Metal Implants and Medical Alloys Market by Type (Titanium, Stainless Steel, Cobalt Chrome), Application (Orthopedic, Dental, Spinal Fusion, Craniofacial, Pacemaker, Stent, Defibrillator, Hip, Knee, & Shoulder Reconstruction) - Global Forecast to 2024

[207 Pages Report] Metal implants and medical alloys are devices that are placed inside or on the surface of the body. Implants such as prosthetics are intended to replace missing body parts. Other implants deliver medication, monitor body functions, or provide support to organs and tissues. Implants can be placed permanently, or they can be removed once they are no longer required.

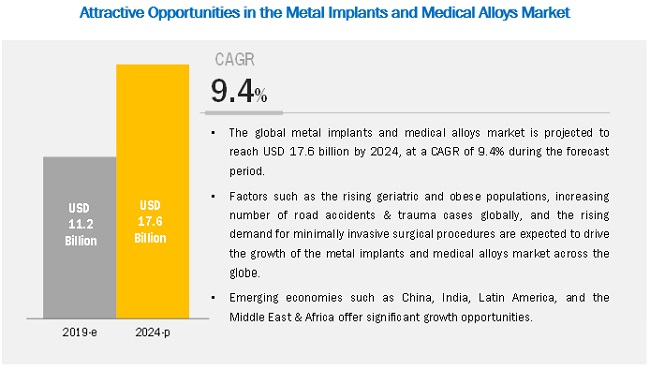

The metal implants and medical alloys market is projected to reach USD 17.64 billion by 2024 from USD 11.25 billion in 2019, at a CAGR of 9.4%. Market growth is driven mainly by factors such as the rising geriatric and obese populations globally, the increasing number of road accidents & trauma cases, the growing demand for minimally invasive surgical procedures, and the growing incidence of lifestyle disorders.

Titanium metal implants and medical alloys to account for the largest share of the metal implants and alloys market

Based on type, the metal implants and medical alloys market is broadly segmented into titanium, stainless steel, cobalt-chromium, and other metal implants and medical alloys. Titanium metal implants and medical alloys accounted for the largest share of the market, and this trend is expected to continue during the forecast period. A large share of this segments growth can be attributed to the advantages offered by titanium, such as high biocompatibility, strength, rigidity, greater strain-bearing capacity, and higher corrosion-resistance properties as compared to other materials. Moreover, it is non-allergic, non-magnetic, and non-radio-opaque, and adheres easily to the bone without any additional coating.

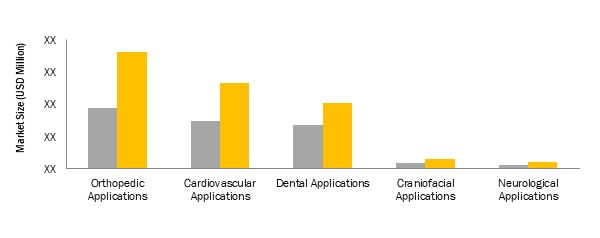

Orthopedic applications to dominate the metal implants and medical alloys market during the forecast period

Based on application, the metal implants and medical alloys market is segmented into orthopedic, cardiovascular, dental, craniomaxillofacial, and neurological applications. The orthopedic applications segment accounted for the largest share of the metal implants and medical alloys market during the forecast period. A large share of this segment growth can be attributed to the growing geriatric population, the rising number of sports injuries, and the high incidence of orthopedic disorders.

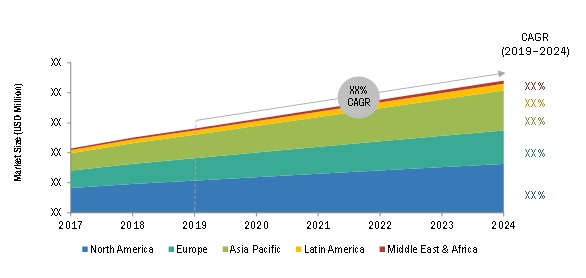

APAC to register the highest growth rate during the forecast period

Emerging markets across Asia Pacific are expected to grow at the highest CAGR during the forecast period. A majority of the growth is driven by factors such as improving healthcare infrastructure in these regions, growing per capita income, increasing health awareness, and the significant increase in the number of trauma/accident cases.

