Medical Equipment Maintenance Market Size, Share & Trends by Device (Imaging (MRI, CT, ultrasound, X-ray), ventilator), Provider (OEM, ISO, In-house), Service (Preventive, Corrective), User (Hospital, Diagnostic Center), Contract (Basic, Customized) - Global Forecast to 2029

Medical Equipment Maintenance Market Size, Share & Trends

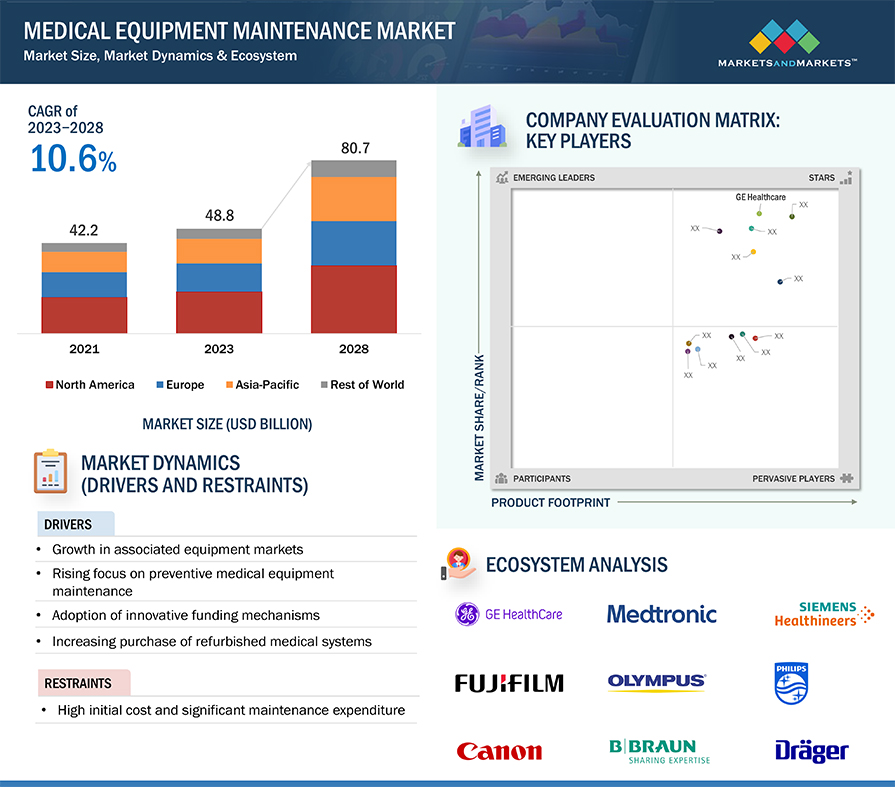

The global medical equipment maintenance market is projected to reach USD 88.9 billion by 2029 from USD 54.0 billion in 2024, growing at a CAGR of 10.5% during the forecast period. The growing prevalence of chronic diseases including cardiovascular diseases, diabetes, cancer have led to the higher utilization of medical devices for diagnosis and treatment, subsequently increasing the demand for maintenance services of these devices. The rising technological advancements in medical technologies and devices, including sophisticated imaging systems and advanced diagnostic tools, increases the frequency of required maintenance. The growing focus of healthacare facilities on implementation of comprehensive medical device maintenance strategies by integrating corrective and predictive maintenance to minimize medical device downtime are likely to boost the market growth.

Additionally, the rising investment on healthcare infrastructure development by government and private sectors maintenance and support services has led to the acquisition of advanced medical devices, further increasing the demand for regular maintenance services. Many hospitals with limited resources are adopting refurbished medical devices, which are cost-effective. However, they require regular maintenance and calibration to meet the safety and performance standards. This is further anticipated to boost the demand for maintenance services, propelling the market growth.

