Medical Lifting Sling Market by Product (Transfer, Hammock, Toilet, Seating, Universal, Standing, Bariatric), by Material (Nylon, Padded, Canvas), by Usage Type (Disposable, Reusable), End User (Home, Hospital, Elderly) -Forecast to 2020

The medical lifting sling market is estimated to grow at a CAGR of 11.4% to reach USD 706.0 Million by 2020.

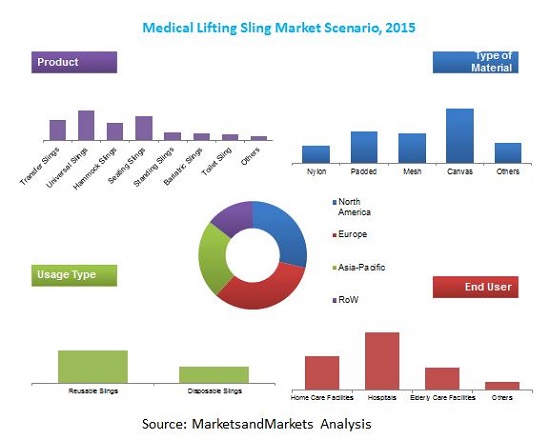

In this report, the medical lifting sling market is broadly segmented on the basis of product, usage type, material, end user and region. On the basis of products, the medical lifting sling market is broadly segmented into standing slings, seating slings, universal slings, hammock slings, transfer slings, toilet slings, bariatric slings, and others (such as positioning and pivot slings). The transfer sling segment is expected to be the largest segment and will also be the fastest growing segment in the forecast period. This growth can be attributed to the multi-purpose application of the sling.

On the basis of type of material, the medical lifting sling market is categorized into nylon, padded, mesh, canvas, and others (polypropylene and cotton). Nylon is the largest as well as fastest growing segment of this market. On the basis of end users, the medical lifting sling market is classified into home care, hospital, elderly care, and others (emergency medical services, long-term acute care facilities, trauma centers, and nursing homes). Hospitals are the major end users of this market.

On the basis of usage type, the medical lifting sling market is segregated into disposable and reusable slings. In 2015, the reusable segment will hold the largest share of the medical lifting sling market. However, the disposable slings segment will show the highest growth rate primarily because the use of these slings helps control and prevent infections.

The medical lifting sling market by region is segmented into North America, Europe, Asia-Pacific and Row.

Factors such as the rise in geriatric population requiring assistance, increasing disabilities resulting from various lifestyle diseases such as diabetes and cardiovascular disease (CVD), government policies promoting the use of lifting slings, and high recovery cost of injuries are driving the growth of this market. However, lack of skilled training and knowledge to handle patients and persistent difficulty in handling obese patients are the key factors limiting the growth of this market.

Key players operating in the medical lifting sling market are ArjoHuntleigh, Inc. (Sweden), Hill-Rom Holdings Inc. (U.S.), Guldmann, Inc. (Denmark), Invacare Corporation (U.S.) and Prism Medical Ltd. (Canada)

Medical Lifting Sling Market : Scope of the Report

- This report covers the global and regional market for medical slings market on the basis of products, usage type, material, and end user

- The market study does not cover the medical lifting slings market in terms of volume

|

Particular |

Scope |

|

Region |

|

|

Historical Years |

2013 |

|

Base Year |

2014 |

|

Estimated Year |

2015 |

|

Projected Year |

2020 |

|

Forecast Period |

2015–2020 |

|

Revenue Currency |

USD ($) |

Market Segmentation

This research report categorizes the medical lifting sling market on the basis of product, usage type, material, end user and region.

Medical Lifting Slings Market, by Usage Type

- Reusable Slings

- Disposable Slings

Medical Lifting Slings Market, by Product

- Universal Slings

- Transfer Slings

- Hammock Slings

- Standing Slings

- Seating Slings

- Toilet Slings

- Bariatric Slings

- Others (Positioning Slings and Pivot Slings)

Medical Lifting Slings Market, by Material

- Nylon

- Padded

- Mesh

- Canvas

- Others (Polypropylene and Cotton)

Medical Lifting Slings Market, by End User

- Home Care Facilities

- Hospitals

- Elderly Care Facilities

- Other End Users (Emergency Medical Services, Long-term Acute Care Facilities, Trauma Centers, and Nursing Homes)

