Bioceramics and Piezoceramics Market by Material (Bio-Inert, Bio-Active, & Bio-Resorbable Ceramics, Piezo Ceramcis), by Application (Dental & Orthopedic Implants, Surgical, & Diagnostic Instrument, Implanatable Electronic Devices), by Region - Global Forecast to 2020

[127 Pages Report] Bioceramics and piezoceramics are materials which are made of alumina or hydroxyapatite, calcium phosphate, which are used in the body to replace a function like bone material or hips or knees, for instance. There are four major types of bioceramics and piezoceramics materials that are, bio-inert ceramics, bio-active ceramics, bio-resorbable ceramics, and piezoceramics. The global bioceramics and piezoceramics market is projected to be worth USD 16.3 Billion by 2020, registering a CAGR of 6.4% between 2015 and 2020. In this study, 2013 has been considered as the historical year and 2014 as the base year for estimating market size of bioceramics and piezoceramics.

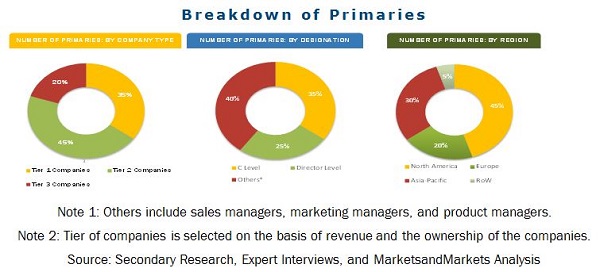

This research study used extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information useful for this technical, market-oriented, and commercial study of the bioceramics and peizoceramics market. The primary sources are mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and organizations related to all segments of the industrys supply chain. The bottom-up approach has been used to estimate market size of bioceramics and peizoceramics material, application, and region, in terms of value and volume. The top-down approach has been implemented to validate the market size, in terms of value and volume. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The main raw materials required for manufacturing bioceramics and piezoceramics are natural minerals and inorganic, non-metallic materials. The top players of bioceramics and piezoceramics are CoorsTek Inc. (U.S.), CeramTec GmbH (Germany), Kyocera Corporation (Japan), Morgan Advanced Materials (U.K.), DePuy Synthes (U.S.), and many more among others.

- This study answers several questions for the stakeholders, primarily which market segments need to be focused in next two to five years for prioritizing the efforts and investments.

- These stakeholders include:

- Bioceramics and peizoceramics manufacturers

- Bioceramics and peizoceramics traders

- Distributors

- Suppliers

- End-use market participants of different segments of bioceramics and peizoceramics

- Government and research organizations

- Associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environment support agencies Investment banks and private equity firms

Scope of the Report:

This research report categorizes the market for bioceramics and peizoceramics based on materials, application, and region and forecasts revenue growth and analysis of trends in each of the submarkets.

On the Basis of Material: The bioceramics and peizoceramics market is segmented on the basis of material that include

- Bio-inert ceramics

- Bio-active ceramics

- Bio-resorbable ceramics

- Piezo ceramics

On the Basis of Application: The bioceramics and peizoceramics market is segmented on the basis of application that include

- Dental implants

- Orthopedic implants

- Surgical instruments

- Diagnostic instruments

- Implantable electronic devices

- Others

On the Basis of Region: The bioceramics and peizoceramics market is segmented by region as

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Rest of Asia-Pacific

- Europe

- Germany

- France

- U.K.

- Italy

- Turkey

- Spain

- Rest of Europe

- North America

- U.S.

- Canada

- Mexico

- RoW

- Brazil

- Others

Available Customizations: The following customization options are available in the report:

- Company Information

Analysis and profiling of additional global as well as regional market players (Up to 3)

The global market size of bioceramics and peizoceramics, in terms of value, is projected to reach USD 16.3 Billion by 2020, at a CAGR of 6.4% between 2015 and 2020. The high potential from the dental & orthopedic implants and increasing global demand for implantable electronic devices along with continuous expansion, merger & acquisition activities undertaken by different companies are the key factors for the growth of the global bioceramics and peizoceramics market.

Bio-inert ceramics are projected to be the largest and fastest-growing type of bioceramics and peizoceramics between 2015 and 2020. Compared to metal and polymer materials, these ceramics are inorganic, non-metallic solids, strong in compression, and brittle. The most widely used bio-inert ceramics in the medical sector are zirconia (ZrO2) and alumina (Al2O3) as these are chemically stable. Bio-inert ceramics are used in bone tissue applications because they are biocompatible, non-toxic, non-inflammatory, non-allergic, non-carcinogenic, and bio-functional. These ceramics are the largest type of medical ceramic materials as the demand in end-use applications, such as dental and orthopedic implants, is growing rapidly. Apart from bio-inert ceramics, there are three other types of ceramics which are widely used. These are bio-active, bio-resorbable, and piezoceramics. These ceramics are also considered as the fine ceramics in many applications.

