Data Center Cooling Market

Data Center Cooling Market by Solution (Air Conditioning, Chilling Unit, Cooling Tower, Economizer System, Liquid Cooling System, Control System), Service, Type of Cooling, Data Center Type, End-use Industry, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

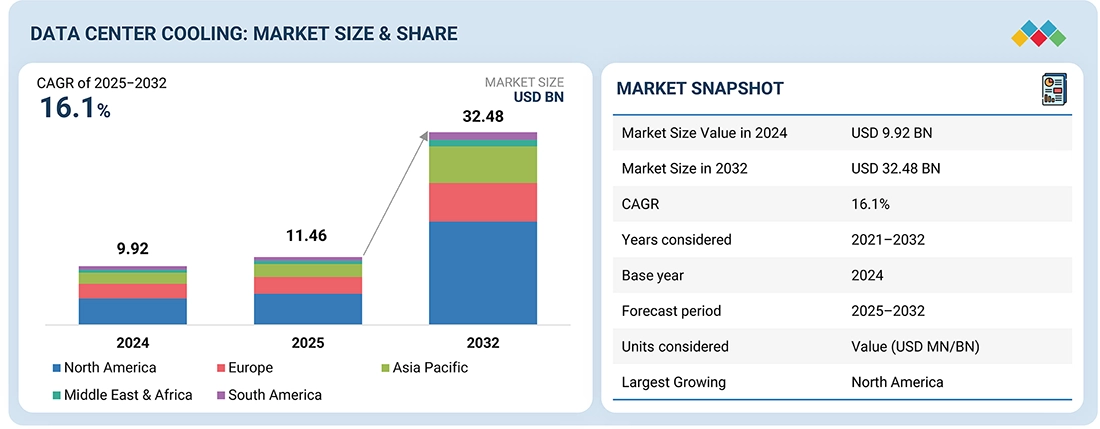

The global data center cooling market is projected to grow from USD 11.46 billion in 2025 to USD 32.48 billion by 2032, at a CAGR of 16.1 % during the forecast period. The market has observed stable growth throughout the study period and is expected to continue with the same trend during the forecast period. Growing awareness among individuals regarding energy savings and government initiatives is expected to drive the market's growth in the coming years.

KEY TAKEAWAYS

-

BY REGIONNorth America accounted for the largest share (43.5%) of the global data center cooling market in 2024.

-

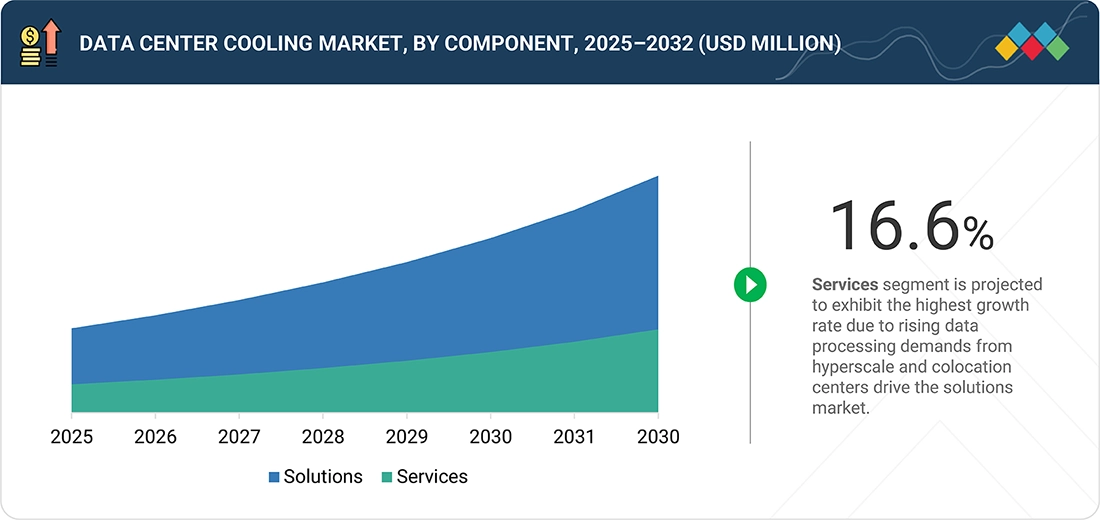

BY COMPONENTBy component, the solutions segment is projected to grow at a CAGR of 15.7% during the forecast period.

-

BY DATA CENTER TYPEBy data center type, the large data centers segment is projected to register a CAGR of 13.8% during the forecast period.

