Metal Nanoparticles Market by Metal (Platinum, Gold, Silver, Iron, Copper, Nickel), Process (Chemical, Physical), End-use (Pharmaceutical & Healthcare, Electrical & electronics, Catalyst, Personal care & cosmetics) and Region - Global Forecast to 2026

Updated on : April 15, 2024

Metal Nanoparticles Market

The global metal nanoparticles market was valued at USD 2.4 billion in 2021 and is projected to reach USD 4.2 billion by 2026, growing at 11.5% cagr from 2021 to 2026. Growing application areas of metal nanoparticles coupled with increasing demand for gold nanoparticles in the pharmaceutical & healthcare industry are major factors expected to drive the growth of the metal nanoparticles market globally. Also, the rapid growth of the healthcare sector is one of the other factors expected to drive the growth of the global market for metal nanoparticles.

Attractive Opportunities in the Metal Nanoparticles Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global metal nanoparticles market

The ongoing COVID-19 pandemic has had a significant impact on the metal nanoparticles market. The outbreak has distorted operational efficiency and disrupted the value chains due to the sudden shutdown of national and international boundaries, which has created revenue loss and damage. The disruptions in the production and supply chain have had a negative impact on the metal nanoparticles market. The implementation of lockdown in various countries along with travel restrictions has lessened the global supply of products along with a reduced logistic operation.

In the US, a group of researchers at the University of Maryland claimed that they have developed a diagnostic test that can detect the novel coronavirus that causes COVID-19 within 10 minutes and the results will be visible with naked eyes. The test is a simple colorimetry-based assay, which uses gold nanoparticles that are capped with the nucleic acid sequence of the nucleocapsid phosphoprotein of the SARS-COV-2 virus. Apart from this, Sugentech, Inc. (South Korea) developed SGTi-flex COVID-19 IgM/IgG test kit, which is a gold nanoparticle-based immunochromatographic test kit that determines COVID-19's IgM and IgG antibodies. Thus, an increased usage of gold nanoparticles in the pharmaceutical industry is having a positive impact on the metal nanoparticles market.

Metal Nanoparticles Market Dynamics

Driver: Growing popularity of gold nanoparticles in pharmaceutical & healthcare industry

In the realm of nanomedicine and nanotechnology, gold nanoparticles are the most extensively investigated type of nanometal, owing to their versatility. Its unique electronic, optical, and catalytic properties; non-immunogenicity; facile surface chemistry; biocompatibility; and antimicrobial properties contribute to the potential applications of gold nanoparticles in the pharmaceutical & healthcare industry. The high atomic mass of gold nanoparticles enables them to absorb more radiation as compared to soft tissue cells and makes them ideal for enhancing the radiation dose for the treatment of tumors.

Various shapes of gold nanoparticles can also be synthesized easily. Moreover, they are non-toxic, biocompatible, have a distinct surface effect, macroscopic quantum tunneling effect, ultra-small size, and presence of surface plasmon resonance (SPR) bands. These specific properties have enabled gold nanoparticles to become potential materials for varied biomedical applications comprising molecular imaging, bio-sensing, and drug carriers.

Restraint: Complex and exclusive manufacturing of nanoparticles

It is of paramount importance the selection of the appropriate method combining synthesis of metal nanoparticles with required properties and limited impurities as well as scalability of the technique. Their industrial use faces many obstacles as there is no suitable regulatory framework and guidance on safety requirements; specific provisions have yet to be established. Moreover, regulations related to the right of intellectual properties as well as the absence of an appropriate framework for patent registration are issues delaying the process of products’ industrial application. Hence, complex and exclusive manufacturing of nanoparticles is one of the major factors expected to restrain the growth of the global metal nanoparticles market. Undoubtedly, the existing gap between basic research relating metal nanoparticles and their application in real life will be overcome in the coming decade. Also, the high cost of these metal nanoparticles is one of the major factors hindering the growth of the target market to a certain extent.

Opportunity: Metal nanoparticles as emerging green catalysts

Green nanotechnology is defined as the technology applied for building clean technology by which one can reduce the potential risks of environment and also improve human health conditions. It is linked with the implementation of products of nanotechnology and its process of manufacturing. Green nanotechnology synthesizes new nanoproducts with improved properties in such a way that they can substitute some of the existing low-quality products. The main motive of developing new nanoproducts is to enhance sustainability and also to make them more environment friendly. In particular, nanoscale materials (e.g., metal nanoparticles) can be defined as those having characteristic length scale lying within the nanometric range, that is, in the range between one and several hundreds of nanometers. Within this length scale, the properties of matter are sufficiently different from individual atoms/molecules or from bulk materials.

Challenge: Volatile prices of metals

Metal nanoparticles are derived from various metals, such as gold, silver, platinum/palladium, copper, iron, and magnesium. The price index of the metal market is highly volatile; these price fluctuations further influence the final pricing of metal nanoparticles. The price of precious metals is volatile, wherein severe price fluctuations in the metals market pose a challenge for companies that include metals in their value creation chain. The factors that directly influence the price of metals include production costs, demand and supply conditions, money supply, and geopolitical stability. The fluctuations in metal prices discourage manufacturers of metal nanoparticles from producing these nanoparticles in large quantities.

Metal Nanoparticles Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Silver nanoparticles was the most extensively consumed metal in the metal nanoparticles market in 2020.

