Magnetic Sensor Market by Type (Hall Effect, Magnetoresistive (AMR, GMR, TMR), SQUID, Fluxgate), Range (<1microgauss, 1microgauss-10gauss, and >10gauss), Application, End-user Industry, Geography - Global Forecast

Magnetic Sensor Market Size

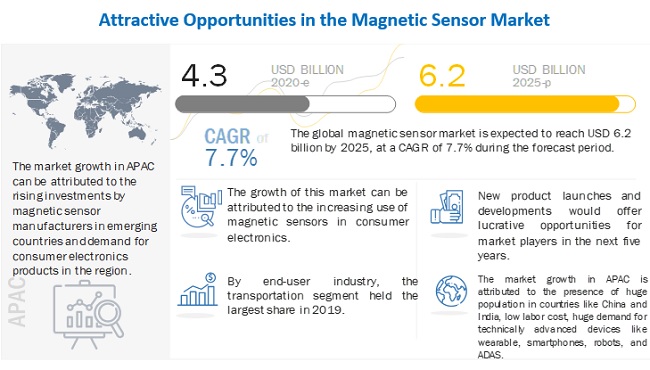

[233 Pages Report] The Magnetic sensor market size is projected to reach USD 6.2 billion by 2025 from an estimated USD 4.3 billion in 2020, at a CAGR of 7.7% from 2020 to 2025.

Magnetic Sensor Market Share

Intensifying focus of manufacturers towards producing 3D magnetic sensors and increasing investments in magnetic sensor ecosystem are among the factors driving the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Magnetic sensor Market

The outbreak and the spread of COVID-19 have significantly impacted players operating in the magnetic sensor value chain. The increased global demand for smartphones is one of the key factors fueling the growth of the magnetic sensor market. However, as the sales of smartphones have decreased significantly worldwide owing to lockdowns imposed by different governments to contain the spread of the COVID-19, it has impacted the growth of market. Moreover, these lockdowns have also impacted the production of magnetic sensors. They have also affected the GDP of countries and the per capita income of individuals across the world. The low disposable income has resulted in reduced purchasing power of masses, thereby resulting in a decline in the y-o-y growth for the whole market.

Market Dynamics:

Driver: Increasing investments in magnetic sensor ecosystem

Rising adoption of magnetic sensors in advanced applications, such as autonomous cars, is expected to spur the growth of magnetic market across the globe. Magnetic sensors used in these systems are highly efficient, highly accurate, reliable, robust, and simple in design. Magnetic sensor manufacturers are increasingly investing in different magnetic sensing technologies, such as 3D sensing, tunnel magnetoresistance (TMR), and giant magnetoresistance (GMR), to enhance their domain expertise and strengthen their market position. Moreover, these players are also expanding their magnetic sensor product portfolios by introducing newer products to cater to the needs of various end-use markets. For instance, in February 2020, Allegro MicroSystems, LLC (US) introduced ATS19580, a fully-integrated, back-biased GMR transmission speed and direction sensor for automotive applications. The sensor helps reduce system size, complexity, and costs, resulting in improved fuel economy.

Restraint: Intense pricing pressure

While the widespread application of magnetic sensors in automated vehicles, consumer electronics, and healthcare devices leads to increased shipment of these sensors, the sales growth is significantly restrained by price erosion. This is partially a result of the intense competition among the rising number of sensor manufacturers. Several companies are channeling their research & development activities toward providing cost-effective solutions for existing magnetic sensing technologies, such as position, speed, and angle sensors manufactured using MEMS and 3D sensing technology. Aggressive R&D efforts lead to rapid innovation in new portable, consumer, and IoT applications, which, in turn, leads to pricing pressure, especially for high-volume applications.

Consequently, manufacturers are compelled to decrease the potential price of magnetic sensors. This fall in price not only hampers the revenue growth in the highly competitive magnetic sensor market but also reduces the profit margins for suppliers. The major challenges for the companies operating in this market are to increase their manufacturing capabilities, provide improved quality products, and reduce the overall cost of production.

Opportunity: Increasing manufacturing of hybrid and electric cars

Hybrid and electric vehicles are gaining traction as they are more digitally connected than conventional vehicles. Also, they reduce the consumption of fossil fuels, such as petrol and diesel, reduce global warming and ecological damage, and offer superior fuel efficiency. Additionally, due to COVID-19, the automotive industry has been facing a slowdown in demand for hybrid, electric, and autonomous vehicles. However, the demand for hybrid, electric, and autonomous cars is likely to be higher than that of any other vehicle type in the post-COVID-19 period. The surge in demand for these cars can be attributed to changing lifestyles, governments encouraging the adoption of green vehicles to reduce CO2 emissions and the advent of advanced technologies.

One of the major advantages of using electric cars is that these cars are pollution free. In addition, several giant car manufacturers, such as GM (US), Ford (US), and Renault (France), are expanding their hybrid and electric car businesses. Power electronics is a key technology for hybrids and accounts for ~20% of the total cost of hybrid vehicles. This creates high growth opportunities for magnetic sensors in position, speed, and angular detection and measurement applications.

Challenge: Anticipated shortage of raw material for manufacturing of sensors and supply chain disruption due to COVID-19

The COVID-19 pandemic, which has led to the loss of several lives, is also charged with political and economic ramifications. Consequently, the problem of raw material shortage for magnetic sensor manufacturing is expected to be aggravated further as the major raw material suppliers belong to China and Taiwan. Moreover, the COVID-19 outbreak has severely affected the global manufacturing sector owing to supply chain disruptions. The pandemic has significantly affected end users of magnetic sensors, including the automotive sector. The decline in automotive production has resulted in decreased global demand for magnetic sensors. Owing to this, the production volume of magnetic sensors has also decreased. This has impacted the revenue of magnetic sensor manufacturers, such as Melexis (Belgium) and Allegro MicroSystems, LLC (US), who majorly offer magnetic sensors for automotive applications. Hence, the shortage of raw material, decrease in demand for end-use products, and supply chain disruptions are acting as challenges for the manufacturers of magnetic sensors.

