Metal Finishing Chemicals Market by Type (Cleaning, Conversion Coating, Proprietary), Process (Electroplating, Polishing, Anodizing), Material (ZN, NI, CR, CU, AU), End Use (Automotive, Electrical & Electronics), Region - Global Forecast to 2021

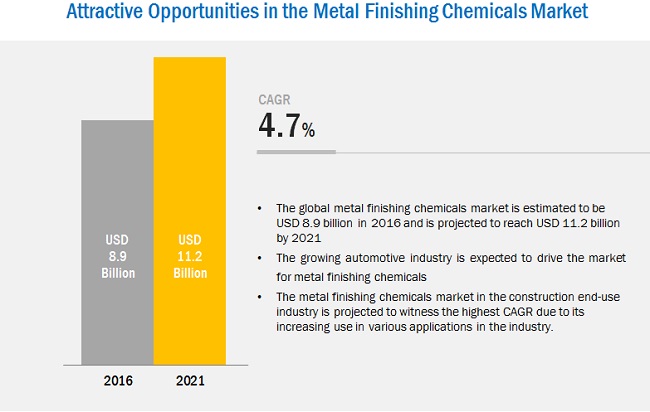

[161 Pages Report] The global metal finishing chemicals market is projected to reach USD 11.21 billion by 2021 at a CAGR of 4.7%, in terms of value. The base year considered for the study is 2015 while the forecast period is from 2016 to 2021. The metal finishing chemicals market is driven by increasing usage in the electroplating and polishing processes as these provide high corrosion resistance, durability, wear resistance, and improve the appearance. The report includes an analysis of the metal finishing chemicals market by region, namely, North America, Europe, Asia-Pacific, Middle East & Africa, and South America.

Market Dynamics

Drivers

- Growing automotive industry

- Increasing demand for durable and wear resistant products

- Significant demand from Asia-Pacific economies

- Growth in the biopharmaceutical industry

Restraints

- Replacement of metals by plastics

Opportunities

- Increasing usage of biobased cleaning chemicals

Challenges

- Stringent government regulations

Growing automotive industry

Metal finishing chemicals are used in automotive interior and exterior parts by protecting it against premature wear and corrosion. These chemicals are also used to enhance the appearance by giving the parts a smooth finish. The moisture content present in the atmosphere can cause corrosion and further can cause the damage in metal parts of the car. Therefore, to protect the metal parts of cars from corrosion, manufacturers offer innovative metal plating. In the automotive industry, metal finishing chemicals are used for plating of various components such as shock absorbers, heat sinks, gears, cylinders, brake calipers, fasteners, fluid delivery tubes, anti-vibration components, piston rings, engine valves, emblems, front grills, plated aluminum wheels, fuel injection housing, car door handles, and piston. Growing global automotive industry is further expected to drive the market for metal finishing chemicals such as aluminum, nickel, and zinc for instance in 2016, the car sales is increased by 15.0% in China, 0.2% in U.S., and in Europe it is increased by 7.0% in comparison to 2015.

In this industry, metal finishing chemicals are used in decorative coatings, functional coatings, and functional electronic coatings.

Objectives of the Study:

- To define, describe, and forecast the metal finishing chemicals market on the basis of type, process, material, end-use industry, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the metal finishing chemical market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

The top-down and bottom-up both approaches have been used to estimate and validate the size of the global metal finishing chemicals market and to estimate the size of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities And Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the metal finishing chemicals market.

To know about the assumptions considered for the study, download the pdf brochure

Key Target Audience:

- Manufacturers of metal finishing chemicals

- Traders, Distributors, and Suppliers of metal finishing chemicals

- Regional Manufacturers Associations and General metal finishing chemicals Associations

- Government and Regional Agencies and Research Organizations

- Investment Research Firms

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This research report categorizes the metal finishing chemicals market on the basis of material, type, process, end-use industry, and region.

Based on Type:

- Plating Chemicals

- Cleaning Chemicals

- Conversion Coating

- Proprietary Chemicals

- Other Chemicals

Based on Material:

- Zinc

- Nickel

- Chrome

- Copper

- Gold

- Silver

- Platinum

- Others

Based on Process:

- Electroplating

- Plating

- Polishing

- Anodizing

- Thermal or Plasma Spray Coating

- Others

Based on End-use Industry:

- Automotive

- Electrical & Electronics

- Industrial Machinery

- Construction

- Aerospace & Defense

- Others

Based on Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

- The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the metal finishing chemicals market is provided by end-use industry and process.

