European Medical Equipment Maintenance Market by Device (Imaging (MRI, CT, X-ray, mammography), Endoscopy, Monitoring, Dental, Lab Devices), Provider (OEM, ISO), Service (Preventive, Corrective), End User (Hospital, ASCs, Clinic) & Region - Forecast to 2026

Market Growth Outlook Summary

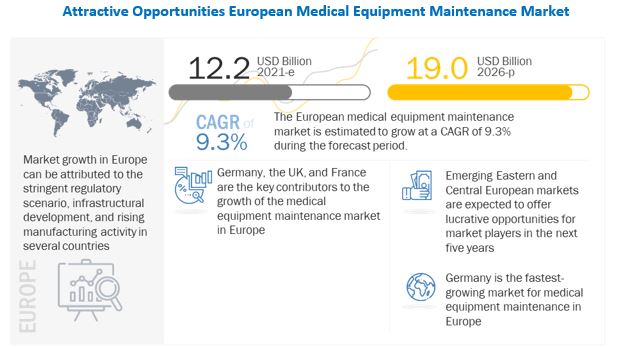

European medical equipment maintenance market growth forecasted to transform from $12.2 billion in 2021 to $19.0 billion by 2026, driven by a CAGR of 9.3%. The expanding patient population, rising focus on early diagnosis, growing number of diagnostic imaging procedures, presence of a large number of OEMs, and strategic agreements and collaborations between service providers and end users are the major factors driving the growth of the European medical equipment maintenance market.

To know about the assumptions considered for the study, Request for Free Sample Report

European medical equipment maintenance Market Dynamics

Driver: Rising focus on preventive medical equipment maintenance

The focus on the preventive maintenance of medical equipment has grown in recent years, as healthcare institutions seek to enhance patient safety and care quality. This involves a carefully designed program where maintenance tasks are performed in a scheduled manner to avoid larger and costly repairs down the line. It also helps in reducing equipment downtime, which enhances day-to-day operations and improves device reliability.

The preventive maintenance approach is gaining prominence as planned inspections, and medical device maintenance help avoid adverse incidents and medical device-related accidents. Regular maintenance services ensure the safe, efficient, and long-lasting use of medical devices. The growing focus on implementing preventive maintenance strategies among healthcare organizations is expected to offer growth opportunities for service providers in the coming years.

Restraint: High initial cost and significant maintenance expenditure

Maintenance programs for medical devices enable healthcare providers to track and monitor their condition, and thereby ensure efficient utilization and maximum uptime. This is also essential, given the current focus on preventive maintenance and cost pressures, to control total expenditure against a background of austerity measures. Such programs include the deployment of asset management solutions, which use advanced technologies.

However, the deployment of these solutions incurs high initial installation costs and significant maintenance expenditure, while the installation of advanced medical equipment incurs a service contract cost (~12% of the cost of medical equipment) to be paid per year. The service cost thus paid during the lifespan of the equipment is usually more than the cost of the equipment. The high cost associated with the purchase and maintenance of advanced medical equipment is restraining end users from adopting them.

Opportunity: Emergence of ISOs

The medical equipment maintenance and services sector was initially dominated by OEMs. However, OEMs typically charge more than third-party vendors, and often take longer for maintenance, resulting in higher associated costs as well as downtime. This situation, especially given the backdrop of continuing austerity measures and the need for cost-curtailment in European healthcare systems, has led to the emergence of ISOs dedicated to solely providing maintenance services.

With a strong team of experts, these organizations can cater to customers in situations where OEMs fail to offer satisfactory and time-efficient solutions. Moreover, ISOs offer services for multiple brands of medical devices, providing end users with a central, independent management platform for uniform service delivery across all asset groups, while reducing maintenance costs.

Challenge: Survival of players in a highly fragmented and competitive market

The European medical equipment maintenance market is highly fragmented and competitive and comprises a broad range of players, including multinational companies and small local players. The high capital required in retaining biomedical engineers, logistics of medical devices, and regulatory approval make it difficult for several companies (especially start-ups and small organizations) to sustain their presence in the industry.

As a result, companies are focusing on the development of better and improved technologies to gain a competitive edge. A few companies have also emphasized acquisitions and partnerships to maintain and improve their market sustainability, expertise, and technological capabilities. This provides a highly competitive and dynamic environment, which makes it difficult for smaller companies to survive.

By service provider, the multi-vendor OEMs segment dominated the European medical equipment maintenance industry

Based on the service provider, the European medical equipment maintenance market is segmented into multi-vendor OEMs, single-vendor OEMs, ISOs, and in-house maintenance. The multi-vendor OEMs dominated the European medical equipment maintenance market in 2020. The total cost of maintenance services provided under multi-vendor management is lower than single-vendor OEM contracts, with a similar quality of services. Cost reduction of 20% can be achieved by outsourcing to a service provider providing multi-vendor services (MVS) which, is expected to fuels the growth of this segment during the forecast period.

By service type, the preventive maintenance segment dominated the European medical equipment maintenance industry

Based on service type, the European medical equipment maintenance market is segmented into corrective, preventive, and operational maintenance. The preventive maintenance segment is estimated to dominate the European medical equipment maintenance market in 2020. The growing focus on implementing preventive maintenance strategies among healthcare organizations is expected to offer growth opportunities for service providers in the coming years.