-

BY END-USE INDUSTRYBy end-use industry, the BFSI segment is projected to register a CAGR of 14.2% by 2032.

-

BY SERVICEBy service, the maintenance & support segment is expected to dominate the market during the forecast period.

-

BY TECHNOLOGYBy technology, the liquid cooling segment is projected to grow at the highest CAGR during the forecast period.

-

BY TYPE OF COOLINGBy type of cooling, the row/rack-based cooling segment is projected to register the highest CAGR during the forecast period.

-

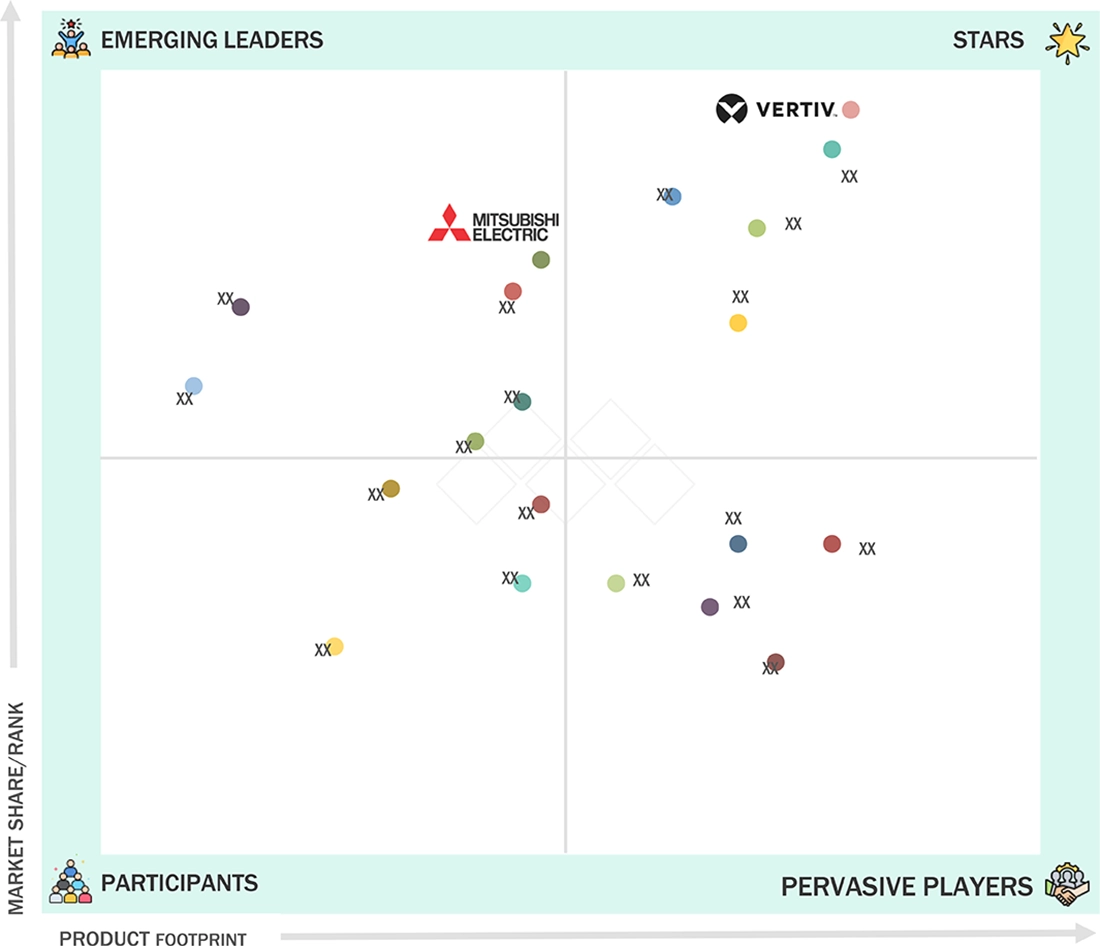

Competitive Landscape - Key PlayersVertiv Group Corp., Johnson Controls, and Schneider Electric were identified as some of the star players in the data center cooling market, given their strong market share and product footprint.

