Medical Waste Management Market by Service (Collection, Treatment, Disposal, Incineration, Recycling), Type of Waste (Non-hazardous, Infectious, Pharmaceutical), Treatment Site (Offsite, Onsite), Waste Generator (Hospital, Labs) & Region - Global Forecast to 2028

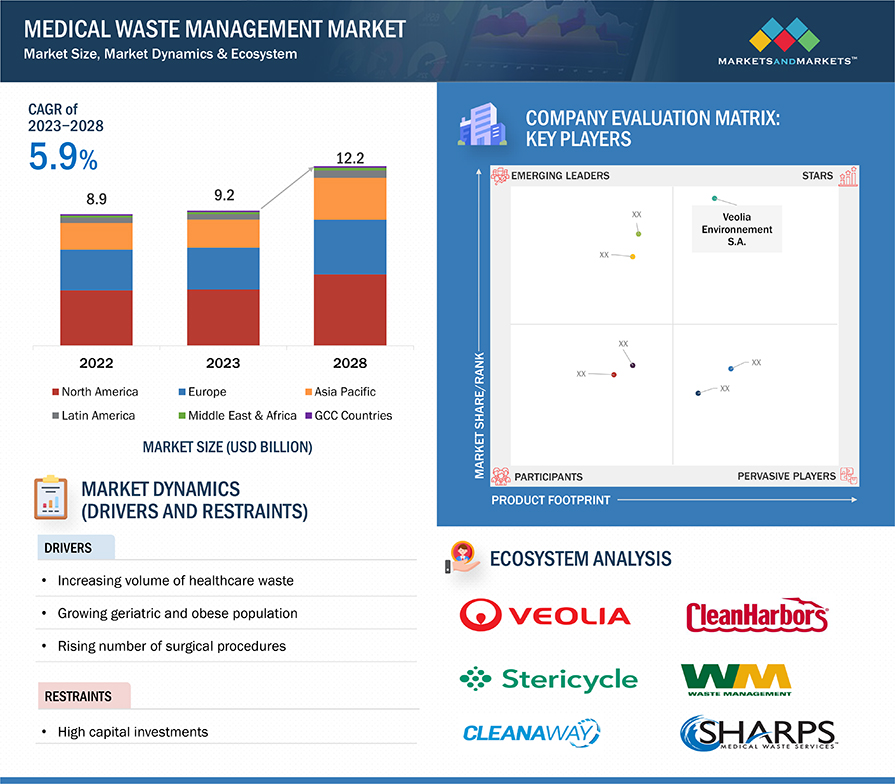

Medical waste management market is projected to reach USD 12.2 billion by 2028 from USD 9.2 billion in 2023, at the CAGR of 5.9%. The increase in investments by research centers, increased number of hospitals, research laboratiories, diagnostic laboratories generating a huge amount of medical waste, improving focus on reducing the medical waste and proper management of medical waste has expected to increase the medical waste management market. Moreover the advancements in the medical waste management technologies like incineration, auto cloaving and rising demand of these technologies combined with stringent government regulations for the disposal of medical waste in various countries for controlling the spread of infections and growing focus on the hazardous impact of medical waste on the environment will also support the growth of this market.

Medical Waste Management Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Medical Waste Management Market Dynamics

DRIVER: Increasing volume of healthcare waste

The medical waste management market has experienced substantial growth due to the expansion of the healthcare industry. This growth is attributed to the rising demand for healthcare services worldwide, which has led to an increase in the number of hospitals, laboratories, research centers, mortuaries, autopsy centers, blood banks, and related collection activities. As these healthcare facilities expand their operations to meet the growing needs of patients, there is a parallel increase in the generation of medical waste. Consequently, there is a heightened demand for efficient medical waste management solutions to handle the larger volumes of waste produced. This trend underscores the critical importance of effective waste management practices within the healthcare sector to ensure public health and environmental safety.

