Middle East and Africa Cloud Infrastructure Services Market by Service Type (Storage as a Service, Compute as a Service, Disaster Recovery & Backup as a Service, Managed Hosting), Deployment Model, Organization Size, Vertical & Country - Forecast to 2023

[133 Pages Report] The MEA cloud infrastructure services market expected to grow from $2.32 billion in 2017 to $4.72 billion by 2023 at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. The base year considered for this report is 2017, and the market forecast period is 20182023.

Major growth drivers for cloud infrastructure services market include shifting of enterprise workloads to the cloud, large scale investments in digitization by governments, and business expansions by major global vendors in the Middle East and Africa (MEA) region.

Market Dynamics

Drivers-

Increasing investment by government for digital transformation

-

Business expansion by global vendors to gain the first-mover advantage

-

Initiatives by government organizations to promote the latest technologies

-

Increased awareness among enterprises regarding the benefits of cloud and its adjacent technologies

-

Business continuity requirements resulting in high demand for disaster recovery services

Restraints

-

Lack of industry standards and regulatory frameworks

-

Limited bandwidth providers and lack of access to high-speed internet

Opportunities

- African countries are gearing up to transform their economy and education system by promoting greater access to mobile connectivity and public cloud

- Telecom service providers are leveraging the existing infrastructure

Challenges

- Delivering reliable cloud services to certain African regions, particularly smaller towns and rural/remote areas

- High latency and workload complexities in the cloud environment

Increasing investment by government for digital transformation

Heavy investments are being made by Middle Eastern countries to digitalize their economy. The UAE government has introduced several digital government initiatives, such as Smart Dubai and Smart Abu Dhabi. These initiatives facilitate collaboration among the private and government sectors. The Abu Dhabi digital transformation initiatives and eGovernment programs are helping in major digital transformation plans and projects, including enhancing the formation of a smart government based on significant and effective services for users, ranging from individuals to government and private sectors. Various other digital initiatives such as improvements to the efficiency and effectiveness of the healthcare sector using IT and digital transformations, and the emergence of technology companies are contributing to digitalization under the National Transformation Program of the Saudi Arabian government. The Qatar e-Government 2020 strategy is expected to assist with eGovernment and eServices, ICT industry development, and national infrastructure development

Objectives of the Study

- To describe and forecast the MEA cloud infrastructure services market by service type, deployment model, organization size, vertical, and country

- To forecast the market size of the main countries, namely Kingdom of Saudi Arabia (KSA), United Arab Emirates (UAE), Qatar, South Africa, and Rest of MEA

- To analyze the market subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the major players

- To track and analyze competitive developments, such as acquisitions, new product developments, and partnerships and collaborations, in the MEA cloud infrastructure services market

Research Methodology

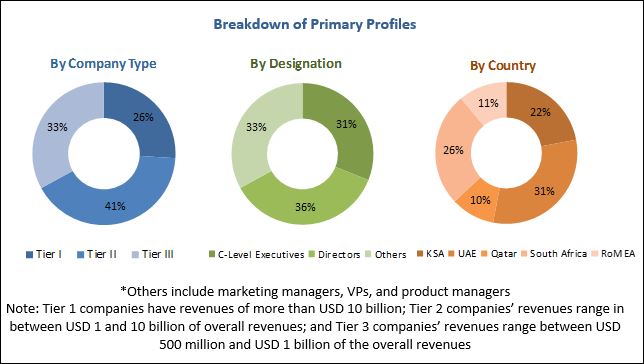

The research methodology used to estimate and forecast the MEA cloud infrastructure services market began with capturing data on key vendor revenues through secondary research, which included directories and databases (D&B Hoovers, Bloomberg Businessweek, and Factiva). The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size that was derived from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The MEA cloud infrastructure services ecosystem comprises vendors, such as Microsoft (US), AWS (US), IBM (US), Oracle (US), Google (US), Alibaba (China), Fujitsu (Japan), Injazat Data Systems (UAE), eHosting DataFort(UAE), BIOS Middle East Group(UAE), Orixcom (UAE), STC Cloud (Saudi Arabia), Mobily (Saudi Arabia), Batelco (Bahrain), Emirates Integrated Telecommunications Company (UAE), Ooredoo (Qatar), and Cloud4C (India).