By type, Hall effect sensor held the largest market share in 2019

In 2019, Hall effect sensors held the largest share of the magnetic sensor market and is expected to continue to account for the largest share over the forecast period. The growth of the segment can be attributed to the rising demand for Hall effect sensors from automotive and consumer electronics industries. The automotive industry is among the major consumers of Hall effect sensors; they are used in ADAS and hybrid and electric vehicles for position and speed measurement.

Speed sensing application is projected to register the highest CAGR from 2020 to 2025

The magnetic sensor market for speed sensing applications is projected to grow at the highest CAGR during the forecast period. The growth can be attributed to the rising demand for highly accurate, small size, simple design, reliable, and pocket-friendly magnetic speed sensors in the automotive industry. In the automotive industry, speed sensors are found in anti-lock braking system (ABS), engine camshafts/crankshafts, speedometers, and automatic transmissions.

Transportation segment lead magnetic sensor market in 2019

In 2019, the transportation segment held the largest share of the magnetic sensor market. The surge in demand for safety and navigation features in the automotive industry has increased the usage of magnetic sensors in this industry. Additionally, safety-related mandates in regions such as North America and Europe are acting as drivers for the adoption of magnetic sensors in the transportation industry. Moreover, modernization of rail networks and deployment of innovative navigation systems in next-generation submarines are also among the factors driving the growth of market in the transportation industry.

To know about the assumptions considered for the study, download the pdf brochure

APAC to lead magnetic sensor market during forecast period

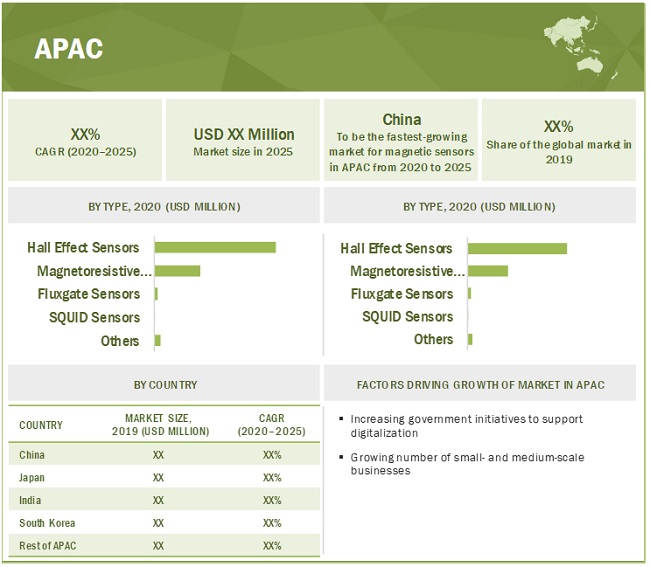

In 2019, APAC held the largest share of the overall market; it is expected to grow at the highest CAGR during the forecast period. Growing demand for magnetic sensors in cars and consumer electronics is driving the growth of the market in APAC. Also, the increasing number of small and medium-sized enterprises (SMEs) and increasing investments by these companies in developing improved magnetic sensors for varied applications are driving the growth of market. Furthermore, China, Japan, India, and South Korea are among the top 20 countries in terms of automotive production worldwide; thus, this region presents huge growth opportunities for the magnetic sensor market.

Key Market Players

Asahi Kasei Corporation (Japan), Allegro MicroSystems, LLC (US), Infineon Technologies AG (Germany), TDK Corporation (Japan), Melexis (Belgium), Honeywell International Inc. (US), TE Connectivity (Switzerland), ams AG (Austria) are some of the key players in the magnetic sensor market.

Scope of Magnetic Sensor Market Report

|

Report Metric |

Details |

| Estimated Market Size | USD 4.3 Billion |

| Projected Market Size | USD 6.2 Billion |

| Growth Rate | CAGR of 7.7% |

|

Market size available for years |

2020–2025 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Increasing Investments In Magnetic Sensor Ecosystem |

| Largest Growing Region | Asia Pacific (APAC) |

| Largest Market Share Segment | Hall Effect Sensor |

| Highest CAGR Segment | Speed Sensing Application |

This research report categorizes the magnetic sensor market based on type, range, application, and end-user industry, and region

Based on type:

- Hall Effect Sensors (Hall ICs, Hall element)

- Magnetoresistive Sensors (anisotropic magnetoresistive (AMR) sensors, giant magnetoresistive (GMR) sensors, tunnel magnetoresistive (TMR) sensors)

- SQUID Sensors (high–temperature SQUID, low–temperature SQUID)

- Fluxgate Sensors

- Others (optically pumped, magnetodiode, magneto-optical, search coil, magnetoinductive, Overhauser, reed)

Based on range:

- <1 microgauss

- 1 microgauss–10 gauss

- >10 gauss

Based on application:

- Speed Sensing

- Proximity Detection/NDT

- Position Sensing

- Navigation and Electronic compass

- Flow rate Sensing

- Others (magnetoencephalography (MEG), magnetic resonance imaging (MRI), magnetocardiography (MCG), magnetomyography, and magnetoneurography as well as rotational reference detection)

Based on end-user industry

- Transportation

- Consumer Electronics

- Healthcare

- Aerospace & Defense

- Industrial

- BFSI

- Others (energy & power, food & beverages (F&B), and research)

Based on region:

- North America

- Europe

- APAC

- RoW

Recent Developments

- In June 2020, Asahi Kasei Corporation launched AK8781, an ultra-small package latch-type Hall IC, suitable for small DC brushless (BL) motors. It is a small package with a fast response time that is suitable for high-temperature operations. The launch of this product is expected to contribute to the micro-miniaturization and high efficiency of DCBL motors.