RESTRAINT: High capital investment

Hospitals, healthcare institutions, and pharmaceutical companies face substantial capital requirements for effectively managing the collection and processing of waste in a manner that minimizes environmental pollution. This includes both hazardous and non-hazardous waste, for which advanced technologies and significant investments are necessary for proper disposal. These entities must allocate resources towards implementing sophisticated waste management systems to ensure compliance with environmental regulations and mitigate the impact on ecosystems. Such investments are crucial not only for meeting regulatory standards but also for safeguarding public health and preserving environmental integrity. Therefore, there is a pressing need for these organizations to prioritize substantial financial commitments towards adopting sustainable waste management practices that prioritize environmental sustainability and community well-being.

OPPORTUNITY: Increasing number of awareness programs for medical waste management in developed countries

In developed nations such as the US and UK, there has been a notable rise in initiatives aimed at promoting awareness regarding proper medical waste management and the prevention of mishandling. This surge includes the organization of awareness programs and conferences dedicated to educating stakeholders about the importance of effectively managing medical waste. These initiatives aim to highlight the potential risks associated with improper disposal practices and emphasize the need for adherence to established protocols and guidelines. By increasing awareness among healthcare professionals, policymakers, and the general public, these efforts seek to foster a culture of responsible waste management practices. Ultimately, the goal is to mitigate environmental harm, protect public health, and enhance overall sustainability within these nations' healthcare systems.

CHALLENGE: Lack of awareness about medical waste management in developing countries

In developing countries, effective medical waste management necessitates both heightened awareness and significant capital investment. However, these countries encounter challenges due to a shortage of focused and stringent regulations governing the medical waste management market. Additionally, limited financial resources hinder the adoption of advanced technologies and the establishment of medical waste treatment facilities. As a result, many healthcare facilities in these regions struggle to implement proper waste management practices, leading to environmental pollution and public health risks. Addressing these issues requires not only raising awareness about the importance of responsible waste management but also facilitating access to funding and support for the implementation of appropriate technologies and infrastructure. Efforts to strengthen regulatory frameworks and enhance financial assistance can play a crucial role in improving medical waste management practices in developing countries, thereby safeguarding both the environment and public health.

Medical Waste Management Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

In 2022, collection, transportation and storage services segment accounted for the largest share of the medical waste management industry, by services.

Based on services, medical waste management market is segmented into collection, transportation and storage services, treatment & disposal services and recycling services. In 2022, collection , transportation and storage services held the second highest CAGR. The growth rate of this market can be attributed to the improved public and government perception on the importance of medical waste management and healthcare cost reduction by appropriate disposal of waste.

In 2022, non-hazardous waste segment accounted for the largest share of the medical waste management industry, by type of waste segment

The medical waste management market is segmented into non-hazardous waste and hazardous waste based on type of waste. In 2022, the non-hazardous waste segment accounted for the largest share. Factors such as increased number of healthcare procedures related to chronic diseases as well as burns and accidents and rising economic developments along with improved healthcare facilities and infrastructure and revised regulatory guidelines for waste management leads to market growth.

In 2022, offsite treatment segment accounted for the largest share in the medical waste management industry, by treatment site

Based on treatment site, the medical waste management market is divided into offsite treatment and onsite treatment. Offsite treatmemt segment held the highest market share in 2022. Understanding the waste to energy opportunities during by waste management and increased collaboration between the healthcare facilities and medical waste management services for addressing complex medical waste management are the factors contributing to the growt of this market.

Hospital & diagnostic laboratories segment accounted for the largest share in the medical waste management industry in 2022, by waste generator

The medical waste management market is divided into hospitals & diagnostic laboratories and other waste generators based on waste generator. The hospital & diagnostic laboratories accounted for the highest market share along with highest growth rate in 2022. Increasing number of awareness programs and conferences for new technologies and practices for medical waste management in developed as well as developing countries is driving the growth of this segment.

North America is the largest regional market for medical waste management industry

Based on region, the medical waste management market is divided into mainly six regions – North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries. North America held the largest market share of the market in 2022 and the Asia Pacific is estimated to have highest growth rate. The North American market's growth can be attributed to the advancements of the healthcare industry and rising healthcare expenditure. Wheres there is a lot of improvement in the healthcare facilities in the Asia Pacific regions along with increased medical tourism leading to the higher growth rate.