Company Information:

- Detailed analysis and profiles of additional market players.

The global metal finishing chemicals market is projected to reach USD 11.21 billion by 2021 at a CAGR of 4.7%. The metal finishing chemicals market has witnessed significant growth in the recent years, and this growth is projected to persist in the coming years as well. Metal finishing chemicals are used in a wide range of end-use industries such as automotive, industrial machinery, aerospace & defense, electrical & electronics, construction, and others as it imparts properties such as corrosion resistance, wear resistance, electrical conductivity, electrical resistance, reflexivity and appearance, torque tolerance, hardness, and chemical resistance to base metal substrate.

Different types of metal finishing chemicals are also covered in the report. The main types are plating chemicals, cleaning chemicals, conversion coating, proprietary chemicals, and others. The plating chemicals type segment is estimated to have accounted for the largest market share in 2016 due to their suitability in several application areas, while cleaning chemicals is the fastest-growing type segment in the metal finishing chemicals market due to its increasing acceptance in various end-use industries such as automotive, industrial machinery, electrical & electronics, and construction. Cleaning chemicals help in effective metal finishing by fulfilling requirements for cleaning and degreasing metal substrate before being plated. The demand for cleaning chemicals is growing as these chemicals remove oils and coolants, lapping compounds, carbon smut, metal oxides, and most other soils deposited from the metal surface during various metal finishing processes.

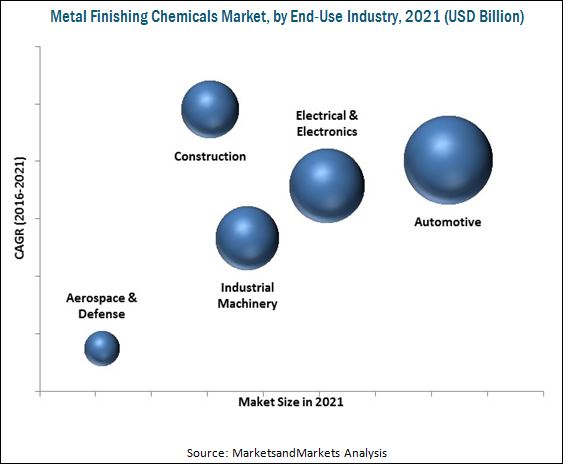

Metal finishing chemicals are used in various end-use industries such as automotive, industrial machinery, electrical & electronics, aerospace & defense, construction, and others, which are the main end-use industries considered in the report. In 2015, the automotive end-use industry accounted for the largest market share, in terms of value, followed by electrical & electronics, industrial machinery, construction, and others. The construction industry is projected to grow at the highest CAGR from 2016 to 2021 among all the end-use industries considered. Metal finishing is done on metal substrates to obtain excellent corrosion resistance, wear resistance, electrical conductivity, electrical resistance, reflexivity and appearance, torque tolerance, hardness, and chemical resistance and thus are in high demand for construction applications such as frames for door and windows, aluminum, steel, and zinc metal finishing.

North America, Europe, Asia-Pacific, Middle East & Africa, and South America are the main regions considered for the metal finishing chemicals market in the report. North America is the largest metal finishing chemicals market. The rising demand for metal finishing chemicals in this region is mainly driven by their increased use in electrical & electronics and automotive industries. Europe is the second-largest consumer and manufacturer of metal finishing chemicals, globally. The Asia-Pacific region is the fastest growing region in the metal finishing chemicals market, which is mainly driven by the growing demand from the automotive industry and also from the growing industrial machinery end-use sector. Automotive and electrical & electronics are the top two end-use industries contributing to the growing demand for metal finishing chemicals globally.The Middle East & Africa is the second fastest-growing region after the Asia-Pacific region due to the growing electrical & electronics industry.

Though the metal finishing chemicals market is growing at a significant rate, a few factors such as the high price of raw materials, shift of the end-use market from developed countries to emerging countries, and the rising cost of production hinder the growth of the market, globally.