-

Competitive Landscape - StartupsNortek Air Solutions, LLC, CoolCentric, and Iceotope Precision Liquid Cooling, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The industry is driven by the increasing growth of data creation and cloud computing. With more businesses being set up on cloud services and newer technologies like AI and big data, the processing load and heat generation of data centers increase, and they need proper cooling to operate at their best.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

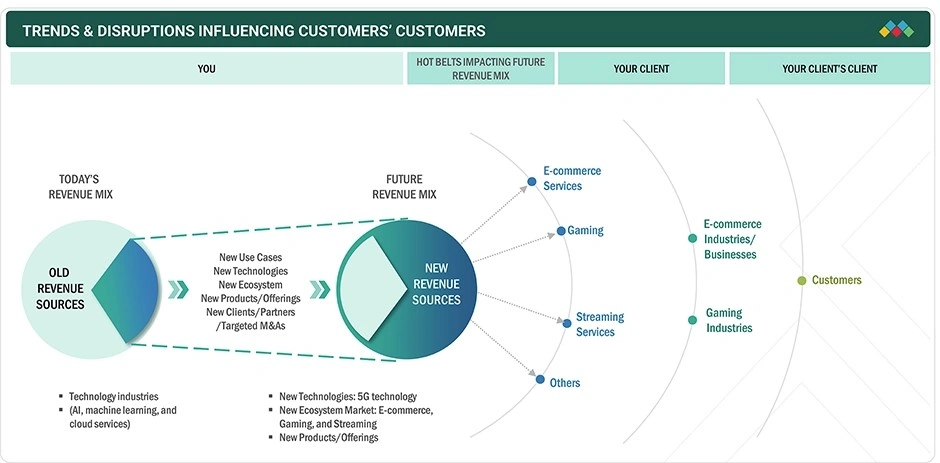

The impact on consumers' business emerges from customer trends or disruptions. The key trends and disruptions set to influence the data center cooling market over the next several years. The data center industry is undergoing a significant revenue mix transformation driven by the growing need for high energy efficiency, reduced carbon footprint, and cost-effective cooling solutions. Currently, the primary revenue sources stem from technology industries, including artificial intelligence (AI), machine learning, and cloud services. The future revenue highlights diversification toward new technologies such as 5G, emerging ecosystem markets like e-commerce, gaming, and streaming, and new product offerings. This shift expands the client landscape linking data center providers (your client) with rapidly growing industries like e-commerce, gaming, and streaming (your client’s clients), ultimately catering to end customers who demand faster, greener, and more immersive digital experiences.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Need for improved efficiency in data centers

-

Significant growth in number of data centers

Level

-

High capital investment

-

Requirement of specialized infrastructure

Level

-

Emergence of liquid cooling technology

-

Growing requirement for modular data center cooling

Level

-

Cooling challenges during power outages

-

Necessity of reducing carbon emissions

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Need for improved efficiency in data centers

One of the major factors driving the data center cooling market is the growing need to enhance data center efficiency. Data centers are becoming power-hungry with the growth in data creation and handling through cloud computing, artificial intelligence (AI), IoT, and high-performance computing (HPC). This has, therefore, raised the need for advanced cooling technologies capable of handling rising heat loads effectively with low power consumption and operational costs. Energy efficiency is not merely a cost-saving requirement but also a goal of sustainability. Conventional cooling mechanisms account for almost 40% of the power consumed in a data center. As a result, operators are now opting for novel cooling systems like liquid cooling, in-row cooling, and free cooling systems to achieve maximum thermal management and lower Power Usage Effectiveness (PUE). In addition, green data centers and regulatory policies are forcing operators to replace their cooling infrastructure with greener cooling systems. The increasing use of modular and edge data centers, generally space and power-limited, also demands efficient and space-efficient cooling systems. Also, hyperscale data centers led by cloud pioneers are embracing AI-powered cooling systems to optimize energy in real time. Such innovations indicate that the market is responding to wider digital transformation and ESG aspirations, which make energy-efficient cooling a strategic imperative and not a desirable upgrade.

Restraint: Requirement of specialized infrastructure

The requirement for improved infrastructure is a significant impediment to expanding the data center cooling business. Even if there is a rising demand for efficient cooling systems, installing them will most likely necessitate considerable adjustments to existing structures or the construction of entirely new ones. These changes take time and can be expensive. This is a significant barrier, especially to small and medium data centers, because of insufficient funds to upgrade to advanced cooling technologies like immersion systems or liquid cooling. Modern cooling technologies have specific architectural shapes, room layouts, raised floors, or specialized fluid distribution systems. Retrofitting current data centers for these infrastructures is an imposing challenge and expense, tending to result in extended periods of inactivity, disrupting continuity of operations. Maintenance and operation also demand trained personnel, presenting additional impediments to widespread uptake. The problem is even worse in developing countries. There are issues with infrastructure, power supply, and technical skills, which discourage the use of high-level cooling systems. Data center operators might be reluctant to move away from traditional air-based cooling systems in developed countries because of the risks and costs associated with redesigning infrastructure. This reliance on existing infrastructure slows the spread of new cooling technologies on the broader market, especially outside of large hyperscale operations. This, in turn, limits overall growth in the data center cooling market.