By device type, the diagnostic imaging equipment segment accounted for the largest share of the European medical equipment maintenance industry

Based on device type, the European medical equipment maintenance market is segmented into diagnostic imaging equipment, patient monitoring & life support devices, endoscopic devices, surgical equipment, ophthalmology equipment, medical lasers, electrosurgical equipment, radiotherapy devices, dental equipment, laboratory equipment, and durable medical equipment. Among these, the diagnostic imaging equipment segment accounted for the largest share of the market in 2020. The large share of this segment is attributed to the increasing application of diagnostic imaging technology in the dental industry and for minimally invasive surgery.

By End User, the hospitals segment accounted for the largest share of the European medical equipment maintenance industry

Based on End User, the European medical equipment maintenance market has been segmented into the hospitals, diagnostic imaging centers, dialysis centers, ambulatory surgical centers, dental clinics & specialty clinics, and other end users. Among these, the hospitals segment accounted for the largest share of the market in 2020. . The rising patient influx is encouraging hospitals to form alliances and partnerships with medical device maintenance service vendors for the establishment of state-of-the-art in-house maintenance facilities or outsourcing maintenance services.

Germany is expected to command the largest share of the European medical equipment maintenance industry

The report covers the European medical equipment maintenance market across major countries, namely, Germany, UK, France, Italy, Spain, Poland, Austria and Switzerland, Scandinavian Countries, Benelux Countries, Baltic Countries and Rest of Europe. Germany commanded the largest share of the European medical equipment maintenance market in 2020. Market growth is mainly attributed to the strong base of independent service provider and in house maintenance , and the growing installation base for medical devices in healthcare facilities .

The major players in the European medical equipment maintenance market are GE Healthcare (US), Siemens Healthineers (Germany), Koninklijke Philips N.V. (Netherlands), Medtronic plc (Ireland), and FUJIFILM Holdings Corporation (Japan), Canon, Inc. (Toshiba Medical System Corporation, Japan), Agfa-Gevaert Group (Belgium), Carestream Health, Inc. (US), Drägerwerk AG & Co. KGaA (Germany), Hitachi Medical Corporation (Japan), Althea Group (Italy), Olympus Corporation (Japan), B. Braun Melsungen AG (Germany), KARL STORZ GmbH & Co. KG (Germany), and Aramark Services, Inc. (US) among others.

GE Healthcare (US) held the leading position in the European medical equipment maintenance market in 2020. The company’s service portfolio includes a wide range of medical equipment services through which it caters to the demand of various end users, including hospitals, ambulatory surgical centers, dialysis centers, and dental clinics. The company also offers multi-vendor services associated with diagnostic imaging systems. In order to ensure its future growth, the company adopted strategies such as partnerships, agreements, and mergers and acquisitions to strengthen its service portfolio and customer base and expand its presence across various regions. GE Healthcare has a strong product portfolio, supporting around medical OEMs, hospitals and specialty clinics worldwide. The company is focused on innovations and improving the quality of its services with increasing investment in its biomedical engineering training.

Scope of the European Medical Equipment Maintenance Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$12.2 billion |

|

Projected Revenue Size by 2026 |

$19.0 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 9.3% |

|

Market Driver |

Rising focus on preventive medical equipment maintenance |

|

Market Opportunity |

Emergence of ISOs |

This report has segmented the european medical equipment maintenance market to forecast revenue and analyze trends in each of the following submarkets:

By Device Type

-

Diagnostic Imaging Equipments

- CT Scanners

- MRI Systems

- Ultrasound Systems

- X-Ray Systems

- Mammography Systems

- Angiography Systems

- Fluoroscopy Systems

- Nuclear Imaging Equipments (PET/SPECT)

- Electrosurgical Equipment

- Endoscopic Devices

- Surgical Equipment

- Medical Lasers

- Opthalmology Equipment

-

Patient Monitoring & Life Support Devices

- Ventilators

- Anesthesia Monitoring Equipments

- Infusion Pumps

- Dialysis Equipment

- Other Life Supported Devices & Patient Monitoring Devices

-

Dental Equipment

- Dental Radiology Equipments

- Dental Laser Devices

- Other Dental Equipment

- Laboratory Equipment

- Durable Medical Equipments

- Radiotherapy Devices

By Service Type

- Preventive Maintenance

- Corrective Maintenance

- Operational Maintenance

By Technology

- Multi-Vendor OEMs

- Single-Vendor OEMs

- Independent Service Organization

- In-House Maintenance

By End User

- Hospital

- Diagnostic Imaging Centers

- Dialysis Centers

- Ambulatory Surgical Centers

- Dental Clinics & Speciality Clinics

- Other End Users

By Region

- Germany

- UK

- France

- Italy

- Spain

- Poland

- Austria and Switzerland

- Baltic Countries (Estonia, Latvia, and Lithuania)

- Benelux Countries (Includes Belgium, Netherlands, And Luxembourg)

- Scandinavian Countries ( Include Denmark, Norway, Sweden, Iceland, Finland)

- Rest of Europe (RoE)

Recent Developments of European Medical Equipment Maintenance Industry:

- In March 2021, FUJIFILM Corporation (Japan) acquired the Diagnostic Imaging-related Business of Hitachi, Ltd. (Japan) to support R&D, manufacturing, marketing, and maintenance services for diagnostic imaging systems (CT, MRI, X-ray, ultrasound systems, and others), electronic medical records, and other medical-related products and services

- In February 2021, Siemens Healthineers (Germany) entered into an eight-year technological partnership with Kantonsspital Baden (KSB, Switzerland)for procurement and maintenance of medical imaging systems, technology management, and the expansion of telemedicine solutions

- In December 2019 GE Healthcare (US) GE Healthcare signed a six-year service contract for imaging technologies across Affidea’s network in the Netherlands

Frequently Asked Questions (FAQ):

What is the expected addressable market value of major European medical equipment maintenance products over a 5-year period?