Silver nanoparticles are colloidal metal nanoparticles, ranging up to 100nm in size. They are adopted in a wide range of industries such as engineering, biomedicine, and manufacturing. These products find growing adoption in active food packaging in combination with either edible or non-biodegradable polymers owing to their high antiviral, anti-yeast, antifungal, and antimicrobial properties. Silver nanoparticles are increasingly incorporated in electronics owing to its high electrical conductivity and ability to be blended with various conductive polymers such as polyaniline, polythiophene, and polypyrrole. Favorable government regulations, growing demand for handheld consumer electronic devices, and growing work-from-home policies in the wake of the coronavirus pandemic will drive the electronic industry in the short to medium term and boost the silver nanoparticles market expansion.

Physical synthesis process to witness the second largest market growth during the forecast period.

The physical synthesis process is projected to be the second-largest segment of the metal nanoparticles market during the forecast period. The physical methods employed in the preparation of metal nanoparticles include ball milling, physical vapor deposition, ultrasonication, thermal evaporation, photoirradiation, laser ablation, spray pyrolysis, radiolysis, pulsed laser ablation, plasma reduction method, and so forth. Each physical method has its own advantages and limitations. For instance, in the case of physical vapor deposition, the method is expensive and generates a low volume of material.

Metal nanoparticles are extensively used as catalyst.

In the catalyst industry, metal nanoparticles find applications in large industrial processes, such as refining and chemical synthesis, and various industries comprising automotive, pharmaceutical, and petrochemicals. Silver, platinum, nickel, and gold nanoparticles are some of the nano-sized metals used in catalysts. Metal nanoparticle catalysts play a vital role in helping refiners to meet fuel standards, better managing operational efficiency, enhancing conversion & selectivity, and keeping pace with the changing clean fuel trends.

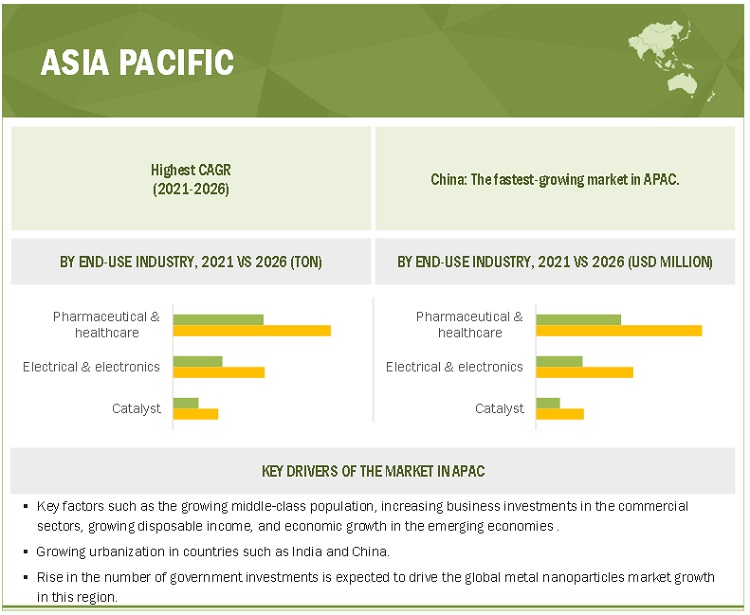

Rapid economic growth in China, and India is expected to propel the Asia Pacific metal nanoparticles market in the coming years.

Asia Pacific is the fastest-growing region for metal nanoparticles market. Innovation, affordability, and rising household incomes, especially in emerging economies of Asia Pacific, have resulted in high demand for consumer electronic products in the region. Countries of this region have numerous large industrial groups with extensive manufacturing capabilities in sectors directly relevant to electronic devices, such as microelectronics, optoelectronics, printed electronics, photovoltaics, and flexible displays. The automotive industry is also well developed in this region, and in recent years greater emphasis has been laid on manufacturing electric vehicles. Countries of this region have become adept in terms of research capabilities due to government support, which includes government laboratories, universities, and company R&D centers.

The growth in the region’s pharmaceutical & healthcare industry is also expected to create growth opportunities for the metal nanoparticles market as these nanoparticles are widely used in the diagnosis as well as therapeutics of chronic diseases and are also employed as drug carriers in the pharmaceutical & healthcare industry. Factors, such as increasing life science R&D activities on nanotechnology, presence of key nanotechnology market players, public-private investments, increasing R&D outsourcing to Asian nations, and rising number of conferences and events in Asian countries are propelling the growth of the Asia Pacific metal nanoparticles market.

Metal Nanoparticles Market Players

Major players operating in the global metal nanoparticles market include American Elements (US), Nanoshel LLC (US), Nanostructured & Amorphous Materials (US), EPRUI Nanoparticles & Microspheres (China), US Research Nanomaterials (US), Tanaka Holdings (Japan), Meliorum Technology (US), Nanocomposix (US), BBI Group (UK), Sigma-Aldrich (US), and Nanocs (US) among many others.

