Rehabilitation Equipment Market by Product (Medical Bed, Mobility Scooter, Walker, Crutcher, Cane, Patient Lift, Sling), Application (Physical, OT, Lower-body Exercise Equipment), End User (Rehabilitation & Physiotherapy Center) & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global rehabilitation equipment market growth forecasted to transform from $14.9 billion in 2022 to $19.8 billion by 2027, driven by a CAGR of 5.9%. The market is driven by the rising incidence of chronic diseases, increasing geriatric and obese populations, and a demand for rehabilitation therapies. Key players include Baxter International, Invacare Corporation, Medline Industries, and Arjo. The market faces challenges such as reimbursement issues, lack of awareness in emerging markets, and difficulties in handling bariatric patients. Notable segments include therapy equipment, physical rehabilitation, and hospitals as the largest end-users. Europe is expected to grow significantly due to an aging population and prevalence of musculoskeletal disorders, while the Asia Pacific region is anticipated to have the highest CAGR, driven by healthcare expenditure. Recent developments include product launches and partnerships aimed at enhancing rehabilitation solutions and integrating smart healthcare technologies.

Rehabilitation Equipment Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Rehabilitation Equipment Market Dynamics

Driver: Increasing incidence of chronic diseases

The manual handling of disabled patients may result in severe musculoskeletal injuries to caregivers. The risk of back injuries increases during lateral transfer, as caregivers must reach over the stretcher to the bed and physically pull the patient across onto a stretcher. This movement forces the body of caregivers into an awkward posture, which can cause musculoskeletal discomfort.

Injuries occurring at healthcare institutions involve direct and indirect costs—direct costs include expenses incurred in the treatment of injuries and the total man-days lost at work, while indirect costs are very difficult to measure and involve the diminished function of caregivers.

Workers at healthcare institutions report substantial pain from work injuries even after many months. Also, injuries to caregivers affect patient care as there are generally no provisions for replacing injured workers on an immediate basis. As a result, a smaller number of caregivers have to move and lift the same number of patients, which affects the quality of care, especially for patients with limited mobility. This, in turn, results in an increase in the length of stay of patients in hospitals, which adds to the overall healthcare expenditure. After the implementation of safe rehabilitation care programs, various rehabilitation equipment such as mobility solutions (including wheelchairs and patient lifts) are being used across healthcare institutions.

Manual handling of patients while transferring them from one place to another across rehabilitation care centers result in injuries to caregivers. This leads to missed workdays and loss of income, while also jeopardizing the health and well-being of patients. In order to overcome these challenges, the healthcare facilities are focusing on providing optimal care without putting their personnel at risk. As a result, the demand for tools like patient lifts, slings, and wheelchairs has increased, thereby boosting the sales growth in market.

Restraint: Lack of awareness and access to rehabilitation services in emerging markets

A general lack of awareness on the effective use of rehabilitation equipment is expected to restrain the growth of this market. For example, in the case of a stroke, the lack of proper assistance and rehabilitation at the correct juncture can have significant ill-effects on the functioning of the body. This lack of awareness can also lead to patients neglecting the symptoms of critical conditions entirely, which affects the adoption of rehabilitation. This is a key problem in countries, such as Malaysia and Taiwan, where the effects of this factor are compounded by a lack of sufficient infrastructure and manpower. In this scenario, patient access to rehabilitation and associated equipment is also affected. Other factors, such as lack of appropriate referrals and lack of knowledge in context to rehabilitation services among members of the family, also restrict access to rehabilitation equipment.

The access to rehabilitation services for people with disabilities in low- and middle-income countries is limited. Evidence suggests that people with disabilities face a large number of barriers to accessing healthcare services. This lack of access to rehabilitation services is limiting the growth of this market.