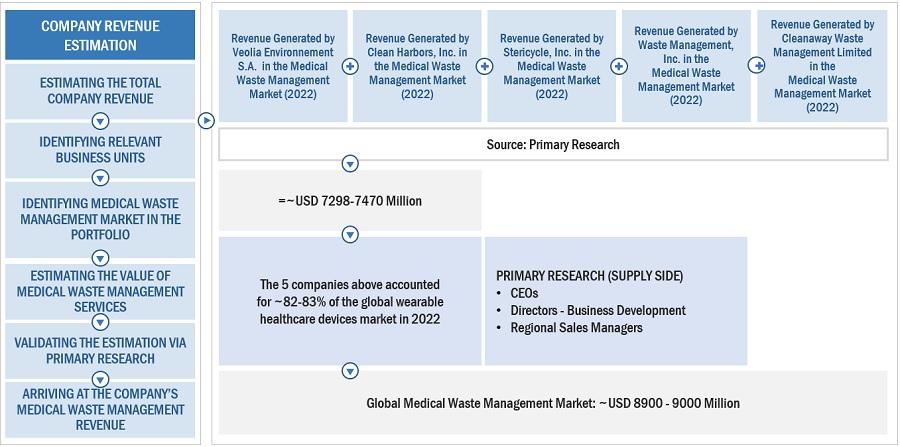

The major players in this market are:

Veolia Environnement S.A. (France), Clean Harbors, Inc. (US), Stericycle Inc. (US), Waste Management, Inc. (US), Cleanaway Waste Management Limited (Australia), among others.

These players' market leadership arises from their extensive service ranges and wide-reaching global presence. These dominant entities enjoy various advantages such as robust marketing and distribution networks, sizable research and development budgets, and firmly established brand recognition.

Scope of the Medical Waste Management Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$9.2 billion |

|

Projected Revenue by 2028 |

$12.2 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 5.9% |

|

Market Driver |

Increasing volume of healthcare waste |

|

Market Opportunity |

Increasing number of awareness programs for medical waste management in developed countries |

This report categorizes the medical waste management market to forecast revenue and analyze trends in each of the following submarkets:

By Service

- Collection, transport and storage services

- Treatment & disposal services

- Recycling services

By Type of Waste

- Non-hazardous Waste

- Hazardous Waste

By Treatment Site

- Offsite Treatment

- Onsite Treatment

By Waste Generator

- Hospital & diagnostic laboratories

- Other waste generator

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

- GCC Countries

Recent Developments of Medical Waste Management Industry:

- In December 2021, the Veolia Environnement S.A. launched the Vigie COVID-19 solution, which can track signs of the Omicron variant in wastewater, acting as an early warning system for monitoring the progression of the pandemic.

- In May 2022, Veolia Environnement S.A. acquired Suez Environnement. The companies signed an agreement for the acquisition of all of the hazardous waste assets in France to address the European Commission competition concerns made by Veolia.

- In October 2020, Waste Management, Inc. acquired Advanced Disposal. This acquisition expanded Waste Management’s footprint and provided access to sustainable waste management and recycling services for customers in the US.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global medical waste management Market?

The global medical waste management market boasts a total revenue value of $12.2 billion by 2028.

What is the estimated growth rate (CAGR) of the global medical waste management Market?

The global medical waste management market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of $9.2 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The objective of the study is to analyze the key market dynamics, such as drivers, opportunities, restraints, challenges and key player strategies. To track company developments such as service launch, acquisition, agreement and partnership of the leading players, the competitive landscape of the medical waste management market to analyze market players on various parameters within the broad categories of business and service strategy. Top-down and bottom-up approaches were used to estimate the market size. To estimate the market size of segments and subsegments, the market breakdown and data triangulation were used.