Medical Lifting Slings Market, by Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest of Europe(ROE)

- Asia-Pacific

- Japan

- Rest of Asia-Pacific (RoAPAC)

Rest of the World (RoW)

The medical lifting sling market is expected to grow at a double-digit CAGR of 11.4% to reach USD 706.0 Million by 2020. Factors such as rising geriatric population, increasing incidences of lifestyle diseases, and high recovery cost from injuries resulting from manual handling of patient handling equipment are driving the growth of this market. However, lack of skilled training and knowledge to handle patients and persistent difficulty in handling obese patients are hindering the growth of this market.

On the basis of products, the medical lifting sling market is segregated into standing slings, seating slings, universal slings, hammock slings, transfer slings, toilet slings, bariatric slings, and others (such as positioning and pivot slings). The transfer sling segment is expected to be the largest segment and fastest growing segment in the forecast period. This growth can be attributed to the multi-purpose usage of the sling.

On the basis of usage type, the medical lifting sling market is divided into disposable and reusable slings. In 2015, the reusable segment will hold the largest share of the medical lifting sling market. However, the disposable slings segment will show the highest growth rate. The growth of the disposable slings segment is propelled by the reduced risk of cross-infection as these slings can only be used by a single patient.

On the basis of end users, the medical lifting sling market is classified into home care, hospital, elderly care, and others (emergency medical services, long-term acute care facilities, trauma centers, and nursing homes). Hospitals are the major end users of this market. On the basis of type of material, the medical lifting sling market is categorized into nylon, padded, mesh, canvas, and others (polypropylene and cotton). Nylon is the largest as well as fastest growing segment of this market. The factor contributing to growth of this segment is the use of nylon in various types of slings used for bathing, toileting and other functions.

Geographically, the medical lifting sling market is dominated by Europe, followed by North America. North America is expected to grow at a double-digit CAGR during the forecast period.

Key players operating in the medical lifting sling market are ArjoHuntleigh, Inc. (Sweden), Hill-Rom Holdings Inc. (U.S.), Guldmann, Inc. (Denmark), Invacare Corporation (U.S.) and Prism Medical Ltd. (Canada)

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.2.1 Key Data From Secondary Sources

2.2.2 Key Data From Primary Sources

2.2.2.1 Key Industry Insights

2.2.3 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Medical Lifting Slings Market to Grow at A Steady Rate

4.2 Medical Lifting Slings Market, By Application

4.3 Geographical Snapshot of the Medical Lifting Slings Market

4.4 Medical Lifting Slings Market, By End User

4.5 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.3 Drivers

5.3.1 Rapid Growth in Aging Population

5.3.2 Government Policies Promoting the Use of Medical Lifting Slings

5.3.3 Increasing Incidences of Lifestyle Diseases

5.3.4 High Recovery Cost of Injuries

5.4 Restraints

5.4.1 Lack of Skilled Training and Adequate Knowledge Necessary to Operate Medical Lifting Slings

5.4.2 Difficulties in Handling Obese Patients

5.5 Opportunities

5.5.1 Private Institutional Nursing

5.5.2 Mergers, Acquisitions, and Joint Ventures

5.6 Threats

5.6.1 Competition Among Players

6 Medical Lifting Slings Market, By Product (Page No. - 39)

6.1 Introduction

6.2 Transfer Slings

6.3 Universal Slings

6.4 Hammock Slings

6.5 Standing Slings

6.6 Seating Slings

6.7 Toileting Slings

6.8 Bariatric Slings

6.9 Others Slings

7 Medical Lifting Slings Market, By Material (Page No. - 63)

7.1 Introduction

7.2 Nylon Slings

7.3 Padded Slings

7.4 Mesh Slings

7.5 Canvas Slings

7.6 Other Material (Polypropylene and Cotton)

8 Medical Lifting Slings Market, By Usage Type (Page No. - 79)

8.1 Introduction

8.2 Disposable Slings

8.3 Reusable Slings

9 Medical Lifting Slings Market, By End User (Page No. - 87)

9.1 Introduction

9.2 Hospitals

9.3 Home Care Facilities

9.4 Elderly Care Facilities

9.5 Other End Users

10 Medical Lifting Slings Market, By Region (Page No. - 101)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.3 Canada

