Marine Engine Monitoring System Market by Engine Type (Propulsion Engine, Auxiliary Engine), End Use (OEM, Aftermarket), Component (Hardware, Software), Ship Type (Commercial, Naval), Deployment (On-Board, Remote), and Region - Global Forecast to 2025

[171 Pages Report] The marine engine monitoring system market is estimated to be USD 490.2 Million in 2017 and is projected to reach USD 656.5 Million by 2025, at a CAGR of 3.72% during the forecast period. The objective of this study is to analyze, define, describe, and forecast the marine engine monitoring system market based on component, engine type, end user, ship type, deployment, and region. The report also focuses on providing a competitive landscape of this market by profiling companies based on their financial positions, product portfolios, and growth strategies as well as analyzing their core competencies and market share to anticipate the degree of competition prevailing in the market. This report tracks and analyzes competitive developments such as contracts, new product launches/developments, and research & development (R&D) activities in the marine engine monitoring system market. The base year considered for this study is 2017 and the forecast period is from 2018 to 2025.

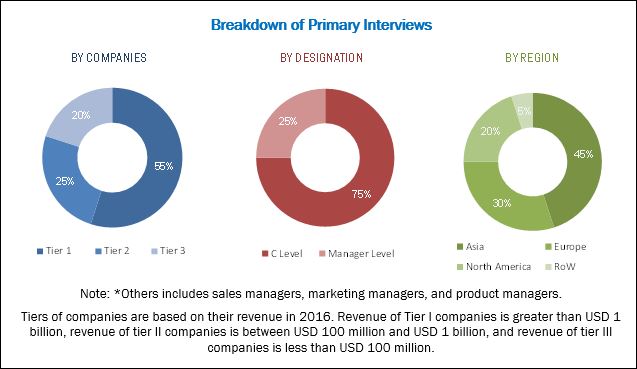

The research methodology used to estimate and forecast the size of the marine engine monitoring system market began with capturing data on key vendor revenues. Secondary sources referred for this study included annual reports, Yahoo Finance, Association of European Shipbuilders, United Nations Conference on Trade and Development (UNCTAD), and press releases. The bottom-up procedure was employed to arrive at the overall size of the market by determining the revenue of key market players. After arriving at the overall market size, the market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key industry experts, such as CEOs, VPs, directors, executives, and engineers. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. Breakdown of profiles of primaries is shown in the figure depicted below:

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The marine engine monitoring system market has been segmented on the basis of component, engine type, end user, ship type, deployment, and region. ABB (Switzerland), AST Group (UK), CMR Group (France), Caterpillar (US), Cummins (US), Emerson (US), Hyundai Heavy Industries (South Korea), Jason Marine (Singapore), Kongsberg (Norway), MAN Diesel & Turbo (Germany), Mitsubishi Heavy Industries (Japan), NORIS Group (Germany), Rolls Royce (UK), and Wartsila (Finland), among others, are the key manufacturers of marine engine monitoring systems. Contracts, new product launches/developments, agreements, and acquisitions are the major strategies adopted by the key players in the marine engine monitoring system market.

Target Audience for this Report

- Manufacturers of Marine Engine Monitoring Systems

- Component Manufacturers of Marine Engine Monitoring Systems

- Government and Certification Bodies

“This study answers several questions for stakeholders, primarily, which market segments to focus on during the next two to five years to prioritize their efforts and investments.”

Scope of the Report:

Marine Engine Monitoring System Market, By Component

- Hardware

- Software

Marine Engine Monitoring System Market, By Engine Type

- Propulsion

- Auxiliary

Marine Engine Monitoring System Market, By Ship Type

- Commercial

- Naval Ships

Marine Engine Monitoring System Market, By End User

- OEM

- Aftermarket

Marine Engine Monitoring System Market, By Deployment

- On-board

- Remote Monitoring

Marine Engine Monitoring System Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for this report:

- Geographic Analysis

- Further breakdown of the marine engine monitoring system market in the Middle East and the Rest of the World (RoW)

- Company Information

- Detailed analysis and profiling of additional market players (up to five)

- Additional Level Segmentation

The marine engine monitoring system market is estimated to be USD 508.4 Million in 2018 and is projected to reach USD 656.5 Million by 2025, at a CAGR of 3.72% during period 2018 to 2025. This growth can be attributed to the increase in international seaborne trade, the rise in the demand for deliveries of smart engines, recreational boats, and growth in maritime tourism.