Opportunity: Rising demand for home healthcare services

Globally, an increasing number of government regulations are being implemented to reduce the duration and cost involved in healthcare treatments. The provision of services at a patient’s home is typically more cost-effective than in institutions, particularly if the available informal care is used effectively. Moreover, with the evolution of new technologies, such as remote patient monitoring, the home care segment is expected to witness significant growth in the coming years. The growing demand for home care will, in turn, increase the demand for equipment required for treating patients in home care settings, including patient transfer devices, mobility devices, and medical beds, in the coming years

Challenge: Reimbursement issues

Reimbursement is a key area that directly affects the adoption of rehabilitation equipment. A number of products in this market are priced at a premium and may not be affordable for patients; in such a case, they would have to depend on reimbursement to access the equipment. Various organizations, such as Medicare and Medicaid in the US, provide only limited coverage for rehabilitation equipment such as hospital beds, patient lifts, commode chairs, crutches, walkers, and manual and electric wheelchairs and scooters. Moreover, this coverage is only applicable for the purchase or rentals from Medicare suppliers, as the supplier is prohibited by Medicare rules to charge more than the Medicare-approved amount for equipment.

The complexity of the enrolment procedure (for securing reimbursements for rehabilitation equipment) itself is a key challenge for patients and potential customers. In addition, rehabilitation equipment can only be reimbursed if they are prescribed by doctors/physicians for a certain medical condition. This may hinder the adoption of rehabilitation equipment for home care purposes.

The rehabilitation equipment industry is projected to grow at a CAGR of 5.9% between 2022 and 2027.

The global rehabilitation equipment market is projected to reach USD 19.8 billion by 2027 from USD 14.9 billion in 2022, at a CAGR of 5.9% during the forecast period. The growth of this market is primarily driven by significant risk of injuries to caregivers while manually handling the patients, increasing growth in geriatric and obese population that often requires rehabilitation therapies, and an increasing demand for rehabilitation care with an increasing access to healthcare. However, a lack of training provided to caregivers for the efficient operation of rehabilitation equipment is a major factor restraining market growth.

Therapy equipment was the largest and fastest-growing segment of the rehabilitation equipment industry by product

Based on product, the rehabilitation equipment market is segmented into therapy equipment, daily living aids, mobility equipment, exercise equipment, and body support devices. In 2021, the therapy equipment segment accounted for the largest share of the global market. Increasing growth in the patients opting for physiotherapy and rehabilitation therapies are driving the demand for therapy equipment globally.

Physical rehabilitation & training segment of the rehabilitation equipment industry is the largest application segment

Based on application, the rehabilitation equipment market is segmented into strength, endurance, and pain reduction; physical rehabilitation & training; and occupational rehabilitation & training. In 2021, the physical rehabilitation & training segment accounted for the largest share of the global market. Physical rehabilitation and training help with osteoarthritis, joint replacement, sports injury, knee pain, back pain, carpal tunnel syndrome, Alzheimer's disease, multiple sclerosis, and cerebral palsy. Increasing incidence of above mentioned injuries and diseases are resulting into a significant growth in the segment.

Hospitals and clinics segment of the rehabilitation equipment industry is the largest end user segment

Based on end users, the rehabilitation equipment market is segmented into hospitals & clinics, rehabilitation centers, physiotherapy centers, home care settings, and other end users. In 2021, the hospitals and clinics segment accounted for the largest share of the global market. Medical beds, slings, hoists, and bathroom and toilet assist devices are commonly used rehabilitation equipment across hospitals. The demand for these equipment are increasing owing to increasing prevalence of diseases/conditions requiring hospital-based treatment.

Europe to witness the highest growth rate during the forecast period for the rehabilitation equipment industry.

Europe accounted for the largest share of the global rehabilitation equipment market. The large share of this regional segment is attributed to a significant contribution from an economically stable and technologically advanced countries such as Germany, UK, and France. Increasing geriatric population and rising prevalence of musculoskeletal disorders across these countries are driving the market growth in Europe. The Asia Pacific market is projected to register the highest CAGR during the forecast period. Market growth in the Asia Pacific is attributed to the rising healthcare expenditure and growing number of healthcare facilities in Asian countries.

