Mega Data Center Market by Solutions: Infrastructure (Server, Storage, Networking), Support (Power, Cooling, Security), by Services (Professional, Monitoring, SI), & by Users (Cloud, Colocation, Enterprises) – Global Forecasts & Analysis (2014-2019)

[223 Pages Report] Mega Data Center Market is to grow from $16.35 billion in 2014 to $20.55 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 4.7% from 2014 to 2019

The rapid and exponential growth in the amount of data consumed by various businesses, individuals, and organizations has resulted in the rise in the demand for data storage. With increasing business needs, organizations are looking for expanding on one’s data storage capacity. Moreover, many large organizations such as Facebook, Google, Apple, Microsoft, Amazon, Oracle, and certain government agencies, are consolidating the traditional data centers into gigantic mega data center. In order to minimize the cost associated with operations of a data center, and to maximize the profit, various organizations are coming up with more scalable and efficient solutions which can serve the enormously increasing demand for data storage. This surging demand for data storage is nurturing the market for data centers globally. This also, presents potential opportunities for numerous vendors serving the data center market. These data center have emerged as a promising solution for the growing data storage demand, with features including extensive scalability, serviceability, operational cost benefits, reliability, efficiency, and automatic error detection. In the present scenario, these data center have significantly impacted the global data center market and are expected to experience exponential growth in the coming years.

The key vendors present in the mega data center market include HP, IBM, Dell, Cisco, Emerson, Schneider Electric, Fujitsu, Juniper, Intel, and EMC. The research report discusses the strategies and insights of the key vendors in the industry, and provides an in-depth study of driving forces and challenges for the mega data center market. The report also analyzes global adoption trends and future growth potentials across different geographical regions.

MarketsandMarkets has segmented the global mega data center market by IT (Information Technology) infrastructure solutions, support infrastructure solutions, services, industry verticals, end-users, and geographical regions. The report also consists of MarketsandMarkets views of the key players and the analyst insights on various developments that are taking place in the mega data center market. This research report covers the global market and categorizes it into the following sub-markets:

By solutions:

- IT infrastructure solutions

- Servers

- Storage solutions

- Networking solutions

- Support infrastructure solutions

- Power solutions

- Cooling solutions

- Security solutions

- Management software

By services:

- System integration

- Monitoring services

- Professional services

By verticals:

- Banking, Financial Services and Insurance (BFSI)

- Telecom and IT

- Media and entertainment

- Government and public

- Others

By end-users:

- Cloud providers

- Colocation providers

- Enterprises

By regions:

- North America (NA)

- Europe (EU)

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America (LA)

Mega data center are impacting the global market for data centers, with its high computing capacity, storage capacity, bandwidth, and ability to facilitate enormous data transfers. These large-scale data centers are clear examples of the IT advancements, and have become crucial for organizations to stay in this competitive environment. Mega data center refers to a single facility sprawling over large areas, and employing a minimum of 15,000 servers. In terms of power, these data center range from 10 Mega-Watts (MW) to 100 MW. These data centers are highly scalable, cost-effective, more secure, reliable, and also have less impact on the environment.

In the present scenario, the rapid increase in the data traffic is driving the demand for data storage. This results in continuous expansion of the global data center market. In order to accommodate this enormous amount of data, companies are forced to operate several data centers, which may or may not be located in the same location. The cost associated with operating these data centers is also high, which results in reduced profits. Also, it is difficult for organizations to manage several data centers running in different locations. Therefore, many companies such as Facebook, Google, Amazon, Microsoft, Apple, and eBay prefer to operate through its gigantic data centers rather than having small data centers at multiple locations. These giant data centers also offer local benefits such as low energy prices for large scale consumption, tax benefits, and climatic advantages. In these mega data center, unwanted infrastructure is eliminated which reduces the operational complexity. Hence, with the continuously increasing demand for data storage across various industry verticals, organizations are forced to come up with more scalable and cost-effective data storage solutions, which will reduce the additional cost of adding thousands of users.

The mega data center market is thriving, and in the coming years these data centers are expected to replace the traditional data centers to a great extent. Many companies have already started transforming its traditional data centers into mega data center, and many others are planning to build in the coming years. The scalability, serviceability, reliability, security, and efficiency are expected to become standard practices for all data centers in the years to come. The mega data center market with significant growth rate is expected to present potential opportunities for various vendors and operators in the data center industry.