The report segments the market based on component, engine type, ship type, end user, deployment, and region. Based on ship type, the market has been segmented into commercial and naval ships. The commercial segment has been further divided into merchant ships and recreational boats. Based on deployment, the market has been segmented into on-board and remote monitoring. Based on end user, the market has been segmented into OEM and aftermarket. Based on component, the market has been categorized into hardware and software. Based on engine type, the market has been segmented into propulsion and auxiliary. Furthermore, the propulsion segment has been further divided into diesel engine, gas turbine, dual-fuel engine, and nuclear power engine.

The commercial segment is the largest ship type segment of the market. The growth of the commercial segment can be attributed to the increasing use of merchant ships for commercial transportation. The commercial segment has been further categorized into merchant ships and recreational ships. Increase in trading activities and growth in maritime tourism has led to the rising demand for cargo and passenger ships worldwide, which, in turn, is driving the demand for ship deliveries, which has further boosted the demand for marine engine monitoring systems.

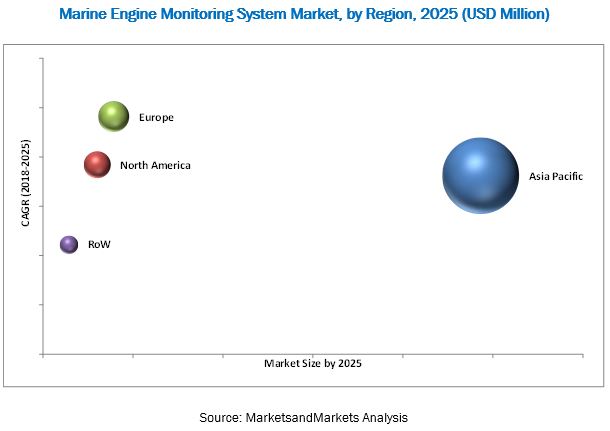

The marine engine monitoring system market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). The market in Europe is projected to grow at the highest CAGR during the forecast period, owing to increasing investments in the defense sector and restructuring efforts undertaken by ship manufacturing companies in the region.

Asia Pacific is the largest market for marine engine monitoring system. Over the past few years, this region has witnessed rapid economic development as well as the growth of the manufacturing and energy sectors, thereby increasing maritime trade. The rise in seaborne trade has subsequently led to an increase in the demand for ships used to transport manufactured goods worldwide. Thus, the increase in the number of ships has contributed to the growing demand for propulsion systems and propellers in the region. China, South Korea, and Japan are the key markets for marine engine monitoring systems in the Asia Pacific region.

The marine engine monitoring system market is anticipated to witness significant growth in the near future, primarily driven by the growth in international seaborne trade and increased demand for marine propellers from the new shipbuilding & repair market. Increased navy budgets worldwide, rise in the usage of inland waterways, and technological innovations in marine propulsion systems are key opportunities in the market. However, factors such as stringent environmental regulations and uncommon data standards are restraining the growth of the market. Fluctuation in oil prices, shipping overcapacity, and low freight rates are key challenges for market growth.

Leading players in the marine engine monitoring system market include ABB (Switzerland), AST Group (UK), CMR Group (France), Caterpillar (US), Cummins (US), Emerson (US), Hyundai Heavy Industries (South Korea), Jason Marine (Singapore), Kongsberg (Norway), MAN Diesel & Turbo (Germany), Mitsubishi Heavy Industries (Japan), NORIS Group (Germany), Rolls Royce (UK), and Wartsila (Finland), among others. Contracts and agreements are key development strategies that together accounted for more than one-third share of the total developments that took place between 2014 and 2018.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Market Stakeholder