The European medical equipment maintenance market is projected to reach USD 19.0 billion by 2026 from USD 12.2 billion in 2021, at a CAGR of 9.3% during the forecast period.

Which device type segment is expected to garner the highest traction within the European medical equipment maintenance market?

The diagnostic imaging equipment segment dominated the European medical equipment maintenance market in 2020. The cost-effectiveness of services is supporting its market growth.

What are the strategies adopted by the top market players to penetrate emerging regions?

The key growth strategies adopted by the top players in this market include partnership: agreements; expansions; and acquisitions.

What are the major factors expected to limit the growth of the European medical equipment maintenance market?

The complex regulatory frameworks that delay the approval of service providers for European medical equipment maintenance are also expected to challenge market growth to a certain extent.

What is the adoption pattern for novel European medical equipment maintenance services across major healthcare markets?

In Germany, medical equipment services are witnessing significant growth. However, the introduction of technologically advanced in European medical equipment maintenance solutions is expected to drive market growth of equipment segment in the region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 MAJOR MARKET STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 BREAKDOWN OF PRIMARIES: EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET

FIGURE 3 PRIMARY SOURCES: EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET

2.1.2.1 Primary Sources

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2020)

FIGURE 5 MARKET SIZE ESTIMATION: COMPANY-WISE REVENUE SHARE ANALYSIS (2020)

FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.2 END USER-BASED MARKET ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS (2020)

2.2.3 GROWTH FORECAST

FIGURE 8 IMPACT OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES ON MARKET GROWTH & CAGR

2.2.4 PRIMARY RESEARCH VALIDATION

2.2.5 INSIGHTS FROM PRIMARY EXPERTS

FIGURE 9 MARKET VALIDATION FROM PRIMARY EXPERTS

2.3 DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 11 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 13 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2021 VS. 2026 (USD MILLION)

FIGURE 14 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET OVERVIEW

FIGURE 15 GROWING TREND OF PREVENTIVE MAINTENANCE IS EXPECTED TO DRIVE MARKET GROWTH IN THE NEXT FIVE YEARS

4.2 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET SHARE, BY SERVICE TYPE AND COUNTRY

FIGURE 16 PREVENTIVE MAINTENANCE TO FORM THE LARGEST SERVICE TYPE SEGMENT IN THIS MARKET

4.3 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET SHARE, BY END USER

FIGURE 17 HOSPITALS FORM THE LARGEST END-USER SEGMENT IN THIS MARKET

4.4 KEY COUNTRIES IN THE EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET

FIGURE 18 MARKET IN GERMANY TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in the associated equipment markets

FIGURE 20 EU: DISTRIBUTION OF POPULATION, BY AGE (2010 VS. 2020 VS. 2030)

FIGURE 21 EUROPE: PERCENTAGE OF GERIATRIC POPULATION, BY COUNTRY, 2010 VS. 2019

FIGURE 22 EUROPE: GERIATRIC POPULATION, BY COUNTRY (MILLION)

FIGURE 23 DISEASE TRENDS IN EU-28 (AS OF 2016)

FIGURE 24 GERMANY REPORTED THE HIGHEST NUMBER OF ROAD ACCIDENTS IN EUROPE (2016)

TABLE 1 EUROPE: COUNTRY-WISE CANCER INCIDENCE PER MILLION POPULATION, 2015–2019

TABLE 2 EUROPE: DIABETIC POPULATION AND DIABETES-RELATED HEALTHCARE EXPENDITURE

FIGURE 25 EUROPE: CT, MRI, AND PET EXAMS PER 1,000 POPULATION, BY COUNTRY (2018)

FIGURE 26 EUROPE: MINIMALLY INVASIVE PROCEDURES PER 100,000 INHABITANTS, BY COUNTRY (2018)

5.2.1.2 Rising focus on preventive medical equipment maintenance

5.2.1.3 Adoption of innovative funding mechanisms

5.2.1.4 Increasing purchase of refurbished medical systems

TABLE 3 REGULATIONS ON THE IMPORT AND USE OF REFURBISHED MEDICAL EQUIPMENT

5.2.2 RESTRAINTS

5.2.2.1 High initial cost and significant maintenance expenditure

5.2.2.2 Fiscal unsustainability due to wasteful spending

TABLE 4 EUROPE: WASTEFUL SPENDING, BY COUNTRY

5.2.3 OPPORTUNITIES

5.2.3.1 Innovation in service offerings and use of IoT

5.2.3.2 Emergence of ISOs

5.2.3.3 Emerging markets across Central and Eastern Europe

5.2.4 CHALLENGES

5.2.4.1 Survival of players in a highly fragmented and competitive market

5.2.4.2 Compliance issues with new MDR regulations and the Golden Rule

5.2.4.3 Dearth of skilled technicians and biomedical engineers

5.2.5 TRENDS

5.2.5.1 Preference for multi-vendor contracts

5.2.5.2 Consolidation of dialysis centers and hospitals

TABLE 5 PROMINENT ACQUISITIONS IN THE DIALYSIS SERVICES INDUSTRY (2015–2017)

5.2.5.3 Managed equipment service providers and group purchasing

FIGURE 27 DEVIATION FROM GOLDEN RULE, BY COUNTRY (2018)