Medical Equipment Maintenance Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

e- Estimated; p- Projected

Medical Equipment Maintenance Industry Dynamics

Driver: Growth in medical equipment markets

The global market for various medical equipment is expanding, driven by the imperative to provide safer, more efficient, and high-quality healthcare. Significant innovations within the sector further propel this growth. Patients increasingly prefer technologically advanced medical devices due to improved financial affordability and accessible market entry points. These devices are distributed through both direct sales and indirect channels, such as e-commerce platforms and third-party providers, facilitated by an expanded delivery infrastructure and a comprehensive distribution network.

In major developed countries, public health insurance policies and government agencies cover medical reimbursements for healthcare procedures, thereby enhancing the adoption of medical devices. Additionally, heightened market competition and localized manufacturing in emerging economies have led to a continuous reduction in the average prices of medical devices by global manufacturers. This trend has made medical devices more affordable and readily available, driving significant demand growth during the forecast period..

Restraint: High initial cost and significant maintenance expenditure

Maintenance programs for medical devices enable healthcare providers to effectively track and monitor equipment conditions, ensuring optimal utilization and maximum uptime. This is particularly crucial in the current climate, which emphasizes preventive maintenance and managing costs amid austerity measures. These programs often involve the implementation of asset management solutions that leverage advanced technologies.

However, the deployment of these solutions entails substantial initial installation costs and ongoing maintenance expenses. Additionally, the installation of advanced medical equipment requires an annual service contract fee, approximately 12% of the equipment's cost. Over the equipment's lifespan, the cumulative service costs typically exceed the initial purchase price. The significant expenses associated with both the acquisition and maintenance of advanced medical equipment have deterred many end users from adopting these technologies.

Opportunity: Emergence of independent service organizations

The medical equipment maintenance and services sector was initially dominated by original equipment manufacturers (OEMs). However, OEMs typically charge more and take longer for maintenance, leading to higher costs and extended downtime. Amid ongoing austerity measures and the need for cost reduction in global healthcare systems, this has paved the way for the rise of Independent Service Organizations (ISOs) dedicated solely to providing maintenance services.

ISOs, staffed by expert teams, offer solutions where OEMs often fall short in terms of efficiency and satisfaction. These organizations service multiple brands of medical devices, providing end users with a centralized, independent management platform that ensures consistent service delivery across all asset groups while significantly reducing maintenance costs. This approach also lowers operating expenses and capital expenditures. Hospitals and patient advocacy groups report that ISOs typically charge 30-50% less than OEMs for equipment maintenance and repairs.

Additionally, competition among third-party service companies and insurance brokers has driven down response times and service costs. ISO contracts have become highly flexible, with negotiable terms for parameters such as response times and spare part costs, whether included in a fixed price or charged separately. Given these advantages over OEMs, ISOs are increasingly preferred by end users. The opportunities within the ISO market are expected to attract numerous companies to this sector in the coming years.

Challenge: Survival of small players in highly fragmented and competitive market

The global market is highly fragmented and competitive, encompassing a wide array of players, from multinational corporations to small local entities. The substantial capital required to retain skilled biomedical engineers, manage the logistics of medical devices, and navigate regulatory approvals poses significant challenges for many companies, particularly startups and small organizations, in sustaining their presence in the industry.

To gain a competitive edge, companies are increasingly focused on developing advanced and improved technologies. Some have also prioritized acquisitions and partnerships to enhance their market sustainability, expertise, and technological capabilities. This has created a highly competitive and dynamic environment, making it difficult for smaller companies to survive.

With numerous service providers offering similar services, cost becomes a critical factor for end users in vendor selection. Service providers face the challenge of delivering high-quality services at a lower cost. The rise of Independent Service Organizations (ISOs) has further pressured OEMs to reduce their service contract prices. In this competitive landscape, maintaining market viability is challenging, prompting many larger companies to pursue consolidation. However, smaller companies often lack this option, adversely impacting their long-term survival in the global market.

Medical Equipment Maintenance Market Ecosystem:

Leading players in this market include well-established and financially stable service providers of medical equipments. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Siemens Healthineers (Germany), GE Healthcare Technologies Inc. (US), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), and FUJIFILM Holdings Corporation (Japan).

