Managed Detection and Response (MDR) Market by Security Type (Network, Endpoint, Cloud), Deployment Mode (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2029

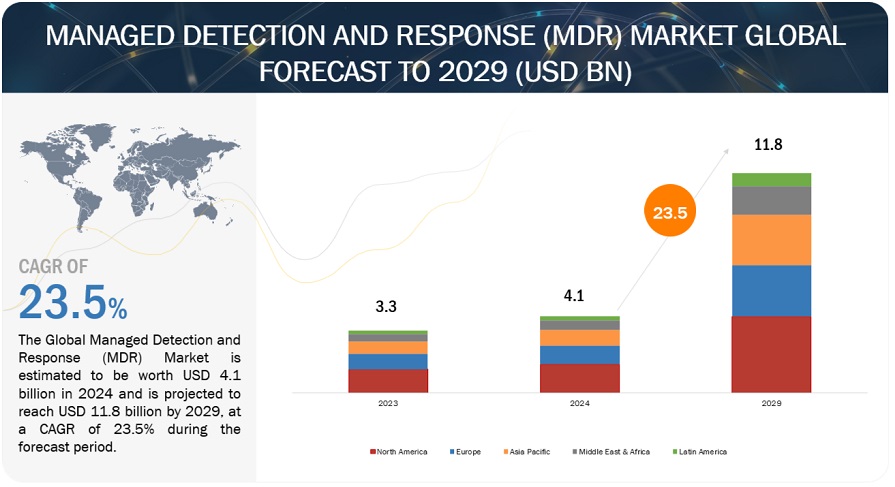

[300 Pages Report] The global Managed Detection and Response (MDR) is estimated to be worth USD 4.1 billion in 2024 and is projected to reach USD 11.8 billion by 2029, at a CAGR of 23.5% during the forecast period.

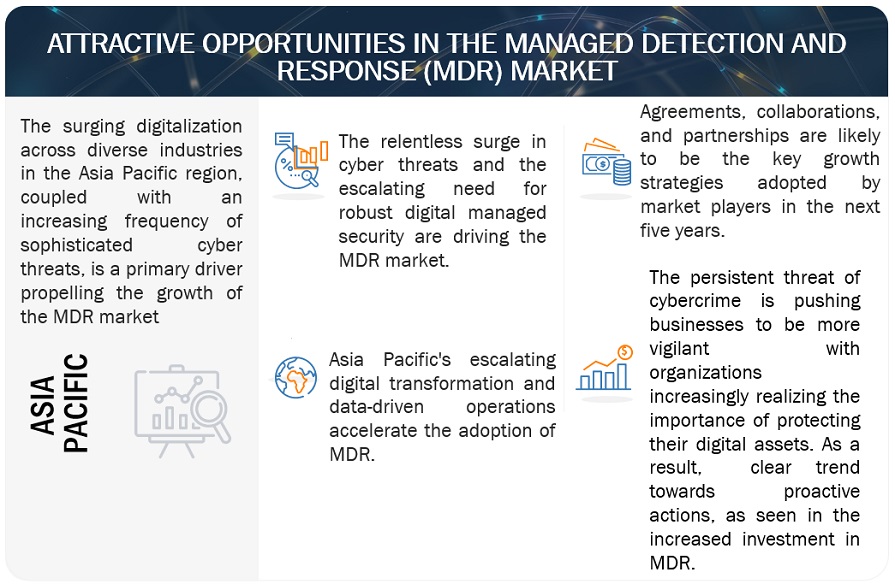

The Managed Detection and Response (MDR) market is experiencing dynamic growth, propelled by several key factors shaping the modern cybersecurity landscape. One significant driver is the evolving nature of cyber threats, with attackers becoming increasingly sophisticated and agile in their methods. Organizations face diverse threats, including ransomware, phishing attacks, and supply chain compromises, necessitating a proactive and multi-layered approach to defense. MDR services offer a comprehensive solution by combining advanced threat detection technologies with expert analysis and rapid incident response capabilities. This holistic approach enables organizations to detect and respond to threats in real time, minimizing the risk of data breaches and operational disruptions.