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Market

4.2 Market, By Product Type

4.3 Asia Pacific Market, By Country and Ship Type

4.4 Market, By Sensor Type

4.5 Market, By End User

4.6 Market, By Propulsion Engine Subtype

4.7 Market, By Engine Type

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Penetration of the Smart Engine for Situational Awareness and Safety

5.2.1.2 Increase in Demand for Remote Engine Monitoring System for Marine Engines

5.2.1.3 Growth in Maritime Tourism

5.2.1.4 Growth in International Marine Freight Transport

5.2.2 Restraints

5.2.2.1 Stringent Environmental Regulations Worldwide

5.2.2.2 Lack of A Common Data Standard

5.2.3 Opportunities

5.2.3.1 Increased Naval Budgets Worldwide

5.2.3.2 Development of Big Data Analytics

5.2.4 Challenges

5.2.4.1 Fluctuations in Oil & Gas Prices

5.2.4.2 Shipping Overcapacity

5.2.4.3 Dipping Global Marine Freight Rates

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Intelligent Engine

6.2.1 Features of the Intelligent Engine:

6.2.2 Advantages of the Intelligent Engine:

6.2.2.1 Increase in Engine Reliability:

6.2.2.2 Fuel and Lube Oil Utilization Cost Decreases:

6.2.2.3 Follow Up of Stringent Air Contamination Emission Standards:

6.3 Trends in Marine Engine Monitoring

6.3.1 Artificial Intelligence

6.3.2 Big Data Analytics

6.3.3 Internet of Things (IoT)

6.3.4 Augmented Reality

6.4 Use of New Information Technologies in the Maintenance of Ship Systems

6.4.1 Diagnostic Technology:

6.4.2 Cloud Computing:

6.4.3 Radio-Frequency Identification Technology (RFID):

6.4.4 E-Navigation

6.4.5 Data Fusion Technologies

6.4.6 Open Architecture

6.4.7 Multi-Sensor Data Fusion

6.5 Regulatory Bodies Across Various Regions

7 Marine Engine Monitoring System Market, By Component (Page No. - 52)

7.1 Introduction

7.2 Hardware

7.2.1 Displays and Control Modules

7.2.2 Controller, Routers & Switches

7.2.3 Sensors

7.2.3.1 Temperature Sensor

7.2.3.2 Displacement Sensor

7.2.3.3 Torque Sensor

7.2.3.4 Speed Sensor

7.2.3.5 Pressure Sensor

7.2.3.6 Bearing Wear Monitoring Sensor

7.2.3.7 Vibration Sensor

7.2.3.8 Water in Oil Sensor

7.3 Software

8 Marine Engine Monitoring System Market, By Engine Type (Page No. - 58)

8.1 Introduction

8.2 Propulsion Engine

8.2.1 Gas Turbine

8.2.2 Diesel Engine

8.2.3 Steam Turbine

8.2.4 Dual-Fuel Engine

8.3 Auxiliary Engine

9 Marine Engine Monitoring System Market, By Ship Type (Page No. - 63)

9.1 Introduction

9.2 Commercial

9.2.1 Merchant Ships

9.2.1.1 Bulk Carrier

9.2.1.2 Container Ships

9.2.1.3 Oil Tankers

9.2.1.4 LNG & LPG Tankers

9.2.1.5 Chemical Tankers

9.2.1.6 Passenger Ships

9.2.2 Recreational Boats

9.3 Naval

9.3.1 Surface Naval Ships

9.3.1.1 Aircraft Carriers

9.3.1.2 Amphibious Warfare

9.3.1.3 Auxiliary Ship

9.3.1.4 Corvette

9.3.1.5 Cruiser

9.3.1.6 Destroyer

9.3.1.7 Patrol Crafts

9.3.2 Underwater Naval Ships

9.3.2.1 Submarines

10 Marine Engine Monitoring System Market, By Deployment (Page No. - 73)

10.1 Introduction

10.2 Remote

10.3 On-Board

11 Marine Engine Monitoring System Market, By End User (Page No. - 76)

11.1 Introduction

11.2 Original Equipment Manufacturer (OEM)

11.3 Aftermarket

12 Regional Analysis (Page No. - 80)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.2 South Korea

12.2.3 Japan

12.2.4 Philippines

12.2.5 Vietnam

12.2.6 India

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 Turkey

12.3.4 Italy

12.3.5 Norway