In this report, MarketsandMarkets provide an in-depth study of the market trends, market sizing, competitive mapping, and market dynamics. The market for mega data center is segmented into various solutions and services, across various geographical regions such as NA, EU, APAC, MEA, and LA. Also, the market has been segmented into diverse industry verticals which include telecom and IT, BFSI, media and entertainment, government and public, and other verticals. In terms of end-users, MarketsandMarkets has segmented the market into cloud providers, colocation providers, and enterprises.

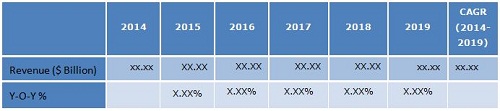

MarketsandMarkets forecasts the global mega data center market to grow from $16.35 billion in 2014 to $20.55 billion by 2019, at a Compound Annual Growth Rate (CAGR) of 4.7%. The figure given below highlights the overall mega data center market opportunity in terms of absolute dollar value and Y-O-Y growth.

Mega Data Center Market Size, 2014-2019 ($Billion, Y-O-Y %)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 21)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.6 Key Data Points

1.7 Data Triangulation and Mega Data Center Market Forecasting

1.8 Forecast Assumptions

2 Executive Summary (Page No. - 28)

2.1 Abstract

2.2 Overall Mega Data Center Market Size

3 Mega Data Center Market Overview (Page No. - 31)

3.1 Market Definition

3.2 Market Evolution

3.3 Market Segmentation

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Cost Benefit

3.4.1.2 Colocation Services

3.4.1.3 Need For Data Center Consolidation

3.4.1.4 Cloud Services

3.4.2 Restraints

3.4.2.1 Huge Investment

3.4.2.2 Disapproval From Local Government

3.4.2.3 Scaling High-Bandwidth Network

3.4.2.4 High Probability of Error Multiplication

3.4.3 Opportunities

3.4.3.1 New Data Center Infrastructure Solutions

3.4.3.2 Colocation Providers

3.4.4 Impact Analysis of Diver Restrain and Opportunities

3.5 Value Chain

4 Mega Data Center Market Size and Forecast By Solution (Page No. - 41)

4.1 Introduction

4.2 It Infrastructure Solutions

4.2.1 Servers

4.2.1.1 Overview

4.2.1.2 Market Size and Forecast By Region

4.2.2 Storage

4.2.2.1 Overview

4.2.2.2 Market Size and Forecast By Region

4.2.3 Networking

4.2.3.1 Overview

4.2.3.2 Market Size and Forecast By Region

4.3 Support Infrastructure Solutions

4.3.1 Power Solutions

4.3.1.1 Overview

4.3.1.2 Market Size and Forecast By Region

4.3.2 Cooling Solutions

4.3.2.1 Overview

4.3.2.2 Market Size and Forecast By Region

4.3.3 Security Solutions

4.3.3.1 Overview

4.3.3.2 Market Size and Forecast By Region

4.3.4 Management Software

4.3.4.1 Overview

4.3.4.2 Market Size and Forecast By Region

5 Mega Data Center Market Size and Forecast By Service (Page No. - 75)

5.1 Introduction

5.1.1 System Integration Services

5.1.1.1 Overview

5.1.1.2 Market Size and Forecast By Region

5.1.2 Monitoring Services

5.1.2.1 Overview

5.1.2.2 Market Size and Forecast By Region

5.1.3 Professional Services

5.1.3.1 Overview

5.1.3.2 Market Size and Forecast By Region

6 Mega Data Center Market Size and Forecast By Vertical (Page No. - 91)

6.1 Introduction

6.2 Banking, Financial Services and Insurance (BFSI)

6.2.1 Overview

6.2.2 Market Size and Forecast

6.2.2.1 Market Size and Forecast By Solution

6.2.2.2 Market Size and Forecast By Service

6.3 Telecom and IT

6.3.1 Overview

6.3.2 Market Size and Forecast

6.3.2.1 Market Size and Forecast By Solution

6.3.2.2 Market Size and Forecast By Service

6.4 Media and Entertainment

6.4.1 Overview

6.4.2 Market Size and Forecast

6.4.2.1 Market Size and Forecast By Solution

6.4.2.2 Market Size and Forecast By Service

6.5 Government and Public

6.5.1 Overview

