Battery Materials Market

Battery Materials Market by Battery Type (Lead-Acid, Lithium-Ion), Material [Cathode (LFP, LCO, NMC, NCA, LMO), Anode, Electrolyte], Application (Automotive, Electric Vehicles, Portable Devices, Industrial), and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global battery materials market is projected to grow from USD 83.95 billion in 2025 to USD 147.93 billion by 2030, at a CAGR of 12.0% during the forecast period. The battery materials market is witnessing strong growth driven by rising electrification across industries, increasing adoption of electric vehicles and renewable energy storage, and the expanding use of batteries in consumer electronics. Additionally, widespread applications in industrial backup power and grid storage are supporting the market’s expansion.

KEY TAKEAWAYS

-

BY MATERIALLithium-ion Battery Materials (Cathode Materials {Lithium iron Phosphate (LFP), Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt (NMC), Lithium Nickel Cobalt Aluminum (NCA), Lithium Manganese Oxide (LMO)}, Anode Materials {Natural Graphite, Artificial Graphite, Others}, Electrolyte Materials, Other Materials); Lead Acid Battery Materials (Cathode Materials, Anode Materials, Electrolyte Materials, Other Materials); Others

-

BY BATTERY TYPELithium-ion, Lead Acid, Others

-

BY APPLICATIONLithium-ion Battery (Portable Devices, Electric Vehicles, Industrial, Others); Lead Acid Battery (Automotive, Industrial, Others); Others

-

BY REGIONThe battery materials market covers Europe, North America, Asia Pacific, and Rest of the World.

-

COMPETITIVE LANDSCAPEBASF (Germany), POSCO Future M (South Korea), Asahi Kasei Corporation (Japan), Umicore (Belgium), and Sumitomo Metal Mining Co., Ltd. (Japan) are the leading manufacturers of battery materials. They focus on expanding their geographic reach to cater to consumer demand. Besides expansions, companies adopted agreements, joint ventures, and others to gain new projects, strengthen their product & service portfolios, and cater to untapped markets.

The battery materials market is experiencing significant growth fueled by accelerating electrification across industries, surging adoption of electric vehicles and renewable energy storage systems, and the rising demand from consumer electronics. The global transition toward clean energy and sustainable mobility, along with ongoing innovations in cathode, anode, and electrolyte technologies, is further boosting demand. Moreover, the expanding use of batteries in industrial backup power and grid storage continues to drive market expansion.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The battery materials market is undergoing rapid expansion, driven by the global shift toward electrification and clean energy adoption. Rising demand for electric vehicles, renewable energy storage systems, and advanced consumer electronics is fueling the need for high-performance materials such as cathodes, anodes, electrolytes, and separators. Continuous innovations in chemistries, including NMC, LFP, LCO, LTO, and LMO, are enhancing battery efficiency, cost-effectiveness, and sustainability. At the same time, the growing use of batteries in industrial applications and grid-scale storage solutions is further reinforcing market growth.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth of HEVs, PHEVs, and EVs to accelerate demand for lithium-ion batteries

-

High demand for lithium-ion technology in the renewable energy industry

Level

-

Stringent safety requirements for batteries during operations

-

Inadequate charging infrastructure

Level

-

Use of batteries in energy storage devices

-

Innovation and advances in lithium-ion battery technology

Level

-

Overheating issues of lithium-ion batteries

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: High demand for lithium-ion technology in the renewable energy industry

The swift expansion of the renewable energy sector is quickly becoming a key driver of the global battery materials market due to the increase in demand for lithium-ion batteries in energy storage applications. As solar and wind energy generation continues to grow, the crucial need for high-capacity batteries to store the increasingly pronounced intermittency of power is also inevitable. The bulge in intermediate transmission is creating very strong demand for battery commodity inputs, ie, lithium, nickel, cobalt, and graphite, which are the major inputs for lithium-ion cell manufacture. Should policies remain favorable with continuing technological advancements and global decarbonization efforts, the battery materials will operate in a long-term and sustained direction.