To know about the assumptions considered for the study, download the pdf brochure

The product and services in the rehabilitation equipment market is dominated by few globally established players such as Baxter International (US), Invacare Corporation (US), Medline Industries, LP (US), and Arjo (Sweden).

Scope of the Rehabilitation Equipment Industry:

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$14.9 billion |

|

Projected Revenue Size by 2027 |

$19.8 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Increasing incidence of chronic diseases |

|

Market Opportunity |

Rising demand for home healthcare services |

The study categorizes the rehabilitation equipment market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

By Pype

- Therapy Equipment

-

Daily Living Aids

- Medical Beds & Related Products

- Bathroom and Toilet Assist Devices

- Reading, Writing, and Computing Aids

- Other Daily Living Aids

-

Mobility Equipment

-

Wheelchairs & Scooters

- Powered Wheelchairs

- Mobility Sccoters

- Manual Wheelchairs

-

Walking Assist Devices

- Canes

- Crutches

- Walkers

-

Wheelchairs & Scooters

-

Exercise Equipment

- Lower-Body Exercise Equipment

- Upper-Body Exercise Equipment

- Full-Body Exercise Equipment

-

Body Support Devices

- Patient Lifts

- Slings

- Other Body Support Devices

By Application

-

By Application

- Physical Rehabilitation & Training

- Stregth, Endurance, and Pain Reduction

- Occupational Rehabilitation & Training

By End User

-

By End User

- Hospitals & Clinics

- Rehabilitation Centers

- Home-care settings

- Physiotherapy Centers

- Other End Users

By Region

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

North America

- US

- Canada

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Rehabilitation Equipment Industry

- In May 2022, Etac AB (Sweden) announced the launch of R82 Crocodile (size 0), the smallest walking aid by the company.

- In March 2022, Medline Industries, LP (US) announced a USD 725 million prime vendor partnership with Mount Sinai Health System (US), to enhance their supply chain strategy and improve patient outcomes.

- In March 2022, Prism Medical (UK) announced a partnership with IoT Solution Group (UK), to enable Prism Medical to advance its existing product portfolio and expand into the smart healthcare market.

- In February 2022, Invacare announced the launch of its next-generation e-fix eco Power Assist Device to upgrade its manual wheelchairs.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global rehabilitation equipment market?

The global rehabilitation equipment market boasts a total revenue value of $19.8 billion by 2027.

What is the estimated growth rate (CAGR) of the global rehabilitation equipment market?

The global rehabilitation equipment market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $14.9 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 REHABILITATION EQUIPMENT MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

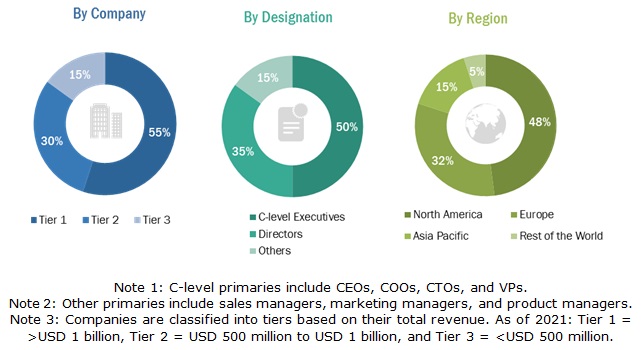

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION: PRODUCT-BASED ANALYSIS

FIGURE 7 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE GLOBAL MARKET (2022-2027)

FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET RANKING ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 10 REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY END USER (2020–2025)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL REHABILITATION EQUIPMENT INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 REHABILITATION EQUIPMENT MARKET OVERVIEW

FIGURE 14 RISING GERIATRIC & OBESE POPULATIONS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY PRODUCT AND COUNTRY (2020)

FIGURE 15 THERAPY EQUIPMENT SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 INDIA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: GLOBAL REHABILITATION EQUIPMENT INDUSTRY (2021−2026)