5.2.5.4 Equipment maintenance insurance tools for imaging centers

5.3 ECOSYSTEM COVERAGE

FIGURE 28 ECOSYSTEM COVERAGE: EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 29 VALUE CHAIN: MEDICAL DEVICES

FIGURE 30 VALUE CHAIN: EUROPEAN MEDICAL EQUIPMENT MAINTENANCE SERVICES WORKFLOW

5.5 SUPPLY CHAIN ANALYSIS

TABLE 6 SUPPLY CHAIN ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

5.7 IMPACT OF COVID-19 ON THE EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET

TABLE 8 SURGICAL CASE TYPES BASED ON INDICATION AND URGENCY

5.8 RECLASSIFICATION OF MEDICAL DEVICES UNDER THE NEW MDR REGULATIONS

5.8.1 CLASSIFICATION OF NON-INVASIVE DEVICES

5.8.2 CLASSIFICATION OF INVASIVE DEVICES

5.8.3 CLASSIFICATION OF ACTIVE DEVICES

5.8.4 CLASSIFICATION OF NANOMATERIALS

5.8.5 SPECIAL RULES

6 REGULATORY STANDARDS (Page No. - 84)

6.1 INTRODUCTION

6.2 ISO STANDARDS

6.2.1 ISO 9001:2015

6.2.2 ISO 13485:2016

7 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE (Page No. - 85)

7.1 INTRODUCTION

TABLE 9 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

7.2 DIAGNOSTIC IMAGING EQUIPMENT

TABLE 10 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR IMAGING EQUIPMENT

TABLE 11 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 13 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 14 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 15 EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.1 MRI SYSTEMS

7.2.1.1 Increasing demand for MRI procedures to fuel the demand for maintenance services

FIGURE 31 EUROPE: MRI EXAMS PER 1,000 POPULATION, BY COUNTRY (2018)

TABLE 16 EUROPEAN MRI SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.2 CT SCANNERS

7.2.2.1 CT scanners need specialized engineers and technicians trained to execute the servicing of equipment

TABLE 17 EUROPEAN CT SCANNERS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.3 X-RAY SYSTEMS

7.2.3.1 Demand for OEM-based X-ray maintenance services is expected to increase among ends users

TABLE 18 EUROPEAN X-RAY SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.4 ULTRASOUND SYSTEMS

7.2.4.1 Demand for preventive maintenance for ultrasound devices is high among end users

TABLE 19 EUROPEAN ULTRASOUND SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.5 ANGIOGRAPHY SYSTEMS

7.2.5.1 Growing obsolescence of angiography equipment to drive the demand for maintenance services

TABLE 20 EUROPEAN ANGIOGRAPHY SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.6 MAMMOGRAPHY SYSTEMS

7.2.6.1 Preference for mammography over general breast ultrasound to drive the growth of this market segment

TABLE 21 EUROPEAN MAMMOGRAPHY SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.7 NUCLEAR IMAGING SYSTEMS (PET/SPECT)

7.2.7.1 Hybrid systems hold greater prospects of dominating the nuclear imaging systems maintenance services market in the near future

TABLE 22 EUROPEAN NUCLEAR IMAGING SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.2.8 FLUOROSCOPY SYSTEMS

7.2.8.1 Increasing adoption of refurbished fluoroscopy equipment to support the demand for maintenance services

TABLE 23 EUROPEAN FLUOROSCOPY SYSTEMS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 PATIENT MONITORING & LIFE SUPPORT DEVICES

TABLE 24 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR ELECTROMEDICAL EQUIPMENT

TABLE 25 EUROPEAN PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 26 EUROPEAN PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 27 EUROPEAN PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 28 EUROPEAN PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 29 EUROPEAN PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.1 VENTILATORS

7.3.1.1 The COVID-19 pandemic has driven the demand for ventilators and the related maintenance services

FIGURE 32 COVID-19 IMPACT ON THE VENTILATORS INDUSTRY

TABLE 30 EUROPEAN VENTILATORS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.2 ANESTHESIA MONITORING EQUIPMENT

7.3.2.1 Stringent regulatory guidelines are in place for the maintenance of anesthesia monitoring equipment

TABLE 31 EUROPEAN ANESTHESIA MONITORING EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.3 DIALYSIS EQUIPMENT

7.3.3.1 Growing number of renal care centers to drive the demand for corresponding maintenance services

FIGURE 33 EUROPE: NUMBER OF DIALYSIS CENTERS, BY COUNTRY/REGION (2019)

TABLE 32 EUROPEAN DIALYSIS EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.4 INFUSION PUMPS

7.3.4.1 Growing adoption of specialty infusion pumps and rental infusion pumps to drive the growth of this market segment

TABLE 33 EUROPEAN INFUSION PUMPS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3.5 OTHER PATIENT MONITORING & LIFE SUPPORT DEVICES

TABLE 34 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR LIFE SUPPORT DEVICES

TABLE 35 EUROPEAN OTHER PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.4 ENDOSCOPIC DEVICES

7.4.1 THE DEMAND FOR AFFORDABLE SERVICES FOR ENDOSCOPIC DEVICES IS INCREASING

TABLE 36 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR ENDOSCOPIC DEVICES

TABLE 37 EUROPEAN ENDOSCOPIC DEVICES MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 38 EUROPEAN ENDOSCOPIC DEVICES MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 39 EUROPEAN ENDOSCOPIC DEVICES MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 40 EUROPEAN ENDOSCOPIC DEVICES MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.5 SURGICAL INSTRUMENTS