The dental orthopedic implants application is the fastest-growing segment in the global bioceramics and peizoceramics market. The dental implants application is expected to grow further with the increasing awareness about dental care & oral hygiene. The growth of the dental implants market is attributed to the rising urban population and increasing consumer incomes across the globe. Moreover, the shift in medical tourism from the U.S. and the U.K. to Malaysia, China, and India is driving the overall bioceramics and peizoceramics market for the dental implants application.

Asia-Pacific is projected to be the fastest-growing market for bioceramics and peizoceramics, in terms of value, between 2015 and 2020. Accelerating demand from end-use applications such as dental implants, orthopedic implants, surgical & diagnostic instruments, implantable electronic devices, and others in Asia-Pacific is driving the growth of the bioceramics and peizoceramics market. Tremendous development in healthcare facilities is expected to drive the bioceramics and peizoceramics market in the region.

The bioceramics and peizoceramics market is gaining importance at a fast pace. However, a few factors act as a bottleneck toward the growth of the bioceramics and peizoceramics market. The stringent clinical and regulatory process for the use of bioceramics and peizoceramics is the major restraint toward the growth of this market. The development of medical ceramic products involves time-consuming processes and expensive clinical trials. As these products have to be implanted inside the human body, they need to be biocompatible and have to undergo the ISO biocompatibility testing standards.

The companies such as CoorsTek Inc. (U.S.), CeramTec GmbH (Germany), DePuy Synthes (U.S.), NGK Spark Plug Co., Ltd., and Morgan Advanced Materials PLC (U.K.) are the dominant market participants in the global bioceramics and peizoceramics market. The diverse product portfolio & strategically positioned R&D centers, continuous adoption of development strategies, and technological advancements are few factors that are responsible for strengthening the position of these companies in the market. They have been adopting various organic and inorganic growth strategies such as expansions, mergers & acquisitions, joint ventures & collaborations, and new product launches to enhance the current market scenario of bioceramics and peizoceramics.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.3.3 Currency and Pricing

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Bioceramics Market and Piezoceramics Market

4.2 Bioceramics Market and Piezoceramics Market: By Material

4.3 Asia-Pacific Bioceramics Market and Piezoceramics Market: By Application

4.4 Bioceramics Market and Piezoceramics Market Attractiveness

4.5 Bioceramics Market and Piezoceramics Market: Developing vs. Developed Nations

4.6 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Material

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Implantable Devices Market

5.3.1.2 Availability of Substitute for Metals

5.3.1.3 Growing Healthcare Sector in the Emerging Markets

5.3.2 Restraints

5.3.2.1 Stringent Clinical and Regulatory Processes

5.3.2.2 Unfavorable Healthcare Reforms in the U.S.

5.3.3 Opportunities

5.3.3.1 Growing Nanotechnology in Bioceramics and Piezoceramics

5.3.4 Challenges

5.3.4.1 Issues About Reparability and Recycling Process

6 Industry Trends (Page No. - 38)

6.1 Value-Chain Analysis

6.2 Raw Material Suppliers

6.3 Manufacturers and Formulators

6.4 Suppliers and Distributors

6.5 End-Use Applications

6.6 Porters Five Forces Analysis

6.6.1 Bargaining Power of Suppliers

6.6.2 Threat of New Entrants

6.6.3 Threat of Substitutes

6.6.4 Bargaining Power of Buyers

6.6.5 Intensity of Rivalry

7 Bioceramics and Piezoceramics Market, By Material (Page No. - 43)

7.1 Introduction

7.2 Market Size & Projection

7.3 Bio-Inert Ceramics

7.3.1 Aluminum Oxide (Al2O3)

7.3.2 Zirconia Oxide (ZrO2)

7.4 Bio-Active Ceramics

7.4.1 Bio Glass

7.4.2 Glass Ceramics

7.5 Bio-Resorbable Ceramics

7.6 Piezoceramics

8 Bioceramics and Piezoceramics Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Dental Implants

8.3 Orthopedic Implants

8.4 Surgical Instruments

8.5 Implantable Electronic Devices

8.6 Diagnostic Instruments

8.7 Other Applications

9 Bioceramics and Piezoceramics Market, By Region (Page No. - 62)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 South Korea