The global shift towards remote work and digital transformation initiatives has amplified the demand for MDR solutions. With the proliferation of cloud-based services, IoT devices, and interconnected systems, the attack surface has expanded exponentially, presenting new challenges for cybersecurity professionals. MDR services provide organizations with the scalability and flexibility to protect their distributed environments effectively. By leveraging cloud-native architectures and automation capabilities, MDR solutions can adapt to dynamic environments and scale resources based on demand, ensuring continuous protection against emerging threats. As businesses prioritize resilience and agility in the face of evolving cyber risks, the MDR market is poised for sustained growth, driven by the imperative to safeguard digital assets and maintain trust in an increasingly interconnected world.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Driver: Cyber Threats and Industry Demand

The Managed Detection and Response (MDR) market is propelled by the escalating sophistication of cyber threats, with attackers leveraging advanced techniques such as ransomware and phishing to breach organizational defenses. Stringent regulatory compliance requirements, including GDPR and HIPAA, are compelling businesses to adopt comprehensive security solutions like MDR to safeguard sensitive data and ensure compliance. The persistent shortage of skilled cybersecurity professionals drives organizations to seek outsourced security expertise through MDR services, which offer continuous monitoring, threat detection, and rapid incident response capabilities.

Restraint: Remote Work and Technology Advancements

Despite the benefits of MDR solutions, implementation challenges such as integration complexities and resource constraints may hinder adoption rates. The initial investment and ongoing subscription costs associated with MDR services can be prohibitive for some organizations and small- and medium-sized enterprises. Data privacy and confidentiality concerns may deter organizations from entrusting sensitive data to third-party MDR providers, especially in highly regulated industries.

Opportunity: Evolving Threats and Competition

The expanding remote work landscape after the COVID-19 pandemic presents significant opportunities for MDR providers to offer tailored solutions addressing the security challenges of remote work environments. Advancements in artificial intelligence, machine learning, and automation technologies enhance the capabilities of MDR solutions, enabling proactive threat detection and response. The increasing awareness of cybersecurity threats and regulatory requirements in emerging markets presents untapped opportunities for MDR providers to expand their customer base and geographic reach.

Challenge: Resource Constraints and Budget Limitations

MDR providers face challenges in keeping pace with the constantly evolving threat landscape, requiring continuous innovation and adaptation to emerging tactics and techniques threat actors use. Talent acquisition and retention pose additional challenges, as recruiting and retaining skilled cybersecurity professionals are crucial for delivering high-quality MDR services. The competitive landscape of the MDR market is intensifying, with numerous vendors vying for market share, leading to increased competition and pricing pressures.

Managed detection and response (MDR) Market Ecosystem

The Managed Detection and Response (MDR) market ecosystem involves key players like IT security vendors, MSSPs, regulators, and end-user organizations across sectors. They work together to create and implement advanced AI and machine learning solutions. Continuous innovation is driven by evolving threats and regulations, aiming to strengthen defenses against attacks in the cybersecurity domain.

Key players like CrowdStrike (US), Rapid7 (US), Red Canary (US), and Arctic Wolf (US) offer comprehensive solutions covering various application areas. These offerings reflect the industry's commitment to enhancing cybersecurity across diverse technological domains to safeguard against evolving cyber risks.