FIGURE 17 EUROPE TO DOMINATE THE GLOBAL MARKET IN 2026

4.5 GLOBAL REHABILITATION EQUIPMENT INDUSTRY: DEVELOPING VS. DEVELOPED MARKETS

FIGURE 18 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 REHABILITATION EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 2 MARKET DYNAMICS: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing incidence of chronic diseases

5.2.1.2 Increasing demand for rehabilitation care with expanding access to healthcare

5.2.1.3 Rising geriatric and obese populations

TABLE 3 GERIATRIC POPULATION, BY REGION, 2018 VS. 2020

5.2.1.4 Risk of injuries to caregivers while handling patients manually

5.2.2 MARKET RESTRAINTS

5.2.2.1 Lack of awareness and access to rehabilitation services in emerging markets

5.2.3 OPPORTUNITIES

5.2.3.1 Growth potential in emerging countries

5.2.3.2 Rising demand for home healthcare services

5.2.4 CHALLENGES

5.2.4.1 Reimbursement issues

5.2.4.2 Persistent difficulties in handling bariatric patients

6 INDUSTRY TRENDS (Page No. - 51)

6.1 INDUSTRY TRENDS

6.1.1 GROWING FOCUS ON ORGANIC GROWTH STRATEGIES

TABLE 4 NUMBER OF PRODUCT LAUNCHES BY KEY PLAYERS, JANUARY 2019–MAY 2022

6.1.2 INTEGRATION OF IOT IN REHABILITATION EQUIPMENT

6.2 REGULATORY ANALYSIS

6.2.1 NORTH AMERICA

6.2.1.1 US

TABLE 5 US: REGULATORY PROCESS FOR MEDICAL DEVICES

6.2.1.2 Canada

6.2.2 EUROPE

6.2.3 ASIA PACIFIC

6.2.3.1 Japan

TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES AND THE REVIEWING BODY

6.2.3.2 China

TABLE 7 NMPA MEDICAL DEVICES CLASSIFICATION

6.2.3.3 India

6.3 ECOSYSTEM ANALYSIS

FIGURE 20 ECOSYSTEM ANALYSIS: REHABILITATION EQUIPMENT MARKET

6.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: REHABILITATION EQUIPMENT

6.5 COVID-19 IMPACT ON THE REHABILITATION EQUIPMENT INDUSTRY

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 INTENSITY OF COMPETITIVE RIVALRY

7 REHABILITATION EQUIPMENT MARKET, BY PRODUCT (Page No. - 59)

7.1 INTRODUCTION

TABLE 9 GLOBAL REHABILITATION EQUIPMENT INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 THERAPY EQUIPMENT

7.2.1 THERAPY EQUIPMENT ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2021

TABLE 10 THERAPY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DAILY LIVING AIDS

TABLE 11 DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 12 DAILY LIVING AIDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 MEDICAL BEDS

7.3.1.1 Technological advancements are supporting the growth of this segment

TABLE 13 MEDICAL BEDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 BATHROOM & TOILET ASSIST DEVICES

7.3.2.1 Bathroom & toilet assist devices form the fastest-growing segment of the daily living aids market

TABLE 14 BATHROOM & TOILET ASSIST DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.3 READING, WRITING, AND COMPUTING AIDS

7.3.3.1 Reading, writing, and computing aids are widely used in home care and hospital settings

TABLE 15 READING, WRITING, AND COMPUTING AIDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.4 OTHER DAILY LIVING AIDS

TABLE 16 OTHER DAILY LIVING AIDS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 MOBILITY EQUIPMENT

TABLE 17 MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 18 MOBILITY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.1 WHEELCHAIRS & SCOOTERS

TABLE 19 WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 20 WHEELCHAIRS & SCOOTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.1.1 Power wheelchairs

7.4.1.1.1 Increased preference for power wheelchairs to support market growth

TABLE 21 POWER WHEELCHAIRS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.1.2 Mobility scooters

7.4.1.2.1 Mobility scooters help users to travel across long distances

TABLE 22 MOBILITY SCOOTERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.1.3 Manual wheelchairs