Market Dynamics

Driver: Growing demand for minimally invasive surgical procedures

Minimally invasive surgical procedures are performed for a broad range of conditions such as herniated discs, degenerative spinal disease, fractures, trauma, tumors, herniated discs with cord compression, herniated discs with Cauda Equina Syndrome (CES), spondylosis/spondylolisthesis, stenosis, pseudoarthrosis, partial knee trauma, and errors in the positioning of prosthetic implants.

Minimally invasive surgical procedures are safer, less traumatic, and have lower mortality and complication rates as compared to open surgeries. According to a study conducted by Clinical Orthopedics and Related Research, the risk of developing surgical-site infections (SSIs) is 5.77 times more in open operations as compared to minimally invasive surgeries. Several advantages of minimally invasive surgeries, such as reduced surgical risk, less pain and blood loss, lower risk of infection, and shorter post-operative recovery periods have resulted in the growing adoption of these procedures among patients and healthcare providers.

Restraint: Shortage of skilled surgeons

According to the Lancet Commission on Global Surgery, approximately 2.2 million more surgeons, anesthetists, and obstetricians are required in low- and middle-income countries (LMICs) each year. Also, major healthcare markets such as the US, Germany, and the UK are witnessing a shortage of surgeons in their respective healthcare systems. For instance, according to the Association of American Medical Colleges, a deficit of 41,000 general surgeons is estimated in the US by 2025, whereas in the UK, there is 1 vascular surgeon per 137,000 individuals. The significant shortage of surgeons available to handle the increasing demand for procedures is expected to affect the uptake of implants in the coming years despite the presence of a large target patient population.

Opportunity: Growth in the number of hospitals and surgical centers

Several hospitals and surgical centers are being established in tier-II cities in both developed and developing countries. This is because there is substantial demand for high-quality and specialist healthcare services in tier-II and tier-III cities in several countries. In July 2017, the Dubai Health Authority (DHA) announced the launch of 12 new private hospitals with 875 beds in Dubai by 2020. Similarly, the number of private hospitals in China doubled to a total of 16,900 hospitals from 2011 to 2017. Similar trends are being observed in India where private healthcare players such as Fortis, the Manipal Group, and Ruby Hall Clinics are establishing state-of-the-art hospitals and surgical centers at multiple locations. These newly established surgical centers and hospitals are expected to use various medical equipment, including implants and alloys, for the treatment of a growing patient base.

Challenge: Lack of awareness about the availability of advanced implants

Awareness of new technologies and devices is relatively lower in emerging markets as compared to mature markets. In developing countries, where procedural volumes are growing at a high rate, physician training and awareness will provide additional advantages to manufacturers of MIS devices to position their businesses in these high-growth markets. Currently, industry- and company-sponsored training programs and workshops are gaining high importance in these markets.

Thus, the lack of adequate physician and patient awareness/education regarding novel techniques (specifically in emerging countries) is negatively affecting the growth of this market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192023 |

|

Forecast units |

USD Million (Value) |

|

Segments covered |

By Product Type, By Application, and By Region |

|

Geographies covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Companies covered |

Carpenter Technology Corporation (US), Royal DSM (Netherlands), Johnson Matthey Plc (UK), ATI Specialty Alloys & Components (US), Ametek Specialty Products (US), Aperam S.A. (Luxembourg), QuesTek Innovations LLC (US), and Fort Wayne Metals (US). |

The research report categorizes the market into the following segments and sub-segments:

By Type

- Titanium

- Stainless Steel

- Cobalt-Chromium

- Other Metal Implants and Medical Alloys (Gold, Silver, and Magnesium Alloys)

By Application

- Orthopedic Applications

- Joint Reconstruction Devices

- Knee Reconstruction Devices

- Hip Reconstruction Devices

- Shoulder Reconstruction Devices

- Other Joint Reconstruction Devices (Ankle, Elbow, Wrist, and Finger Arthroplasty)

