korea- Japan- India- Rest of Asia Pacific

-

10.3 NORTH AMERICAIMPACT OF RECESSION- US- Canada- Mexico

-

10.4 EUROPEIMPACT OF RECESSION- Germany- France- UK- Italy- Netherlands- Rest of Europe

-

10.5 MIDDLE EAST & AFRICASAUDI ARABIA- Focus on renewables to drive marketUAE- Focus on reducing dependency on oil to drive marketISRAEL- Government initiative to boost automotive sector to contribute to market growthREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICABRAZIL- Growing investment in data centers to help in market growthARGENTINA- Huge lithium ore reserves and government initiatives for electric vehicles to drive marketREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY PLAYERSOVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2021MARKET SHARE OF KEY PLAYERS- Arkema- Solvay- LG Chem- ENEOS Corporation- Zeon CorporationREVENUE ANALYSIS OF TOP 5 PLAYERS

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.5 COMPANY EVALUATION MATRIX (TIER-1 PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING

-

11.7 START-UP/SME EVALUATION QUADRANTRESPONSIVE COMPANIESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY COMPANIESARKEMA- Business overview- Products offered- Recent developments- MnM viewSOLVAY- Business overview- Products offered- Recent developments- MnM viewLG CHEM- Business overview- Products offered- Recent developments- MnM viewENEOS CORPORATION- Business overview- Products offered- Recent developments- MnM viewZEON CORPORATION- Business overview- Products offered- Recent developments- MnM viewASHLAND GLOBAL HOLDINGS INC.- Business overview- Products offeredBASF SE- Business overview- Products offered- Recent developmentsCRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.- Business overview- Products offered- Recent developmentsDAIKIN INDUSTRIES, LTD.- Business overview- Products offered- Recent developmentsDUPONT- Business overview- Products offered- Recent developmentsFUJIAN BLUE OCEAN & BLACK STONE TECHNOLOGY CO., LTD.- Business overview- Products offered- Recent developmentsKUREHA CORPORATION- Business overview- Products offered- Recent developmentsRESONAC HOLDINGS CORPORATION- Business overview- Products offeredSUMITOMO SEIKA CHEMICALS COMPANY, LIMITED- Business overview- Products offeredSYNTHOMER PLC- Business overview- Products offered- Recent developmentsTRINSEO- Business overview- Products offered- Recent developments

-

12.2 OTHER COMPANIESAPV ENGINEERED COATINGS- Products offeredELCAN INDUSTRIES- Products offered- Recent developmentsFUJIFILM WAKO PURE CHEMICAL CORPORATION- Products offeredNANOGRAFI NANO TECHNOLOGY- Products offeredXIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 LITHIUM-ION BATTERY BINDERS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 LITHIUM-ION BATTERY BINDERS MARKET SNAPSHOT: 2022 VS. 2027

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON LITHIUM-ION BATTERY BINDERS MARKET

- TABLE 4 LITHIUM-ION BATTERY BINDERS MARKET: ROLE IN ECOSYSTEM

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REGULATIONS AND STANDARDS FOR LITHIUM-ION BATTERIES

- TABLE 10 LIST OF RECENT PATENTS BY ZEON CORP

- TABLE 11 LIST OF RECENT PATENTS BY TOYOTA MOTOR CO LTD.

- TABLE 12 LIST OF RECENT PATENTS BY ZHUHAI COSMX BATTERY CO LTD

- TABLE 13 LIST OF RECENT PATENTS BY LG CHEM LTD.

- TABLE 14 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 15 LITHIUM-ION BATTERY BINDERS MARKET: KEY CONFERENCES AND EVENTS (2023–2024)

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USES (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END-USES

- TABLE 18 IMPORT DATA ON LITHIUM-ION BATTERIES

- TABLE 19 EXPORT DATA ON LITHIUM-ION BATTERIES

- TABLE 20 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 21 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 22 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY BATTERY CHEMISTRY, 2018–2020 (USD MILLION)

- TABLE 23 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY BATTERY CHEMISTRY, 2021–2027 (USD MILLION)

- TABLE 24 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY MATERIAL, 2018–2020 (USD MILLION)

- TABLE 25 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY MATERIAL, 2021–2027 (USD MILLION)

- TABLE 26 COMPARISON OF HYDROPHILIC AND PVDF BINDER PROCESSING REQUIREMENTS

- TABLE 27 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 28 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 29 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

- TABLE 30 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 31 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY REGION, 2018–2020 (TON)

- TABLE 32 LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY REGION, 2021–2027 (TON)