7.4.1.3.1 Manual wheelchairs are affordable & cost less than power wheelchairs

TABLE 23 MANUAL WHEELCHAIRS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.2 WALKING ASSIST DEVICES

TABLE 24 WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 25 WALKING ASSIST DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.2.1 Walkers

7.4.2.1.1 Walkers are used by the disabled & the elderly for additional support while walking

TABLE 26 WALKERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.2.2 Crutches

7.4.2.2.1 Axilla crutches are the most preferred as they are easy to use and are often used by people who have a temporary injury

TABLE 27 CRUTCHES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4.2.3 Canes

7.4.2.3.1 Canes are the most common assistive devices

TABLE 28 CANES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 EXERCISE EQUIPMENT

TABLE 29 EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 30 EXERCISE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.1 LOWER-BODY EXERCISE EQUIPMENT

7.5.1.1 Lower-body exercise equipment is the largest & fastest-growing segment of the exercise equipment market

TABLE 31 LOWER-BODY EXERCISE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.2 UPPER-BODY EXERCISE EQUIPMENT

7.5.2.1 Increasing incidence of orthopedic conditions is driving market growth

TABLE 32 UPPER BODY EXERCISE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5.3 FULL-BODY EXERCISE EQUIPMENT

7.5.3.1 Full-body exercise equipment is used for spine rehabilitation, body balance, and posture rehabilitation

TABLE 33 FULL-BODY EXERCISE EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 BODY SUPPORT DEVICES

TABLE 34 BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 35 BODY SUPPORT DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6.1 PATIENT LIFTS

7.6.1.1 Growing number of surgical procedures has increased the demand for patient lifts

TABLE 36 PATIENT LIFTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6.2 SLINGS

7.6.2.1 Government policies promoting the use of medical slings are supporting the growth of this segment

TABLE 37 SLINGS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6.3 OTHER BODY SUPPORT DEVICES

TABLE 38 OTHER BODY SUPPORT DEVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 REHABILITATION EQUIPMENT MARKET, BY APPLICATION (Page No. - 84)

8.1 INTRODUCTION

TABLE 39 GLOBAL REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 PHYSICAL REHABILITATION & TRAINING

8.2.1 PHYSICAL REHABILITATION & TRAINING IS THE LARGEST APPLICATION SEGMENT OF REHABILITATION EQUIPMENT

TABLE 40 GLOBAL MARKET FOR PHYSICAL REHABILITATION & TRAINING, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 STRENGTH, ENDURANCE, AND PAIN REDUCTION

8.3.1 THIS REHABILITATION PROGRAM FOCUSES ON EXERCISE TO HELP PATIENTS GAIN STRENGTH, ENDURANCE, AND FLEXIBILITY

TABLE 41 GLOBAL MARKET FOR STRENGTH, ENDURANCE, AND PAIN REDUCTION, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 OCCUPATIONAL REHABILITATION & TRAINING

8.4.1 THE GROWING NUMBER OF DISABLED INDIVIDUALS IS DRIVING THE DEMAND FOR OCCUPATIONAL REHABILITATION

TABLE 42 GLOBAL MARKET FOR OCCUPATIONAL REHABILITATION & TRAINING, BY COUNTRY, 2020–2027 (USD MILLION)

9 REHABILITATION EQUIPMENT MARKET, BY END USER (Page No. - 89)

9.1 INTRODUCTION

TABLE 43 GLOBAL REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS & CLINICS

9.2.1 HOSPITALS & CLINICS ARE THE LARGEST END USERS OF REHABILITATION EQUIPMENT

TABLE 44 GLOBAL MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 REHABILITATION CENTERS

9.3.1 INCREASING INCIDENCE OF DISABILITIES TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 45 GLOBAL MARKET FOR REHABILITATION CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 HOME CARE SETTINGS

9.4.1 RISING DEMAND FOR HOME CARE TO DRIVE THE GROWTH OF THIS END-USER SEGMENT

TABLE 46 GLOBAL MARKET FOR HOME CARE SETTINGS, BY COUNTRY, 2020–2027 (USD MILLION)