- Spinal Implants

- Spinal Fusion Devices

- Motion Preservation Devices

- Vertebral Compression Fracture Devices

- Spinal Decompression Devices

- Trauma Fixation Devices

- Metal Plates & Screws

- Pins

- Nails & Rods

- Wires

- Joint Reconstruction Devices

- Cardiovascular Applications

- Implantable Cardiac Defibrillators (ICDs)

- Implantable Cardiac Pacemakers (ICPs)

- Mechanical Heart Valves

- Stents

- Guidewires

- Dental Applications

- Dental Implants

- Orthodontic Appliances

- Metal Bridges & Crowns

- Craniomaxillofacial Applications

- Facial Implants

- Cranial Implants

- Neurological Application

By Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- The Middle East and Africa

Key Market Players

Carpenter Technology Corporation (US), Royal DSM (Netherlands), Johnson Matthey Plc (UK), ATI Specialty Alloys & Components (US), Ametek Specialty Products (US)

Recent Developments

- In January 2019, Ametek Specialty Metal Products introduced two new Titanium strip grades grades 9 and 23 to expand its product portfolio for implanted medical devices when incorporated into the external shell.

- In 2018, Carpenter Technology Corporation acquired LPW Technology Ltd., a developer, and supplier of advanced metal powders and powder lifecycle management solutions to the additive manufacturing industry, for approximately USD 81 million to combine LPWs metal powder lifecycle management technology and processes with its technical expertise in producing highly engineered metal powders and additively manufactured components.

- In January 2018, Wayne Metals acquired G&S Titanium, a company that specializes in titanium and specialty alloy wire & bar drawing, to expand its presence in the medical device industry by adding new products to its portfolio.

- In April 2017, TITAN Metal Fabricators acquired selected assets of Edge International, a leading stocking distributor of medical grade raw materials used in the manufacture of implants and instruments for the orthopedic, spine, and trauma markets. The addition expands and diversifies TITANs portfolio with a complementary business model similar to Supra Alloys, a division of TITAN Metal Fabricators to more effectively support the Midwest and East Coast customer base.

Key questions addressed in the report

- Where will all these developments take the industry in the mid to long term?

- What are the major application areas of metal implants and medical alloys?

- Which are the major metal implants and medical alloy products?

- What is the global scenario of metal implants and medical alloys?

- Who are the major players in the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Limitations

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Approach

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 37)

4.1 Metal Implants and Medical Alloys: Market Overview

4.2 Metal Implants and Medical Alloys Market: Geographic Overview (2018)

4.3 Regional Mix: Market (20192024)

4.4 Asia Pacific: Market, By End User & Country (2018)

4.5 Market: Developed vs Developing Markets

5 Market Overview (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Geriatric and Obese Populations

5.2.1.2 Increasing Number of Road Accidents & Trauma Cases Globally

5.2.1.3 Growing Demand for Minimally Invasive Surgical Procedures

5.2.1.4 Increasing Incidence of Lifestyle Disorders

5.2.2 Restraints

5.2.2.1 High Cost of Metal Implants

5.2.2.2 Shortage of Skilled Surgeons

5.2.3 Opportunities

5.2.3.1 Emerging Countries

5.2.3.2 Growth in the Number of Hospitals and Surgical Centers

5.2.4 Challenges

5.2.4.1 Lack of Awareness About the Availability of Advanced Implants

5.2.4.2 Uncertainties in Reimbursements

6 Industry Insights (Page No. - 48)

6.1 Introduction

6.2 Industry Trends

6.2.1 Additive Manufacturing

6.2.2 Growing Focus on Biodegradable Metals

6.3 Regulatory Analysis

6.3.1 North America

6.3.1.1 US

6.3.1.2 Canada

6.3.2 Europe

6.3.3 Asia Pacific

6.3.3.1 Japan

6.3.3.2 China

6.3.3.3 India

6.3.4 Rest of the World

6.4 Vendor Benchmarking

7 Metal Implants and Medical Alloys Market, By Type (Page No. - 56)

7.1 Introduction

7.2 Titanium

7.2.1 Titanium is the Most Commonly Used Material for Implants Due to Its Greater Corrosion-Resistance Properties as Compared to Other Materials