Opportunity: Emergence of liquid cooling technology

Liquid cooling plays a crucial role in propelling the data center cooling market. Thanks to advances in AI, machine learning, and HPC, servers are getting extremely powerful and have more demanding applications. Hence, typical air-cooling mechanisms cannot suffice anymore. They're becoming less effective and falling short of what's needed. Direct-to-chip and immersion cooling liquid cooling technologies offer a better alternative by delivering better thermal management with no additional energy costs. One of the primary advantages of liquid cooling technology is that it can handle high thermal loads in confined spaces and is highly efficient for highly dense server environments and edge data centers. Liquid cooling reduces energy use and noise produced because air movement is eliminated. This leads to an increase in PUE and greener operations. This is in addition to providing data-center designs that are more compact, modular, and efficient. Hence, advantages in scalability and reduced requirements for massive cooling systems. Liquid cooling is being widely embraced by cloud service providers and hyperscale operators in their endeavor to maximize computational performance while minimizing environmental footprint. With data center operators looking toward energy efficiency and the future of even higher computational needs, liquid cooling is considered a revolutionary solution. Growing technology uptake is a deliberate effort to create high-performance and efficient cooling systems and is one of the main drivers of future market potential.

Challenge: Cooling challenges during power outages

The cooling challenge during a blackout is a significant factor in the supply of unintended outages for the data center cooling market in terms of reliability and resilience. Essentially, data centers run 24/7, and partial power outages can cause immediate rises in temperature, thereby endangering delicate equipment to excessive heating, a short period of failure, or permanent damage. Thermal stability must be provided during power outages to save the client from massive downtime and data loss costs. The hue of backup power systems, like generators and Uninterruptible Power Supplies, usually shines on keeping IT equipment alive. The cooling systems are generally very energy-hungry and seldom form part of these backup scenarios. That leaves a risk scenario; consuming computing processes is okay if they do so without adequate cooling to stop thermal stress and eventual system failure. Plus, operations with high-density racks and compute-intensive workloads further temporarily escalate the issue by generating high heat. If the systems are allowed to shut down for any reason, starting them up could be a big challenge; it will require a ramp-up cycle to avoid thermal shock to the systems. The demand for backup-power-compatible cooling systems is becoming increasingly important. Battery-powered cooling, efficient chillers, and phase-change materials are all options being considered, but technical and cost challenges have prevented their widespread adoption. Thus, cooling problems due to power outages remain a sure threat to business continuity and market reliability at large.

data-center-cooling-solutions-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Implemented liquid immersion cooling in Azure data centers to manage high-performance computing (HPC) and AI workloads. | Reduced energy consumption by up to 30% |

|

Deployed AI-driven cooling optimization using DeepMind technology to automate real-time temperature and airflow control. | Achieved up to 40% reduction in cooling energy |

|

Introduced evaporative and liquid cooling systems in hyperscale data centers for high-demand cloud operations. | Increased energy efficiency and thermal stability |

|

Adopted direct-to-chip liquid cooling and waste heat recovery systems in its data centers in Denmark and the U.S. | Enables reuse of waste heat for local heating |

|

Integrated modular cooling infrastructure for colocation data centers to support rapid deployment and mixed workloads. | Flexible scaling based on client demand |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