9.5 PHYSIOTHERAPY CENTERS

9.5.1 RISING INCIDENCE OF SPORTS INJURIES TO SUPPORT THE GROWTH OF THIS END-USER SEGMENT

TABLE 47 GLOBAL MARKET FOR PHYSIOTHERAPY CENTERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.6 OTHER END USERS

TABLE 48 GLOBAL MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

10 REHABILITATION EQUIPMENT MARKET, BY REGION (Page No. - 96)

10.1 INTRODUCTION

FIGURE 22 GLOBAL REHABILITATION EQUIPMENT INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 49 GLOBAL REHABILITATION EQUIPMENT INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

10.2 EUROPE

FIGURE 23 EUROPE: REHABILITATION EQUIPMENT MARKET SNAPSHOT

TABLE 50 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 EUROPE: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 EUROPE: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 57 EUROPE: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.1 GERMANY

10.2.1.1 The rising geriatric population and the subsequent increase in chronic conditions drive the market growth in Germany

TABLE 60 GERMANY: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 61 GERMANY: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 GERMANY: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 GERMANY: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 GERMANY: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 GERMANY: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 66 GERMANY: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 68 GERMANY: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 UK

10.2.2.1 Wide acceptance of the ‘no-lift’ approach has increased the adoption of rehabilitation equipment

TABLE 69 UK: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 70 UK: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 UK: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 UK: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 UK: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 UK: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 UK: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 77 UK: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.3 FRANCE

10.2.3.1 Growing healthcare expenditure and favorable reimbursement scenario to support the market growth in France

TABLE 78 FRANCE: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 79 FRANCE: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 FRANCE: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 FRANCE: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 FRANCE: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 FRANCE: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 FRANCE: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 FRANCE: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.4 ITALY

10.2.4.1 Increasing incidence of fall injuries & orthopedic disorders to support the market growth in Italy

TABLE 87 ITALY: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 88 ITALY: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 ITALY: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 ITALY: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 ITALY: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 ITALY: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 ITALY: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 95 ITALY: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.2.5 SPAIN

10.2.5.1 The large senior population in Spain is expected to drive the adoption of rehabilitation equipment

TABLE 96 SPAIN: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 97 SPAIN: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 SPAIN: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 SPAIN: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 SPAIN: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 SPAIN: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 SPAIN: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 SPAIN: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.6 ROE

TABLE 105 REST OF EUROPE: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 106 REST OF EUROPE: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 REST OF EUROPE: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 REST OF EUROPE: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 REST OF EUROPE: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 REST OF EUROPE: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 111 REST OF EUROPE: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 REST OF EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 113 REST OF EUROPE: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

TABLE 114 NORTH AMERICA: REHABILITATION EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 115 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 NORTH AMERICA: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 NORTH AMERICA: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 NORTH AMERICA: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 NORTH AMERICA: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 NORTH AMERICA: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 123 NORTH AMERICA: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 US

10.3.1.1 The rising prevalence of obesity drives the market growth in the US

TABLE 124 US: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 125 US: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 126 US: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 US: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 US: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 US: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 130 US: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 US: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 132 US: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.3.2 CANADA

10.3.2.1 Rising number of people with disabilities drives the market growth for rehabilitation equipment in Canada

TABLE 133 CANADA: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 134 CANADA: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 CANADA: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 136 CANADA: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 CANADA: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 CANADA: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 139 CANADA: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 140 CANADA: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 141 CANADA: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 24 ASIA PACIFIC: REHABILITATION EQUIPMENT MARKET SNAPSHOT

TABLE 142 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 145 ASIA PACIFIC: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 ASIA PACIFIC: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 149 ASIA PACIFIC: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 151 ASIA PACIFIC: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Large geriatric population in Japan to drive the adoption of rehabilitation equipment in Japan

TABLE 152 JAPAN: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 153 JAPAN: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 154 JAPAN: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 JAPAN: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 JAPAN: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 157 JAPAN: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 158 JAPAN: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 JAPAN: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 160 JAPAN: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China is the fastest-growing market for rehabilitation equipment in the APAC