7.3 Stainless Steel

7.3.1 Stainless Steel is Popular in Surgical Practices as It is the Most Corrosion Resistant When in Direct Contact With A Biological Fluid

7.4 Cobalt Chromium

7.4.1 Cobalt Chromium is One of the Most Widely Used Metals in Hip and Knee Implants

7.5 Other Metal Implants and Medical Alloys

8 Metal Implants and Medical Alloys Market, By Application (Page No. - 64)

8.1 Introduction

8.2 Orthopedic Applications

8.2.1 Joint Reconstruction Devices

8.2.1.1 Knee Reconstruction Devices

8.2.1.1.1 The Increasing Number of Knee Replacement Procedures Across the Globe is Likely to Drive Market Growth

8.2.1.2 Hip Reconstruction Devices

8.2.1.2.1 Mobile Bearing Implants are A Recent Development in This Market Segment

8.2.1.3 Shoulder Reconstruction Devices

8.2.1.3.1 Shoulder Reconstruction is the Third-Most-Common Joint Replacement Surgery Conducted Globally

8.2.1.4 Other Joint Reconstruction Devices

8.2.2 Trauma Fixation Devices

8.2.2.1 Metal Plates & Screws

8.2.2.1.1 Growing Prevalence of Degenerative Joint Diseases and Growth in the Aging Population are Driving the Market

8.2.2.2 Wires

8.2.2.2.1 Wires Can Be Used Alone Or in Combination With Other Fixation Devices

8.2.2.3 Pins

8.2.2.3.1 Pin Fixation is Mostly Used for Fractures of the Phalanges, Metacarpals, and Metatarsals

8.2.2.4 Nails & Rods

8.2.2.4.1 Their Rigidity, Cost-Efficiency, and Easy Mobilization have Driven the Demand for Nails & Rods

8.2.3 Spinal Implants

8.2.3.1 Spinal Fusion Devices

8.2.3.1.1 Spinal Fusion Devices are Made of Titanium, Titanium Allow, and Stainless Steel

8.2.3.2 Motion Preservation Devices

8.2.3.2.1 Motion Preservation is Rapidly Replacing Spinal Fusion

8.2.3.3 Vertebral Compression Fracture Devices

8.2.3.3.1 Low Diagnosis Rate of Fractures and High Risk of Adjacent-Level Fractures are Major Challenges Limiting the Growth of the Market

8.2.3.4 Spinal Decompression Devices

8.2.3.4.1 Growing Incidences of Spinal Tumors and , Development of Minimally Invasive Devices are Driving Market Growth

8.3 Cardiovascular Applications

8.3.1 Stents

8.3.1.1 With the Rising Number of Coronary Intervention Procedures Performed Worldwide, the Demand for Stents is Set to Increase

8.3.2 Implantable Cardioverter Defibrillators

8.3.2.1 Advancements in Defibrillators have Greatly Driven Their Adoption

8.3.3 Implantable Cardiac Pacemakers

8.3.3.1 Pacemaker Implant Rates have Grown in Line With the Rising Geriatric Population

8.3.4 Guidewires

8.3.4.1 Adoption of Zig-Zag Wire Technology has Increased Due to Its Ease of Use and Higher Success Rate

8.3.5 Mechanical Heart Valves

8.3.5.1 Possibility of Blood Clot Formation Associated With Valves Leaves Patients Reliant on Daily Doses of Anticoagulant Drugs

8.4 Dental Applications

8.4.1 Dental Implants

8.4.1.1 Titanium is A Key Component of Dental Implants

8.4.2 Orthodontic Appliances

8.4.2.1 Orthodontic Fixed Braces are the Most Common Type of Orthodontic Non-Removable Appliances

8.4.3 Metallic Bridges and Crowns

8.4.3.1 Metallic Crowns Require Less Removal of the Original Tooth Material as Compared to Other Crown Types

8.5 Craniofacial Implants

8.5.1 Facial Implants

8.5.1.1 Increasing Incidence of Congenital Deformities and the Rising Number of Road Accident Injuries are Driving Market Growth