Restraints: Stringent safety requirements for batteries during operation

Aviation experts and safety officials are worried about the rise in fires and smoke due to batteries on planes. Storing a lot of energy in small packages is becoming increasingly essential with portable electronic devices becoming smaller and lighter due to improvements in lithium battery technology. We are able to put a lot more energy into smaller packages now than we could even a decade ago. As lithium battery use has grown in consumer electronics, we have seen an increase in battery fires in devices such as laptops and smartphones. Over five years, the U.S. Consumer Product Safety Commission has recorded over 25,000 overheating or fire incidents related to more than 400 types of lithium battery-powered products. There have been battery fires in electric scooters. In 2022, Ola Electric was forced to recall its electric scooters. Similarly, there was a recall of the Samsung Galaxy Note7 due to fire hazard issues. Recall incidents can make or break the sale of any electric vehicle or gadget; they can negatively impact the market for battery materials.

Opportunity: Use of batteries in energy storage devices

An energy storage device is a device that is used to store electrical energy. Energy storage technology is relatively new technology, and it is becoming more widespread. These technologies are used in hybrid automobile systems and renewable energy generation to combat the rising issues of global warming. Lithium-ion batteries and lead-acid batteries can be used as large-capacity energy storage systems. These batteries are made to give high levels of performance and high-power demands in many applications. Battery energy storage systems use high-quality materials in the battery structure to achieve sufficient energy storage plus longevity in the battery life cycle. Battery energy storage devices serve a critical function in data centers, smoothing electrical fluctuations when the main electrical supply is lost. When the UPS detects an interruption in the utility supply, the UPS, plus battery energy storage devices, guarantees continuous power to important loads. The likelihood of a fault should create demand for UPS in large data centers, possibly creating opportunities for battery storage technologies, using lithium-ion type batteries and lead-acid type batteries.

Challenge: Overheating issues of lithium-ion batteries

Lithium-ion batteries are utilized in consumer electronics, automobiles, electrical systems, commercial aviation, AGVs, forklifts, pallet trucks, and material handling equipment. The lithium-ion battery does store a relatively large amount of energy in its volume but is susceptible to rapidly heating up can even catch fire with a fault. There are many reasons overheating occurs. Lithium is an extremely volatile material and when in the battery, when the separator is positioned between the cathode and the anode, there is disruption, a short circuit takes place, and the physical insult to the separator causes melting of the separator and overheating. When a battery leaks the liquid will react chemically with surrounding components and cause overheating. Some overheating can be caused through software as there are devices that use software that are not capable of issuing automated instructions to turn off the charging port, this can take place while the battery is charging. This can also lead to continued charging, thus overcharging and as a battery expands, this will lead to the battery swelling, this introduces another major problem for lithium-ion battery producers. All of these represent a barrier to market development for the battery and negative issues with battery materials.

Battery Materials Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Production of high-nickel cathode active materials (NCM & NCMA) and synthetic graphite anodes for EV and ESS batteries. | Higher energy density, longer driving range, enhanced charging speed, stable supply chain integration. |

|

Supplies high-quality nickel and cobalt materials used in NCA and NMC cathodes for leading EV battery makers. | Ensures consistent cathode performance, high thermal stability, supports high-capacity and long-life batteries. |

|

Development of battery separators (Hipore™ polyolefin microporous membrane) widely used in lithium-ion batteries. | Superior safety (prevents short-circuits), high ionic conductivity, thinner and more efficient separators enabling higher energy density. |

|

Development of next-gen cathode active materials with reduced cobalt content. | Cost reduction, improved sustainability, optimized battery performance. |

|

Cathode material production (NMC and NCA) for multiple EV manufacturers. | Sustainable sourcing, improved performance, and recycling integration. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The battery materials market ecosystem consists of raw material suppliers (Glencore, Nyrstar, Korea Zinc), manufacturers (Asahi Kasei Corporation, BASF, Umicore), and end users (Power Sonic, BYD, Amaron). Raw materials like lithium, nickel, cobalt, and graphite are processed into advanced battery-grade components used in electric vehicles, consumer electronics, and energy storage systems. End users drive demand for energy density, safety, and cost-efficiency, while manufacturers deliver innovative, tailored chemistries and engineered solutions. Collaboration across the battery materials value chain is key to technological innovation, supply chain resilience, and overall market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Battery Materials Market, By Battery Type