7.5.1 INCREASING NUMBER OF SURGERIES PERFORMED ACROSS EUROPE IS DRIVING THE GROWTH OF THIS MARKET SEGMENT

FIGURE 34 EUROPE: SURGICAL PROCEDURES PER 1,000 POPULATION, BY COUNTRY (2018)

TABLE 41 LEADING VENDORS OFFERING MAINTENANCE SERVICES FOR SURGICAL INSTRUMENTS

TABLE 42 EUROPEAN SURGICAL INSTRUMENTS MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 43 EUROPEAN SURGICAL INSTRUMENTS MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 44 EUROPEAN SURGICAL INSTRUMENTS MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 45 EUROPEAN SURGICAL INSTRUMENTS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.6 OPHTHALMOLOGY EQUIPMENT

7.6.1 HIGH EQUIPMENT COSTS DRIVING THE FOCUS ON PREVENTIVE MAINTENANCE AMONG END USERS

FIGURE 35 EUROPE: CATARACT SURGERIES PER 1,000 POPULATION, BY COUNTRY (2018)

TABLE 46 EUROPEAN OPHTHALMOLOGY EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 47 EUROPEAN OPHTHALMOLOGY EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 48 EUROPEAN OPHTHALMOLOGY EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 49 EUROPEAN OPHTHALMOLOGY EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.7 MEDICAL LASERS

7.7.1 MEDICAL LASERS ARE EXTREMELY FRAGILE AND EXPENSIVE AND THUS REQUIRE PREVENTIVE MAINTENANCE

TABLE 50 EUROPEAN MEDICAL LASERS MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 51 EUROPEAN MEDICAL LASERS MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 52 EUROPEAN MEDICAL LASERS MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 53 EUROPEAN MEDICAL LASERS MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.8 ELECTROSURGICAL EQUIPMENT

7.8.1 GROWING ADOPTION OF SPVATS AND ELECTROSURGERY DEVICES WILL INCREASE THE DEMAND FOR MAINTENANCE SERVICES

TABLE 54 EUROPEAN ELECTROSURGICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 55 EUROPEAN ELECTROSURGICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 56 EUROPEAN ELECTROSURGICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 57 EUROPEAN ELECTROSURGICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.9 RADIOTHERAPY DEVICES

7.9.1 STRINGENT REGULATORY GUIDELINES TO SUPPORT THE DEMAND FOR PREVENTIVE MAINTENANCE

TABLE 58 EUROPEAN RADIOTHERAPY DEVICES MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 59 EUROPEAN RADIOTHERAPY DEVICES MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 60 EUROPEAN RADIOTHERAPY DEVICES MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 61 EUROPEAN RADIOTHERAPY DEVICES MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.10 DENTAL EQUIPMENT

TABLE 62 EUROPEAN DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 63 EUROPEAN DENTAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 64 EUROPEAN DENTAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 65 EUROPEAN DENTAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 66 EUROPEAN DENTAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.10.1 DENTAL RADIOLOGY EQUIPMENT

7.10.1.1 Technological complexity of dental radiology equipment to drive the demand for maintenance services

TABLE 67 EUROPEAN DENTAL RADIOLOGY EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.10.2 DENTAL LASER DEVICES

7.10.2.1 Sophisticated maintenance workflow offered by service providers to drive the demand for services

TABLE 68 EUROPEAN DENTAL LASER DEVICES MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.10.3 OTHER DENTAL EQUIPMENT

TABLE 69 EUROPEAN OTHER DENTAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.11 LABORATORY EQUIPMENT

7.11.1 INCREASED LABORATORY AUTOMATION TO DRIVE THE DEMAND FOR LABORATORY EQUIPMENT MAINTENANCE SERVICES

TABLE 70 EUROPEAN LABORATORY EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 71 EUROPEAN LABORATORY EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 72 EUROPEAN LABORATORY EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 73 EUROPEAN LABORATORY EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.12 DURABLE MEDICAL EQUIPMENT

7.12.1 GROWING AWARENESS ABOUT IN-HOUSE MAINTENANCE SERVICES TO IMPACT THE GROWTH OF THIS MARKET SEGMENT

TABLE 74 EUROPEAN DURABLE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 75 EUROPEAN DURABLE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 76 EUROPEAN DURABLE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

TABLE 77 EUROPEAN DURABLE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE (Page No. - 135)

8.1 INTRODUCTION

TABLE 78 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

8.2 PREVENTIVE MAINTENANCE

8.2.1 BENEFITS OF PREVENTIVE MAINTENANCE TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 79 PREVENTIVE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 CORRECTIVE MAINTENANCE

8.3.1 ONLINE AVAILABILITY OF MULTI-VENDOR MEDICAL DEVICE SPARE PARTS TO STREAMLINE THE WORKFLOW FOR CORRECTIVE MAINTENANCE

TABLE 80 CORRECTIVE MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 OPERATIONAL MAINTENANCE

8.4.1 GROWING AWARENESS OF OPERATIONAL MAINTENANCE AMONG END USERS TO DRIVE THE GROWTH OF THIS MARKET SEGMENT

TABLE 81 OPERATIONAL MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

9 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER (Page No. - 141)

9.1 INTRODUCTION

TABLE 82 COST OF CONTRACTS FROM DIFFERENT TYPES OF SERVICE PROVIDERS

TABLE 83 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

9.2 MULTI-VENDOR OEMS

9.2.1 AVAILABILITY OF 24/7 REMOTE SERVICES DRIVING THE PREFERENCE FOR MULTI-VENDOR OEMS

TABLE 84 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR MULTI-VENDOR OEMS, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 SINGLE-VENDOR OEMS