8.5.2 Cranial Implants

8.5.2.1 Cranial Implants Account for the Largest Share of the Craniofacial Applications Market

8.6 Neurological Applications

8.6.1 Rising Disease Incidence is Driving Demand for Neurological Application

9 Metal Implants and Medical Alloys Market, By Region (Page No. - 103)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 The US is the Largest Market for Metal Implants and Medical Alloys Globally

9.2.2 Canada

9.2.2.1 Rising Prevalence of Chronic Diseases to Support Market Growth in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Germany Holds the Largest Share of the European Market

9.3.2 UK

9.3.2.1 Rising Prevalence of Chronic Diseases to Drive Market Growth in the Uk

9.3.3 France

9.3.3.1 Presence of A Strong Healthcare System in France Allows the Adoption of Technologically Advanced Products for the Management of Various Disease Conditions

9.3.4 Italy

9.3.4.1 Rising Geriatric Population and the Subsequent Increase in the Incidence of Various Age-Related Disorders to Increase the Demand for Metal Implants and Medical Alloys in Italy

9.3.5 Spain

9.3.5.1 One-Third of Spains Population is Expected to Be Over 65 Years of Age By 2050

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China to Hold the Largest Share of the APAC Market During the Forecast Period

9.4.2 Japan

9.4.2.1 Growth in the Aging Population and Consequent Rise in Disease Prevalence Will Contribute to Market Growth

9.4.3 India

9.4.3.1 The Indian Market is Among the Fastest-Growing in APAC

9.4.4 Rest of Asia Pacific

9.5 Latin America

9.5.1 The Prevalence of Cvd and Neurological Diseases has Increased in Latin America

9.6 Middle East & Africa

9.6.1 A Number of Middle Eastern Countries are Investing in the Modernization of Their Healthcare Systems

10 Competitive Landscape (Page No. - 163)

10.1 Overview

10.2 Competitive Leadership Mapping, 2018

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Market Ranking Analysis

10.4 Competitive Situation and Trends

10.4.1 New Product Launches

10.4.2 Agreements, Partnerships, and Joint Ventures

10.4.3 Expansions

10.4.4 Acquisitions

11 Company Profiles (Page No. - 174)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Carpenter Technology Corporation

11.2 Royal Dsm

11.3 Johnson Matthey PLC.

11.4 Fort Wayne Metals

11.5 ATI Specialty Alloys & Components

11.6 Ametek Specialty Metal Products

11.7 Questek Innovations LLC

11.8 Supra Alloys Inc.

11.9 Materion Corporation

11.10 Aperam S.A.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 197)

12.1 Insights of Industry Experts

12.2 Market Sizing & Validation Approach

12.3 Discussion Guide

12.4 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (151 Tables)

Table 1 Market Dynamics: Impact Analysis

Table 2 US: Regulatory Process for Medical Devices

Table 3 Japan: Regulatory Process for Medical Devices

Table 4 China: Cfda Classification of Medical Devices

Table 5 Stringency of Regulations for Medical Implants and Medical Alloys, By Region

Table 6 Metal Implants and Medical Alloys Market: Vendor Benchmarking

Table 7 Market, By Type, 20172024 (USD Million)

Table 8 Titanium Implants and Medical Alloys Market, By Country, 20172024 (USD Million)

Table 9 Stainless Steel Implants and Medical Alloys Market, By Country, 20172024 (USD Million)

Table 10 Cobalt Chromium Implants and Medical Alloys Market, By Country, 20172024 (USD Million)

Table 11 Other Market, By Country, 20172024 (USD Million)

Table 12 Market, By Application, 20172024 (USD Million)

Table 13 Market for Orthopedic Applications, By Type, 20172024 (USD Million)

Table 14 Market for Orthopedic Applications, By Country, 20172024 (USD Million)

Table 15 Joint Reconstruction Devices Market, By Type, 20172024 (USD Million)

Table 16 Joint Reconstruction Devices Market, By Country, 20172024 (USD Million)