Automotive

Metal finishing chemicals are majorly used in the automotive industry for better wear resistance and protection of metal components from corrosion. Electroplating and electroless plating are widely used processes for plating automotive components and finishing metal surfaces. Apart from corrosion protection, metal finishing can brighten the finish on metal or non-metal parts and even metallize plastic parts to improve durability. Metal finishing chemicals are used in various applications such as shock absorbers, heat sinks, gears, cylinders, and capacitors. Automotive components are finished using various materials such as zinc-nickel for corrosion protection, gold for enhancing appearance of exterior parts, and palladium for excellent corrosion and wear resistance.

Electrical & Electronics

Electronics parts and components are electroplated using processes such as electroplating and electrodeposition. The components are coated to enhance electrical conductivity, improve corrosion resistance, increase the solderability of the substrate and protect against wear. Metal finishing chemicals are used for various applications in electrical & electronics such as semiconductor, PCB, capacitors, and resistors. Gold, silver, platinum, rhodium, palladium, copper, nickel, and tin are mostly used materials for finishing electronics components.

Industrial Machinery

Metal finishing chemicals are extensively used in industrial machinery industry for finishing industrial components and tools. It is used on industrial components owing to its features such as it forms a protective barrier, enhances appearance, reduces friction, conducts electricity, resists heat, increases hardness, increases thickness, and prevents tarnishing. Plated industrial parts and components last longer and need to be replaced less frequently.

Atotech Deutschland GmbH (Germany), Chemetall (Germany), The Dow Chemical Company (U.S.), Elementis plc (U.K.), and Platform Specialty Products Corporation (U.S.) are the leading companies in this market. These companies are projected to account for a significant share of the market in the near future. Entering into related industries and targeting new markets will enable the metal finishing chemicals manufacturers to overcome the effects of volatile economies, leading to diversified business portfolios and increase in revenues. Other major metal finishing chemicals manufacturers are, Advanced Chemical Company (U.S.), Coral Chemical Company (U.S.), Houghton International, Inc. (U.S.), McGean-Rohco, Inc. (U.S.), and NOF Corporation (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Research Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

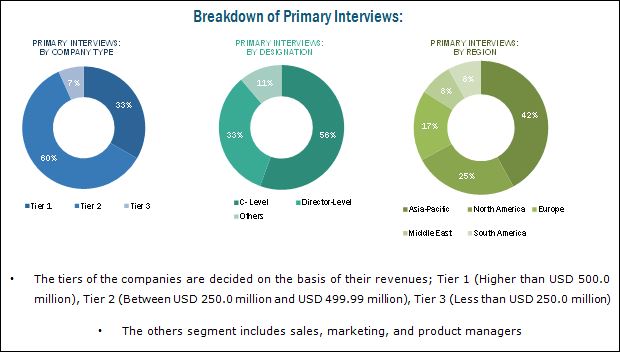

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Significant Opportunities in the Global Metal Finishing Chemicals Market