9.3.1 COMPLEXITY IN MANAGING CONTRACTS TO HINDER THE GROWTH OF THIS MARKET SEGMENT

TABLE 85 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR SINGLE-VENDOR OEMS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 INDEPENDENT SERVICE ORGANIZATIONS

9.4.1 LOWER COST OF CONTRACTS IS LIKELY TO SUPPORT THE GROWTH OF THIS MARKET SEGMENT

TABLE 86 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR ISOS, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 IN-HOUSE MAINTENANCE

9.5.1 QUICK RESPONSE TIME FOR BREAKDOWNS IS LIKELY TO SUPPORT THE GROWTH OF THIS MARKET SEGMENT

TABLE 87 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR IN-HOUSE MAINTENANCE, BY COUNTRY, 2019–2026 (USD MILLION)

10 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER (Page No. - 148)

10.1 INTRODUCTION

TABLE 88 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2 HOSPITALS

10.2.1 INCREASING NUMBER OF SURGERIES TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 89 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR HOSPITALS, BY COUNTRY, 2019–2026 (USD MILLION)

10.3 AMBULATORY SURGICAL CENTERS

10.3.1 PATIENTS ARE INCREASINGLY OPTING FOR AMBULATORY SURGICAL CENTERS AS A MORE CONVENIENT ALTERNATIVE TO HOSPITAL-BASED OUTPATIENT PROCEDURES

TABLE 90 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.4 DENTAL CLINICS & SPECIALTY CLINICS

10.4.1 PREFERENCE FOR SPECIALTY CLINICS IS GROWING OWING TO THEIR GREATER VERSATILITY

TABLE 91 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DENTAL CLINICS & SPECIALTY CLINICS, BY COUNTRY, 2019–2026 (USD MILLION)

10.5 DIAGNOSTIC IMAGING CENTERS

10.5.1 INCREASING NUMBER OF PRIVATE IMAGING CENTERS IS CONTRIBUTING TO MARKET GROWTH

TABLE 92 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.6 DIALYSIS CENTERS

10.6.1 INCREASING NUMBER OF DIALYSIS CENTERS TO INCREASE THE DEMAND FOR MAINTENANCE SERVICES

TABLE 93 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR DIALYSIS CENTERS, BY COUNTRY, 2019–2026 (USD MILLION)

10.7 OTHER END USERS

TABLE 94 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

11 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET, BY REGION (Page No. - 156)

11.1 INTRODUCTION

TABLE 95 EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

11.2 GERMANY

11.2.1 GERMANY IS THE LARGEST MARKET FOR MEDICAL EQUIPMENT MAINTENANCE IN EUROPE

TABLE 96 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 97 GERMANY: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 98 GERMANY: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 GERMANY: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 101 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 102 GERMANY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.3 UK

11.3.1 UK IS THE SECOND-LARGEST MARKET FOR MEDICAL EQUIPMENT MAINTENANCE IN EUROPE

TABLE 103 CONTRACTS BETWEEN THE NHS AND EQUIPMENT MAINTENANCE SERVICE PROVIDERS (2014–2017)

TABLE 104 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE,2019–2026 (USD MILLION)

TABLE 105 UK: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 106 UK: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 107 UK: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 109 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 110 UK: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.4 FRANCE

11.4.1 INFLUX OF MULTINATIONAL COMPANIES TO DRIVE THE DEMAND FOR MAINTENANCE SERVICES

TABLE 111 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 112 FRANCE: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 113 FRANCE: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 114 FRANCE: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 115 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 116 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 117 FRANCE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.5 ITALY

11.5.1 THE DEMAND FOR EFFECTIVE EQUIPMENT MAINTENANCE SERVICES IS INCREASING IN ITALY

TABLE 118 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 119 ITALY: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 ITALY: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 121 ITALY: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 123 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 124 ITALY: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.6 SPAIN

11.6.1 GROWING INVESTMENTS IN NEW TECHNOLOGIES TO FUEL THE DEMAND FOR EQUIPMENT MAINTENANCE

TABLE 125 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 126 SPAIN: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 127 SPAIN: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 SPAIN: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 129 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 130 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 131 SPAIN: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.7 POLAND

11.7.1 PUBLIC HEALTHCARE FACILITIES IN POLAND HAVE A LARGE INSTALLATION BASE OF IMAGING MODALITIES

FIGURE 36 LEADING CAUSES OF DISEASE-RELATED DEATHS IN POLAND (AS OF 2017)

TABLE 132 POLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 133 POLAND: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 POLAND: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 135 POLAND: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 136 POLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 137 POLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 138 POLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.8 AUSTRIA & SWITZERLAND

11.8.1 HIGH HEALTHCARE INVESTMENTS TO OFFER OPPORTUNITIES FOR MARKET GROWTH IN THESE COUNTRIES

TABLE 139 AUSTRIA & SWITZERLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 140 AUSTRIA & SWITZERLAND: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 141 AUSTRIA & SWITZERLAND: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 AUSTRIA & SWITZERLAND: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 143 AUSTRIA & SWITZERLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 144 AUSTRIA & SWITZERLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 145 AUSTRIA & SWITZERLAND: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.9 SCANDINAVIAN COUNTRIES