Metal Nanoparticles Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million/USD Thousand), Volume (Ton/KG) |

|

Segments |

Metal, Synthesis Process, End-use Industry |

|

Regions |

North America, Europe, APAC, the Middle East & Africa, and South America |

|

Companies |

American Elements (US), Nanoshel LLC (US), Nanostructured & Amorphous Materials (US), EPRUI Nanoparticles & Microspheres (China), US Research Nanomaterials (US), Tanaka Holdings (Japan), Meliorum Technology (US), Nanocomposix (US), BBI Group (UK), Sigma-Aldrich (US), and Nanocs (US) |

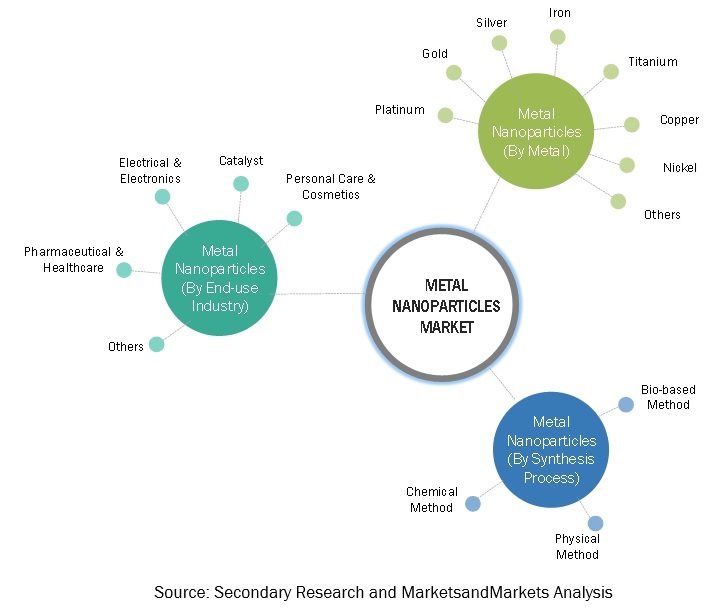

This research report categorizes the metal nanoparticles market based on metal, synthesis process, end-use industry, and region.

Metal Nanoparticles Market based on the Metal:

- Platinum/Palladium

- Gold

- Silver

- Copper

- Nickel

- Iron

- Others

Metal Nanoparticles Market based on the Synthesis process:

- Chemical

- Physical

- Bio based

Metal Nanoparticles Market based on the End-use industry:

- Pharmaceutical & healthcare

- Electrical & electronics

- Catalyst

- Personal care & cosmetics

- Others

Metal Nanoparticles Market based on the Region:

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2021, nanoComposix signed an agreement with BIOZOL Diagnostica Vertrieb GmbH to broaden the distribution of nanoComposix products to customers throughout Germany and Austria. BIOZOL Diagnostica Vertrieb GmbH markets and distributes products for immunology, cell biology, molecular biology, biochemistry, and human and veterinary diagnostics, such as antibodies, recombinant proteins, ELISA/EIA, detection kits, biochemicals, and further reagents for cell culture, flow cytometry, immunohistology, and cytogenetics. The partnership will widen its geographical reach in Germany.

- In September 2018, Tanaka Holdings developed a wire forming technology (Low-temperature sintered silver nanometal printing technique) capable of sintering at a low temperature of 70°C using TANAKA Kikinzoku Kogyo’s low-temperature sintered silver nano ink, and a full-surface silver metal film forming technology using existing processes. This technology will contribute to thinner devices, increased flexibility, and higher image quality of smartphone touch panels, organic electroluminescence displays, and other applications.

Frequently Asked Questions (FAQ):

What is the current size of the global metal nanoparticles market?

The global metal nanoparticles market is estimated to be USD 2.4 billion in 2021 and is projected to reach USD 4.2 billion by 2026, at a CAGR of 11.5%.

What are the factors influencing the growth of metal nanoparticles market?

The growth of this market can be attributed to rising demand from the key end-use industries.

What is the biggest restraint for metal nanoparticles?

The toxicity caused due to metal nanoparticles is restraining the growth of the market.

Who are the major manufacturers?

Major manufacturers include American Elements (US), Nanoshel LLC (US), Nanostructured & Amorphous Materials (US), EPRUI Nanoparticles & Microspheres (China), US Research Nanomaterials (US), Tanaka Holdings (Japan), Meliorum Technology (US), Nanocomposix (US), BBI Group (UK), Sigma-Aldrich (US), and Nanocs (US), among others.

What is the impact of COVID-19 on the overall metal nanoparticles market?

Metal nanoparticles are used in industries, such as pharmaceutical & healthcare, electrical electronics, catalyst, personal care & cosmetics, and others. Due to the ongoing pandemic, these industries has been severely affected throughout the world. Manpower shortage, logistical restrictions, material unavailability, and other restrictions have slowed the growth of the industry in a considerable manner.

What will be the growth prospects of the metal nanoparticles market?