- In April 2020, TDK Corporation ventured with Genetesis, a US-based magnetocardiography (MCG) technology company and a world leader in non-invasive biomagnetic imaging solutions, to develop advanced medical imaging solutions for cardiac diagnostics. As a part of this development, Genetesis is expected to leverage global reach and expertise of TDK Corporation in biomagnetic sensors, piezoelectric actuators, magnetic noise suppression systems, MEMS technologies, etc.

- In April 2020, Infineon Technologies AG acquired Cypress Semiconductor Corporation, a US-based semiconductor designing and manufacturing company to strengthen its power semiconductors, automotive microcontrollers, sensors, and security solutions offerings. In addition, the company also focuses on catering to the requirements of ADAS/AD, IoT, and 5G mobile infrastructures.

- In March 2020, Melexis introduced high-linearity, low-drift linear Hall sensor IC for safety-critical automotive torque-sensing applications such as electric power-assisted steering (EPAS).

- In February 2020, Allegro MicroSystems, LLC introduced ATS19580, a fully-integrated, back-biased GMR transmission speed and direction sensor. This sensor reduces system size, complexity, and costs, resulting in improved fuel economy.

Frequently Asked Questions (FAQ):

Which are the major companies in the magnetic sensor market? What are their major strategies to strengthen their market presence?

The major companies in the image sneers market are – Asahi Kasei Corporation (Japan), Allegro MicroSystems, LLC (US), Infineon Technologies AG (Germany), TDK Corporation (Japan), Melexis (Belgium). The major strategies adopted by these players are product launches and developments, and expansions.

Which is the potential market for magnetic sensors in terms of region?

The APAC region is expected to dominate the magnetic sensor market due to the rising population and rising penetration of smartphones in countries in APAC are expected to further drive the market in the near future. The increase in demand for green vehicles are creating demand for magnetic sensors for the automotive sector.

What are the opportunities for new market entrants?

The different types of solution considered in the research study include data analytics, data discovery, data visualization, inventory analytics, and data management.

What are the drivers and opportunities for the magnetic sensor market?

Factors such as intensifying focus of manufacturers toward producing 3D magnetic sensors and increasing investments in magnetic sensor ecosystem are the major factors driving the growth of the magnetic sensor market. Moreover, increasing adoption of magnetic sensors in healthcare applications provides significant opportunities.

Which end-user industry is expected to drive the growth of the market in the next 5 years?

Yes, the report includes the impact of COVID-19 on mobile apps and web analytics market. It illustrates the pre- and post- COVID-19 market scenario. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

FIGURE 1 MAGNETIC SENSOR INDIRECTLY MEASURING PHYSICAL PARAMETERS

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 2 MAGNETIC SENSOR MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 3 MAGNETIC SENSOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 FACTOR ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF MAGNETIC SENSORS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): ILLUSTRATIVE EXAMPLE OF COMPANY OPERATING IN MAGNETIC SENSOR MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 – BOTTOM-UP APPROACH FOR ESTIMATION OF SIZE OF MARKET BASED ON END USER

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.1.1 Approach for capturing market size using bottom-up analysis (demand side)

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.3.2.1 Approach for capturing market share using top-down analysis (supply side)

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 MAGNETORESISTIVE SENSORS TO REGISTER HIGHEST CAGR FROM 2020 TO 2025

FIGURE 11 >10 GAUSS SEGMENT TO CONTINUE TO LEAD MAGNETIC SENSOR MARKET FROM 2020 TO 2025

FIGURE 12 SPEED SENSING SEGMENT OF MARKET TO WITNESS HIGHEST GROWTH FROM 2020 TO 2025

FIGURE 13 CONSUMER ELECTRONICS TO EXHIBIT HIGHEST CAGR IN MARKET FROM 2020 TO 2025

FIGURE 14 APAC LIKELY TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2025

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 15 INCREASING DEMAND FOR SMARTPHONES, PERSONAL COMPUTERS, LAPTOPS, AND TABLETS TO FUEL DEMAND FOR MAGNETIC SENSORS IN COMING YEARS

4.2 MARKET, BY REGION

FIGURE 16 APAC TO CAPTURE LARGEST SHARE OF GLOBAL MARKET IN 2025

4.3 MARKET, BY COUNTRY

FIGURE 17 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4.4 MARKET, BY RANGE AND END-USER INDUSTRY

FIGURE 18 > 10 GAUSS AND TRANSPORTATION SEGMENTS TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MAGNETIC SENSOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Intensifying focus of manufacturers toward producing 3D magnetic sensors

5.2.1.2 Increasing investments in magnetic sensor ecosystem

5.2.1.3 Unceasing growth of consumer electronics industry

FIGURE 20 MARKET: DRIVERS AND THEIR IMPACTS

5.2.2 RESTRAINTS

5.2.2.1 Intense pricing pressure

FIGURE 21 MARKET: RESTRAINTS AND THEIR IMPACTS

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of magnetic sensors in healthcare applications