The battery materials market is divided based on battery types into lead-acid, lithium-ion, and others. Other battery types include nickel-cadmium (NiCd), nickel-metal hydride (NiMH), flow batteries, and sodium-based batteries. These rechargeable batteries, also called secondary batteries, can be charged, discharged, and recharged multiple times because of their reversible electrochemical reactions. Each battery system features a unique mix of cathode, anode, electrolyte, and separator materials, designed for different voltage, size, and energy capacity needs. These technologies are used in a variety of applications, including electric vehicles (EVs), portable electronics, grid-scale energy storage systems (ESS), industrial power backup, and consumer devices.

Battery Materials Market, By Material

The battery materials market is segmented based on material into anode, cathode, electrolytes, and others. The other materials include binders, current collectors, and packaging materials. The anode and cathode are the key electrode materials that generate electricity through redox reactions, with the electrolyte enabling this process by allowing ions to flow between them inside the battery. The growing demand for batteries in mobile phones, tablets, motor vehicles, and eco-friendly EVs is leading to the growth of the battery materials market.

Battery Materials Market, By Application

The battery materials market is segmented into various applications, depending on the type of battery. For lithium-ion batteries, the market is segmented based on application into EVs, portable devices, and industrial. For lead-acid batteries, the market is segmented into automotive and industrial. The characteristics of lead-acid batteries make them attractive for use in stationary & non-stationary applications. The non-stationary applications of lead-acid batteries include their use in automobiles for starters. Stationary application includes use in the industrial sector. The demand for lithium-ion batteries is increasing because of the growing need for miniature and lightweight sources of power in various EVs, portable devices, and industrial equipment. Lithium-ion batteries can deliver effective power while managing manufacturing costs as well as the weight and size of products. The use of lithium-ion batteries in consumer electronics and medical applications can aid in manufacturing small-sized and lightweight products. Manufacturers of battery materials are adopting different technologies to increase the efficiency of batteries used in various applications. Huge investment is also made in the R&D of batteries and battery materials to make them more compatible with different devices.

REGION

Asia Pacific is to be fastest-growing region in global battery materials market during forecast period

The Asia Pacific battery materials market is expected to register the highest CAGR during the forecast period, driven by Rapid industrialization, particularly the expansion of the automotive and other key sectors, which are major consumers of battery materials, is expected to drive the regional battery materials market during the forecast period

Battery Materials Market: COMPANY EVALUATION MATRIX

In the battery materials market matrix, BASF stands out as a star performer, holding a leading market share with a broad and advanced product footprint across key battery material segments. The company's strategic investments in chemical innovation and supply chain integration enable it to address industry demands for quality, performance, and sustainability. Mitsubishi Chemical Group, as an emerging leader, is steadily increasing its visibility through expanding product lines and technology advancements, supporting next-generation battery applications. Companies positioned as participants and pervasive players contribute to market dynamism with targeted offerings and specialized solutions, collectively driving growth and evolution within the battery materials value chain.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 73.43 BN |

| Market Forecast in 2030 (value) | USD 147.93 BN |

| Growth Rate | CAGR of 12.0% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, and Rest of the World |

WHAT IS IN IT FOR YOU: Battery Materials Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading EV OEM |

|

|

| Battery Material Manufacturer |

|

|

| Battery Cell Producer |

|

|

| Raw Material Supplier |

|

|

| Energy Storage Developer |

|

|

RECENT DEVELOPMENTS

- March 2025 : POSCO Future M introduced a new silicon-carbon (Si-C) anode material designed to significantly enhance lithium-ion battery performance. This next-generation anode offers approximately five times the storage capacity of traditional graphite-based anodes, contributing to extended driving ranges for electric vehicles. A demonstration plant for the Si-C anode has been operational since May 2024, with plans for mass production by 2027.