Growing pharmaceutical & healthcare industry is expected to offer significant growth opportunities to manufacturers of metal nanoparticles. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 INCLUSIONS AND EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 PRIMARY INTERVIEWS

2.1.3.1 Primary interviews – demand and supply sides

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for arriving at market size using top-down analysis

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach for arriving at market size using bottom-up analysis

2.3 DATA TRIANGULATION

2.4 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS & RISKS ASSOCIATED WITH METAL NANOPARTICLES MARKET

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN METAL NANOPARTICLES MARKET

4.2 METAL NANOPARTICLES MARKET, BY METAL

4.3 METAL NANOPARTICLES MARKET, BY SYNTHESIS PROCESS

4.4 METAL NANOPARTICLES MARKET, BY END-USE INDUSTRY

4.5 METAL NANOPARTICLES MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Rising focus of government on nanotechnology research

5.2.1.2 Growing popularity of gold nanoparticles in pharmaceutical & healthcare industry

5.2.1.3 Increasing application areas of nanoparticles

5.2.2 RESTRAINTS

5.2.2.1 Toxicity caused due to nanoparticles

5.2.3 OPPORTUNITIES

5.2.3.1 Growing pharmaceutical & healthcare industry

5.2.4 CHALLENGES

5.2.4.1 Volatile prices of metals

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM MAPPING

5.5 TRADE ANALYSIS

5.6 REGULATORY ANALYSIS

5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.7 PRICING ANALYSIS

5.8 TECHNOLOGY ANALYSIS

5.9 KEY CONFERENCES & EVENTS IN 2022-2023

5.10 CASE STUDY ANALYSIS

5.10.1 AMERICAN ELEMENTS DEVELOPS NEW PRECIOUS METAL CATALYST FOR GREENER ROCKET FUEL

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 DOCUMENT TYPE

5.11.3 INSIGHT

5.11.4 LEGAL STATUS OF PATENTS

5.11.5 TOP COMPANIES/APPLICANTS

5.12 IMPACT OF COVID-19 ON METAL NANOPARTICLES MARKET

5.12.1 COVID-19 IMPACT ON END-USE INDUSTRIES

5.12.1.1 Pharmaceutical & Healthcare

5.12.1.2 Personal Care & Cosmetics

5.12.1.3 Electrical & Electronics

5.12.1.4 Catalyst

5.12.1.5 Others

6 METAL NANOPARTICLES MARKET, BY METAL (Page No. - 68)

6.1 INTRODUCTION

6.2 PLATINUM/PALLADIUM

6.2.1 PHYSICAL AND CHEMICAL PROPERTIES SUITABLE FOR RESEARCH APPLICATIONS

6.3 GOLD

6.3.1 LOW MELTING POINT LEADING TO INCREASING DEMAND IN THIS SEGMENT

6.4 SILVER

6.4.1 HIGH-TEMPERATURE RESISTANCE AND ELECTRICAL CONDUCTIVITY RESULTING IN HIGH DEMAND FOR SILVER

6.5 COPPER

6.5.1 INCREASING DEMAND FROM ELECTRICAL & ELECTRONICS INDUSTRY

6.6 NICKEL

6.6.1 THERMAL RESISTANCE, BETTER REACTIVITY, SEMICONDUCTOR CONDUCTION PROPERTIES, DRIVING DEMAND IN THIS SEGMENT

6.7 IRON

6.7.1 INCREASING APPLICATIONS OF METAL TO DRIVE SEGMENT

6.8 OTHERS

7 METAL NANOPARTICLES MARKET, BY SYNTHESIS PROCESS (Page No. - 84)

7.1 INTRODUCTION

7.2 CHEMICAL

7.2.1 VERSATILITY, LOW TEMPERATURE OF PROCESSING, AND EASY SHAPING TO DRIVE SEGMENT

7.3 PHYSICAL

7.3.1 NO USE OF TOXIC CHEMICALS, PURITY, UNIFORM SIZE AND SHAPE TO LEAD GROWTH OF SEGMENT IN MARKET

7.4 BIO BASED

7.4.1 LOW COST AND ENVIRONMENT-FRIENDLY NATURE OF BIO-BASED METHODS TO DRIVE SEGMENT

8 METAL NANOPARTICLES MARKET, BY END-USE INDUSTRY (Page No. - 89)

8.1 INTRODUCTION

8.2 PHARMACEUTICAL & HEALTHCARE

8.2.1 PHARMACEUTICAL & HEALTHCARE SEGMENT LED METAL NANOPARTICLES MARKET IN 2020

8.2.2 DRUG DELIVERY

8.2.3 CANCER TREATMENT

8.2.4 BIOIMAGING

8.2.5 OTHERS

8.3 ELECTRICAL & ELECTRONICS

8.3.1 EMERGING TREND OF MINIATURIZATION IN ELECTRICAL & ELECTRONICS INDUSTRY TO DRIVE SEGMENT

8.3.2 CIRCUIT BOARDS

8.3.3 BATTERIES

8.3.4 CONNECTING RESISTORS

8.3.5 FUNCTIONAL INKS

8.3.6 DESIGNING CHIPS

8.3.7 OTHERS

8.4 CATALYST

8.4.1 VARIOUS APPLICATIONS OF CATALYSTS IN DIFFERENT INDUSTRIES DRIVING SEGMENT

8.4.2 REFINERY

8.4.3 INDUSTRIAL

8.4.4 AUTOMOTIVE

8.5 PERSONAL CARE & COSMETICS

8.5.1 VERSATILITY AND UNIQUE PROPERTIES OF METAL NANOPARTICLES MAKE THEM SUITABLE FOR USE IN PERSONAL CARE & CONSUMER PRODUCTS

8.5.2 COSMECEUTICALS

8.5.3 SKIN CARE

8.5.4 HAIR CARE

8.6 OTHERS

9 METAL NANOPARTICLES MARKET, BY REGION (Page No. - 109)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 IN NORTH AMERICA