TABLE 161 CHINA: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 162 CHINA: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 163 CHINA: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 CHINA: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 CHINA: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 166 CHINA: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 CHINA: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 169 CHINA: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 The increasing incidence of disabilities drives the demand for rehabilitation equipment in India

TABLE 170 INDIA: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 171 INDIA: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 172 INDIA: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 INDIA: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 INDIA: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 175 INDIA: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 INDIA: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 INDIA: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 178 INDIA: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 179 REST OF ASIA PACIFIC: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 180 REST OF ASIA PACIFIC: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 181 REST OF ASIA PACIFIC: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 REST OF ASIA PACIFIC: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 REST OF ASIA PACIFIC: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 185 REST OF ASIA PACIFIC: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 REST OF ASIA PACIFIC: REHABILITATION EQUIPMENT INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

10.5 REST OF THE WORLD (ROW)

10.5.1 THE RISING PREVALENCE OF LIFESTYLE DISEASES & GROWING SENIOR POPULATION IN THIS REGION IS EXPECTED TO DRIVE THE MARKET GROWTH

TABLE 188 ROW: REHABILITATION EQUIPMENT MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 189 ROW: DAILY LIVING AIDS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 ROW: MOBILITY EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 191 ROW: WHEELCHAIRS & SCOOTERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 ROW: WALKING ASSIST DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 ROW: EXERCISE EQUIPMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 194 ROW: BODY SUPPORT DEVICES MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 195 ROW: REHABILITATION EQUIPMENT INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 196 ROW: REHABILITATION EQUIPMENT MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 159)

11.1 OVERVIEW

FIGURE 25 KEY PLAYER STRATEGIES

11.2 MARKET RANKING ANALYSIS, 2021

FIGURE 26 REHABILITATION EQUIPMENT MARKET RANKING ANALYSIS, BY KEY PLAYER, 2021

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE PLAYERS

11.3.4 PARTICIPANTS

FIGURE 27 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

11.4 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

11.4.1 PROGRESSIVE COMPANIES

11.4.2 DYNAMIC COMPANIES

11.4.3 STARTING BLOCKS

11.4.4 RESPONSIVE COMPANIES

FIGURE 28 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2021)

11.5 COMPETITIVE SCENARIO

11.5.1 PRODUCT LAUNCHES

TABLE 197 PRODUCT LAUNCHES, JANUARY 2019–MAY 2022

11.5.2 DEALS

TABLE 198 DEALS, JANUARY 2019–MAY 2022

11.5.3 OTHER DEVELOPMENTS

TABLE 199 OTHER DEVELOPMENTS, JANUARY 2019–MAY 2022

12 COMPANY PROFILES (Page No. - 170)

12.1 KEY PLAYERS

(Business Overview, Products, Recent Developments, MnM View)*

12.1.1 INVACARE CORP.

TABLE 200 INVACARE CORP.: BUSINESS OVERVIEW

FIGURE 29 INVACARE CORP.: COMPANY SNAPSHOT (2021)

12.1.2 MEDLINE INDUSTRIES, LP

TABLE 201 MEDLINE INDUSTRIES, LP.: BUSINESS OVERVIEW

12.1.3 ARJO

TABLE 202 ARJO: BUSINESS OVERVIEW

FIGURE 30 ARJO: COMPANY SNAPSHOT (2021)

12.1.4 BAXTER INTERNATIONAL (HILL-ROM HOLDINGS)

TABLE 203 BAXTER INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 31 BAXTER INTERNATIONAL: COMPANY SNAPSHOT (2021)

12.1.5 SUNRISE MEDICAL

TABLE 204 SUNRISE MEDICAL: BUSINESS OVERVIEW

12.1.6 DYNATRONICS CORP.

TABLE 205 DYNATRONICS CORP.: BUSINESS OVERVIEW

FIGURE 32 DYNATRONICS CORP.: COMPANY SNAPSHOT (2021)