10.4 Europe

10.4.1 U.K.

10.4.2 Germany

10.4.3 France

10.4.4 Italy

10.4.5 Spain

10.4.6 Rest of Europe

10.5 Asia-Pacific

10.5.1 Japan

10.5.2 Rest of Asia-Pacific (RoAPAC)

10.6 Rest of the World

11 Company Profiles (Page No. - 146)

11.1 Introduction

11.2 Getinge Group (Arjohuntleigh)

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 MnM View

11.3 Hill-Rom Holdings, Inc.

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 MnM View

11.4 Invacare Corporation

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 Recent Developments

11.4.4 MnM View

11.5 Prism Medical Ltd.

11.5.1 Business Overview

11.5.2 Products Offered

11.5.3 Recent Developments

11.5.4 MnM View

11.6 Guldmann Inc.

11.6.1 Business Overview

11.6.2 Products Offered

11.6.3 Recent Developments

11.7 ETAC AB

11.7.1 Business Overview

11.7.2 Products Offered

11.7.3 Recent Development

11.8 Handicare as

11.8.1 Business Overview

11.8.2 Products Offered

11.8.3 Recent Developments

11.9 Joerns Healthcare, LLC

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Development

11.10 Silvalea Ltd.

11.10.1 Business Overview

11.10.2 Products Offered

11.10.3 Recent Developments

11.11 Spectra Care Group

11.11.1 Business Overview

11.11.2 Spectra Care Group: Company Snapshot

11.11.3 Products Offered

11.11.4 Recent Developments

12 Appendix (Page No. - 166)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Other Developments

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (136 Tables)

Table 1 Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 2 Transfer Slings Market Size, By Region, 2013–2020 (USD Million)

Table 3 Europe: Transfer Slings Market Size, By Country, 2013–2020 (USD Million)

Table 4 North America: Transfer Slings Market Size, By Country, 2013–2020 (USD Million)

Table 5 Asia-Pacific: Transfer Slings Market Size, By Country, 2013–2020 (USD Million)

Table 6 Universal Slings Market Size, By Region, 2013–2020 (USD Million)

Table 7 Europe: Universal Slings Market Size, By Country, 2013–2020 (USD Million)

Table 8 North America: Universal Slings Market Size, By Country, 2013–2020 (USD Million)

Table 9 Asia-Pacific: Universal Slings Market Size, By Country, 2013–2020 (USD Million)

Table 10 Hammock Slings Market Size, By Region, 2013–2020 (USD Million)

Table 11 Europe: Hammock Slings Market Size, By Country, 2013–2020 (USD Million)

Table 12 North America: Hammock Slings Market Size, By Country, 2013–2020 (USD Million)

Table 13 Asia-Pacific: Hammock Slings Market Size, By Country, 2013–2020 (USD Million)

Table 14 Standing Slings Market Size, By Region, 2013–2020 (USD Million)

Table 15 Europe: Standing Slings Market Size, By Country, 2013–2020 (USD Million)

Table 16 North America: Standing Slings Market Size, By Country, 2013–2020 (USD Million)

Table 17 Asia-Pacific: Standing Slings Market Size, By Country, 2013–2020 (USD Million)

Table 18 Seating Slings Market Size, By Region, 2013–2020 (USD Million)

Table 19 Europe: Seating Slings Market Size, By Country, 2013–2020 (USD Million)

Table 20 North America: Seating Slings Market Size, By Country, 2013–2020 (USD Million)

Table 21 Asia-Pacific: Seating Slings Market Size, By Country, 2013–2020 (USD Million)

Table 22 Toileting Slings Market Size, By Region, 2013–2020 (USD Million)

Table 23 Europe: Toileting Slings Market Size, By Country, 2013–2020 (USD Million)

Table 24 North America: Toileting Slings Market Size, By Country, 2013–2020 (USD Million)

Table 25 Asia-Pacific: Toileting Slings Market Size, By Country, 2013–2020 (USD Million)

Table 26 Bariatric Slings Market Size, By Region, 2013–2020 (USD Million)

Table 27 Europe: Bariatric Slings Market Size, By Country, 2013–2020 (USD Million)

Table 28 North America: Bariatric Slings Market Size, By Country, 2013–2020 (USD Million)