Other stakeholders of the MEA cloud infrastructure services market include cloud vendors, application design and development service providers, system integrators/migration service providers, consultancy firms/advisory firms, training and education service providers, data integration service providers, managed service providers, and data quality service providers.

Major Market Development

- In July 2018, AWS launched EC2 compute instances for its Snowball Edge appliance. The availability of EC2 compute instances is expected to give the system an edge over other appliances that target such environments.

- In May 2018, Microsoft and Red Hat expanded their alliance for container-based applications across Microsoft Azure and on-premises. With this partnership, the companies would introduce the first jointly managed OpenShift offering in the public cloud, combining the power of Red Hat OpenShift and Azure, Microsofts public cloud.

- In November 2017, IBM launched a new IBM Cloud Private software platform to help companies in technology investments in core data and applications, and extend cloud-native tools across public and private clouds.

Key Target Audience Of MEA Cloud Infrastructure Services Market

- Cloud Computing Software Vendors

- Cloud Computing Solution Providers

- Cloud Security Vendors

- Cloud Brokerage Services Providers (CSBs)

- Cloud Service Providers (CSPs)

- Managed Service Providers (MSPs)

- System Integrators

- Networking Companies

- Value-Added Resellers (VARS)

- Government Institutions

- Consultants/Consultancies/Advisory Firms

- Support and Maintenance Service Providers

- Technology Providers

Scope of the MEA Cloud Infrastructure Services Market Research Report

The research report categorizes the MEA cloud infrastructure services market to forecast the revenues and analyze the trends in each of the following subsegments:

By Service Type

- Storage as a Service

- Compute as a Service

- Disaster Recovery and Backup as a Service

- Networking as a Service

- Desktops as a Service

- Managed Hosting

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others (Education, and Travel and Hospitality)

By Country

- KSA

- UAE

- Qatar

- South Africa

- Rest of MEA

Critical questions which the report answers

- What are the industries which the Cloud Infrastructure Services companies are exploring?

- Which are the key players in the market and how intense is the competition?

The cloud infrastructure services market in the Middle East and Africa (MEA) is expected to grow from USD 2.80 billion in 2018 to USD 4.72 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 11.0% during the forecast period. Cloud infrastructure services are important as these services offer crucial benefits to the enterprises, such as rapid deployments, optimized capital expenditures, and low maintenance costs. Due to major technology upgrades, several enterprises have shifted their setup from on-premises to the cloud. With this, enterprises can save costs and at the same time modernize and protect their IT infrastructure.

This report provides detailed insights into the MEA cloud infrastructure services market, split across service type, deployment model, organization size, vertical, and region. The report segments market by service type, deployment model, organization size, vertical, and country. The service type includes storage as a service, compute as a service, disaster recovery and backup as a service, networking as a service, desktops as a service, and managed hosting.

The deployment model for the cloud infrastructure services market covers public cloud, private cloud, and hybrid cloud. By organization size, the market has 2 categories: Small and Medium-sized Enterprises (SMEs) and large enterprises. The large enterprises segment is expected to hold a larger market size, owing to the easy deployment, affordable costs, availability of advanced technologies, and sophisticated IT infrastructure.

DISASTER RECOVERY AND BACKUP AS A SERVICE

Disaster recovery and backup as a service is a category of cloud services that protects and recovers data from any manmade or natural disaster. Disaster can occur in many ways, such as communication failure, power outage, downtime, data loss, fire, flood, hurricane, hardware failure, software bug, security breach, service disruption, nuclear reaction, or terrorism. It is very critical for enterprises and consumers to protect their data to ensure business continuity at all times. This service provided through the cloud minimizes the operational and capital expenditure incurred. It had been observed that the disaster recovery and backup as a service is being rapidly adopted by enterprises due to its pay-as-you-go pricing model. This pricing model reduces the total cost of the organization to a great extent, as the organization needs to pay only for what it used. Disaster recovery and backup as a service is offered by vendors, such as AWS, IBM, Equinix, and HPE.