9.2.2 US

9.2.2.1 Continued investments in national nanotechnology initiatives

9.2.3 CANADA

9.2.3.1 Supportive rewarding systems for research activities related to nanoparticles

9.2.4 MEXICO

9.2.4.1 Attractive destination for investments in pharmaceutical sector

9.3 ASIA PACIFIC

9.3.1 IMPACT OF COVID-19 IN ASIA PACIFIC

9.3.2 CHINA

9.3.2.1 China to remain dominant market for metal nanoparticles in Asia Pacific

9.3.3 JAPAN

9.3.3.1 Increasing government initiatives to drive market

9.3.4 INDIA

9.3.4.1 Increasing demand in the electrical & electronics industry to drive metal nanoparticles market

9.3.5 SOUTH KOREA

9.3.5.1 Rapid economic growth and a strong healthcare sector to boost market

9.3.6 AUSTRALIA

9.3.6.1 Government investments in nanotechnology research to influence market growth

9.3.7 REST OF ASIA PACIFIC

9.4 EUROPE

9.4.1 IMPACT OF COVID-19 IN EUROPE

9.4.2 GERMANY

9.4.2.1 Smart manufacturing and e-mobility to drive the German electrical & electronics industry

9.4.3 UK

9.4.3.1 Significant application of metal nanoparticles in wastewater treatment

9.4.4 FRANCE

9.4.4.1 Demand for innovative drug solutions creating scope for metal nanoparticles in France’s pharmaceutical & healthcare industry

9.4.5 ITALY

9.4.5.1 Economic recovery, electrical & electronics industry growth, and substantial refining capacity increasing demand for metal nanoparticles

9.4.6 RUSSIA

9.4.6.1 Government support and investments in nanotechnology to drive market

9.4.7 SPAIN

9.4.7.1 Demand for innovative medicines to boost domestic pharmaceuticals market

9.4.8 REST OF EUROPE

9.5 MIDDLE EAST & AFRICA

9.5.1 IMPACT OF COVID-19 IN MIDDLE EAST & AFRICA

9.5.2 TURKEY

9.5.2.1 One of the major exporters and producers of electrical & electronics products

9.5.3 SAUDI ARABIA

9.5.3.1 Positive trend in Saudi industrial exports of electrical machines and equipment & tools to drive market

9.5.4 UAE

9.5.4.1 Rising demand for portable consumer electronics and supportive government initiatives to attract manufacturers

9.5.5 SOUTH AFRICA

9.5.5.1 Supportive government initiatives enhancing healthcare system to boost domestic healthcare sector

9.5.6 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 IN SOUTH AMERICA

9.6.2 BRAZIL

9.6.2.1 Manufacturers establishing electronics manufacturing plants

9.6.3 ARGENTINA

9.6.3.1 Rising government support to promote electronics manufacturing

9.6.4 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 220)