11.9.1 GROWING BURDEN ON HEALTHCARE SYSTEMS TO DRIVE THE DEMAND FOR EFFECTIVE MAINTENANCE SERVICES

TABLE 146 SCANDINAVIAN COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 147 SCANDINAVIAN COUNTRIES: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 SCANDINAVIAN COUNTRIES: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 149 SCANDINAVIAN COUNTRIES: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 SCANDINAVIAN COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 151 SCANDINAVIAN COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 152 SCANDINAVIAN COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.1 BENELUX COUNTRIES

11.10.1 HIGH INVESTMENTS IN HEALTHCARE TO DRIVE THE DEMAND FOR VARIOUS MEDICAL EQUIPMENT MAINTENANCE SERVICES IN THESE COUNTRIES

TABLE 153 MEDICAL EQUIPMENT DETAILS IN THE NETHERLANDS

TABLE 154 BENELUX COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 155 BENELUX COUNTRIES: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 BENELUX COUNTRIES: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 157 BENELUX COUNTRIES: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 158 BENELUX COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 159 BENELUX COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 160 BENELUX COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.11 BALTIC COUNTRIES

11.11.1 MARKET IN BALTIC COUNTRIES IS ESTIMATED TO GROW AT A STEADY RATE DURING THE FORECAST PERIOD

TABLE 161 BALTIC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 162 BALTIC COUNTRIES: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 163 BALTIC COUNTRIES: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 BALTIC COUNTRIES: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 165 BALTIC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 166 BALTIC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 167 BALTIC COUNTRIES: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

11.12 REST OF EUROPE

TABLE 168 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 169 REST OF EUROPE: DIAGNOSTIC IMAGING EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 REST OF EUROPE: PATIENT MONITORING & LIFE SUPPORT DEVICES MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: DENTAL EQUIPMENT MAINTENANCE MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 172 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE PROVIDER, 2019–2026 (USD MILLION)

TABLE 173 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY SERVICE TYPE, 2019–2026 (USD MILLION)

TABLE 174 REST OF EUROPE: MEDICAL EQUIPMENT MAINTENANCE MARKET, BY END USER, 2019–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 208)

12.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN THE EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET (2017 TO 2021)

12.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 38 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS IN THE MEDICAL EQUIPMENT MAINTENANCE MARKET

12.3 GLOBAL MARKET SHARE ANALYSIS (2020)

TABLE 175 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: DEGREE OF COMPETITION

FIGURE 39 GE HEALTHCARE HELD THE LARGEST SHARE OF THE EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET IN 2020

12.4 COMPETITIVE SCENARIO (JANUARY 2017 TO JULY 2021)

TABLE 176 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: DEALS, JANUARY 2017–JULY 2021

TABLE 177 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: OTHER DEVELOPMENTS, JANUARY 2017–JULY 2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 40 EUROPEAN MEDICAL EQUIPMENT MAINTENANCE MARKET: COMPANY EVALUATION QUADRANT, 2020

13 COMPANY PROFILES (Page No. - 214)

(Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.1 MAJOR PLAYERS

13.1.1 GE HEALTHCARE (GENERAL ELECTRIC COMPANY)

TABLE 178 GE HEALTHCARE: COMPANY OVERVIEW

FIGURE 41 GE HEALTHCARE: COMPANY SNAPSHOT (2020)

TABLE 179 GE HEALTHCARE: DEALS

TABLE 180 GE HEALTHCARE: OTHER DEVELOPMENTS

13.1.2 SIEMENS HEALTHINEERS (A SUBSIDIARY OF SIEMENS GROUP)

TABLE 181 SIEMENS AG: COMPANY OVERVIEW

FIGURE 42 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2020)

TABLE 182 SIEMENS HEALTHINEERS: DEALS

TABLE 183 SIEMENS HEALTHINEERS: OTHER DEVELOPMENTS

13.1.3 KONINKLIJKE PHILIPS N.V.

TABLE 184 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

FIGURE 43 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

TABLE 185 KONINKLIJKE PHILIPS N.V.: DEALS

13.1.4 MEDTRONIC PLC

TABLE 186 MEDTRONIC PLC: COMPANY OVERVIEW

FIGURE 44 MEDTRONIC PLC: COMPANY SNAPSHOT (2020)

TABLE 187 MEDTRONIC PLC: DEALS

TABLE 188 MEDTRONIC PLC: OTHER DEVELOPMENTS

13.1.5 FUJIFILM HOLDINGS CORPORATION

TABLE 189 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 45 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 190 FUJIFILM HOLDINGS CORPORATION: DEALS

13.2 OTHER PLAYERS

13.2.1 OLYMPUS CORPORATION

TABLE 191 OLYMPUS CORPORATION: COMPANY OVERVIEW

FIGURE 46 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2020)

13.2.2 CANON INC.

TABLE 192 CANON INC.: COMPANY OVERVIEW

FIGURE 47 CANON INC.: COMPANY SNAPSHOT (2020)

TABLE 193 CANON INC.: DEALS

13.2.3 DRÄGERWERK AG & CO. KGAA

TABLE 194 DRÄGERWERK AG & CO. KGAA: COMPANY OVERVIEW

FIGURE 48 DRÄGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2020)

TABLE 195 DRÄGERWERK AG & CO. KGAA: DEALS

13.2.4 HITACHI, LTD.

TABLE 196 HITACHI LTD.: COMPANY OVERVIEW

FIGURE 49 HITACHI, LTD.: COMPANY SNAPSHOT (2020)