12.1.7 PERMOBIL AB

TABLE 206 PERMOBIL AB: BUSINESS OVERVIEW

FIGURE 33 PERMOBIL AB.: COMPANY SNAPSHOT (2021)

12.1.8 HANDICARE GROUP AB

TABLE 207 HANDICARE GROUP AB: BUSINESS OVERVIEW

12.1.9 COLFAX CORP. (ENOVIS CORP.)

TABLE 208 COLFAX CORP.: BUSINESS OVERVIEW

FIGURE 34 COLFAX CORP.: COMPANY SNAPSHOT (2021)

12.1.10 DRIVE DEVILBISS INTERNATIONAL

TABLE 209 DRIVE DEVILBISS INTERNATIONAL: BUSINESS OVERVIEW

12.1.11 ETAC AB

TABLE 210 ETAC AB: BUSINESS OVERVIEW

12.1.12 CAREX HEALTH BRANDS (A SUBSIDIARY OF COMPASS HEALTH BRANDS)

TABLE 211 CAREX HEALTH BRANDS: BUSINESS OVERVIEW

12.1.13 ROMA MEDICAL

TABLE 212 ROMA MEDICAL: BUSINESS OVERVIEW

12.1.14 CAREMAX REHABILITATION EQUIPMENT CO. LTD.

TABLE 213 CAREMAX REHABILITATION EQUIPMENT CO. LTD.: BUSINESS OVERVIEW

12.1.15 GF HEALTH PRODUCTS INC.

TABLE 214 GF HEALTH PRODUCTS INC.: BUSINESS OVERVIEW

12.1.16 JOERNS HEALTHCARE LLC

TABLE 215 JOERNS HEALTHCARE LLC: BUSINESS OVERVIEW

12.1.17 PRISM MEDICAL UK LTD.

TABLE 216 PRISM MEDICAL UK LTD.: BUSINESS OVERVIEW

12.1.18 GULDMANN

TABLE 217 GULDMANN: BUSINESS OVERVIEW

12.1.19 EZ WAY INC.

TABLE 218 EZ WAY INC.: BUSINESS OVERVIEW

12.1.20 LINET

TABLE 219 LINET: BUSINESS OVERVIEW

12.1.21 ANTANO GROUP

TABLE 220 ANTANO GROUP: BUSINESS OVERVIEW

12.1.22 OSSENBERG GMBH

TABLE 221 OSSENBERG GMBH: BUSINESS OVERVIEW

12.1.23 WINNCARE

TABLE 222 WINNCARE: BUSINESS OVERVIEW

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 TECNOBODY

12.2.2 PROXOMED

12.2.3 ENRAF-NONIUS

13 APPENDIX (Page No. - 249)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The report presents a detailed assessment of the rehabilitation equipment market, along with qualitative inputs and insights from MarketsandMarkets. This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify the segmentation types, industry trends, key players, competitive landscape of different products provided by market players, key player strategies, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; companies’ house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the rehabilitation equipment market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include CEOs, vice presidents, managing directors, marketing heads and sales directors, marketing managers, product managers and related key executives from various key companies and organizations operating in the Rehabilitation Equipment Market. The primary sources from the demand side include physiotherapist, hospital managers, directors, healthcare providers, department heads, research and academic professionals.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Rehabilitation Equipment Market Size Estimation

The total size of the rehabilitation equipment market was arrived at after data triangulation from three different approaches- revenue share analysis, segmental extrapolation, and primary interviews. After the completion of each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Objectives of the Study

- To define, describe, and forecast the rehabilitation equipment market on the basis of product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall rehabilitation equipment market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific, and rest of the world.

- To profile the key players and comprehensively analyze their core competencies2 in terms of key developments, product portfolios, and recent financials

- To track and analyze competitive developments such as acquisitions, product launches, partnerships, and expansions in the rehabilitation equipment market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of the World into Middle East and Africa, and Latin America region (Brazil, Mexico, and Rest of Latin America)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rehabilitation Equipment Market