By device type, the diagnostic imaging equipment segment accounted for the largest share of the medical equipment maintenance industry in 2023

Segmented by device type, the medical equipment maintenance market encompasses diagnostic imaging equipment, surgical equipment, dental equipment, radiotherapy devices, patient monitoring & life support devices, endoscopic devices, laboratory equipment, ophthalmology equipment, medical lasers, electrosurgical equipment, radiotherapy devices, and durable medical equipment. Notably, in 2023, the diagnostic imaging equipment segment commanded the largest market share. The rapid evolution of technology in this sector necessitates frequent upgrades and updates to remain competitive, consequently driving demand for maintenance services. This dynamic landscape underscores the imperative of staying current with technological advancements to maintain relevance and efficacy in the market. With the emergence of newer and more advanced imaging technologies, healthcare facilities are compelled to invest in maintenance services to optimize equipment performance and lifespan. This enables them to deliver enhanced diagnostic capabilities and uphold their competitive positioning within the industry.

By service provider, the multi-vendor OEMs segment commanded for the largest share of the medical equipment maintenance industry in 2023

Segmented by service provider, the medical equipment maintenance market is delineated into multi-vendor OEMs, single-vendor OEMs, ISOS, and in-house maintenance. Notably, the multi-vendor OEMs segment holds the dominant share of the global market. These service providers deliver customized maintenance solutions meticulously designed to align with the unique requirements and financial parameters of healthcare institutions. This bespoke approach ensures that the maintenance plans cater precisely to the facilities' needs while adhering to budget constraints. Furthermore, these providers offer flexibility in both service scheduling and contract terms, allowing for adjustments and accommodations as necessitated by the evolving demands of the healthcare environment. This tailored approach enhances operational efficiency and cost-effectiveness while maintaining the reliability and longevity of critical medical equipment.

By service type, the preventive maintenance segment of the medical equipment maintenance industry is expected to witness significant growth during the forecast period

Segmented on service type, the medical equipment maintenance market is segmented into operational, corrective, and preventive maintenance. Forecasted growth is anticipated particularly within the preventive maintenance segment. This growth trajectory is attributed to the proactive benefits associated with preventive maintenance practices. By implementing preventive maintenance protocols, healthcare facilities cultivate a culture of continuous improvement. This approach encourages proactive problem-solving, facilitates knowledge sharing, and enables the refinement and optimization of maintenance strategies over time. Consequently, healthcare facilities can enhance operational efficiency, minimize downtime, and ensure the sustained reliability and performance of critical medical equipment assets.

By End User, the hospitals segment accounted for the largest share of the medical equipment maintenance industry in 2023

Segmented by end users, the medical equipment maintenance market is segmented into hospitals, diagnostics imaging centers, dialysis centers, ambulatory surgical centers, dental clinics & speciality clinics and other end users. Hospitals are actively involved in ongoing improvement endeavors geared towards maximizing operational efficiency, cutting costs, and elevating the quality of patient care. Within this framework, maintenance services serve as a crucial enabler by guaranteeing the dependability, effectiveness, and durability of medical equipment assets. These services play an integral role in sustaining the hospital's operational integrity, enabling seamless healthcare delivery, and ultimately contributing to the enhancement of patient outcomes and satisfaction.

By Contract type, the premium contract segment accounted for the largest share of the medical equipment maintenance industry in 2023

Segmented by contract type, the medical equipment maintenance market is segmented into basic contract, premium contract, customized contract, and add-on contract. The premium contract segment holds the largest share in the global market. Healthcare facilities often face budgetary limitations that shape their preferences regarding maintenance services. Premium contracts can be customized to accommodate these financial constraints by providing adaptable pricing models, flexible payment terms, and cost-effective strategies tailored to the facility's specific financial objectives and limitations. This bespoke approach ensures that maintenance services remain accessible and aligned with the facility's budgetary parameters, enabling efficient management of healthcare assets while optimizing cost-effectiveness and operational efficiency.