9.2.4 India

9.2.5 Indonesia

9.2.6 Malayasia

9.2.7 Rest of Asia-Pacific

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Turkey

9.4.3 France

9.4.4 U.K.

9.4.5 Italy

9.4.6 Spain

9.4.7 Rest of Europe

9.5 RoW

9.5.1 Brazil

9.5.2 Others

10 Competitive Landscape (Page No. - 94)

10.1 Introduction

10.2 Competitive Situations and Trends

10.3 Mergers & Acquisitions

10.4 New Product Launches/Developments

10.5 Expansions

11 Company Profiles (Page No. - 98)

11.1 Introduction

11.2 Coorstek Inc.

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Ceramtec GmbH

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Kyocera Corporation

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 Morgan Advanced Materials PLC

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 NGK Spark Plug Co., Ltd.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 SWOT Analysis

11.6.4 MnM View

11.7 SaintGobain Ceramic Materials

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 SWOT Analysis

11.7.4 MnM View

11.8 Depuy Synthes

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.8.4 SWOT Analysis

11.9 Rauschert GmbH

11.9.1 Business Overview

11.9.2 Products Offered

11.10 H.C. Starck GmbH

11.10.1 Business Overview

11.10.2 Products Offered

12 Appendix (Page No. - 120)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (63 Tables)

Table 1 Bioceramics and Piezoceramics Market, By Material

Table 2 Bioceramics and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 3 Comparision of Mechanical Properties of Zirconia and Alumina

Table 4 Bio-Inert Ceramics Market Size, By Region, 20132020 (USD Million)

Table 5 Bio-Active Ceramics Market Size, By Region, 20132020 (USD Million)

Table 6 Bio-Resorbable Ceramics Market Size, By Region, 20132020 (USD Million)

Table 7 Piezoceramics Market Size, By Region, 20132020 (USD Million)

Table 8 Bioceramics Market and Piezoceramics Market Size in Dental Implants, By Region, 20132020 (USD Million)

Table 9 Bioceramics Market and Piezoceramics Market Size in Orthopedic Implants, By Region, 20132020 (USD Million)

Table 10 Bioceramics Market and Piezoceramics Market Size in Surgical Instruments, By Region, 20132020 (USD Million)

Table 11 Bioceramics Market and Piezoceramics Market Size in Implantable Electronic Devices, By Region, 20132020 (USD Million)

Table 12 Bioceramics Market and Piezoceramics Market Size in Diagnostic Instruments, By Region, 20132020 (USD Million)

Table 13 Bioceramics Market and Piezoceramics Market Size in Other Applications, By Region, 20132020 (USD Million)

Table 14 Bioceramics Market and Piezoceramics Market Size, By Region, 20132020 (USD Million)

Table 15 Asia-Pacific: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 16 Asia-Pacific: Mdical Ceramics Market Size, By Application, 20132020 (USD Million)

Table 17 China: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 18 China: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 19 Japan: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 20 Japan: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 21 South Korea: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 22 South Korea: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 23 India: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 24 India: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 25 Indonesia: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 26 Indonesia: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 27 Malayasia: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 28 Malayasia: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 29 Rest of Asia-Pacific: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 30 Rest of Asia-Pacific: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 31 North America: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 32 North America: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 33 U.S.: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 34 U.S.: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 35 Canada: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 36 Canada: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 37 Mexico: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 38 Mexico: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 39 Europe: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 40 Europe: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 41 Germany: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 42 Germany: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 43 Turkey: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 44 Turkey: Bioceramics and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 45 France: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 46 France: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 47 U.K.: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 48 U.K.: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 49 Italy: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 50 Italy: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 51 Spain: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 52 Spain: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 53 Rest of Europe: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 54 Rest of Europe: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 55 RoW: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 56 RoW: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 57 Brazil: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 58 Brazil: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 59 Others: Bioceramics Market and Piezoceramics Market Size, By Material, 20132020 (USD Million)

Table 60 Others: Bioceramics Market and Piezoceramics Market Size, By Application, 20132020 (USD Million)

Table 61 Mergers & Acquisitions, 20112015

Table 62 New Product Launches /Developments, 20112015

Table 63 Expansions, 20112015

List of Figures (50 Figures)

Figure 1 Bioceramics Market and Piezoceramics Market Segmentation

Figure 2 Bioceramics Market and Piezoceramics Market: Research Design

Figure 3 Breakdown of Primary Interviews, By Company Type, Designation, and Region

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Market Size Estimation: Bottom-Up Approach

Figure 6 Market Breakdown and Data Triangulation

Figure 7 Dental Implants to Dominate the Bioceramics Market and Piezoceramics Market