4.2 Metal Finishing Chemicals, By End-Use Industry

4.3 Metal Finishing Chemicals Market in Asia-Pacific, 2015

4.4 Metal Finishing Chemicals Market Share, By Type

4.5 Metal Finishing Chemicals, By Process

5 Market Overview and Industry Trends (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing Automotive Industry

5.2.1.2 Increase in Demand for Durable and Wear Resistant Products

5.2.1.3 Significant Demand From Asia-Pacific Economies

5.2.2 Restraints

5.2.2.1 Replacement of Metals By Plastics

5.2.3 Opportunities

5.2.3.1 Increasing Usage of Biobased Cleaning Chemicals

5.2.4 Challenges

5.2.4.1 Stringent Government Regulations

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Overview

5.4.1 Introduction

5.4.2 Trends and Forecast of GDP

5.5 Trends and Forecast of the Construction Industry

5.5.1 Trends and Forecast of the Construction Industry in North America

5.5.2 Trends and Forecast of the Construction Industry in Europe

5.5.3 Trends and Forecast of the Construction Industry in Asia-Pacific

5.5.4 Trends and Forecast of the Construction Industry in Middle East & Africa

5.5.5 Trends and Forecast of the Construction Industry in South America

5.6 Trends of the Aerospace Industry

5.7 Trends of the Automotive Industry

6 Metal Finishing Chemicals Market, By Type (Page No. - 53)

6.1 Introduction

6.2 Plating Chemicals

6.3 Proprietary Chemicals

6.4 Cleaning Chemicals

6.5 Conversion Coating Chemicals

7 Metal Finishing Chemicals, By Process (Page No. - 57)

7.1 Introduction

7.1.1 Electroplating

7.1.2 Plating

7.1.2.1 Immersion Plating

7.1.2.2 Electroless Plating

7.1.3 Anodizing

7.1.4 Carbonizing

7.1.5 Polishing

7.1.5.1 Electropolishing

7.1.6 Thermal Or Plasma Spray Coating

7.1.7 Others

8 Metal Finishing Chemicals Market, By Material (Page No. - 62)

8.1 Introduction

8.2 Mostly Used Metals

8.3 Zinc

8.4 Nickel

8.4.1 Nickel-Iron

8.4.2 Nickel-Cobalt

8.4.3 Nickel-Manganese

8.4.4 Zinc-Nickel

8.5 Chromium

8.5.1 Hard Chromium Electroplating

8.5.2 Decorative Chromium Electroplating

8.5.3 Trivalent Chromium Plating

8.6 Aluminum

8.7 Copper

8.8 Precious Metals

8.8.1 Gold

8.8.2 Silver

8.8.3 Platinum

8.9 Others

9 Metal Finishing Chemicals, By End-Use Industry (Page No. - 68)

9.1 Introduction

9.2 Automotive

9.2.1 Shock Absorbers

9.2.2 Heat Sinks

9.2.3 Gears

9.2.4 Cylinders

9.2.5 Capacitors

9.3 Electrical & Electronics

9.3.1 Semiconductors

9.3.2 Pcbs (Printed Circuit Boards)

9.3.3 Capacitors

9.3.4 Resistors

9.4 Industrial Machinery

9.5 Aerospace & Defense

9.5.1 Aircraft Engines

9.5.2 Landing Gear

9.5.3 Bolts

9.5.4 Valve Components

9.5.5 Satellite & Rocket Components

9.6 Construction

9.7 Others

10 Metal Finishing Chemicals Market, By Region (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Italy

10.3.4 U.K.

10.3.5 Spain

10.3.6 Russia

10.4 Asia-Pacific

10.4.1 China

10.4.2 India

10.4.3 Japan

10.4.4 South Korea

10.4.5 Thailand

10.4.6 Indonesia

10.4.7 Taiwan

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 South Africa

10.5.3 UAE

10.5.4 Qatar

10.6 South America

10.6.1 Brazil

11 Competitive Landscape (Page No. - 118)

11.1 Overview

11.2 Market Share Analysis of Metal Finishing Chemicals Market in Terms of Sales, 2015

11.2.1 Elementis PLC (U.K.)

11.2.2 Platform Specialty Products Corporation (U.S.)

11.2.3 The DOW Chemical Company (U.S.)

11.2.4 NOF Corporation (Japan)

11.2.5 Atotech Deutschland GmbH (Germany)

11.3 Competitive Situations & Trends

11.4 Key Growth Strategies in the Metal Finishing Chemicals Market, 20122016

11.5 Mergers, Joint Ventures & Acquisitions

11.6 New Product Launches

12 Company Profiles (Page No. - 125)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 The DOW Chemical Company

12.2 Platform Specialty Products Corporation

12.3 NOF Corporation

12.4 Elementis PLC

12.5 Advanced Chemical Company

12.6 Atotech Deutschland GmbH

12.7 Chemetall

12.8 Coral Chemical Company

12.9 Houghton International, Inc.

12.10 Mcgean-Rohco, Inc.

12.11 Other Key Players

12.11.1 A Brite Company

12.11.2 Coventya

12.11.3 C.Uyemura & Co., Ltd.

12.11.4 Grauer & Weil India Ltd.

12.11.5 Henkel Corporation

12.11.6 Industrial Metal Finishing, Inc.

12.11.7 Metal Finishing Technologies LLC

12.11.8 Quaker Chemical Corporation

12.11.9 Raschig GmbH

12.11.10 Wuhan Jadechem International Trade Co., Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 152)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (73 Tables)