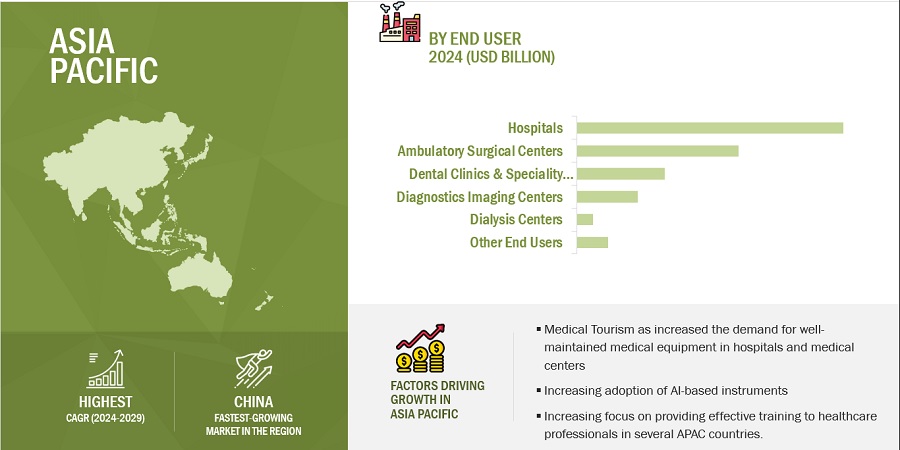

APAC is estimated to be the fastest-growing regional market during the forecast period of the medical equipment maintenance industry

To know about the assumptions considered for the study, download the pdf brochure

The medical equipment maintenance market has been segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Governments across the Asia Pacific region are implementing healthcare reforms and initiatives to improve access to quality healthcare services. This includes investments in medical equipment maintenance infrastructure to enhance the reliability and efficiency of healthcare delivery systems. The Asia Pacific region has emerged as a popular destination for medical tourism, attracting patients from around the world seeking affordable and high-quality healthcare services. This influx of medical tourists has increased the demand for well-maintained medical equipment in hospitals and medical centers. The aforementioned factors will drive the growth of the market in this region.

Key players in this market include Siemens Healthineers (Germany), GE Healthcare Technologies Inc. (US), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), FUJIFILM Holdings Corporation (Japan), Olympus Corporation (Japan), Stryker Corporation (US), Canon Inc (Japan), Drägerwerk AG & Co. KGaA (Germany), Hitachi, Ltd (Japan), B. Braun SE (Germany), Elekta (Sweden), Shimadzu Corporation (Japan), Althea Group (Italy), Agfa-Gevaert N.V. (Belgium), BCAS Bio-medical Services Ltd. (UK), Agenor Mantenimientos (Spain), Grupo Empresarial Electromédico (Spain), Carestream Healthv (US), Karl Storz Gmbh & Co. Kg (Germany), STERIS Plc (US), Avensys UK Ltd. (UK), The Intermed Group (US), Crothall Healthcare (US), and Trimedx Holdings LLC (US).

Scope of the Medical Equipment Maintenance Industry

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$54.0 billion |

|

Projected Revenue by 2029 |

$88.9 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 10.5% |

|

Market Driver |

Growth in medical equipment markets |

|

Market Opportunity |

Emergence of independent service organizations |

This report has segmented the global medical equipment maintenance market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

- Diagnostic Imaging Equipment

- CT Scanners

- MRI Systems

- Ultrasound Systems

- X-Ray Systems

- Mammography Systems

- Angiography Systems

- Fluoroscopy Systems

- Nuclear Imaging Equipment (PET/SPECT)