- TABLE 33 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 34 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 35 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 36 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 38 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (TON)

- TABLE 40 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 41 CHINA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 42 CHINA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 43 SOUTH KOREA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 44 SOUTH KOREA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 45 JAPAN: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 46 JAPAN: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 47 INDIA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 48 INDIA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 49 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 52 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 53 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 54 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 56 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (TON)

- TABLE 58 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 59 US: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 60 US: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 61 CANADA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 62 CANADA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 63 MEXICO: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 64 MEXICO: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 65 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 66 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 67 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 68 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 69 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 70 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 71 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (TON)

- TABLE 72 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 73 GERMANY: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 74 GERMANY: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 75 FRANCE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 76 FRANCE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 77 UK: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 78 UK: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 79 ITALY: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 80 ITALY: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 81 NETHERLANDS: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 82 NETHERLANDS: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 83 REST OF EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 84 REST OF EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 86 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 88 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 89 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 90 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (TON)

- TABLE 92 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 93 SAUDI ARABIA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 94 SAUDI ARABIA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 95 UAE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 96 UAE: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 97 ISRAEL: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 98 ISRAEL: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 99 REST OF MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 100 REST OF MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 101 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2018–2020 (USD MILLION)

- TABLE 102 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 103 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 104 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 105 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

- TABLE 106 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 107 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2018–2020 (TON)

- TABLE 108 SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY COUNTRY, 2021–2027 (TON)

- TABLE 109 BRAZIL: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 110 BRAZIL: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 111 ARGENTINA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 112 ARGENTINA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 113 REST OF SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

- TABLE 114 REST OF SOUTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

- TABLE 115 LITHIUM-ION BATTERY BINDERS MARKET: DEGREE OF COMPETITION

- TABLE 116 LITHIUM-ION BATTERY BINDERS MARKET: COMPANY TYPE FOOTPRINT

- TABLE 117 LITHIUM-ION BATTERY BINDERS MARKET: COMPANY END-USE FOOTPRINT

- TABLE 118 LITHIUM-ION BATTERY BINDERS MARKET: COMPANY REGION FOOTPRINT

- TABLE 119 LITHIUM-ION BATTERY BINDERS MARKET: LIST OF KEY START-UPS/SMES

- TABLE 120 LITHIUM-ION BATTERY BINDERS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 121 LITHIUM-ION BATTERY BINDERS MARKET: PRODUCT LAUNCHES (2019–2022)

- TABLE 122 LITHIUM-ION BATTERY BINDERS MARKET: DEALS (2019–2022)

- TABLE 123 LITHIUM-ION BATTERY BINDERS MARKET: OTHER DEVELOPMENTS (2019–2022)

- TABLE 124 ARKEMA: COMPANY OVERVIEW

- TABLE 125 ARKEMA: PRODUCTS OFFERED

- TABLE 126 ARKEMA: PRODUCT LAUNCHES

- TABLE 127 ARKEMA: DEALS

- TABLE 128 ARKEMA: OTHERS

- TABLE 129 SOLVAY: COMPANY OVERVIEW

- TABLE 130 SOLVAY: PRODUCTS OFFERED

- TABLE 131 SOLVAY: DEALS

- TABLE 132 SOLVAY: OTHERS

- TABLE 133 LG CHEM: COMPANY OVERVIEW

- TABLE 134 LG CHEM: PRODUCTS OFFERED

- TABLE 135 LG CHEM: DEALS

- TABLE 136 LG CHEM: OTHERS

- TABLE 137 ENEOS CORPORATION: COMPANY OVERVIEW

- TABLE 138 ENEOS CORPORATION: PRODUCTS OFFERED

- TABLE 139 ENEOS CORPORATION: DEALS

- TABLE 140 ZEON CORPORATION: COMPANY OVERVIEW

- TABLE 141 ZEON CORPORATION: PRODUCTS OFFERED

- TABLE 142 ZEON CORPORATION: OTHERS

- TABLE 143 ASHLAND GLOBAL HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 144 ASHLAND GLOBAL HOLDINGS INC.: PRODUCTS OFFERED

- TABLE 145 BASF SE: COMPANY OVERVIEW

- TABLE 146 BASF SE: PRODUCTS OFFERED

- TABLE 147 BASF SE: PRODUCT LAUNCHES

- TABLE 148 CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 149 CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.: PRODUCTS OFFERED

- TABLE 150 CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.: OTHERS

- TABLE 151 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 152 DAIKIN INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 153 DAIKIN INDUSTRIES, LTD.: OTHERS