Figure 8 North America to Dominate the Bioceramics Market and Piezoceramics Market, By Application in 2014

Figure 9 Bio-Inert Ceramics to Dominate the Bioceramics Market and Piezoceramics Market, (USD Million)

Figure 10 Asia-Pacific has High Potential in Bioceramics Market and Piezoceramics Market (20152020)

Figure 11 Bioceramics and Piezoceramics Market to Register High Growth Between 2015 and 2020

Figure 12 Bio-Inert Ceramics to Be the Fastest-Growing Segment Between 2015 and 2020

Figure 13 China Accounted for the Largest Share of the Asia-Pacific Bioceramics and Piezoceramics Market in 2014

Figure 14 India to Register the Highest Growth Rate During the Forecast Period

Figure 15 India to Emerge as A Lucrative Market Between 2015 and 2020

Figure 16 Asia-Pacific has the Highest Growth Potential in the Global Bioceramics and Piezoceramics Market

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Bioceramics and Piezoceramics Market

Figure 18 Value-Chain Analysis of the Bioceramics and Piezoceramics Market

Figure 19 Porters Five Forces Analysis

Figure 20 Bio-Inert Ceramics to Dominate the Bioceramics and Piezoceramics Market, 2015-2020

Figure 21 North America to Be the Largest Market for Bio-Inert Ceramics, 2015 vs. 2020 (USD Million)

Figure 22 Asia-Pacific to Be the Fastest-Growing Bio-Active Ceramics Market, By 2020

Figure 23 North America to Be the Largest Market of Bio-Resorbable Ceramics, By 2020

Figure 24 Asia-Pacific to Be the Fastest-Growing Market for Piezo Ceramics, By 2020

Figure 25 Dental Implants Application Dominated the Overall Bioceramics and Piezoceramics Market in 2014

Figure 26 North America is the Largest Market for Bioceramics and Piezoceramics in Dental Implants, 2015 vs. 2020 (USD Million)

Figure 27 Asia-Pacific to Be the Fastest-Growing Market for Bioceramics and Piezoceramics in Orthopedic Implants, 2015 vs. 2020 (USD Million)

Figure 28 Asia-Pacific to Be the Fastest-Growing Market for Bioceramics and Piezoceramics in Surgical Instruments, 2015 vs. 2020 (USD Million)

Figure 29 Asia-Pacific to Drive the Bioceramics and Piezoceramics Market for Implantable Electronic Devices, 2015 vs. 2020

Figure 30 North America to Dominate the Bioceramics and Piezoceramics Market in Diagnostic Instruments 2015 vs. 2020, (USD Million)

Figure 31 India: the Fastest-Growing Bioceramics and Piezoceramics Market, 2014 (USD Million)

Figure 32 Asia-Pacific: the Fastest-Growing Bioceramics and Piezoceramics Market in Different Applications, 20152020

Figure 33 Asia-Pacific Presents High Growth Opportunities in Bioceramics and Piezoceramics Market, 2020

Figure 34 North America: the U.S. to Be the Fastest-Growing Market for Bioceramics and Piezoceramics, 20152020, (USD Million)

Figure 35 Dental Implants: the Highest and Fastest-Growing Application in the U.S. Bioceramics and Piezoceramics Market, 2015 vs. 2020 (USD Million)

Figure 36 Bio-Inert Ceramics is the Major Material of Bioceramics and Piezoceramics in Europe, 2014 and 2020

Figure 37 Mergers & Acquisitions: Most Preferred Strategy By Key Companies, 20112015

Figure 38 Mergers & Acquisitions Was the Key Strategy, 20112015

Figure 39 Regional Revenue Mix of Top 5 Market Players

Figure 40 Coorstek Inc.: SWOT Analysis

Figure 41 Ceramtec GmbH: SWOT Analysis

Figure 42 Kyocera Corporation : Company Snapshot

Figure 43 Kyocera Corporation: SWOT Analysis

Figure 44 Morgan Advanced Materials PLC: Company Snapshot

Figure 45 Morgan Advanced Materials PLC: SWOT Analysis

Figure 46 NGK Spark Co. Ltd.: Company Snapshot

Figure 47 NGK Spark Plug Co., Ltd.: SWOT Analysis

Figure 48 Saint-Gobain Ceramic Materials: SWOT Analysis

Figure 49 Depuy Synthes: SWOT Analysis

Figure 50 H.C. Starck GmbH: Company Snapshot

Growth opportunities and latent adjacency in Bioceramics and Piezoceramics Market