5.2.3.2 Increasing manufacturing of hybrid and electric cars

FIGURE 22 PROJECTED INCREASE IN SALES FROM 2019 TO 2040

FIGURE 23 MARKET: OPPORTUNITIES AND THEIR IMPACTS

5.2.4 CHALLENGES

5.2.4.1 Need for high product differentiation and innovation to meet unique end-use requirements

5.2.5 COVID-19-DRIVEN CHALLENGES

5.2.5.1 Anticipated shortage of raw material for manufacturing of sensors and supply chain disruption due to COVID-19

FIGURE 24 MAGNETIC SENSOR MARKET: CHALLENGES AND THEIR IMPACTS

5.3 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MARKET

FIGURE 25 REVENUE SHIFT IN MARKET

5.4 MAGNETIC SENSOR ECOSYSTEM

FIGURE 26 MAGNETIC SENSOR ECOSYSTEM

5.5 AVERAGE SELLING PRICE ANALYSIS

TABLE 1 AVERAGE SELLING PRICE OF MAGNETIC SENSORS FROM 2018 TO 2019

5.6 VALUE CHAIN ANALYSIS

FIGURE 27 MAGNETIC SENSOR VALUE CHAIN

5.7 TECHNOLOGY TRENDS

5.7.1 KEY TECHNOLOGIES

5.7.1.1 MEMS technology

5.7.2 COMPLEMENTARY TECHNOLOGIES

5.7.2.1 3D magnetic sensing technology

5.7.3 ADJACENT TECHNOLOGIES

5.7.3.1 CMOS technology

5.7.3.2 CCD technology

5.8 CASE STUDIES

5.8.1 TMR CURRENT SENSORS OFFERED BY TDK CORPORATION FOR BATTERY MONITORING

5.8.2 MAGNETOINDUCTIVE SENSORS OFFERED BY MICRO-EPSILON FOR CATRA (UK) HELPED CATRA IN QUALITY CONTROL

6 IMPACT OF COVID-19 ON MAGNETIC SENSOR MARKET (Page No. - 65)

FIGURE 28 GLOBAL PROPAGATION OF COVID-19

FIGURE 29 PROPAGATION OF COVID-19 IN SELECTED COUNTRIES

FIGURE 30 PRE-AND POST-COVID-19 SCENARIO OF MARKET

FIGURE 31 PRE-AND POST-COVID-19 SCENARIO OF MARKET, BY TYPE

FIGURE 32 PRE-AND POST-COVID-19 SCENARIO OF MARKET, BY RANGE

FIGURE 33 PRE-AND POST-COVID-19 SCENARIO OF MARKET, BY APPLICATION

FIGURE 34 PRE-AND POST-COVID-19 SCENARIO OF MARKET, BY END-USER INDUSTRY

FIGURE 35 PRE-AND POST-COVID-19 SCENARIO OF MAGNETIC SENSOR MARKET, BY REGION

7 MAGNETIC SENSOR MARKET, BY TYPE (Page No. - 71)

7.1 INTRODUCTION

FIGURE 36 MAGNETIC SENSOR MARKET, BY TYPE

FIGURE 37 MAGNETORESISTIVE SENSORS TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 2 MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 3 MARKET, BY TYPE, 2017–2025 (MILLION UNITS)

7.2 HALL EFFECT SENSORS

7.2.1 HALL ICS

7.2.1.1 Hall ICs held larger share of market in 2019

7.2.2 HALL ELEMENTS

7.2.2.1 Increasing demand for reliable and highly accurate Hall elements to fuel market growth

TABLE 4 MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY SUBTYPE, 2017–2025 (USD MILLION)

TABLE 5 MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY SUBTYPE, 2017–2025 (MILLION UNITS)

TABLE 6 MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 7 MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 8 TRANSPORTATION MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 9 CONSUMER ELECTRONICS MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 10 HEALTHCARE MARKET FOR HALL EFFECT MAGNETIC SENSOR, BY REGION, 2017–2025 (USD MILLION)

FIGURE 38 AEROSPACE AND DEFENSE MARKET FOR HALL EFFECT MAGNETIC SENSORS IN APAC IS PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 11 AEROSPACE & DEFENSE MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 12 INDUSTRIAL MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 13 OTHERS MARKET FOR HALL EFFECT MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

7.3 MAGNETORESISTIVE SENSORS

TABLE 14 BENEFITS AND APPLICATIONS OF MAGNETORESISTIVE SENSORS

7.3.1 ANISOTROPIC MAGNETORESISTIVE (AMR) SENSORS

7.3.1.1 AMR held largest share of magnetic sensor market in 2019

7.3.2 GIANT MAGNETORESISTIVE (GMR) SENSORS

7.3.2.1 Use of GMR sensors for measuring magnetic field strength over a wide range of field

7.3.3 TUNNEL MAGNETORESISTIVE (TMR) SENSORS

7.3.3.1 Technological advancement in automotive, industrial, and consumer electronics industry increases demand for TMR sensors

TABLE 15 MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY SUBTYPE, 2017–2025 (USD MILLION)

TABLE 16 MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY SUBTYPE, 2017–2025 (MILLION UNITS)

FIGURE 39 MAGNETORESISTIVE MARKET FOR CONSUMER ELECTRONICS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 17 MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 18 MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 19 TRANSPORTATION MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 20 CONSUMER ELECTRONICS MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 21 HEALTHCARE MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 22 AEROSPACE & DEFENSE MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 23 INDUSTRIAL MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 24 BFSI MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 25 OTHERS MARKET FOR MAGNETORESISTIVE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

7.4 SQUID SENSORS

7.4.1 HIGH-TEMPERATURE SQUID

7.4.1.1 Use of high-temperature SQUID sensors for measuring small magnetic fields fuels growth of magnetic sensor market

7.4.2 LOW-TEMPERATURE SQUID

7.4.2.1 Rise in adoption of low-temperature SQUID for detecting neurological problems propel market growth

TABLE 26 MARKET FOR SQUID MAGNETIC SENSORS, BY SUBTYPE, 2017–2025 (USD MILLION)

FIGURE 40 SQUID MARKET FOR HEALTHCARE TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 27 MARKET FOR SQUID MAGNETIC SENSORS, BY END-USER INDUSTRY, 2017–2025 (USD THOUSAND)

TABLE 28 MARKET FOR SQUID MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 29 HEALTHCARE MARKET FOR SQUID MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 30 AEROSPACE & DEFENSE MARKET FOR SQUID MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 31 OTHERS MARKET FOR SQUID MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