12.3.6 Russia

12.3.7 UK

12.4 North America

12.4.1 US

12.4.2 Canada

12.5 Rest of the World

12.5.1 Latin America

12.5.2 Middle East and Africa

13 Competitive Landscape (Page No. - 116)

13.2 Rank Analysis of Key Players in the Marine Engine Monitoring System Market

13.3.1 Contracts

13.3.3 Agreements, Expansions, Joint Ventures, Acquisitions, and Partnerships

14 Company Profile (Page No. - 126)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 ABB

14.2 AST Group

14.3 CMR Group

14.4 Caterpillar

14.5 Cummins

14.6 Emerson Electric

14.7 Hyundai Heavy Industries

14.8 Jason Marine Group

14.9 Kistler Group

14.10 Kongsberg Gruppen

14.11 Man Diesel & Turbo

14.12 Mitsubishi Heavy Industries

14.13 Noris Group

14.14 Rolls-Royce

14.15 Wartsila

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 164)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Introducing RT: Real-Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

15.6 Author Details

List of Tables (97 Tables)

Table 1 Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 2 Hardware Engine Monitoring System Market Size, By Subtype, 2016–2025 (USD Million)

Table 3 Hardware Marine Engine Monitoring System Industry Size, By Region, 2016–2025 (USD Million)

Table 4 Sensors Hardware Engine Monitoring System Market Size, By Subtype, 2016–2025 (USD Million)

Table 5 Software Marine Engine Monitoring System Industry Size, By Region, 2016–2025 (USD Million)

Table 6 Marine Engine Monitoring System Industry, By Engine Type, 2016-2025 (USD Million)

Table 7 Propulsion Engine: Marine Engine Monitoring Systems Market, By Region, 2016-2025 (USD Million)

Table 8 Propulsion Engine: Market, By Sub Type, 2016-2025 (USD Million)

Table 9 Auxiliary Marine Engine: Market, By Region, 2016-2025 (USD Million)

Table 10 Marine Engine Monitoring System Industry Size, By Ship Type, 2016-2025 (USD Million)

Table 11 Commercial Ships Marine Engine Monitoring System Industry Size, By Region, 2016-2025 (USD Million)

Table 12 Commercial Ship Type Marine Market Size, By Subtype, 2016-2025 (USD Million)

Table 13 Merchant Ships Marine Engine Monitoring System Industry Size, By Region, 2016-2025 (USD Million)

Table 14 Merchant Ships Marine Engine Monitoring System Industry, By Subtype, 2016-2025 (USD Million)

Table 15 Recreational Boats Commercial Marine Engine Monitoring System Industry Size, By Region, 2016-2025 (USD Million)

Table 16 Naval Ships Marine Engine Monitoring System Industry Size, By Region, 2016-2025 (USD Million)

Table 17 Naval Ship Market Size, By Subtype, 2016-2025 (USD Million)

Table 18 Surface Naval Ships Marine Engine Monitoring Systems Market Size, By Region, 2016-2025 (USD Million)

Table 19 Surface Naval Ships Market Size, By Subtype, 2016-2025 (USD Million)

Table 20 Underwater Naval Ships Market Size, By Region, 2016-2025 (USD Million)

Table 21 Market, By Deployment, 2016-2025 (USD Million)

Table 22 Market Size, By End User, 2016-2025 (USD Million)

Table 23 OEM Segment, By Region, 2016-2025 (USD Million)

Table 24 OEM End User, By Ship Type, 2016-2025 (USD Million)

Table 25 Aftermarket Segment, By Region, 2016-2025 (USD Million)

Table 26 Aftermarket Segment, By Ship Type, 2016-2025 (USD Million)

Table 27 Marine Engine Monitoring Systems Market Size, By Region, 2016-2025 (USD Million)

Table 28 Asia Pacific: Market Size, By Component, 2016-2025 (USD Million)

Table 29 Asia Pacific: Market Size, By End User, 2016-2025 (USD Million)