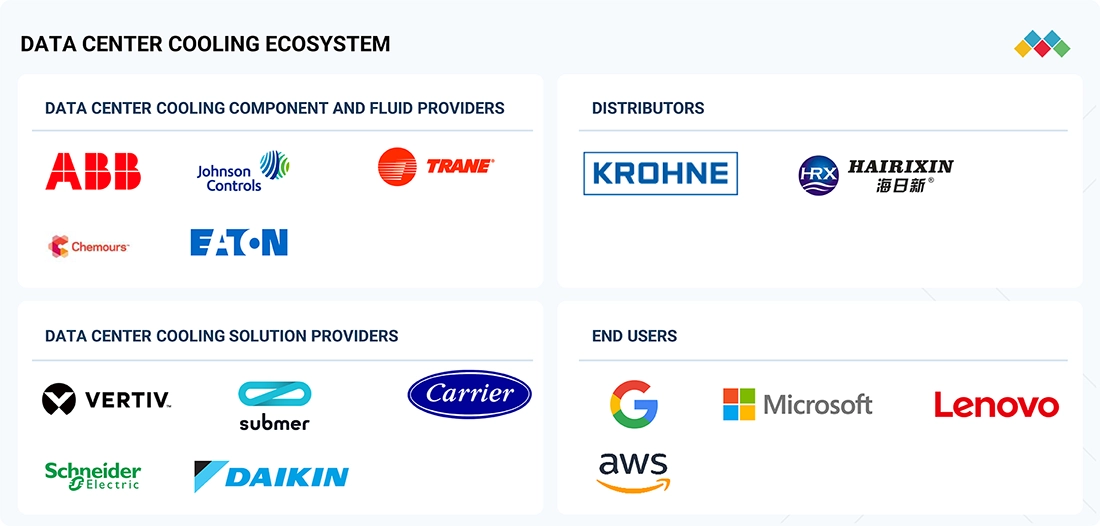

MARKET ECOSYSTEM

The data center cooling ecosystem comprises an integrated network of component manufacturers, solution providers, distributors, and end users working collaboratively to enhance efficiency, sustainability, and performance in data infrastructure. Component and fluid providers such as ABB, Johnson Controls, Chemours, Trane, and Eaton supply essential electrical systems, control technologies, and thermal management fluids that form the foundation of cooling systems. Distributors like KROHNE and Suzhou Hairi New Material Technology Co., Ltd. play a vital role in ensuring seamless supply, integration, and distribution of these technologies across global markets. Leading solution providers including Vertiv, Schneider Electric, Carrier, Daikin, and Submer develop advanced cooling systems ranging from air-based to liquid and immersion cooling tailored to diverse data center needs. On the demand side, global technology leaders such as Google, Microsoft, Amazon Web Services (AWS), and Lenovo are driving innovation and adoption of next-generation cooling solutions to support high-density workloads, cloud computing, and AI-driven operations. Collectively, this ecosystem underpins the industry’s transition toward energy-efficient, low-carbon, and cost-effective data center cooling.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data center cooling Market, By Component

By components, the solution segment held the most significant share in the data center cooling market, driven by the rising demand for advanced and efficient cooling infrastructure. The solutions include various systems, including air conditioners, chillers, cooling towers, liquid cooling units, and economizers. These very technologies are the backbone of thermal management of data centers. Due to the data centers' increased size and complexity, mainly due to the sprouting of hyperscale facilities and high-density racks, the demand for advanced and scalable cooling solutions has further surged. These systems must maintain the temperature and humidity at optimum levels to facilitate the uninterrupted functioning of servers and IT equipment. Also, such massive cooling systems need low latency and are customizable to different workloads and environments due to AI, edge computing, and cloud-based services. Further focus on energy efficiency and sustainability has compelled data center operators to consider alternative cooling methods such as liquid cooling, free cooling, in-row cooling, and others to reduce energy consumption and environmental impact. Vendors are also rolling out modular and prefab cooling systems to facilitate rapid deployment and scalability. The solution segment's dominance reflects the market's strong emphasis on performance, energy efficiency, and reliability, making it a key growth driver of the global data center cooling care market.

Data center cooling Market, By Type of Cooling

Based on cooling type, the room-based segment had secured the largest share in the data center cooling market. The dominance of room-based cooling is mainly due to its widespread adoption in traditional and mid-sized data centers, which consider it a reliable and cost-effective thermal management solution for their centers. Room-based cooling is based on a strategy wherein it uses a perimeter or centralized air conditioning system that cools the air in a uniform manner inside the room to maintain stable and sound environmental conditions for all IT equipment. One major driver cultivating this segment has been that it is simple in design and installation and has low operating costs. The systems are simple enough to easily be adapted to traditional infrastructure and remain unchanged; hence, they are still preferred by most legacy and colocation facilities. Hot aisle/cold aisle containment is an energy-efficient enhancement. Likewise, continuous advancement in CRAC (Computer Room Air Conditioning) and CRAH (Computer Room Air Handling) systems contributes to the improved efficiency and environmental sustainability of room-based cooling. These systems are also easier to scale in facilities with moderate computing demands. Although high-density environments are exploring newer cooling technologies, room-based cooling remains dominant due to its adaptability, affordability, and broad application. It is a foundational component of the current data center cooling market landscape.