6.5.2 Market Size and Forecast

6.5.2.1 Market Size and Forecast By Solution

6.5.2.2 Market Size and Forecast By Service

6.6 Other Verticals

6.6.1 Overview

6.6.2 Market Size and Forecast

6.6.2.1 Market Size and Forecast By Solution

6.6.2.2 Market Size and Forecast By Service

7 Mega Data Center Market Size and Forecast By User (Page No. - 134)

7.1 Introduction

7.2 Cloud Providers

7.2.1 Overview

7.2.2 Market Size and Forecast

7.2.2.1 Market Size and Forecast By Vertical

7.2.2.2 Market Size and Forecast By Region

7.3 Colocation Providers

7.3.1 7.3.1 Overview

7.3.2 Market Size and Forecast

7.3.2.1 Market Size and Forecast By Vertical

7.3.2.2 Market Size and Forecast By Region

7.4 Enterprises

7.4.1 Overview

7.4.2 Market Size and Forecast

7.4.2.1 Market Size and Forecast By Vertical

7.4.2.2 Market Size and Forecast By Region

8 Mega Data Center Market Size and Forecast By Region (Page No. - 156)

8.1 Introduction

8.1.1 Parfait Charts

8.2 North America (NA)

8.2.1 Overview

8.2.2 8.2.2 Market Size and Forecast By Vertical

8.3 Europe (EU)

8.3.1 Overview

8.3.2 Market Size and Forecast By Vertical

8.4 Asia Pacific Including Japan (APAC)

8.4.1 Overview

8.4.2 Market Size and Forecast By Vertical

8.5 Middle East and Africa (MEA)

8.5.1 Overview

8.5.2 Market Size and Forecast By Vertical

8.6 Latin America (LA)

8.6.1 Overview

8.6.2 Market Size and Forecast By Vertical

9 Mega Data Center Market Landscape (Page No. - 177)

9.1 Competitive Landscape

9.1.1 Ecosystem and Roles

9.1.2 Portfolio Comparison

9.1.2.1 Overview

9.1.2.2 Product Category Mapping

9.2 End User Landscape

9.2.1 End User Analysis

9.2.1.1 Colocation Market Expected to Surpass $32 Billion By 2015

9.2.1.2 Number of Data Centers in The U.S. Are Expected to Decrease to 2.8 Million By 2015

9.2.1.3 Mobile Data Traffic to Reach 6 Million Terabyte Per Month By 2015

10 Company Profiles (Overview, Products & Services, Strategies & Insights, Developments and Mnm View)* (Page No. - 183)

10.1 Cisco

10.2 Dell

10.3 EMC

10.4 Emerson Network Power

10.5 Fujitsu

10.6 HP

10.7 IBM

10.8 Intel

10.9 Juniper Networks, Inc.

10.10 Schneider Electric

*Details on Overview, Products & Services, Strategies & Insights, Developments and Mnm View Might Not Be Captured in Case of Unlisted Companies.

Appendix (Page No. - 221)

Mergers and Acquisitions (M&A)

List of Tables (95 Tables)

Table 1 Mega Data Center Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 2 IT Infrastructure Solutions Market Size, By Type, 2014-2019 ($Billion)

Table 3 IT Infrastructure Solutions Market, By Type, 2014-2019, Y-O-Y (%)

Table 4 Mega Data Center Servers Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 5 Servers Market Size, By Region, 2014-2019 ($Million)

Table 6 Servers Market, By Region, 2014-2019, Y-O-Y (%)

Table 7 Storage Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 8 Storage Solutions Market Size, By Region, 2014-2019 ($Million)

Table 9 Storage Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 10 Networking Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 11 Networking Solutions Market Size, By Region, 2014-2019 ($Million)

Table 12 Networking Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 13 Support Infrastructure Solutions Market Size, By Type, 2014-2019 ($Billion)

Table 14 Support Infrastructure Solutions Market, By Type, 2014-2019, Y-O-Y (%)

Table 15 Power Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 16 Power Solutions Market Size, By Region, 2014-2019 ($Million)

Table 17 Power Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 18 Cooling Solutions Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 19 Cooling Solutions Market Size, By Region, 2014-2019 ($Million)