Table 29 Asia-Pacific: Bariatric Slings Market Size, By Country, 2013–2020 (USD Million)

Table 30 Other Slings Market Size, By Region, 2013–2020 (USD Million)

Table 31 Europe: Other Slings Market Size, By Region/Country, 2013–2020 (USD Million)

Table 32 North America: Other Slings Market Size, By Country, 2013–2020 (USD Million)

Table 33 Asia-Pacific: Other Slings Market Size, By Country, 2013–2020 (USD Million)

Table 34 Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 35 Nylon Slings Market Size, By Region, 2013–2020 (USD Million)

Table 36 Europe: Nylon Slings Market Size, By Country, 2013–2020 (USD Million)

Table 37 North America: Nylon Slings Market Size, By Country, 2013–2020 (USD Million)

Table 38 Asia-Pacific: Nylon Slings Market, By Country, 2013–2020 (USD Million)

Table 39 Padded Slings Market Size, By Region, 2013–2020 (USD Million)

Table 40 Europe: Padded Slings Market Size, By Country, 2013–2020 (USD Million)

Table 41 North America: Padded Slings Market Size, By Country, 2013–2020 (USD Million)

Table 42 Asia-Pacific: Padded Slings Market Size, By Country, 2013–2020 (USD Million)

Table 43 Mesh Slings Market Size, By Region, 2013–2020 (USD Million)

Table 44 Europe: Mesh Slings Market Size, By Country, 2013–2020 (USD Million)

Table 45 North America: Mesh Slings Market Size, By Country, 2013–2020 (USD Million)

Table 46 Asia-Pacific: Mesh Slings Market Size, Country, 2013–2020 (USD Million)

Table 47 Canvas Slings Market Size, By Region, 2013–2020 (USD Million)

Table 48 Europe: Canvas Slings Market Size, By Country, 2013–2020 (USD Million)

Table 49 North America: Canvas Slings Market Size, By Country, 2013–2020 (USD Million)

Table 50 Asia-Pacific: Canvas Slings Market Size, By Country, 2013–2020 (USD Million)

Table 51 Medical Lifting Slings Market Size for Other Material, By Region, 2013–2020 (USD Million)

Table 52 Europe: Medical Lifting Slings Market Size for Other Material, By Country, 2013–2020 (USD Million)

Table 53 North America: Medical Lifting Slings Market Size for Other Material, By Country, 2013–2020 (USD Million)

Table 54 Asia-Pacific: Medical Lifting Slings Market Size for Other Material, By Country, 2013–2020 (USD Million)

Table 55 Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 56 Disposable Slings Market Size, By Region, 2013–2020 (USD Million)

Table 57 Europe: Disposable Slings Market Size, By Region/Country, 2013–2020 (USD Million)

Table 58 North America: Disposable Slings Market Size, By Country, 2013–2020 (USD Million)

Table 59 Asia-Pacific: Disposable Slings Market Size, By Region/Country, 2013–2020 (USD Million)

Table 60 Reusable Slings Market Size, By Region, 2013–2020 (USD Million)

Table 61 Europe: Reusable Slings Market Size, By Region/Country, 2013–2020 (USD Million)

Table 62 North America: Reusable Slings Market Size, By Country, 2013–2020 (USD Million)

Table 63 Asia-Pacific: Reusable Slings Market Size, By Region/Country, 2013–2020 (USD Million)

Table 64 Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 65 Medical Lifting Slings Market Size for Hospitals, By Region, 2013–2020 (USD Million)

Table 66 Europe: Medical Lifting Slings Market Size for Hospitals, By Country, 2013–2020 (USD Million)

Table 67 North America: Medical Lifting Slings Market Size for Hospitals, By Country, 2013–2020 (USD Million)

Table 68 Asia-Pacific: Medical Lifting Slings Market Size for Hospitals, By Country, 2013–2020 (USD Million)

Table 69 Medical Lifting Slings Market Size for Home Care Facilities, By Region, 2013–2020 (USD Million)

Table 70 Europe: Medical Lifting Slings Market Size for Home Care Facilities, By Country, 2013–2020 (USD Million)

Table 71 North America: Medical Lifting Slings Market Size for Home Care Facilities, By Country, 2013–2020 (USD Million)

Table 72 Asia-Pacific: Medical Lifting Slings Market Size for Home Care Facilities, By Country, 2013–2020 (USD Million)