REGION

North America is estimated to account for the largest market during the forecast period

As per regional analysis, North America has vast advanced digital infrastructure and hyperscale and enterprise data centers, making the North American market for data center cooling the largest share. Being such a big region, especially the United States, many cloud service providers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, offer cooling solutions for their high-density and high-performance environments. Now, with more and more AI, big data analytics, etc., applications coming into play, data centers have a very high thermal load. Hence, there is a push for next-generation cooling technologies such as liquid cooling and economizer chillers. Also, the region has strict energy codes with a greater emphasis on sustainability, promoting energy-efficient and green cooling systems. With government initiatives and R&D funding for sustainable infrastructure, the government also spurs innovation in this area. In addition, the cooler climate of Canada and its access to renewable energy present ideal conditions for free cooling and green data center deployments. The ongoing emphasis on data sovereignty remains North America’s driver of technological advancement, and scalable, resilient IT infrastructure continues to be highly sought after, securing the region’s front-runner status in the throes of growth in the global data center cooling market.

data-center-cooling-solutions-market: COMPANY EVALUATION MATRIX

In the Data center cooling market matrix, Vertiv (Star) leads with a strong market share and extensive product footprint, driven by its Data center cooling solutions which is adopted by various end users. Mitsubishi Electric Corporation (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Vertiv dominates through scale and diversified portfolio, Mitsubishi’s data center cooling shows significant potential to move toward the leaders’ quadrant as demand for Data center cooling continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Vertiv Group Corp (US)

- Johnson Controls, Inc. (US)

- Schneider Electric (France)

- Carrier (US)

- Daikin Industries Ltd. (Japan)

- Mitsubishi Electric Corporation (Japan)

- Super Micro Computer Inc (US)

- Modine (US)

- Trane Technologies PLC (Ireland)

- Lenovo (China)

- STULZ GMBH (Germany)

- Sugon Information Industry Co., Ltd. (China)

- Munters (Sweden)

- Delta Power Solution (Taiwan)

- CoolIT Systems (Canada)

- Baltimore Aircoil Company, Inc. (US)

- Eaton (Ireland)

- Rittal Gmbh & Co. KG (Germany)

- Black Box (US)

- DCX Liquid Cooling Systems (Poland)

- Taisol Electronics Co., Ltd. (Taiwan)

- Alfa Laval (Sweden)

- Green Revolution Cooling Inc. (US)

- Flex Ltd (US)

- Koari Heat Treatment Co., Ltd. (Taiwan)

- GIGA-BYTE Technology Co., Ltd. (Taiwan)

- Delta Power Solutions (Taiwan)

- USystems Limited (UK)

- LiquidStack Holdings B.V. (US)

- Submer (Spain)

- BOYD (US)

- Inspur Co., Ltd. (China)

- Asperitas (Netherlands)

- Zutacore Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 9.92 BN |

| Market Forecast in 2032 | USD 32.48 BN |

| CAGR (2025–2032) | 16.1% |

| Years considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | The report defines, segments, and projects the Data center cooling market size based on component, data center type, end-use industry, service, technology, type of cooling, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions they undertake in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

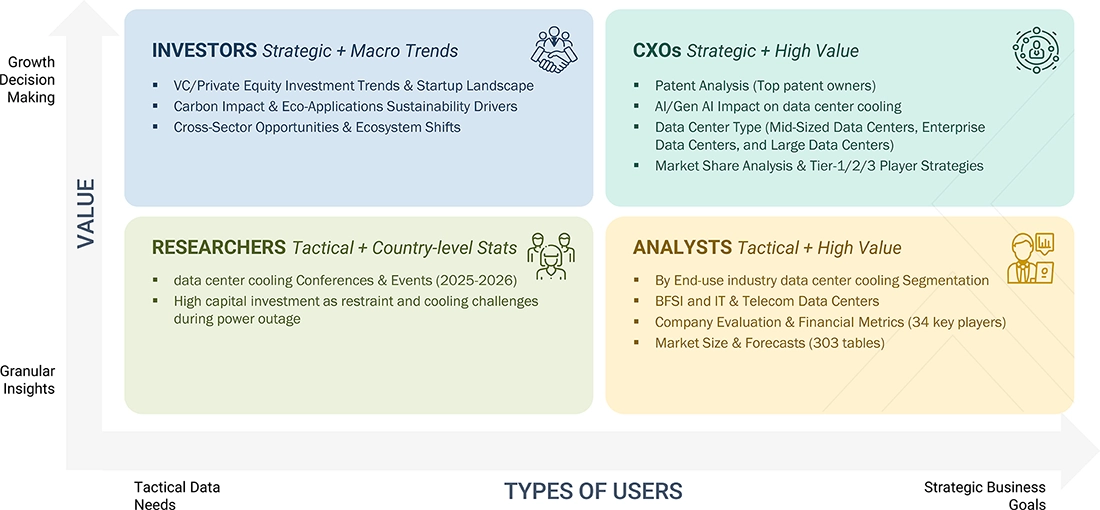

WHAT IS IN IT FOR YOU: data-center-cooling-solutions-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale & Enterprise Data Center Operators | Development of advanced liquid and immersion cooling systems for AI, HPC, and cloud data centers. | Enhanced cooling efficiency and power usage effectiveness (PUE). |

| Colocation Providers & SMEs | Modular, scalable, and quick-to-deploy cooling systems for flexible capacity management. | Scalability and adaptability to evolving client requirements. |

| Edge Data Centers & Cloud Service Providers | Compact and high-density cooling architectures suited for decentralized and remote sites. | Reliable performance in space-constrained and variable environments. |