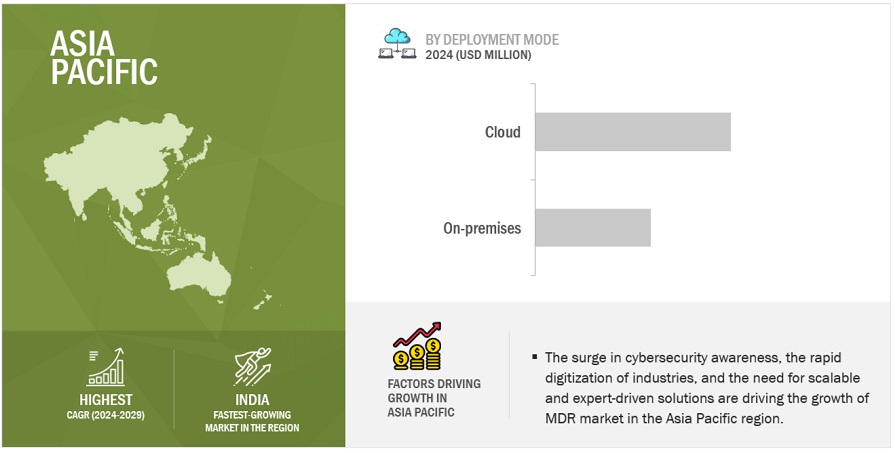

“The cloud segment will experience the highest growth rate during the forecast period by deployment mode.”

As organizations increasingly migrate their operations and data to the cloud, they seek robust security solutions to protect their digital assets effectively. Managed Detection and Response (MDR) services delivered through the cloud offer organizations scalability, flexibility, and centralized management, ensuring comprehensive protection against evolving cyber threats. The cloud's inherent resilience and redundancy enhance the reliability and availability of MDR services, further driving the adoption of cloud-based deployment models. As businesses prioritize cloud technologies to drive innovation and efficiency, the cloud segment is poised to experience substantial growth during the forecast period, cementing its position as a preferred deployment mode for MDR solutions.

“Based on organization size, the SMEs segment accounts for the largest market size.”

The SME segment is poised to claim the largest market size in the Managed Detection and Response (MDR) landscape, reflecting the increasing awareness among smaller organizations of the critical importance of cybersecurity. As SMEs become more digitally integrated and interconnected, they confront various cyber threats, including malware, phishing, and ransomware attacks. Many SMEs need more resources and expertise to implement comprehensive cybersecurity measures internally. MDR services offer a viable solution by providing SMEs with access to advanced threat detection, continuous monitoring, and expert incident response capabilities on a subscription basis. This enables SMEs to enhance their security posture without needing significant upfront investment or dedicated cybersecurity personnel. As cybersecurity continues to emerge as a top priority for SMEs aiming to protect their operations and data, the SME segment is poised to dominate the MDR market landscape.

"The Asia Pacific region is projected to exhibit the highest growth rate during the forecast period."

The Asia Pacific region is expected to showcase the most robust growth rate, underpinned by burgeoning digital transformation initiatives and a rapidly expanding digital ecosystem. As countries across Asia increasingly embrace digitalization, fueled by rising internet penetration, smartphone adoption, and cloud service utilization, the region becomes a focal point for technological innovation and economic development. The evolving threat landscape and growing awareness of cybersecurity risks drive organizations in the Asia Pacific region to prioritize investments in robust security solutions like Managed Detection and Response (MDR). With governments and businesses alike recognizing the imperative of safeguarding digital assets against cyber threats, the Asia Pacific region emerges as a key growth engine in the MDR market, poised to drive innovation and resilience in cybersecurity strategies.

Key Market Players:

The major players in the Managed Detection and Response (MDR) market are CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland),SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By security type, deployment mode, organization size, vertical and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Managed detection and response Companies |

CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US) |

This research report categorizes the managed detection and response market to forecast revenues and analyze trends in each of the following submarkets:

Based on the Security type:

- Endpoint Security

- Network Security

- Cloud Security

- Other Security Types

Based on Deployment mode:

- On-premises

- Cloud

Based on Organization size:

- Large Enterprises

- SMES

Based on the vertical:

- BFSI

- IT and ITeS

- Government

- Energy and Utilities

- Manufacturing

- Healthcare

- Retail

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- Rest of Asia Pacific

-

Middle East and Africa

-

Gulf Cooperation Council (GCC)

- KSA

- UAE

- Rest of GCC Countries

- South Africa

- Rest of Middle East and Africa

-

Gulf Cooperation Council (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- March 2023 - Dell Technologies expanded its MDR platform to address the needs of the mid-market and customers facing skills shortages. It also added CrowdStrike as a partner to further enhance its threat management capabilities. Dell's MDR Pro Plus offers breach and attack simulations, penetration testing, continuous security training, and Incident Recovery Care.