NETWORKING AS A SERVICE

Networking as a service is the latest entrant in the IaaS offering that offers on-demand network connectivity, provisioning, and management of network services. It also provides seamless connectivity across storage, networking, and server resources, which changes to meet the demands of virtualized infrastructures. The service permits tenants to customize the service that they receive from networks. Networking as a service enables tenants to launch custom routing protocols, including multicast services or anycast/incast protocols, as well as, more sophisticated mechanisms, such as content-based routing and content-centric networking. It allows enterprises to order, provision, and modify WAN services, such as Ethernet connectivity and virtual private network via web portals. The service comprises network services from third parties to customers who do not want to invest in building their own networking infrastructure. Zero upfront costs, scalability, flexibility, and security are some of the benefits offered by this service

STORAGE AS A SERVICE

Storage as a service refers to the service in which the service provider offers storage infrastructure to another company for storing data. Enterprises that lack the budget to implement and maintain their own storage infrastructure or hardware generally avail this service. Moreover, enterprises use storage as a service to mitigate risks in disaster recovery and enhance business continuity and availability. These services provide self-service portals that allow the provision of storage, transfer data to different tiers of storage, and add or remove storage as needed. The service providers also have the latest storage technologies and offer virtually limitless capacities to address the business demands of customers. To address the security needs of enterprise data, cloud-based storage offers security controls to ensure that all the data is stored securely in data center facilities and is instantly available. The storage as a service segment offers enterprises the flexibility to scale up or scale down the storage capacity depending on their business requirements.Critical questions the report answers:

-

Where will all these developments take the industry in the mid to long term?

-

What are the upcoming industry applications for MEA cloud infrastructure services?

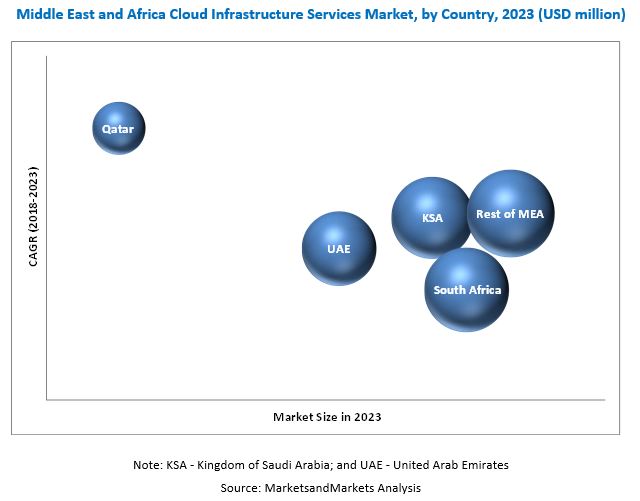

The report covers all the major aspects of the cloud infrastructure services market and provides an in-depth analysis across MEA countries of KSA, UAE, Qatar, South Africa, and Rest of MEA region. Qatar is expected to have the highest CAGR due to the increase in adoption of associated services. Qatar will provide several growth opportunities in the MEA cloud infrastructure services market and grow at the highest CAGR during the forecast period. However, lack of access to high speed internet and lack of proper industry standards may restrain the market growth.