- TABLE 154 DUPONT: COMPANY OVERVIEW

- TABLE 155 DUPONT: PRODUCTS OFFERED

- TABLE 156 DUPONT: DEALS

- TABLE 157 FUJIAN BLUE OCEAN & BLACK STONE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 158 FUJIAN BLUE OCEAN & BLACK STONE TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 159 FUJIAN BLUE OCEAN & BLACK STONE TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 160 KUREHA CORPORATION: COMPANY OVERVIEW

- TABLE 161 KUREHA CORPORATION: PRODUCTS OFFERED

- TABLE 162 KUREHA CORPORATION: OTHERS

- TABLE 163 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 164 RESONAC HOLDINGS CORPORATION: PRODUCTS OFFERED

- TABLE 165 SUMITOMO SEIKA CHEMICALS COMPANY, LIMITED: COMPANY OVERVIEW

- TABLE 166 SUMITOMO SEIKA CHEMICALS COMPANY, LIMITED: PRODUCTS OFFERED

- TABLE 167 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 168 SYNTHOMER PLC: PRODUCTS OFFERED

- TABLE 169 SYNTHOMER PLC: OTHERS

- TABLE 170 TRINSEO: COMPANY OVERVIEW

- TABLE 171 TRINSEO: PRODUCTS OFFERED

- TABLE 172 TRINSEO: DEALS

- TABLE 173 APV ENGINEERED COATINGS: COMPANY OVERVIEW

- TABLE 174 ELCAN INDUSTRIES: COMPANY OVERVIEW

- TABLE 175 ELCAN INDUSTRIES: OTHERS

- TABLE 176 FUJIFILM WAKO PURE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 177 NANOGRAFI NANO TECHNOLOGY: COMPANY OVERVIEW

- TABLE 178 XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 LITHIUM-ION BATTERY BINDERS MARKET SEGMENTATION

- FIGURE 2 LITHIUM-ION BATTERY BINDERS MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR LITHIUM-ION BATTERY BINDERS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 LITHIUM-ION BATTERY BINDERS MARKET: DATA TRIANGULATION

- FIGURE 7 POLYVINYLIDENE FLUORIDE MATERIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 ANODE BINDERS TYPE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 LITHIUM COBALT OXIDE BATTERY CHEMISTRY TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 INDUSTRIAL SEGMENT TO LEAD LITHIUM-ION BATTERY BINDERS MARKET BETWEEN 2022 AND 2027

- FIGURE 11 ASIA PACIFIC DOMINATED LITHIUM-ION BATTERY BINDERS MARKET IN 2021

- FIGURE 12 LITHIUM-ION BATTERY BINDERS MARKET TO WITNESS SIGNIFICANT GROWTH BETWEEN 2022 AND 2027

- FIGURE 13 CHINA AND ANODE BINDERS SEGMENTS ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 ASIA PACIFIC TO BE DOMINANT MARKET DURING FORECAST PERIOD

- FIGURE 15 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LITHIUM-ION BATTERY BINDERS MARKET

- FIGURE 17 GLOBAL VOLUME SALES OF BATTERY ELECTRIC VEHICLES AND PLUG-IN HYBRID ELECTRIC VEHICLES, 2018–2021

- FIGURE 18 LITHIUM-ION BATTERY PACK PRICE, 2013–2021

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS OF LITHIUM-ION BATTERY BINDERS MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS OF BATTERY BINDERS MARKET: HIGHEST VALUE ADDITION DURING MANUFACTURING PHASE

- FIGURE 21 ECOSYSTEM MAPPING OF LITHIUM-ION BATTERY BINDERS MARKET

- FIGURE 22 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 23 PUBLICATION TRENDS – LAST 10 YEARS

- FIGURE 24 LEGAL STATUS OF PATENTS

- FIGURE 25 TOP JURISDICTION, BY DOCUMENT

- FIGURE 26 TOP 10 PATENT APPLICANTS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END-USES

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE, BY REGION

- FIGURE 31 AVERAGE SELLING PRICE, BY MATERIAL

- FIGURE 32 ANODE BINDERS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 33 LITHIUM COBALT OXIDE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 POLYVINYLIDENE FLUORIDE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 35 INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC: LITHIUM-ION BATTERY BINDERS MARKET SNAPSHOT