7.5 FLUXGATE SENSORS

7.5.1 HIGH MEASUREMENT ACCURACY ATTRIBUTE OF FLUXGATE SENSORS MAKE THEM IDEAL FOR CONSUMER ELECTRONICS, INDUSTRIAL, AND MEDICAL EQUIPMENT APPLICATIONS

TABLE 32 MARKET FOR FLUXGATE MAGNETIC SENSORS, BY END-USER INDUSTRY, 2017–2025 (USD THOUSAND)

TABLE 33 MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD MILLION)

TABLE 34 TRANSPORTATION MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 35 CONSUMER ELECTRONICS MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 36 HEALTHCARE MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

FIGURE 41 FLUXGATE MAGNETIC SENSOR MARKET FOR AEROSPACE & DEFENSE IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 37 AEROSPACE & DEFENSE MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 38 INDUSTRIAL MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 39 BFSI MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 40 OTHERS MARKET FOR FLUXGATE MAGNETIC SENSORS, BY REGION, 2017–2025 (USD THOUSAND)

7.6 OTHERS

7.6.1 OPTICALLY PUMPED

7.6.1.1 Advancement in atomic physics has led to development of optically pumped sensors

7.6.2 MAGNETODIODE

7.6.2.1 Deployment of magnetodiode sensors in photonics applications

7.6.3 MAGNETO-OPTICAL

7.6.3.1 Major deployment of magneto-optical sensors for direct field and vertical visualization of magnetic fields

7.6.4 MAGNETOINDUCTIVE

7.6.4.1 Magnetoinductive sensors are alternative to inductive and proximity sensors

7.6.5 SEARCH COIL

7.6.5.1 Search coil sensors are helpful in measuring variations in magnetic flux

7.6.6 OVERHAUSER

7.6.6.1 Implementation of Overhauser sensors for scientific, space, and engineering applications to fuel market growth

7.6.7 REED

7.6.7.1 Rising use of reed sensor due to no maintenance requirement propel market growth

TABLE 41 MARKET FOR OTHER MAGNETIC SENSORS, BY END-USER INDUSTRY, 2017–2025 (USD THOUSAND)

TABLE 42 MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

TABLE 43 TRANSPORTATION MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 44 CONSUMER ELECTRONICS MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 45 HEALTHCARE MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 46 AEROSPACE & DEFENSE MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 47 INDUSTRIAL MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 48 BFSI MARKET FOR OTHERS, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 49 OTHERS MARKET FOR OTHERS, BY REGION, 2017–2025 (USD MILLION)

8 MAGNETIC SENSOR MARKET, BY RANGE (Page No. - 100)

8.1 INTRODUCTION

FIGURE 42 MARKET, BY RANGE

FIGURE 43 MARKET FOR >10 GAUSS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 50 MAGNETIC SENSOR MARKET, BY RANGE, 2017–2025 (USD MILLION)

FIGURE 44 VARIOUS MAGNETIC SENSORS AND THEIR DETECTABLE FIELD RANGE

8.2 <1 MICROGAUSS (LOW-FIELD SENSORS)

8.2.1 INCREASING ADOPTION OF LOW-FIELD SENSORS FOR MILITARY SURVEILLANCE AND MEDICAL APPLICATION TO BOOST MARKET GROWTH

8.3 1 MICROGAUSS–10 GAUSS (EARTH FIELD SENSORS)

8.3.1 EARTH FIELD SENSORS HELD SECOND-LARGEST SHARE OF MARKET IN 2019

8.4 >10 GAUSS (BIAS MAGNETIC FIELD SENSORS)

8.4.1 INCREASE IN DRIVERLESS CARS PROJECTED TO SPUR MARKET GROWTH

9 MAGNETIC SENSOR MARKET, BY APPLICATION (Page No. - 106)

9.1 INTRODUCTION

FIGURE 45 MARKET, BY APPLICATION

FIGURE 46 SNAPSHOT OF MAGNETIC SENSOR TYPES WITH THEIR RANGES AND APPLICATIONS

FIGURE 47 SPEED SENSING APPLICATION OF MAGNETIC SENSORS TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 51 MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

9.2 POSITION SENSING

9.2.1 RISING DEMAND FOR 3D POSITION SENSORS FROM AUTOMOTIVE AND CONSUMER ELECTRONICS INDUSTRIES TO PROPEL MARKET GROWTH

9.3 SPEED SENSING

9.3.1 RISING DEMAND FOR AUTONOMOUS VEHICLES TO FUEL DEMAND FOR MAGNETIC SPEED SENSORS

9.4 NAVIGATION AND ELECTRONIC COMPASS

9.4.1 INCREASING DEMAND FOR MAGNETIC SENSORS FROM CONSUMER ELECTRONICS INDUSTRY TO DRIVE MARKET GROWTH

9.5 FLOW RATE SENSING

9.5.1 INDUSTRIAL DEMAND FOR HIGH ACCURATE FLOW SENSING TO DRIVE MARKET GROWTH

9.6 PROXIMITY DETECTION/NON-DESTRUCTIVE TESTING

9.6.1 NEED FOR QUALITY INSPECTION OF AIRCRAFT, CARS, AND OTHER AUTOMOTIVE FUEL MARKET GROWTH

9.7 OTHERS

10 MAGNETIC SENSOR MARKET, BY END-USER INDUSTRY (Page No. - 114)

&nbnbsp; 10.1 INTRODUCTION

FIGURE 48 MARKET, BY END-USER INDUSTRY

FIGURE 49 CONSUMER ELECTRONICS TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 52 MARKET, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

10.2 TRANSPORTATION

10.2.1 AUTOMOTIVE

10.2.1.1 Increase in deployment of navigation systems in vehicles to fuel growth of magnetic sensors market

10.2.2 RAILWAY

10.2.2.1 Modernization of rail networks expected to propel market growth

10.2.3 MARINE

10.2.3.1 Use of magnetic sensors for surveillance application in marine industry to spur market growth

TABLE 53 MAGNETIC SENSOR MARKET FOR TRANSPORTATION, BY SUBTYPE, 2017–2025 (USD MILLION)