Table 1 Trends and Forecast of GDP, 20152021 (USD Billion )

Table 2 Contribution of the Construction Industry to the GDP of North America, 20142021 (USD Billion)

Table 3 Contribution of the Construction Industry to the GDP of Europe, 20142021 (USD Billion)

Table 4 Contribution of the Construction Industry to the GDP of Asia-Pacific, 20142021 (USD Billion)

Table 5 Contribution of the Construction Industry to the GDP of Middle East & Africa, 20142021 (USD Billion)

Table 6 Contribution of the Construction Industry to the GDP of South America, 20142021 (USD Billion)

Table 7 Market of New Airplanes, 2014

Table 8 Automotive Production, 20112015 (Million Units)

Table 9 Metal Finishing Chemicals Market Size, By Type, 20142021 (USD Million)

Table 10 By Market Size, By Process, 20142021 (USD Million)

Table 11 By Market Size, By Material, 20142021 (USD Million)

Table 12 Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 13 By Market Size, By Region, 20142021 (USD Million)

Table 14 North America: Metal Finishing Chemicals Market Size, By Country, 20142021 (USD Million)

Table 15 North America: By Market Size, By Process, 20142021 (USD Million)

Table 16 North America: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 17 U.S.: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 18 U.S.: By Market Size, By Process, 20142021 (USD Million)

Table 19 Canada: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 20 Canada: By Market Size, By Process, 20142021 (USD Million)

Table 21 Mexico: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 22 Mexico: By Market Size, By Process, 20142021 (USD Million)

Table 23 Europe: Metal Finishing Chemicals Market Size, By Country, 20142021 (USD Million)

Table 24 Europe: By Market Size, By Process, 20142021 (USD Million)

Table 25 Europe: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 26 Germany: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 27 Germany: By Market Size, By Process, 20142021 (USD Million)

Table 28 France: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 29 France: By Market Size, By Process, 20142021 (USD Million)

Table 30 Italy: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 31 Italy: By Market Size, By Process, 20142021 (USD Million)

Table 32 U.K.: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 33 U.K.: By Market Size, By Process, 20142021 (USD Million)

Table 34 Spain: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 35 Spain: By Size, By Process, 20142021 (USD Million)

Table 36 Russia: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 37 Russia: By Market Size, By Process, 20142021 (USD Million)

Table 38 Asia-Pacific: Metal Finishing Chemicals Market Size, By Country, 20142021 (USD Million)

Table 39 Asia-Pacific: By Market Size, By Process, 20142021 (USD Million)

Table 40 Asia-Pacific: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 41 China: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 42 China: By Market Size, By Process, 20142021 (USD Million)

Table 43 India: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 44 India: By Market Size, By Process, 20142021 (USD Million)

Table 45 Japan: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 46 Japan: By Market Size, By Process, 20142021 (USD Million)

Table 47 South Korea: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 48 South Korea: By Market Size, By Process, 20142021 (USD Million)

Table 49 Thailand: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 50 Thailand: By Market Size, By Process, 20142021 (USD Million)

Table 51 Indonesia: Metal Finishing Chemicals Market Size, By End-Use Industry, 20142021 (USD Million)

Table 52 Indonesia: By Market Size, By Process, 20142021 (USD Million)

Table 53 Taiwan: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 54 Taiwan: By Market Size, By Process, 20142021 (USD Million)

Table 55 Middle East & Africa: By Market Size, By Country, 20142021 (USD Million)

Table 56 Middle East & Africa: By Market Size, By Process, 20142021 (USD Million)

Table 57 Middle East & Africa: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 58 Saudi Arabia: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 59 Saudi Arabia: By Market Size, By Process, 20142021 (USD Million)

Table 60 South Africa: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 61 South Africa: By Market Size, By Process, 20142021 (USD Million)

Table 62 UAE: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 63 UAE: By Market Size, By Process, 20142021 (USD Million)

Table 64 Qatar: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 65 Qatar: By Market Size, By Process, 20142021 (USD Million)

Table 66 South America: By Market Size, By Country, 20142021 (USD Million)

Table 67 South America: By Market Size, By Process, 20142021 (USD Million)

Table 68 South America: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 69 Brazil: By Market Size, By End-Use Industry, 20142021 (USD Million)