Table 30 Asia Pacific: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 31 Asia Pacific: Market Size, By Country, 2016-2025 (USD Million)

Table 32 China: Market Size, By Component, 2016-2025 (USD Million)

Table 33 China: Market Size, By End User, 2016-2025 (USD Million)

Table 34 China: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 35 South Korea: Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 36 South Korea: Market Size, By End User, 2016-2025 (USD Million)

Table 37 South Korea: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 38 Japan: Market Size, By Component, 2016-2025 (USD Million)

Table 39 Japan: Market Size, By End User, 2016-2025 (USD Million)

Table 40 Japan: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 41 Philippines: Market Size, By Component, 2016-2025 (USD Million)

Table 42 Philippines: Market Size, By End User, 2016-2025 (USD Million)

Table 43 Philippines: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 44 Vietnam: Market Size, By Component, 2016-2025 (USD Million)

Table 45 Vietnam: Market Size, By End User, 2016-2025 (USD Million)

Table 46 Vietnam: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 47 India: Market Size, By Component, 2016-2025 (USD Million)

Table 48 India: Market Size, By End User, 2016-2025 (USD Million)

Table 49 India: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 50 Europe: Market Size, By Component, 2016-2025 (USD Million)

Table 51 Europe: Market Size, By End User, 2016-2025 (USD Million)

Table 52 Europe: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 53 Europe: Market Size, By Country, 2016-2025 (USD Million)

Table 54 Germany: Market Size, By Component, 2016-2025 (USD Million)

Table 55 Germany: Marine Engine Monitoring Systems Market Size, By End User, 2016-2025 (USD Million)

Table 56 Russia: Marine Engine Monitoring System Industry Size, By Ship Type, 2016-2025 (USD Million)

Table 57 France: Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 58 France: Market Size, By End User, 2016-2025 (USD Million)

Table 59 France: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 60 Turkey: Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 61 Turkey: Market Size, By End User, 2016-2025 (USD Million)

Table 62 Turkey: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 63 Italy: Marine Engine Monitoring Systems Market Size, By Component, 2016-2025 (USD Million)

Table 64 Italy: Market Size, By End User, 2016-2025 (USD Million)

Table 65 Italy: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 66 Norway: Marine Engine Monitoring Systems Market Size, By Component, 2016-2025 (USD Million)

Table 67 Norway: Market Size, By End User, 2016-2025 (USD Million)

Table 68 Norway: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 69 Russia: Market Size, By Component, 2016-2025 (USD Million)

Table 70 Russia: Market Size, By End User, 2016-2025 (USD Million)

Table 71 Russia: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 72 UK: Market Size, By Component, 2016-2025 (USD Million)

Table 73 UK: Market Size, By End User, 2016-2025 (USD Million)

Table 74 UK: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 75 North America: Market Size, By Component, 2016-2025 (USD Million)

Table 76 North America: Market Size, By End User, 2016-2025 (USD Million)

Table 77 North America: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 78 North America: Market Size, By Country, 2016-2025 (USD Million)

Table 79 US: Market Size, By Component, 2016-2025 (USD Million)

Table 80 US: Market Size, By End User, 2016-2025 (USD Million)

Table 81 US: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 82 Canada: Industry Size, By Component, 2016-2025 (USD Million)

Table 83 Canada: Market Size, By End User, 2016-2025 (USD Million)

Table 84 Canada: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 85 Rest of the World: Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 86 Rest of the World: Market Size, By End User, 2016-2025 (USD Million)

Table 87 Rest of the World: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 88 Rest of the World: Market Size, By Region, 2016-2025 (USD Million)

Table 89 Latin America: Marine Engine Monitoring System Industry Size, By Component, 2016-2025 (USD Million)

Table 90 Latin America: Market Size, By End User, 2016-2025 (USD Million)

Table 91 Latin America: Market Size, By Ship Type, 2016-2025 (USD Million)

Table 92 Middle East and Africa: Market Size, By Component, 2016-2025 (USD Million)

Table 93 Software: Marine Engine Monitoring Systems Market Size, By End User, 2016-2025 (USD Million)

Table 94 Middle East and Africa: Marine Engine Monitoring Systems Market Size, By Ship Type, 2016-2025 (USD Million)