The four steps involved in estimating the market size are

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

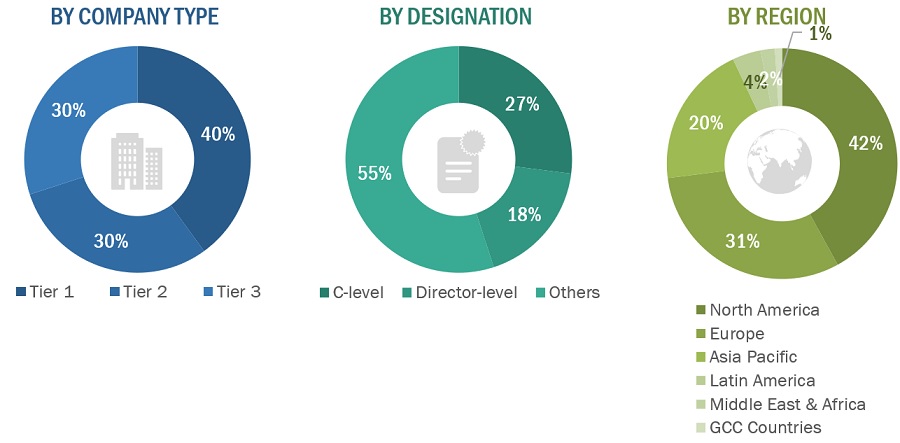

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as assess prospects.

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Companies are classified into tiers based on their total revenues. As of 2022, Tier 1 = >USD 100 million, Tier 2 = USD 10 million to USD 100 million, and Tier 3 = <USD 10 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Veolia Environnement S.A. |

Senior Product Manager |

|

Waste Management, Inc. |

Quality Control Manager |

|

Clean Harbor, Inc. |

Marketing Manager |

Market Size Estimation

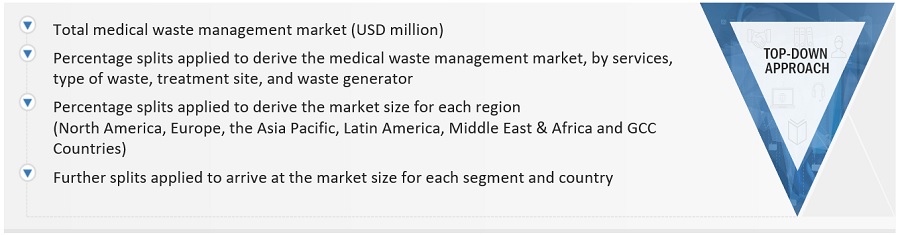

Both top-down and bottom-up approaches were used to estimate and validate the medical waste management market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the medical waste management market have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Medical Waste Management Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Medical Waste Management Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size by applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Medical waste encompasses materials such as infectious waste, hazardous waste, sharps waste, cytotoxic waste, and any other waste produced by medical facilities such as hospitals, laboratories, or pharmaceutical companies. The process of managing medical waste, known as medical waste management, involves collecting, transporting, storing, treating, disposing, and recycling medical waste through methods such as incineration and autoclaving.

Key Stakeholders

- Medical Waste Treatment Device Manufacturers

- Medical Waste Management Service Providers

- Research Institutes

- Research and Consulting Firms

- Environment, Health, and Safety Organizations

- Regulatory Bodies

Report Objectives

- To define, describe, segment, and forecast the medical waste management market by services, type of waste, treatment site, waste generator and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa and GCC Countries.

- To profile the key players and comprehensively analyze their service portfolios, market positions, and core competencies2.

- To track and analyze company developments such as Service launch, acquisition, agreement, Partnership in the medical waste management market.

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and service strategy.

Available Customizations

- MarketsandMarkets offers the following customizations for this market report.

Country Information

- Additional country-level analysis of the medical waste management market

Company profiles

- Additional five company profiles of players operating in the medical waste management market.

Product Analysis

- Service matrix, which provides a detailed comparison of the service portfolio of each company in the medical waste management market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Medical Waste Management Market

Who are the top key players in the medical waste management market in North America?