RECENT DEVELOPMENTS

- June 2025 : Green Revolution Cooling, Inc., and Samsung Ventures join GRC's major shareholders in this latest financing, including HTS, SK Enmove, and ENEOS. Samsung C&T enters a strategic partnership with the company. Investment enables Green Revolution Cooling to meet global demand and deliver innovation to the global data center ecosystem.

- December 2024 : Vertiv Group Corp acquired certain assets and technologies from BiXin Energy Technology Co., Ltd. This acquisition, made through Vertiv's Chinese subsidiary, expands its portfolio and enhances its capabilities in providing liquid cooling solutions for data centers. Integrating BiXin's technologies aims to improve Vertiv’s offering for managing the thermal demands of high-performance computing and AI workloads, aligning with growing market needs for efficient and scalable cooling solutions in data center environments.

- October 2024 : Submer and Zero Two formed a strategic partnership to provide sustainable computing solutions to meet the UAE's growing demands for AI workloads. The collaboration combines Zero Two’s ability to scale rapidly with Submer’s modular AI platforms, focusing on delivering liquid cooling solutions for data centers. This partnership aims to optimize energy usage and performance, addressing the specific cooling needs of AI workloads while supporting the region's expanding AI infrastructure.

- June 2023 : Green Revolution Cooling, Inc. (“GRC”) launched the HashRaQ MAX. It is a powerful, reliable, and efficient cooling system for data center operations. It is designed to minimize CapEx, OpEx, and carbon footprint while maximizing density, uptime, and profitability. The HashRaQ MAX is a next-generation, productivity-driven, immersion cooling solution that tackles the extreme heat loads generated by data centers.

- October 2021 : Submer and AMAX announced a partnership to deliver high-density immersion cooling server solutions deployed for various data center workloads. AMAX will provide the most efficient server solution that submerges in a nontoxic, non-conductive, single-phase immersion coolant.