- March 2023—Rapid7 has acquired Minerva Labs, Ltd., a leading anti-evasion and ransomware prevention technology provider. This acquisition will further extend Rapid7's MDR capabilities, enabling it to orchestrate advanced ransomware prevention.

- March 2023 - SentinelOne and Wiz have partnered to offer a cloud security solution that detects, prevents, investigates, and responds to cloud security threats. The partnership will enable customers to gain complete visibility into their infrastructure hosted in the cloud, quickly identify and remediate attack paths, and prevent threats with comprehensive runtime protection.

- January 2023 - Red Canary integrates with Microsoft Sentinel and Microsoft Defender for Cloud, detecting attacks early and stopping them more quickly for Microsoft clients. This increased integration will effectively defend against identity-based attacks, enhance cloud security coverage, and operationalize Microsoft's security capabilities. Additionally, this integration with Microsoft 365 helps to create custom detections to identify business email compromises.

- February 2022 - Arctic Wolf has completed the acquisition of Tetra Defense. With Tetra Defense’s capabilities, Arctic Wolf will further expand its Security Operations platform to confidently deliver on many critical outcomes across the security operations framework, proactively protecting existing customers from threats and helping new customers who have been breached get back to business faster.

Frequently Asked Questions (FAQ):

What is a market guide for Managed Detection and Response (MDR) services?

The Managed Detection and Response (MDR) market encompasses a range of cybersecurity services and solutions aimed at proactively monitoring, detecting, investigating, and responding to cyber threats within organizations' IT environments. MDR offerings typically include continuous threat monitoring, threat hunting, incident detection and response, forensic analysis, and remediation support. Leveraging advanced technologies such as artificial intelligence, machine learning, behavioral analytics, and expert human oversight, MDR solutions aim to provide organizations with comprehensive, real-time protection against cyber threats. The primary objective of the MDR market is to enhance organizations' security posture by mitigating risks, minimizing potential impact, and maintaining operational continuity in the face of evolving cyber threats.

What is the market size of the managed detection and response market?

The global Managed Detection and Response (MDR) is estimated to be worth USD 4.1 billion in 2024 and is projected to reach USD 11.8 billion by 2029, at a CAGR of 23.5% during the forecast period.

What are the major drivers in the managed detection and response market?

The escalating sophistication and frequency of cyber threats, including ransomware, phishing attacks, and insider threats, create a pressing need for proactive security measures. Stringent regulatory requirements, such as GDPR and HIPAA, mandate organizations to implement robust cybersecurity solutions like MDR to protect sensitive data and ensure compliance. The shortage of skilled cybersecurity professionals further drives the demand for MDR services as organizations seek outsourced security expertise to augment their defenses against evolving threats. The increasing adoption of cloud services and remote work arrangements amplifies the demand for MDR solutions as businesses strive to secure digital assets and maintain operational resilience in dynamic and distributed environments. These drivers collectively underscore the critical role of MDR in mitigating cyber risks and safeguarding organizations' digital infrastructure and data.

Who are the major players in the managed detection and response market?

The major players in the Managed Detection and Response (MDR) market are CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US).

Which key technology trends prevail in the managed detection and response market?