- FIGURE 38 NORTH AMERICA: LITHIUM-ION BATTERY BINDERS MARKET SNAPSHOT

- FIGURE 39 EUROPE: LITHIUM-ION BATTERY BINDERS MARKET SNAPSHOT

- FIGURE 40 RANKING OF TOP 5 PLAYERS IN LITHIUM-ION BATTERY BINDERS MARKET, 2021

- FIGURE 41 LITHIUM-ION BATTERY BINDERS MARKET SHARE ANALYSIS

- FIGURE 42 REVENUE ANALYSIS OF TOP 5 PLAYERS DURING 2017-2021

- FIGURE 43 LITHIUM-ION BATTERY BINDERS MARKET: COMPANY FOOTPRINT

- FIGURE 44 COMPANY EVALUATION QUADRANT FOR LITHIUM-ION BATTERY BINDERS MARKET (TIER-1 PLAYERS)

- FIGURE 45 START-UP/SME EVALUATION QUADRANT FOR LITHIUM-ION BATTERY BINDERS MARKET

- FIGURE 46 ARKEMA: COMPANY SNAPSHOT

- FIGURE 47 SOLVAY: COMPANY SNAPSHOT

- FIGURE 48 LG CHEM: COMPANY SNAPSHOT

- FIGURE 49 ENEOS CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 ZEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 ASHLAND GLOBAL HOLDINGS INC.: COMPANY SNAPSHOT

- FIGURE 52 BASF SE: COMPANY SNAPSHOT

- FIGURE 53 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 54 DUPONT: COMPANY SNAPSHOT

- FIGURE 55 KUREHA CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 SUMITOMO SEIKA CHEMICALS COMPANY, LIMITED: COMPANY SNAPSHOT

- FIGURE 58 SYNTHOMER PLC: COMPANY SNAPSHOT

- FIGURE 59 TRINSEO: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the lithium-ion battery binders market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the lithium-ion battery binders value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, lithium-ion battery binders manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The lithium-ion battery binders market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of lithium-ion battery binders manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for lithium-ion battery binders, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and lithium-ion battery binders manufacturing companies.

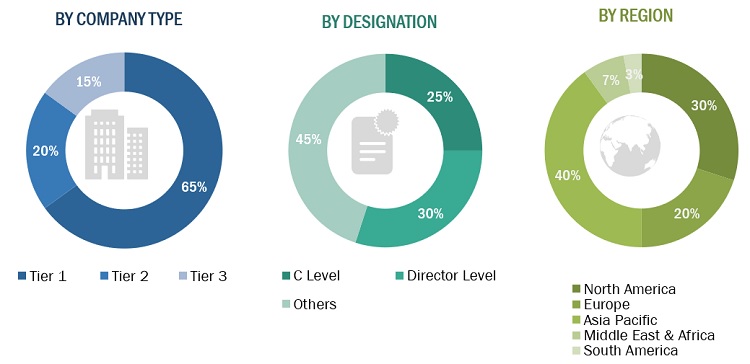

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue <USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

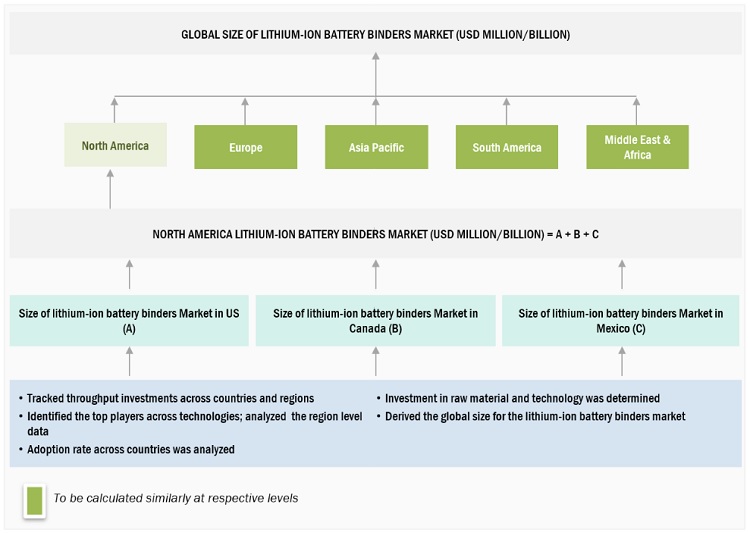

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the lithium-ion battery binders market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the lithium-ion battery binders industry, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Lithium-ion battery binders Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the lithium-ion battery binders market in terms of value and volume

- To define, describe, and forecast the market size by material, type, battery chemistry, end-use, and region

- To forecast the market size with respect to five main regions, namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, joint ventures and expansions in the lithium-ion battery binders market

Competitive Intelligence

- To identify and profile the key players in the lithium-ion battery binders market

- To determine the top players offering various products in the lithium-ion battery binders market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium-ion Battery Binders Market