Table 73 Medical Lifting Slings Market Size for Elderly Care Facilities, By Region, 2013–2020 (USD Million)

Table 74 Europe: Medical Lifting Slings Market Size for Elderly Care Facilities, By Country, 2013–2020 (USD Million)

Table 75 North America: Medical Lifting Slings Market Size for Elderly Care Facilities, By Country, 2013–2020 (USD Million)

Table 76 Asia-Pacific: Medical Lifting Slings Market Size for Elderly Care Facilities, By Country, 2013–2020 (USD Million)

Table 77 Medical Lifting Slings Market Size for Other End Users, By Region, 2013–2020 (USD Million)

Table 78 Europe: Medical Lifting Slings Market Size for Other End Users, By Country, 2013–2020 (USD Million)

Table 79 North America: Medical Lifting Slings Market Size for Other End Users, By Country, 2013–2020 (USD Million)

Table 80 Asia-Pacific: Medical Lifting Slings Market Size for Other End Users, By Country/Region, 2013–2020 (USD Million)

Table 81 Medical Lifting Slings Market Size, By Region, 2013-2020 (USD Million)

Table 82 North America: Medical Lifting Slings Market Size, By Country, 2013–2020 (USD Million)

Table 83 North America: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 84 North America: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 85 North America: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 86 North America: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 87 U.S.: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 88 U.S.: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 89 U.S.: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 90 U.S.: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 91 Canada: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 92 Canada: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 93 Canada: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 94 Canada: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 95 Europe: Medical Lifting Slings Market Size, By Country, 2013–2020 (USD Million)

Table 96 Europe: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 97 Europe: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 98 Europe: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 99 Europe: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 100 U.K.: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 101 U.K.: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 102 U.K.: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 103 U.K.: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 104 Germany: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 105 Germany: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 106 Germany: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 107 Germany: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 108 France: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 109 France: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 110 France: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 111 France: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 112 Italy: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 113 Italy: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 114 Italy: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 115 Italy: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 116 Spain: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 117 Spain: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 118 Spain: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 119 Spain: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 120 Asia-Pacific: Medical Lifting Slings Market Size, By Country/Region, 2013–2020 (USD Million)

Table 121 Asia-Pacific: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 122 Asia-Pacific: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 123 Asia-Pacific: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 124 Asia-Pacific: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 125 Japan: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 126 Japan: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 127 Japan: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 128 Japan: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 129 RoAPAC: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 130 RoAPAC: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 131 RoAPAC: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 132 RoAPAC: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

Table 133 RoW: Medical Lifting Slings Market Size, By Usage Type, 2013–2020 (USD Million)

Table 134 RoW: Medical Lifting Slings Market Size, By Product, 2013–2020 (USD Million)

Table 135 RoW: Medical Lifting Slings Market Size, By Material, 2013–2020 (USD Million)

Table 136 RoW: Medical Lifting Slings Market Size, By End User, 2013–2020 (USD Million)

List of Figures (65 Figures)

Figure 1 Research Design: Medical Lifting Slings Market

Figure 2 Market Size Estimation Approach

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Data Triangulation Methodology

Figure 5 Medical Lifting Slings Market Snapshot, 2015 vs 2020

Figure 6 Transfer Sling Segment Expected to Dominate the Market in the Forecast Period

Figure 7 Nylon Material Segment Expected to Dominate the Market in the Forecast Period

Figure 8 Home Care Facilities, the Fastest-Growing End-User Segment

Figure 9 Asia-Pacific Expected to Be the Fastest-Growing Market During the Forecast Period

Figure 10 New Product Launches is the Dominant Strategy Adopted By the Market Players During the Forecast Period

Figure 11 Rising Aging Population to Drive Market Growth

Figure 12 Transfer Slings to Account for the Largest Share of the Market in 2015

Figure 13 North America to Witness Highest Growth Rate During the Forecast Period

Figure 14 Hospitals Segment Will Continue to Dominate the Market in 2020

Figure 15 North America Market Showcases Lucrative Growth Opportunities

Figure 16 Transfer Slings are Expected to Dominate Medical Lifting Slings Market in 2015

Figure 17 U.K. is Expected to Grow at the Highest Rate in the European Transfer Slings Market