Several key technology trends in the managed detection and response (MDR) market are driving innovation and shaping the cybersecurity landscape. One significant trend is the increasing adoption of AI and ML algorithms to enhance threat detection and response capabilities. These technologies enable MDR solutions to analyze large volumes of data in real time, identify patterns indicative of cyber threats, and automate response actions, thereby reducing detection and response times. There is a growing emphasis on integrating threat intelligence feeds and advanced analytics to provide context-rich insights into emerging threats and enable proactive threat hunting. The shift towards cloud-native architectures and automation and orchestration tools is streamlining MDR operations, improving scalability, and enhancing the efficiency of security operations centers (SOCs). These technology trends highlight the evolving nature of MDR solutions and their crucial role in defending organizations against increasingly sophisticated cyber threats. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

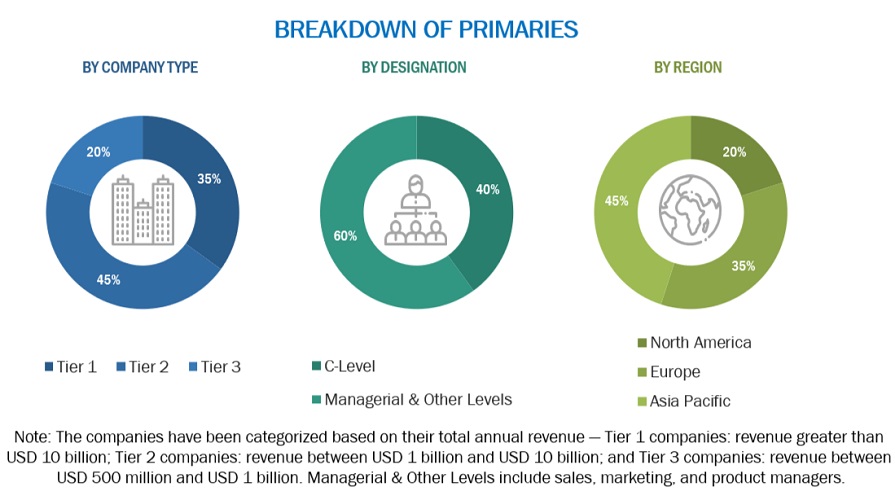

The research study involved significant activities in estimating the managed detection and response market size. Exhaustive secondary research utilized various secondary sources about the market and peer markets. To gather information for analyzing the managed detection and response market. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Primary sources included interviews with industry experts, suppliers, manufacturers, and other stakeholders across the market's value chain. These interviews with key industry figures and subject matter experts aimed to gather qualitative and quantitative data, ensuring accuracy and reliability in assessing market trends and prospects. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain critical information about industry insights, the market's monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the managed detection and response market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the managed detection and response market. The first approach involved estimating the market size by summating companies' revenue generated through managed detection and response solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the managed detection and response market. The research methodology used to estimate the market size includes the following:

- Key players in managed detection and response were identified through secondary research, and their revenue contributions in the respective regions were determined through primary and secondary research

- Regarding value, primary and secondary research have determined the industry's supply chain and market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

All the possible parameters that impact the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The Managed Detection and Response (MDR) market encompasses a range of cybersecurity services and solutions designed to proactively monitor, detect, investigate, and respond to cyber threats within an organization's IT environment. MDR offerings typically include continuous threat monitoring, threat hunting, incident detection and response, forensic analysis, and remediation support. These services are often delivered through advanced technologies like machine learning, artificial intelligence, behavioral analytics, and expert human oversight. The primary objective of the MDR market is to provide organizations with comprehensive, real-time protection against cyber threats, helping them mitigate risks, minimize potential impact, and maintain operational continuity.

Key Stakeholders

- Government bodies and public safety agencies

- Project managers

- Developers

- Business analysts

- Quality Assurance (QA)/test engineers

- Consulting firms

- Third-party vendors

- Investors and venture capitalists

- Technology providers

The main objectives of this study are as follows:

- To describe and forecast the global managed detection and response market by security type, deployment mode, organization size, vertical, and region

- To forecast the market size of five central regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the managed detection and response market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as Mergers and Acquisitions (M&A), new product developments, and partnerships and collaborations in the market

- To track and analyze the impact of the recession on the managed detection and response market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Detection and Response (MDR) Market