Table of Contents

Methodology

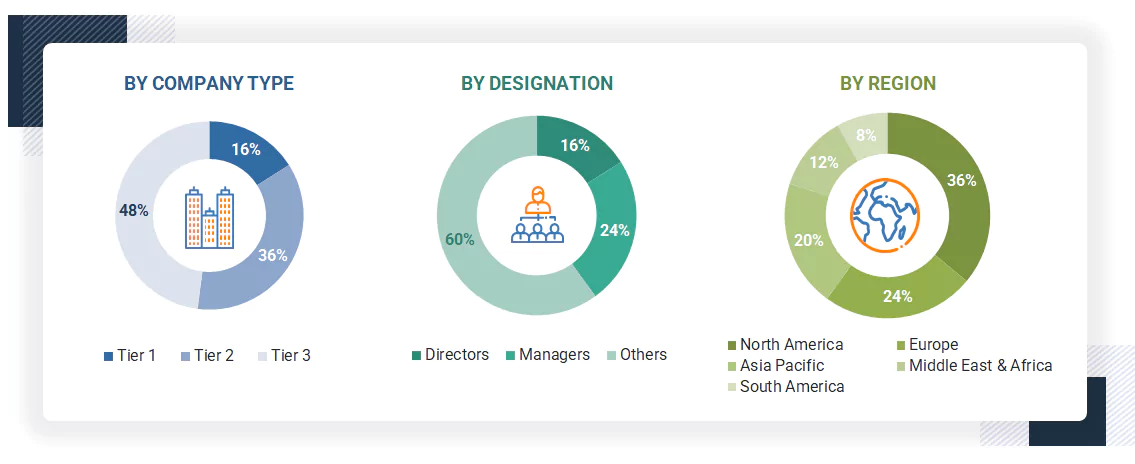

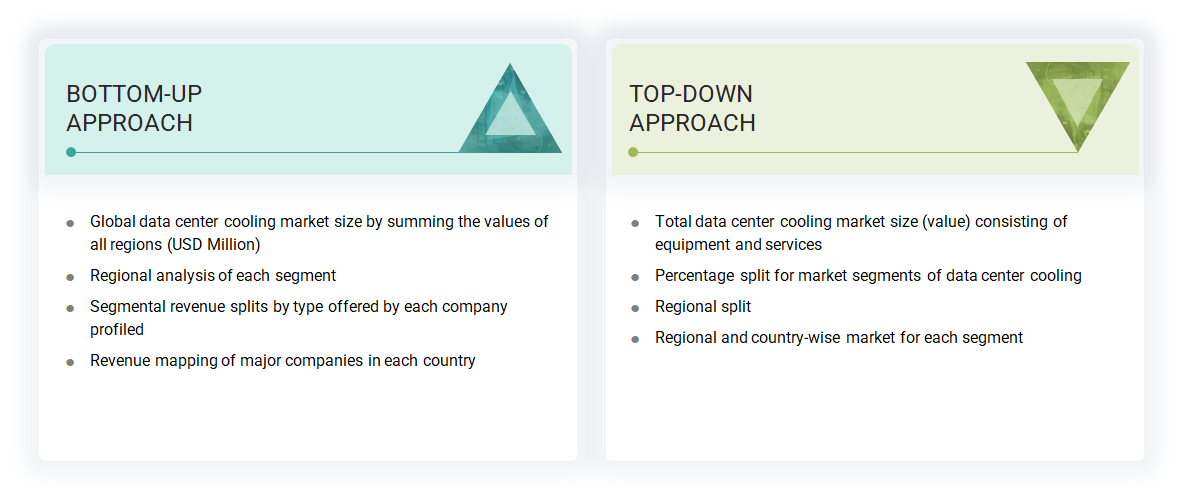

The study involved four major activities in estimating the current data center cooling market size. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizes with industry experts across the data center cooling value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to calculate the size of the market’s segments and sub-segments.

Secondary Research

The research methodology used to estimate and forecast the data center cooling market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

The data center cooling market comprises several stakeholders, such as raw material suppliers, processors, recycling companies, data center cooling manufacturers, and regulatory organizations in the supply chain. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the data center cooling market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries.

The following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the total size of the data center cooling market. These approaches have also been used extensively to estimate the size of various dependent market subsegments. The research methodology used to estimate the market size included the following.

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the data center cooling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included studying the annual and financial reports of the top market players and interviewing industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Data Center Cooling Market Size: Bottom-Up Approach and Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the data center cooling sector.

Market Definition

Data center cooling is a system of equipment, tools, processes, and techniques designed to manage and control the generation of heat by the hardware within the data centers, and the temperature of the data center infrastructure to be at an optimal level to keep the systems running and avoid downtime. Air and liquid systems are a few cooling methods used to ventilate and maintain the gadgets at their optimum temperatures. The global data center cooling market is growing quickly due to increasing data generation, adoption of cloud computing, and a rising number of hyper-scale and edge data centers. All these high power density poses a significant challenge to the cooling solutions; if not well designed, it can threaten the safety of hardware facilities, which is quite common in traditional infrastructures. The market trend is rising towards high-end liquid cooling and power-saving technologies with the implementation of environmental regulations and the need to keep down on the energy consumption and carbon emissions.

Stakeholders

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

- Telecom Services Providers

- Original Equipment Manufacturers

- Value-added Service Providers

- Data Center Cooling Solution Vendors

- Data Center Operators

- Data Center Colocation Service Providers

- System Integrators

- Cloud Service Providers

Report Objectives

- To define, describe, and forecast the global data center cooling market based on component, solution, type of cooling, service, data center type, end-use industry, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets concerning individual growth trends, prospects, and contributions to the total market

- To forecast the market size relating to five central regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, product launches, and research & development (R&D) activities in the data center cooling market

- To strategically profile the key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

What is the current size of the data center cooling market?

The data center cooling market is projected to grow from USD 11.08 billion in 2025 to USD 24.19 billion by 2032, at a CAGR of 11.8% during the same period.

Which region is expected to hold the highest data center cooling market share?

North America is expected to hold the highest market share, driven by strong demand from the government & defense and research & academic sectors.

What is the primary end-use industry of data center cooling?

The IT & telecom industry is the primary end-use industry for data center cooling.

Who are the major players operating in the data center cooling market?

Major players include Vertiv Group Corp. (US), Green Revolution Cooling, Inc. (US), Submer (Spain), Asperitas (Netherlands), and COOLIT Systems (Canada).

What total CAGR will be recorded for the data center cooling market during 2025–2032?

The market is expected to record a CAGR of 11.8% from 2025 to 2032.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Cooling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Cooling Market