Table 20 Cooling Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 21 Security Solutions Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 22 Security Solutions Market Size, By Region, 2014-2019 ($Million)

Table 23 Security Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Table 24 Management Software Market Size, 2014-2019 ($Million, Y-O-Y %)

Table 25 Management Software Market Size, By Region, 2014-2019 ($Million)

Table 26 Management Software Market, By Region, 2014-2019, Y-O-Y (%)

Table 27 Mega Data Center Services Market Size, By Type, 2014-2019 ($Billion)

Table 28 Services Market, By Type, 2014-2019, Y-O-Y (%)

Table 29 System Integration Services Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 30 System Integration Services Market Size, By Region, 2014-2019 ($Million)

Table 31 System Integration Services Market, By Region, 2014-2019, Y-O-Y (%)

Table 32 Monitoring Services Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 33 Monitoring Services Market Size, By Region, 2014-2019 ($Million)

Table 34 Monitoring Services Market, By Region, 2014-2019, Y-O-Y (%)

Table 35 Professional Services Market Size, 2014-2019 ($Billion, Y-O-Y %)

Table 36 Professional Services Market Size, By Region, 2014-2019 ($Million)

Table 37 Professional Services Market, By Region, 2014-2019, Y-O-Y (%)

Table 38 Mega Data Center Market Size, By Vertical, 2014-2019 ($Billion)

Table 39 Mega Data Center Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 40 BFSI Market Size, By It Infrastructure Solution, 2014-2019 ($Million)

Table 41 BFSI Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 42 BFSI Market Size, By Support Infrastructure Solution, 2014-2019 ($Million)

Table 43 BFSI Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 44 BFSI Market Size, By Service, 2014-2019 ($Million)

Table 45 BFSI Market, By Service, 2014-2019, Y-O-Y (%)

Table 46 Telecom and IT Market Size, By IT Infrastructure Solution, 2014-2019 ($Million)

Table 47 Telecom and IT Market, By IT Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 48 Telecom and IT Market Size, By Support Infrastructure Solution, 2014-2019 ($Million)

Table 49 Telecom and IT Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 50 Telecom and IT Market Size, By Service, 2014-2019 ($Million)

Table 51 Telecom and IT Market, By Service, 2014-2019, Y-O-Y (%)

Table 52 Media and Entertainment Market Size, By It Infrastructure Solution, 2014-2019 ($Million)

Table 53 Media and Entertainment Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 54 Media and Entertainment Market Size, By Support Infrastructure Solution, 2014-2019 ($Million)

Table 55 Media and Entertainment Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 56 Media and Entertainment Market Size, By Service, 2014-2019 ($Million)

Table 57 Media and Entertainment Market, By Service, 2014-2019, Y-O-Y (%)

Table 58 Government and Public Market Size, By It Infrastructure Solution, 2014-2019 ($Million)

Table 59 Government and Public Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 60 Government and Public Market Size, By Support Infrastructure Solution, 2014-2019 ($Million)

Table 61 Government and Public Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 62 Government and Public Market Size, By Service, 2014-2019 ($Million)

Table 63 Government and Public Market, By Service, 2014-2019, Y-O-Y (%)

Table 64 Mega Data Center Other Verticals Market Size, By It Infrastructure Solution, 2014-2019 ($Million)

Table 65 Other Verticals Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 66 Other Verticals Market Size, By Support Infrastructure Solution, 2014-2019 ($Million)

Table 67 Other Verticals Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Table 68 Other Verticals Market Size, By Service, 2014-2019 ($Million)

Table 69 Other Verticals Market, By Service, 2014-2019, Y-O-Y (%)

Table 70 Mega Data Center, Market Size, By User, 2014-2019 ($Billion)

Table 71 Mega Data Center Market, By User, 2014-2019, Y-O-Y (%)

Table 72 Cloud Providers Market Size, By Vertical, 2014-2019 ($Million)

Table 73 Cloud Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 74 Cloud Providers Market Size, By Region, 2014-2019 ($Million)

Table 75 Cloud Providers Market, By Region, 2014-2019, Y-O-Y (%)

Table 76 Colocation Providers Market Size, By Vertical, 2014-2019 ($Million)

Table 77 Colocation Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 78 Colocation Providers Market Size, By Region, 2014-2019 ($Million)

Table 79 Colocation Providers Market, By Region, 2014-2019, Y-O-Y (%)

