The study focused on estimating the current size of the medical displays market through several key activities. Comprehensive secondary research was conducted to gather relevant information. Following this, the findings, assumptions, and estimates were validated by consulting with industry experts throughout the value chain using primary research methods. Various approaches, including top-down and bottom-up methods, were utilized to determine the overall market size. Subsequently, market segmentation and data triangulation procedures were employed to estimate the sizes of different segments and subsegments of the medical displays market.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Business, Factiva, whitepapers, and documents from companies' houses. The secondary research aimed to gather information for a comprehensive technical, market-oriented, and commercial analysis of the medical displays market. It also provided crucial insights about the leading companies, market classification, segmentation based on industry trends down to the smallest details, geographic markets, and significant developments related to the market. Additionally, a database of key industry leaders was compiled using the information obtained through secondary research.

Primary Research

Various supply-side and demand-side sources were interviewed in the primary research process to gather qualitative and quantitative information for this report. On the supply side, primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, engineers, and other key executives from companies and organizations within the medical displays market. On the demand side, primary sources comprised hospitals, clinics, researchers, lab technicians, purchasing managers, and stakeholders from corporate and government bodies.

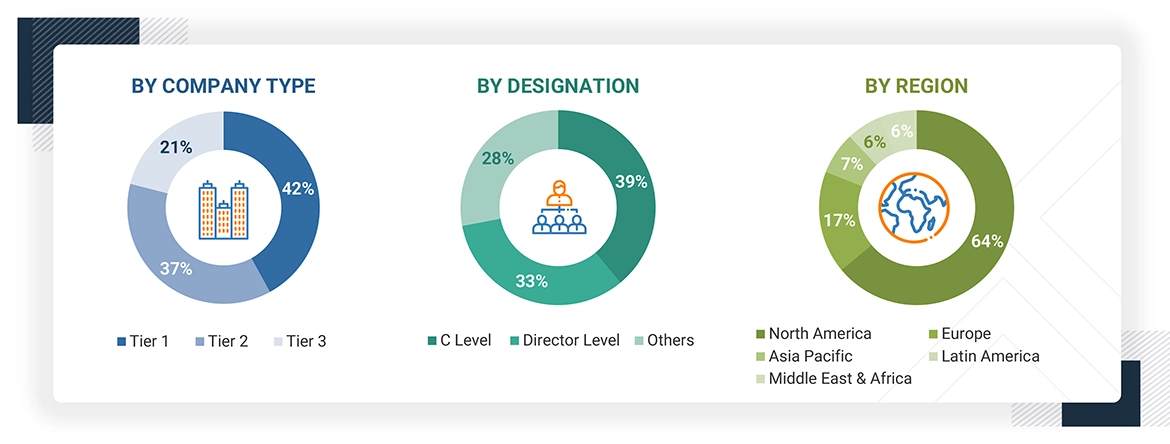

Breakdown of Primary Interviews

Note 1: C-level executives include CEOs, COOs, and CTOs.

Note 2: Others include sales, marketing, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

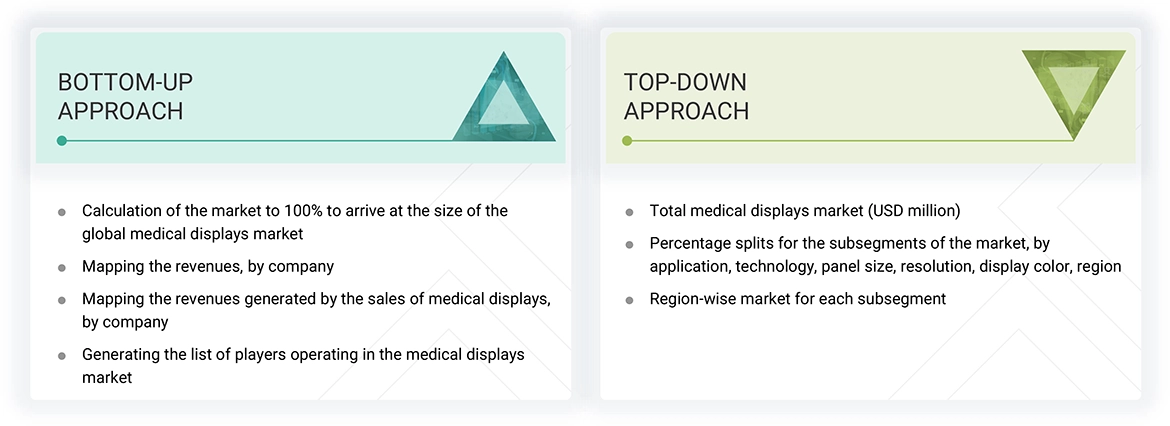

Both top-down and bottom-up approaches were used to estimate and validate the total size of the medical displays market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Data Triangulation

When the market size was determined, the entire market was split into five segments. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Market rankings for major players in the medical displays sector were established using secondary data from both paid and unpaid sources. Due to data limitations, the revenue share for some companies was assessed through a detailed analysis of their product portfolios and individual sales performance. This information was validated at each stage through in-depth interviews with industry professionals.

Market Definition

A display is an output device essential for presenting information, which can encompass textual content, images, or graphical data. Medical-grade displays are specialized monitors designed to precisely interpret diagnostic images, such as X-rays, MRIs, and CT scans. These displays adhere to strict standards for resolution, color accuracy, and contrast, enabling healthcare providers to view intricate details crucial for accurate diagnoses. By utilizing medical displays, healthcare professionals can make better-informed decisions regarding patient symptoms, disease diagnoses, and surgical procedures. The enhanced clarity and detail provided by these displays significantly improve the assessment and monitoring of medical conditions. Medical-grade displays are employed across a wide range of applications, including diagnostic imaging, surgical and interventional procedures, dentistry, and clinical reviews. Additionally, they play a vital role in training and educational settings, where precise visual representation is key to effective learning and understanding in the medical field. This ensures that both current and future healthcare providers are well-equipped to deliver high-quality patient care.

Stakeholders

-

Raw material providers

-

Medical display panel manufacturers

-

Medical display-related service providers

-

Medical display-related associations, organizations, forums, and alliances

-

Government bodies, such as regulating authorities and policymakers

-

Venture capitalists and start-ups

-

Semiconductor component suppliers

-

Medical display panel and device distributors & sales firms

-

Medical display device end users

-

Research institutes, organizations, and consulting companies

-

Healthcare service providers

-

Medical display software and service providers

Report Objectives

-

To define, describe, and forecast the medical displays market based on application, technology, panel size, resolution, display color, and region

-

To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

-

To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall medical displays market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the medical displays market in six regions: North America (US and Canada), Europe (Germany, the UK, France, Spain, Italy, and the Rest of Europe), the Asia Pacific (Japan, China, India, Australia & New Zealand, South Korea, and the Rest of Asia Pacific), Latin America (Brazil, Mexico, Colombia, and the Rest of Latin America), the Middle East & Africa, and GCC Countries

-

To analyze the impact of Gen AI on the growth of the medical displays market

-

To strategically profile the key players in the global market and comprehensively analyze their core competencies

-

To track and analyze competitive developments, such as product approvals, launches, expansions, and acquisitions, of the leading players in the market

Growth opportunities and latent adjacency in Medical Display Market