Table 17 Knee Reconstruction Devices Market, By Country, 20172024 (USD Million)

Table 18 Hip Reconstruction Devices Market, By Country, 20172024 (USD Million)

Table 19 Shoulder Reconstruction Devices Market, By Country, 20172024 (USD Million)

Table 20 Other Joint Reconstruction Devices Market, By Country, 20172024 (USD Million)

Table 21 Trauma Fixation Devices Market, By Type, 20172024 (USD Million)

Table 22 Trauma Fixation Devices, By Country, 20172024 (USD Million)

Table 23 Metal Plates & Screws Market, By Country, 20172024 (USD Million)

Table 24 Wires Market, By Country, 20172024 (USD Million)

Table 25 Pins Market, By Country, 20172024 (USD Million)

Table 26 Nails & Rods Market, By Country, 20172024 (USD Million)

Table 27 Spinal Implants Market, By Type, 20172024 (USD Million)

Table 28 Spinal Implants Market, By Country, 20172024 (USD Million)

Table 29 Spinal Fusion Devices Market, By Country, 20172024 (USD Million)

Table 30 Motion Preservation Devices Market, By Country, 20172024 (USD Million)

Table 31 Vertebral Compression Fracture Devices Market, By Country, 20172024 (USD Million)

Table 32 Spinal Decompression Devices Market, By Country, 20172024 (USD Million)

Table 33 Market for Cardiovascular Application, By Type, 20172024 (USD Million)

Table 34 Market for Cardiovascular Applications, By Country, 20172024 (USD Million)

Table 35 Stents Market, By Country, 20172024 (USD Million)

Table 36 Implantable Cardioverter Defibrillators Market, By Country, 20172024 (USD Million)

Table 37 Implantable Cardiac Pacemakers Market, By Country, 20172024 (USD Million)

Table 38 Guidewires Market, By Country, 20172024 (USD Million)

Table 39 Mechanical Heart Valves Market, By Country, 20172024 (USD Million)

Table 40 Market for Dental Applications, By Type, 20172024 (USD Million)

Table 41 Market for Dental Applications, By Country, 20172024 (USD Million)

Table 42 Dental Implants Market, By Country, 20172024 (USD Million)

Table 43 Orthodontic Appliances Market, By Country, 20172024 (USD Million)

Table 44 Metallic Crowns and Bridges Market, By Country, 20172024 (USD Million)

Table 45 Market for Craniofacial Application, By Type, 20172024 (USD Million)

Table 46 Metal Implants and Medical Alloys Market for Craniofacial Applications, By Country, 20172024 (USD Million)

Table 47 Facial Implants Market, By Country, 20172024 (USD Million)

Table 48 Cranial Implants Market, By Country, 20172024 (USD Million)

Table 49 Market for Neurological Applications, By Country, 20172024 (USD Million)

Table 50 Market, By Region, 20172024 (USD Million)

Table 51 North America: Market, By Country, 20172024 (USD Million)

Table 52 North America: Market, By Product, 20172024 (USD Million)

Table 53 North America: Market, By Application, 20172024 (USD Million)

Table 54 North America: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 55 North America: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 56 North America: Dental Applications Market, By Type, 20172024 (USD Million)

Table 57 US: Macroeconomic Indicators

Table 58 US: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 59 US: Market, By Application, 20172024 (USD Million)

Table 60 US: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 61 US: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 62 US: Dental Applications Market, By Type, 20172024 (USD Million)

Table 63 Canada: Macroeconomic Indicators

Table 64 Canada: Market, By Product, 20172024 (USD Million)

Table 65 Canada: Market, By Application, 20172024 (USD Million)

Table 66 Canada: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 67 Canada: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 68 Canada: Dental Applications Market, By Type, 20172024 (USD Million)

Table 69 Europe: Market, By Country, 20172024 (USD Million)

Table 70 Europe: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 71 Europe: Market, By Application, 20172024 (USD Million)

Table 72 Europe: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 73 Europe: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 74 Europe: Dental Applications Market, By Type, 20172024 (USD Million)

Table 75 Germany: Macroeconomic Indicators

Table 76 Germany: Market, By Product, 20172024 (USD Million)