Major vendors of cloud infrastructure services help their clients to reduce their Capital Expenditure (CAPEX). Oracle, one of the major vendors, offers compute, storage, and network-based cloud infrastructure services to its customers. Other major vendors in the MEA cloud infrastructure services market include IBM (US), Microsoft (US), AWS (US), Oracle (US), Google (US), Alibaba (China), Fujitsu (Japan), Injazat Data Systems (UAE), eHosting DataFort(UAE), BIOS Middle East Group(UAE), Orixcom (UAE), STC Cloud (Saudi Arabia), Mobily (Saudi Arabia), Batelco (Bahrain), Emirates Integrated Telecommunications Company (UAE), Ooredoo (Qatar), and Cloud4C (India). These market players have adopted various strategies, such as partnerships, collaborations, and expansions, to further strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Growth Opportunities in the MEA Cloud Infrastructure Services Market

4.2 Market By Service Type, 2018 vs 2023

4.3 Market By Deployment Model, 2018

4.4 Market By Vertical, 2018 vs 2023

5 Market Overview and Industry Trends (Page No. - 33)

5.1 Market Overview

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Investment By Government for Digital Transformation

5.2.1.2 Business Expansion By Global Vendors to Gain the First-Mover Advantage

5.2.1.3 Initiatives By Government Organizations to Promote the Latest Technologies

5.2.1.4 Increased Awareness Among Enterprises Regarding the Benefits of Cloud and ITs Adjacent Technologies

5.2.1.5 Business Continuity Requirements Resulting in High Demand for Disaster Recovery Services

5.2.2 Restraints

5.2.2.1 Lack of Industry Standards and Regulatory Frameworks

5.2.2.2 Limited Bandwidth Providers and Lack of Access to High-Speed Internet

5.2.3 Opportunities

5.2.3.1 African Countries are Gearing Up to Transform Their Economy and Education System By Promoting Greater Access to Mobile Connectivity and Public Cloud

5.2.3.2 Telecom Service Providers are Leveraging the Existing Infrastructure

5.2.4 Challenges

5.2.4.1 Delivering Reliable Cloud Services to Certain African Regions, Particularly Smaller Towns and Rural/Remote Areas

5.2.4.2 High Latency and Workload Complexities in the Cloud Environment

5.3 Regulatory Landscape

5.3.1 United Arab Emirates

5.3.1.1 UAE Civil Code: Number 5 of 1985 on the Civil Transactions Law

5.3.1.2 UAE Federal Law Number 2 on the Prevention of IT Crimes

5.3.1.3 Federal Law Number 1 of 2006 Concerning Electronic Transactions and Ecommerce

5.3.1.4 Dubai International Financial Centre (DIFC) Law Number 5 of 2012

5.3.1.5 Electronic Transactions Law, DIFC Law Number 2 of 2017

5.3.2 Kingdom of Saudi Arabia

5.3.2.1 Law Number 20 of 2014 Pertaining to Electronic Transactions

5.3.2.2 Anti-Cyber Crime Law

5.3.2.3 Saudi Arabia Telecommunications Act

5.3.2.4 Shariah Principles

5.3.3 Qatar

5.3.3.1 Penal Code: Law 11 of 2004

5.3.3.2 Electronic Commerce and Transactions Law

5.3.3.3 Telecommunications Law

5.3.3.4 Banking Law: Law 33 of 2006

5.3.3.5 Qatar Computer Emergency Response (QCERT)

5.3.3.6 Data Protection and Privacy Law

5.4 Use Cases

5.4.1 Use Case #1: ABU Dhabi Finance

5.4.2 Use Case #2: Mediclinic International

5.4.3 Use Case #3: Waha Capital

5.4.4 Use Case #4: Flydubai

5.4.5 Use Case #5: Alpha Apps

6 MEA Cloud Infrastructure Services Market, By Service Type (Page No. - 47)

6.1 Introduction

6.2 Compute as A Service

6.3 Storage as A Service

6.4 Disaster Recovery and Backup as A Service

6.5 Networking as A Service

6.6 Desktop as A Service

6.7 Managed Hosting

7 Market By Deployment Model (Page No. - 54)

7.1 Introduction

7.2 Public Cloud

7.3 Private Cloud

7.4 Hybrid Cloud

8 MEA Cloud Infrastructure Services Market, By Organization Size (Page No. - 58)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Market By Vertical (Page No. - 62)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 IT and Telecommunications