- December 2024 : Mitsubishi Chemical Group Corporation announced a significant anode production capacity expansion at its Kagawa Plant in Sakaide, Japan. Starting in October 2026, the facility will ramp up its output of natural-graphite-based anode material to 11,000?t/year, leveraging its proprietary low-swelling natural graphite technology for superior battery life and lower GHG emissions.

- November 2024 : Asahi Kasei Corporation and Honda Motor Co., Ltd. formed a joint venture in Ontario, Canada, named Asahi Kasei Honda Battery Separator Corporation. This partnership will locally produce Hipore lithium-ion battery separators.

- July 2024 : POSCO Future M and General Motors (GM) partnered to supply both cathode and anode materials for the Cadillac Lyriq—GM’s first electric vehicle to fully incorporate POSCO Future M’s battery components. The Lyriq features high-nickel NCMA cathodes and low-expansion natural graphite anodes developed by POSCO Future M. These advanced materials help improve the vehicle’s energy density, extend its driving range, and support faster charging times.

Table of Contents

Methodology

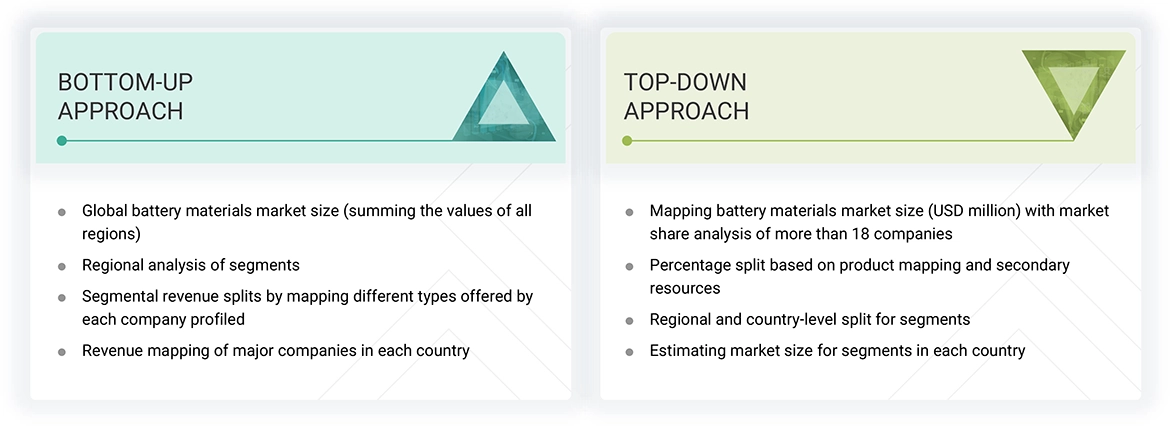

The research involved four main steps to assess the current market size of battery materials. Extensive secondary research was carried out to collect information on the market, related peer markets, and parent markets. The next phase was to verify these findings, assumptions, and measurements with industry experts across the battery materials value chain through primary research. The overall market size was determined using both top-down and bottom-up approaches. Then, market segmentation analysis and data triangulation were used to define the sizes of different market segments and sub-segments.

Secondary Research

The research approach used to evaluate and forecast the battery materials market starts with collecting revenue data from leading suppliers through secondary research. During this process, multiple sources such as Hoovers, Bloomberg BusinessWeek, Factiva, the World Bank, and industry magazines were employed to gather information for this study. These secondary sources included annual reports, press releases, investor presentations from companies, white papers, reputable periodicals, writings by respected authors, regulatory agency announcements, trade directories, and databases. Vendor offerings were examined to determine market segmentation.