- Electrosurgical Equipment

- Endoscopic Devices

- Surgical Equipment

- Medical Lasers

- Ophthalmology Equipment

- Patient Monitoring & Life Support Devices

- Ventilators

- Anesthesia Monitoring Equipment

- Infusion Pumps

- Dialysis Equipment

- Other Life-Supported Devices & Patient Monitoring Devices

- Dental Equipment

- Dental Radiology Equipment

- Dental Laser Devices

- Other Dental Equipment

- Laboratory Equipment

- Durable Medical Equipment

- Radiotherapy Devices

By Service Type

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

By Service Provider

- Multi-Vendor OEMs

- Single-Vendor OEMs

- Independent Service Organization

- In-House Maintenance

By End User

- Hospitals

- Diagnostic Imaging Centers

- Dialysis Centers

- Ambulatory Surgical Centers

- Dental Clinics & Specialty Clinics

- Other End Users

By Contract Type

- Basic Contract

- Premium Contract

- Customized Contract

- Add-On Contract

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

Middle East & Africa

- GCC Countries

- Rest of MEA

Recent Developments of the Medical Equipment Maintenance Industry:

- In October 2023, GE Healthcare and reLink Medical announced a collaboration to deliver asset management solutions aimed at helping healthcare providers minimize medical device waste, increase operational efficiency, and maximize equipment utilization. This partnership will assist healthcare providers in managing their end-of-life medical equipment and offer potential benefits for optimizing their resources.

- In May 2023, Siemens Healthineers and CommonSpirit Health acquired Block Imaging. This acquisition aims to offer more sustainable options and meet the growing demand from U.S. hospitals, health systems, and other care sites for multi-vendor imaging parts and services.

- In April 2023, Koninklijke Philips collaborated with Amazon Web Services (AWS). This collaboration supports the development and deployment of generative AI applications. Both Philips and AWS provide migration expertise and planning services, total cost-of-ownership analysis, and cybersecurity technical expertise to enable an easy migration from on-premises to cloud-based solutions for customers.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical equipment maintenance market?

The global medical equipment maintenance market boasts a total revenue value of $88.9 billion by 2029.

What is the estimated growth rate (CAGR) of the global medical equipment maintenance market?

The global medical equipment maintenance market has an estimated compound annual growth rate (CAGR) of 10.5% and a revenue size in the region of $54.0 billion in 2024. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

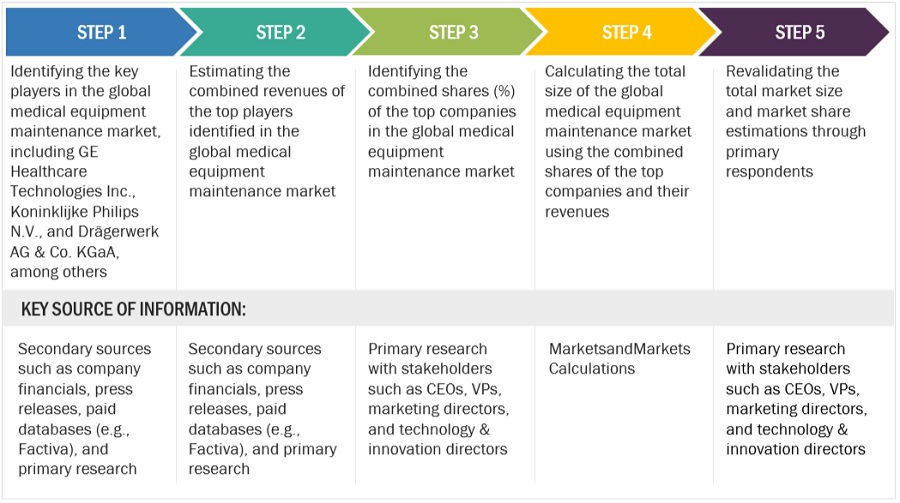

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the medical equipment maintenance market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