TABLE 54 MARKET FOR TRANSPORTATION, BY TYPE, 2017–2025 (USD MILLION)

TABLE 55 MARKET FOR TRANSPORTATION, BY REGION, 2017–2025 (USD MILLION)

TABLE 56 MARKET FOR TRANSPORTATION IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 57 MARKET FOR TRANSPORTATION IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 58 MARKET FOR TRANSPORTATION IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 59 MARKET FOR TRANSPORTATION IN ROW, BY REGION, 2017–2025 (USD MILLION)

10.3 CONSUMER ELECTRONICS

10.3.1 CONSUMER APPLIANCES

10.3.1.1 Widespread deployment of Hall effect and reed sensors in high-tech consumer appliances

10.3.2 SMARTPHONES

10.3.2.1 Use of micro-sized magnetic sensors in smartphones for space reduction

10.3.3 WEARABLES

10.3.3.1 Heightened use of magnetic sensors in fitbits and smart watches

10.3.4 GAMING CONSOLES

10.3.4.1 Use of magnetic sensors for motion and position sensing

10.3.5 CONSUMER DRONES

10.3.5.1 Adoption of magnetic sensors in consumer drones for navigation and surveillance

10.3.6 OTHERS

FIGURE 50 CONSUMER DRONES SEGMENT IS EXPECTED TO GROW AT HIGHEST CAGR IN MAGNETIC SENSOR MARKET FOR CONSUMER ELECTRONICS FROM 2020 TO 2025

TABLE 60 MARKET FOR CONSUMER ELECTRONICS, BY SUBTYPE, 2017–2025 (USD MILLION)

TABLE 61 MARKET FOR CONSUMER ELECTRONICS, BY TYPE, 2017–2025 (USD MILLION)

TABLE 62 MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD MILLION)

TABLE 63 MARKET FOR CONSUMER ELECTRONICS IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 64 MARKET FOR CONSUMER ELECTRONICS IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 65 MAGNETIC SENSOR MARKET FOR CONSUMER ELECTRONICS IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 66 MARKET FOR CONSUMER ELECTRONICS IN ROW, BY REGION, 2017–2025 (USD MILLION)

10.4 HEALTHCARE

10.4.1 USE OF MAGNETIC SENSORS IN HEALTHCARE INDUSTRY HELP ACCURATE DETECTION OF ANOMALIES

TABLE 67 MARKET FOR HEALTHCARE, BY TYPE, 2017–2025 (USD MILLION)

TABLE 68 MARKET FOR HEALTHCARE, BY REGION, 2017–2025 (USD MILLION)

TABLE 69 MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 70 MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 71 MARKET FOR HEALTHCARE IN APAC, BY COUNTRY, 2017–2025 (USD THOUSAND)

TABLE 72 MAGNETIC SENSOR MARKET FOR HEALTHCARE IN ROW, BY REGION, 2017–2025 (USD MILLION)

10.5 AEROSPACE & DEFENSE

10.5.1 MAGNETIC SENSORS USED IN MULTITUDE OF ELECTRICAL SYSTEMS IN AEROSPACE & DEFENSE INDUSTRY

TABLE 73 MARKET FOR AEROSPACE AND DEFENSE, BY TYPE, 2017–2025 (USD THOUSAND)

FIGURE 51 APAC EXPECTED TO LEAD MARKET FOR AEROSPACE & DEFENSE INDUSTRY FROM 2020 TO 2025

TABLE 74 MARKET FOR AEROSPACE & DEFENSE, BY REGION, 2017–2025 (USD THOUSAND)

TABLE 75 MAGNETIC SENSOR MARKET FOR AEROSPACE & DEFENSE IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 76 MARKET FOR AEROSPACE & DEFENSE IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 77 MARKET FOR AEROSPACE & DEFENSE IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 78 MARKET FOR AEROSPACE & DEFENSE IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

10.6 INDUSTRIAL

10.6.1 RISE IN INDUSTRIAL AUTOMATION TO FUEL DEPLOYMENT OF MAGNETIC SENSORS

TABLE 79 MARKET FOR INDUSTRIAL, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 80 MARKET FOR INDUSTRIAL, BY REGION, 2017–2025 (USD MILLION)

TABLE 81 MARKET FOR INDUSTRIAL IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 82 MARKET FOR INDUSTRIAL IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 83 MARKET FOR INDUSTRIAL IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 84 MARKET FOR INDUSTRIAL IN ROW, BY REGION, 2017–2025 (USD MILLION)

10.7 BFSI

10.7.1 POINT-OF-SALE (POS) TERMINAL

10.7.1.1 Growing focus of developing countries on digitalization to increase demand for POS terminals

10.7.2 CURRENCY COUNTER/DETECTOR/SORTER

10.7.2.1 Escalating counterfeiting offenses increases demand for currency detectors

10.7.3 ATM

10.7.3.1 Installation of ATMs on large scale to propel demand for magnetic sensors

FIGURE 52 POS TERMINAL SEGMENT EXPECTED TO GROW AT HIGHEST CAGR IN MAGNETIC SENSOR MARKET FOR BFSI FROM 2020 TO 2025

TABLE 85 MARKET FOR BFSI, BY SUBTYPE, 2017–2025 (USD MILLION)

TABLE 86 MARKET FOR BFSI, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 87 MARKET FOR BFSI, BY REGION, 2017–2025 (USD MILLION)

TABLE 88 MARKET FOR BFSI IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 89 MARKET FOR BFSI IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 90 MARKET FOR BFSI IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 91 MARKET FOR BFSI IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