Table 77 Germany: Market, By Application, 20172024 (USD Million)

Table 78 Germany: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 79 Germany: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 80 Germany: Dental Applications Market, By Type, 20172024 (USD Million)

Table 81 UK: Macroeconomic Indicators

Table 82 UK: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 83 UK: Market, By Application, 20172024 (USD Million)

Table 84 UK: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 85 UK: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 86 UK: Dental Applications Market, By Type, 20172024 (USD Million)

Table 87 France: Macroeconomic Indicators

Table 88 France: Market, By Product, 20172024 (USD Million)

Table 89 France: Market, By Application, 20172024 (USD Million)

Table 90 France: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 91 France: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 92 France: Dental Applications Market, By Type, 20172024 (USD Million)

Table 93 Italy: Macroeconomic Indicators

Table 94 Italy: Market, By Product, 20172024 (USD Million)

Table 95 Italy: Market, By Application, 20172024 (USD Million)

Table 96 Italy: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 97 Italy: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 98 Italy: Dental Applications Market, By Type, 20172024 (USD Million)

Table 99 Spain: Macroeconomic Indicators

Table 100 Spain: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 101 Spain: Market, By Application, 20172024 (USD Million)

Table 102 Spain: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 103 Spain: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 104 Spain: Dental Applications Market, By Type, 20172024 (USD Million)

Table 105 RoE: Market, By Product, 20172024 (USD Million)

Table 106 RoE: Market, By Application, 20172024 (USD Million)

Table 107 RoE: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 108 RoE: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 109 RoE: Dental Applications Market, By Type, 20172024 (USD Million)

Table 110 APAC: Market, By Country, 20172024 (USD Million)

Table 111 APAC: Market, By Product, 20172024 (USD Million)

Table 112 APAC: Market, By Application, 20172024 (USD Million)

Table 113 APAC: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 114 APAC: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 115 APAC: Dental Applications Market, By Type, 20172024 (USD Million)

Table 116 China: Market, By Product, 20172024 (USD Million)

Table 117 China: Metal Implants and Medical Alloys Market, By Application, 20172024 (USD Million)

Table 118 China: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 119 China: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 120 China: Dental Applications Market, By Type, 20172024 (USD Million)

Table 121 Japan: Market, By Product, 20172024 (USD Million)

Table 122 Japan: Market, By Application, 20172024 (USD Million)

Table 123 Japan: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 124 Japan: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 125 Japan: Dental Applications Market, By Type, 20172024 (USD Million)

Table 126 India: Market, By Product, 20172024 (USD Million)

Table 127 India: Market, By Application, 20172024 (USD Million)

Table 128 India: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 129 India: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 130 India: Dental Applications Market, By Type, 20172024 (USD Million)

Table 131 RoAPAC: Market, By Product, 20172024 (USD Million)

Table 132 RoAPAC: Market, By Application, 20172024 (USD Million)

Table 133 RoAPAC: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 134 RoAPAC: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 135 RoAPAC: Dental Applications Market, By Type, 20172024 (USD Million)

Table 136 Latin America: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 137 Latin America: Market, By Application, 20172024 (USD Million)

Table 138 Latin America: Orthopedic Implants Market, By Type, 20172024 (USD Million)

Table 139 Latin America: Cardiovascular Implants Market, By Type, 20172024 (USD Million)

Table 140 Latin America: Dental Applications Market, By Type, 20172024 (USD Million)

Table 141 Middle East & Africa: Metal Implants and Medical Alloys Market, By Product, 20172024 (USD Million)

Table 142 Middle East & Africa: Market, By Application, 20172024 (USD Million)

Table 143 Middle East & Africa: Orthopedic Applications Market, By Type, 20172024 (USD Million)

Table 144 Middle East & Africa: Cardiovascular Applications Market, By Type, 20172024 (USD Million)

Table 145 Middle East & Africa: Dental Applications Market, By Type, 20172024 (USD Million)