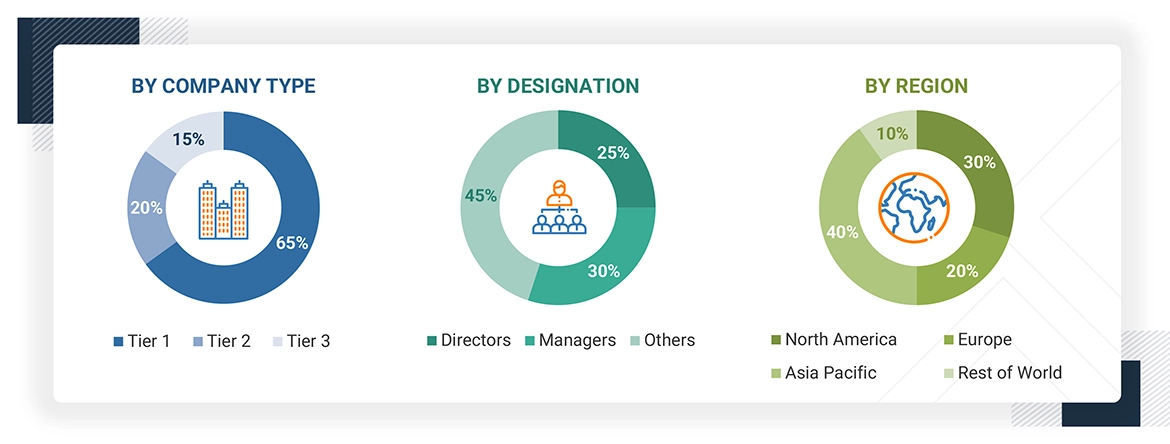

Primary Research

The battery materials market involves various stakeholders, such as manufacturers, suppliers, traders, associations, and regulatory organizations within the supply chain. The demand side is driven by the growth of electric vehicles, portable devices, industrial, and other applications. On the supply side, technological advancements are prominent. To gather qualitative and quantitative data, interviews were conducted with several key sources from both the supply and demand sides of the market.

The following outlines the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were employed to estimate and verify the overall size of the battery materials market. These methods were also widely used to determine the size of various sub-segments within the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the battery materials market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Battery Materials Market Size: Bottom-up and Top-down Approach

Data Triangulation

After estimating the overall market size using the methods described above, the market was divided into various segments and sub-segments. To complete the market engineering process and determine precise statistics for each segment and sub-segment, data triangulation and market breakdown procedures were used where applicable. The global market size was then calculated by adding together the data from individual countries and regions.

Market Definition

Batteries utilize various elements that are mined from the Earth's crust. Each battery consists of four main components: anode, cathode, electrolyte, and separators. There are also several other important parts, such as binders, current collectors, and packaging materials. Different raw materials are used in manufacturing batteries for different types. In this study, materials used in making rechargeable lead-acid batteries, lithium-ion batteries, and others (such as sodium-based, nickel-based, and flow batteries) are examined.

Stakeholders

- Battery material manufacturers

- Battery material suppliers

- Battery material traders, distributors, and suppliers

- Investment banks and private equity firms

- Raw material suppliers

- Government and research organizations

- Consulting companies/consultants in the chemicals and materials sectors

- Industry associations

- Contract manufacturing organizations (CMOs)

- NGOs, governments, investment banks, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the size of the global battery materials market in terms of volume and value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global battery materials market

- To analyze and forecast the size of various segments (raw material and application) of the battery materials market based on four major regions—North America, Asia Pacific, Europe, and Rest of World, along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as agreements, partnerships, product launches, and joint ventures, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the critical driver for the battery materials market?

High demand for lithium-ion technology in the renewable energy industry.

Which region is expected to register the highest CAGR in the battery materials market during the forecast period?

The Asia Pacific region is projected to register the highest CAGR during the forecast period.

What is the major end-use industry of battery materials?

Electric vehicles are the major end-use industry for battery materials.

Who are the major players in the battery materials market?

Key players include BASF (Germany), POSCO Future M (South Korea), Asahi Kasei Corporation (Japan), Umicore (Belgium), and Sumitomo Metal Mining Co., Ltd. (Japan).

What is expected to be the CAGR of the battery materials market from 2025 to 2030?

The market is expected to grow at a CAGR of 12.0% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Battery Materials Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Battery Materials Market