10.8 OTHERS

TABLE 92 MARKET FOR OTHER INDUSTRIES, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 93 MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 94 MARKET FOR OTHER INDUSTRIES IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 95 MARKET FOR OTHER INDUSTRIES IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 96 MAGNETIC SENSOR MARKET FOR OTHER INDUSTRIES IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 97 MARKET FOR OTHER INDUSTRIES IN ROW, BY REGION, 2017–2025 (USD THOUSAND)

11 DIFFERENT TYPES OF MAGNETS IN MAGNETIC SENSORS (Page No. - 141)

11.1 INTRODUCTION

11.2 PERMANENT MAGNETS

11.3 CERAMIC MAGNETS

11.4 ALNICO MAGNETS

11.5 SAMARIUM COBALT MAGNETS

11.6 NEODYMIUM MAGNETS

12 MAGNETIC SENSOR MARKET, BY REGION (Page No. - 143)

12.1 INTRODUCTION

FIGURE 53 MAGNETIC SENSOR MARKET, BY REGION

FIGURE 54 MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 98 MARKET, BY REGION, 2017–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 55 NORTH AMERICA: MAGNETIC SENSOR SNAPSHOT

TABLE 99 MARKET IN NORTH AMERICA, BY TYPE, 2017–2025 (USD MILLION)

TABLE 100 MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 101 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

12.2.1 US

12.2.1.1 US held the largest share of market in North America in 2019

12.2.2 CANADA

12.2.2.1 Increasing demand from automotive, healthcare, and consumer electronics industries to boost market growth

12.2.3 MEXICO

12.2.3.1 Increase in production of vehicles is bolstering growth of market in Mexico

12.3 EUROPE

FIGURE 56 EUROPE: MAGNETIC SENSOR MARKET SNAPSHOT

TABLE 102 MARKET IN EUROPE, BY TYPE, 2017–2025 (USD MILLION)

FIGURE 57 TRANSPORTATION SEGMENT TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 103 MARKET IN EUROPE, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 104 MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

12.3.1 UK

12.3.1.1 High demand for magnetic sensors in automotive and consumer electronics to propel growth of market

12.3.2 GERMANY

12.3.2.1 Increasing demand for magnetic sensors from automotive to propel market growth

12.3.3 FRANCE

12.3.3.1 Established automotive and aerospace industries to propel market growth

12.3.4 ITALY

12.3.4.1 Surge in ventilator demand and production is fueling market growth

12.3.5 REST OF EUROPE

12.4 APAC

FIGURE 58 APAC: MAGNETIC SENSOR MARKET SNAPSHOT

TABLE 105 MARKET IN APAC, BY TYPE, 2017–2025 (USD MILLION)

TABLE 106 MARKET IN APAC, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

TABLE 107 MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Developing economy and growing implementation of sensors in various sectors driving market growth

12.4.2 JAPAN

12.4.2.1 Presence of major automotive and magnetic sensor manufacturers driving market growth

12.4.3 INDIA

12.4.3.1 Government initiatives towards industrial development to support market growth in India

12.4.4 SOUTH KOREA

12.4.4.1 Burgeoning demand from consumer electronics and automotive industries to support market growth in South Korea

12.4.5 REST OF APAC

12.5 ROW

TABLE 108 MAGNETIC SENSOR MARKET IN ROW, BY TYPE, 2017–2025 (USD THOUSAND)

TABLE 109 MARKET IN ROW, BY END-USER INDUSTRY, 2017–2025 (USD MILLION)

FIGURE 59 MARKET IN SOUTH AMERICA TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 110 MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

12.5.1 MIDDLE EAST AND AFRICA

12.5.1.1 Presence of oil & gas companies in MEA is expected to fuel market growth

12.5.2 SOUTH AMERICA

12.5.2.1 South America to witness higher CAGR during forecast period

13 COMPETITIVE LANDSCAPE (Page No. - 162)

13.1 INTRODUCTION

FIGURE 60 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGY FROM JANUARY 2017 TO JUNE 2020

13.2 MARKET RANKING ANALYSIS OF PLAYERS IN MAGNETIC SENSOR MARKET, 2019

FIGURE 61 RANKING OF TOP 5 PLAYERS IN MARKET, 2019

13.3 MARKET EVALUATION FRAMEWORK

FIGURE 62 MARKET EVALUATION FRAMEWORK-FOCUS OF KEY COMPANIES ON RESEARCH AND DEVELOPMENT ACTIVITIES AND INNOVATIONS FROM JANUARY 2017 TO JUNE 2020

13.3.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 111 PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2017–JUNE 2020

13.3.2 EXPANSIONS

TABLE 112 EXPANSIONS, JANUARY 2017–JUNE 2020

13.3.3 AGREEMENTS, COLLABORATIONS, JOINT VENTURES, AND PARTNERSHIPS

TABLE 113 AGREEMENTS, COLLABORATIONS, JOINT VENTURES, AND PARTNERSHIPS, JANUARY 2017–JUNE 2020

13.3.4 MERGERS AND ACQUISITIONS

TABLE 114 MERGERS AND ACQUISITIONS, JANUARY 2017–JUNE 2020

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019

TABLE 115 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2019

14 COMPANY EVALUATION MATRIX (Page No. - 172)

14.1 OVERVIEW

14.2 COMPANY EVALUATION MATRIX DEFINITION AND METHODOLOGY

14.2.1 MARKET SHARE/RANKING

FIGURE 63 ASAHI KASEI CORPORATION LED MARKET IN 2019

14.2.2 STAR

14.2.3 PERVASIVE

14.2.4 EMERGING LEADERS

14.3 COMPANY EVALUATION MATRIX

FIGURE 64 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2019

14.4 SME EVALUATION MATRIX

FIGURE 65 MAGNETIC SENSOR MARKET (GLOBAL) SME EVALUATION MATRIX, 2019

14.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 66 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