Table 146 Growth Strategy Matrix, 20162019

Table 147 Ranking of the Key Players in the Market, 2018

Table 148 New Product Launches, 20162019

Table 149 Agreements, Partnerships, and Joint Ventures, 20152018

Table 150 Expansions, 2016-2018

Table 151 Acquisitions, 2017-2018

List of Figures (35 Figures)

Figure 1 Metal Implants and Medical Alloys Market Segmentation

Figure 2 Research Design

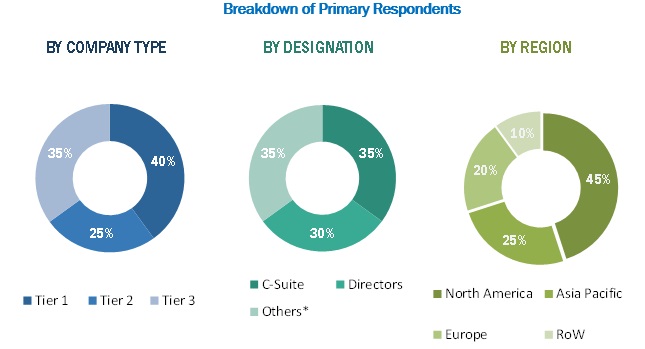

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Market, By Type, 2019 vs 2024 (USD Million)

Figure 8 Market, By Application, 2019 vs 2024 (USD Million)

Figure 9 Market for Orthopedic Applications, By Type, 2019 vs 2024 (USD Million)

Figure 10 Metal Implants and Medical Alloys Market for Cardiovascular Applications, By Type, 2019 vs 2024 (USD Million)

Figure 11 Market for Dental Applications, By Type, 2019 vs 2024 (USD Million)

Figure 12 Geographical Snapshot of the Market

Figure 13 Growing Geriatric Population and the Subsequent Increase in the Incidence of Orthopedic and Cardiovascular Disorders is Expected to Drive Market Growth

Figure 14 The US Dominated the Market in 2018

Figure 15 APAC to Register the Highest Growth Rate During the Forecast Period (20192024)

Figure 16 China Accounted for the Largest Share of the APAC Metal Implants and Medical Alloys Market in 2018

Figure 17 Developing Markets to Register A Higher Growth Rate During the Forecast Period

Figure 18 Canada: Approval Process for Class Iii Medical Devices

Figure 19 Europe: CE Approval Process

Figure 20 Titanium Segment Will Continue to Dominate the Market During the Forecast Period

Figure 21 Orthopedic Applications Will Dominate the Market During the Forecast Period

Figure 22 Market: Geographic Snapshot

Figure 23 North America: Market Snapshot

Figure 24 Europe: Metal Implants and Medical Alloys Market Snapshot

Figure 25 APAC: Market Snapshot

Figure 26 New Product LaunchesKey Growth Strategy Adopted By Market Players Between 2016 & 2019

Figure 27 Competitive Leadership Mapping

Figure 28 Battle for Market Share: New Product Launches Was the Key Strategy Adopted By Prominent Players

Figure 29 Carpenter Technology Corporation: Company Snapshot

Figure 30 Royal DSM: Company Snapshot

Figure 31 Johnson Matthey: Company Snapshot

Figure 32 ATI: Company Snapshot

Figure 33 Ametek Inc.: Company Snapshot

Figure 34 Materion Corporation: Company Snapshot

Figure 35 Aperam S.A.: Company Snapshot

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Business, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the metal implants and medical alloys market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, industry experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Industry experts from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of companies manufacturing metal implants and medical alloys products, key opinion leaders, and suppliers and distributors; whereas, industry experts from the demand side include researchers, biotechnologists, R&D heads, and related key personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and top-down approach (assessment of utilization/adoption/penetration trends, by type, application, and region).

Data Triangulation

After arriving at the market size, the total metal implants and medical alloys market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the metal implants and medical alloys market by type, application, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions (along with major countries)North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers and acquisitions; new product/technology launches; expansions; collaborations and agreements; and R&D activities of the leading players in the metal implants and medical alloys market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the Latin American metal implants and medical alloys market into Brazil, Mexico, and the Rest of Latin America

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metal Implants and Medical Alloys Market