Table 80 Enterprises Market Size, By Vertical, 2014-2019 ($Million)

Table 81 Enterprises Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 82 Enterprises Market Size, By Region, 2014-2019 ($Million)

Table 83 Enterprises Market, By Region, 014-2019, Y-O-Y (%)

Table 84 Mega Data Center Market Size, By Region, 2014-2019 ($Billion)

Table 85 Mega Data Center Market, By Region, 2014-2019, Y-O-Y (%)

Table 86 NA: Mega Data Center Market Size, By Vertical, 2014-2019 ($Million)

Table 87 NA Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 88 EU Mega Data Center Market Size, By Vertical, 2014-2019 ($Million)

Table 89 EU Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 90 APAC Mega Data Center Market Size, By Vertical, 2014-2019 ($Million)

Table 91 APAC Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 92 MEA Mega Data Center Market Size, By Vertical, 2014-2019 ($Million)

Table 93 MEA Market, By Vertical, 2014-2019, Y-O-Y (%)

Table 94 LA Mega Data Center Market Size, By Vertical, 2014-2019 ($Million)

Table 95 LA Market, By Vertical, 2014-2019, Y-O-Y (%)

List of Figures (53 Figures)

Figure 1 Mega Data Center: Research Methodology

Figure 2 Mega Data Center Market Size, 2014-2019 ($Billion, Y-O-Y %)

Figure 3 Mega Data Center Market Evolution

Figure 4 Mega Data Center Market Segmentation

Figure 5 Impact Analysis of Diver Restraint and Opportunities

Figure 6 Value Chain

Figure 7 IT Infrastructure Solutions Market, By Type, 2014-2019, Y-O-Y (%)

Figure 8 Servers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 9 Storage Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 10 Networking Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 11 Support Infrastructure Solutions Market, By Type, 2014-2019, Y-O-Y (%)

Figure 12 Power Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 13 Cooling Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 14 Security Solutions Market, By Region, 2014-2019, Y-O-Y (%)

Figure 15 Management Software Market, By Region, 2014-2019, Y-O-Y (%)

Figure 16 Mega Data Center Services Market, By Type, 2014-2019, Y-O-Y (%)

Figure 17 System Integration Services Market, By Region, 2014-2019, Y-O-Y (%)

Figure 18 Monitoring Services Market, By Region, 2014-2019, Y-O-Y (%)

Figure 19 Professional Services Market, By Region, 2014-2019, Y-O-Y (%)

Figure 20 Mega Data Center Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 21 BFSI Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 22 BFSI Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 23 BFSI Market, By Service, 2014-2019, Y-O-Y (%)

Figure 24 Telecom and IT Market, By IT Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 25 Telecom and IT Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 26 Telecom and IT Market, By Service, 2014-2019, Y-O-Y (%)

Figure 27 Media and Entertainment Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 28 Media and Entertainment Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 29 Media and Entertainment Market, By Service, 2014-2019, Y-O-Y (%)

Figure 30 Government and Public Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 31 Government and Public Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 32 Government and Public Market, By Service, 2014-2019, Y-O-Y (%)

Figure 33 Mega Data Center Other Verticals Market, By It Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 34 Other Verticals Market, By Support Infrastructure Solution, 2014-2019, Y-O-Y (%)

Figure 35 Other Verticals Market, By Service, 2014-2019, Y-O-Y (%)

Figure 36 Mega Data Center Market, By User, 2014-2019, Y-O-Y (%)

Figure 37 Cloud Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 38 Cloud Providers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 39 Colocation Providers Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 40 Colocation Providers Market, By Region, 2014-2019, Y-O-Y (%)

Figure 41 Mega Data Center Enterprises Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 42 Enterprises Market, By Region, 2014-2019, Y-O-Y (%)

Figure 43 Mega Data Center Market, By Region, 2014-2019, Y-O-Y (%)

Figure 44 Parfait Chart (2014-2019)

Figure 45 NA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 46 EU Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 47 APAC Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 48 MEA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 49 LA Market, By Vertical, 2014-2019, Y-O-Y (%)

Figure 50 Ecosystem

Figure 51 Roles of Ecosystem Players

Figure 52 Product Category Mapping

Figure 53 Mega Data Center Market Opportunity Plot

Growth opportunities and latent adjacency in Mega Data Center Market