9.4 Government and Public Sector

9.5 Retail and Consumer Goods

9.6 Manufacturing

9.7 Energy and Utilities

9.8 Media and Entertainment

9.9 Healthcare and Life Sciences

9.10 Others

10 MEA Cloud Infrastructure Services Market, By Country (Page No. - 73)

10.1 Introduction

10.2 Kingdom of Saudi Arabia

10.3 United Arab Emirates

10.4 Qatar

10.5 South Africa

10.6 Rest of Middle East and Africa

11 Competitive Landscape (Page No. - 88)

11.1 Overview

11.2 Competitive Scenario

11.2.1 New Product Launches

11.2.2 Acquisitions

11.2.3 Partnerships

12 Company Profiles (Page No. - 92)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Introduction

12.2 IBM

12.3 Microsoft

12.4 AWS

12.5 Alibaba

12.6 Oracle

12.7 Google

12.8 Injazat Data Systems

12.9 STC Cloud

12.10 Fujitsu

12.11 Ehosting Datafort

12.12 BIOS Middle East Group

12.13 Orixcom

12.14 Mobily

12.15 Batelco

12.16 Emirates Integrated Telecommunications

12.17 Ooredoo

12.18 Cloud4c

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 126)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (48 Tables)

Table 1 MEA Cloud Infrastructure Services Market Size, By Service Type, 20162023 (USD Million)

Table 2 Compute as A Service: Market Size, By Country, 20162023 (USD Million)

Table 3 Storage as A Service: Market Size, By Country, 20162023 (USD Million)

Table 4 Disaster Recovery and Backup as A Service: Market Size, By Country, 20162023 (USD Million)

Table 5 Networking as A Service: Market Size, By Country, 20162023 (USD Million)

Table 6 Desktop as A Service: Market Size, By Country, 20162023 (USD Million)

Table 7 Managed Hosting: Market Size, By Country, 20162023 (USD Million)

Table 8 MEA Cloud Infrastructure Services Market Size, By Deployment Model, 20162023 (USD Million)

Table 9 Public Cloud: Market Size By Country, 20162023 (USD Million)

Table 10 Private Cloud: Market Size By Country, 20162023 (USD Million)

Table 11 Hybrid Cloud: Market Size By Country, 20162023 (USD Million)

Table 12 MEA Cloud Infrastructure Services Market Size, By Organization Size, 20162023 (USD Million)

Table 13 Small and Medium-Sized Enterprises: Market Size By Country, 20162023 (USD Million)

Table 14 Large Enterprises: Market Size By Country, 20162023 (USD Million)

Table 15 MEA Cloud Infrastructure Services Market Size, By Vertical, 20162023 (USD Million)

Table 16 Banking, Financial Services, and Insurance: Market Size By Country, 20162023 (USD Million)

Table 17 IT and Telecommunications: Market Size By Country, 20162023 (USD Million)

Table 18 Government and Public Sector: Market Size By Country, 20162023 (USD Million)

Table 19 Retail and Consumer Goods: Market Size By Country, 20162023 (USD Million)

Table 20 Manufacturing: Market Size By Country, 20162023 (USD Million)

Table 21 Energy and Utilities: Market Size By Country, 20162023 (USD Million)

Table 22 Media and Entertainment: Market Size By Country, 20162023 (USD Million)

Table 23 Healthcare and Life Sciences: Market Size By Country, 20162023 (USD Million)

Table 24 Others: Market Size By Country, 20162023 (USD Million)

Table 25 MEA Cloud Infrastructure Services Market Size, By Country, 20162023 (USD Million)

Table 26 Kingdom of Saudi Arabia: Market Size By Service Type, 20162023 (USD Million)

Table 27 Kingdom of Saudi Arabia: Market Size By Deployment Model, 20162023 (USD Million)

Table 28 Kingdom of Saudi Arabia: Market Size By Organization Size, 20162023 (USD Million)

Table 29 Kingdom of Saudi Arabia: Market Size By Vertical, 20162023 (USD Million)

Table 30 United Arab Emirates: Market Size By Service Type, 20162023 (USD Million)