Table 70 Brazil: By Market Size, By Process, 20142021 (USD Million)

Table 71 Expansions, Agreements, and Investments, 2012-2016

Table 72 Mergers, Joint Ventures & Acquisitions, 20122016

Table 73 New Product Launches, 20122016

List of Figures (47 Figures)

Figure 1 Market Segmentation

Figure 2 Metal Finishing Chemicals Market: Research Methodology

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Metal Finishing Chemicals Data Triangulation

Figure 6 Metal Finishing Chemical Market in Construction Industry to Register the Highest CAGR, 20162021

Figure 7 Plating Chemical to Lead the Metal Finishing Chemicals Market By 2021

Figure 8 Zinc to Lead Metal Finishing Chemical Market By 2021

Figure 9 Electroplating Process is the Widely Used Process in Metal Finishing Chemicals Market in 2016

Figure 10 U.S. Leads the Metal Finishing Chemicals Market

Figure 11 North America Led the Metal Finishing Chemicals Market

Figure 12 Attractive Opportunities in the Metal Finishing Chemicals Market, 20162021

Figure 13 Construction to Be the Fastest-Growing End-Use Industry From 2016 to 2021

Figure 14 China to Be the Largest Market in Asia-Pacific

Figure 15 Plating Chemicals Estimated to Have Accounted for the Largest Share of the Metal Finishing Chemicals Market, 2016

Figure 16 Electroplating to Account for the Largest Market Share During the Forecast Period

Figure 17 Metal Finishing Chemicals: Market Dynamics

Figure 18 Porters Five Forces Analysis: Metal Finishing Chemicals Market

Figure 19 Trends and Forecast of GDP, 20162021 (USD Billion )

Figure 20 Contribution of the Construction Industry to the GDP of North America, 2015 & 2021

Figure 21 Construction Industry in the U.K. Expected to Contribute Maximum to the GDP of Europe, 2015 & 2021

Figure 22 India is Projected to Register the Highest CAGR in the Construction Industry From 2016 to 2021

Figure 23 Saudi Arabia Accounted for the Largest Market Share in the Construction Industry

Figure 24 Brazil Expected to Account for the Largest Market Share in the Construction Industry From 2015 to 2021

Figure 25 New Airplane Deliveries, By Region, 2014

Figure 26 Cleaning Chemicals Projected to Lead the Metal Finishing Chemicals Market From 2016 to 2021

Figure 27 Metal Finishing Chemicals Market By Process

Figure 28 Electroplating Process to Witness the Highest CAGR From 2016 to 2021

Figure 29 Metal Finishing Chemicals Market Size, By Material, 20162021

Figure 30 Metal Finishing Chemicals Market in Construction Segment to Grow Rapidly From 2016 to 2021

Figure 31 India, China, and Brazil are Emerging as the New Hotspots, 20162021

Figure 32 Germany Led the Metal Finishing Chemicals Market in North America, 2015

Figure 33 U.S. to Remain the Leading Player in the Metal Finishing Chemicals Market in North America, 20162021

Figure 34 Germany Led the European Metal Finishing Chemicals Market in 2015.

Figure 35 Asia-Pacific is the Fastest-Growing Market for Metal Finishing Chemicals

Figure 36 China to Remain the Leading Metal Finishing Chemicals Market in Asia-Pacific, 20162021

Figure 37 Brazil is the Largest Metal Finishing Chemicals Market in South America

Figure 38 Companies Adopted Expansions, Agreements, Joint Ventures & Investments as Key Strategies, 20122016

Figure 39 Battle for Market Share: Mergers, Joint Ventures, and Acquisitions Were the Key Strategies, 20122016

Figure 40 The DOW Chemical Company: Company Snapshot

Figure 41 The DOW Chemical Company: SWOT Analysis

Figure 42 Platform Specialty Products Corporation: Company Snapshot

Figure 43 Platform Specialty Chemicals Corporation: SWOT Analysis

Figure 44 NOF Corporation: Company Snapshot

Figure 45 NOF Corporation: SWOT Analysis

Figure 46 Elementis PLC: Company Snapshot

Figure 47 Elementis PLC: SWOT Analysis

Growth opportunities and latent adjacency in Metal Finishing Chemicals Market