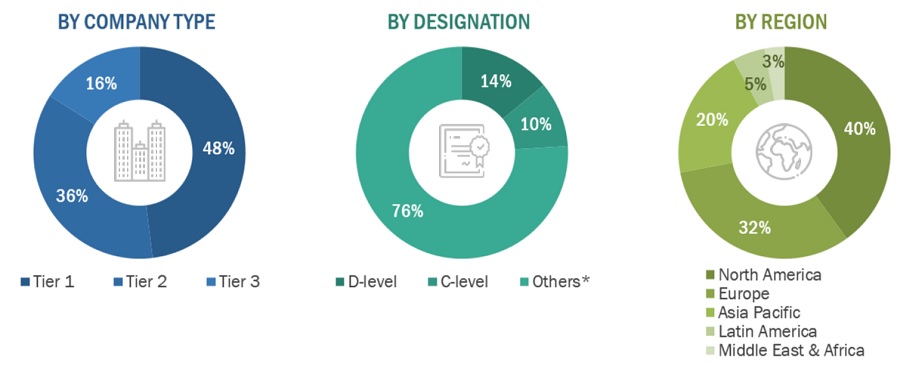

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the medical equipment maintenance market. The primary sources from the demand side include medical OEMs, medical device ISOs, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

Breakdown of Primary Interviews:

A breakdown of the primary respondents for medical equipment maintenance market (supply side) market is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