Table 31 United Arab Emirates: Market Size By Deployment Model, 20162023 (USD Million)

Table 32 United Arab Emirates: Market Size By Organization Size, 20162023 (USD Million)

Table 33 United Arab Emirates: Market Size By Vertical, 20162023 (USD Million)

Table 34 Qatar: Market Size By Service Type, 20162023 (USD Million)

Table 35 Qatar: Market Size By Deployment Model, 20162023 (USD Million)

Table 36 Qatar: Market Size By Organization Size, 20162023 (USD Million)

Table 37 Qatar: Market Size By Vertical, 20162023 (USD Million)

Table 38 South Africa: Market Size By Service Type, 20162023 (USD Million)

Table 39 South Africa: Market Size By Deployment Model, 20162023 (USD Million)

Table 40 South Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 41 South Africa: Market Size By Vertical, 20162023 (USD Million)

Table 42 Rest of Middle East and Africa: Market Size By Service Type, 20162023 (USD Million)

Table 43 Rest of Middle East and Africa: Market Size By Deployment Model, 20162023 (USD Million)

Table 44 Rest of Middle East and Africa: Market Size By Organization Size, 20162023 (USD Million)

Table 45 Rest of Middle East and Africa: Market Size By Vertical, 20162023 (USD Million)

Table 46 New Product Launches, 20172018

Table 47 MEA Cloud Infrastructure Services Market: Acquisitions, 2017-2018

Table 48 Partnerships, 2018

List of Figures (40 Figures)

Figure 1 MEA Cloud Infrastructure Services Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Country

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 MEA Cloud Infrastructure Services Market: Assumptions

Figure 8 Market is Expected to Grow at A Significant Rate During the Forecast Period

Figure 9 Market Top Segments, 20182023

Figure 10 Market By Country

Figure 11 Improving Economic Conditions and Government Initiatives are Expected to Boost the Growth of the MEA Cloud Infrastructure Services Market

Figure 12 Storage as A Service Segment is Estimated to Hold the Largest Market Size in 2018

Figure 13 Public Cloud Deployment Model is Estimated to Hold the Highest Market Share in 2018

Figure 14 Banking, Financial Services, and Insurance Vertical is Estimated to Hold the Largest Market Size in 2018

Figure 15 MEA Cloud Infrastructure Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Disaster Recovery and Backup as A Service Segment is Expected to Grow at the Highest Rate During the Forecast Period

Figure 17 Public Deployment Model is Expected to Account for the Largest Market Size During the Forecast Period

Figure 18 Large Enterprises Segment is Expected to Account for the Larger Market Size During the Forecast Period

Figure 19 Retail and Consumer Goods Vertical is Projected to Grow at the Highest Rate During Forecast Period

Figure 20 Qatar is Projected to Grow at the Highest Rate During the Forecast Period

Figure 21 Kingdom of Saudi Arabia: Market Snapshot

Figure 22 Qatar: Market Snapshot

Figure 23 Key Developments By the Leading Players in the MEA Cloud Infrastructure Services Market During 20162018

Figure 24 IBM: Company Snapshot

Figure 25 IBM: SWOT Analysis

Figure 26 Microsoft: Company Snapshot

Figure 27 Microsoft: SWOT Analysis

Figure 28 AWS: Company Snapshot

Figure 29 AWS: SWOT Analysis

Figure 30 Alibaba: Company Snapshot

Figure 31 Alibaba: SWOT Analysis

Figure 32 Oracle: Company Snapshot

Figure 33 Oracle: SWOT Analysis

Figure 34 Google: Company Snapshot

Figure 35 STC Cloud: Company Snapshot

Figure 36 Fujitsu: Company Snapshot

Figure 37 Mobily: Company Snapshot

Figure 38 Batelco: Company Snapshot

Figure 39 Emirates Integrated Telecommunications: Company Snapshot

Figure 40 Ooredoo: Company Snapshot

Growth opportunities and latent adjacency in Middle East and Africa Cloud Infrastructure Services Market