Figure 18 Europe is Expected to Dominate the Universal Slings Market in 2015

Figure 19 U.K. is Expected to Grow at the Highest Rate in the European Hammock Slings Market

Figure 20 U.S. is Expected to Dominate in the North American Standing Slings Market

Figure 21 U.K. is Expected to Grow at the Highest Rate in the European Transfer Slings Market

Figure 22 Europe is Expected to Dominate the Global Toileting Slings Market

Figure 23 U.K. is Expected to Grow at the Highest Rate in the European Bariatric Slings Market

Figure 24 Europe is Expected to Dominate the European Other Slings Market

Figure 25 Nylon Segment is Expected to Dominate the Medical Lifting Slings Market in 2015

Figure 26 North American Market to Witness Highest Growth in the Nylon Slings Market

Figure 27 Europe is Expected to Dominate the Padded Slings Market in 2015

Figure 28 North America to Grow at the Highest Cagr in the Mesh Slings Market

Figure 29 Europe is Expected to Dominate the Canvas Slings Market

Figure 30 North America to Grow at the Highest Rate in the Medical Lifting Slings Market for Other Material

Figure 31 Reusable Slings to Dominate the Medical Lifting Slings Market in 2015

Figure 32 Reusable Slings Segment to Command Medical Lifting Slings Market in 2015

Figure 33 Europe is Expected to Dominate the Reusable Slings Market in 2015

Figure 34 Hospitals Expected to Dominate Medical Lifting Slings Market in 2015

Figure 35 North America to Grow at the Highest Rate in the Medical Lifting Slings Market for Hospitals

Figure 36 Europe is Expected to Dominate the Home Care Facilities End-User Segment

Figure 37 North America to Grow at the Highest Rate in the Elderly Care Facilities End-User Market

Figure 38 Europe is Expected to Dominate Other End User Market

Figure 39 Geographic Snapshot (2015): Medical Lifting Sling Market in Asia-Pacific to Witness Highest Growth in the Forecast Period

Figure 40 North America: An Attractive Destination for the Medical Lifting Slings Market

Figure 41 North American Market Snapshot: Increasing Number of Musculoskeletal Disorders to Drive the Demand for Medical Lifting Slings

Figure 42 Reusable Slings Expected to Dominate Medical Lifting Slings Market

Figure 43 Transfer Slings Expected to Grow at the Highest Rate in the U.S. Medical Lifting Slings Market

Figure 44 Nylon Slings are Expected to Dominate the Canadian Medical Lifting Slings Market

Figure 45 European Market Snapshot: Increasing Number of Obese and Morbidly Obese Patients to Drive Demand for Medical Lifting Slings

Figure 46 U.K. to Grow at the Highest Rate in the European Medical Lifting Slings Market

Figure 47 Reusable Slings Expected to Dominate the U.K. Medical Lifting Slings Market

Figure 48 Home Care Facilities Segment is Expected to Grow at the Highest Rate in Germany Medical Lifting Slings Market in 2015

Figure 49 Transfer Slings to Dominate the French Medical Lifting Slings Market

Figure 50 Disposable Slings Expected to Grow at the Highest Rate in the Italian Medical Lifting Slings Market

Figure 51 Nylon Slings to Hold Largest Share of the Spain Medical Lifting Slings Market

Figure 52 Homecare Facilities Segment to Grow at the Highest Rate in the Asia-Pacific Medical Lifting Slings Market

Figure 53 Reusable Slings to Command Largest Share of Japanese Medical Lifting Slings Market

Figure 54 Transfer Slings Expected to Grow at the Highest Rate in the RoAPAC Medical Lifting Slings Market

Figure 55 Nylon Slings are Expected to Dominate the RoW Medical Lifting Slings Market

Figure 56 Geographic Revenue Mix of Top Four Market Players

Figure 57 Getinge Group: Company Snapshot

Figure 58 Hill-Rom Holdings, Inc.: Company Snapshot

Figure 59 Invacare Corporation: Company Snapshot

Figure 60 Prism Medical Ltd.: Company Snapshot

Figure 61 Guldmann Inc.: Company Snapshot

Figure 62 ETAC AB: Company Snapshot

Figure 63 Handicare As: Company Snapshot

Figure 64 Joerns Healthcare, LLC: Company Snapshot

Figure 65 Silvalea Ltd.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Lifting Sling Market