TABLE 197 HITACHI, LTD.: DEALS

13.2.5 B. BRAUN MELSUNGEN AG

TABLE 198 B. BRAUN MELSUNGEN AG: COMPANY OVERVIEW

FIGURE 50 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2020)

13.2.6 ALTHEA GROUP

TABLE 199 ALTHEA GROUP: COMPANY OVERVIEW

TABLE 200 ALTHEA GROUP: DEALS

TABLE 201 ALTHEA GROUP: OTHER DEVELOPMENTS

13.2.7 AGFA–GEVAERT N.V.

TABLE 202 AGFA-GEVAERT: COMPANY OVERVIEW

FIGURE 51 AGFA–GEVAERT GROUP: COMPANY SNAPSHOT (2020)

TABLE 203 AGFA–GEVAERT GROUP: OTHER DEVELOPMENTS

13.2.8 BCAS BIO-MEDICAL SERVICES LTD.

TABLE 204 BCAS BIO-MEDICAL SERVICES LTD: COMPANY OVERVIEW

13.2.9 AGENOR MANTENIMIENTOS

TABLE 205 AGENOR MANTENIMIENTOS: COMPANY OVERVIEW

13.2.10 GRUPO EMPRESARIAL ELECTROMÉDICO

TABLE 206 GRUPO EMPRESARIAL ELECTROMÉDICO: COMPANY OVERVIEW

13.2.11 CARESTREAM HEALTH

13.2.12 KARL STORZ GMBH & CO. KG

13.2.13 ALLIANCE MEDICAL

13.2.14 AVENSYS UK LTD.

13.2.15 ARAMARK SERVICES, INC.

*Details on Business Overview, Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 259)

14.1 DEMAND-SIDE DISCUSSION GUIDE

14.2 SUPPLY-SIDE DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

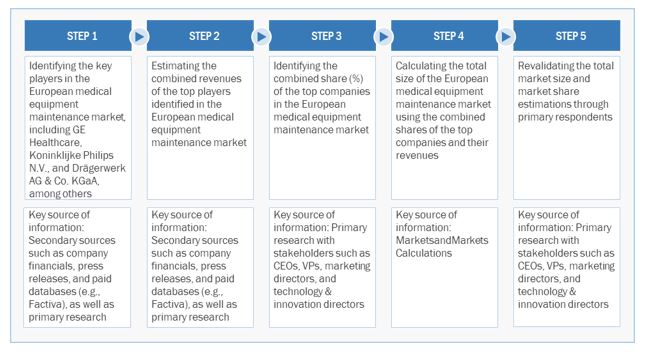

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the European Medical Equipment Maintenance market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

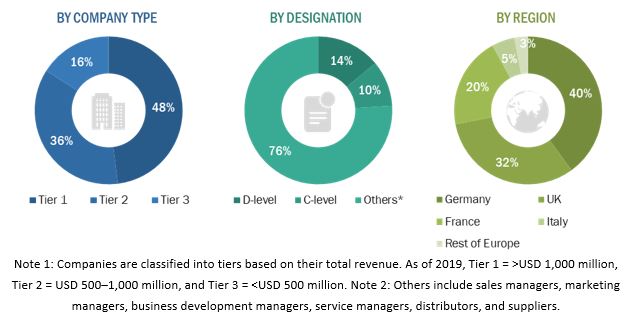

Primary research was conducted after acquiring extensive knowledge about the European Medical Equipment Maintenance market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, surgical centers, orthopedic clinics, dental clinics, CROs, CMOs, academic institutions, and medical device companies among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, service manage, biomedical engineers, heads of business units, and senior managers) across major countries, namely, Germany, UK, France, Italy, Spain, Poland, Austria and Switzerland, Baltic Countries (Estonia, Latvia, and Lithuania), Benelux Countries (Includes Belgium, Netherlands, And Luxembourg), Scandinavian Countries ( Include Denmark, Norway, Sweden, Iceland, Finland) and Rest of Europe (RoE). Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews. A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the European Medical Equipment Maintenance market and other dependent submarkets.

- The key players in the European Medical Equipment Maintenance market were identified through secondary research, and their European market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the European Medical Equipment Maintenance market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation:

After deriving the overall European Medical Equipment Maintenance market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Report Objectives:

- To define, describe, and forecast the European Medical Equipment Maintenance market on the basis of service type, service provider, device type, end user and countries

- To provide detailed information regarding the major factors influencing the growth potential of the European Medical Equipment Maintenance market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the European Medical Equipment Maintenance market

- To analyze key growth opportunities in the European Medical Equipment Maintenance market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to major countries, namely, Germany, UK, France, Italy, Spain, Poland, Austria and Switzerland, Baltic Countries (Estonia, Latvia, and Lithuania), Benelux Countries (Includes Belgium, Netherlands, And Luxembourg), Scandinavian Countries ( Include Denmark, Norway, Sweden, Iceland, Finland) and Rest of Europe (RoE)

- To profile the key players in the European Medical Equipment Maintenance market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the European Medical Equipment Maintenance market, such as agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global Medical Equipment Maintenance market report:

Product Analysis

- Service matrix, which gives a detailed comparison of the service portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Medical Equipment Maintenance market into Belgium, Austria, and Russia, among other

- Further breakdown of the Rest of Asia Pacific European Medical Equipment Maintenance market into wan, New Zealand, Vietnam, the Philippines, Singapore, Malaysia, Thailand, and Indonesia among other

- Further breakdown of the Latin American European Medical Equipment Maintenance market into Argentina, Chile, Peru, and Colombia, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Medical Equipment Maintenance Market