10.1 INTRODUCTION

10.2 MARKET EVALUATION FRAMEWORK

10.3 MARKET RANKING ANALYSIS

10.3.1 AMERICAN ELEMENTS

10.3.2 NANOSHEL LLC

10.3.3 NANOSTRUCTURED & AMORPHOUS MATERIALS

10.3.4 EPRUI NANOPARTICLES & MICROSPHERES

10.3.5 US RESEARCH NANOMATERIALS

10.4 COMPANY EVALUATION MATRIX (TIER 1)

10.4.1 STAR

10.4.2 PERVASIVE

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

10.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 STARTING BLOCKS

10.5.4 DYNAMIC COMPANIES

10.6 COMPETITIVE BENCHMARKING

11 COMPANY PROFILES (Page No. - 229)

11.1 KEY COMPANIES

11.1.1 AMERICAN ELEMENTS

11.1.1.1 Business overview

11.1.1.2 Products offered

11.1.1.3 MnM view

11.1.1.3.1 Key strengths/Right to win

11.1.1.3.2 Weaknesses and competitive threats

11.1.2 NANOSHEL LLC

11.1.2.1 Business overview

11.1.2.2 Products offered

11.1.2.3 MnM view

11.1.2.3.1 Key strengths/Right to win

11.1.2.3.2 Strategic choices

11.1.2.3.3 Weaknesses and competitive threats

11.1.3 NANOSTRUCTURED & AMORPHOUS MATERIALS

11.1.3.1 Business overview

11.1.3.2 Products offered

11.1.3.3 MnM view

11.1.3.3.1 Key strengths/Right to win

11.1.3.3.2 Strategic choices

11.1.3.3.3 Weaknesses and competitive threats

11.1.4 EPRUI NANOPARTICLES & MICROSPHERES

11.1.4.1 Business overview

11.1.4.2 Products offered

11.1.4.3 MnM view

11.1.4.3.1 Key strengths/Right to win

11.1.4.3.2 Strategic choices

11.1.4.3.3 Weaknesses and competitive threats

11.1.5 US RESEARCH NANOMATERIALS

11.1.5.1 Business overview

11.1.5.2 Products offered

11.1.5.3 MnM view

11.1.5.3.1 Key strengths/Right to win

11.1.5.3.2 Strategic choices

11.1.5.3.3 Weaknesses and competitive threats

11.1.6 TANAKA HOLDINGS

11.1.6.1 Business overview

11.1.6.2 Products offered

11.1.6.3 Recent developments: New product launches

11.1.6.4 MnM view

11.1.7 MELIORUM TECHNOLOGY

11.1.7.1 Business overview

11.1.7.2 Products offered

11.1.7.3 MnM view

11.1.8 NANOCOMPOSIX

11.1.8.1 Products offered

11.1.8.2 Recent developments: Deals

11.1.8.3 MnM view

11.1.9 BBI GROUP

11.1.9.1 Business overview

11.1.9.2 Products offered

11.1.10 SIGMA-ALDRICH

11.1.10.1 Business overview

11.1.10.2 Products offered

11.1.11 NANOCS

11.1.11.1 Business overview

11.1.11.2 Products offered

11.2 OTHER COMPANIES

11.2.1 STREM CHEMICALS

11.2.2 CLINE SCIENTIFIC

11.2.3 NANO LABS

11.2.4 CYTODIAGNOSTICS

11.2.5 NANOPARTZ

11.2.6 HONGWU INTERNATIONAL GROUP

11.2.7 INNOVA BIOSCIENCES

11.2.8 BLACKTRACE HOLDINGS

11.2.9 QUANTUMSPHERE

11.2.10 SEASHELL TECHNOLOGY

11.2.11 PARTICULAR GMBH

11.2.12 PLASMACHEM

11.2.13 SKYSPRING NANOMATERIALS

12 APPENDIX (Page No. - 261)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (352 TABLES)

TABLE 1 METAL NANOPARTICLES MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 PRECIOUS METALS IMPORT DATA, 2020 (USD THOUSAND)

TABLE 3 PRECIOUS METALS EXPORT DATA, 2020 (USD THOUSAND)

TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 METAL NANOPARTICLES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

TABLE 6 PATENTS BY LG CHEMICAL LTD.

TABLE 7 PATENTS BY XEROX CORPORATION

TABLE 8 PATENTS BY KOREA ADVANCED INSTITUTE SCIENCE AND TECHNOLOGY

TABLE 9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 10 METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD MILLION)

TABLE 11 METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD MILLION)

TABLE 12 METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (TON)

TABLE 13 METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (TON)

TABLE 14 PLATINUM/PALLADIUM: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 15 PLATINUM/PALLADIUM: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 16 PLATINUM/PALLADIUM: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 17 PLATINUM/PALLADIUM: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 18 GOLD: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 19 GOLD: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 20 GOLD: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 21 GOLD: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 22 SILVER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 23 SILVER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 24 SILVER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 25 SILVER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 26 COPPER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 27 COPPER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 28 COPPER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 29 COPPER: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 30 NICKEL: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 31 NICKEL: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 32 NICKEL: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 33 NICKEL: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 34 IRON: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 35 IRON: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 36 IRON: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 37 IRON: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 38 OTHER METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 39 OTHER METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 40 OTHER METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 41 OTHER METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 42 METAL NANOPARTICLES MARKET SIZE, BY SYNTHESIS PROCESS, 2017–2020 (USD MILLION)

TABLE 43 METAL NANOPARTICLES MARKET SIZE, BY SYNTHESIS PROCESS, 2021–2026 (USD MILLION)

TABLE 44 METAL NANOPARTICLES MARKET SIZE, BY SYNTHESIS PROCESS, 2017–2020 (TON)

TABLE 45 METAL NANOPARTICLES MARKET SIZE, BY SYNTHESIS PROCESS, 2021–2026 (TON)

TABLE 46 METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 47 METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 48 METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 49 METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 50 PHARMACEUTICAL & HEALTHCARE: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 51 PHARMACEUTICAL & HEALTHCARE: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 52 PHARMACEUTICAL & HEALTHCARE: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 53 PHARMACEUTICAL & HEALTHCARE: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 54 ELECTRICAL & ELECTRONICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 55 ELECTRICAL & ELECTRONICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 56 ELECTRICAL & ELECTRONICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 57 ELECTRICAL & ELECTRONICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 58 CATALYST: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 59 CATALYST: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 60 CATALYST: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 61 CATALYST: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 62 PERSONAL CARE & COSMETICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 63 PERSONAL CARE & COSMETICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 64 PERSONAL CARE & COSMETICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 65 PERSONAL CARE & COSMETICS: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 66 OTHER END-USE INDUSTRIES: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 67 OTHER END-USE INDUSTRIES: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD THOUSAND)

TABLE 68 OTHER END-USE INDUSTRIES: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (KG)

TABLE 69 OTHER END-USE INDUSTRIES: METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (KG)

TABLE 70 INTERIM ECONOMIC OUTLOOK FORECAST, 2019 TO 2021

TABLE 71 METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 73 METAL NANOPARTICLES MARKET SIZE, BY REGION, 2017–2020 (TON)

TABLE 74 METAL NANOPARTICLES MARKET SIZE, BY REGION, 2021–2026 (TON)

TABLE 75 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 76 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 77 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (KG)

TABLE 78 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (KG)

TABLE 79 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 80 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 81 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 82 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 83 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 84 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 85 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 86 NORTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 87 US: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 88 US: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 89 US: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 90 US: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 91 US: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 92 US: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 93 US: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 94 US: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 95 CANADA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 96 CANADA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 97 CANADA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 98 CANADA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 99 CANADA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 100 CANADA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 101 CANADA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 102 CANADA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 103 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 104 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 105 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 106 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 107 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 108 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 109 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 110 MEXICO: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 111 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 112 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 113 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (KG)