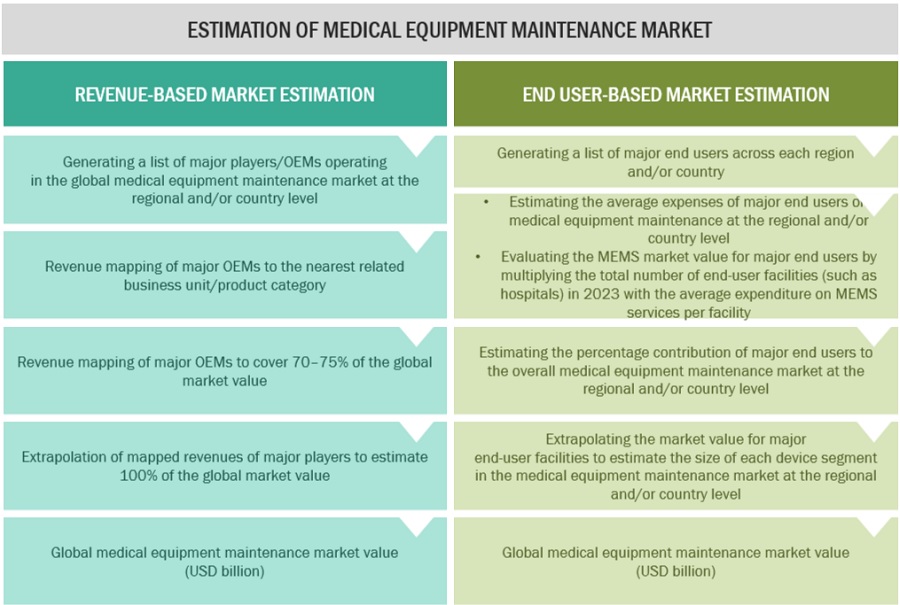

Market Estimation Methodology

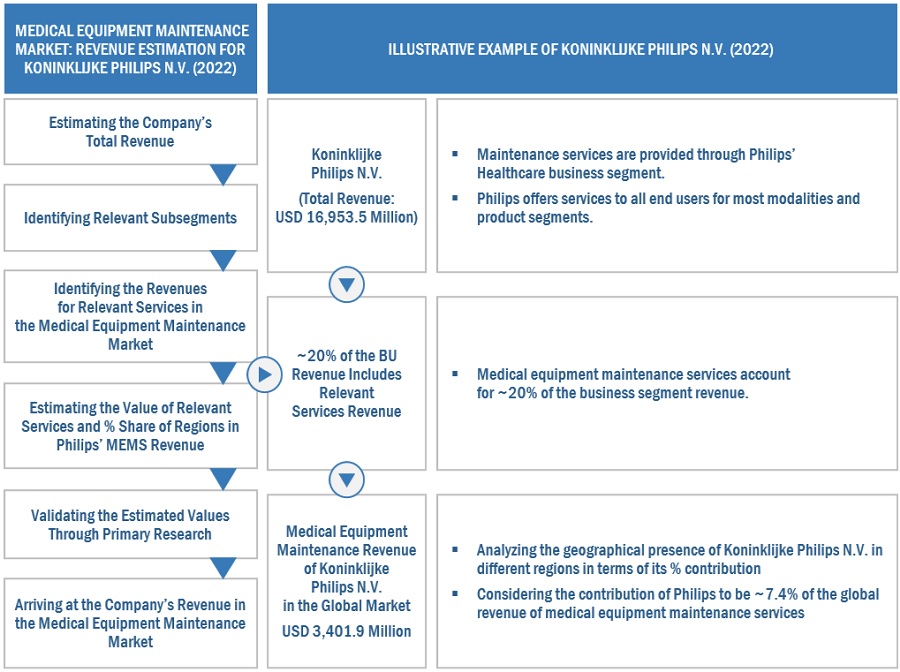

In this report, the global medical equipment maintenance market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the medical equipment maintenance business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the medical equipment maintenance market

- Mapping annual revenues generated by major global players from the medical equipment maintenance segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global market as of 2023

- Extrapolating the global value of the medical equipment maintenance industry

To know about the assumptions considered for the study, Request for Free Sample Report

Supply-Side Analysis - Revenue Share Analysis

Revenue Share Analysis Illustration of Koninklijke Philips N.V.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global medical equipment maintenance market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the medical equipment maintenance market was validated using both top-down and bottom-up approaches.

Market Definition

Medical equipment maintenance encompasses a comprehensive suite of services including monitoring, diagnosing failures, supplying spare parts, corrective maintenance, preventive maintenance, automation and upgrades, inventory management and testing, consulting, planning equipment renewal, and user training. It is indispensable for identifying and preempting potential performance issues before they escalate, thus optimizing equipment performance and curtailing operational costs. These critical services are typically executed internally or outsourced to Original Equipment Manufacturers (OEMs) or Independent Service Organizations (ISOs), ensuring the sustained reliability and efficiency of healthcare equipment.

Key Market Stakeholders

- Original equipment manufacturers

- Independent service providers

- Independent service organizations

- Product distributors and channel partners

- Hospitals and surgical centers

- Dental hospitals, laboratories, and clinics

- Dental academic and research institutes

- Ambulatory care centers and physician-operated laboratories

- Contract manufacturers and third-party suppliers

- Research laboratories and academic institutes

- Clinical research organizations

- Contract manufacturing organizations

- Government and non-governmental regulatory authorities

- Venture capitalists and investors

- Trade associations and industry bodies

- Insurance companies

- Market research and consulting firms

Objectives of the Study

- To define, describe, and forecast the medical equipment maintenance market on the basis of device type, service type, service provider, end user, contract type, and region.

- To provide detailed information regarding the major factors influencing the growth potential of the global medical equipment maintenance market (drivers, restraints, opportunities, challenges, and trends).

- To analyze the micro markets with respect to individual growth trends, future prospects, and contributions to the global medical equipment maintenance market.

- To analyze key growth opportunities in the global medical equipment maintenance market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the global medical equipment maintenance market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To profile the key players in the global medical equipment maintenance market and comprehensively analyze their market shares and core competencies.

- To track and analyze the competitive developments undertaken in the global medical equipment maintenance market, such as agreements, expansions, and & acquisitions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global medical equipment maintenance market report:

Service Analysis

- Service matrix, which gives a detailed comparison of the service portfolios of the top twelve companies

Company Information

- Detailed analysis and profiling of additional market players (up to 13)

Geographic Analysis

- Further breakdown of the Rest of Europe's medical equipment maintenance market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of Asia Pacific medical equipment maintenance market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Rest of the Latin America medical equipment maintenance market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Equipment Maintenance Market

Can you share the detailed information on technological advancements in the Medical Equipment Maintenance Market?

In what way COVID19 is Impacting the global growth of the Medical Equipment Maintenance Market?

Can you enlighten us about the key players operating in the global Medical Equipment Maintenance Market?