14.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 67 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

15 COMPANY PROFILES (Page No. - 178)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 INTRODUCTION

15.2 KEY PLAYERS

15.2.1 ASAHI KASEI CORPORATION

FIGURE 68 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

15.2.2 ALLEGRO MICROSYSTEMS, LLC

15.2.3 INFINEON TECHNOLOGIES AG

FIGURE 69 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

15.2.4 TDK CORPORATION

FIGURE 70 TDK CORPORATION: COMPANY SNAPSHOT

15.2.5 MELEXIS

FIGURE 71 MELEXIS: COMPANY SNAPSHOT

15.2.6 HONEYWELL INTERNATIONAL INC.

FIGURE 72 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

15.2.7 TE CONNECTIVITY

FIGURE 73 TE CONNECTIVITY: COMPANY SNAPSHOT

15.2.8 NXP SEMICONDUCTORS N.V.

FIGURE 74 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

15.2.9 TEXAS INSTRUMENTS INCORPORATED

FIGURE 75 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

15.2.10 AMS AG

FIGURE 76 AMS AG: COMPANY SNAPSHOT

15.3 RIGHT TO WIN

15.4 OTHER KEY PLAYERS

15.4.1 EMERSON ELECTRIC CO.

15.4.2 SENSATA TECHNOLOGIES

15.4.3 IFM ELECTRONIC GMBH

15.4.4 TT ELECTRONICS PLC

15.4.5 KOHSHIN ELECTRIC CORPORATION

15.4.6 KITA SENSOR

15.4.7 COTO TECHNOLOGY

15.5 STARTUP PLAYER

15.5.1 SENSITEC GMBH

15.5.2 CROCUS TECHNOLOGY

15.5.3 MULTIDIMENSION TECHNOLOGY CO., LTD.

15.5.4 QUSPIN

15.5.5 ABLIC INC.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 226)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

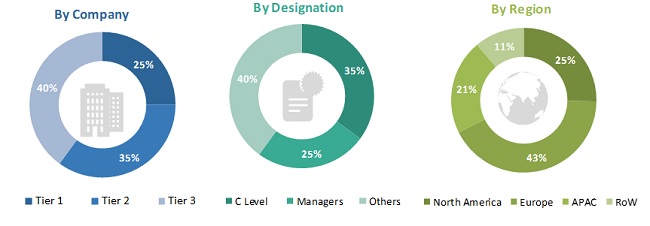

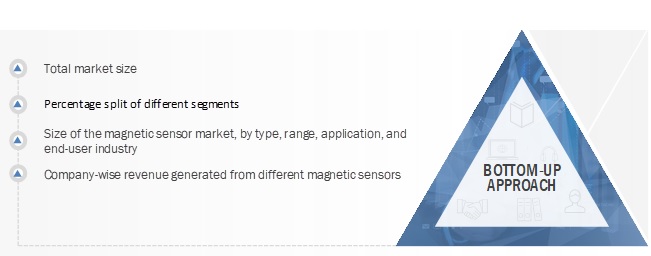

The study involved four major activities in estimating the size of the magnetic sensor market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include various industry organizations such as the International Monetary Fund (US), Bloomberg New Energy Finance (UK), World Health Organization (Switzerland), and International Organization of Motor Vehicle Manufacturers (OICA) (France); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the automotive positioning, speed sensing, and seatbelts market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (industrial and automotive sectors) and supply-side (magnetic sensor manufacturers) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World (Middle East and Africa, and South America). Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach have been used to estimate and validate the total size of the magnetic sensor market.

- Identifying different types of magnetic sensors

- Analyzing the global penetration of each type of magnetic sensor through secondary and primary research

- Identifying the penetration ratio of different magnetic sensors operating in various ranges and different end-user industries for different applications

- Conducting multiple discussion sessions with the key opinion leaders to understand different types of magnetic sensors and their implementation in multiple industries; analyzing break-up of the work carried out by each key company

- Verifying and crosschecking estimates at every level with the key opinion leaders, including chief executive officers (CEOs), directors, and operation managers, and then finally with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides in the magnetic sensor market.

Report Objectives

- To analyze, segment, and forecast the size of the magnetic sensor market based on type, range, application, and end-user industry in terms of value

- To estimate and forecast the size of the magnetic sensor market based on type in terms of volume and value

- To estimate and forecast the magnetic sensor market size with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contribution to the overall magnetic sensor market

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the magnetic sensor market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape for the market leaders

- To provide a detailed overview of the magnetic sensor value chain

- To provide brief information about the use cases and different types of magnets used in magnetic sensors

- To analyze competitive developments such as product launches and developments, expansions, partnerships, joint ventures, collaborations, agreements, and mergers and acquisitions undertaken by players in the magnetic sensor market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

- Additional country-level analysis of magnetic sensor market

- Profiling of additional market players (up to 3)

- Country-level analysis of consumer electronics and transportation segment

Growth opportunities and latent adjacency in Magnetic Sensor Market

I am researching on low offset, high sensitivity Hall effect sensors with materials that survive in extreme environments from last 6 years. Can you provide the qualitative insights for same?

Interested to get the idea about the type of sensors are used in industry and what they are going to get replaced with.

I'd like to get a quote for the following chapters which are main area of interest in this report: - chapter 4.3: current sensors - chapter 6.5 Fluxgate technology.

I mainly interested in the application based trend in EU market for Magnetic Motion Control Sensors (Encoders).

Our company is developing high-current current sensors integrated into our EV and HEV connectors. We are interested in exploring the wider Non-Automotive market for these types of sensors.

interested in market overview of magnetic sensors as parts and function that can be found in a vehicle.

I am interested to understand the market for emerging magnetometer technology, in particular highly sensitive magnetometers.

Need to understand the scope of magnetic field sensor market.