TABLE 114 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (KG)

TABLE 115 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 116 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 117 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 118 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 119 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 120 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 121 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 122 ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 123 CHINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 124 CHINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 125 CHINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 126 CHINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 127 CHINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 128 CHINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 129 CHINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 130 CHINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 131 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 132 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 133 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 134 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 135 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 136 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 137 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 138 JAPAN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 139 INDIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 140 INDIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 141 INDIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 142 INDIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 143 INDIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 144 INDIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 145 INDIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 146 INDIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 147 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 148 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 149 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 150 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 151 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 152 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 153 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 154 SOUTH KOREA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 155 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 156 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 157 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 158 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 159 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 160 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 161 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 162 AUSTRALIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 163 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 164 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 165 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 166 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 167 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 168 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 169 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 170 REST OF ASIA PACIFIC: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 171 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 172 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 173 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (KG)

TABLE 174 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (KG)

TABLE 175 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 176 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 177 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 178 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 179 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 180 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 181 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 182 EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 183 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 184 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 185 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 186 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 187 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 188 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 189 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 190 GERMANY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 191 UK: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 192 UK: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 193 UK: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 194 UK: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 195 UK: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 196 UK: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 197 UK: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 198 UK: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 199 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 200 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 201 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 202 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 203 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 204 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 205 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 206 FRANCE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 207 ITALY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 208 ITALY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 209 ITALY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 210 ITALY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 211 ITALY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 212 ITALY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 213 ITALY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 214 ITALY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 215 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 216 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 217 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 218 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 219 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 220 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 221 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 222 RUSSIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 223 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 224 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 225 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 226 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 227 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 228 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 229 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 230 SPAIN: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 231 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 232 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 233 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 234 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 235 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 236 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 237 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 238 REST OF EUROPE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 239 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 240 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 241 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (KG)

TABLE 242 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (KG)

TABLE 243 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 244 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 245 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 246 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 247 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 248 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 249 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 250 MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 251 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 252 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 253 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 254 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 255 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 256 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 257 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 258 TURKEY: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 259 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 260 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 261 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 262 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 263 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 264 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 265 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 266 SAUDI ARABIA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 267 UAE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 268 UAE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 269 UAE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 270 UAE: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 271 UAE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 272 UAE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 273 UAE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 274 UAE: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 275 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 276 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 277 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 278 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 279 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 280 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 281 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 282 SOUTH AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 283 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 284 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 285 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 286 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 287 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 288 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 289 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 290 REST OF MIDDLE EAST & AFRICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 291 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (USD THOUSAND)

TABLE 292 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (USD THOUSAND)

TABLE 293 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2017–2020 (KG)

TABLE 294 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY COUNTRY, 2021–2026 (KG)

TABLE 295 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 296 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 297 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 298 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 299 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 300 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 301 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 302 SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 303 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 304 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 305 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 306 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 307 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 308 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 309 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 310 BRAZIL: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 311 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 312 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 313 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 314 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 315 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 316 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 317 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 318 ARGENTINA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 319 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (USD THOUSAND)

TABLE 320 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (USD THOUSAND)

TABLE 321 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2017–2020 (KG)

TABLE 322 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY METAL, 2021–2026 (KG)

TABLE 323 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD THOUSAND)

TABLE 324 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD THOUSAND)

TABLE 325 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KG)

TABLE 326 REST OF SOUTH AMERICA: METAL NANOPARTICLES MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KG)

TABLE 327 METAL NANOPARTICLES MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 328 METAL NANOPARTICLES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

TABLE 329 AMERICAN ELEMENTS: BUSINESS OVERVIEW

TABLE 330 NANOSHEL LLC: BUSINESS OVERVIEW

TABLE 331 NANOSTRUCTURED & AMORPHOUS MATERIALS: BUSINESS OVERVIEW

TABLE 332 EPRUI NANOPARTICLES & MICROSPHERES: BUSINESS OVERVIEW

TABLE 333 US RESEARCH NANOMATERIALS: BUSINESS OVERVIEW

TABLE 334 TANAKA HOLDINGS: BUSINESS OVERVIEW

TABLE 335 MELIORUM TECHNOLOGY: BUSINESS OVERVIEW

TABLE 336 NANOCOMPOSIX: BUSINESS OVERVIEW

TABLE 337 BBI GROUP: BUSINESS OVERVIEW

TABLE 338 SIGMA-ALDRICH: BUSINESS OVERVIEW

TABLE 339 NANOCS: BUSINESS OVERVIEW

TABLE 340 STREM CHEMICALS: COMPANY OVERVIEW

TABLE 341 CLINE SCIENTIFIC: COMPANY OVERVIEW

TABLE 342 NANO LABS: COMPANY OVERVIEW

TABLE 343 CYTODIAGNOSTICS: COMPANY OVERVIEW

TABLE 344 NANOPARTZ: COMPANY OVERVIEW

TABLE 345 HONGWU INTERNATIONAL GROUP: COMPANY OVERVIEW

TABLE 346 INNOVA BIOSCIENCES: COMPANY OVERVIEW

TABLE 347 BLACKTRACE HOLDINGS: COMPANY OVERVIEW

TABLE 348 QUANTUMSPHERE: COMPANY OVERVIEW

TABLE 349 SEASHELL TECHNOLOGY: COMPANY OVERVIEW

TABLE 350 PARTICULAR GMBH: COMPANY OVERVIEW

TABLE 351 PLASMACHEM: COMPANY OVERVIEW

TABLE 352 SKYSPRING NANOMATERIALS: COMPANY OVERVIEW

LIST OF FIGURES (34 FIGURES)