Table 95 Contracts (2014-2018)

Table 96 New Product Launches (2014-2018)

Table 97 Agreements, Expansions, Joint Ventures, Acquisitions, and Partnerships (2014-2018)

List of Figures (48 Figures)

Figure 1 Research Process Flow

Figure 2 Marine Engine Monitoring Systems Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Based on Product Type, the Hardware Segment is Projected to Lead the Marine Engine Monitoring Systems Market From 2018 to 2025

Figure 7 The Strain Gauge Sensor of the Sensor Type is Estimated to Lead the Marine Engine Monitoring Systems Market in 2018

Figure 8 Propulsion Engine Type is Projected to Lead the Marine Engine Monitoring Systems Market From 2018 to 2025

Figure 9 Diesel Engine of Propulsion Engine Type is Projected to Lead the Market From 2018 to 2025

Figure 10 Based on Ship Type, the Commercial Segment is Estimated to Lead the Market in 2018

Figure 11 The Asia Pacific Region is Projected to Lead the Market From 2018 to 2025

Figure 12 Growth in International Seaborne Trade is Projected to Drive the Market During the Forecast Period

Figure 13 The Hardware Segment is Projected to Lead the Market During the Forecast Period

Figure 14 Based on Application, the Commercial Ships Segment is Estimated to Account for the Largest Share of the Asia Market in 2018

Figure 15 The Vibration Sensor Subsegment is Projected to Lead the Sensor Type Market From 2018 to 2025

Figure 16 The Aftermarket Segment is Projected to Lead the Market From 2018 to 2025

Figure 17 The Diesel Engine Subsegment is Projected to Lead the Market From 2018 to 2025

Figure 18 The Propulsion Subsegment is Projected to Lead the Market From 2018 to 2025

Figure 19 Market Dynamics of the Marine Engine Monitoring System

Figure 20 Global Ocean Cruise Passengers (In Million)

Figure 21 Global Sea Freight Transport, 2008-2016 (Million Tons)

Figure 22 Emission Control Area (ECA)

Figure 23 The Software Segment of the Market is Projected to Grow at the Higher CAGR During the Forecast Period

Figure 24 Propulsion Engine Segment Projected to Lead the Market During the Forecast Period

Figure 25 Commercial Segment Projected to Lead the Market During the Forecast Period

Figure 26 On-Board Projected to Lead the Market During the Forecast Period

Figure 27 The Aftermarket Segment of the Market is Projected to Grow at the Higher CAGR From 2018 to 2025

Figure 28 Asia Pacific is Estimated to Account for the Largest Share of the Market in 2018

Figure 29 Asia Pacific Market Snapshot

Figure 30 Europe Marine Market Snapshot

Figure 31 North America Market Snapshot

Figure 32 Companies Adopted Contracts and New Product Launches as Key Growth Strategies From 2014 to 2018

Figure 33 Ranking of Key Players in the Market - 2016

Figure 34 Key Developments Undertaken By Leading Market Players in the Market (2014-2018)

Figure 35 Regional Presence of Leading Companies in the Market

Figure 36 ABB: Company Snapshot

Figure 37 CMR Group: Company Snapshot

Figure 38 Caterpillar: Company Snapshot

Figure 39 Cummins.: Company Snapshot

Figure 40 Emerson Electric : Company Snapshot

Figure 41 Hyundai Heavy Industries: Company Snapshot

Figure 42 Hyundai Heavy Industries: SWOT Analysis

Figure 43 Jason Marine Group: Company Snapshot

Figure 44 Kongsberg Gruppen: Company Snapshot

Figure 45 Man Diesel & Turbo: Company Snapshot

Figure 46 Mitsubishi Heavy Industries: Company Snapshot

Figure 47 Rolls-Royce: Company Snapshot

Figure 48 Wärtsilä: Company Snapshot

Growth opportunities and latent adjacency in Marine Engine Monitoring System Market

We are developing current IOT connectivity solutions for filtration monitoring of diesel powered vehicles/machines/vessels and are interested in gaining an in-depth view of the marine market—both commercial and naval.