FIGURE 1 METAL NANOPARTICLES MARKET SEGMENTATION

FIGURE 2 METAL NANOPARTICLES MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION APPROACH

FIGURE 4 TOP-DOWN APPROACH

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 METAL NANOPARTICLES MARKET: DATA TRIANGULATION

FIGURE 7 GOLD TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

FIGURE 8 CHEMICAL SYNTHESIS PROCESS TO LEAD MARKET

FIGURE 9 PHARMACEUTICAL & HEALTHCARE INDUSTRY TO LEAD METAL NANOPARTICLES MARKET

FIGURE 10 NORTH AMERICA LED METAL NANOPARTICLES MARKET IN 2020

FIGURE 11 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN METAL NANOPARTICLES MARKET DURING FORECAST PERIOD

FIGURE 12 SILVER TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 13 CHEMICAL PROCESS SEGMENT TO WITNESS HIGHER CAGR

FIGURE 14 PHARMACEUTICAL & HEALTHCARE END-USE INDUSTRY TO LEAD MARKET BY 2026

FIGURE 15 MARKET IN CHINA TO REGISTER HIGHEST CAGR

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METAL NANOPARTICLES MARKET

FIGURE 17 METAL NANOPARTICLES MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 METAL NANOPARTICLES ECOSYSTEM

FIGURE 19 GRANTED PATENTS

FIGURE 20 PUBLICATION TRENDS - LAST 10 YEARS

FIGURE 21 LEGAL STATUS

FIGURE 22 TOP JURISDICTION-BY DOCUMENT

FIGURE 23 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO. OF PATENTS

FIGURE 24 GOLD NANOPARTICLES TO BE FASTEST-GROWING SEGMENT, BY METAL

FIGURE 25 CHEMICAL SYNTHESIS PROCESS REMAINS LARGEST SEGMENT IN METAL NANOPARTICLES MARKET

FIGURE 26 PHARMACEUTICAL & HEALTHCARE INDUSTRY WAS LARGEST END-USE SEGMENT IN 2021

FIGURE 27 CHINA TO BE FASTEST-GROWING MARKET

FIGURE 28 NORTH AMERICA: METAL NANOPARTICLES MARKET SNAPSHOT

FIGURE 29 ASIA PACIFIC: METAL NANOPARTICLES MARKET SNAPSHOT

FIGURE 30 ELECTRICAL & ELECTRONICS TO BE FASTEST-GROWING INDUSTRY IN EUROPE

FIGURE 31 PARTNERSHIP WAS MOST ADOPTED STRATEGY BY METAL NANOPARTICLES MANUFACTURERS

FIGURE 32 RANKING OF TOP FIVE PLAYERS IN METAL NANOPARTICLES MARKET, 2020

FIGURE 33 METAL NANOPARTICLES MARKET: COMPANY EVALUATION MATRIX, 2020

FIGURE 34 START-UP/SMES EVALUATION MATRIX FOR METAL NANOPARTICLES MARKET

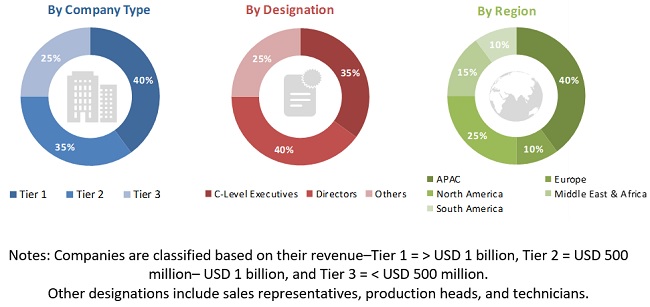

The study involved four major activities in estimating the current size of the metal nanoparticles market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and subsegments of the overall market.

Secondary Research

This research report involves extensive secondary sources, directories, and databases, such as Bloomberg, BusinessWeek, Factiva, ICIS, and OneSource, to identify and collect information useful for the technical, market-oriented, and commercial study of the metal nanoparticles market. The secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles from recognized authors, authenticated directories, and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the metal nanoparticles market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (metal nanoparticles manufacturers) and supply-side (end-product manufacturers, buyers, and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the metal nanoparticles market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Metal Nanoparticles Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the metal nanoparticles market was split into several segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the metal nanoparticles market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the metal nanoparticles market

- To analyze and forecast the size of the market based on metal, synthesis process, and end-use industry

- To estimate and forecast the market size based on five regions, namely, North America, Europe, APAC, the Middle East & Africa, and South America

- To analyze the market opportunities and competitive landscape of the market leaders and stakeholders

- To analyze the competitive developments, such as merger & acquisition, investment & expansion, new product launch/development, and partnerships, contracts & agreements in the metal nanoparticles market

- To strategically identify and profile the key market players and analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the metal nanoparticles market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the metal nanoparticles market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metal Nanoparticles Market